Fidelity National Information (FIS) PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fidelity National Information (FIS) Bundle

Unlock critical insights into Fidelity National Information (FIS) by understanding the complex interplay of Political, Economic, Social, Technological, Legal, and Environmental factors. Our comprehensive PESTLE analysis reveals how these external forces are shaping the financial services landscape and impacting FIS's strategic decisions and future growth. Don't get left behind; equip yourself with the knowledge to anticipate market shifts and capitalize on emerging opportunities. Download the full PESTLE analysis now and gain a definitive competitive advantage.

Political factors

The financial technology sector, including major players like Fidelity National Information Services (FIS), is under constant and evolving regulatory scrutiny worldwide. Regulators are sharpening their focus on critical areas such as data protection, safeguarding consumer privacy, and ensuring the overall integrity of digital financial markets. This heightened oversight necessitates substantial investment from FIS in robust compliance frameworks to adapt to new mandates and mitigate the risk of penalties.

Governments globally are actively pushing for digital transformation within financial services, aiming to boost efficiency and competitiveness. This focus translates into tangible opportunities for companies like FIS, as initiatives often involve modernizing banking infrastructure and promoting advanced payment systems. For instance, the European Union's Digital Finance Strategy, with significant funding allocated through programs like the Digital Europe Programme, directly supports such modernization efforts.

FIS's Modern Banking Platform is well-positioned to capitalize on these trends. Many governments are offering incentives and grants for financial institutions to adopt cloud-native solutions and open banking frameworks, areas where FIS excels. The U.S. government's ongoing investment in cybersecurity and digital resilience for financial institutions also creates a favorable environment for FIS's comprehensive security and data management solutions.

Fidelity National Information Services (FIS) navigates a complex global landscape, making its operations highly sensitive to geopolitical stability. Changes in trade policies, like those impacting cross-border data flows or financial services regulations, directly affect FIS's market access and operational costs. For instance, increased protectionism in key markets could lead to higher compliance burdens or reduced opportunities for its payment processing and banking solutions.

The company's extensive reach, serving clients in over 100 countries, demands constant vigilance regarding international relations and potential conflicts. A significant geopolitical event in a major economic region, such as Europe or Asia, could disrupt supply chains for hardware components or impact the demand for digital transformation services among financial institutions in that area. FIS's revenue, which was approximately $14.4 billion in 2023, is therefore directly tied to the smooth functioning of international trade and political cooperation.

Data Privacy and Cross-Border Regulations

Data privacy and cross-border regulations present significant challenges for FIS. Strict laws like GDPR, and emerging regional equivalents, mandate intricate protocols for financial data handling, storage, and international transfers. FIS, managing extensive sensitive financial information, must maintain rigorous compliance to preserve client confidence and meet global legal obligations.

The EU's Digital Operational Resilience Act (DORA), effective January 2025, is a prime example of this evolving landscape. DORA aims to bolster the digital security and operational resilience of financial entities, directly impacting how FIS manages its technological infrastructure and data protection measures. This legislation is expected to drive increased investment in cybersecurity and data governance frameworks across the financial sector.

- GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher.

- DORA mandates comprehensive ICT risk management frameworks for financial institutions.

- Cross-border data transfer restrictions can impact service delivery and operational efficiency.

- Compliance costs for data privacy regulations are a growing concern for global financial technology providers.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Policies

Governments globally are intensifying Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. This push necessitates financial institutions, including FIS clients, to adopt more advanced monitoring and reporting technologies to comply with these increasingly rigorous demands. The new EU AML package, adopted in June 2024, represents a significant step in harmonizing and strengthening these rules across all member states, impacting how financial services operate and the technology they rely on.

FIS, as a provider of financial technology solutions, is directly affected by these evolving compliance landscapes. The company must ensure its platforms not only enable clients to meet these stringent requirements but also adhere to the regulations themselves. This dual responsibility means continuous investment in robust compliance features and staying ahead of legislative changes.

- Increased Regulatory Scrutiny: Governments are enhancing AML/CTF oversight, demanding greater transparency and accountability from financial firms.

- Technological Demands: Sophisticated transaction monitoring, Know Your Customer (KYC) processes, and suspicious activity reporting systems are becoming standard requirements.

- EU AML Harmonization: The June 2024 EU AML legislation aims to create a unified framework, potentially increasing compliance burdens for firms operating across multiple member states.

- FIS's Role: FIS's solutions must facilitate client compliance while itself maintaining adherence to evolving global AML/CTF standards.

