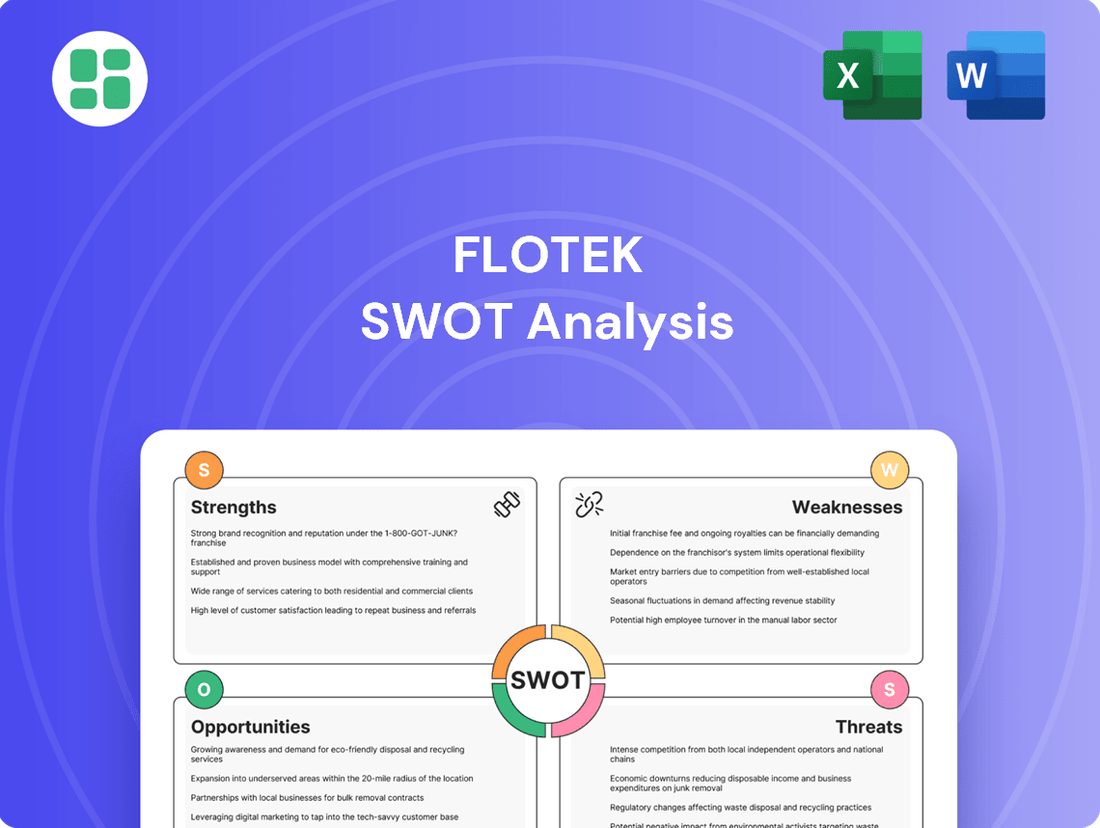

Flotek SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flotek Bundle

Flotek's current position reveals significant opportunities for growth, but also highlights critical areas needing strategic attention. Understanding these dynamics is key to navigating the competitive landscape effectively.

Want the full story behind Flotek's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Flotek Industries, Inc. leverages a distinct advantage through its specialized chemistry and data-driven solutions, catering specifically to the energy and industrial markets. This dual focus allows for a holistic approach, offering everything from essential drilling chemicals to sophisticated reservoir analytics.

The company's Q1 and Q2 2025 financial results demonstrate this strength, showing robust year-over-year increases in both its external chemistry and data analytics segments. This growth, reaching double-digit percentages in certain areas, validates the market's positive reception to Flotek's integrated service model.

Flotek has shown impressive financial strength recently. In the first quarter of 2025, the company achieved its best performance in ten years, with revenues climbing 37% compared to the previous year. Net income saw an even more dramatic increase, jumping 244%.

This marks the fifth consecutive quarter where Flotek has seen growth in its key financial indicators. This consistent upward trend highlights a positive and sustained momentum for the company.

