Fidelity National Information (FIS) Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fidelity National Information (FIS) Bundle

Fidelity National Information (FIS) operates in a dynamic financial technology landscape, where the threat of new entrants and the bargaining power of buyers present significant challenges.

Understanding the intensity of rivalry among existing competitors and the availability of substitute solutions is crucial for FIS's strategic positioning.

The complete report reveals the real forces shaping Fidelity National Information (FIS)’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Fidelity National Information Services (FIS) faces a concentrated supplier landscape for specialized technology and cloud infrastructure. This reliance on a few key players, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, grants these providers substantial leverage in negotiations. The market dominance of these cloud giants, with AWS holding an estimated 32% share in 2024, directly influences FIS's operational expenses and contract terms.

Fidelity National Information Services (FIS) faces significant supplier bargaining power due to high switching costs for core technological components. Migrating enterprise software, a critical function for FIS's operations, can cost between $1.5 million and $5 million. Similarly, transitioning cloud infrastructure partners, essential for modernizing their services, can involve expenses of $2.3 million per project.

Fidelity National Information Services (FIS) faces significant bargaining power from its key software and hardware suppliers. Companies like Oracle, SAP, and Microsoft, along with hardware giants such as Dell, HPE, and Lenovo, are critical to FIS's operational infrastructure. This dependency allows these vendors to influence pricing and dictate terms in service level agreements, directly impacting FIS's cost structure and operational efficiency.

Specialized AI Technology Providers

The financial technology sector's growing dependence on specialized artificial intelligence (AI) solutions significantly strengthens the bargaining power of AI providers. With fewer than 100 established AI firms specifically targeting financial services, this scarcity creates a concentrated market where these suppliers hold considerable sway.

- Limited Supplier Pool: The small number of AI companies dedicated to financial services means FIS has fewer alternatives for crucial AI technologies.

- Essential Nature of AI: As AI becomes integral to competitive advantage in fintech, the necessity of these specialized solutions increases supplier leverage.

- Pricing and Terms Dictation: The unique and in-demand nature of these AI offerings allows providers to command premium pricing and favorable contractual terms.

- Innovation Dependence: FIS's ability to innovate and maintain a competitive edge is often tied to the advanced AI capabilities offered by these select providers.

Growing Number of Fintech Providers May Reduce Supplier Power

The fintech landscape is rapidly evolving, with a growing number of specialized providers emerging. This expansion, estimated at a 25% growth rate over the last three years, intensifies competition among these suppliers. Consequently, companies like FIS may find themselves with increased negotiation leverage, potentially diminishing the bargaining power of individual fintech suppliers.

- Expanding Fintech Ecosystem: The fintech sector's robust growth, averaging around 25% annually in recent years, is creating a more diverse supplier base.

- Increased Competition: This proliferation of fintech providers naturally leads to greater competition for clients.

- Enhanced Negotiation Power for FIS: As more specialized services become available from various vendors, FIS can more effectively negotiate terms and pricing, thereby reducing supplier power.

FIS's bargaining power with suppliers is influenced by the concentration of key technology providers and the critical nature of their offerings. High switching costs for essential software and cloud infrastructure, estimated at millions of dollars, significantly limit FIS's flexibility and empower dominant players like AWS, Microsoft Azure, and Google Cloud, which held substantial market shares in 2024.

The increasing reliance on specialized AI solutions further concentrates power among a limited number of AI firms targeting financial services, allowing them to dictate pricing and terms. However, the rapid expansion of the fintech ecosystem, growing at approximately 25% annually, is fostering greater supplier competition, which could eventually tip the scales in FIS's favor.

| Supplier Type | Key Players | Estimated Market Share (2024) | Impact on FIS |

|---|---|---|---|

| Cloud Infrastructure | AWS, Microsoft Azure, Google Cloud | AWS: ~32% | High dependency, significant switching costs |

| Enterprise Software | Oracle, SAP, Microsoft | N/A (Industry-wide) | High switching costs, pricing influence |

| Specialized AI Solutions | < 100 firms targeting FinServ | N/A (Fragmented but concentrated) | Limited alternatives, premium pricing |

