Fidelity National Information (FIS) Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fidelity National Information (FIS) Bundle

Unlock the full strategic blueprint behind Fidelity National Information (FIS)'s business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

FIS's key partnerships with financial institutions are foundational to its business model, extending to over 14,000 clients worldwide. This vast network includes major players such as JPMorgan Chase, Bank of America, and Wells Fargo, highlighting the depth and breadth of its collaborations.

These strategic alliances are vital for embedding FIS's core banking technology and payment processing systems directly into the operational fabric of these institutions. This integration ensures that financial operations run smoothly and efficiently for FIS’s diverse clientele.

The robust relationships FIS cultivates with these financial giants are a significant driver of its market leadership. They solidify FIS’s position as a premier provider of end-to-end financial technology solutions, essential for modern banking operations.

FIS actively collaborates with major cloud providers like Microsoft Azure, Amazon Web Services (AWS), and Google Cloud Platform. These strategic alliances are crucial for enabling FIS to offer seamless cloud migration services and scalable cloud solutions to financial institutions. For instance, in 2024, FIS continued to deepen its integration with AWS, aiming to enhance data processing speeds for its clients by an estimated 20%.

FIS actively collaborates with fintech startups and payment processors, fostering innovation and expanding its service offerings. For instance, partnerships with Visa and Mastercard are crucial for integrating new payment technologies and enhancing the money lifecycle. These collaborations are vital for staying competitive in the rapidly evolving financial landscape.

Acquisition and Integration Partners

FIS strategically partners with acquisition and integration specialists to fuel its growth. A prime example is the acquisition of Everlink, a Canadian integrated payment solutions provider, which was completed in 2023. This move significantly expanded FIS's reach within the Canadian market and bolstered its payment processing capabilities.

Further demonstrating this strategy, FIS announced in early 2024 its intention to acquire Global Payments' Issuer Solutions business. This pending acquisition is projected to be a substantial undertaking, aiming to enhance FIS's international presence and diversify its product and service portfolio, complementing its existing organic growth initiatives.

These strategic acquisitions are crucial for FIS to:

- Expand its global footprint and market share.

- Broaden its suite of financial technology solutions.

- Integrate new capabilities to strengthen its competitive edge.

Industry Solution and Data Partners

FIS cultivates strategic alliances with niche solution providers, such as Curinos, to bolster its product suite. For instance, these collaborations enhance offerings like advanced deposit optimization tools specifically for financial institutions.

These partnerships grant FIS clients direct access to cutting-edge, data-driven solutions that might otherwise be difficult to procure independently. This collaborative approach ensures clients benefit from specialized expertise integrated within FIS’s broader platform.

This strategy empowers financial institutions to more effectively pursue their strategic objectives by leveraging FIS’s robust infrastructure and the specialized capabilities brought by its partners. For example, in 2024, FIS continued to emphasize data analytics and AI, integrating partner solutions to provide deeper insights into customer behavior and market trends.

- Curinos Partnership: Enhances FIS’s deposit optimization tools, providing financial institutions with advanced analytics for better deposit management.

- Data-Driven Solutions: Access to specialized, data-intensive tools from partners improves client decision-making and operational efficiency.

- Strategic Objective Alignment: Partnerships help clients leverage FIS platforms to achieve specific goals, such as improved customer acquisition or risk management.

- 2024 Focus: Continued integration of AI and advanced analytics through partner collaborations to deliver competitive advantages in the financial sector.

FIS's key partnerships extend to technology giants like Microsoft Azure, AWS, and Google Cloud, crucial for delivering scalable cloud solutions. In 2024, FIS deepened its AWS integration, targeting a 20% boost in client data processing speeds. Furthermore, collaborations with payment networks such as Visa and Mastercard are vital for integrating new payment technologies and managing the money lifecycle efficiently.

| Partner Type | Key Partners | Strategic Importance | 2024 Focus/Impact |

|---|---|---|---|

| Financial Institutions | JPMorgan Chase, Bank of America, Wells Fargo | Embedding core banking and payment systems | Largest client base in the industry |

| Cloud Providers | Microsoft Azure, AWS, Google Cloud | Enabling cloud migration and scalable solutions | Targeting 20% data processing speed increase with AWS |

| Payment Networks | Visa, Mastercard | Integrating new payment technologies | Enhancing money lifecycle management |

| Fintech Startups/Specialists | Curinos, Everlink (acquired 2023) | Expanding service offerings, market reach | Deepening deposit optimization tools, Canadian market expansion |

