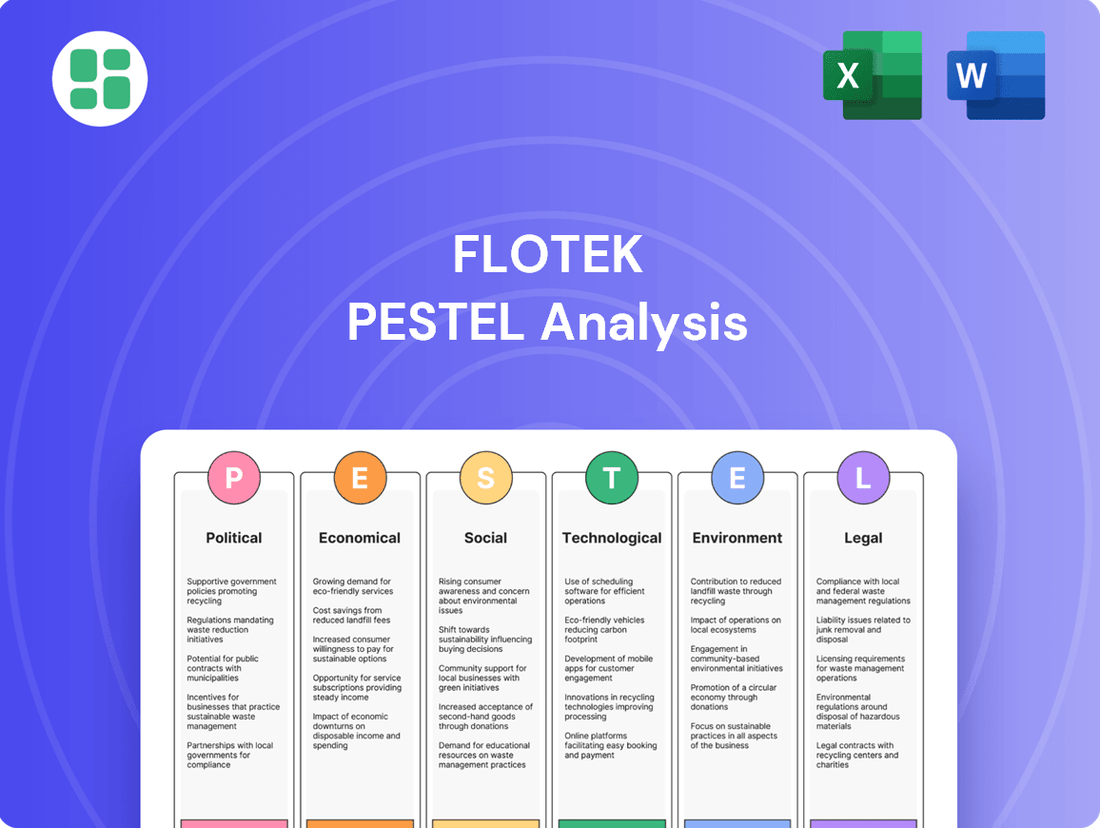

Flotek PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flotek Bundle

Navigate the complex external forces shaping Flotek's destiny with our comprehensive PESTLE Analysis. Uncover critical political, economic, social, technological, legal, and environmental factors that influence its operations and strategic direction. Equip yourself with actionable intelligence to anticipate challenges and capitalize on emerging opportunities. Purchase the full analysis now for a strategic advantage.

Political factors

The energy sector, including companies like Flotek Industries, operates within a complex web of government regulations. For instance, the U.S. Environmental Protection Agency’s (EPA) new methane emission standards, known as NSPS OOOOb/c, finalized in March 2024, are a significant development. These rules necessitate the adoption of advanced technologies for leak detection and repair, which will incur compliance costs but also spur technological advancements in emissions control.

Further regulatory shifts are anticipated, with ongoing discussions around proposed amendments to these standards. These potential changes could impact monitoring requirements for flares and might even influence compliance deadlines, creating a dynamic operational landscape for Flotek.

State-level legislation also plays a crucial role. California's Senate Bill 1137, for example, imposes restrictions on oil and gas operations near sensitive areas, compelling companies like Flotek to adapt their operational strategies or consider relocation to ensure compliance.

Global geopolitical tensions, exemplified by the ongoing Israel/Iran conflict in June 2025, directly influence oil prices and energy trade routes. This volatility creates an unpredictable market environment, impacting the operational costs and investment decisions of Flotek's clientele, thereby affecting demand for its services.

Governments globally are intensifying their focus on energy security. This strategic shift translates into policies favoring domestic oil and gas production and the adoption of enhanced oil recovery (EOR) techniques, potentially boosting demand for Flotek's specialized chemistry solutions.

