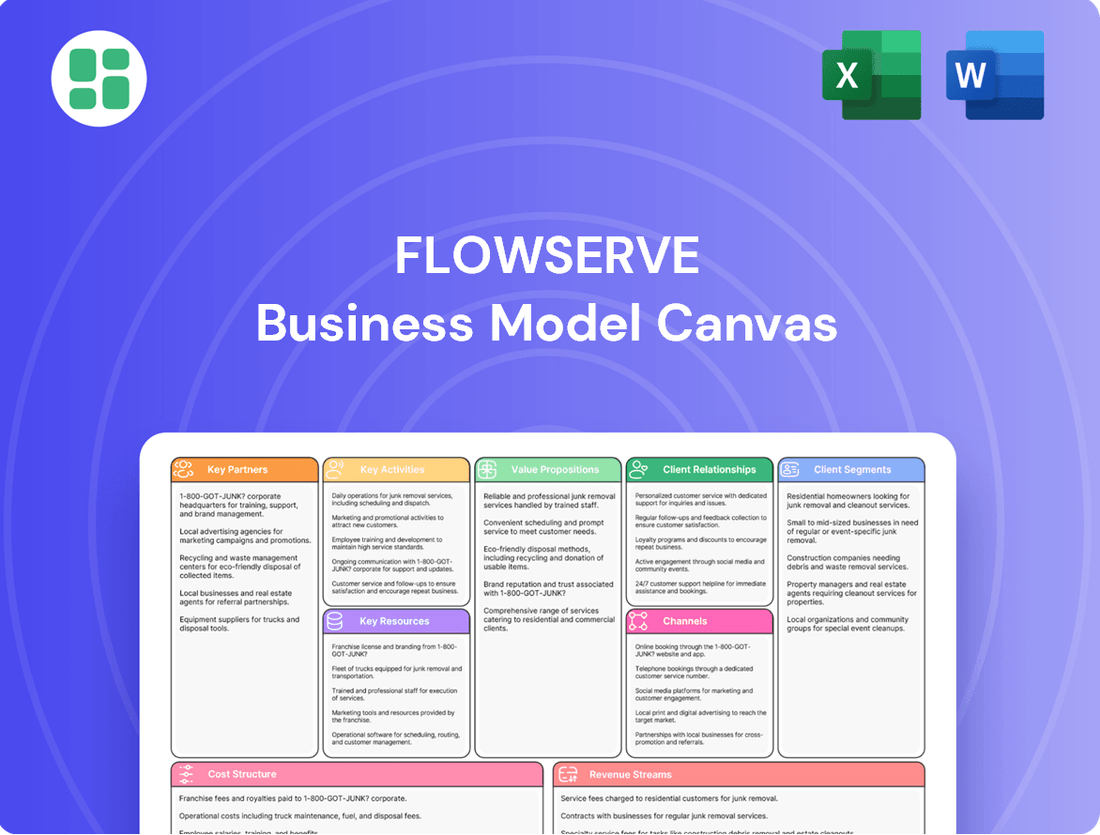

Flowserve Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flowserve Bundle

Unlock the full strategic blueprint behind Flowserve's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Flowserve actively pursues strategic alliances to broaden its market presence and bolster its technological expertise. These partnerships are crucial for accessing new geographies and developing innovative solutions.

While a proposed merger with Chart Industries was called off in 2024, Flowserve received a substantial termination fee. This payment underscores the financial implications and strategic considerations involved in evaluating potential collaborations, even when they don't materialize.

Flowserve leverages a robust global distributor network, a critical component of its business model, to ensure widespread market access and localized customer support. These authorized partners are instrumental in extending the company's sales and service capabilities across diverse geographical regions, facilitating deeper market penetration and responsive client engagement.

In 2023, Flowserve's extensive network of over 200 authorized distributors played a pivotal role in its operational success, contributing significantly to its global revenue streams and customer satisfaction metrics. This strategic reliance on distributors allows Flowserve to maintain a lean direct operational footprint while effectively serving a broad customer base, particularly in emerging markets where establishing a direct presence can be challenging.

Flowserve relies on a broad network of suppliers for critical raw materials like specialized alloys and precision-machined components, ensuring the quality and performance of its fluid motion control products. For instance, in 2023, the company continued to strengthen relationships with key component manufacturers to support its extensive product portfolio, which includes pumps, valves, and seals.

Strategic partnerships with technology providers are also vital, enabling Flowserve to integrate cutting-edge innovations into its offerings. A prime example is the acquisition of intellectual property related to liquefied natural gas (LNG) technology, which significantly bolsters its capabilities in the growing energy sector and allows for more advanced solutions.

Industry Associations and Research Institutions

Flowserve actively collaborates with key industry associations and leading research institutions to drive innovation and maintain its technological edge. These partnerships are crucial for developing next-generation flow control solutions and influencing industry standards, as seen in their participation in organizations like the American Petroleum Institute (API) and the Fluid Controls Institute (FCI).

These alliances enable Flowserve to tap into cutting-edge research and development, ensuring their products meet evolving market demands and regulatory requirements. For instance, collaborations with universities often focus on advanced materials science and fluid dynamics, directly impacting product design and performance.

- Industry Association Engagement: Participation in bodies like the Hydraulic Institute (HI) and the European Pump Manufacturers Association (Europump) allows for input on standards development and market trend analysis.

- Academic Research Collaborations: Partnerships with universities such as Texas A&M University's Turbomachinery Laboratory provide access to specialized testing facilities and academic expertise.

- Joint Development Projects: Engaging in co-development initiatives with research institutions helps accelerate the creation of novel technologies, like advanced sealing solutions and predictive maintenance algorithms.

Aftermarket Service Partners

Flowserve collaborates with a global network of aftermarket service partners to ensure robust support for its extensive installed base of equipment. This strategic alliance enhances Flowserve's ability to provide specialized repair, maintenance, and on-site field services, complementing the capabilities of its own Quick Response Centers.