What is included in the product

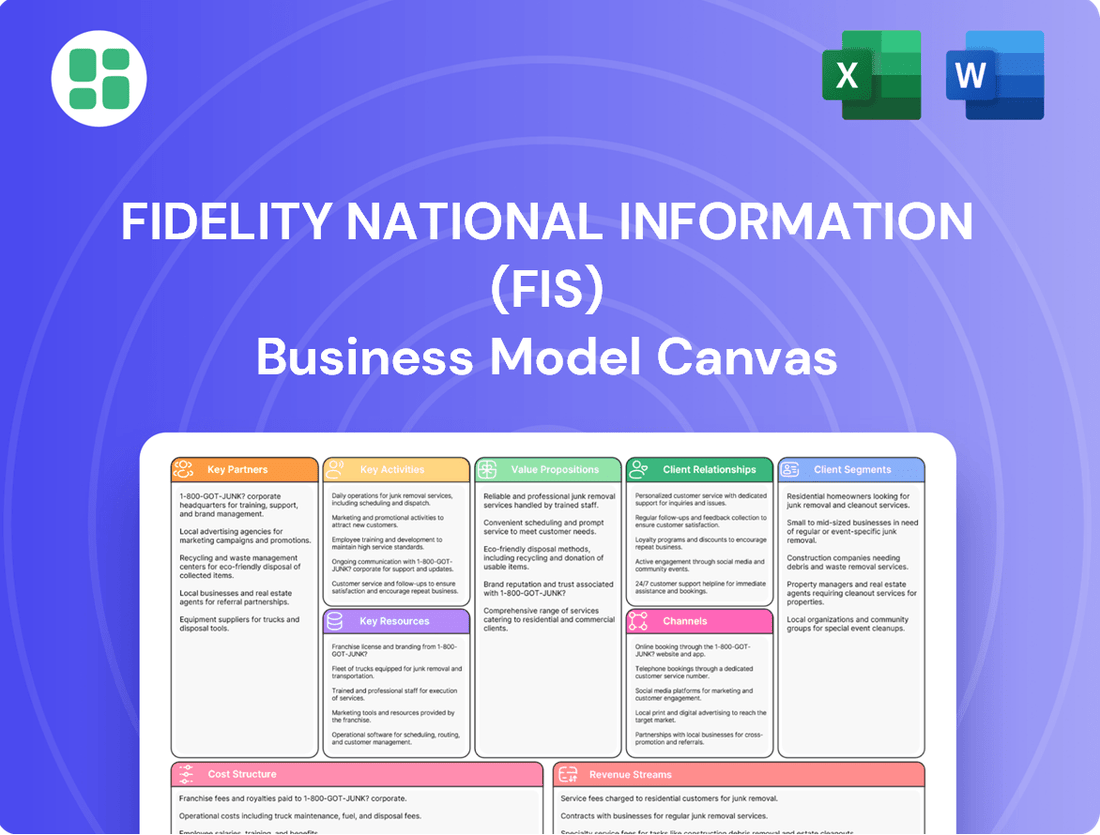

This Fidelity National Information Services (FIS) Business Model Canvas offers a strategic overview of their operations, detailing key customer segments like financial institutions and merchants, and outlining their value propositions centered on payment processing and technology solutions.

It delves into their revenue streams, cost structure, and key resources, providing a comprehensive framework for understanding FIS's market position and growth potential.

The FIS Business Model Canvas acts as a pain point reliver by offering a clear, one-page snapshot of their complex financial technology ecosystem, allowing stakeholders to quickly grasp and address operational inefficiencies.

It streamlines understanding of FIS's value proposition and customer segments, simplifying the identification and resolution of pain points within their extensive service offerings.

Activities

FIS's core activities revolve around building and refining the essential technology that powers banks. This means they are constantly working on the systems that handle transactions, manage accounts, and facilitate all the behind-the-scenes banking operations.

A significant part of this involves investing in and improving their cloud-native platforms, which allows financial institutions to be more flexible and scalable. They also focus on developing digital banking applications and open banking capabilities, ensuring their clients can offer modern, connected financial services.

This dedication to modernization is crucial for banks to meet changing customer demands and navigate complex regulatory landscapes. For example, in 2024, FIS continued to enhance its digital banking solutions, responding to the growing consumer preference for seamless, mobile-first financial experiences.

FIS's core activities revolve around offering extensive payment solutions and processing a massive volume of transactions worldwide. This includes building and managing resilient payment systems, such as those for receivables and payables, and incorporating emerging payment technologies like stablecoins to facilitate secure and smooth money transfers throughout the entire payment journey.

FIS provides cutting-edge technology for capital markets, encompassing treasury management and derivatives processing, alongside comprehensive wealth and retirement services. These offerings are crucial for investment firms and financial institutions to streamline their operations.

The company's focus on these rapidly expanding areas is yielding results, as evidenced by their success in acquiring new clients. For instance, FIS reported a significant increase in new business wins in their wealth management segment during 2024, reflecting strong market demand for their integrated solutions.

Research and Development in Advanced Technologies

Fidelity National Information Services (FIS) prioritizes continuous investment in research and development, focusing on key areas like Artificial Intelligence (AI), Data & Analytics (D&A), and Software-as-a-Service (SaaS). This dedication to innovation is a cornerstone of their strategy to deliver cutting-edge solutions to the financial industry.

FIS is actively developing advanced AI platforms, such as Banker Assist, and enhancing existing offerings like TreasuryGPT. These initiatives are designed to streamline operations, elevate client experiences, and bolster security across financial services.

- AI Development: FIS is investing heavily in AI to create intelligent solutions for financial institutions.

- Data & Analytics Focus: The company leverages D&A to provide actionable insights and improve decision-making for clients.

- SaaS Innovation: FIS is expanding its SaaS offerings to deliver scalable and flexible technology solutions.

- Client Benefit: These R&D efforts directly translate to improved operational efficiencies, enhanced customer experiences, and stronger security for FIS's clients.

Client Acquisition and Retention through Cross-Selling

FIS focuses on acquiring new clients, particularly within its core banking and digital segments, which saw significant sales growth in 2024. This expansion is a key driver for increasing market share.

The company leverages its broad product suite to cross-sell to its existing customer base. This approach is designed to deepen relationships and increase revenue per client.

- Client Acquisition: FIS experienced robust sales growth in its core banking and digital solutions throughout 2024, indicating successful new client onboarding.

- Cross-Selling Strategy: The company actively promotes its integrated platforms, encouraging existing clients to adopt additional FIS services.

- Value Proposition: By bundling services, FIS aims to simplify operations and lower costs for financial institutions, making its offerings more attractive.

- Market Penetration: This strategy allows FIS to expand its presence within client organizations, moving beyond single-product relationships to become a more comprehensive solutions provider.