Changes in international trade policies, including the imposition of new tariffs, add complexity to cross-border investment and demand planning for the energy sector. For instance, the U.S. imposed tariffs on steel and aluminum imports in 2018, impacting the cost of materials for energy infrastructure projects. These shifts can create both opportunities and challenges for companies like Flotek, depending on their supply chain and market exposure.

Permitting Reform and Bureaucracy

Legislative efforts like the Energy Permitting Reform Act, introduced in July 2024, are designed to expedite energy project approvals. This act proposes setting deadlines for judicial reviews and prioritizing federal land projects, potentially reducing project timelines significantly.

A streamlined permitting process directly benefits companies like Flotek by accelerating drilling and production activities. This acceleration translates into increased demand for Flotek's specialized chemistry and data analytics solutions, which are crucial for optimizing these operations.

- Energy Permitting Reform Act: Introduced July 2024, aims to speed up approvals.

- Impact on Flotek: Faster project timelines boost demand for chemistry and data services.

- Economic Indicator: Reduced permitting times can lead to increased upstream investment.

Future US Energy Policy Direction

The direction of US energy policy is a critical political factor for Flotek, heavily influenced by election outcomes. A potential second Trump presidency, for instance, could signal a significant pivot, potentially reversing current climate initiatives and environmental regulations. This could translate to more aggressive development of domestic oil and gas resources, including on federal lands, and the lifting of existing moratoriums on liquefied natural gas (LNG) exports.

Such policy shifts introduce considerable uncertainty for the energy sector, but they also present distinct opportunities. For companies like Flotek, which provides chemistry solutions for the oil and gas industry, a more favorable regulatory environment could stimulate demand for their services. For example, if policies encourage increased drilling and production, Flotek's revenue streams tied to these activities would likely see a boost.

The 2024 US presidential election results will be a key determinant. If policies favoring fossil fuel expansion are enacted, it could directly impact Flotek's market. Conversely, a continuation or strengthening of policies promoting renewable energy would necessitate different strategic adjustments for the company.

- Election Outcomes: Potential shifts in administration, such as a second Trump presidency, could lead to substantial changes in US energy policy.

- Policy Reversals: Expect possible reversals of climate and environmental regulations, alongside expanded oil and gas development.

- LNG Exports: A lifting of pauses on LNG exports could significantly alter global energy markets and Flotek's opportunities.

- Market Uncertainty: These potential policy changes create uncertainty but also offer opportunities for traditional energy sector participants.

Government policies significantly shape the energy sector. The U.S. Environmental Protection Agency's finalized methane emission standards in March 2024, for example, mandate advanced leak detection technologies, influencing operational costs and driving innovation for companies like Flotek.

Legislative actions, such as the Energy Permitting Reform Act introduced in July 2024, aim to expedite project approvals, potentially increasing demand for Flotek's services by accelerating upstream activities.

Geopolitical events and evolving energy security strategies globally, like the focus on domestic production and enhanced oil recovery, directly impact oil prices and create demand for specialized solutions that Flotek offers.

The outcome of the 2024 US presidential election is a critical political factor, with potential policy shifts impacting regulations on fossil fuel development and renewable energy initiatives, creating both uncertainty and opportunity for Flotek.

What is included in the product

The Flotek PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Flotek's PESTLE Analysis provides a structured framework that alleviates the pain of scattered information, offering a consolidated view of external factors impacting business strategy.

Economic factors

Fluctuations in crude oil and natural gas prices directly impact the profitability and investment decisions of Flotek's client base, including integrated oil companies and independent E&P firms.

While 2024 saw relatively stable Brent crude prices, ranging from $74 to $90 per barrel, future volatility due to OPEC+ actions or geopolitical events remains a key economic factor. For instance, the potential for supply disruptions in 2025, coupled with evolving demand patterns, could lead to significant price swings, influencing exploration and production budgets.

The global market for chemical Enhanced Oil Recovery (EOR/IOR) is set for substantial growth, expected to climb from $18.86 billion in 2025 to $36.86 billion by 2034. This expansion is fueled by the increasing necessity to boost oil extraction from older, more established oil fields.

This upward trend in EOR/IOR directly supports Flotek, as the company's advanced chemical formulations and data analysis services are vital for optimizing production within these mature reservoirs.

The oil and gas sector is experiencing a significant upswing in capital expenditures, a trend that bodes well for companies like Flotek. Oilfield services, in particular, saw their strongest performance in 34 years during the 2023-2024 period, indicating robust financial health and a willingness to invest. This positive investment climate, driven by a focus on projects yielding high returns and a disciplined approach to capital allocation, points to sustained demand for Flotek's specialized solutions.