These partnerships are crucial for delivering timely and expert solutions to customers worldwide, particularly in regions where Flowserve may not have a direct service presence. For instance, in 2023, Flowserve reported that its aftermarket services, including those delivered through partners, contributed significantly to its revenue, underscoring the importance of this channel.

- Global Reach: Extends specialized repair and maintenance capabilities to customers in diverse geographic locations.

- Enhanced Service Offerings: Provides customers with access to a broader range of technical expertise and localized support.

- Complementary Capabilities: Augments Flowserve's internal service infrastructure, ensuring comprehensive coverage and rapid response times.

- Customer Support: Facilitates efficient and effective solutions for equipment upkeep and operational efficiency.

Flowserve's key partnerships are vital for market expansion and technological advancement, encompassing a global distributor network and strategic alliances with technology providers. These collaborations are essential for accessing new markets, enhancing product innovation, and extending service capabilities.

The company's reliance on over 200 authorized distributors in 2023 highlights their role in driving revenue and customer satisfaction, particularly in emerging markets. Furthermore, Flowserve's engagement with industry associations and academic institutions, such as the Hydraulic Institute and Texas A&M University, fuels innovation and influences industry standards.

These partnerships are critical for developing next-generation flow control solutions and ensuring products meet evolving demands. The call-off of a proposed merger with Chart Industries in 2024, which resulted in a substantial termination fee, also illustrates the significant financial and strategic considerations in evaluating potential collaborations.

| Partnership Type | Key Activities | Impact on Flowserve | Example/Data Point |

|---|---|---|---|

| Distributors | Market access, localized sales & support | Extended reach, increased revenue | Over 200 distributors in 2023 |

| Technology Providers | IP acquisition, product integration | Enhanced product offerings, market competitiveness | LNG technology IP acquisition |

| Industry Associations | Standards development, market analysis | Influence on industry, technological edge | Engagement with Hydraulic Institute (HI) |

| Academic Institutions | Joint R&D, specialized testing | Innovation acceleration, advanced solutions | Collaboration with Texas A&M University |

What is included in the product

A detailed breakdown of Flowserve's operations, outlining key customer segments, value propositions, and revenue streams. This model highlights their approach to managing partnerships and cost structures within the industrial equipment sector.

The Flowserve Business Model Canvas acts as a pain point reliever by providing a clear, structured overview that simplifies complex operational challenges.

It addresses the pain of information overload by condensing Flowserve's strategy into a digestible format for quick review and understanding.

Activities

Flowserve's fundamental operations revolve around the intricate design, meticulous engineering, and precise manufacturing of advanced flow control equipment. This encompasses a wide array of products, including sophisticated pumps, robust valves, and critical seals, all engineered to meet the rigorous demands of various industrial sectors.

These core activities are crucial for delivering high-quality, dependable solutions that are essential for the smooth and efficient operation of complex industrial processes worldwide. The company's commitment to engineering excellence ensures that its products can withstand challenging environments and deliver consistent performance.

In 2023, Flowserve reported revenue of $4.1 billion, with a significant portion attributed to the sales of these engineered products, highlighting the market's reliance on their specialized manufacturing capabilities.

Flowserve's aftermarket service and support is a crucial activity, encompassing the provision of spare parts, repair services, and ongoing maintenance for its installed base of equipment. This segment is vital for ensuring customers' long-term operational efficiency and reliability.

In 2024, Flowserve's aftermarket business continued to be a significant driver of both bookings and revenue. This segment is designed to foster recurring revenue streams and strengthen customer relationships by offering solutions that extend equipment life and optimize performance.

Flowserve's commitment to Research and Development (R&D) is a cornerstone of its business model, driving the creation of advanced fluid motion and control products. This continuous investment fuels innovation, essential for meeting evolving industry demands, especially those related to sustainability and efficiency. For instance, the company's focus on developing solutions for decarbonization, a key element of its 3D growth strategy, directly addresses customer needs for reduced environmental impact.

Innovation in R&D allows Flowserve to enhance its existing product lines and introduce new technologies that provide tangible benefits to its customers. This includes optimizing performance, improving reliability, and lowering operational costs. The company's efforts in digitization are also heavily reliant on R&D, enabling smarter, more connected products that offer predictive maintenance and enhanced control capabilities, thereby supporting customer digital transformation initiatives.

Global Sales and Distribution

Flowserve's global sales and distribution network is critical for engaging customers in over 50 countries. This reach is achieved through a combination of direct sales teams and a network of authorized distributors, ensuring efficient delivery of their engineered products and services.

In 2024, Flowserve continued to refine its go-to-market strategy, focusing on strengthening relationships with key accounts and expanding its presence in emerging markets. The company's ability to manage this extensive network directly impacts its revenue generation and market penetration.

- Global Reach: Serves customers in more than 50 countries through direct sales and authorized distributors.

- Distribution Strategy: Leverages a hybrid model of direct sales and channel partners for efficient product and solution delivery.

- Market Penetration: The effectiveness of this network is a primary driver for market share and revenue growth.

Implementation of Flowserve Business System (FBS)

Flowserve actively implements its Flowserve Business System (FBS), a comprehensive operational framework. This system is specifically designed to foster operational excellence across the organization, leading to improved delivery times and significant cost reductions. The FBS is central to enhancing Flowserve's overall company performance and its ability to execute strategic initiatives effectively.

The implementation of FBS directly impacts key activities by standardizing processes and promoting continuous improvement. This leads to more efficient manufacturing, streamlined supply chains, and better project management. For instance, in 2023, Flowserve reported progress in its operational efficiency initiatives, contributing to a 3% reduction in its cost of sales as a percentage of revenue.

- Operational Excellence: FBS drives standardization and best practices in manufacturing and service operations.

- Cost Reduction: A key objective of FBS is to identify and implement cost-saving measures throughout the business.

- Delivery Improvement: The system aims to enhance on-time delivery performance for products and services.

- Performance Enhancement: FBS serves as a critical tool for improving overall company execution and financial results.