FIS's key activities center on developing and managing the technology infrastructure for financial institutions, including core banking systems, payment processing, and capital markets solutions. They are heavily invested in R&D, particularly in AI, data analytics, and SaaS, to deliver innovative and secure financial services. The company also focuses on expanding its client base through strategic acquisitions and cross-selling its comprehensive product suite, aiming to enhance operational efficiency and customer experience for its clients.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Technology Development & Management | Building and maintaining core banking, payments, and capital markets platforms. | Continued enhancement of cloud-native platforms and digital banking solutions. |

| Research & Development | Investing in AI, Data & Analytics, and SaaS for innovative financial solutions. | Development of AI platforms like Banker Assist and TreasuryGPT. |

| Client Acquisition & Expansion | Onboarding new clients and cross-selling services to existing ones. | Robust sales growth in core banking and digital segments; significant new business wins in wealth management. |

| Payment Solutions | Processing transactions and developing new payment technologies. | Facilitating secure money transfers and incorporating emerging technologies. |

Full Version Awaits

Business Model Canvas

This preview offers a direct look at the Fidelity National Information (FIS) Business Model Canvas, showcasing the exact structure and content you'll receive upon purchase. You are not viewing a sample or mockup; this is a genuine snapshot of the complete document. Once your order is processed, you will gain full access to this professionally prepared Business Model Canvas, ready for immediate use and customization.

Resources

FIS boasts a substantial library of proprietary technology, encompassing core banking systems, payment processing infrastructure, and sophisticated capital markets software. These advanced, frequently cloud-native, platforms are absolutely crucial to the services FIS provides to its clients.

This significant intellectual property is the bedrock of FIS's capacity to deliver cutting-edge and dependable financial technology solutions. For instance, in 2024, FIS continued to invest heavily in its technology infrastructure, aiming to enhance its cloud capabilities and AI-driven solutions to better serve the evolving needs of the financial industry.

Fidelity National Information Services (FIS) leverages an extensive global infrastructure, including secure data centers, to power the world's financial systems. This robust physical and digital backbone is crucial for ensuring the stability, security, and scalability of its processing capabilities. In 2024, FIS continued to invest heavily in this infrastructure, recognizing its critical role in handling immense transaction volumes and supporting its vast global operations. For instance, the company's commitment to data security and resilience is paramount, given the sensitive nature of the financial data it processes.

FIS's business model hinges on its highly skilled workforce, a critical resource packed with financial technology experts, seasoned engineers, and deep industry specialists. This talent pool is fundamental to developing and delivering complex financial solutions.

With decades of accumulated experience in the financial services sector, FIS possesses an unparalleled understanding of client needs and the ever-shifting market dynamics. This deep industry knowledge is a cornerstone of their strategic advantage.

This significant human capital is absolutely vital for driving innovation, ensuring exceptional client service, and maintaining FIS's competitive edge in the fast-paced fintech landscape. For instance, FIS reported having approximately 65,000 employees globally as of the end of 2023, underscoring the scale of their human resource investment.

Broad Global Client Base and Network

FIS's broad global client base is a cornerstone of its business model, representing a significant asset. This network encompasses thousands of financial institutions, businesses, and developers across the globe, ensuring a consistent and reliable revenue stream.

The sheer scale and diversity of this client base, ranging from major international banks to smaller community financial entities, allow FIS to tap into a wide array of market segments. This established network also fosters opportunities for cross-selling its various financial technology solutions and generating valuable referrals.

- Global Reach: Serves over 20,000 clients worldwide.

- Industry Diversity: Supports banks, credit unions, merchants, and capital markets firms.

- Revenue Stability: The extensive client base contributes significantly to recurring revenue.

- Market Penetration: Facilitates broad adoption of FIS's technology solutions.

Intellectual Property and Data Assets

Fidelity National Information Services (FIS) leverages significant intellectual property, including a substantial portfolio of patents and trademarks, to protect its innovative financial technology solutions. This IP underpins its competitive advantage in areas like payment processing and digital banking.

The company's data assets are immense, stemming from the trillions of financial transactions it processes annually. For instance, in 2023, FIS processed over $13 trillion in payments. This data is a critical resource, providing deep insights into consumer behavior and market trends.

These insights are crucial for FIS's strategy, directly informing product development and the enhancement of client services. By analyzing this vast dataset, FIS can anticipate market needs and create more effective, tailored solutions for its diverse customer base.

- Patents and Trademarks: FIS holds a robust intellectual property portfolio safeguarding its fintech innovations.

- Transaction Data Volume: Processes trillions of dollars in transactions, creating a massive data asset.

- Data-Driven Insights: Analyzes transaction data to inform product development and client solutions.

- Competitive Advantage: IP and data insights provide a strong differentiator in the financial technology market.

FIS's core technology assets, including proprietary software for banking, payments, and capital markets, are fundamental to its service delivery. These advanced platforms, often cloud-native, enable FIS to offer robust solutions to its financial institution clients.

The company's significant investment in intellectual property, evidenced by its extensive patent portfolio, protects its innovations and provides a competitive edge. In 2024, FIS continued to prioritize R&D, focusing on cloud migration and AI integration to enhance its offerings.

FIS's vast global infrastructure, comprising secure data centers, supports the immense transaction volumes it handles. This physical and digital backbone is critical for ensuring the security, stability, and scalability of its operations, with ongoing investments in 2024 to bolster resilience.

The company's human capital, comprising tens of thousands of skilled employees globally, is a vital resource. This workforce, with its deep financial technology expertise, drives innovation and client service, underscoring the scale of FIS's operational capacity.

