Flotek Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flotek Bundle

Uncover the strategic power of the Flotek BCG Matrix and see how its product portfolio stacks up. This insightful preview highlights key areas, but to truly master your product strategy and make informed investment decisions, you need the full picture. Purchase the complete Flotek BCG Matrix for a detailed breakdown of Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights.

Stars

Flotek's Advanced Data Analytics Platforms are positioned as stars within its business portfolio. The company's Data Analytics segment experienced a remarkable 189% revenue surge in Q2 2025 compared to the prior year, with service revenues alone jumping over 450%.

This explosive growth signifies a dynamic market where Flotek is effectively capturing significant share with its innovative data solutions. The acquisition of real-time gas monitoring and dual fuel optimization assets, coupled with a substantial $156 million multi-year contract, reinforces its strong standing in this expanding sector.

Flotek's proprietary green chemistry innovations are a key differentiator, focusing on developing specialty chemicals that minimize environmental impact. This aligns perfectly with the burgeoning demand for sustainable solutions, fueled by stricter environmental regulations and a global push towards eco-friendly practices.

The company's commitment to these green solutions positions it for high growth, particularly within the sustainable energy sector. For instance, Flotek's external chemistry revenue saw a significant 38% increase in Q2 2025, underscoring the market's positive reception to its environmentally conscious product portfolio.

Flotek's JP3 VeraCal analyzer is positioned as a Star in the BCG Matrix due to its first-mover advantage in the real-time flare monitoring market, driven by the EPA's NSPS OOOOb rule. As the first EPA-approved alternative method, it addresses a critical need for compliance, tapping into a substantial and expanding market.

The company's proactive deployment of these analyzers and securing of contracts highlight significant market penetration and a robust growth trajectory. This early traction suggests strong demand and a competitive edge, solidifying its Star status as it captures market share in this evolving regulatory landscape.

Mobile Power Generation Solutions (PWRtek acquisition)

Flotek's strategic acquisition of mobile power generation assets in April 2025, leading to the formation of PWRtek LLC, is poised to deliver substantial high-margin rental revenue, surpassing initial projections. This move marks a significant expansion into the energy infrastructure sector, a high-growth area where Flotek is solidifying its presence and tapping into new revenue opportunities.

The PWRtek acquisition is expected to contribute significantly to Flotek's revenue diversification. In 2024, the broader energy infrastructure rental market saw substantial growth, with projections indicating a continued upward trend. Flotek's entry into this market is strategically timed to capitalize on this momentum.

- Market Entry: Flotek acquired mobile power generation assets in April 2025, establishing PWRtek LLC.

- Revenue Potential: The acquisition is projected to generate high-margin rental revenue, exceeding initial expectations.

- Growth Sector: This expansion targets the high-growth energy infrastructure market.

- Strategic Positioning: Flotek aims to capture new revenue streams and establish a strong market position.

International Chemistry Expansion (UAE and Saudi Arabia)

Flotek's international chemistry segment, with a particular focus on the UAE and Saudi Arabia, is experiencing robust expansion. This strategic push into key Middle Eastern markets is yielding significant revenue growth.

The company reported an impressive 83% increase in international chemistry revenue for Q2 2025, highlighting the success of its global strategy. This surge is largely attributed to the burgeoning energy sectors in the UAE and Saudi Arabia.

- Strong Regional Growth: Flotek's international chemistry revenue in the UAE and Saudi Arabia saw an 83% increase in Q2 2025.

- Market Penetration: Expansion into these new geographical markets is driven by growing energy demands.

- Technological Advantage: Specific approvals for Flotek's slickwater fracturing systems are facilitating market entry and share growth.

- High Growth Potential: The combination of market demand and approved technologies points to significant future growth prospects in these regions.

Flotek's Advanced Data Analytics Platforms are positioned as stars within its business portfolio, demonstrating exceptional growth. The company's Data Analytics segment experienced a remarkable 189% revenue surge in Q2 2025 compared to the prior year, with service revenues alone jumping over 450%. This explosive growth signifies a dynamic market where Flotek is effectively capturing significant share with its innovative data solutions.

Flotek's JP3 VeraCal analyzer is also a Star due to its first-mover advantage in the real-time flare monitoring market, driven by the EPA's NSPS OOOOb rule. As the first EPA-approved alternative method, it addresses a critical need for compliance, tapping into a substantial and expanding market.

