Flowserve Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flowserve Bundle

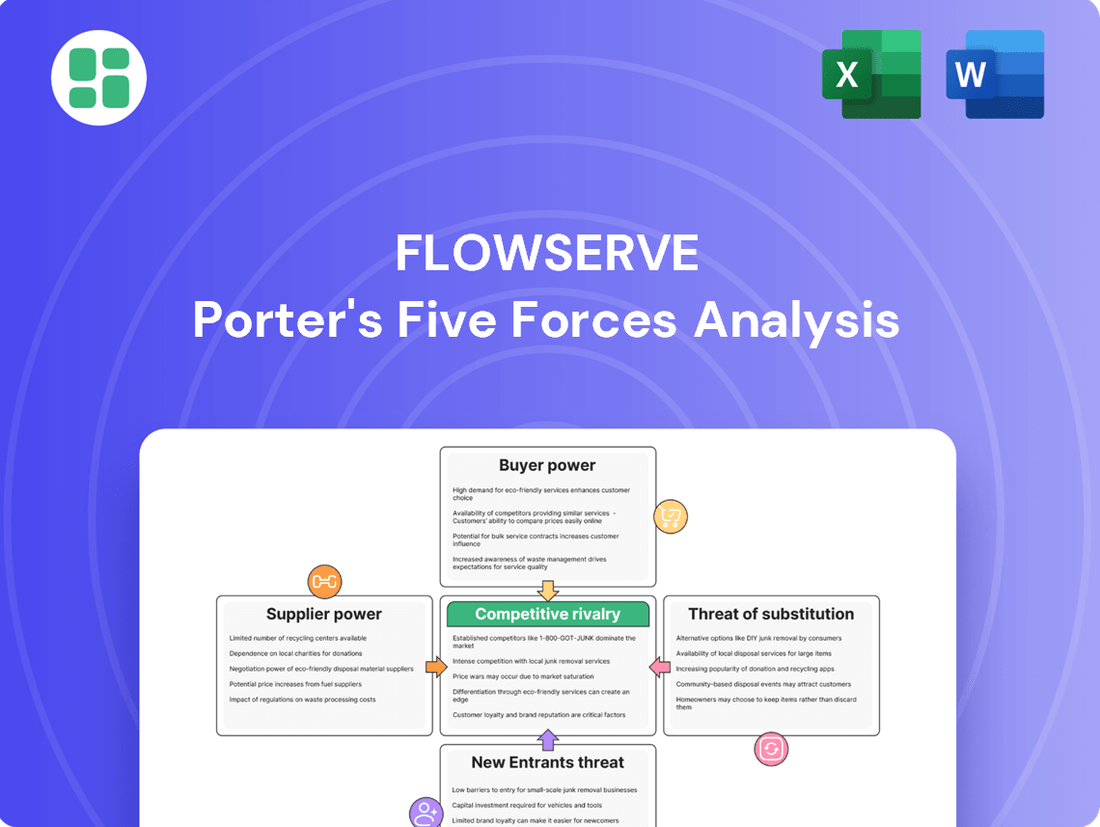

Flowserve operates within a competitive landscape shaped by several key forces, including the bargaining power of buyers and suppliers, the threat of new entrants, and the intensity of rivalry. Understanding these dynamics is crucial for any stakeholder looking to navigate this sector.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Flowserve’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Flowserve depends on suppliers for specialized components and high-grade raw materials essential for its sophisticated pumps, valves, and seals. The specific nature of these inputs, especially for demanding sectors like oil and gas, power generation, and chemicals, can give suppliers considerable bargaining power.

For instance, in 2024, the global market for high-performance alloys, often used in Flowserve's critical applications, saw price increases due to supply chain constraints and increased demand from the aerospace and energy sectors. This situation directly impacts Flowserve's cost of goods sold and its ability to secure necessary materials without significant price concessions.