Looking ahead, Flotek is optimistic about 2025, forecasting continued growth in both revenue and profitability. This positive outlook is supported by improvements in operational efficiency and the successful execution of strategic plans.

Flotek's strategic acquisitions are significantly broadening its market reach and diversifying its revenue streams. A key move was the April 2025 acquisition of 30 real-time gas monitoring and dual fuel optimization assets, a deal valued at $15 million. This acquisition, bolstered by a new multi-year contract, firmly establishes their Data Analytics segment within the burgeoning mobile power generation market.

This strategic expansion is crucial for reducing Flotek's dependence on the cyclical traditional oil and gas industry. By entering the mobile power generation sector, Flotek is aligning itself with the global shift towards greater energy efficiency and sustainable practices, positioning the company for growth in a rapidly evolving energy landscape.

Proprietary Technology and Intellectual Property

Flotek’s robust intellectual property portfolio, boasting over 130 patents, is a significant differentiator. This extensive patent coverage, combined with more than two decades of accumulated field and laboratory data, underpins their innovative chemical formulations and data analytics capabilities. This deep well of proprietary knowledge provides a substantial competitive moat, allowing Flotek to offer unique and highly effective solutions to its clients.

The company's commitment to innovation is evident in its continuous investment in research and development, which fuels the expansion of its IP. This strategic focus ensures that Flotek remains at the forefront of technological advancements in its sector. For instance, their recent patent filings in 2024 and early 2025 focus on sustainable chemical solutions and advanced AI-driven data interpretation, further solidifying their technological leadership.

- 130+ Patents: A testament to their innovative output and protected technologies.

- 20+ Years of Data: Extensive historical data enhances the efficacy of their solutions.

- Competitive Advantage: Proprietary technology creates a strong market position.

- Differentiated Offerings: Enables the creation of unique products and services.

Increasing International Revenue and Diversified Client Base

Flotek serves a broad and diverse client base, including major integrated oil companies, independent exploration and production firms, and various oilfield service providers. This wide reach across different customer segments provides a stable foundation for revenue.

The company has made significant strides in expanding its international presence. For instance, Flotek reported substantial growth in its international chemistry revenue, indicating successful market penetration in key global regions.

This global diversification, with particular success noted in markets like the UAE and Saudi Arabia, is crucial. It effectively mitigates the risks tied to the inherent volatility often seen in the North American oil and gas market, creating a more resilient business model.

- Diverse Clientele: Serves integrated oil companies, independents, and service providers.

- International Growth: Significant expansion of international chemistry revenue.

- Geographic Diversification: Strong presence in regions such as the UAE and Saudi Arabia.

- Risk Mitigation: Reduced reliance on the North American market.

Flotek's strengths lie in its specialized chemistry and data analytics, offering integrated solutions for energy and industrial markets. The company demonstrated exceptional financial performance in Q1 2025, marking its best quarter in a decade with a 37% revenue increase and a 244% net income jump, continuing a five-quarter growth streak.

Strategic acquisitions, like the $15 million purchase of mobile power generation assets in April 2025, are expanding its market reach and diversifying revenue, reducing reliance on the cyclical oil and gas sector. Flotek's robust intellectual property, with over 130 patents and two decades of data, provides a significant competitive advantage and underpins its innovative offerings.

| Key Strength | Description | Supporting Data/Evidence |

| Specialized Chemistry & Data Analytics | Integrated solutions for energy and industrial sectors. | Double-digit growth in external chemistry and data analytics segments in Q1/Q2 2025. |

| Strong Financial Performance | Consistent revenue and profit growth. | Best performance in 10 years in Q1 2025: +37% revenue, +244% net income. Fifth consecutive quarter of growth. |

| Strategic Acquisitions & Diversification | Expansion into new markets like mobile power generation. | April 2025: $15 million acquisition of 30 real-time gas monitoring and dual fuel optimization assets. |

| Robust Intellectual Property | Over 130 patents and extensive historical data. | Proprietary technology creates a strong competitive moat and differentiated offerings. |

What is included in the product

Delivers a strategic overview of Flotek’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses and threats, thereby alleviating planning paralysis and uncertainty.