The company's international chemistry segment, particularly in the UAE and Saudi Arabia, is experiencing robust expansion, with an impressive 83% increase in international chemistry revenue for Q2 2025. This surge is largely attributed to the burgeoning energy sectors in these key Middle Eastern markets.

Flotek's strategic acquisition of mobile power generation assets in April 2025, leading to the formation of PWRtek LLC, is poised to deliver substantial high-margin rental revenue, exceeding initial projections and tapping into the high-growth energy infrastructure market.

| Business Segment | BCG Category | Q2 2025 Revenue Growth (YoY) | Key Drivers |

|---|---|---|---|

| Advanced Data Analytics | Star | 189% | Innovative data solutions, real-time monitoring, $156M contract |

| JP3 VeraCal Analyzer | Star | N/A (Specific product) | EPA approval, first-mover advantage, regulatory compliance |

| International Chemistry (UAE/KSA) | Star | 83% | Growing energy sectors, approved fracturing systems |

| PWRtek LLC (Mobile Power) | Star | N/A (New Acquisition) | High-margin rental revenue, energy infrastructure market |

What is included in the product

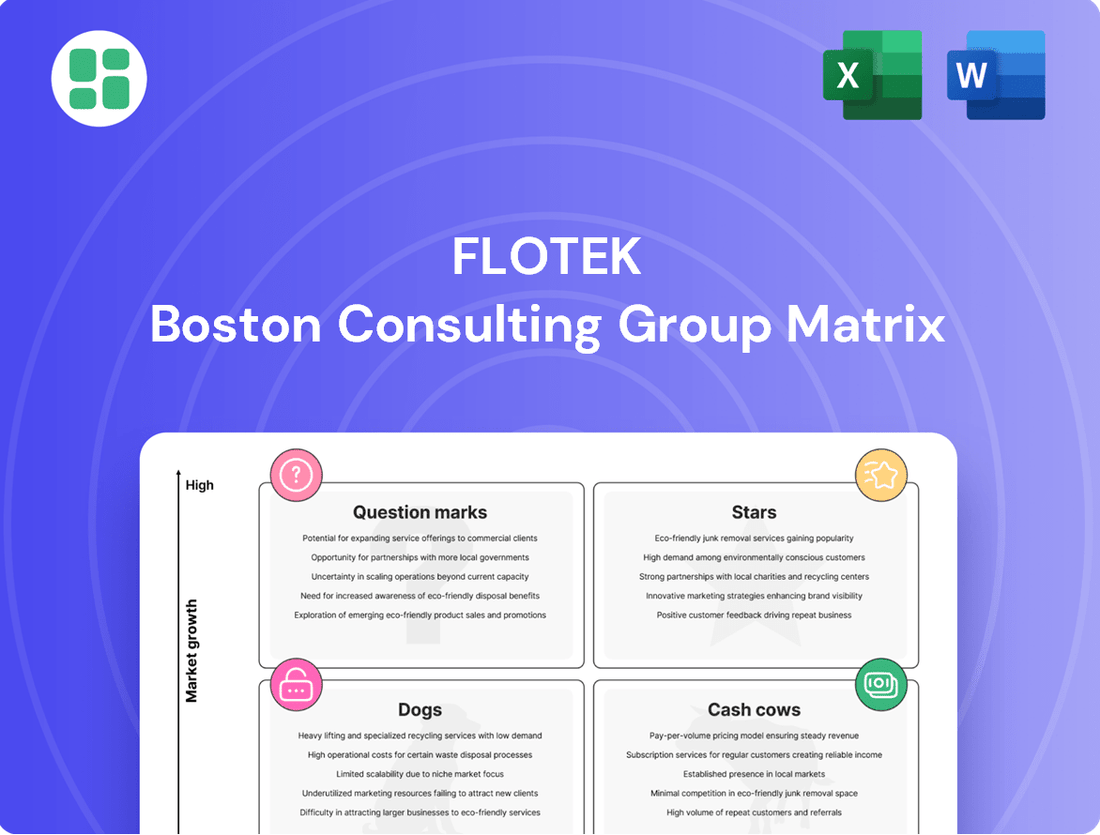

The Flotek BCG Matrix provides a framework for analyzing a company's product portfolio by categorizing business units into Stars, Cash Cows, Question Marks, and Dogs based on market growth and share.