For specialized components crucial to Flowserve's operations, the pool of suppliers meeting rigorous industry standards and possessing unique technical expertise can be quite small. This limited availability of qualified providers significantly bolsters their negotiating leverage.

This scarcity means these suppliers can often dictate terms, potentially driving up the cost of essential materials or extending delivery schedules, impacting Flowserve's production efficiency and profitability. For instance, in 2024, the semiconductor industry, a key supplier for many advanced manufacturing processes, continued to face supply chain constraints, leading to price increases for critical components.

To mitigate this, Flowserve must actively cultivate robust relationships with its existing key suppliers and explore avenues for diversifying its supplier base, even for highly specialized needs, to reduce dependency and enhance its own bargaining position.

Supplier switching costs can significantly influence Flowserve's bargaining power. When Flowserve relies on highly integrated or proprietary components, switching to a new supplier can incur substantial expenses. These costs often include redesigning existing products, the lengthy process of re-qualifying new vendors, and the potential for production downtime, which can be very disruptive. For instance, in 2024, the semiconductor industry, a critical supplier for many advanced manufacturing processes, experienced lead times extending to over 52 weeks for certain components, highlighting the difficulty and cost of finding alternative sources quickly.

Forward Integration Threat from Suppliers

The threat of suppliers engaging in forward integration, meaning they start manufacturing the same products Flowserve produces, is generally low but not entirely absent. While the significant capital and specialized knowledge needed to enter Flowserve's manufacturing space are considerable barriers, very large and specialized suppliers could theoretically consider this. This would directly compete with Flowserve, potentially disrupting their market position.

A more plausible scenario involves suppliers of critical components. These suppliers might leverage their position by threatening to bypass Flowserve and sell their sub-assemblies directly to Flowserve's end customers. Alternatively, they could bundle these essential parts with other services, making it more attractive for customers to source directly from them, thus increasing their bargaining power over Flowserve.

Flowserve's strategy to mitigate this risk is rooted in its extensive global operations. With a presence in over 50 countries, Flowserve can cultivate a diverse and resilient supply chain. This geographical diversification reduces reliance on any single supplier or region, making it harder for individual suppliers to exert undue influence through threats of forward integration or direct sales.

- Forward Integration Barrier: The high capital investment and specialized expertise required for suppliers to enter Flowserve's manufacturing domain act as a significant deterrent.

- Component Supplier Leverage: Suppliers of critical sub-assemblies can exert power by threatening direct sales to Flowserve's customers or by bundling their offerings.

- Global Operational Footprint: Flowserve's operations in more than 50 countries enable a diversified supply chain, reducing the impact of any single supplier's potential power plays.

Impact of ESG and Regulatory Compliance on Supply Chain

Suppliers who meet stringent Environmental, Social, and Governance (ESG) criteria and comply with industry-specific regulations, such as those for nuclear or decarbonization initiatives, can leverage this adherence to demand higher prices. Flowserve's 2024 ESG Report underscores its commitment to climate action, culture, and core responsibilities, suggesting an expectation for its suppliers to align with these foundational principles. This alignment can indeed strengthen the bargaining position of suppliers who demonstrably meet these elevated standards.

Flowserve's strategic collaborations aimed at fostering innovation further emphasize its reliance on suppliers possessing specialized capabilities and regulatory adherence. This reliance can translate into increased bargaining power for those suppliers who can consistently meet Flowserve's demanding technical and compliance requirements.

- Suppliers with strong ESG credentials and regulatory compliance can negotiate premium pricing.

- Flowserve's 2024 ESG Report emphasizes alignment with climate, culture, and core responsibility principles for its supply chain.

- Strategic partnerships for innovation highlight Flowserve's dependence on specialized, compliant suppliers, enhancing their bargaining power.

The bargaining power of suppliers for Flowserve is significant due to the specialized nature of components and raw materials required for its advanced products. In 2024, supply chain challenges, particularly in sectors like high-performance alloys and semiconductors, led to price increases, directly impacting Flowserve's costs and material availability.