What is included in the product

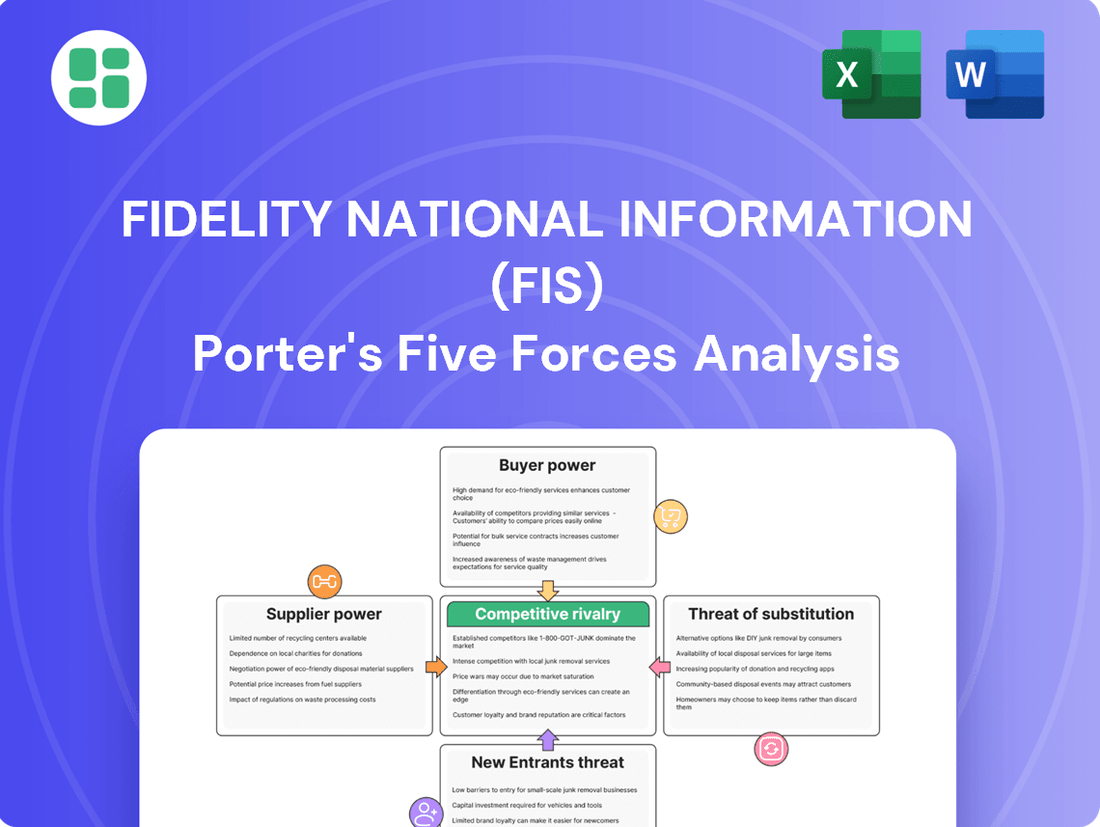

This Porter's Five Forces analysis for Fidelity National Information (FIS) dissects the competitive intensity within the financial technology sector, evaluating supplier and buyer power, threats of new entrants and substitutes, and the rivalry among existing players.

Quickly assess competitive pressures with a visual breakdown of FIS's Porter's Five Forces, allowing for rapid strategic adjustments.

Customers Bargaining Power

Fidelity National Information Services (FIS) caters to a vast and varied global clientele, encompassing everything from community banks to multinational corporations. This broad reach means FIS must be adept at meeting a wide array of specific demands. For instance, a small credit union will have very different technology needs than a large investment bank, impacting how FIS structures its services and pricing.

For financial institutions, switching core processing or payment solutions away from a provider like FIS involves substantial time, significant expense, and the risk of operational disruption. This inherent complexity and high cost of integrating new technology create formidable switching barriers.

These high switching costs effectively lower the bargaining power of customers. For instance, in 2024, the average cost for a mid-sized bank to migrate its core banking system was estimated to be in the tens of millions of dollars, often exceeding $50 million, making such transitions infrequent and costly.

This dynamic contributes to FIS's recurring revenue stability, as clients are less likely to seek alternative providers due to the prohibitive costs and complexities associated with a change.

Financial institutions are increasingly demanding highly tailored and cutting-edge solutions to keep pace with dynamic consumer expectations and stringent regulatory environments. For instance, in 2024, the global financial technology market size was valued at approximately $11.3 trillion, showcasing the immense demand for innovation.