Flowserve's key activities are centered on designing, engineering, and manufacturing advanced flow control equipment like pumps, valves, and seals. These are critical for industrial operations worldwide, ensuring reliability and performance in demanding environments. In 2023, Flowserve’s product revenue was a substantial part of its $4.1 billion in total revenue, underscoring the market's need for these specialized products.

The company also focuses heavily on aftermarket services, including repairs and spare parts, to maintain customer equipment efficiency and build recurring revenue. Flowserve's aftermarket bookings and revenue in 2024 demonstrated its importance in supporting long-term customer operations.

Furthermore, Flowserve invests significantly in Research and Development (R&D) to innovate new fluid control technologies, particularly for sustainability and efficiency goals. This R&D fuels advancements in product performance and digitization, as seen in their focus on decarbonization solutions.

Finally, Flowserve leverages a global sales and distribution network, reaching over 50 countries through direct sales and distributors, which is crucial for market penetration and revenue growth. Their 2024 strategy aimed to strengthen key account relationships and expand into emerging markets.

| Key Activity | Description | 2023/2024 Relevance |

|---|---|---|

| Product Design & Manufacturing | Engineering and producing pumps, valves, and seals. | Core revenue driver, essential for industrial operations. |

| Aftermarket Services | Providing repairs, spare parts, and maintenance. | Drives recurring revenue and customer loyalty. |

| Research & Development | Innovating new flow control technologies. | Supports sustainability and efficiency goals, drives future growth. |

| Sales & Distribution | Global network for customer engagement and delivery. | Key to market penetration and revenue generation. |

Delivered as Displayed

Business Model Canvas

The Flowserve Business Model Canvas preview you are viewing is the actual, unedited document you will receive upon purchase. This means the structure, content, and formatting you see are precisely what will be delivered to you, ensuring complete transparency and no unexpected changes. You can be confident that the comprehensive insights and strategic framework presented here are the exact tools you will have access to for your business planning.

Resources

Flowserve's extensive product portfolio, encompassing proprietary pumps, valves, seals, and automation solutions, forms a cornerstone of its business model. This diverse offering is bolstered by significant intellectual property, including a substantial number of patents protecting its innovative designs.

The company's commitment to research and development, evident in its robust patent filings, translates into a competitive edge. For instance, in 2023, Flowserve continued to invest in innovation, which is crucial for maintaining its market position and driving future growth in the industrial equipment sector.

Acquired technologies further enrich Flowserve's intellectual property, allowing it to offer integrated solutions and address a wider range of customer needs. This strategic approach to IP management underpins its ability to deliver value and differentiate itself in a competitive global market.

Flowserve's global manufacturing and service infrastructure is a cornerstone of its business model. The company boasts a worldwide network of manufacturing plants, ensuring localized production capabilities to meet diverse market demands. This extensive operational footprint is crucial for its ability to serve a broad international customer base efficiently.

Complementing its manufacturing prowess, Flowserve operates over 180 Quick Response Centers (QRCs) strategically located across the globe. These QRCs are vital for providing rapid aftermarket services, including repairs, maintenance, and spare parts, ensuring minimal downtime for clients. This robust service network is a key differentiator, offering immediate support wherever its products are deployed.

In 2023, Flowserve's commitment to this infrastructure was evident in its continued investment in operational efficiency and service delivery. The company's ability to leverage this global network allows for optimized supply chains and responsive customer support, critical factors in the demanding industrial sectors it serves.

Flowserve's global team of over 17,500 associates is a cornerstone of its business model, with a significant emphasis on skilled engineers and technical specialists. This human capital is indispensable for driving innovation in fluid motion and control technologies, developing customized solutions for complex industrial challenges, and ensuring the high-quality delivery of their extensive service offerings.

Strong Financial Capital and Backlog

Flowserve's robust financial capital and substantial backlog are cornerstones of its business model, offering a solid foundation for sustained operations and strategic expansion. This financial strength translates directly into the company's ability to undertake significant projects and weather market fluctuations.

The company's consistent earnings and healthy cash flow generation are critical enablers. For instance, in the first quarter of 2024, Flowserve reported adjusted earnings per share of $0.60, up from $0.42 in the prior year, demonstrating strong profitability. This financial performance underpins their capacity for ongoing investment in research and development, operational enhancements, and potential acquisitions, all vital for maintaining a competitive edge.

- Financial Strength: Flowserve's substantial financial resources provide the liquidity and flexibility needed to fund large-scale projects and strategic investments.

- Order Backlog: A significant backlog, reported at $4.1 billion at the end of Q1 2024, ensures a predictable revenue stream and operational stability for the foreseeable future.

- Cash Flow Generation: Strong operating cash flow, which was $189 million in Q1 2024, allows for reinvestment in the business, debt reduction, and shareholder returns.

- Investment Capacity: The financial capacity supports continued investment in innovation, efficiency improvements, and expansion into new markets, driving long-term growth.

Proprietary Flowserve Business System

The Proprietary Flowserve Business System (FBS) is a cornerstone organizational resource, functioning as an internal operational framework designed to drive efficiency and value. It meticulously outlines and governs key functional disciplines crucial for consistent performance and value creation across the organization.

This system emphasizes three core pillars: people excellence, ensuring a skilled and motivated workforce; operational excellence, focusing on streamlined and effective processes; and portfolio excellence, managing the product and service offerings for maximum market impact. In 2024, Flowserve continued to refine its FBS, aiming to enhance customer satisfaction and operational throughput.

- Proprietary Flowserve Business System (FBS): An internal operational framework for consistent performance.

- Key Disciplines: People Excellence, Operational Excellence, and Portfolio Excellence are central to the FBS.

- Value Creation: The FBS is designed to foster sustained value creation through disciplined execution.

- 2024 Focus: Continued refinement of the FBS to improve customer experience and operational efficiency.