Limited qualified suppliers for critical inputs and high switching costs for Flowserve further bolster supplier leverage. For example, extended lead times of over 52 weeks for certain semiconductor components in 2024 illustrate the difficulty and expense of finding alternatives, strengthening suppliers' negotiating positions.

Suppliers with strong Environmental, Social, and Governance (ESG) credentials and regulatory compliance can also command higher prices, as Flowserve's 2024 ESG Report indicates an expectation for supply chain alignment with these principles. Strategic collaborations for innovation also increase reliance on specialized, compliant suppliers, enhancing their bargaining power.

| Factor | Impact on Flowserve | 2024 Data/Observation |

|---|---|---|

| Specialized Components | High supplier bargaining power due to limited qualified providers. | Continued supply chain constraints in semiconductors led to extended lead times. |

| Raw Material Costs | Price volatility and increases affect cost of goods sold. | Global market for high-performance alloys saw price increases due to demand and supply issues. |

| Switching Costs | High costs (redesign, re-qualification) reduce Flowserve's ability to switch suppliers. | Semiconductor component lead times over 52 weeks highlight switching difficulties. |

| ESG & Regulatory Compliance | Suppliers meeting these standards can negotiate premium pricing. | Flowserve's 2024 ESG Report emphasizes supply chain alignment with climate and core responsibility principles. |

What is included in the product

This Porter's Five Forces analysis provides a comprehensive examination of the competitive landscape for Flowserve, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential for substitute products.

Easily identify and prioritize competitive threats with a visual breakdown of each force, enabling targeted strategic responses.

Customers Bargaining Power

Flowserve's customer base is dominated by major players in sectors like oil and gas, power generation, and chemicals. These are often massive, multinational corporations with substantial purchasing power.

Because these industrial giants buy in such large volumes, they can negotiate hard on prices and contract terms. For instance, a single large project for a major energy company could represent a significant portion of Flowserve's revenue, giving that customer considerable leverage.

This strong bargaining position means customers can push for competitive pricing and customized solutions, directly impacting Flowserve's profit margins. In 2023, Flowserve reported total revenue of $3.9 billion, highlighting the scale of operations where such customer power is most keenly felt.

Flowserve's pumps, valves, and seals are vital for industrial fluid handling, directly impacting operational efficiency and reliability. The critical nature of these components means customers often cannot afford disruptions, making product performance paramount.

A significant portion of Flowserve's offerings are precision-engineered or customized to meet specific client needs. This high degree of specialization makes it difficult and costly for customers to switch to alternative suppliers, thereby limiting their bargaining power.

For instance, in 2023, Flowserve reported that a substantial portion of its revenue came from engineered-to-order products, highlighting the customization aspect that locks in customers. Their robust aftermarket services, including maintenance and spare parts, further increase customer stickiness and reduce the perceived ease of switching.

Flowserve's aftermarket services, encompassing maintenance, repairs, and upgrades, represent a substantial revenue driver. In 2023, aftermarket sales contributed significantly to their overall financial performance, underscoring its importance.

The high switching costs associated with replacing installed Flowserve equipment create a strong lock-in effect for customers. This is particularly true for critical infrastructure where downtime and re-qualification are extremely costly, solidifying customer reliance on Flowserve for ongoing support.

This reliance on aftermarket services ensures a predictable and recurring revenue stream for Flowserve. It also strengthens their competitive advantage throughout the entire lifecycle of their products, effectively reducing the bargaining power of customers for these essential services.

Customer Price Sensitivity and Project Economics

Customers in sectors like oil and gas, which are capital-intensive, frequently face stringent budget limitations for major undertakings. This makes them acutely aware of pricing, and they will actively seek out the most economical options, prioritizing the total cost of ownership over the initial purchase price.

