FirstEnergy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstEnergy Bundle

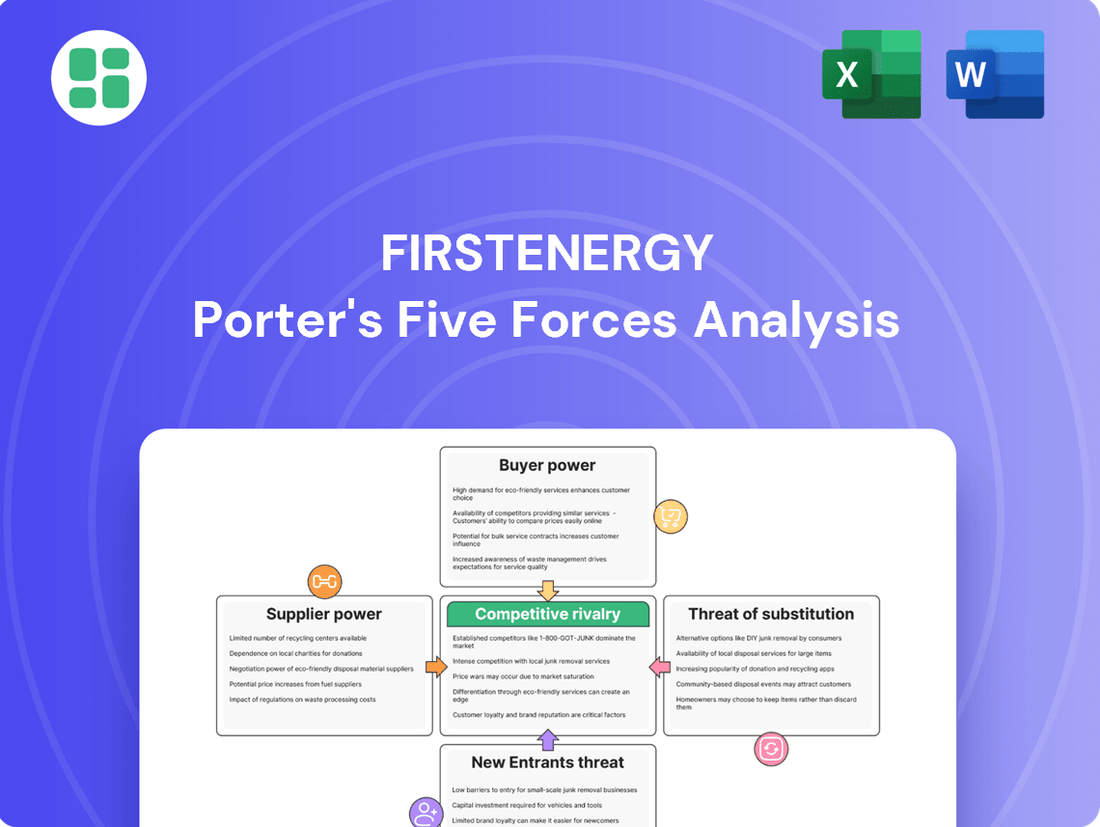

FirstEnergy navigates a complex energy landscape shaped by powerful competitive forces. Understanding the intensity of rivalry, the leverage of suppliers and buyers, and the impact of substitutes and new entrants is crucial for strategic success.

The complete report reveals the real forces shaping FirstEnergy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

FirstEnergy's limited influence from raw material suppliers stems from its strategic shift away from competitive power generation. As a fully regulated utility, its core business is electricity transmission and distribution, minimizing direct reliance on fuel inputs. This focus means that even when fuel costs are incurred for generation, they are often passed through to customers, thereby reducing the suppliers' leverage over FirstEnergy's profit margins.

FirstEnergy's reliance on a select group of specialized suppliers for essential transmission and distribution equipment, including transformers and advanced grid technologies, grants these suppliers a degree of bargaining power. This is particularly true when dealing with proprietary technologies or components that come with substantial switching costs, making it difficult and expensive for FirstEnergy to change providers.

The potential for supply chain disruptions, a known vulnerability for utility companies, further amplifies the leverage these specialized suppliers can wield. For instance, a shortage of critical components could force FirstEnergy to accept less favorable terms.

However, FirstEnergy's substantial capital expenditure plans, such as the ambitious $28 billion Energize365 program, provide opportunities to negotiate long-term contracts or forge strategic partnerships. These arrangements can effectively counterbalance the suppliers' inherent power by securing favorable pricing and ensuring supply continuity.