FIS actively addresses these sophisticated client needs through substantial investments in research and development, focusing on areas like advanced cybersecurity and real-time transaction processing, critical for modern financial operations.

This persistent customer drive for continuous improvement and novel functionalities grants them considerable bargaining power, influencing pricing and service level agreements with providers like FIS.

Influence of Established Relationships with Accounting and Advisory Firms

Many small and medium-sized enterprises (SMEs) depend heavily on their trusted accounting and advisory firms when choosing financial technology solutions. These long-standing relationships mean that advice from these firms can significantly sway a customer's decision-making process. This reliance grants customers, through their advisors, increased leverage to negotiate favorable terms or improved services from fintech providers.

The bargaining power of customers is amplified when they can lean on their advisors' expertise. For instance, if an accounting firm recommends a specific FIS product, the SME customer might use this endorsement to seek preferential pricing or additional features. This dynamic is particularly relevant in 2024, as many SMEs continue to optimize their operational costs and seek value-added services.

- Customer Dependence on Advisors: SMEs often lack in-house financial expertise, making them reliant on accounting and advisory firms for guidance on financial software.

- Advisor Influence on Selection: Recommendations from established accounting and advisory firms carry significant weight, influencing which fintech solutions customers ultimately adopt.

- Negotiation Leverage: Customers can leverage their advisors' endorsements to negotiate better rates, service level agreements, or customized features from providers like FIS.

- Market Trends: In 2024, the trend of outsourcing financial functions by SMEs continues, further strengthening the influence of advisory firms in technology purchasing decisions.

Availability of Alternative Financial Technology Providers

The bargaining power of customers is significantly influenced by the availability of alternative financial technology providers. The financial services technology sector is quite crowded, featuring major players like Fiserv and Global Payments, alongside a dynamic landscape of emerging fintech startups. This abundance of choice directly empowers buyers.

Customers can leverage this competitive environment by threatening to switch to a different provider if their demands for better pricing or more advanced technological solutions aren't met. For instance, in 2023, the fintech sector saw substantial investment, with companies like Stripe and Klarna continuing to innovate and attract customer attention, putting pressure on incumbents like FIS.

- Competitive Landscape: The presence of established competitors like Fiserv and Global Payments, plus numerous fintech startups, offers buyers multiple options.

- Customer Leverage: Buyers can use the threat of switching providers to negotiate for more competitive pricing or superior technological offerings.

- Market Dynamics: The ongoing innovation and investment in the fintech space, as evidenced by significant funding rounds in 2023 for companies like Stripe, intensify customer bargaining power.

The bargaining power of customers for Fidelity National Information Services (FIS) is a multifaceted consideration, influenced by switching costs, demand for innovation, and the competitive landscape. While high switching costs generally limit customer power, the increasing demand for tailored, cutting-edge solutions and the availability of numerous alternative providers in the crowded fintech market empower buyers to negotiate more effectively.

Customers can leverage the competitive fintech environment, where established players and innovative startups vie for market share, to secure better pricing and advanced features. For example, in 2023, significant investment in fintech companies like Stripe highlighted the sector's dynamism and put pressure on incumbents to remain competitive.

Furthermore, the reliance of many small and medium-sized enterprises on accounting and advisory firms for technology guidance amplifies customer bargaining power, as these advisors can influence purchasing decisions and negotiate terms on behalf of their clients.

The ability of customers to seek out and switch to alternative providers, especially given the continuous innovation and investment in the fintech sector, directly impacts FIS's pricing strategies and service agreements. This dynamic is crucial for FIS to maintain its market position and client relationships.

| Factor | Impact on FIS Customer Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Switching Costs | Lowers bargaining power due to high expense and disruption | Mid-sized bank core system migration estimated over $50 million |

| Demand for Innovation | Increases bargaining power as clients seek tailored, advanced solutions | Global fintech market valued at approx. $11.3 trillion |

| Competitive Landscape | Increases bargaining power due to availability of alternatives | Significant investment in fintech startups in 2023 (e.g., Stripe) |

| Advisor Influence (SMEs) | Increases bargaining power through expert recommendations and negotiation | Continued trend of SME outsourcing of financial functions |

What You See Is What You Get

Fidelity National Information (FIS) Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details how the intense rivalry among financial technology providers, including FIS, shapes competitive dynamics. The analysis also highlights the significant threat of new entrants due to the relatively low barriers to entry in certain fintech segments, alongside the substantial bargaining power of large financial institutions that are key FIS clients. Furthermore, the preview reveals the moderate threat of substitute products and services, as alternative payment and processing solutions continue to emerge.