Flowserve's key resources include its extensive intellectual property, a global manufacturing and service infrastructure with over 180 Quick Response Centers, a skilled workforce of over 17,500 associates, strong financial capital, and the proprietary Flowserve Business System (FBS). These elements collectively enable the company to innovate, deliver high-quality products and services, and maintain operational efficiency worldwide.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Intellectual Property | Proprietary pumps, valves, seals, automation solutions, and patents. | Continued investment in innovation in 2023. |

| Global Infrastructure | Worldwide manufacturing plants and service centers. | Over 180 Quick Response Centers (QRCs) globally. |

| Human Capital | Skilled engineers and technical specialists. | Over 17,500 associates globally. |

| Financial Capital | Liquidity, flexibility, and strong cash flow. | $4.1 billion order backlog (Q1 2024); $189 million operating cash flow (Q1 2024). |

| Proprietary Business System (FBS) | Internal framework for operational excellence. | Focus on refining FBS in 2024 for customer satisfaction and efficiency. |

Value Propositions

Flowserve's value proposition centers on delivering enhanced operational efficiency and reliability. Their advanced fluid handling solutions, including pumps, valves, and seals, are engineered to optimize industrial processes, directly impacting customer uptime and productivity. For instance, Flowserve's predictive maintenance services, leveraging IoT technology, aim to prevent unexpected equipment failures, a critical concern for industries where downtime can cost millions. In 2024, Flowserve reported a significant reduction in customer-reported equipment failures through their digital monitoring programs, underscoring the tangible benefits of their reliability-focused offerings.

Flowserve excels in providing specialized and engineered solutions, meticulously crafted for the most demanding and critical applications. This focus on precision engineering means that even the most complex fluid control challenges, often found in sectors like oil and gas or power generation, are met with highly effective and safe outcomes.

In 2024, Flowserve reported significant revenue from its Engineered Products and Services segment, underscoring the market's demand for these tailored solutions. For instance, their advanced sealing technologies and pumps are designed to operate under extreme pressures and temperatures, crucial for maintaining operational integrity in hazardous environments.

Flowserve's commitment to sustainability is a core value proposition, directly supporting customers in their decarbonization efforts. Their engineered products are designed for enhanced energy efficiency, helping clients reduce their environmental footprint and operational costs.

This focus is further solidified by Flowserve's 3D strategy, which explicitly prioritizes decarbonization as a key pillar. This strategic direction ensures that their solutions are aligned with global environmental objectives, offering tangible support for the energy transition.

Reduced Total Cost of Ownership

Flowserve significantly reduces a customer's total cost of ownership by providing highly durable products engineered for extended service lives. This focus on longevity means fewer replacements and less frequent maintenance interventions, directly impacting operational budgets.

Beyond initial product quality, Flowserve's comprehensive aftermarket services are crucial for cost optimization. These services, including advanced diagnostics, predictive maintenance, and expert repair, ensure equipment operates at peak efficiency, thereby minimizing energy consumption and preventing costly unplanned downtime. For instance, their digital solutions can predict potential failures, allowing for scheduled maintenance that is far less expensive than emergency repairs.

- Extended Equipment Lifespan: Flowserve's robust product design and materials science contribute to equipment lasting longer in demanding environments, delaying capital expenditure for replacements.

- Optimized Operational Efficiency: Through proactive maintenance and performance tuning, Flowserve helps customers reduce energy usage and waste, directly lowering operating expenses.

- Minimized Downtime Costs: Reliable equipment and responsive aftermarket support prevent unscheduled shutdowns, which can cost industries millions in lost production and revenue.

- Lifecycle Cost Management: Flowserve partners with clients to manage the total cost of ownership from acquisition through decommissioning, offering integrated solutions for maximum value.

Global Aftermarket Support and Responsiveness

Flowserve's commitment to global aftermarket support is a cornerstone of its value proposition. Through a worldwide network of over 100 Quick Response Centers, the company ensures customers have swift access to critical spare parts, expert repair services, and immediate technical assistance. This rapid deployment capability is crucial for industries where downtime translates directly into significant financial losses.

This extensive support infrastructure directly addresses the need for operational continuity. By minimizing the time equipment is out of service, Flowserve helps its clients maintain maximum asset uptime. For instance, in 2023, Flowserve reported that its aftermarket services segment generated approximately $1.9 billion in revenue, highlighting the significant demand and reliance on these offerings.

- Global Reach: Over 100 Quick Response Centers strategically located worldwide.

- Rapid Response: Ensures fast access to parts, repairs, and technical expertise.

- Minimized Downtime: Focuses on maximizing customer asset uptime and operational efficiency.

- Revenue Contribution: Aftermarket services represented a substantial portion of Flowserve's 2023 revenue, underscoring its importance.

Flowserve's value proposition is built on delivering enhanced operational efficiency and reliability through advanced fluid handling solutions. Their engineered products and comprehensive aftermarket services focus on minimizing customer downtime and reducing total cost of ownership. In 2024, Flowserve continued to emphasize its predictive maintenance capabilities, aiming to prevent critical equipment failures and ensure maximum asset uptime for its diverse industrial clientele.

Flowserve provides highly specialized, engineered solutions tailored for critical applications across various industries, ensuring safety and effectiveness. This expertise is crucial for sectors like oil and gas and power generation, where operational integrity is paramount. The company's 2024 financial reports highlighted strong demand for these customized offerings, reinforcing their market position.

Sustainability is a key element of Flowserve's value, aiding customers in their decarbonization goals through energy-efficient products. Their strategic focus on sustainability, including their 3D strategy, aligns their solutions with global environmental objectives and the energy transition, offering tangible benefits for clients seeking to reduce their environmental impact.