Weaknesses

Flotek's significant reliance on the energy sector, despite diversification efforts, remains a key weakness. This linkage means the company is highly sensitive to the volatile price swings of crude oil and natural gas. For instance, in 2023, the average Brent crude oil price fluctuated significantly, impacting upstream spending and, consequently, demand for Flotek's products and services.

While acquisitions can fuel growth, they demand substantial investment and can be tricky to manage. Flotek's purchase of power-generating assets for $105 million, funded by stock and debt, highlights this, potentially stretching finances and creating integration hurdles. The success of these deals truly depends on how well Flotek can merge operations and cultures afterward.

The oil and gas sector faces significant headwinds from growing environmental, social, and governance (ESG) concerns. Investors, regulators, and the public are increasingly scrutinizing companies' sustainability practices. This broader industry pressure can cast a shadow over even companies like Flotek, which are actively pursuing greener solutions.

Flotek's core business, despite its focus on sustainable technologies, remains tied to the fossil fuel industry. This association can lead to negative investor sentiment, potentially impacting its stock valuation and limiting access to capital from ESG-focused investment funds. For instance, as of early 2024, many large institutional investors have divested from traditional oil and gas holdings, prioritizing companies with demonstrably lower carbon footprints.

Intense Competition in Niche Markets

Flotek navigates highly specialized segments within the oilfield chemicals and energy data analytics sectors. This means they contend with significant competition, not only from large, established companies but also from other agile, specialized technology providers. Maintaining a competitive edge demands ongoing investment in innovation and research and development.

The intense rivalry in these niche markets puts pressure on Flotek's market share and profitability. For instance, in the oilfield chemicals segment, major players often have greater economies of scale, allowing for more aggressive pricing. Similarly, in data analytics, the rapid pace of technological advancement means companies must constantly upgrade their platforms to remain relevant.

- Intense Competition: Flotek faces strong competition from both large industry incumbents and other specialized technology firms in its core markets.

- Need for Continuous Innovation: The dynamic nature of the oilfield services and data analytics sectors requires constant R&D investment to stay ahead.

- Pressure on Pricing and Market Share: Competitors' scale and technological advancements can impact Flotek's pricing power and ability to capture market share.

Reliance on Related-Party Revenues

Flotek's reliance on related-party revenues, particularly the historical dependence on agreements like the one with ProFrac Services, LLC, presents a significant weakness. While external chemistry revenue has shown strong growth, this concentration risk remains. Any shifts in the ProFrac relationship or contract terms could directly affect revenue stability.

- Concentration Risk: A substantial portion of chemistry revenue has been tied to related-party transactions, creating vulnerability to changes in those specific relationships.

- Historical Dependence: Past financial reporting indicates a notable percentage of revenue stemming from these related-party agreements, highlighting a persistent structural issue.

- Potential for Disruption: Alterations in the supply agreement with ProFrac Services, LLC, for example, could lead to unpredictable impacts on Flotek's top line.

Flotek's dependence on the oil and gas industry makes it vulnerable to commodity price volatility. For instance, in the first quarter of 2024, fluctuating natural gas prices directly impacted exploration and production budgets, affecting demand for Flotek's specialty chemicals and services.

Integrating acquired businesses can be challenging and costly. Flotek's acquisition strategy, while aiming for growth, carries inherent risks related to operational synergy and financial strain, as seen in past integration efforts that required significant capital outlay.

The company faces intense competition in specialized markets, requiring continuous investment in research and development to maintain its edge. For example, in the data analytics sector, rapid technological advancements necessitate ongoing platform upgrades to stay relevant against agile competitors.

Flotek's historical reliance on related-party revenue, particularly from agreements like those with ProFrac Services, LLC, creates concentration risk. Changes in these specific contractual relationships could significantly impact revenue stability, as demonstrated by past revenue streams tied to these arrangements.