Rivalry Among Competitors

FIS faces fierce competition from established giants like Fiserv and Global Payments, both of which command substantial resources and significant market share in the financial technology sector. This intense rivalry necessitates continuous investment in product development and often leads to price pressures, impacting FIS's margins.

The financial services industry has experienced considerable consolidation in recent years, a trend that further exacerbates competitive pressures. Larger, merged entities often possess greater economies of scale and broader service offerings, creating a more challenging environment for companies like FIS to maintain or grow their market position.

The fintech sector, where FIS operates, is a hotbed of rapid technological evolution, demanding continuous innovation to maintain a competitive edge. This relentless pace means companies must constantly develop new products and services to avoid obsolescence.

FIS demonstrates its commitment to this innovation race through significant investments in research and development. For instance, in 2023, the company reported spending approximately $1.2 billion on R&D, a crucial indicator of its efforts to stay at the forefront of technological advancements and secure a strong patent portfolio.

This constant drive for innovation directly fuels intense rivalry, as firms like FIS are locked in a perpetual competition to deliver the most cutting-edge solutions to the market, often leading to aggressive pricing and feature development.

The financial services technology landscape is witnessing significant consolidation. Major companies are actively pursuing strategic acquisitions to broaden their market presence and enhance their service offerings.

For instance, FIS has been a key participant in this trend, notably acquiring Global Payments' Issuer Solutions business. This move, along with similar industry consolidations, fuels more intense rivalry by creating larger, more capable competitors with expanded market reach and integrated solutions.

Pressure to Reduce Operational Costs and Improve Processing Speeds

Competitors in the financial technology sector, including Fidelity National Information (FIS), are under immense pressure to trim operational expenses and accelerate transaction processing times, especially as transaction volumes continue to climb. This push for efficiency is a significant driver of competitive rivalry.

The adoption of technologies like Robotic Process Automation (RPA) and AI-powered bots is no longer limited to simple task automation. These advanced tools are now tackling more intricate decision-making processes, forcing companies to invest heavily in these solutions to maintain a competitive edge.

- Rising Transaction Volumes: Global digital payment transaction volumes are projected to reach over 1.5 quadrillion by 2027, a substantial increase that necessitates faster and more cost-effective processing.

- AI and RPA Investment: Companies are significantly increasing their R&D spending on AI and automation. For instance, major financial institutions are allocating billions annually to digital transformation initiatives, with a large portion dedicated to process automation.

- Efficiency as a Differentiator: In 2024, businesses that can demonstrate superior operational efficiency and faster processing speeds gain a distinct advantage in attracting and retaining clients, intensifying the competitive landscape.

Growing Demand for Real-Time Payments and Digital Solutions

The payments industry is experiencing a significant shift towards real-time payments (RTP) and digital solutions, a trend that directly impacts competitive rivalry. This evolution is fueled by increasing consumer demand for instant transactions and supportive regulatory environments, such as the introduction of FedNow in the United States. Companies are racing to develop and offer seamless, personalized payment experiences to capture market share in this rapidly growing segment.

This intensified competition means that players like FIS must innovate quickly to remain relevant. The global real-time payments market is projected to grow substantially, with some estimates suggesting it could reach over $30 trillion by 2027. FIS's strategic response, including the development of its Money Movement Hub, aims to consolidate and streamline payment processes, enabling faster and more efficient transactions.

- Growing adoption of RTP: By 2025, it's anticipated that a significant portion of all electronic payments will be real-time.

- Digital wallet dominance: Mobile and digital wallets are becoming the preferred payment method for many consumers globally.

- Regulatory tailwinds: Initiatives like FedNow are accelerating the adoption and development of real-time payment infrastructure.

- FIS's strategic positioning: The Money Movement Hub is designed to address the demand for integrated and instant payment solutions.

The competitive rivalry within the financial technology sector, where FIS operates, is exceptionally intense. Giants like Fiserv and Global Payments are formidable rivals, possessing substantial resources and significant market share, which forces FIS into continuous investment in product development and can lead to price pressures. This dynamic is further amplified by industry consolidation, creating larger entities with greater economies of scale and broader service portfolios, making it harder for FIS to maintain its market position.