The utility sector, including companies like FirstEnergy, frequently contends with a unionized labor force. This union presence grants workers considerable leverage in negotiating wages, benefits, and overall working conditions. For instance, in 2023, unionized employees represented a significant portion of the workforce across major utility companies, impacting labor cost structures.

Labor disruptions, such as strikes or work stoppages, pose a tangible risk to FirstEnergy's operational continuity and the timely execution of critical infrastructure projects. Maintaining a highly skilled and dependable workforce is paramount for ensuring grid reliability, especially as utilities undertake extensive modernization efforts. The ability to attract and retain qualified personnel remains a key human capital challenge.

Regulatory oversight on supplier costs

In the regulated utility sector, FirstEnergy's supplier costs, particularly for major infrastructure initiatives, often face scrutiny from regulatory bodies. This oversight means that suppliers cannot freely dictate price hikes, as any cost recovery through customer rates requires official approval, aiming to keep consumer charges fair.

This regulatory framework inherently dampens the bargaining power of suppliers. For instance, in 2024, utilities like FirstEnergy must navigate approvals for capital expenditures, impacting how much of a supplier's increased cost can be passed on. This contrasts sharply with the pricing freedom enjoyed by suppliers in less regulated industries.

The regulatory environment provides a crucial buffer against excessive supplier price increases. Key aspects include:

- Rate Case Filings: Utilities must justify all significant costs, including those from suppliers, in rate cases presented to regulators.

- Prudence Reviews: Regulators assess whether incurred costs were necessary and reasonable, limiting unilateral supplier price hikes.

- Long-Term Contracts: Approved long-term supply agreements often lock in prices, reducing supplier leverage for spot increases.

Diverse energy mix and procurement strategies

FirstEnergy, while largely focused on transmission and distribution, still needs to secure electricity for its customers. A diverse energy mix, utilizing purchased power agreements from various sources like natural gas and renewables, helps mitigate reliance on any single supplier. This strategic diversification strengthens FirstEnergy's leverage when negotiating with energy generators.

- Diversified Procurement: FirstEnergy can secure power from a range of sources, including wholesale markets and bilateral contracts.

- Reduced Supplier Dependence: By not being tied to a single generation type or supplier, FirstEnergy lessens the bargaining power of individual suppliers.

- Negotiating Advantage: A broader array of power procurement options enhances FirstEnergy's ability to negotiate favorable terms and pricing.

- 2024 Outlook: As of early 2024, utilities like FirstEnergy continue to navigate evolving energy markets, with a growing emphasis on renewable energy integration influencing procurement strategies and supplier relationships.

FirstEnergy's bargaining power with suppliers is moderate, influenced by regulatory oversight and its diversified procurement strategy. While specialized equipment suppliers hold some leverage due to proprietary technology and switching costs, regulatory approvals for rate cases and prudence reviews temper unchecked price increases. For example, in 2024, utilities must justify capital expenditures, limiting the pass-through of supplier cost hikes.

The company's strategic diversification of power sources, including wholesale markets and bilateral contracts, reduces dependence on any single energy generator, thereby strengthening its negotiating position. This approach is crucial as FirstEnergy continues to integrate more renewable energy into its portfolio, a trend that reshaped supplier dynamics throughout 2023 and into 2024.

FirstEnergy's significant capital investment programs, such as the $28 billion Energize365 initiative, offer opportunities to negotiate favorable long-term contracts, further balancing supplier power. These large-scale projects allow for strategic sourcing and partnership development, ensuring supply continuity and competitive pricing.

What is included in the product

This Porter's Five Forces analysis dissects the competitive landscape for FirstEnergy, examining the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and their collective impact on the company's profitability and strategic positioning.

Instantly identify and address competitive threats with a dynamic overview of FirstEnergy's industry landscape.

Customers Bargaining Power

FirstEnergy, as a regulated electric utility, serves millions across the Midwest and Mid-Atlantic. In these areas, customers generally have no alternative electricity distribution providers, making them a captive audience.

This lack of choice inherently limits the bargaining power of individual customers regarding electricity rates and service quality. For instance, in Ohio, a key market for FirstEnergy, residential electricity prices have seen fluctuations, but the regulated nature of distribution means customers cannot switch providers to negotiate better terms.