Governments worldwide are increasingly prioritizing financial sector stability and consumer protection, leading to more stringent regulations. For FIS, this means adapting its services to comply with evolving data privacy laws like GDPR and upcoming frameworks such as the EU's Digital Operational Resilience Act (DORA), effective January 2025. These regulations necessitate significant investment in compliance infrastructure and cybersecurity measures to manage sensitive financial data effectively.

The push for digital transformation in finance by governments presents opportunities for FIS, particularly with initiatives supporting open banking and cloud-native solutions. However, geopolitical shifts and trade policy changes can impact cross-border data flows and market access, influencing FIS's operational costs and revenue streams, which were approximately $14.4 billion in 2023.

Heightened scrutiny on Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) is also a key political factor. The recent EU AML package, adopted in June 2024, exemplifies this trend, requiring financial institutions and their technology providers like FIS to implement advanced monitoring and reporting systems. This requires continuous adaptation of FIS's platforms to meet both client compliance needs and its own regulatory obligations.

What is included in the product

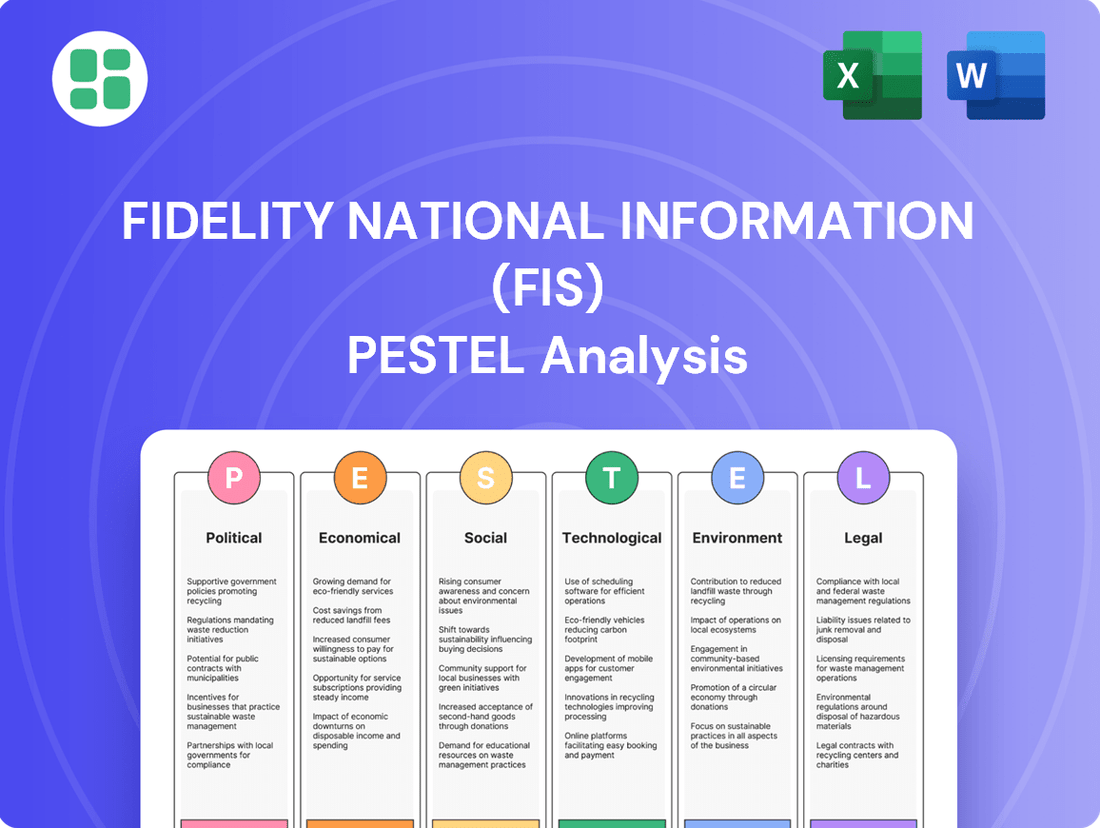

This PESTLE analysis of Fidelity National Information (FIS) examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic planning.

It provides actionable insights into how these external forces create both challenges and opportunities for FIS within the global financial technology landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, distilling the complex PESTLE factors impacting FIS into actionable insights.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the political, economic, social, technological, environmental, and legal forces affecting FIS.

Economic factors

Fidelity National Information Services (FIS) sees its performance closely tied to the global economic climate and how much consumers are spending, particularly in areas like digital payments and banking services. A healthy economy generally means more transactions and thus more revenue for companies like FIS.

In 2024, FIS experienced revenue growth and even improved its 2025 financial outlook. However, persistent economic uncertainty can lead consumers to tighten their belts, which directly impacts payment processors by potentially slowing down transaction volumes and affecting fee-based revenue streams.