Visualize your portfolio's strategic positioning, identifying areas for growth or divestment.

Cash Cows

Flotek's established drilling and cementing chemical additives represent a classic cash cow in the BCG matrix. These products, honed over years of service, hold significant market share and generate steady, predictable revenue. Their strength lies in deep-rooted client relationships and a mature market where dependable performance is paramount.

The demand for these essential additives remains robust, driven by ongoing oil and gas exploration and production activities. For instance, in 2024, the global oilfield chemicals market was projected to reach over $35 billion, with drilling and cementing chemicals forming a substantial segment. This stability means less need for aggressive marketing spend, allowing these offerings to efficiently fund other strategic initiatives within Flotek.

Flotek's standard production enhancement chemicals are firmly positioned as cash cows within the BCG matrix. These mature offerings, integral to energy sector operations, boast a loyal customer base and likely command strong profit margins due to their established competitive advantage.

Flotek's long-term supply agreements, such as the one with ProFrac Services, LLC, create a predictable revenue stream for its core chemistry products. This stability suggests a strong, secured market position within a mature segment of the industry.

These agreements allow Flotek to generate consistent cash flow, effectively acting as a cash cow. This reliable income can then be strategically reinvested to support growth areas or research and development within the company.

Legacy Chemistry Technologies with High Adoption

Flotek's legacy chemistry technologies, deeply embedded in the daily operations of major oil and gas producers, represent a core cash cow. These established products, like their CnF® fluid technology, benefit from high adoption rates and strong customer loyalty, ensuring consistent revenue streams even in a mature market. For instance, in 2023, Flotek reported that its CnF® technology was utilized in over 1,000 wells across the U.S. onshore market, highlighting its significant market penetration and reliability.

These offerings maintain a dominant market share due to their proven track record and the familiarity operators have with their performance. While the overall growth in these specific segments might be modest, their established position provides a stable and predictable revenue base for Flotek.

- Established Market Position: Legacy chemistries benefit from decades of use and proven efficacy.

- High Customer Familiarity: Integrated oil companies and independent E&P firms are comfortable and reliant on these solutions.

- Stable Revenue Generation: Despite potentially lower market growth, widespread adoption ensures consistent cash flow.

- Operational Integration: These technologies are often deeply woven into existing operational workflows, making them difficult to replace.

Basic Reservoir Intelligence Services

Flotek's basic reservoir intelligence services, while not the high-growth Stars of their portfolio, likely function as Cash Cows. These are foundational offerings that have a proven track record, generating steady revenue from a dependable customer base. Think of them as the reliable workhorses that consistently contribute to the company's bottom line.

These services typically involve routine data analysis and reporting, requiring less investment in cutting-edge research and development compared to their more advanced analytics counterparts. This stability means they don't need significant capital infusions to maintain their market position or drive aggressive expansion. Flotek can leverage these established services to fund growth in other areas of the business.

For instance, in 2024, Flotek continued to serve established clients with these core reservoir intelligence solutions. While specific revenue breakdowns for this segment aren't publicly detailed, the company's overall focus on optimizing production for its clients suggests a consistent demand for such services. Their ability to provide these foundational insights allows clients to make informed decisions about reservoir management.

- Established Offerings: These services represent mature solutions with a well-defined market.

- Consistent Revenue: They generate predictable income streams due to a loyal customer base.

- Lower Growth Potential: Unlike Stars, they are not expected to experience rapid expansion.

- Profitability Contribution: They provide stable profits without requiring substantial new investment.

Flotek's legacy drilling and cementing chemical additives are strong cash cows. These mature products, with their established market share and loyal clientele, generate consistent, predictable revenue. For example, in 2024, the global oilfield chemicals market, a significant portion of which comprises drilling and cementing chemicals, was projected to exceed $35 billion, underscoring the stability of this sector.

Full Transparency, Always

Flotek BCG Matrix

The Flotek BCG Matrix preview you're examining is precisely the document you will receive upon purchase, offering a complete and unwatermarked strategic tool. This means you're seeing the final, analysis-ready BCG Matrix, fully formatted for immediate application in your business planning. No demo content or hidden surprises await; just the comprehensive report designed for strategic clarity and professional use. Once purchased, this exact file will be yours to edit, present, or integrate into your decision-making processes without any further modifications.