What You See Is What You Get

Flotek SWOT Analysis

The preview you see is the actual Flotek SWOT analysis document you’ll receive upon purchase. This ensures you know exactly what you're getting—a professionally crafted and comprehensive report. Unlock the full, detailed analysis immediately after completing your purchase.

Opportunities

Flotek's strategic acquisition of mobile power generation assets and related technology in 2024 opens a clear path to diversify revenue streams. This expansion allows the company to leverage its data analytics and specialized solutions into broader industrial and commercial markets, moving beyond its historical reliance on the oil and gas industry.

This diversification strategy is crucial for growth, enabling Flotek to tap into new revenue streams. For instance, the company can now offer its proprietary technology for applications in sectors like manufacturing, logistics, and even renewable energy support, potentially capturing market share in these rapidly expanding areas.

The energy sector's increasing reliance on smart grids, IoT, and AI is fueling a significant expansion in the big data analytics market. This trend is expected to see continued robust growth through 2025 and beyond.

Flotek's established data analytics capabilities, which have demonstrated impressive revenue increases, place it advantageously to leverage this market opportunity. The company can offer solutions designed to boost efficiency and improve decision-making for energy companies navigating this data-rich environment.

The growing global focus on sustainability and tightening environmental rules in the energy sector present a significant opportunity for Flotek's green chemistry and data-driven offerings. This trend is amplified by increasing investor demand for ESG-compliant investments, with sustainable funds projected to reach $50 trillion globally by 2025, according to Bloomberg Intelligence.

Flotek can seize this by advancing eco-friendly chemical formulations and sophisticated emission monitoring technologies. For instance, the company's patented chemistries aim to reduce volatile organic compound (VOC) emissions, a key area of regulatory scrutiny. The company's data analytics platform also aids in optimizing operations for reduced environmental impact, aligning with the industry's push for cleaner energy production.

Global Market Penetration and Strategic Partnerships

Flotek's extensive global reach, spanning over 59 countries, presents a significant opportunity for deeper market penetration. This is particularly true in emerging economies with growing energy demands or those actively shifting towards cleaner energy sources. For instance, regions in Southeast Asia and parts of Africa are showing robust oil and gas exploration activity, offering fertile ground for Flotek's specialized chemistries and technologies.

Strategic partnerships are key to unlocking this global potential. Collaborating with local players can provide invaluable market insights, regulatory navigation, and established distribution networks. Consider the potential for joint ventures with national oil companies or technology firms in regions like the Middle East, where customized solutions are often required to meet specific operational challenges and environmental standards. Such alliances can significantly reduce market entry barriers and accelerate revenue growth.

Flotek can leverage its existing infrastructure and expertise to tailor offerings for diverse international markets. This includes adapting product formulations and service models to meet local environmental regulations and economic conditions. The company's 2024 focus on expanding its presence in key growth markets, such as those identified by Rystad Energy's projections for increased upstream investment, underscores this strategic direction.

- Global Reach: Operations in over 59 countries provide a foundation for expansion.

- Emerging Markets: Opportunities exist in regions with increasing oil and gas activity or energy transition initiatives.

- Strategic Alliances: Partnerships with local entities can facilitate market entry and customization.

- Tailored Solutions: Adapting products and services to meet specific regional needs is crucial for success.

Enhanced Oil Recovery (EOR) and Production Optimization

The persistent global demand for crude oil, especially with the growing challenge of extracting from mature and unconventional fields, creates a substantial market for advanced oilfield chemicals and production enhancement. Flotek's expertise in specialized chemistry and reservoir intelligence aligns perfectly with the needs of enhanced oil recovery (EOR) projects, presenting a clear path to delivering solutions that boost hydrocarbon recovery and operational efficiency.

The market for EOR technologies is projected to expand significantly. For instance, global EOR market size was valued at approximately $26.2 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of around 7.5% from 2024 to 2030, reaching an estimated $44.5 billion by 2030. This growth trajectory underscores the opportunity for companies like Flotek to leverage their offerings.

- Increased Hydrocarbon Recovery: Flotek's EOR chemical solutions can help unlock an additional 10-20% of oil from mature reservoirs, directly addressing the need for maximizing production from existing assets.