The prevailing interest rate environment significantly shapes the financial health of Fidelity National Information Services (FIS)'s core clientele: financial institutions. For instance, if central banks, like the Federal Reserve, maintain higher interest rates throughout 2024 and into 2025, banks may face increased funding costs. This could prompt them to scrutinize their budgets more closely, potentially leading to a slowdown in technology investments and longer sales cycles for FIS's new solutions.

Conversely, a stable or declining interest rate scenario, which could emerge if inflation moderates by late 2024 or 2025, might encourage financial institutions to allocate more capital towards modernizing their infrastructure. This could translate into increased demand for FIS's services, particularly in areas like digital transformation and payment processing, as banks seek efficiency gains to boost profitability in a lower-yield environment. For example, the U.S. benchmark interest rate remained at 5.25%-5.50% as of mid-2024, a level that has already spurred some caution in tech spending among financial firms.

Rising inflation directly impacts Fidelity National Information Services (FIS) by increasing the cost of doing business. For instance, higher wages are needed to attract and retain talent in a competitive labor market, and the expense of maintaining and upgrading technology infrastructure, from data centers to cloud services, also escalates with inflation. Energy costs, crucial for powering these operations, are similarly subject to upward price pressure.

These increased operational costs can squeeze FIS's profit margins if not effectively passed on or absorbed through efficiency gains. For example, in the first quarter of 2024, FIS reported that while revenue grew, the company was actively managing its cost structure to offset inflationary impacts.

Effectively managing these cost pressures is paramount for FIS to maintain its competitive edge. This involves strategic sourcing, optimizing technology investments, and driving operational efficiencies. Crucially, the company must continue to allocate resources towards innovation, such as developing new fintech solutions and enhancing existing platforms, to stay ahead in a rapidly evolving financial services landscape.

Competition and Market Consolidation

The financial technology landscape is intensely competitive, marked by persistent consolidation and the continuous arrival of new fintech innovators. FIS navigates this dynamic environment, facing rivals from major technology corporations, traditional financial powerhouses, and agile emerging fintech companies. This necessitates a commitment to ongoing innovation and strategic acquisitions to secure and grow its market position.

The fintech sector's competitive intensity is evident in several key trends. For instance, by the end of 2023, the global fintech market was valued at approximately $1.17 trillion, with projections indicating significant growth. This growth fuels both new entrants and consolidation activities. FIS must adapt to these shifts:

- Intense Rivalry: FIS competes with a broad spectrum of players, from established giants like IBM and Oracle to specialized fintechs such as Stripe and Adyen.

- Consolidation Trends: The sector has seen notable mergers and acquisitions, with companies like Fiserv acquiring First Data in a significant 2019 deal, highlighting the drive for scale and market dominance.

- Innovation Pressure: The rapid pace of technological advancement, including AI and blockchain, demands continuous investment in R&D to avoid obsolescence.

- Market Share Defense: Maintaining market share requires not only competitive pricing but also superior product offerings and robust customer service.

Investment in Digital Transformation by Clients

Financial institutions are notably ramping up their digital transformation initiatives, even amidst economic headwinds. A significant 55% of global banks surveyed indicated plans to boost their spending on trade finance platforms within the next year, signaling a strong commitment to modernizing operations.

This ongoing surge in technology investment by banks creates a fertile ground for growth for companies like FIS. Their expertise in providing financial technology solutions positions them to capitalize on this expanding market.

- Increased Spending: 55% of global banks plan to increase spending on trade finance platforms in the next 12 months.

- Digital Focus: Banks are prioritizing digital transformation despite economic uncertainties.

- Growth Opportunity: This sustained investment presents a significant growth avenue for FIS.

Economic factors significantly influence Fidelity National Information Services (FIS). A robust economy generally boosts transaction volumes and consumer spending, directly benefiting FIS's payment processing and banking solutions. However, economic downturns can lead to reduced spending and cautious investment by financial institutions, impacting FIS's revenue streams and sales cycles. For instance, while FIS reported revenue growth in early 2024, ongoing economic uncertainty remains a key consideration for future performance.

Interest rates play a crucial role, with higher rates in 2024 and projected into 2025 potentially increasing funding costs for FIS's clients, leading to tighter IT budgets and slower adoption of new technologies. Conversely, stabilizing or declining rates could encourage financial institutions to invest more in modernization, benefiting FIS. The U.S. benchmark interest rate hovering around 5.25%-5.50% in mid-2024 illustrates this dynamic, prompting some caution in tech spending.