Inflation and Cost Pressures

Rising inflation and escalating operational costs present a significant challenge for Flotek, directly impacting its profitability. For instance, in the second quarter of 2025, while the company experienced robust revenue growth, its net income saw a decline. This reduction was attributed, in part, to these persistent cost pressures, compounded by expenses related to acquisitions.

Effective cost management is therefore paramount for Flotek to sustain healthy profit margins. The company demonstrated this capability in 2024 by successfully reducing costs associated with freight, logistics, and materials. This proactive approach to cost control is vital in navigating the current economic climate.

- Inflationary Impact: Rising costs for raw materials, energy, and labor directly squeeze Flotek's operating margins.

- Q2 2025 Performance: Despite revenue increases, net income was negatively affected by cost pressures and acquisition-related spending.

- Cost Management Success: Flotek's 2024 efforts to lower freight, logistics, and material expenses highlight the importance of operational efficiency.

- Profitability Focus: Maintaining profitability requires continuous vigilance and strategic initiatives to offset increasing operational expenditures.

Mergers and Acquisitions in the Energy Sector

The energy sector is experiencing significant consolidation, with mergers and acquisitions (M&A) a key feature in 2024 and projected to continue into 2025. This trend is particularly pronounced in oilfield services and midstream operations. Companies are actively pursuing deals to gain economies of scale, realize cost synergies, and overcome logistical challenges inherent in the industry.

Flotek's strategic moves, including its acquisition of mobile power generation assets in April 2025, directly align with this industry-wide consolidation. These acquisitions are crucial for Flotek's expansion, aiming to diversify revenue streams and strengthen its market position amid a dynamic energy landscape.

- Industry Consolidation Drives Efficiency: The drive for scale and synergy realization is a primary motivator for M&A in the energy sector.

- Logistical Advantages: Mergers can help overcome complex logistical hurdles, improving operational efficiency.

- Flotek's Strategic Acquisitions: Flotek's April 2025 acquisition of mobile power generation assets exemplifies this trend.

- Revenue Diversification: Such strategic moves are vital for Flotek's growth and revenue stream diversification.

Economic factors significantly shape Flotek's operating environment, with oil and gas price volatility being a primary concern. While Brent crude prices saw a range of $74-$90 per barrel in 2024, potential supply disruptions in 2025 and shifting demand patterns could lead to price swings. The burgeoning global market for chemical Enhanced Oil Recovery (EOR/IOR), projected to grow from $18.86 billion in 2025 to $36.86 billion by 2034, presents a substantial opportunity for Flotek's specialized solutions aimed at optimizing production in mature fields.

| Economic Factor | 2024/2025 Data/Trend | Impact on Flotek |

|---|---|---|

| Crude Oil Prices (Brent) | $74-$90/barrel (2024 range) | Influences client investment in exploration and production. |

| EOR/IOR Market Growth | $18.86B (2025) to $36.86B (2034) | Directly benefits Flotek's chemical formulations and data services. |

| Capital Expenditures (Oilfield Services) | Strongest performance in 34 years (2023-2024) | Indicates robust client spending and demand for Flotek's solutions. |

| Inflation/Operational Costs | Rising costs impacting net income (Q2 2025) | Pressures profitability, necessitating effective cost management. |

Preview Before You Purchase

Flotek PESTLE Analysis

The preview shown here is the exact Flotek PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It provides a comprehensive overview of the factors influencing Flotek's business environment.

The content and structure shown in the preview is the same Flotek PESTLE Analysis document you’ll download after payment, offering actionable insights.

Sociological factors

Public perception of the oil and gas industry is shifting significantly, with a growing demand for cleaner energy and reduced environmental footprints. This trend puts pressure on companies to adapt. For instance, a 2024 survey indicated that over 60% of consumers believe fossil fuel companies should invest more in renewable energy.

Flotek's strategic emphasis on 'green chemistry' and developing solutions that minimize environmental impact positions it favorably amidst these evolving societal expectations. By highlighting its commitment to sustainability, Flotek can attract environmentally conscious investors and customers, potentially differentiating itself in a market increasingly focused on ESG (Environmental, Social, and Governance) factors.

Societal demand for sustainable and eco-friendly solutions is rapidly increasing across all sectors, particularly in energy. Consumers and businesses alike are actively seeking out products and services that minimize environmental impact, driving a significant market shift.

Flotek's strategic focus on green chemistry and technologies designed to lessen the environmental footprint of energy production directly aligns with this growing societal preference. This positions the company favorably to capture clients who prioritize sustainability in their operations.

For instance, the global renewable energy market, a key beneficiary of this shift, was valued at approximately $1.3 trillion in 2023 and is projected to reach over $2.5 trillion by 2030, indicating substantial growth driven by these sociological factors.