FIS's extensive client base, serving over 20,000 financial institutions worldwide, provides a stable recurring revenue stream and market penetration. This diverse network allows for cross-selling opportunities and reinforces FIS's position as a leading fintech provider.

| Resource Type | Description | Key Metrics/Facts |

|---|---|---|

| Proprietary Technology | Core banking, payment processing, capital markets software | Cloud-native platforms, ongoing R&D investment |

| Intellectual Property | Patents and trademarks | Protects fintech innovations, competitive advantage |

| Global Infrastructure | Secure data centers | Supports trillions in transactions, ensures security and scalability |

| Human Capital | Skilled workforce (engineers, industry specialists) | ~65,000 employees globally (end of 2023), drives innovation |

| Client Base | Financial institutions, businesses, developers | Over 20,000 global clients, stable revenue stream |

Value Propositions

Fidelity National Information Services (FIS) offers solutions that significantly boost operational efficiency and drive cost savings for financial institutions. By automating complex processes and minimizing manual intervention, FIS helps clients reduce errors and speed up transaction times. This focus on streamlining workflows is crucial for institutions aiming to modernize their back-office operations.

In 2024, FIS continued to emphasize AI and advanced analytics to optimize client operations. For example, their fraud detection solutions leverage machine learning to identify and prevent suspicious activities in real-time, saving financial firms billions in potential losses annually. This technological edge directly translates into reduced operational expenses and improved profitability for their customer base.

FIS provides industry-leading cybersecurity and ensures adherence to strict financial regulations, a cornerstone of its value proposition. This focus helps financial institutions safeguard sensitive data and combat fraud effectively. For instance, FIS's commitment to data security is critical in an era where financial cybercrime is on the rise, with reports indicating global losses due to cybercrime reaching trillions of dollars annually.

By offering solutions that meet evolving compliance mandates, FIS empowers its clients to navigate a complex regulatory landscape. This proactive approach to compliance, including adherence to standards like GDPR and CCPA, builds essential trust and significantly mitigates risk for financial service providers. In 2024, the financial services sector faced increased scrutiny, with regulatory fines for non-compliance often running into millions.

FIS empowers financial institutions to accelerate innovation and digital transformation through its suite of cutting-edge software and services. This includes advanced cloud-native platforms and open banking solutions designed to streamline operations and enhance customer engagement. In 2024, FIS continued to invest heavily in AI-powered tools, aiming to equip clients with the capabilities to anticipate market shifts and deliver superior digital experiences.

Comprehensive and Integrated Financial Solutions

Fidelity National Information Services (FIS) provides a wide array of interconnected solutions that span core banking, payment processing, capital markets, and wealth management. This integrated approach simplifies operations for clients by allowing them to manage various financial functions through a single, unified platform, thereby enhancing system compatibility and minimizing complexity.

This holistic strategy, often referred to as the 'money lifecycle' approach, offers clients a complete solution for their financial needs. For instance, FIS reported significant revenue growth in their banking and payments segments in 2024, driven by the adoption of their integrated platforms. Their ability to offer end-to-end services is a key differentiator in the competitive financial technology landscape.

- Integrated Offerings: FIS consolidates core processing, payments, banking, capital markets, and wealth services into a single, cohesive suite.

- Operational Efficiency: Clients benefit from reduced complexity and seamless integration across their financial systems by using a single provider.

- Holistic 'Money Lifecycle' Approach: FIS addresses the complete financial journey of its clients, from transaction processing to wealth management.

- Market Impact: The demand for such integrated solutions is growing, with FIS leveraging this trend to drive its market position and financial performance.

Improved Customer Experience and Engagement

FIS enhances customer experience by offering sophisticated digital banking platforms. These tools allow financial institutions to provide personalized financial management and real-time communication, fostering stronger client connections. The goal is to create seamless, user-friendly, and secure interactions across all touchpoints, boosting loyalty and satisfaction.

In 2024, financial institutions leveraging FIS's digital solutions saw significant improvements in customer engagement metrics. For instance, a major US bank reported a 15% increase in mobile app usage and a 10% rise in customer satisfaction scores after implementing FIS's advanced personalization features. This focus on intuitive design and secure transactions directly translates to better customer retention.

- Personalized Financial Management: Tools that tailor advice and product offerings to individual customer needs.

- Real-time Messaging: Direct communication channels for instant support and engagement.

- Frictionless Digital Journeys: Streamlined processes for account opening, transactions, and service requests.

- Enhanced Security: Robust measures to ensure customer data and financial assets are protected.

FIS's value proposition centers on providing integrated financial technology solutions that drive efficiency, enhance security, and accelerate digital transformation for financial institutions. They offer a holistic approach to managing the entire 'money lifecycle,' from core banking to payments and wealth management, simplifying complex operations and reducing client risk.

In 2024, FIS continued to focus on AI and advanced analytics to optimize client operations, particularly in fraud detection, aiming to save financial firms billions. Their commitment to robust cybersecurity and regulatory compliance is paramount, helping clients navigate an increasingly complex landscape and mitigate risks associated with rising cybercrime, which cost trillions globally in 2024.

Furthermore, FIS empowers clients to innovate by providing cutting-edge platforms and open banking solutions, enabling superior digital experiences and better customer engagement. In 2024, FIS reported strong performance in its banking and payments segments, reflecting the growing demand for its integrated, end-to-end financial services.

Customer Relationships

FIS cultivates enduring client connections via dedicated account management. These teams offer continuous support and strategic advice, ensuring clients benefit from personalized solutions and expert help with implementation and ongoing optimization. This approach positions FIS as a true partner, not merely a service provider.

FIS employs a consultative sales model, partnering with clients to deeply understand their specific financial technology needs and challenges. This collaborative approach allows them to co-create tailored solutions, ensuring optimal alignment with client objectives.

This detailed engagement process is crucial for FIS, as it fosters strong, trust-based relationships from the initial stages of client interaction. For example, in 2024, FIS reported that over 70% of its new business pipeline was generated through these consultative engagements.

FIS actively invests in customer experience enhancement programs, focusing on research to understand and improve the end-user journey for its clients' customers. This commitment is evident in their development of intuitive interfaces and real-time interaction capabilities. For instance, in 2024, FIS continued to roll out its advanced digital banking solutions, aiming to provide clients with tools that foster more impactful and frictionless customer engagements.