Inflation directly impacts FIS's operational costs, including wages and technology infrastructure expenses. While FIS actively manages these costs, as seen in early 2024 efforts, persistent inflation can pressure profit margins if these costs cannot be effectively passed on or offset by efficiency gains. Strategic cost management and continued investment in innovation are therefore critical for FIS to maintain its competitive position amid these economic pressures.

| Economic Factor | Impact on FIS | 2024/2025 Data/Trend |

|---|---|---|

| Economic Growth | Increased transaction volumes, higher revenue | Revenue growth reported in early 2024, but uncertainty persists |

| Interest Rates | Higher rates can reduce tech investment by clients; lower rates can boost it | U.S. benchmark rate at 5.25%-5.50% (mid-2024), leading to some caution |

| Inflation | Increases operational costs (wages, tech); potential margin squeeze | Active cost management by FIS in Q1 2024 to offset impacts |

Same Document Delivered

Fidelity National Information (FIS) PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Fidelity National Information (FIS) covers political, economic, social, technological, legal, and environmental factors impacting the company's operations and strategy. You can confidently assess the depth and quality of this report, knowing it reflects the complete analysis provided upon purchase.

Sociological factors

Consumers today expect digital interactions to be as smooth and easy as possible, whether they're banking or making payments. This means intuitive interfaces and robust security are no longer optional; they're essential. For instance, a 2024 Accenture report found that 78% of consumers consider a seamless digital experience a key factor when choosing a financial provider.

FIS is actively addressing these evolving consumer expectations. They've launched updated mobile banking applications, such as Digital One™ Flex Mobile 6.0. This platform is designed to offer both user-friendly navigation and a comprehensive set of features, all while prioritizing the security consumers demand in their digital financial lives.

The global move towards digital and cashless payments is gaining serious momentum, fueled by the sheer convenience and ongoing tech upgrades. This trend is a significant positive for Fidelity National Information (FIS), as their core payment processing services are perfectly aligned with how consumers are increasingly choosing to pay.

By 2024, it's estimated that over 80% of global retail transactions will be digital, a substantial jump from just a few years prior. This growing reliance on digital payment methods means FIS is well-positioned to capitalize on this evolving consumer behavior, as these platforms become central to how shoppers make purchasing decisions.

Societal trends highlight a strong push for financial inclusion, aiming to provide access to vital financial services for all segments of the population. This growing awareness means companies like FIS are increasingly expected to contribute to this goal.

FIS is actively working to promote sustainability by building more inclusive societies. A key part of this involves championing financial inclusion, offering tools and support designed to empower individuals financially. For example, by 2023, FIS reported enabling over 700 million consumers to access digital payment solutions, a significant step in broadening financial access.

Trust in Digital Financial Systems

Consumer trust in digital financial systems is crucial, particularly as cyber threats and fraud become more sophisticated. Fidelity National Information (FIS) addresses this by prioritizing strong security features in its digital offerings and actively combating cybercrime. For instance, in 2024, the financial services sector saw a significant increase in reported cyber incidents, underscoring the importance of reliable security measures.

FIS's commitment to safeguarding digital transactions directly supports this sociological factor. Their investment in advanced fraud detection and prevention tools aims to build and maintain user confidence. Reports from late 2024 indicated that a substantial percentage of consumers consider security a top priority when choosing digital financial services, highlighting the market's demand for trusted platforms.

- Cybersecurity Investment: FIS continues to invest heavily in cybersecurity solutions to protect its clients and their data.

- Fraud Prevention: The company deploys AI-powered fraud detection systems to identify and mitigate suspicious activities in real-time.

- Consumer Confidence: Maintaining high levels of consumer trust is essential for the adoption and success of digital financial services.

- Regulatory Compliance: Adherence to evolving data privacy and security regulations is a key component of building trust.

Generational Differences in Banking Habits

Generational differences significantly shape banking habits, impacting how financial institutions like FIS must adapt. Younger generations, particularly Gen Z and Millennials, are often more inclined to use a variety of digital tools and fintech applications, sometimes even bypassing traditional banking channels for certain transactions. For instance, a 2024 report indicated that over 70% of Gen Z consumers prefer digital banking solutions, with many utilizing peer-to-peer payment apps and neobanks alongside their primary accounts.

FIS needs to recognize this evolving landscape by ensuring its platforms are not only robust for traditional banking needs but also flexible enough to integrate with or offer services that appeal to these diverse preferences. Catering to a spectrum from Gen Z's digital-first approach to the preferences of older generations, who may still value in-person interactions or more established digital interfaces, is crucial for market penetration and customer retention. This means offering seamless mobile banking experiences, supporting various payment methods, and potentially partnering with popular fintech providers.