Flowserve's customers, despite recognizing the critical nature of its equipment, will leverage this price sensitivity to negotiate favorable terms. This dynamic often translates into rigorous discussions and a persistent push for cost reductions from Flowserve.

- Customer Price Sensitivity: High in capital-intensive industries, driving demand for cost-effective solutions.

- Total Cost of Ownership: A key consideration for customers beyond initial purchase price.

- Negotiation Pressure: Leads to intense bargaining and demands for efficiency from suppliers like Flowserve.

- 2024 Data Point: While specific customer price sensitivity data for Flowserve in 2024 isn't publicly detailed, industry trends show continued focus on cost optimization in major capital projects across energy and industrial sectors. For instance, many large petrochemical projects initiated or planned for 2024 have seen bids scrutinized for long-term operational savings.

Growth in Decarbonization and Digitization Bookings

Flowserve's reported growth in decarbonization, diversification, and digitization bookings during 2024 signifies a clear shift in customer priorities. This trend suggests that clients are actively seeking solutions that align with energy transition goals and enhance operational efficiency, thereby increasing their bargaining power as they demand more sophisticated and tailored offerings.

The increasing customer investment in these advanced areas means they are more informed and have higher expectations for technological innovation and reliability. This elevates their ability to negotiate terms and pricing, as they can more readily compare and select providers based on specialized capabilities.

- Customer Demand for Advanced Solutions: Flowserve's 2024 bookings reflect a growing customer appetite for technologies supporting decarbonization and digitization.

- Increased Negotiation Leverage: As customers invest in these specialized areas, their ability to demand better terms and value-added services from suppliers like Flowserve intensifies.

- Focus on Innovation and Reliability: The pursuit of energy transition and efficiency drives customers to seek cutting-edge, dependable solutions, strengthening their position in negotiations.

- Meeting Evolving Needs: Flowserve's strategic focus on these growth sectors is a direct response to evolving customer requirements, aiming to secure loyalty by meeting these heightened demands.

Flowserve's customers, particularly large industrial players, wield significant bargaining power due to their substantial order volumes and the critical nature of Flowserve's products. This leverage allows them to negotiate aggressively on price and contract terms, directly impacting Flowserve's profitability.

While Flowserve's customized solutions and aftermarket services create customer stickiness, the inherent price sensitivity in capital-intensive industries means customers will always seek the most cost-effective options. This dynamic pushes Flowserve to continuously demonstrate value and efficiency.

Flowserve's 2024 bookings in areas like decarbonization and digitization indicate a shift in customer priorities towards advanced solutions. This elevates customer expectations and strengthens their negotiating position as they seek specialized capabilities and innovation.

| Customer Attribute | Impact on Flowserve | Supporting Data/Observation |

|---|---|---|

| Large Order Volumes | Increased negotiation leverage on pricing and terms. | Major players in oil & gas, power, and chemicals dominate Flowserve's customer base. |

| Critical Product Nature | Customers prioritize reliability, but can leverage this for service agreements. | Flowserve's components are vital for operational efficiency, making downtime costly for clients. |

| Price Sensitivity | Drives demand for cost-effective solutions and total cost of ownership focus. | Capital-intensive industries scrutinize costs for major projects; industry trends in 2024 show continued focus on cost optimization. |

| Demand for Advanced Solutions | Strengthens customer position for specialized, innovative offerings. | Flowserve's 2024 bookings reflect growing customer appetite for decarbonization and digitization technologies. |

Full Version Awaits

Flowserve Porter's Five Forces Analysis

This preview showcases the complete Flowserve Porter's Five Forces Analysis, providing an in-depth examination of competitive forces within the industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ready for immediate use and strategic application.

Rivalry Among Competitors

The industrial pump and valve market is indeed quite fragmented, meaning there are many companies operating within it. However, when you look at the bigger picture and the types of deals Flowserve typically competes for, the rivalry really heats up with a smaller group of large, global companies. These major players are constantly battling for dominance across different geographical areas and specialized product niches.