Customer bargaining power for FirstEnergy is significantly influenced by regulatory protection and the rate case process. Public utility commissions (PUCs) and consumer advocacy groups act as intermediaries, scrutinizing and approving any proposed rate hikes.

For instance, in 2024, the Pennsylvania PUC initiated an investigation into FirstEnergy's requested rate increases. Similarly, the Ohio Consumers' Counsel (OCC) actively contests FirstEnergy's rate increase proposals in Ohio, demonstrating a direct challenge to pricing power.

These regulatory bodies represent consumers, ensuring that rates remain fair and reasonable. This oversight effectively grants customers an indirect but potent form of bargaining power by limiting the company's ability to unilaterally set prices.

While individual residential customers of FirstEnergy hold very little bargaining power, large industrial and commercial clients, particularly those with substantial energy needs such as data centers, can exert some influence. Their significant electricity consumption gives them leverage to negotiate tailored service agreements or even consider on-site generation if FirstEnergy's pricing becomes uncompetitive, though these options are still subject to regulatory oversight.

FirstEnergy's strategic focus on capturing the growing demand from data centers highlights the increasing importance of these large customers. This surge in demand for reliable power from entities like data centers, which are critical infrastructure for the digital economy, positions them as key stakeholders whose needs and potential for alternative solutions FirstEnergy must carefully consider in its service offerings and pricing structures.

Customer engagement and public sentiment

Customer engagement and public sentiment significantly influence the bargaining power of customers for FirstEnergy. Public outcry and organized consumer movements, particularly against rate hikes or service issues, can exert considerable pressure on regulators to scrutinize FirstEnergy's proposals more closely. For instance, in Ohio, FirstEnergy has faced public hearings concerning its rate increase requests, providing a direct avenue for consumers to voice their concerns and objections.

Negative public sentiment can also profoundly impact a regulated utility's reputation and its crucial relationships with state commissions. This sentiment can translate into increased regulatory hurdles and a more challenging environment for approving necessary revenue adjustments. In 2023, FirstEnergy reported that it served approximately 6 million customers across six states, highlighting the sheer scale of its customer base and the potential impact of widespread public opinion.

- Public outcry and organized consumer movements can pressure regulators regarding rate hikes or service issues.

- FirstEnergy has faced public hearings in Ohio for its rate increase requests, allowing consumer input.

- Negative public sentiment can damage a utility's reputation and relationships with state commissions.

Demand-side management and energy efficiency programs

Customers can indirectly influence FirstEnergy's bargaining power through demand-side management and energy efficiency initiatives. By reducing their energy consumption, customers lessen the overall demand FirstEnergy must meet, potentially impacting revenue and necessitating adjustments in future investment strategies. For instance, utility-sponsored energy efficiency programs, which saw significant growth and investment in 2024, empower customers to control their usage and costs.

This shift towards customer-driven demand management means utilities must increasingly focus on customer-centric investments. FirstEnergy, like many in the sector, is investing in programs aimed at improving grid reliability and facilitating the energy transition, directly responding to evolving customer expectations and potential shifts in energy demand patterns.

- Customer Influence: Energy efficiency programs and demand-side management allow customers to reduce consumption, indirectly impacting FirstEnergy's revenue and strategic planning.

- 2024 Trends: The utility sector saw a notable increase in investment in customer-focused energy efficiency and grid modernization projects throughout 2024.

- Strategic Response: Utilities are adapting by prioritizing capital investments that enhance customer value and support grid resilience amidst changing demand.

For FirstEnergy, the bargaining power of customers is generally low due to the regulated nature of the electric utility industry and the absence of direct competition for distribution services. While individual customers cannot switch providers, large commercial and industrial clients can exert some influence through their substantial energy consumption and potential for on-site generation, though this is still subject to regulatory oversight.

Regulatory bodies and consumer advocacy groups, such as the Pennsylvania PUC and the Ohio Consumers' Counsel, act as powerful intermediaries. They scrutinize rate increase proposals, effectively granting customers indirect bargaining power by limiting FirstEnergy's ability to unilaterally set prices. For instance, in 2024, the Pennsylvania PUC investigated FirstEnergy's requested rate hikes, demonstrating this oversight.

Public sentiment and engagement also play a role, with consumer movements and public hearings influencing regulatory decisions. FirstEnergy, serving approximately 6 million customers in 2023, must consider this broader public opinion to maintain positive relationships with state commissions and avoid increased regulatory hurdles.