The challenge for FIS lies in creating a unified yet adaptable ecosystem. Key considerations for 2024-2025 include:

- Digital Engagement: Enhancing mobile app functionality and user experience to meet the expectations of digitally native consumers.

- Fintech Integration: Exploring partnerships or developing proprietary solutions that mimic the convenience of popular fintech apps for payments, budgeting, and investing.

- Personalized Services: Leveraging data analytics to offer tailored financial advice and product recommendations that resonate with the specific needs and life stages of different generations.

- Omnichannel Approach: Maintaining strong traditional banking channels while ensuring a consistent and high-quality experience across all digital touchpoints.

Societal shifts towards greater financial literacy and a demand for transparent financial practices are paramount. Consumers, increasingly informed by readily available online resources, expect financial institutions to operate with integrity and provide clear, understandable product offerings. This heightened awareness means that companies like FIS must not only meet regulatory standards but also proactively build trust through educational initiatives and accessible information. A 2024 survey highlighted that 65% of consumers consider clear communication about fees and terms as a critical factor in their banking relationships.

FIS is responding to this demand for transparency and education by enhancing its client-facing platforms. Initiatives include providing clearer explanations of services and investing in resources that help users understand their financial products better. For instance, their digital platforms are being updated to offer more intuitive navigation and readily accessible FAQs, aiming to demystify complex financial processes for a broader audience. This focus on clarity is vital for retaining and attracting customers in a market where informed decision-making is increasingly valued.

The growing emphasis on financial inclusion and accessibility continues to shape consumer expectations. This means a greater societal push for financial services that cater to underserved populations and those with varying levels of financial experience. FIS, as a key player in the financial technology sector, is expected to contribute to this trend by developing and supporting solutions that broaden access to essential financial tools. By 2025, projections indicate that over 1.5 billion individuals globally will still be unbanked or underbanked, presenting a significant opportunity for impact.

FIS is actively engaged in initiatives that promote financial inclusion, such as supporting digital payment solutions for emerging markets and developing platforms that simplify account management for diverse user groups. Their commitment is evident in their efforts to expand access to digital banking, with a reported 15% increase in users from previously unbanked demographics accessing their services through FIS-powered platforms by late 2024. This aligns with the broader societal goal of ensuring more equitable participation in the global economy.

Technological factors

Fidelity National Information Services (FIS) is strategically investing in artificial intelligence (AI) and machine learning (ML) to bolster its financial services solutions. Financial industry leaders are increasingly positive about AI's potential, with many planning to boost their investments in both applied and generative AI technologies.

FIS is actively developing advanced AI platforms, such as Banker Assist, and refining existing offerings like TreasuryGPT, demonstrating a commitment to leveraging AI for enhanced client services. Furthermore, their accelerator program actively fosters fintech innovation by supporting startups that utilize AI to create novel solutions.

Fidelity National Information Services (FIS) likely benefits from the ongoing trend of cloud computing adoption, which is fundamental for scalability and agility in the fintech sector. While specific FIS cloud adoption figures aren't readily available in recent public statements, the industry-wide push for modernizing banking platforms and offering flexible solutions strongly suggests FIS is prioritizing cloud-based capabilities to meet evolving client demands and maintain a competitive edge.

Fidelity National Information Services (FIS) is actively integrating emerging payment technologies like stablecoins, notably through its partnership with Circle for USD Coin (USDC) transfers. This strategic move positions FIS to capitalize on the growing digital asset economy.

Furthermore, FIS is enhancing its open banking offerings with platforms such as Open Access. This initiative streamlines payment acceptance for financial institutions, making it easier for them to connect with diverse payment methods and services.

Cybersecurity Innovation and Threat Landscape

The financial sector is grappling with a rapidly evolving threat landscape, characterized by increasingly sophisticated cyberattacks. These include AI-driven fraud schemes and insidious supply chain vulnerabilities, underscoring the vital importance of continuous cybersecurity innovation. FIS is actively responding by bolstering the security protocols embedded within its product offerings and actively supporting fintech companies that specialize in fraud prevention and regulatory compliance solutions.

The increasing frequency and complexity of cyber threats necessitate significant investment in advanced security measures. For instance, in 2023, the financial services industry reported a substantial rise in ransomware attacks, with average losses escalating significantly. FIS's commitment to cybersecurity innovation is demonstrated through its strategic investments and partnerships aimed at mitigating these risks.

- Growing Threat Sophistication: Financial institutions are facing advanced persistent threats (APTs) and AI-powered attacks that can bypass traditional security measures.

- FIS's Proactive Stance: FIS is enhancing its platforms with next-generation security features, including advanced threat detection and response capabilities.