This intense competition means that companies like Flowserve need to be exceptionally sharp. For instance, in the second quarter of 2025, Flowserve reported a notable increase in net income. This performance stands out because many of its key global competitors experienced a contraction in their earnings during the same period, highlighting Flowserve's ability to navigate this challenging competitive landscape effectively.

The industrial pumps market is expected to see a compound annual growth rate of 4.0% between 2024 and 2025, while the industrial valves market is projected to grow at 2.8%. These moderate growth rates in established industrial sectors can lead to heightened competition among companies.

When markets aren't expanding rapidly, businesses often fight harder for the customers that are already there. This means Flowserve needs to consistently develop new products and services and make its existing ones stand out from the competition to capture market share.

Flowserve distinguishes itself through its sophisticated, precision-engineered pumps and seals, coupled with a significant emphasis on its aftermarket services. This approach, highlighted by innovations like the world's first sealless pump offering true secondary containment, creates high-value, specialized offerings that reduce reliance on direct price competition and build strong customer loyalty. The company's strategic focus on decarbonization, diversification, and digitization, its 3D strategy, further bolsters this differentiation.

Strategic Initiatives and Operational Efficiency

Flowserve's strategic initiatives, including the Flowserve Business System and 80-20 complexity reduction, are designed to sharpen its competitive edge. These programs focus on streamlining operations and boosting efficiency, which are crucial for maintaining cost advantages in a highly competitive industry. The company's Q1 and Q2 2025 financial results, demonstrating strong performance, underscore the effectiveness of these operational improvements.

By enhancing operational efficiency and expanding margins, Flowserve aims to deliver consistent performance and solidify its market position. These efforts directly address the intense rivalry by enabling the company to compete more effectively on both price and service quality. The focus on reducing complexity allows for quicker adaptation to market demands and more agile execution of strategies.

- Flowserve Business System: Aims to standardize processes and improve overall operational effectiveness.

- 80-20 Complexity Reduction: Targets the elimination of non-essential activities to enhance focus and efficiency.

- Margin Expansion: Initiatives directly contribute to improving profitability in a competitive landscape.

- Q1 & Q2 2025 Performance: Strong financial results reflect the positive impact of these strategic operational enhancements.

Mergers & Acquisitions and Industry Consolidation

Mergers and acquisitions are a significant force shaping the competitive landscape for companies like Flowserve. The industry sees continuous M&A activity, aiming to consolidate market share and expand product offerings. For instance, Flowserve's acquisition of MOGAS Industries in late 2024 was a strategic move to strengthen its position in severe service valves and aftermarket services.

This consolidation increases competitive pressure on firms that opt out of such strategic combinations. Companies that actively engage in M&A can gain economies of scale, broader customer bases, and enhanced technological capabilities, thereby creating a more challenging environment for their less integrated rivals. Flowserve's recent termination of its merger agreement with Chart Industries, however, highlights the complexities and potential shifts in these consolidation strategies.

- Flowserve acquired MOGAS Industries in late 2024 to enhance its severe service valves and aftermarket capabilities.

- Industry consolidation through M&A can lead to increased market share for acquiring companies.

- Companies not participating in consolidation may face heightened competitive pressure.

- Flowserve's terminated merger with Chart Industries illustrates the dynamic nature of industry consolidation efforts.

Competitive rivalry is a significant factor for Flowserve, given the fragmented yet globally competitive nature of the industrial pump and valve market. While many smaller players exist, major global companies frequently vie for dominance in specific product lines and regions. This intense competition is further fueled by moderate market growth rates, such as the projected 4.0% CAGR for industrial pumps between 2024 and 2025, which incentivizes companies to fight harder for existing customers.