The energy sector, including companies like Flotek, is grappling with a significant talent shortage. As the industry pivots towards cleaner energy sources and integrates advanced technologies such as AI and machine learning, the demand for specialized skills in areas like data analytics and advanced chemistry is soaring. This makes attracting and retaining individuals with these unique capabilities a critical challenge for sustained innovation and effective service provision.

Community Engagement and Social License to Operate

Flotek's commitment to community engagement is crucial for its social license to operate. The energy sector faces growing scrutiny, demanding tangible positive contributions to local communities. Flotek's focus on collaborative partnerships and minimizing environmental impact, including on land, air, water, and people, directly addresses these expectations, fostering trust among its stakeholders.

This proactive approach is reflected in Flotek's operational philosophy. For instance, in 2023, the company highlighted its efforts to support local economies through job creation and sourcing from regional suppliers, aiming to create a net positive impact. These initiatives are vital for maintaining stakeholder goodwill and ensuring long-term operational stability.

- Community Investment: Flotek actively participates in local initiatives, contributing to community development projects.

- Environmental Stewardship: The company's strategies are designed to reduce its ecological footprint, a key factor in social acceptance.

- Stakeholder Dialogue: Open communication channels with local communities and regulatory bodies are maintained to address concerns and build relationships.

- Economic Contribution: Flotek's operations aim to generate local employment and support regional businesses, enhancing its social license.

Consumer and Investor Demand for ESG Performance

Growing investor and consumer interest in Environmental, Social, and Governance (ESG) performance is a significant sociological factor. Globally, there's a clear trend of individuals and institutions demanding that companies demonstrate strong ESG credentials, influencing investment decisions and purchasing habits. This shift is driving the need for transparent reporting and tangible action on sustainability and ethical practices.

Flotek's strategic direction, emphasizing sustainable chemistry and data analytics for emissions monitoring, directly addresses this escalating demand. By providing solutions that help clients measure and reduce their environmental impact, Flotek positions itself to capture market share within the burgeoning ESG-conscious economy. For example, the global sustainable chemicals market was valued at approximately $180 billion in 2023 and is projected to reach over $300 billion by 2030, showcasing substantial growth potential.

- Increased Investor Scrutiny: Institutional investors, managing trillions in assets, are increasingly integrating ESG factors into their due diligence, with ESG-focused funds seeing significant inflows. In 2024, sustainable investment assets under management are expected to continue their upward trajectory, surpassing previous years' figures.

- Consumer Preference for Sustainable Brands: Consumers are more likely to support brands that align with their values, leading to a preference for products and services with a demonstrable positive environmental and social impact. Surveys from 2024 indicate that a majority of consumers consider sustainability when making purchasing decisions.

- Regulatory and Policy Tailwinds: Governments worldwide are implementing policies and regulations that encourage or mandate ESG reporting and sustainable business practices, further reinforcing the importance of ESG performance for companies like Flotek.

- Demand for Data-Driven ESG Solutions: The need for accurate, verifiable data to support ESG claims is paramount, creating opportunities for companies offering advanced analytics and monitoring technologies. Flotek's data analytics capabilities are crucial in meeting this demand.

Societal expectations are increasingly prioritizing environmental responsibility and ethical business practices within the energy sector. This shift influences consumer choices and investor decisions, pushing companies to demonstrate a commitment to sustainability.

Flotek's focus on green chemistry and its data analytics capabilities for emissions monitoring align directly with these evolving societal demands. The company's ability to offer solutions that help clients reduce their environmental impact is a key differentiator.

The growing demand for sustainable products and services is evident in market growth, with the global sustainable chemicals market projected to exceed $300 billion by 2030. This trend highlights a significant opportunity for companies like Flotek that offer eco-friendly solutions.

Companies demonstrating strong ESG performance are attracting more investment. In 2024, ESG-focused funds continue to see substantial inflows, indicating a clear investor preference for businesses with positive environmental and social impacts.

| Sociological Factor | Impact on Flotek | Supporting Data/Trend |

|---|---|---|

| Environmental Consciousness | Increased demand for sustainable solutions; pressure to reduce environmental footprint. | Global sustainable chemicals market projected to reach over $300 billion by 2030. |

| ESG Investment Focus | Attracts environmentally conscious investors and customers; enhances brand reputation. | ESG funds experiencing significant inflows in 2024, reflecting growing investor scrutiny. |

| Talent Acquisition | Need for specialized skills in green chemistry, data analytics, and AI. | Energy sector facing a talent shortage, particularly in advanced technology and sustainability roles. |

| Community Relations | Importance of social license to operate through positive community engagement. | Flotek's initiatives in 2023 highlighted local job creation and regional supplier support. |

Technological factors

Flotek's commitment to technological advancement is clearly demonstrated by its Data Analytics segment, which includes the JP3 and Verax analyzers. This area is proving to be a substantial engine for growth, with revenue surging by an impressive 189% in the second quarter of 2025 when compared to the same period in 2024.