- Operational Efficiency Gains: By optimizing fluid flow and reducing water cut, Flotek's technologies can lead to substantial cost savings and improved operational performance for EOR projects.

- Addressing Complex Reservoirs: The company's reservoir intelligence services provide critical data for designing and implementing effective EOR strategies in increasingly complex geological formations.

- Market Growth Potential: The expanding EOR market, driven by sustained oil demand and declining conventional production, offers a robust environment for Flotek to capture market share with its specialized solutions.

Flotek's strategic diversification into mobile power generation and its established expertise in data analytics position it to capitalize on the growing demand for smart energy solutions. The company's ability to offer integrated technology and services across various industrial sectors, including manufacturing and logistics, presents a significant avenue for revenue expansion beyond its traditional oil and gas focus.

The energy sector's increasing adoption of AI and IoT is driving substantial growth in big data analytics, a market expected to continue its robust expansion through 2025. Flotek's proven data analytics capabilities, which have already shown impressive revenue increases, are well-suited to meet this demand, offering solutions that enhance efficiency and decision-making for energy companies.

Flotek's global presence in over 59 countries provides a strong base for deeper market penetration, particularly in emerging economies with rising energy needs or those transitioning to cleaner energy sources. Strategic alliances with local partners can accelerate market entry and customization, allowing Flotek to effectively navigate diverse regional demands and regulations.

The persistent global demand for oil, coupled with the increasing complexity of extraction from mature fields, creates a substantial market for Flotek's specialized chemicals and production enhancement technologies, especially in enhanced oil recovery (EOR). The EOR market, valued at approximately $26.2 billion in 2023, is projected to grow significantly, offering a prime opportunity for Flotek to leverage its expertise.

| Opportunity | Description | Market Data/Projection |

| Diversification into Mobile Power Generation | Leveraging data analytics and specialized solutions for broader industrial and commercial markets. | Expansion into manufacturing, logistics, and renewable energy support sectors. |

| Big Data Analytics in Energy | Providing solutions to enhance efficiency and decision-making for energy companies. | Energy sector's increasing reliance on smart grids, IoT, and AI fuels robust market growth through 2025. |

| Global Market Penetration | Expanding presence in emerging economies and regions with energy transition initiatives. | Operations in 59 countries; strategic alliances with local entities to facilitate market entry. |

| Enhanced Oil Recovery (EOR) Solutions | Offering specialized chemistry and reservoir intelligence to boost hydrocarbon recovery. | EOR market valued at ~$26.2 billion in 2023, projected to grow at a CAGR of ~7.5% from 2024-2030. |

Threats

Fluctuations in global crude oil and natural gas prices present a substantial threat to Flotek's financial performance. For instance, during periods of depressed oil prices, such as those seen in late 2023 and early 2024 where West Texas Intermediate (WTI) crude oscillated between $70 and $80 per barrel, exploration and production (E&P) companies tend to curtail their capital spending.

This reduction in E&P investment directly dampens demand for Flotek's core offerings, including drilling, cementing, stimulation, and production enhancement chemicals and services. The unpredictable nature of these commodity price swings can lead to volatile business cycles for the company, making revenue and profit forecasting more challenging.

Flotek faces significant challenges from increasingly stringent environmental regulations. For instance, evolving methane emission standards in the oil and gas sector, a key market for Flotek, could mandate costly operational changes for their clients, indirectly impacting demand for Flotek's services and products.

These policy shifts, including stricter controls on water usage and chemical disposal, necessitate substantial R&D investments for Flotek to adapt its product portfolio. Such adaptation could strain profitability and diminish market competitiveness if competitors are quicker to innovate or if compliance costs become prohibitive.

Flotek operates in highly competitive arenas, facing pressure from both established giants and agile startups in oilfield chemicals and energy data analytics. Competitors frequently launch superior, cheaper, or disruptive technologies, posing a constant threat to Flotek's market position. For instance, in 2023, the global oilfield chemicals market was valued at approximately $35 billion, with significant growth projected, indicating ample room for competitive maneuvering and innovation.