Flowserve's commitment to global aftermarket support, with over 100 Quick Response Centers, ensures rapid access to parts and services, minimizing customer downtime. This extensive network is vital for maintaining operational continuity and maximizing asset uptime. In 2023, aftermarket services contributed significantly to Flowserve's revenue, demonstrating the critical role these offerings play for their customers.

| Value Proposition Aspect | Key Offering | Customer Benefit | 2024/2023 Data Point |

|---|---|---|---|

| Operational Efficiency & Reliability | Advanced Pumps, Valves, Seals, Predictive Maintenance | Increased uptime, reduced failures, optimized processes | Reported reduction in customer-reported equipment failures via digital monitoring (2024) |

| Specialized & Engineered Solutions | Custom-engineered fluid control systems | Effective and safe outcomes for complex industrial challenges | Significant revenue from Engineered Products and Services segment (2024) |

| Sustainability | Energy-efficient products | Reduced environmental footprint, lower operational costs | 3D strategy prioritizes decarbonization (ongoing) |

| Lifecycle Cost Management | Durable products, comprehensive aftermarket services | Extended equipment lifespan, minimized downtime costs, optimized total cost of ownership | Aftermarket services generated ~$1.9 billion revenue (2023) |

Customer Relationships

Flowserve focuses on building enduring strategic partnerships with its industrial clientele, a cornerstone of its business model. These aren't fleeting transactions; they are deep, collaborative engagements that often span years, characterized by comprehensive service agreements and joint project development.

This strategic emphasis on long-term relationships allows Flowserve to gain an intricate understanding of each customer's unique operational challenges and evolving requirements. For instance, in 2023, Flowserve reported that a significant portion of its revenue was derived from aftermarket services, which are intrinsically tied to these ongoing customer partnerships.

Flowserve provides dedicated technical support and expert consultation, ensuring customers receive specialized guidance throughout their product's lifecycle. This commitment extends to extensive after-sales service, crucial for maintaining optimal performance and swiftly resolving any issues that arise.

Flowserve offers proactive service and maintenance agreements, incorporating predictive analytics and remote monitoring. This approach helps clients sidestep expensive equipment failures and guarantees their fluid handling systems operate at optimal efficiency.

Global and Localized Support through QRCs

Flowserve's customer relationships are significantly bolstered by its extensive global network of Quick Response Centers (QRCs). These centers are strategically positioned to offer localized support, ensuring that customers receive assistance tailored to their specific regional needs and operational contexts.

The accessibility and efficiency of these QRCs directly translate into enhanced customer satisfaction. Flowserve reported that its QRCs achieved an average turnaround time of 2.5 days for critical repairs in 2024, a testament to their responsiveness.

- Global Reach, Local Touch: QRCs provide on-the-ground support, reducing downtime and logistical complexities for clients worldwide.

- Rapid Repair Services: Flowserve's QRCs are equipped to handle urgent repair needs, with many offering 24/7 service availability.

- Parts Availability: Maintaining readily available spare parts at QRCs ensures that repairs are completed swiftly, minimizing operational interruptions for customers.

- Customer Satisfaction: The combination of localized expertise and quick service contributes directly to higher customer retention and loyalty.

Value-Driven Engagement and Commercial Excellence

Flowserve prioritizes customer relationships by embedding value-driven engagement and commercial excellence into its core operations. Initiatives like the 80/20 program streamline offerings to better meet customer needs, while the commercial excellence pillar within the Flowserve Business System sharpens sales and service delivery.

This focus ensures that every customer interaction is geared towards optimizing outcomes and ensuring efficient portfolio delivery. For example, Flowserve's commitment to customer success is reflected in its ongoing efforts to improve lead times and service responsiveness, key metrics for customer satisfaction.

- Value Focus: The 80/20 program identifies and prioritizes the most impactful customer segments and product lines, ensuring resources are concentrated where they deliver the most value.

- Commercial Excellence: This pillar drives consistent, high-quality customer interactions, from initial contact through post-sale support, aiming to enhance the overall customer experience.

- Outcome Optimization: Flowserve's engagement aims to help customers achieve their operational goals, whether through improved equipment performance, reduced downtime, or enhanced efficiency.

- Portfolio Delivery: Efficiently managing and delivering its diverse product and service portfolio is crucial for meeting customer expectations and strengthening long-term partnerships.

Flowserve cultivates deep, long-term partnerships through dedicated support and proactive service, aiming to optimize customer operations. Their global network of Quick Response Centers (QRCs) provides localized, rapid assistance, exemplified by an average 2.5-day turnaround for critical repairs in 2024.

This focus on customer relationships is further strengthened by initiatives like the 80/20 program and a commitment to commercial excellence, ensuring efficient delivery and value-driven engagement across their diverse product and service portfolio.

| Customer Relationship Aspect | Description | Key Metric/Example |

|---|---|---|

| Strategic Partnerships | Building enduring, collaborative engagements spanning years. | Significant portion of revenue from aftermarket services (2023). |

| Technical Support & Consultation | Providing specialized guidance throughout product lifecycle. | Expert advice and after-sales service. |

| Proactive Service & Maintenance | Using predictive analytics and remote monitoring. | Minimizing equipment failures and ensuring optimal efficiency. |

| Global Quick Response Centers (QRCs) | Localized support and rapid repair services. | Average 2.5-day turnaround for critical repairs (2024). |

| Value-Driven Engagement | Streamlining offerings and sharpening sales/service delivery. | 80/20 program, Commercial Excellence pillar. |

Channels

Flowserve employs a dedicated direct sales force to cultivate relationships with major industrial customers, particularly for intricate project sales. This approach enables direct negotiation of terms and fosters the creation of customized solutions, ensuring client needs are precisely met.

This direct engagement is crucial for managing the lifecycle of complex projects, allowing for in-depth technical discussions and the development of long-term partnerships. In 2024, Flowserve's focus on direct sales contributed to securing significant orders in key sectors, reflecting the value of this customer-centric strategy.

Flowserve's global distributor network is a cornerstone of its market penetration strategy. These authorized partners are crucial for extending Flowserve's reach into diverse geographical regions, ensuring products are available and supported locally.

These distributors offer vital local presence and specialized technical support, bridging the gap between Flowserve's global operations and regional customer needs. In 2024, Flowserve continued to leverage this network to serve a broad customer base across various industrial sectors.

Flowserve's extensive network of over 180 Quick Response Centers (QRCs) acts as a crucial channel for its aftermarket business. These centers are strategically positioned to offer immediate support, focusing on repairs and essential services for Flowserve's installed base of equipment.

The QRCs are designed for rapid turnaround, addressing urgent customer needs and minimizing downtime. This direct service model is key to Flowserve's strategy of maintaining strong customer relationships and ensuring operational continuity for clients across various industries.