Furthermore, customer engagement in demand-side management and energy efficiency programs, which saw increased investment in 2024, allows customers to reduce consumption, indirectly impacting FirstEnergy's revenue and strategic planning by necessitating customer-centric investments.

| Factor | Description | Impact on FirstEnergy |

|---|---|---|

| Lack of Alternatives | Customers typically cannot choose an electricity distributor other than FirstEnergy in its service areas. | Significantly reduces individual customer bargaining power. |

| Regulatory Oversight | Public Utility Commissions (PUCs) approve rates and service changes. | Acts as a proxy for customer interests, limiting unilateral price increases. |

| Large Industrial Customers | High-volume users can negotiate service agreements or explore on-site generation. | Provides some leverage, especially for critical infrastructure like data centers. |

| Public Opinion & Advocacy | Consumer movements and public hearings influence regulatory decisions. | Can lead to increased scrutiny and challenges to rate proposals. |

| Energy Efficiency Programs | Customer participation reduces overall demand. | Indirectly influences utility planning and investment strategies. |

Preview Before You Purchase

FirstEnergy Porter's Five Forces Analysis

This preview showcases the complete FirstEnergy Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape. The document you see here is precisely the same professionally written and formatted report you will receive immediately after purchase, ensuring no surprises. You are viewing the actual deliverable, ready for your immediate use and strategic planning.

Rivalry Among Competitors

FirstEnergy's competitive rivalry is significantly shaped by its status as a regulated electric utility. This means that within its defined service territories, the company generally operates as a geographic monopoly, holding exclusive rights to distribute electricity to end-use customers. This regulatory structure inherently limits direct competition, as other power providers cannot easily enter these established markets to vie for the same customer base.

This lack of direct head-to-head competition for customers within its operating regions substantially reduces the intensity of rivalry. For instance, in 2024, FirstEnergy continued to serve millions of customers across Ohio, Pennsylvania, New Jersey, and West Virginia, with its regulated transmission and distribution segments forming the core of its business. The company's strategy is built around managing these regulated assets efficiently rather than engaging in aggressive market share battles.

Even though FirstEnergy has moved away from owning power plants, its regulated distribution businesses still need to buy electricity. This means there's a competitive landscape among wholesale power suppliers and marketers vying to serve these FirstEnergy utilities.

This competition among generators and marketers indirectly impacts FirstEnergy's costs. For instance, in 2024, wholesale electricity prices in regions where FirstEnergy operates saw fluctuations due to factors like natural gas prices and renewable energy integration, directly affecting the procurement costs for its distribution companies.

While FirstEnergy operates in a regulated environment with limited direct competition, state commissions frequently compare its performance, including reliability and efficiency metrics, against other utilities. This benchmarking creates indirect competitive pressure, encouraging FirstEnergy to operate efficiently and make prudent capital investments to secure favorable regulatory treatment and avoid potential penalties.

In 2024, FirstEnergy continued its focus on enhancing grid reliability and resiliency through significant capital investments. For instance, the company planned to invest billions in grid modernization projects, aiming to reduce outage durations and improve service quality, directly responding to the performance expectations set by regulators and implicitly by industry peers.

Competition for capital and investment

FirstEnergy faces intense competition for investor capital not only from other utility companies but also from a wide array of industries. Its capacity to secure funding for substantial initiatives, like the ambitious $28 billion Energize365 program, is directly influenced by its financial performance, future growth potential, and the predictability of its regulatory environment when measured against alternative investment avenues.

To attract and retain investors, FirstEnergy has set a target of achieving 6-8% compound annual Core earnings growth through 2029. This growth objective is crucial for demonstrating its value proposition in a crowded investment landscape.

- Capital Allocation: Investors weigh FirstEnergy's capital needs against opportunities in sectors like technology, renewable energy, and other infrastructure projects.

- Financial Health Metrics: Key financial indicators such as debt-to-equity ratios, earnings per share growth, and dividend yields are scrutinized against industry peers and broader market benchmarks.

- Growth Projections: The company's ability to meet or exceed its projected 6-8% annual earnings growth rate is a critical factor for investors evaluating its long-term investment appeal.

- Regulatory Environment: Stability and favorability of regulatory frameworks directly impact FirstEnergy's revenue predictability and, consequently, its attractiveness to capital compared to less regulated industries.

Reputational and service quality rivalry

Even without direct price wars, utilities like FirstEnergy engage in rivalry through public perception, customer service, and reliability. Downtime, poor customer interactions, or perceived operational failures can invite regulatory attention, public criticism, and affect future rate decisions. In 2023, FirstEnergy reported a significant improvement in its reliability metrics, with the average duration of power interruptions decreasing.