- Fintech Collaboration: The company is actively partnering with and supporting fintechs that develop innovative solutions for fraud detection, identity verification, and regulatory compliance, thereby strengthening the overall ecosystem.

- Industry Impact: A robust cybersecurity posture is crucial for maintaining customer trust and operational resilience in an increasingly digital financial environment.

Digitalization of Core Banking and Payment Infrastructure

FIS is at the forefront of digitalizing core banking and payment systems, a crucial technological shift for financial institutions. This modernization allows banks to replace outdated infrastructure with more agile and efficient platforms, directly impacting operational costs and customer service capabilities. For example, FIS's Modern Banking Platform is designed to streamline processes and enhance user experience, reflecting the industry's move towards digital-first financial services.

The company's commitment to transforming back-office operations is evident in solutions like the Automated Finance – Receivables Suite. This focus on digitalization not only improves internal efficiencies but also enables financial institutions to offer smoother, faster payment experiences to their customers. By investing in these technologies, FIS is helping banks adapt to evolving consumer expectations and regulatory demands in the digital age.

The broader trend of digitalization in banking is significant. In 2024, global digital payment transaction volumes are projected to reach over $1.5 trillion, highlighting the massive market opportunity and the necessity for robust, digital-ready infrastructure. FIS's role in providing these foundational technologies positions it to capitalize on this ongoing digital transformation within the financial sector.

- Digital Core Banking: FIS's Modern Banking Platform facilitates the transition from legacy systems to cloud-native, API-driven architectures.

- Payment Modernization: The company's solutions support real-time payments and enhanced payment processing capabilities.

- Operational Efficiency: Digitalization of back-office functions, like receivables management, reduces manual effort and errors.

- Customer Experience: Modernized infrastructure enables financial institutions to offer seamless digital interactions and faster service delivery.

FIS is heavily investing in artificial intelligence (AI) and machine learning (ML) to enhance its financial solutions, with industry leaders increasingly optimistic and planning to boost AI investments. The company is developing advanced AI platforms like Banker Assist and refining TreasuryGPT, alongside fostering fintech innovation through its accelerator program.

The company is actively integrating emerging payment technologies, such as stablecoins through its partnership with Circle for USD Coin (USDC) transfers, positioning itself within the growing digital asset economy. Furthermore, FIS is expanding its open banking capabilities with platforms like Open Access, simplifying payment acceptance for financial institutions.

FIS is at the forefront of digitalizing core banking and payment systems, enabling financial institutions to replace outdated infrastructure with agile platforms. Solutions like the Modern Banking Platform and Automated Finance – Receivables Suite streamline operations and improve customer experience, aligning with the industry's digital-first shift. Global digital payment transaction volumes are projected to exceed $1.5 trillion in 2024, underscoring the need for robust digital infrastructure.

The financial sector faces sophisticated cyber threats, including AI-driven fraud. FIS is responding by strengthening its product security and supporting fintechs specializing in fraud prevention and regulatory compliance. The industry saw a significant rise in ransomware attacks in 2023, with average losses escalating, making cybersecurity innovation critical for trust and resilience.

Legal factors

The financial technology sector, including companies like FIS, operates within a constantly shifting global regulatory environment. For instance, the European Union's Payment Services Directive 3 (PSD3), anticipated to be fully implemented by late 2024 or early 2025, aims to enhance payment security and bolster consumer protections.

FIS must proactively adjust its offerings and operational procedures to navigate these intricate and ever-changing legal requirements. This includes staying abreast of data privacy laws, anti-money laundering regulations, and cybersecurity mandates that vary significantly by jurisdiction.

Fidelity National Information Services (FIS) operates within a landscape increasingly shaped by stringent data protection and privacy laws globally. Navigating regulations like the EU's General Data Protection Regulation (GDPR) or California's Consumer Privacy Act (CCPA) demands meticulous adherence to data handling, consent management, and security protocols. Failure to comply can result in substantial financial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, underscoring the critical importance of robust compliance frameworks for FIS.

Global financial institutions face increasingly stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, compelling technology providers like FIS to bolster their compliance solutions. These regulations demand sophisticated methods for identifying and reporting illicit financial activities.

FIS actively addresses these evolving compliance requirements through initiatives such as its accelerator program, which supports innovative companies developing AI-powered platforms for KYC and AML processes. This strategic focus ensures FIS clients are equipped to navigate the complex regulatory landscape effectively.