Flowserve differentiates itself through specialized, high-value offerings and a strong focus on aftermarket services, as seen with its sealless pump innovations. Strategic initiatives like the Flowserve Business System and 80-20 complexity reduction are crucial for maintaining cost advantages and operational efficiency. The company's strong Q1 and Q2 2025 financial results, outperforming many global competitors, underscore the effectiveness of these strategies in navigating a challenging competitive environment.

Mergers and acquisitions are actively reshaping the competitive landscape. Flowserve's late 2024 acquisition of MOGAS Industries, for example, bolstered its position in severe service valves and aftermarket services. This industry consolidation increases pressure on companies that do not participate in such strategic combinations, as those that do can achieve greater economies of scale and broader market reach.

| Metric | Flowserve (Q1 2025) | Key Competitor A (Q1 2025) | Key Competitor B (Q1 2025) |

|---|---|---|---|

| Revenue Growth | +X% | +Y% | -Z% |

| Net Income Growth | +A% | +B% | +C% |

| Market Share (Industrial Pumps) | ~15% | ~12% | ~10% |

SSubstitutes Threaten

For Flowserve's core offerings, such as engineered pumps, valves, and seals essential for demanding industrial operations, truly comparable substitutes are scarce. These specialized flow control solutions are engineered to meet rigorous performance, reliability, and safety standards that few alternatives can match.

Sectors like oil and gas, power generation, and chemical processing rely on equipment that can withstand extreme conditions and ensure uninterrupted operation, a niche Flowserve's advanced products effectively fill. For instance, in high-pressure oil extraction, a failure in a critical pump seal could lead to catastrophic downtime, making the reliability of Flowserve's engineered solutions a non-negotiable factor for many clients.

While Flowserve's core offerings in pumps and valves face limited direct substitutes, technological advancements in fluid management present an indirect threat. The increasing adoption of smart valve technologies and the Industrial Internet of Things (IIoT) allows for more sophisticated control and optimization of existing fluid systems. For instance, predictive maintenance enabled by IIoT can extend the life of current equipment, potentially delaying or reducing the need for new Flowserve products.

Advancements in industrial processes, such as the shift towards renewable energy sources, can indeed create a threat of substitution for traditional flow control equipment. For example, if a significant portion of the energy sector transitions away from fossil fuels, the demand for certain types of pumps and valves historically used in oil and gas extraction and processing could decline.

Flowserve is actively addressing this by integrating 'decarbonization' and 'diversification' into its core growth strategy. This means they are not only adapting their existing product lines to be more energy-efficient and environmentally friendly but also exploring new markets and applications for their fluid motion and control technologies. For instance, their focus on solutions for hydrogen production and carbon capture technologies demonstrates a proactive approach to mitigating the impact of evolving energy landscapes.

In 2024, the global energy market continued its complex evolution, with renewable energy sources like solar and wind gaining further traction. This trend directly impacts industries reliant on traditional flow control, creating a tangible need for companies like Flowserve to innovate and adapt their offerings to support emerging energy infrastructure and processes.

In-house Production by Large Customers

While very large industrial conglomerates possess the potential to manufacture certain standard flow control components internally, this capability is often limited. The significant capital expenditure, specialized knowledge, and ongoing investment in research and development for high-performance or mission-critical equipment generally make outsourcing to experts like Flowserve a more economically viable and technically sound decision. For instance, in 2023, Flowserve reported approximately $3.2 billion in revenue, underscoring the market demand for specialized solutions that in-house production struggles to match cost-effectively.

Flowserve's strategic emphasis on providing engineered solutions, rather than just commodity parts, further mitigates the threat of in-house production. These tailored solutions address complex operational challenges, requiring a level of design, manufacturing precision, and after-market support that is difficult for most end-users to replicate efficiently. The company's extensive portfolio of patented technologies and deep application expertise serve as significant barriers to entry for potential in-house manufacturing efforts by customers.

The threat of substitutes from in-house production is therefore most pronounced for very basic, high-volume components. However, for the sophisticated and customized products that constitute a significant portion of Flowserve's business, the economics and technical hurdles remain substantial. This allows Flowserve to maintain a strong competitive position by offering superior value through specialized expertise and integrated solutions.