Dogs

Outdated chemical formulations, often characterized by lower efficiency or environmental concerns, typically fall into the Dogs category of the BCG Matrix. These products likely hold a small market share and operate within a shrinking market. For instance, in 2024, Flotek Industries (FTK) might have legacy chemical offerings that are being phased out due to regulatory changes or the availability of superior, eco-friendlier alternatives, leading to a decline in their contribution to overall revenue.

Niche or non-core services with limited demand represent offerings that struggled to gain traction, often due to targeting very specific, small markets that didn't expand. These products or services typically hold a low market share within slow-growing or stagnant industries. For instance, a company might have invested in a highly specialized data analytics tool for a single, emerging industry that ultimately failed to materialize, leading to minimal adoption. In 2024, such ventures often require careful divestment or repurposing to avoid continued resource drain.

Flotek's underperforming regional operations in declining basins represent areas where the company has a limited market footprint and faces shrinking demand. These segments are characterized by low market share and minimal growth potential, directly impacting their profitability and efficiency. For instance, if Flotek had operations in a specific shale basin that saw a significant drop in drilling activity in 2024, and their market share there was already below 5%, it would fit this category.

Commoditized Chemical Products Without Differentiation

Chemical products that have become highly commoditized, lacking any unique features, would find it challenging to hold onto their market position or charge higher prices. This situation would force Flotek into aggressive price wars within a market that isn't expanding much, leading to very thin profit margins and disappointing financial results.

For instance, if Flotek were heavily involved in basic industrial chemicals like sulfuric acid or ammonia, it would be competing on price alone. The global market for these chemicals is vast but often characterized by oversupply, making it difficult for any single player to gain a significant advantage. In 2023, the global industrial chemicals market was valued at approximately $570 billion, with growth projected at a modest 3-4% annually, highlighting the mature and competitive nature of such segments.

- Low Profitability: Intense price competition in commoditized markets typically squeezes profit margins, often to single digits.

- Limited Growth Potential: Mature commodity markets usually experience slow or stagnant growth, capping revenue expansion opportunities.

- High Capital Intensity: Production of commodity chemicals often requires significant upfront investment in large-scale facilities, creating high barriers to entry but also high fixed costs.

- Vulnerability to Input Costs: Profitability is highly sensitive to fluctuations in raw material and energy prices, which are often outside a company's control.

Discontinued or Phased-Out Product Lines

Flotek’s discontinued or phased-out product lines represent offerings that are no longer actively supported or promoted. These are typically products that have become obsolete, proved unprofitable, or no longer align with the company's strategic direction. For instance, Flotek has been actively streamlining its portfolio to focus on core competencies.

These legacy products are likely generating negligible revenue and may even incur costs associated with their wind-down. In 2024, Flotek continued its strategic repositioning, which often involves divesting or discontinuing less profitable or non-core segments to enhance overall financial performance and operational efficiency.

- Obsolescence: Products rendered outdated by technological advancements or market shifts.

- Profitability Issues: Offerings that consistently fail to meet profitability targets.

- Strategic Refocusing: Product lines that no longer fit Flotek's long-term business strategy.

- Resource Allocation: Discontinuation frees up capital and management attention for more promising ventures.

Flotek's "Dogs" are essentially their underperforming assets, often legacy chemicals or services with a small market share in declining industries. These offerings typically yield low profits due to intense competition or lack of demand, and their future growth prospects are minimal. For example, in 2024, Flotek may have had specialized chemical formulations that were superseded by newer, more effective alternatives, leading to their classification as Dogs.

These products or services struggle to gain traction, often due to targeting very specific, small markets that didn't expand. They typically hold a low market share within slow-growing or stagnant industries, making them a drain on resources. In 2024, such ventures often require careful divestment or repurposing to avoid continued resource drain.

Flotek's underperforming regional operations in declining basins represent areas where the company has a limited market footprint and faces shrinking demand. These segments are characterized by low market share and minimal growth potential, directly impacting their profitability and efficiency. For instance, if Flotek had operations in a specific shale basin that saw a significant drop in drilling activity in 2024, and their market share there was already below 5%, it would fit this category.

| Category | Description | Flotek Example (2024) | Key Characteristics |

| Dogs | Low market share, low growth market | Legacy chemical formulations, underperforming regional operations | Low profitability, limited growth potential, high capital intensity |

Question Marks

Flotek's commitment to sustainable chemistry positions it well for emerging energy sectors. New chemical solutions designed for areas like geothermal energy or carbon capture represent a high-growth potential market. However, these innovative products likely hold a low market share currently as they are in the early stages of adoption and require substantial investment to scale.