Digital Operational Resilience Act (DORA) Compliance

The Digital Operational Resilience Act (DORA), set to be fully effective in the EU from January 17, 2025, represents a significant regulatory shift for the financial sector and its technology partners. This comprehensive framework mandates enhanced cybersecurity measures and robust operational resilience across all third-party ICT service providers supporting financial entities. For a company like Fidelity National Information Services (FIS), which plays a crucial role in the financial technology ecosystem, DORA compliance means a deep dive into its operational processes and security protocols to align with these new, stricter EU standards.

FIS must demonstrate adherence to DORA's requirements, which encompass a wide range of areas including ICT risk management, incident reporting, resilience testing, and third-party risk oversight. Failure to comply could result in penalties, impacting business operations and reputation within the EU market. The act aims to create a more secure and resilient digital financial infrastructure, a goal that necessitates proactive adaptation from major service providers.

Key DORA compliance aspects for FIS include:

- ICT Risk Management Framework: Implementing comprehensive policies and procedures to identify, assess, and manage ICT risks.

- Digital Operational Resilience Testing: Conducting regular and advanced testing, including threat-led penetration testing, to assess resilience capabilities.

- Third-Party Risk Management: Ensuring that all critical ICT third-party service providers meet DORA's stringent requirements.

- Incident Reporting: Establishing clear protocols for reporting ICT-related incidents to relevant authorities within specified timelines.

Consumer Protection and Fair Practices Laws

Consumer protection laws, mandating transparent disclosures, fair lending practices, and robust dispute resolution mechanisms, significantly shape how FIS designs its products and delivers services to financial institutions. These regulations ensure that end-users, the consumers of banking services, are treated fairly and have recourse when issues arise.

FIS's commitment to these principles is evident in its product development, particularly in areas like mobile banking. For instance, their enhanced mobile banking applications incorporate features focused on improving user experience and bolstering security, directly aligning with the spirit and letter of consumer protection mandates.

- Enhanced Security Features: FIS's mobile platforms in 2024 often include multi-factor authentication and real-time transaction alerts, bolstering consumer confidence and security.

- Transparent Fee Structures: Regulatory pressure, particularly from bodies like the Consumer Financial Protection Bureau (CFPB) in the US, pushes FIS to ensure its financial institution clients clearly communicate all fees associated with services.

- Dispute Resolution Tools: The integration of streamlined dispute resolution processes within FIS's software empowers consumers to efficiently address any transactional discrepancies.

- Fair Lending Compliance: FIS's solutions assist financial institutions in adhering to fair lending laws, preventing discriminatory practices in credit and loan applications, a critical aspect of consumer protection.

The evolving legal landscape presents both challenges and opportunities for FIS, particularly concerning data privacy and digital operational resilience. New regulations like the EU's Digital Operational Resilience Act (DORA), effective January 2025, mandate stringent cybersecurity and resilience standards for ICT service providers within the financial sector.

FIS must ensure its offerings align with these requirements, which include robust ICT risk management, advanced resilience testing, and rigorous third-party oversight. For example, DORA's focus on third-party risk management means FIS must not only comply itself but also ensure its own vendors meet these elevated standards.

Furthermore, consumer protection laws continue to shape FIS's product development, emphasizing transparency and fair practices. Regulations like the CFPB's oversight in the US push for clearer fee structures and improved dispute resolution mechanisms within financial services, areas where FIS provides critical technology solutions.

Compliance with these varied legal frameworks is paramount for maintaining market access and client trust. For instance, the potential fines for non-compliance with GDPR, up to 4% of global annual revenue, highlight the financial imperative of robust legal adherence for companies like FIS.

Environmental factors

Investors and stakeholders are increasingly demanding that companies like Fidelity National Information Services (FIS) showcase robust Environmental, Social, and Governance (ESG) performance. This trend is driving a greater focus on transparency and measurable impact across the financial services sector.

FIS actively addresses this by publishing its annual Impact Report, which outlines its progress and dedication to sustainability initiatives. This report highlights how ESG is viewed as a collective responsibility, integrated across all facets of FIS's operations and strategic planning.

FIS demonstrates a strong commitment to sustainability by actively measuring and working to reduce its greenhouse gas (GHG) emissions. This focus is evident in their collaborations with environmental experts and the development of tools like a CO₂ calculator, designed to help clients and the company itself minimize their environmental impact.

Regulatory bodies globally are intensifying their focus on green finance and sustainable investing, a trend that directly impacts FIS. While FIS doesn't directly offer green financial products, its core technology underpins financial institutions that must now comply with evolving environmental, social, and governance (ESG) regulations and meet growing investor demand for sustainable options.

This regulatory push means FIS must adapt its data management and reporting solutions to support clients in tracking, measuring, and disclosing their sustainability performance. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) requires financial market participants to disclose sustainability-related information, creating a need for robust data infrastructure that FIS can provide.