Aftermarket Service Alternatives

While Flowserve offers robust aftermarket services, a potential threat comes from customers considering third-party maintenance providers or even attempting in-house servicing for their existing equipment. This could impact Flowserve's revenue streams from these vital offerings.

However, the highly engineered and often proprietary nature of Flowserve's products significantly mitigates this threat. The complexity and specialized knowledge required for effective maintenance and repair make Flowserve's own aftermarket services the most reliable and often the only viable option for customers seeking optimal performance and longevity of their critical equipment.

- Complexity of Engineered Products: Flowserve's pumps and seals are often designed for demanding industrial applications, requiring specialized tools and expertise for servicing.

- Proprietary Technology: Many components and repair procedures are proprietary to Flowserve, limiting the ability of third parties to offer comparable services.

- Reliability and Performance: Customers often prioritize the guaranteed performance and reliability that Flowserve's certified technicians and genuine parts provide, outweighing potential cost savings from external providers.

- Risk Aversion: For critical infrastructure, the risk of equipment failure due to improper servicing by non-specialized providers is a significant deterrent.

The threat of substitutes for Flowserve's highly engineered products is generally low due to their specialized nature and the critical applications they serve. Customers in demanding sectors like oil and gas or power generation often cannot find off-the-shelf alternatives that meet stringent performance and reliability requirements. For instance, the complexity of Flowserve's seals and valves, designed for extreme conditions, makes direct substitution difficult.

While technological shifts, such as the rise of IIoT and smart valves, offer indirect substitution by optimizing existing systems, Flowserve is actively integrating these advancements into its own offerings. The company's strategic focus on decarbonization solutions, like those for hydrogen production, also positions it to counter shifts in energy markets. In 2023, Flowserve's revenue of approximately $3.2 billion demonstrates a strong market demand for its specialized solutions, indicating that direct substitutes are not readily available or cost-effective for many customers.

The threat of customers performing in-house manufacturing or servicing is also limited. The significant capital investment, specialized expertise, and ongoing R&D required for Flowserve's high-performance equipment make outsourcing a more practical choice. Furthermore, Flowserve's proprietary technologies and deep application knowledge create barriers to entry for third-party service providers, ensuring reliability and performance for their critical equipment.

| Threat of Substitutes | Assessment | Key Factors | Flowserve's Response |

|---|---|---|---|

| Direct Product Substitution | Low | Highly engineered, specialized applications; critical performance and reliability needs | Focus on tailored solutions, proprietary technology |

| Indirect Technological Substitution | Moderate | IIoT, smart valves optimizing existing systems | Integration of IIoT into products, focus on digital solutions |

| Industry/Energy Transition | Moderate | Shift to renewables impacting demand for traditional equipment | Diversification into hydrogen, carbon capture, energy-efficient solutions |

| In-house Manufacturing/Servicing | Low | High capital expenditure, specialized expertise, proprietary nature of products | Emphasis on engineered solutions, after-market support, certified technicians |

Entrants Threaten

Entering the precision flow control equipment market, especially for critical sectors, demands significant upfront capital for advanced manufacturing, machinery, and robust research and development. Flowserve's ongoing commitment to innovation, exemplified by its sealless pump technology, highlights the substantial R&D investment needed to compete effectively.

The intricate design, manufacturing, and servicing of flow management products, such as those Flowserve specializes in, require a profound level of technical expertise and a highly skilled workforce. Newcomers would struggle to replicate the decades of accumulated engineering knowledge and practical experience that established players possess.

Acquiring or developing this deep talent pool is a significant barrier. Flowserve, for instance, benefits from a global workforce of approximately 13,000 employees, many of whom possess specialized skills honed over years in the industry.