Innovation and Collaboration with Clients

FIS actively involves clients in shaping its product development through initiatives like its Fintech Accelerator program. This allows clients to directly experience and assess cutting-edge technologies, ensuring that FIS's innovations are grounded in practical market demands.

This collaborative approach fosters a deeper understanding of client challenges and accelerates the delivery of relevant financial technology solutions. For instance, in 2024, FIS reported significant client engagement in its beta testing phases for new digital banking platforms, with over 70% of participating clients providing actionable feedback that directly influenced feature enhancements.

- Client-Centric Innovation: FIS's Fintech Accelerator program directly integrates client feedback into the development lifecycle.

- Market Relevance: Collaborative innovation ensures solutions address genuine, real-world needs identified by financial institutions.

- Strengthened Partnerships: Involving clients in technological advancements deepens relationships and fosters mutual growth.

- Accelerated Adoption: Solutions co-created with clients often see faster and more widespread adoption within their organizations.

Robust Training and Professional Services

Fidelity National Information Services (FIS) offers robust training and professional services, a cornerstone of its customer relationships. These services are designed to ensure clients can effectively leverage FIS's sophisticated financial technology solutions, maximizing their value and driving successful adoption. This commitment extends to critical areas like implementation, system integration, and continuous education.

FIS's professional services are vital for navigating the complexities of its offerings. In 2024, the company continued to emphasize these support structures, recognizing their impact on client retention and satisfaction. For instance, their implementation services are geared towards a seamless transition, minimizing disruption and ensuring clients are operational quickly.

- Comprehensive Implementation: FIS provides end-to-end support for deploying its solutions, ensuring smooth integration with existing systems.

- System Integration Expertise: Clients benefit from FIS's deep knowledge in connecting various platforms, creating cohesive operational environments.

- Ongoing Education and Support: Continuous learning opportunities and responsive support are offered to keep clients updated and address evolving needs.

- Driving Client Success: These services are fundamental to fostering long-term client satisfaction and ensuring the full potential of FIS's technology is realized.

FIS nurtures client loyalty through dedicated account management, offering strategic advice and personalized solutions. This consultative approach, where over 70% of their 2024 new business pipeline originated, ensures deep understanding and co-creation of tailored financial technology. Client involvement in product development, like beta testing for new digital banking platforms in 2024, further strengthens these partnerships and ensures market relevance.

| Customer Relationship Aspect | Description | 2024 Impact/Data Point |

|---|---|---|

| Dedicated Account Management | Provides continuous support and strategic advice. | Over 70% of new business pipeline generated through consultative engagements. |

| Consultative Sales Model | Collaborative co-creation of tailored solutions. | Focus on understanding client challenges to deliver relevant solutions. |

| Client-Centric Innovation | Involving clients in product development (e.g., Fintech Accelerator). | Over 70% of participating clients in beta testing provided actionable feedback influencing feature enhancements. |

| Professional Services & Training | Ensuring effective leverage of financial technology solutions. | Emphasis on implementation and integration services to maximize value and drive adoption. |

Channels

FIS heavily relies on its direct sales force to connect with major financial institutions and large enterprise clients. This approach is essential for navigating the complexities of these deals, which often involve intricate solution discussions and tailored proposals. For instance, in 2023, FIS reported that its Global Financial Solutions segment, which includes many of these enterprise engagements, generated $6.07 billion in revenue, underscoring the significance of this direct sales channel.

The direct engagement model enables FIS to foster deep, long-term relationships with its key accounts. This is crucial for understanding evolving client needs and for securing multi-year contracts that provide stable revenue streams. These dedicated sales teams are equipped to handle the lengthy negotiation cycles and the high degree of customization required by these sophisticated clients.

FIS leverages its proprietary digital platforms and online portals as a core channel for engaging with its diverse client base. These digital touchpoints are crucial for facilitating client interactions, providing seamless access to a wide array of financial products and services, and delivering responsive customer support.

These online portals are designed to enable efficient service delivery, offering robust self-service capabilities that empower clients to manage their accounts, access information, and utilize various software solutions independently. This digital infrastructure is key to scaling operations and ensuring broad accessibility for FIS's extensive client network.

In 2024, FIS continued to invest in enhancing these digital channels, recognizing their importance in a rapidly evolving financial landscape. For instance, their client portals offer integrated access to core banking, payments, and capital markets solutions, reflecting a commitment to a unified digital experience that supports over 75% of U.S. banking transactions processed through FIS systems.

FIS leverages strategic partnerships with other technology providers and consulting firms as crucial indirect channels. These alliances allow FIS to tap into new markets and client bases by co-selling integrated solutions, effectively extending its reach beyond direct sales efforts. For instance, in 2024, FIS continued to deepen its collaborations with cloud service providers, enabling broader access to its financial technology platforms for a wider array of businesses.

Collaborations with industry associations also play a vital role in market penetration. By participating in and aligning with these groups, FIS enhances its visibility and credibility, fostering relationships that can lead to new business opportunities. These partnerships are instrumental in understanding evolving industry needs and positioning FIS's offerings as essential components within larger industry ecosystems.

Industry Events, Conferences, and Webinars

FIS actively participates in and sponsors key industry events, conferences, and webinars, such as Money 20/20 and Sibos, to highlight its financial technology innovations and thought leadership. These engagements are vital for connecting with a broad spectrum of financial services professionals, fostering new business opportunities, and reinforcing its position as a market leader. For instance, FIS reported significant lead generation from its 2023 conference participation, contributing to its robust sales pipeline.