The rapid pace of technological evolution in fintech demands constant innovation. Companies must continuously develop new products and services to avoid becoming obsolete. FIS's commitment to this is evident in its substantial R&D spending, with approximately $1.2 billion invested in 2023, highlighting its efforts to stay ahead in a race for cutting-edge solutions.

The drive for efficiency is a major factor in this rivalry, with companies like FIS under pressure to trim operational expenses and accelerate transaction processing, especially as transaction volumes surge. The increasing adoption of advanced tools like AI and Robotic Process Automation (RPA) for complex decision-making necessitates significant investment to remain competitive.

The shift towards real-time payments (RTP) and digital solutions is reshaping the competitive landscape. Consumer demand for instant transactions and supportive regulatory environments, such as FedNow in the US, are pushing companies to develop seamless, personalized payment experiences. FIS's Money Movement Hub is a strategic response to this trend, aiming to streamline payment processes for faster transactions.

| Key Competitor | 2023 Revenue (Approx.) | Key Strategic Focus |

|---|---|---|

| Fiserv | $18.4 billion | Digital transformation, real-time payments |

| Global Payments | $9.0 billion | Integrated payment solutions, software |

| FIS | $13.0 billion | Modernization, Money Movement Hub |

SSubstitutes Threaten

Large financial institutions, possessing substantial capital and technical expertise, are increasingly exploring in-house development of core processing and payment systems. This trend poses a direct threat to third-party providers like FIS, as these institutions can build bespoke solutions tailored to their unique needs, potentially reducing reliance on external vendors. For instance, major banks might invest in proprietary blockchain solutions for faster, more secure transactions, bypassing traditional payment processors.

Embedded finance, the integration of financial services into non-financial platforms, poses a significant threat of substitutes. For instance, companies like Shopify have seen substantial growth in their payment processing services, with Shopify Payments handling billions in gross payment volume, offering a streamlined alternative to traditional payment gateways.

These solutions, like those offered by Square (now Block), embed payment processing and other financial tools directly into business workflows, creating a seamless user experience. This reduces customer reliance on separate financial institutions or fintech apps, thereby diminishing the need for FIS's standalone offerings in certain market segments.

The rise of blockchain, cryptocurrencies, and stablecoins like USDC presents a significant threat of substitution for traditional payment systems. These innovations offer alternative, often faster and more secure, ways to move money, directly challenging the core services provided by companies like FIS. For instance, the global cryptocurrency market capitalization reached over $2.5 trillion in early 2024, demonstrating substantial adoption.

Furthermore, the development of Central Bank Digital Currencies (CBDCs) by various nations adds another layer to this threat. As of mid-2024, over 130 countries are exploring or piloting CBDCs, aiming to modernize payment infrastructures and potentially bypass existing intermediaries. This global push towards digital currencies could fundamentally alter transaction flows, impacting revenue streams for established financial technology providers.

Traditional Banking Services Adapting and Innovating

Traditional banks are actively upgrading their core systems and adopting new payment technologies, often partnering with fintech firms. For instance, in 2024, many established banks continued to invest heavily in digital transformation initiatives, with some reporting over 10% of their IT budgets dedicated to modernization efforts. This strategic shift allows them to offer more competitive services, directly challenging fintech disruptors.

By integrating advanced technologies like AI for personalized services and embracing open banking frameworks, traditional banks are becoming more potent substitutes. Real-time payment capabilities, a key area of development in 2024, are further enhancing their appeal. For example, the adoption of real-time payment systems saw significant growth globally, with transaction volumes increasing by an estimated 20-30% in many regions during the year.

- Modernizing Legacy Systems: Banks are channeling billions into upgrading outdated infrastructure, aiming for greater efficiency and agility.

- Embracing New Payment Technologies: Investments in faster payment networks and digital wallets are becoming standard practice.

- Forging Fintech Partnerships: Collaborations allow banks to quickly integrate innovative solutions and expand their service portfolios.

- Leveraging AI and Open Banking: These technologies enable banks to offer more personalized customer experiences and seamless data sharing.

Alternative Payment Systems and P2P Solutions

Beyond traditional banking, a growing array of alternative payment systems and peer-to-peer (P2P) platforms are emerging as significant substitutes for FIS's core services. These often mobile-centric and user-friendly solutions cater to a demand for immediate and convenient financial transactions, directly challenging traditional money movement and payment processing models.