Online Presence and Digital Platforms

Flowserve utilizes its official website and dedicated investor relations portal as primary digital channels for corporate communications, detailed product information, and direct stakeholder engagement. This digital presence ensures broad accessibility to essential company resources and updates.

These platforms serve as a crucial touchpoint for investors, customers, and potential employees, offering a centralized hub for financial reports, news releases, and career opportunities. In 2024, Flowserve continued to enhance its digital engagement, with its investor relations section providing real-time stock performance data and SEC filings.

- Website Accessibility: Flowserve's website offers comprehensive product catalogs and technical specifications, facilitating informed decision-making for customers.

- Investor Relations Portal: This platform provides timely access to financial statements, annual reports, and investor presentations, crucial for financial analysis.

- Digital Engagement: The company uses its online presence to share corporate responsibility initiatives and sustainability reports, reflecting a commitment to transparency.

- Information Dissemination: Key financial data, such as Q1 2024 earnings reports, were readily available through these digital channels.

Industry-Specific Exhibitions and Conferences

Industry-specific exhibitions and conferences are a vital channel for Flowserve to directly engage with its target audience. These events provide a platform to unveil new technologies and solutions, such as advanced sealing technologies and digital monitoring systems, which are critical for industries like oil and gas, chemical processing, and power generation. For instance, Flowserve actively participates in events like the Offshore Technology Conference (OTC) and ACHEMA, where they can demonstrate their capabilities to a highly relevant and concentrated group of professionals.

These gatherings are not just about showcasing products; they are crucial for building relationships and understanding market needs. By exhibiting at these events, Flowserve can gather direct feedback on their offerings and identify emerging trends. In 2024, participation in these key industry events allows Flowserve to reinforce its position as a leader in flow control, directly impacting lead generation and sales pipeline development. The company often highlights its commitment to sustainability and efficiency at these forums, aligning with industry-wide goals.

- Showcasing Innovation: Flowserve uses these events to launch and demonstrate new products, like their advanced pump and valve technologies.

- Customer Engagement: Direct interaction with potential and existing clients allows for relationship building and understanding specific needs.

- Market Intelligence: Conferences provide insights into industry trends, competitor activities, and customer demands.

- Brand Visibility: Participation enhances Flowserve's brand recognition and reinforces its expertise in flow management solutions.

Flowserve's channel strategy is multifaceted, encompassing direct sales for complex projects, a global distributor network for broad market reach, and a robust aftermarket service network through its Quick Response Centers. Digital channels, including its corporate website and investor relations portal, are key for information dissemination and stakeholder engagement. Industry events and conferences serve as vital platforms for showcasing innovation and gathering market intelligence.

In 2024, Flowserve continued to emphasize its direct sales force for high-value, intricate projects, particularly in sectors like oil and gas and chemical processing. This focus was instrumental in securing significant new orders throughout the year. The company also leveraged its extensive global distributor network to ensure product availability and local support across diverse geographical markets, effectively reaching a wider customer base.

The Quick Response Centers (QRCs) remained a critical component of Flowserve's aftermarket strategy, providing rapid repair and service solutions to minimize customer downtime. In 2024, these centers played a pivotal role in maintaining customer satisfaction and operational continuity. Flowserve's digital presence, including its website and investor relations portal, facilitated transparent communication and provided access to key financial data, such as Q1 2024 earnings reports, to a broad audience.

Participation in key industry events in 2024, such as the Offshore Technology Conference (OTC) and ACHEMA, allowed Flowserve to highlight its latest technologies and engage directly with industry professionals. These events were crucial for lead generation and reinforcing the company's brand as a leader in flow control solutions.

| Channel | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Sales Force | Cultivating relationships with major industrial customers for intricate project sales. | Secured significant orders in key sectors, emphasizing customized solutions. |

| Global Distributor Network | Extending market penetration and providing local product support and technical expertise. | Ensured broad product availability and served a diverse customer base across various industries. |

| Quick Response Centers (QRCs) | Providing immediate aftermarket support, repairs, and services for installed equipment. | Crucial for minimizing customer downtime and maintaining operational continuity. |

| Digital Channels (Website, Investor Relations) | Corporate communications, product information, and stakeholder engagement. | Enhanced digital engagement, providing real-time stock data and access to financial reports. |

| Industry Exhibitions & Conferences | Showcasing new technologies, gathering market intelligence, and building relationships. | Reinforced leadership in flow control and impacted lead generation and sales pipeline development. |

Customer Segments

Flowserve is a vital partner for the entire oil and gas value chain, supporting upstream exploration and production, midstream transportation, and downstream refining and petrochemical operations. They provide essential equipment like pumps, valves, and seals that are critical for the safe and efficient handling of hydrocarbons, from the wellhead to the finished product.

In 2024, the oil and gas sector continued to be a significant market for Flowserve, with substantial investments in both traditional and emerging energy projects. For example, global upstream capital expenditure was projected to reach over $500 billion in 2024, driving demand for Flowserve's robust solutions in challenging environments.

The Power Generation sector is a cornerstone customer segment for Flowserve, encompassing crucial areas like nuclear power. Flowserve supplies essential flow control equipment vital for the reliable generation of electricity across various power sources.

Demand within this sector is robust, as evidenced by Flowserve's significant year-over-year increases in bookings. For instance, in the first quarter of 2024, Flowserve reported a substantial increase in bookings, with the power generation segment being a key contributor to this growth.

Flowserve provides essential flow management solutions to the chemical and petrochemical sectors, vital for the safe and efficient handling of corrosive and hazardous substances. These industries require exceptionally reliable and high-performing equipment to maintain operational integrity.

In 2024, the global chemical industry was valued at approximately $5.7 trillion, with petrochemicals forming a significant portion. The demand for robust sealing and pumping technologies from Flowserve in this segment is driven by stringent safety regulations and the need to prevent costly downtime.

Water Resources and Wastewater Management

Flowserve serves both municipal and industrial clients, providing essential support for water treatment, distribution networks, and wastewater management initiatives. Their technologies are crucial for maintaining the efficiency and dependability of water infrastructure, a sector that saw significant investment globally.