By 2024, the global sustainable investment market is projected to exceed $50 trillion, underscoring the immense market pressure for financial institutions to integrate ESG factors. FIS's ability to facilitate compliance and reporting for these sustainable mandates will be crucial for its clients' success and, consequently, for FIS's own market position.

Climate Change Impact on Operations and Infrastructure

Fidelity National Information Services (FIS) faces tangible risks from climate change. Extreme weather events, such as increased frequency and intensity of hurricanes or floods, could disrupt operations and damage critical infrastructure like data centers. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, totaling over $170 billion in damages. This highlights the growing threat to the physical assets essential for FIS's service delivery.

Ensuring business continuity requires a proactive approach to climate resilience. FIS must integrate robust strategies into its planning to mitigate the impact of these physical risks. This includes investing in hardened infrastructure, diversifying data center locations, and developing comprehensive disaster recovery protocols. The company's ability to maintain uninterrupted service delivery is paramount for client trust and operational stability in an increasingly unpredictable climate.

- Physical Risk: Increased frequency and severity of extreme weather events (e.g., hurricanes, floods, wildfires) pose a direct threat to FIS's physical infrastructure, including data centers and office facilities.

- Operational Disruption: Damage to or inaccessibility of these facilities can lead to service interruptions, impacting client operations and potentially causing significant financial losses.

- Business Continuity Planning: FIS must enhance its business continuity and disaster recovery plans to account for climate-related risks, ensuring resilience and rapid restoration of services.

- Infrastructure Investment: Strategic investments in climate-resilient infrastructure and redundant systems are crucial to safeguard operations against physical climate impacts.

Reputation and Brand Image in Relation to Environmental Responsibility

FIS's dedication to environmental responsibility significantly bolsters its reputation and brand image, a critical asset in the competitive financial technology sector. This commitment is vital for attracting and retaining clients, top-tier talent, and increasingly, environmentally conscious investors. For instance, in 2023, FIS reported a 15% reduction in its Scope 1 and Scope 2 greenhouse gas emissions compared to its 2019 baseline, showcasing tangible progress.

Publicly available sustainability reports and active participation in global environmental forums underscore FIS's proactive stance. These actions not only demonstrate a commitment to a healthier planet but also provide transparency to stakeholders. The company's 2024 ESG report highlighted investments in renewable energy for its data centers, aiming to source 75% of its electricity from renewables by 2028.

- Enhanced Client Trust: A strong environmental record builds trust, particularly with large financial institutions that face their own sustainability pressures.

- Talent Attraction: Millennials and Gen Z, who prioritize working for socially responsible companies, are more likely to seek employment with FIS.

- Investor Confidence: Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions, with FIS's sustainability initiatives likely appealing to a growing segment of the investment community.

- Regulatory Preparedness: Proactive environmental management positions FIS favorably for evolving environmental regulations.

FIS must navigate increasing regulatory scrutiny on environmental impact, particularly concerning data centers and energy consumption. The push for green finance means FIS's technology must support clients in meeting evolving ESG disclosure requirements, such as those mandated by the EU's SFDR.

The company faces physical risks from climate change, with extreme weather events like floods and hurricanes potentially disrupting critical infrastructure. For instance, in 2023, the U.S. experienced 28 billion-dollar weather disasters, highlighting the vulnerability of physical assets essential for FIS's operations.

FIS's commitment to sustainability, demonstrated by a 15% reduction in Scope 1 and 2 GHG emissions by 2023 from a 2019 baseline, enhances its brand reputation and appeal to ESG-conscious investors and talent. The company aims to source 75% of its data center electricity from renewables by 2028.

| Environmental Factor | Impact on FIS | Mitigation/Response |

|---|---|---|

| Climate Change & Extreme Weather | Disruption to data centers and physical infrastructure; increased operational costs. | Investing in climate-resilient infrastructure, diversifying data center locations, enhancing disaster recovery plans. |

| Green Finance Regulations | Need for technology solutions supporting client ESG reporting and compliance. | Adapting data management and reporting solutions to facilitate sustainability disclosures. |

| Energy Consumption & Emissions | Operational costs, regulatory compliance, reputational risk. | Reducing GHG emissions (15% by 2023 vs. 2019), increasing renewable energy use (target 75% by 2028). |

PESTLE Analysis Data Sources

Our PESTLE analysis for Fidelity National Information (FIS) draws on a comprehensive mix of data, including financial market reports, regulatory filings, and technological innovation studies. We meticulously gather insights from government publications, industry-specific research, and economic forecasts to provide a robust understanding of the macro-environment impacting FIS.