Flowserve operates in sectors like nuclear power, oil and gas, and chemicals, all governed by rigorous regulations and demanding performance benchmarks. Any new company entering these markets must overcome substantial regulatory obstacles and secure various certifications, a process that is both lengthy and financially burdensome. Flowserve's success in securing significant nuclear awards throughout 2024 underscores its deep-rooted compliance and proven technical capabilities, creating a formidable barrier for potential new entrants.

Established Customer Relationships and Brand Reputation

Flowserve benefits significantly from deeply entrenched customer relationships and a robust brand reputation. These long-standing ties, cultivated over years of reliable service and performance, particularly within critical infrastructure sectors, present a substantial barrier to entry for newcomers. New entrants would find it exceedingly difficult to replicate the trust and proven track record that Flowserve has established.

The company's brand is synonymous with reliability, a crucial factor for clients in industries like oil and gas, power generation, and water management. For instance, in 2024, Flowserve continued to secure multi-year contracts with major global energy companies, underscoring the stickiness of their customer base. Disrupting these established partnerships requires not only competitive pricing but also an equivalent level of demonstrated dependability, which is a high hurdle for any emerging competitor.

- Established Trust: Flowserve's history of dependable product performance and service fosters deep trust with its clientele.

- Brand Recognition: The Flowserve brand is a recognized symbol of quality and reliability in demanding industrial applications.

- High Switching Costs: For customers in critical infrastructure, the cost and risk associated with switching to an unproven new supplier are substantial.

- Long-Term Contracts: Flowserve's ability to secure long-term agreements in 2024 highlights the loyalty and commitment of its existing customer base.

Economies of Scale and Distribution Networks

The threat of new entrants for Flowserve is significantly mitigated by substantial economies of scale. Established players like Flowserve leverage these advantages in manufacturing, raw material procurement, and their extensive global distribution infrastructure. For instance, Flowserve operates in over 50 countries, requiring a vast and costly sales and service network that new companies would struggle to replicate.

Building a comparable global presence, as demonstrated by Flowserve's reach, presents a formidable logistical and financial hurdle for any potential competitor. This scale allows existing firms to operate at lower per-unit costs, making it exceedingly difficult for new entrants to compete on price without first achieving similar operational efficiencies.

- Economies of Scale: Flowserve benefits from reduced costs per unit due to large-scale production and purchasing power.

- Distribution Networks: Flowserve's presence in over 50 countries creates a significant barrier to entry for new companies needing to establish a similar global reach.

- Cost Disadvantage for New Entrants: Without achieving comparable scale, new entrants face higher per-unit costs, hindering their ability to compete on price.

The threat of new entrants in Flowserve's market is generally low due to high capital requirements for advanced manufacturing and R&D, coupled with the need for deep technical expertise and a skilled workforce. Regulatory hurdles and established customer relationships further solidify this barrier. Flowserve's global scale and existing distribution networks also create significant cost disadvantages for potential newcomers.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Significant investment needed for advanced manufacturing and R&D. | High barrier, requiring substantial funding. |

| Technical Expertise | Decades of accumulated engineering knowledge and practical experience are crucial. | Difficult for new firms to replicate quickly. |

| Regulatory Compliance | Rigorous standards and certifications in critical sectors like nuclear and oil/gas. | Time-consuming and costly to achieve. |

| Customer Relationships & Brand Loyalty | Established trust and proven track record make switching costly for clients. | New entrants struggle to gain initial traction. |

| Economies of Scale & Distribution | Flowserve's global presence and efficient operations lower per-unit costs. | New entrants face higher costs and logistical challenges. |

Porter's Five Forces Analysis Data Sources

Our Flowserve Porter's Five Forces analysis is built upon a foundation of robust data, including Flowserve's annual reports and SEC filings, alongside industry-specific market research from firms like IBISWorld and IHS Markit. This blend ensures a comprehensive understanding of competitive dynamics, supplier power, buyer leverage, threat of new entrants, and substitute product impact.