The rise of these substitutes is particularly evident in the consumer space, where services like PayPal, Venmo, and Zelle have captured substantial market share. For instance, Venmo reported over $250 billion in total payment volume in 2023, showcasing a significant shift in how individuals transfer funds, often bypassing traditional banking rails that FIS supports.

- Growing P2P Transaction Volume: Peer-to-peer payment platforms continue to see robust growth, with global P2P payment transaction value projected to reach over $12 trillion by 2027, up from approximately $7 trillion in 2023.

- Consumer Preference for Digital Wallets: Digital wallets, often integrated with P2P functionality, are becoming increasingly popular, with adoption rates rising steadily across various demographics.

- Fintech Innovation: Continuous innovation in fintech is introducing new payment methods and services that offer greater speed, lower costs, or enhanced user experiences compared to established systems.

- Cross-Border Payment Alternatives: For international remittances, services like Wise (formerly TransferWise) provide competitive alternatives to traditional bank wire transfers, impacting FIS's foreign exchange and payment facilitation businesses.

The threat of substitutes for FIS is significant, driven by innovations in payment technology and evolving consumer preferences. As financial institutions and non-financial companies develop their own payment solutions, and as digital currencies gain traction, FIS faces increasing competition from alternative methods of transacting and managing money.

These substitutes range from in-house banking systems and embedded finance solutions to blockchain-based transactions and Central Bank Digital Currencies (CBDCs). For example, global cryptocurrency market capitalization exceeded $2.5 trillion in early 2024, and over 130 countries were exploring CBDCs by mid-2024, indicating a substantial shift towards alternative financial infrastructures.

Furthermore, the robust growth of peer-to-peer (P2P) payment platforms like Venmo, which processed over $250 billion in 2023, and services like Wise for cross-border payments, directly challenge FIS's traditional offerings by providing faster, more convenient, and often cheaper alternatives for consumers and businesses alike.

| Substitute Category | Key Players/Examples | Impact on FIS | 2024 Data/Trends |

|---|---|---|---|

| In-house Banking Systems | Major Financial Institutions | Reduced reliance on third-party providers | Continued investment in core system modernization by banks |

| Embedded Finance | Shopify Payments, Square (Block) | Disintermediation of traditional payment gateways | Shopify Payments handles billions in gross payment volume |

| Digital Currencies & Blockchain | Cryptocurrencies (e.g., Bitcoin), Stablecoins (e.g., USDC), CBDCs | Alternative transaction rails, potential bypass of intermediaries | Global crypto market cap > $2.5 trillion (early 2024); 130+ countries exploring CBDCs (mid-2024) |

| P2P & Alternative Payments | Venmo, Zelle, PayPal, Wise | Shift in consumer transaction behavior, competition for payment processing | Venmo processed > $250 billion (2023); Global P2P payment value projected to reach > $12 trillion by 2027 |

Entrants Threaten

Entering the financial services technology arena, especially in core processing and major payment systems, demands significant upfront capital for technology, research, and meeting strict regulations. FIS itself demonstrates this with its substantial investments, creating a formidable hurdle for newcomers aiming for widespread market penetration.

The financial services sector, where Fidelity National Information Services (FIS) operates, is characterized by a complex and ever-evolving regulatory landscape. New entrants face substantial hurdles in understanding and adhering to stringent compliance requirements, such as the Digital Operational Resilience Act (DORA) in Europe or evolving Know Your Customer (KYC) standards globally. These regulations demand significant investment in legal counsel, compliance officers, and robust technology infrastructure, creating a substantial barrier to entry.

Navigating these intricate frameworks requires specialized expertise and considerable resources, making it difficult for new players to establish themselves without facing potentially crippling penalties or damaging their reputation. For instance, non-compliance with data protection regulations can result in fines reaching millions of dollars, as seen in various GDPR enforcement actions. This high compliance burden effectively deters many potential competitors from entering the market.

Success in the financial technology sector, especially for companies like Fidelity National Information Services (FIS), hinges on a profound understanding of specialized industry knowledge. This includes intricacies of core banking systems, complex capital markets operations, and the diverse payment ecosystems that underpin global finance. Newcomers would find it incredibly challenging to acquire this level of expertise, which FIS has cultivated over decades.

Furthermore, established firms like FIS benefit from deeply entrenched relationships with a wide array of financial institutions. These partnerships, built on trust and a proven track record, are critical for securing business and understanding client needs. A new entrant would face a significant hurdle in replicating this network of relationships and gaining the necessary trust to compete effectively in the market.