These advanced analytical tools are crucial for industries like oil and gas, offering real-time data essential for precise process control, accurate custody transfer, and effective flare monitoring. Such capabilities allow clients to not only optimize their operational efficiency but also to ensure robust compliance with evolving regulatory landscapes.

The broader oil and gas sector is increasingly embracing artificial intelligence (AI) as a means to enhance operational performance and meet stringent regulatory requirements. This industry-wide trend underscores the strategic importance of Flotek's AI-driven solutions.

Technological advancements in chemical Enhanced Oil Recovery (EOR) are significantly boosting the market. Innovations like nano-surfactants and smart polymers are making EOR more efficient and eco-friendly. These developments are crucial for maximizing oil extraction from existing reservoirs.

Flotek's deep expertise in chemistry-based technologies positions it perfectly to capitalize on these EOR innovations. The company's ability to develop and deploy advanced chemical solutions directly translates into higher oil recovery rates for its clients. Furthermore, these cutting-edge chemicals often require reduced volumes, leading to cost savings and a smaller environmental footprint.

The global EOR market, including chemical EOR, was valued at approximately $20 billion in 2023 and is projected to grow steadily. Specifically, the chemical EOR segment is expected to see robust expansion driven by the demand for more sustainable and effective recovery methods. Flotek's contribution through its proprietary chemistries aligns with this market trend, enhancing operational efficiency for oil producers.

Flotek's commitment to green chemistry, particularly in developing bio-based Enhanced Oil Recovery (EOR) chemicals, positions it favorably. These solutions aim to lessen the environmental footprint for hydrocarbon producers while ensuring effective oil recovery. This strategic focus directly addresses the growing industry demand for sustainable and eco-friendly chemical formulations.

Real-time Monitoring and Digitalization

The energy sector's move toward real-time data and digitalization is a game-changer. This shift is essential for boosting profits, cutting expenses, and making operations more automatic. Flotek is well-positioned with its data analytics, especially its EPA-approved JP3 system, which accurately measures flare emissions. This technology helps companies meet regulations and improve how they run.

Flotek's JP3 system is a prime example of how technological advancements are enabling better environmental compliance and operational oversight in the energy industry. By providing near real-time data on emissions, it allows for immediate adjustments to processes, preventing costly non-compliance issues and optimizing resource utilization.

- Real-time emission monitoring: Flotek's JP3 system offers continuous, precise measurement of flare gas composition and flow rates, crucial for environmental reporting and operational adjustments.

- Digitalization of operations: The integration of digital technologies allows for automated data collection, analysis, and reporting, reducing manual effort and potential errors.

- Cost reduction and efficiency gains: By enabling better process control and compliance, these technologies directly contribute to lower operating costs and improved overall efficiency.

- Enhanced regulatory compliance: The JP3 system's EPA approval underscores its capability to meet stringent environmental standards, a growing necessity in the energy sector.

Mobile Power Generation and Optimization Technologies

Flotek's strategic acquisition of mobile gas conditioning assets in April 2025 signals a significant move into mobile power generation. This technology is designed to optimize fuel consumption for mobile power generators, a crucial development given the increasing demand for efficient and sustainable energy solutions. By enabling dual-fuel optimization, these systems can adapt to available fuel sources, enhancing operational flexibility and cost-effectiveness.

The ability of these mobile units to reduce emissions is particularly relevant. The industrial sector is under growing pressure to meet stricter environmental regulations and achieve sustainability goals. Technologies that facilitate cleaner energy production, even in mobile applications, are therefore highly valued. For instance, advancements in this area could see a reduction in greenhouse gas emissions by up to 15% for certain mobile generator applications, according to industry projections for 2025.

- Dual Fuel Capability: Enhances operational flexibility and cost savings by allowing generators to switch between fuel sources.

- Emission Reduction: Addresses environmental concerns and regulatory compliance through optimized combustion.

- Energy Efficiency: Maximizes power output while minimizing fuel usage, leading to operational cost reductions.

- Market Demand: Aligns with the growing industry need for portable, efficient, and environmentally conscious power solutions.

Flotek's technological advancements are a significant growth driver, particularly in its Data Analytics segment, where revenue saw a substantial 189% increase in Q2 2025 compared to Q2 2024. The company's JP3 and Verax analyzers provide critical real-time data for industries like oil and gas, aiding in process control and regulatory compliance. This aligns with the broader industry trend of adopting AI for improved performance and adherence to environmental standards.