Advanced AI-driven predictive analytics tools, while nascent and in early commercialization stages, represent a significant opportunity within the high-growth operational optimization market. These tools currently hold a low market share, necessitating considerable investment in research and development, alongside robust marketing and client education initiatives to demonstrate their value and achieve scalability.

New international market entries for Flotek, where the company is just starting to establish its presence and build brand awareness, would be categorized as Dogs within the BCG Matrix. These markets often represent significant growth opportunities but come with the challenge of low initial market share. For instance, a hypothetical entry into a rapidly developing African market in 2024, requiring substantial investment in distribution channels and local partnerships, would fit this description.

Specialized Data Solutions for Non-Energy Industrial Sectors

While Flotek is widely recognized for its deep roots in the energy sector, the company is exploring avenues to leverage its data analytics and chemistry expertise in broader industrial applications. This strategic pivot acknowledges the potential for growth in markets beyond oil and gas, such as advanced manufacturing and specialized mining operations.

Developing new, specialized data solutions for these non-energy industrial sectors represents a significant opportunity for Flotek. These markets, while potentially high-growth, are characterized by Flotek's current low market share. Consequently, substantial investment will be necessary to establish credibility, demonstrate the efficacy of its offerings, and gain meaningful traction.

- Market Diversification: Targeting non-energy sectors like manufacturing and mining allows Flotek to reduce its reliance on the cyclical energy market.

- Investment Requirements: Entering these new markets necessitates considerable R&D and sales/marketing investment to build brand awareness and product acceptance.

- Growth Potential: Successful penetration into these sectors could unlock new, substantial revenue streams, capitalizing on Flotek's core technological competencies.

- Competitive Landscape: Flotek will face established players in these industries, requiring a clear value proposition and differentiated solutions to compete effectively.

Next-Generation Emissions Monitoring Technologies Beyond Flare

Flotek's exploration into next-generation emissions monitoring beyond flares positions them in a rapidly expanding, regulation-fueled market. This segment, driven by increasing environmental scrutiny, promises significant growth potential.

However, entering this space means facing established players and the need for substantial capital investment. Flotek would likely start with a small market share, requiring considerable resources for research, development, and market penetration to gain widespread adoption.

- Market Potential: The global environmental monitoring market is projected to reach over $60 billion by 2027, with emissions monitoring being a key driver.

- Regulatory Tailwinds: Stricter environmental regulations worldwide, including those from the EPA and international bodies, are creating a continuous demand for advanced monitoring solutions.

- Technological Investment: Developing new technologies for diverse industrial sources, such as continuous emissions monitoring systems (CEMS) for power plants or industrial facilities, demands significant R&D expenditure.

- Market Entry Challenges: Initial market share will be low, necessitating aggressive sales, marketing, and strategic partnerships to compete against incumbents with established reputations and customer bases.

Question marks in Flotek's BCG Matrix represent new ventures or products with low market share in high-growth industries. These initiatives require significant investment to develop and scale, aiming to capture future market leadership.

While the potential for substantial returns exists, the uncertainty surrounding adoption and competitive response means these ventures carry higher risk. Flotek must carefully manage resources allocated to these areas, balancing innovation with market realities.

Examples include early-stage sustainable chemistry solutions for emerging energy sectors and advanced AI-driven predictive analytics tools, both currently in nascent commercialization stages.

The company's strategic exploration into non-energy industrial applications, such as advanced manufacturing and specialized mining, also falls into this category, demanding significant R&D and market penetration investment.

| Category | Description | Market Growth | Market Share | Investment Needs | Example |

| Question Marks | New products/ventures in high-growth markets | High | Low | High | Sustainable chemistry for geothermal energy |

| Requires significant investment for development and scaling | AI-driven predictive analytics tools | ||||

| High risk, high potential reward | Entry into new industrial sectors (e.g., advanced manufacturing) |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial disclosures, market research reports, and industry growth projections to provide a comprehensive view of business unit performance.