In 2024, the global water and wastewater treatment market was valued at approximately $700 billion, with projections indicating continued growth. This highlights the substantial demand for Flowserve's solutions, particularly as aging infrastructure requires upgrades and environmental regulations become stricter.

- Municipal Water Systems: Supporting the safe and efficient delivery of potable water and the collection of wastewater for communities worldwide.

- Industrial Water Treatment: Providing solutions for process water, cooling water, and effluent treatment across diverse industries like power generation, petrochemicals, and manufacturing.

- Wastewater Management: Enabling the effective treatment and disposal of wastewater, crucial for public health and environmental protection.

General Industrial and Manufacturing

Flowserve serves a wide array of general industrial and manufacturing sectors beyond traditional heavy industries. These sectors rely on precise fluid control for critical operations.

This includes applications in areas like food and beverage processing, pharmaceuticals, and water and wastewater treatment, where hygiene, efficiency, and reliability are non-negotiable. For instance, in 2024, the global industrial pumps market, a key segment for Flowserve, was valued at approximately $45 billion, with general industrial applications forming a significant portion of this. Flowserve's solutions ensure optimal performance and compliance in these diverse settings.

- Food & Beverage: Ensuring sanitary and efficient fluid handling in processing and packaging.

- Pharmaceuticals: Providing high-purity pumping and valve solutions for sensitive applications.

- Water & Wastewater: Delivering reliable equipment for municipal and industrial water management.

- General Manufacturing: Supporting diverse processes from chemical production to automotive manufacturing with robust fluid control.

Flowserve's customer base is diverse, spanning critical global industries that rely heavily on fluid motion and control. Their primary segments include oil and gas, power generation, chemical and petrochemical, and water and wastewater management. These sectors demand highly reliable and efficient equipment for handling challenging substances and ensuring operational continuity.

In 2024, Flowserve continued to see strong demand from these core markets. The oil and gas sector, for example, represented a significant portion of their business, with global upstream capital expenditure projected to exceed $500 billion. Similarly, the power generation sector's need for reliable flow control, particularly with ongoing investments in nuclear and renewable energy infrastructure, contributed substantially to Flowserve's bookings growth in early 2024.

The chemical and petrochemical industries, valued at trillions globally, also represent a key segment. Flowserve's solutions are crucial here due to stringent safety regulations and the need for equipment that can handle corrosive materials. Furthermore, the water and wastewater sector, a market worth hundreds of billions in 2024, relies on Flowserve for essential infrastructure upgrades and maintenance.

| Customer Segment | 2024 Market Relevance (Illustrative) | Key Needs |

|---|---|---|

| Oil & Gas | Global upstream CAPEX > $500B | Reliability in harsh environments, efficiency |

| Power Generation | Robust demand for nuclear & renewables | Safe, continuous operation, high performance |

| Chemical & Petrochemical | Global industry ~$5.7T | Corrosion resistance, leak prevention, safety |

| Water & Wastewater | Global market ~$700B | Durability, efficiency, regulatory compliance |

Cost Structure

Flowserve's Cost of Goods Sold (COGS) is the most significant part of its expenses. This includes the direct costs of making its pumps, valves, and seals. Think raw materials like metals and specialized components, the wages for the skilled workers on the assembly line, and the costs of running the factories, such as utilities and depreciation of machinery.

In 2023, Flowserve reported a Cost of Goods Sold of $3.1 billion. Efficiently controlling these direct manufacturing costs is crucial for Flowserve's profitability, directly influencing its gross profit margins.

Flowserve's Selling, General, and Administrative (SG&A) expenses cover essential functions like sales and marketing efforts, the operational costs of running the business, and overarching corporate support. These costs are critical for maintaining customer relationships and ensuring efficient business operations.

In 2024, Flowserve has seen an increase in its SG&A expenses. This rise is largely attributable to costs associated with merger transactions and the subsequent integration of acquired entities, which are common in the industrial sector as companies seek growth and synergy.

Flowserve consistently invests heavily in Research and Development (R&D) to drive product innovation and enhance its existing fluid motion and control technologies. These significant expenditures are vital for staying ahead in a competitive market and developing cutting-edge solutions for its diverse customer base.

In 2023, Flowserve reported R&D expenses of $131.3 million. This commitment underscores the company's focus on developing new technologies and improving the performance and efficiency of its product portfolio, ensuring it maintains a strong technological edge.

Realignment and Integration Costs

Flowserve's cost structure includes significant expenses associated with organizational realignment and integrating acquired businesses, like the MOGAS acquisition. These efforts are crucial for streamlining operations and achieving future growth.

In 2024, Flowserve continued to invest in these strategic initiatives. For instance, the company's focus on business system implementations and ongoing integration activities from past acquisitions contribute to these costs.

- Organizational Realignment: Costs incurred from restructuring programs to improve efficiency.

- Business System Implementations: Expenses related to upgrading and integrating enterprise resource planning (ERP) and other critical business software.

- Acquisition Integration: Costs associated with merging acquired companies, such as MOGAS, into Flowserve's existing operations, including IT systems, processes, and personnel.

- Strategic Investments: These expenditures are viewed as necessary investments for long-term operational improvements and market competitiveness.

Capital Expenditures and Asset Maintenance

Flowserve's cost structure includes significant capital expenditures for its manufacturing facilities and Quick Response Centers. These investments in property, plant, and equipment are crucial for maintaining operational capacity and efficiency.

Ongoing asset maintenance is also a key cost component, ensuring the longevity and optimal performance of these critical infrastructure assets. These expenditures directly support Flowserve's ability to deliver its products and services reliably.

- Capital Expenditures: Investments in manufacturing plants, R&D facilities, and Quick Response Centers.

- Asset Maintenance: Costs for upkeep, repairs, and upgrades to existing property, plant, and equipment.

- Operational Efficiency: These costs are incurred to ensure high levels of production capacity and service delivery.