Innovations in chemical Enhanced Oil Recovery (EOR) are also boosting the market, with Flotek leveraging its chemistry expertise to develop more efficient and eco-friendly solutions. The global EOR market, valued around $20 billion in 2023, is seeing robust growth in its chemical segment, driven by demand for sustainable recovery methods. Flotek’s proprietary chemistries contribute to higher oil recovery rates and reduced environmental impact.

The energy sector's push for digitalization and real-time data is further amplified by Flotek's offerings, such as the EPA-approved JP3 system for accurate flare emission monitoring. This technology supports better environmental compliance and operational efficiency. Furthermore, Flotek's April 2025 acquisition of mobile gas conditioning assets positions it in mobile power generation, focusing on optimizing fuel consumption and reducing emissions, a key need for industries striving for sustainability.

| Technology Area | Key Flotek Offering | Impact/Benefit | Market Context (2024/2025) |

|---|---|---|---|

| Data Analytics | JP3 and Verax Analyzers | Real-time process control, custody transfer, flare monitoring; 189% revenue growth Q2 2025 vs Q2 2024 | Industry-wide AI adoption for operational enhancement and regulatory compliance |

| Chemical EOR | Proprietary Chemistries (e.g., nano-surfactants, smart polymers) | Increased oil recovery, reduced environmental footprint, cost savings | Global EOR market ~$20 billion (2023), strong growth in chemical EOR segment |

| Emission Monitoring | EPA-approved JP3 system | Accurate flare emission measurement, improved regulatory compliance, operational optimization | Growing pressure for stricter environmental regulations and sustainability goals |

| Mobile Power Generation | Mobile Gas Conditioning Assets | Optimized fuel consumption, dual-fuel capability, emission reduction | Increasing demand for efficient and sustainable portable energy solutions |

Legal factors

Flotek is significantly influenced by Environmental Protection Agency (EPA) regulations, especially concerning methane emissions in the oil and gas sector. The New Source Performance Standards (NSPS OOOOb/c), which took effect in May 2024, directly target these emissions, compelling operators to adopt stricter monitoring and control measures.

A key development for Flotek is the EPA's approval in July 2024 of its JP3 analyzer system. This approval designates the JP3 system as a recognized measurement technology for the new flare monitoring regulations, positioning Flotek to capitalize on a substantial market need for compliant solutions.

State-level environmental legislation introduces significant regulatory complexity for companies like Flotek. For instance, California's Senate Bill 1137 mandates a phase-out of oil and gas operations within specific buffer zones, impacting operational scope and requiring tailored compliance strategies for businesses operating in the state.

Navigating these diverse state-specific laws means Flotek must adapt its services and compliance approaches to meet varying requirements across different jurisdictions. This can lead to increased operational costs and potential limitations on where and how certain services can be offered, particularly in states with stringent environmental mandates.

Flotek, as a publicly traded entity, faces increasing legal obligations regarding Environmental, Social, and Governance (ESG) disclosures. The U.S. Securities and Exchange Commission's (SEC) climate disclosure rules, finalized in 2024, and the European Union's Corporate Sustainability Reporting Directive (CSRD) are significant developments impacting reporting standards.

These mandates necessitate comprehensive reporting on ESG metrics, directly influencing how investors perceive Flotek's sustainability performance and requiring sophisticated data collection and management systems to ensure compliance and transparency.

Intellectual Property Protection

Flotek Industries' robust intellectual property portfolio, boasting over 130 patents as of early 2024, is a cornerstone of its competitive strategy. These patents are critical for safeguarding its innovative chemistry and advanced data analytics, particularly within the demanding energy and industrial markets. The company's ongoing investment in maintaining and defending this IP directly underpins its market differentiation and future revenue streams.

The legal landscape surrounding intellectual property is constantly evolving, requiring Flotek to remain vigilant in protecting its innovations. This includes navigating international patent laws and addressing potential infringements. A strong IP position allows Flotek to command premium pricing for its specialized solutions and deter competitors from replicating its unique technologies.

- Patent Portfolio Strength: Flotek holds over 130 patents, a significant asset in its specialized sectors.

- Competitive Advantage: IP protection is vital for maintaining Flotek's edge in chemistry and data-driven solutions.

- Legal Vigilance: Ongoing efforts are needed to defend patents against potential infringement and adapt to changing IP laws.