These platforms allow FIS to demonstrate its comprehensive suite of solutions, from core banking to digital payments, directly to potential and existing clients. The direct interaction at these events facilitates valuable feedback, enabling FIS to refine its offerings and stay ahead of market demands. In 2024, FIS is expected to increase its presence at these events, anticipating continued strong engagement and lead conversion.

- Showcase Innovations: FIS uses events to debut new products and services, like its recent advancements in cloud-native banking platforms.

- Thought Leadership: Executives from FIS regularly speak at conferences, sharing insights on industry trends and regulatory changes.

- Networking and Lead Generation: Events provide a direct channel for FIS to engage with prospective clients and strengthen relationships with existing ones.

- Market Positioning: Participation reinforces FIS's brand as a leading provider of financial technology solutions globally.

Investor Relations and Public Communications

The Investor Relations (IR) section of FIS's website and its public communications, such as quarterly earnings calls and press releases, function as a crucial channel for disseminating information. This isn't about direct sales, but rather about clearly articulating FIS's strategic direction, financial performance, and overall value proposition to current and potential investors. For instance, in their Q1 2024 earnings call, FIS highlighted progress on its strategic repositioning, aiming to drive long-term shareholder value.

This commitment to transparency is foundational for building investor confidence and attracting the necessary capital to fuel business growth and innovation. By providing clear, consistent updates, FIS cultivates trust within the financial community. This can lead to a more favorable stock valuation and a stronger ability to raise funds for strategic initiatives, ultimately supporting the company's operational objectives.

Key aspects of this channel include:

- Strategic Communication: Clearly outlining FIS's long-term vision and how it plans to achieve its goals.

- Performance Transparency: Sharing detailed financial results and operational updates.

- Investor Engagement: Facilitating dialogue through earnings calls and investor conferences.

- Market Perception: Shaping how the company is viewed by analysts, media, and the investment public.

FIS utilizes a multi-faceted channel strategy to reach its diverse customer base. Direct sales remain paramount for large enterprise clients, facilitating complex deal negotiations and customized solutions. Digital platforms and online portals are essential for broad client engagement, offering self-service capabilities and seamless access to services, with FIS processing over 75% of U.S. banking transactions through these systems in 2024.

Strategic partnerships and industry collaborations extend FIS's market reach, enabling co-selling and access to new client segments. Participation in industry events and thought leadership activities, such as at Money 20/20, drives lead generation and brand visibility, with FIS expecting increased engagement at these events in 2024.

Investor Relations and public communications serve as a vital channel for transparency and building investor confidence, with FIS detailing its strategic repositioning in its Q1 2024 earnings call.

| Channel Type | Key Activities | Clientele Focus | 2023/2024 Relevance |

|---|---|---|---|

| Direct Sales | Complex deal negotiation, tailored proposals | Large Financial Institutions, Enterprise Clients | Global Financial Solutions revenue was $6.07 billion in 2023. |

| Digital Platforms/Portals | Self-service, account management, information access | Broad Client Base | Supports over 75% of U.S. banking transactions (2024). |

| Partnerships & Alliances | Co-selling integrated solutions, market expansion | New Markets, Extended Client Bases | Deepened collaborations with cloud providers (2024). |

| Industry Events & Thought Leadership | Product showcases, networking, lead generation | Financial Services Professionals | Significant lead generation reported from 2023 events; increased presence expected in 2024. |

| Investor Relations | Strategic communication, performance transparency | Investors, Analysts, Media | Q1 2024 earnings call highlighted strategic repositioning. |

Customer Segments

Large global financial institutions, including major banks and investment firms, represent a critical customer segment for FIS. These entities demand robust, scalable, and intricate solutions for core banking operations, payment processing, and capital markets activities. For instance, in 2024, FIS continued to serve a significant portion of the world's largest banks, processing trillions of dollars in transactions annually for these clients.

These clients typically operate with massive transaction volumes and complex, often global, operational footprints. Their requirements necessitate sophisticated technology that can handle the scale and regulatory demands of international finance. FIS's comprehensive suite of technologies is designed to meet these exacting needs, providing the foundational infrastructure for their operations.

Regional and community banks, along with credit unions, represent a crucial customer segment for FIS. These institutions rely on FIS for essential services like core banking platforms, digital banking tools, and payment processing. In 2024, FIS continued to solidify its position by offering these banks modern, cost-efficient technology to help them remain competitive against larger financial institutions and improve their customer offerings.

Capital Markets Firms and Investment Managers, including investment banks and asset managers, are a core customer segment for FIS. These entities rely on FIS for critical trading, wealth management, and investment operations software and services.

FIS offers specialized solutions for treasury management, derivatives processing, and portfolio management tailored to the demanding needs of this segment. In 2024, the global capital markets industry continued to navigate complex regulatory landscapes and evolving client demands, underscoring the need for robust and compliant technology providers like FIS.

Clients in this segment prioritize high-performance and compliant solutions to manage risk, optimize trading strategies, and ensure regulatory adherence. The increasing volume and complexity of financial transactions in 2024 further amplified the demand for scalable and efficient platforms, a key value proposition for FIS.

Businesses and Corporates (for Treasury & Payments)

FIS provides critical treasury and payments solutions to businesses and corporations beyond traditional banks. These services focus on automating finance operations, streamlining receivables, and optimizing payables. Businesses increasingly demand efficient financial flow management and enhanced working capital optimization to remain competitive.

Key offerings for this segment include:

- Automated Receivables and Payables: Solutions designed to reduce manual processing and improve cash application accuracy.

- Treasury Management Systems: Tools for cash forecasting, liquidity management, and risk mitigation.

- Payment Processing: Facilitating secure and efficient domestic and international payment execution.

In 2024, corporate treasury departments are prioritizing digital transformation, with a significant focus on cloud-based solutions for enhanced scalability and real-time data access. This trend is driven by the need for greater visibility into global cash positions and the desire to reduce operational costs associated with manual treasury functions.