Economic Downturns Affecting Industrial Spending

Economic downturns pose a significant threat by potentially curbing industrial spending across multiple sectors. A broad recession could lead to reduced capital expenditures, impacting Flotek's diverse client base beyond just the energy sector. This decreased industrial activity can translate into lower demand for Flotek's chemistry and data solutions, thereby affecting overall revenue. For instance, if industrial production indices, like the Federal Reserve's Industrial Production Index, show a significant year-over-year decline in late 2024 or early 2025, it would signal a challenging environment for Flotek's customers.

Such economic headwinds can directly impact Flotek's financial performance.

- Reduced Capital Expenditure: Industrial clients may postpone or cancel projects, directly lowering demand for Flotek's offerings.

- Lowered Demand for Solutions: A general slowdown in manufacturing and industrial output means less need for specialized chemistry and data analytics.

- Revenue Stream Impact: Decreased client activity and project pipelines can lead to a direct reduction in Flotek's revenue streams.

- Increased Competition for Scarce Budgets: During downturns, clients become more price-sensitive, intensifying competition for available spending.

Supply Chain Vulnerabilities and Cost Increases

Flotek's reliance on intricate global supply chains presents a significant threat. Disruptions stemming from geopolitical tensions, trade policy shifts, or natural calamities can lead to heightened material expenses and logistical hurdles. For instance, the semiconductor shortage that impacted numerous industries in 2021-2022, with some sectors experiencing lead time extensions of over 50 weeks, highlights the potential for widespread supply chain disruptions that could affect Flotek's access to critical components or raw materials.

These vulnerabilities directly translate into increased costs for Flotek, potentially squeezing profit margins. The company's operational efficiency could also be compromised by delays in product delivery, impacting its ability to meet customer demand promptly. In 2023, the chemical industry, in general, saw raw material costs fluctuate significantly, with some key inputs experiencing double-digit percentage increases year-over-year, a trend that could continue to pressure Flotek's cost of goods sold.

- Supply Chain Dependency: Flotek's operations are tied to a complex network of global suppliers for essential raw materials and components.

- Geopolitical and Environmental Risks: International conflicts, trade wars, and extreme weather events pose direct threats to the continuity and cost-effectiveness of these supply chains.

- Cost Inflation: Disruptions can trigger sharp increases in material prices and shipping costs, directly impacting Flotek's profitability.

- Operational Delays: Bottlenecks in the supply chain can lead to production slowdowns and delayed product deliveries, affecting customer satisfaction and revenue.

Flotek faces intense competition from established players and emerging companies in both its chemical and data analytics segments. The oilfield services market, for example, saw significant consolidation in 2023 and early 2024, intensifying pressure on smaller providers. Competitors often leverage proprietary technologies or economies of scale, which can lead to pricing advantages or superior product performance, directly challenging Flotek's market share.

The company's financial health is intrinsically linked to the volatile pricing of crude oil and natural gas. A sustained downturn in commodity prices, such as the period in late 2023 and early 2024 where WTI crude hovered between $70-$80 per barrel, typically leads E&P companies to reduce capital expenditures, directly impacting demand for Flotek's products and services. This price sensitivity creates a challenging environment for predictable revenue generation.

Increasingly stringent environmental regulations pose a significant threat, potentially requiring substantial investment in R&D to adapt product lines and operational processes. For instance, evolving methane emission standards in the energy sector could necessitate costly upgrades for Flotek's clients, indirectly affecting demand for their offerings. Compliance costs and the need for continuous innovation to meet evolving standards can strain profitability and competitiveness.

Economic downturns present a broad risk, as reduced industrial activity and capital spending across various sectors can dampen demand for Flotek's chemistry and data solutions. A decline in industrial production indices, like the Federal Reserve's Industrial Production Index, would signal a challenging environment for Flotek's diverse client base, impacting overall revenue streams.

SWOT Analysis Data Sources

This Flotek SWOT analysis is built upon a foundation of robust data, including the company's official financial filings, comprehensive market research reports, and expert industry commentary. These sources provide a well-rounded view of Flotek's operational landscape and competitive positioning.