Occupational Safety and Health Regulations

Flotek Industries, operating in energy and industrial sectors, must adhere to a complex web of federal, state, and local occupational safety and health regulations. These rules are critical for protecting its employees and preventing costly fines and operational disruptions. For instance, the Occupational Safety and Health Administration (OSHA) sets standards that directly impact how Flotek conducts its operations, from chemical handling to equipment safety.

In 2024, OSHA continued its focus on enforcement, with penalties for serious violations often reaching tens of thousands of dollars per incident. Flotek's commitment to robust safety protocols, including regular training and equipment maintenance, is therefore not just a matter of compliance but a significant financial consideration. The company's investment in safety infrastructure and personnel directly mitigates the risk of accidents and associated liabilities.

- OSHA's General Duty Clause: Requires employers to provide a workplace free from recognized hazards likely to cause death or serious physical harm.

- Specific Standards: Flotek must comply with standards related to hazard communication, personal protective equipment (PPE), and process safety management, depending on its specific operations.

- Recordkeeping Requirements: Companies like Flotek are mandated to maintain records of work-related injuries and illnesses, which are subject to OSHA inspections and potential penalties for non-compliance.

- State-Specific Regulations: Beyond federal OSHA rules, Flotek may also face additional or more stringent safety requirements imposed by states where it operates, such as Texas or Oklahoma, which have their own OSHA-approved state plans.

Flotek's operations are heavily shaped by evolving environmental regulations, particularly those from the EPA concerning methane emissions, with new standards effective May 2024. The company received a significant boost in July 2024 when its JP3 analyzer was approved by the EPA as a recognized measurement technology for flare monitoring, addressing a critical compliance need for the industry.

State-specific environmental laws, such as California's SB 1137, create a complex compliance landscape. Flotek must adapt its service offerings and operational strategies to meet these varying state requirements, which can impact costs and market access.

Flotek faces increasing legal mandates for ESG disclosures, driven by the SEC's climate disclosure rules finalized in 2024 and the EU's CSRD. These regulations require comprehensive reporting on sustainability metrics, influencing investor perception and demanding robust data management systems.

The company's intellectual property, protected by over 130 patents as of early 2024, is a key differentiator. Continuous investment in defending this IP is crucial for maintaining its competitive edge in specialized chemistry and data analytics, especially given the dynamic nature of patent law.

Flotek must also adhere to stringent occupational safety and health regulations, including those set by OSHA. In 2024, OSHA's continued focus on enforcement means that compliance with standards for hazard communication, PPE, and safety management is critical to avoid significant fines and operational disruptions, with penalties for serious violations often reaching tens of thousands of dollars per incident.

Environmental factors

The oil and gas sector, a key market for Flotek, is under intense scrutiny to curb methane emissions, driven by regulations like the EPA's New Source Performance Standards OOOOb/c, which became effective in 2024. These rules mandate significant reductions in methane leaks from oil and gas operations, impacting upstream, midstream, and downstream segments.

Flotek's data analytics, especially its JP3 system which is EPA-approved for flare monitoring, directly addresses these environmental pressures. This technology enables clients to accurately measure and report methane emissions, a critical step in meeting compliance requirements and demonstrating progress towards a reduced environmental footprint.

By providing real-time, verifiable data on flaring efficiency and associated emissions, Flotek's solutions empower companies to identify and rectify sources of methane loss, potentially avoiding substantial fines and improving operational sustainability. For instance, improved flare efficiency can translate to millions of cubic feet of gas saved annually per facility.

Flotek's core business relies heavily on chemistry for oil and gas operations, making water management and chemical use critical environmental factors. The company's commitment to sustainable chemistry solutions directly addresses the need to minimize the environmental footprint of energy extraction on water resources. For instance, in 2023, Flotek reported a significant reduction in water usage for its clients through its advanced chemical formulations, contributing to more responsible resource management in the sector.

The global momentum towards a lower-carbon economy significantly shapes the long-term prospects for traditional fossil fuels, simultaneously fueling demand for cleaner, more sustainable energy production. This shift presents both challenges and opportunities for companies across the energy sector.

Flotek's strategic redirection toward green chemistry and advanced data analytics, particularly for emissions monitoring, directly addresses this evolving landscape. This pivot is designed to align the company with the growing market for environmentally conscious solutions, potentially unlocking future growth avenues.

For instance, the International Energy Agency (IEA) projects that global energy-related CO2 emissions are expected to rise slightly in 2024 before stabilizing and beginning to decline in 2025, a trend driven by the rapid expansion of renewables and energy efficiency measures. Flotek's focus on emissions monitoring technology is therefore positioned to capitalize on the increasing regulatory and market pressure for verifiable emissions reductions.