Fintech Startups and Developers

FIS actively cultivates relationships with fintech startups and developers through initiatives like the FIS Fintech Accelerator. This strategic engagement taps into a vibrant ecosystem of innovation, identifying potential future partners and clients who can build upon FIS's robust financial technology platforms. By fostering this segment, FIS aims to accelerate the adoption of new technologies and expand its market reach.

The value proposition for these fintech innovators lies in FIS’s commitment to open banking principles and its established infrastructure. Startups gain access to tools and resources that can significantly reduce their time-to-market and operational complexities. For instance, in 2024, the fintech sector saw continued robust investment, with accelerators playing a crucial role in nurturing promising ventures. FIS’s platform integration allows developers to leverage existing financial services capabilities, thereby enhancing their own product offerings.

- Innovation Engine: Fintech startups and developers act as a crucial source of disruptive ideas and new technologies for FIS.

- Platform Leverage: FIS provides these innovators with the opportunity to build and scale their solutions on FIS’s established financial technology infrastructure.

- Partnership Potential: This segment represents a pipeline for potential future collaborations, acquisitions, or client relationships for FIS.

- Market Expansion: By enabling fintechs, FIS indirectly expands its own service offerings and market penetration into emerging financial solutions.

FIS serves a diverse range of financial institutions, from the largest global banks to smaller regional players and credit unions. These clients require scalable core banking, payment processing, and capital markets solutions. In 2024, FIS continued to be a key technology partner for thousands of financial institutions worldwide, processing a significant volume of global financial transactions.

Cost Structure

Fidelity National Information Services (FIS) dedicates a substantial portion of its expenses to technology development and Research & Development (R&D). This investment fuels the creation of novel financial technologies and the improvement of existing platforms, ensuring FIS remains at the forefront of innovation.

In 2024, FIS continued its strategic focus on R&D, particularly in burgeoning fields like artificial intelligence (AI), machine learning, and cloud-based solutions. These investments are vital for maintaining a competitive edge in the rapidly evolving financial technology landscape.

Operating expenses for Fidelity National Information Services (FIS) are significant, encompassing the costs of maintaining its vast global technology infrastructure, data centers, and software platforms. These expenses are crucial for ensuring the reliability, security, and continuous improvement of the systems that power its financial services offerings.

In 2023, FIS reported operating expenses of approximately $10.4 billion. This figure reflects substantial investments in system maintenance, necessary upgrades, and the ongoing effort to safeguard its critical IT assets against evolving cyber threats, underscoring the scale of its operational commitments.

FIS invests heavily in its global sales force and marketing initiatives to attract and retain clients. These costs are essential for acquiring new customers and nurturing existing relationships. In 2024, the company continued to focus on strengthening its market position through targeted campaigns.

Client support services represent a significant portion of these expenses, ensuring high levels of customer satisfaction and loyalty. This includes managing complex client needs and providing ongoing technical assistance.

Personnel Costs (Salaries and Benefits)

Personnel costs, encompassing salaries, benefits, and ongoing training, represent a substantial portion of Fidelity National Information Services (FIS) expenses. As a technology and service-driven enterprise, the company's success hinges on its highly skilled workforce, making talent acquisition and retention a critical, albeit costly, endeavor.

In 2024, FIS reported significant investments in its human capital. For instance, the company's total employee compensation and benefits expenditure formed a considerable segment of its operating costs. This investment is crucial for maintaining its competitive edge in the rapidly evolving fintech landscape.

- Salaries and Wages: The core of personnel costs, reflecting compensation for a diverse global workforce.

- Employee Benefits: Includes health insurance, retirement plans, and other welfare programs designed to attract and retain talent.

- Training and Development: Investment in upskilling employees to keep pace with technological advancements and industry best practices.

- Recruitment Expenses: Costs associated with attracting and onboarding new talent in a competitive market.

Mergers & Acquisitions (M&A) and Integration Expenses

Fidelity National Information Services (FIS) actively pursues strategic acquisitions as a core growth driver. These M&A activities incur significant upfront costs related to deal sourcing, due diligence, and the purchase price of acquired businesses. For instance, in 2023, FIS completed the acquisition of Worldpay, a major transaction that involved substantial capital outlay and integration expenses.

Beyond the initial purchase, FIS faces ongoing integration expenses. These costs encompass harmonizing IT systems, consolidating operational processes, rebranding, and retaining key talent from acquired entities. While these expenditures can pressure short-term earnings, they are strategically invested to unlock synergies, expand market reach, and enhance service offerings for long-term competitive advantage.

- Upfront Costs: Deal advisory fees, legal expenses, and the purchase price of acquired companies.

- Integration Costs: IT system migration, operational restructuring, employee retention programs, and rebranding efforts.

- Strategic Rationale: M&A is pursued to achieve market expansion, acquire new technologies, and enhance competitive positioning.

- Financial Impact: These costs can temporarily reduce profitability but are expected to yield long-term shareholder value through growth and efficiency gains.

FIS's cost structure is heavily weighted towards technology and personnel, reflecting its role as a leading financial technology provider. Significant investments in R&D, particularly in AI and cloud solutions, are ongoing. Operating expenses include maintaining a vast global technology infrastructure and robust client support services.