- 2024 Data: Flowserve's capital expenditures for 2024 were projected to be between $250 million and $270 million, reflecting ongoing investment in its global infrastructure.

Flowserve's cost structure is dominated by its Cost of Goods Sold (COGS), which includes direct manufacturing expenses like materials, labor, and factory overhead. Selling, General, and Administrative (SG&A) expenses are also significant, covering sales, marketing, and corporate operations, with recent increases attributed to merger integration. The company also makes substantial investments in Research and Development (R&D) to foster innovation and maintains considerable capital expenditures for its facilities and ongoing asset maintenance.

| Expense Category | 2023 Actuals | 2024 Projections/Trends | Key Drivers |

|---|---|---|---|

| Cost of Goods Sold (COGS) | $3.1 billion | Continued focus on managing direct manufacturing costs. | Raw materials, direct labor, factory overhead. |

| Selling, General, and Administrative (SG&A) | Not specified | Increased due to merger transaction costs and integration efforts. | Sales, marketing, corporate operations, integration expenses. |

| Research and Development (R&D) | $131.3 million | Ongoing investment in product innovation and technology enhancement. | New product development, performance improvements. |

| Capital Expenditures | Not specified | Projected between $250 million and $270 million. | Manufacturing facilities, R&D centers, Quick Response Centers. |

| Organizational Realignment/Integration | Significant | Continued investment in business system implementations and acquisition integration (e.g., MOGAS). | Restructuring, ERP upgrades, IT systems, process alignment. |

Revenue Streams

Flowserve's primary revenue comes from selling new, custom-engineered pumps, valves, seals, and automation products. These are critical components for industries like oil and gas, power generation, and water management. For instance, in the first quarter of 2024, Flowserve reported strong performance in its Engineered Product business, driven by significant bookings for new projects and expansions across these key sectors.

Flowserve's aftermarket services represent a substantial and expanding revenue source, encompassing the sale of parts, repair, maintenance, and upgrades for their extensive installed equipment base. This segment is crucial, consistently contributing significantly to both overall bookings and profit margins.

In 2024, Flowserve reported that its aftermarket business continued to be a strong performer, with orders in this segment showing robust growth, outpacing new equipment orders in certain periods. This focus on servicing existing installations not only generates recurring revenue but also strengthens customer relationships, leading to greater loyalty and opportunities for future sales.

Flowserve's revenue growth is significantly boosted by bookings tied to its 3D strategy: decarbonization, diversification, and digitization. This focus allows them to tap into rapidly expanding markets and secure projects centered on sustainability.

In 2024, Flowserve reported a substantial increase in bookings, with a notable portion attributed to these strategic growth areas. For instance, their backlog for decarbonization projects, including those for hydrogen and carbon capture, saw a marked uptick, reflecting strong customer demand for cleaner energy solutions.

The company's diversification efforts, expanding into new industrial sectors and geographical regions, also contributed positively to bookings. Digitization initiatives, such as offering advanced monitoring and predictive maintenance services, are creating recurring revenue streams and enhancing customer value, further driving bookings.

Geographical Market Sales

Flowserve generates revenue by selling its products and services across a wide array of global markets. This geographical spread is a key element in its business model, offering stability against regional economic downturns.

In 2023, Flowserve saw significant contributions from its operations in various regions. For instance, the Americas continued to be a strong market, alongside robust performance in Europe, the Middle East, Africa, and Asia Pacific. This diversification helps mitigate risks and capture opportunities worldwide.

- Americas: Remained a core revenue-generating region.

- Europe, Middle East, Africa (EMEA): Exhibited solid demand for Flowserve's solutions.

- Asia Pacific: Showcased growth potential, particularly in emerging economies.

- Latin America: Contributed to the company's global sales footprint.

Specialized Project-Based Revenue

Flowserve generates substantial income from specialized, project-based contracts, often involving intricate engineering and long execution timelines. These large-scale endeavors are particularly prevalent in the power generation sector, including significant contributions from nuclear power projects, as well as in the development of major industrial infrastructure.

These substantial contracts represent a cornerstone of Flowserve's revenue, reflecting the company's expertise in handling complex, high-value projects that demand specialized solutions and extensive project management capabilities.

- Project-Based Revenue: Flowserve's revenue is significantly bolstered by large, complex project awards.

- Key Sectors: Power generation (including nuclear) and large-scale industrial infrastructure are primary sources for these projects.

- Contract Value: These projects typically involve long lead times and substantial contract values, contributing significantly to financial performance.

- 2024 Performance Indicator: While specific project revenue figures for 2024 are still being finalized, Flowserve's backlog of $3.7 billion as of Q1 2024 indicates strong demand for these specialized project-based services.

Flowserve's revenue streams are diverse, stemming from the sale of new engineered products, a robust aftermarket business, and specialized project-based contracts. The company's strategic focus on decarbonization, diversification, and digitization is also a significant driver of new bookings and future revenue growth.

The company's global presence is a key factor, with revenue generated across the Americas, EMEA, and Asia Pacific regions. This geographical diversification helps to stabilize earnings and capture opportunities in various economic climates.

| Revenue Stream | Description | 2024 Relevance/Data Point |

|---|---|---|

| New Engineered Products | Sale of custom pumps, valves, seals, and automation. | Strong Q1 2024 performance driven by new project bookings. |

| Aftermarket Services | Parts, repair, maintenance, and upgrades for installed base. | Consistent contributor to bookings and profit margins; robust growth in 2024. |

| Project-Based Contracts | Large, complex contracts for sectors like power generation and industrial infrastructure. | Significant backlog of $3.7 billion as of Q1 2024 indicates strong demand. |

| Strategic Growth Areas (3D) | Revenue linked to decarbonization, diversification, and digitization initiatives. | Notable uptick in bookings for hydrogen and carbon capture projects in 2024. |

Business Model Canvas Data Sources

The Flowserve Business Model Canvas is built upon a foundation of comprehensive financial reports, in-depth market analysis, and internal strategic planning documents. These diverse data sources ensure each component of the canvas accurately reflects Flowserve's operational realities and market positioning.