Sustainability Reporting and ESG Integration

The growing investor and regulatory emphasis on Environmental, Social, and Governance (ESG) factors necessitates that Flotek clearly articulate its sustainability commitments. This trend is evident in the increasing volume of ESG-focused investment funds, which saw significant growth through 2024, with many actively seeking companies with robust sustainability reporting. Flotek's development of more environmentally friendly chemical solutions and its data analytics tools designed for environmental compliance directly bolster its ESG standing.

Flotek's strategic positioning in eco-friendly chemical development and data solutions for environmental compliance is a key differentiator in the current market. For instance, by early 2025, a significant portion of institutional capital is expected to be allocated to ESG-aligned investments, making Flotek's offerings particularly attractive. The company's ability to provide data that aids clients in meeting stringent environmental regulations, such as those related to emissions and water usage, further enhances its value proposition.

- Investor Demand: A substantial majority of investors surveyed in late 2024 indicated that ESG performance is a material factor in their investment decisions.

- Regulatory Landscape: Emerging regulations in 2024 and projected for 2025 globally are mandating greater transparency in corporate environmental impact reporting.

- Flotek's Contribution: The company's eco-friendly product lines and environmental data solutions directly address these increasing demands for sustainability.

- Market Opportunity: Flotek is well-positioned to capitalize on the growing market for sustainable chemical solutions and environmental compliance technology.

Waste Management and Pollution Control

Flotek's business, which involves specialty chemicals for the energy sector, inherently creates waste streams and carries the potential for pollution. This necessitates rigorous waste management and pollution control strategies to mitigate environmental impact. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to emphasize stringent oversight of chemical manufacturing and disposal, with significant fines levied for non-compliance in the sector.

Adherence to regulations covering the entire lifecycle of chemistry products—from manufacturing and storage to transportation, sale, use, and disposal—is paramount. These regulations are designed to minimize environmental harm and ensure Flotek operates responsibly. The company's commitment to these standards is reflected in its ongoing efforts to develop and implement best practices in chemical handling and waste reduction.

- Regulatory Compliance: Flotek must navigate complex environmental regulations at federal, state, and local levels concerning chemical production and waste disposal.

- Waste Stream Management: Effective management of waste generated from chemical manufacturing and application is critical, including recycling, treatment, and safe disposal methods.

- Pollution Prevention: Implementing technologies and processes that prevent or minimize the release of pollutants into air, water, and soil is a core operational focus.

- Sustainable Product Development: Flotek's R&D efforts increasingly focus on creating chemistries with reduced environmental footprints, aligning with evolving industry expectations and regulatory pressures.

Environmental regulations are a significant driver for Flotek, particularly concerning methane emissions and water management in the oil and gas sector. The EPA's 2024 methane emission rules directly influence client needs, pushing demand for Flotek's JP3 monitoring system, which is EPA-approved for flare monitoring.

Flotek's focus on sustainable chemistry addresses concerns about water usage and chemical footprints, with the company reporting reduced water consumption for clients in 2023. The global shift towards a lower-carbon economy, projected by the IEA to see CO2 emissions stabilize and decline from 2025, creates opportunities for Flotek's emissions monitoring and green chemistry solutions.

Investor demand for ESG performance, with a majority of surveyed investors in late 2024 prioritizing it, further solidifies the market for Flotek's environmentally conscious offerings. By early 2025, a substantial portion of institutional capital is expected to target ESG-aligned investments, making Flotek's alignment with sustainability trends a key advantage.

Flotek must manage waste streams and prevent pollution from its chemical operations, adhering to stringent EPA oversight that continued in 2023. Navigating federal, state, and local regulations for chemical lifecycle management, including safe disposal and pollution prevention, is crucial for responsible operation and sustainable product development.

| Environmental Factor | Impact on Flotek | Flotek's Response/Opportunity | Relevant Data/Projections |

|---|---|---|---|

| Methane Emission Regulations | Increased demand for emissions monitoring technology. | JP3 system for flare monitoring, EPA-approved. | EPA's New Source Performance Standards OOOOb/c effective 2024. |

| Water Management & Chemical Use | Need for sustainable chemistry solutions. | Development of eco-friendly chemical formulations. | Reported reduction in client water usage in 2023. |

| Low-Carbon Economy Transition | Shift in energy market dynamics. | Strategic redirection to green chemistry and data analytics. | IEA projects CO2 stabilization/decline from 2025. |

| ESG Investor Focus | Growing importance of sustainability reporting. | Bolstered ESG standing through eco-friendly products and data solutions. | Majority of investors surveyed in late 2024 consider ESG material; significant institutional capital allocation to ESG by early 2025. |

PESTLE Analysis Data Sources

Our Flotek PESTLE Analysis is meticulously crafted using a blend of official government publications, reputable financial institutions, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the energy sector.