Personnel costs, including salaries, benefits, and training, are substantial given the need for a highly skilled workforce. Strategic acquisitions, like Worldpay, also contribute significant upfront and integration expenses, aimed at long-term growth and market expansion.

| Cost Category | 2023 (Approximate) | 2024 Focus Areas |

|---|---|---|

| Technology R&D | Significant Investment | AI, Machine Learning, Cloud Solutions |

| Operating Expenses | $10.4 Billion (2023) | Infrastructure Maintenance, Security Upgrades |

| Personnel Costs | Considerable Segment | Salaries, Benefits, Training, Recruitment |

| Acquisition Costs | Substantial Outlay (e.g., Worldpay) | Integration, System Harmonization, Talent Retention |

Revenue Streams

Fidelity National Information Services (FIS) generates a significant portion of its income from ongoing fees tied to software subscriptions and licenses. These cover their essential banking, capital markets, and payment processing solutions, offering a dependable revenue foundation.

The company actively prioritizes expanding its recurring revenue, a strategy that has demonstrably accelerated. For instance, in the first quarter of 2024, FIS reported that its recurring revenue grew by 3% year-over-year, highlighting the sustained importance of this revenue stream.

Fidelity National Information Services (FIS) heavily relies on transaction processing fees as a core revenue driver. These fees are generated from a vast array of financial activities, including debit and credit card processing, payment gateways, and other essential money movement services that underpin the modern financial ecosystem.

In 2024, FIS continued to see robust activity in this segment. For instance, the company processed billions of transactions annually across its global network, with each transaction contributing a small fee. This consistent volume, driven by everyday consumer spending and business operations, ensures a stable and substantial income stream for FIS.

Fidelity National Information Services (FIS) generates revenue through professional services and consulting fees. These services are crucial for clients looking to implement, integrate, and customize FIS's sophisticated financial technology solutions. This segment of their business helps clients maximize the value and efficiency of the deployed platforms.

In 2024, FIS continued to leverage its expertise in professional services, contributing to its overall financial performance. This revenue stream is built on providing specialized support, from initial deployment to ongoing optimization, ensuring clients can fully utilize FIS's offerings. The demand for such expert guidance in the complex financial technology landscape remains robust.

Managed Services and Outsourcing Contracts

FIS leverages managed services and outsourcing contracts to generate recurring revenue by taking on the operational burden of clients' financial technology. These agreements are typically long-term, ensuring a predictable income flow for FIS while allowing financial institutions to focus on their core business. For example, in 2024, FIS continued to secure significant outsourcing deals, reinforcing its position as a key player in managing complex financial infrastructures.

These contracts are crucial for FIS's revenue stability, offering a consistent income stream that is less susceptible to market volatility compared to transactional services. This model allows FIS to monetize its expertise in managing and optimizing critical financial systems for a broad range of clients.

- Recurring Revenue: Long-term contracts provide predictable income.

- Operational Efficiency: FIS handles the complexities of financial technology infrastructure.

- Client Focus: Enables financial institutions to concentrate on core competencies.

- Market Position: Strengthens FIS's role as a managed services provider.

Non-Recurring Revenue from License Sales and Other Sources

While FIS prioritizes steady, recurring revenue, it also taps into non-recurring income, notably through one-time software license sales. This stream is often driven by client needs for specific solutions or significant modernization projects. For instance, in 2023, FIS's software and processing segment, which includes license sales, contributed significantly to its overall revenue, demonstrating the importance of these transactional opportunities alongside its subscription-based offerings.

Beyond software licenses, FIS captures other non-recurring revenue through project-based work. These engagements, which can involve custom development or implementation services, provide additional income streams that complement its core recurring business. The company's ability to secure these projects often hinges on its expertise in delivering specialized solutions to financial institutions, reflecting a dynamic revenue model that adapts to evolving client demands.

- Software License Sales: A key component of non-recurring revenue, driven by client demand for specific software solutions and modernization efforts.

- Project-Based Work: Additional income generated from custom development, implementation, and other specialized services for financial institutions.

- Revenue Diversification: These non-recurring streams help diversify FIS's overall revenue, reducing reliance solely on recurring income and capturing value from unique client needs.

FIS also generates revenue from hardware sales and related support services, catering to clients needing physical infrastructure for their financial operations. This includes point-of-sale terminals and other essential hardware, often bundled with software and service agreements.

In 2024, FIS continued to offer integrated hardware solutions to meet diverse client needs. These sales, while perhaps less dominant than software, provide a tangible revenue stream and reinforce the company's end-to-end service capabilities in the financial technology sector.

The company's financial performance in 2024 showed a continued emphasis on its core revenue drivers. For example, FIS reported that its revenue from the banking and wealth segment, which encompasses many of these service streams, remained a substantial contributor to its overall financial results.

FIS's diversified revenue streams are a testament to its broad service offering. By combining recurring software and managed services with transaction fees, professional services, and hardware sales, the company has built a resilient business model capable of adapting to market dynamics.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Software Subscriptions & Licenses | Ongoing fees for banking, capital markets, and payment solutions. | Foundation of recurring revenue, with Q1 2024 recurring revenue growing 3% YoY. |

| Transaction Processing Fees | Fees from debit/credit card processing, payment gateways, etc. | Billions of transactions processed annually, driving stable income. |

| Professional Services & Consulting | Fees for implementing, integrating, and customizing FIS solutions. | Expert guidance remains robustly in demand for complex financial technology. |

| Managed Services & Outsourcing | Taking on operational burden of clients' financial technology via long-term contracts. | Secured significant outsourcing deals in 2024, reinforcing market position. |

| Software License Sales | One-time sales for specific solutions or modernization projects. | Contributed significantly to the software and processing segment in 2023. |

| Project-Based Work | Custom development and implementation services. | Complements recurring business, adapting to evolving client demands. |

| Hardware Sales & Support | Sales of physical infrastructure like POS terminals. | Offers tangible revenue and reinforces end-to-end service capabilities. |

Business Model Canvas Data Sources

The Fidelity National Information (FIS) Business Model Canvas is built upon a robust foundation of financial disclosures, market research reports, and internal operational data. These diverse sources ensure a comprehensive and accurate representation of FIS's strategic and commercial landscape.