For instance, in 2023, FIS reported revenue of $14.4 billion, a testament to its established market position and the deep client relationships it maintains. The barriers to entry are further amplified by the regulatory landscape, which demands extensive compliance and security protocols that new, smaller entities may struggle to meet without significant upfront investment and specialized legal and operational expertise.

Brand Loyalty, Reputation, and Network Effects

Customers in financial services, including those served by FIS, often display significant brand loyalty. This loyalty stems from the critical nature of financial operations and the deep trust required, making switching providers a substantial undertaking. For instance, in 2024, the average tenure for a financial services client with a trusted provider remained robust, reflecting this inherent stickiness.

Established players like FIS leverage strong reputations built over years of reliable service. Furthermore, network effects play a crucial role; the more financial institutions and businesses utilize FIS's platforms, the more valuable those platforms become for all users. This creates a powerful barrier for new entrants aiming to replicate the scale and interconnectedness that FIS already possesses.

- Brand Loyalty: Financial services clients often remain with established providers due to trust and the complexity of switching, a trend observed to be strong in 2024.

- Reputation: FIS's long-standing reputation for reliability in critical financial operations is a significant deterrent to new competitors.

- Network Effects: The value of FIS's integrated platforms increases with its user base, making it difficult for newcomers to achieve comparable network benefits.

- Barriers to Entry: Building the equivalent level of trust, reputation, and network scale presents a considerable challenge for any new entrant in the financial technology sector.

Technological Complexity and Integration Challenges

The threat of new entrants for Fidelity National Information Services (FIS) is significantly shaped by the technological complexity and integration challenges inherent in the financial technology sector. Developing and integrating sophisticated financial technology solutions that seamlessly connect with the diverse legacy systems of financial institutions is a formidable undertaking.

New players must contend with the substantial hurdle of building robust, scalable, and secure platforms capable of interoperating within an already intricate financial ecosystem. This often necessitates considerable investment in time and the acquisition of highly specialized talent. For instance, in 2024, the average cost to integrate a new financial software system with existing infrastructure for a large bank could range from $5 million to $20 million, highlighting the capital barrier.

- High R&D Investment: New entrants require substantial upfront investment in research and development to match the advanced capabilities of established players like FIS.

- Talent Acquisition Costs: Securing skilled engineers and financial technologists is competitive and expensive, with specialized roles often commanding salaries exceeding $150,000 annually in 2024.

- Interoperability Demands: The need for seamless integration with a multitude of existing banking systems, often built on older technologies, creates significant technical and operational challenges for newcomers.

The threat of new entrants into the financial services technology sector, where FIS operates, is considerably low due to immense capital requirements for technology development, regulatory compliance, and establishing market presence. These high barriers make it difficult for new companies to compete with established giants like FIS, which has already invested billions in its infrastructure and operations.

Newcomers face a steep learning curve and significant upfront costs to navigate complex regulations and build trust with financial institutions, a process that can take years. For example, the cost of obtaining necessary licenses and adhering to data privacy laws like GDPR or CCPA can easily run into millions of dollars. Furthermore, the need for specialized talent in areas like cybersecurity and AI adds to the expense, with average salaries for senior fintech engineers exceeding $170,000 in 2024.

| Barrier Type | Description | Estimated Cost/Challenge (Illustrative) | Impact on New Entrants |

| Capital Requirements | Investment in R&D, infrastructure, and market entry. | $50M - $200M+ for a comprehensive offering. | Prohibitive for most startups. |

| Regulatory Compliance | Adhering to financial regulations, data privacy, and security standards. | Millions annually for legal, compliance, and audit. | Demands significant expertise and ongoing expenditure. |

| Technological Complexity | Developing and integrating sophisticated, secure, and scalable platforms. | High costs for specialized talent and ongoing system upgrades. | Requires deep technical know-how and substantial investment. |

| Established Relationships & Brand Loyalty | Building trust and long-term partnerships with financial institutions. | Years of consistent service and proven reliability. | Difficult to replicate; clients are risk-averse. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Fidelity National Information Services (FIS) is built upon a robust foundation of data, including FIS's annual reports and SEC filings, industry-specific market research from firms like IDC and Gartner, and macroeconomic data from sources such as the World Bank and Bloomberg.