FirstEnergy actively highlights its commitment to core values such as integrity, safety, reliability, and operational excellence. This focus aims to build trust and differentiate itself from competitors in the eyes of customers and regulators. For instance, the company invested over $2.7 billion in capital expenditures in 2023, largely directed towards grid modernization and reliability enhancements.

- Reputational Impact: Negative press or sustained service issues can damage a utility's standing, influencing regulatory proceedings.

- Customer Service Focus: Superior customer support and communication during outages are key differentiators.

- Reliability as a Metric: Performance indicators like SAIDI (System Average Interruption Duration Index) are closely watched by stakeholders.

- Investment in Infrastructure: Capital spending on grid upgrades directly impacts service reliability and, by extension, reputation.

FirstEnergy's competitive rivalry is notably subdued within its regulated service territories, where it largely operates as a monopoly. This structure limits direct competition for its core customer base. However, rivalry emerges indirectly through performance benchmarking by state commissions and competition for investor capital against a broad range of industries.

In 2024, FirstEnergy's focus remained on efficient management of its regulated distribution assets, rather than aggressive market share battles. The company's strategic objective to achieve 6-8% compound annual Core earnings growth through 2029 highlights its efforts to stand out in the investment landscape.

Indirect competition also exists among wholesale power suppliers and marketers who vie to provide electricity to FirstEnergy's regulated utilities. Fluctuations in wholesale electricity prices, influenced by factors like natural gas costs, directly impact FirstEnergy's procurement expenses.

FirstEnergy also competes on customer service and reliability, as poor performance can attract regulatory scrutiny and public criticism. For instance, the company invested over $2.7 billion in capital expenditures in 2023 to enhance grid modernization and reliability.

SSubstitutes Threaten

The rise of distributed generation, especially rooftop solar, presents a significant threat to FirstEnergy. Customers generating their own power means less demand from the traditional grid. In 2023, U.S. residential solar capacity grew by an estimated 15%, demonstrating this increasing customer adoption.

While distributed generation currently accounts for a modest portion of total electricity consumption, a combination of supportive government policies and falling solar panel prices could accelerate its growth. This trend directly impacts FirstEnergy's revenue by reducing the volume of electricity it sells. For instance, the Investment Tax Credit (ITC) continues to make solar more accessible for homeowners.

Improvements in energy efficiency across appliances, buildings, and industrial processes present a significant threat of substitutes for utilities like FirstEnergy. As customers can achieve the same or better outcomes with less electricity, this directly reduces demand from the traditional grid supply. For instance, advancements in LED lighting alone have drastically cut energy consumption compared to older technologies.

While FirstEnergy actively promotes energy efficiency through various programs, the success of these initiatives inherently dampens the need for increased electricity generation and sales. This trend can impact the utility's revenue growth projections. In 2024, the residential sector continued to see adoption of more efficient appliances, with ENERGY STAR certified products accounting for a notable portion of new sales.

The rise of microgrids and advanced battery storage presents a significant threat of substitutes for FirstEnergy. These systems enable large customers and communities to generate and store their own power, potentially reducing their reliance on traditional grid services. For instance, by 2024, the global energy storage market is projected to reach hundreds of billions of dollars, indicating substantial investment and technological advancement in this area.

This capability allows these entities to operate independently or semi-independently, offering improved reliability and potentially more predictable energy costs. Such a shift could directly bypass FirstEnergy's transmission and distribution infrastructure for a portion of its customer base, impacting revenue streams. Utilities are actively investigating energy storage as both a challenge and a strategic opportunity.

Self-generation by industrial and commercial customers

Large industrial and commercial clients are increasingly capable of generating their own electricity. This is a significant threat as it directly replaces the need to purchase power from FirstEnergy. For instance, in 2024, the adoption of distributed generation, including rooftop solar and on-site combined heat and power (CHP) systems, continued to rise among large energy consumers seeking greater control over their energy costs and supply reliability.

These self-generation capabilities, such as natural gas CHP or extensive solar installations, offer a direct alternative to FirstEnergy's grid supply. While customers can produce their own power, they often still rely on FirstEnergy's infrastructure for grid connection, providing backup power, or selling excess generation. This creates a complex dynamic where the threat of substitution is present but not absolute.

The financial and technical capacity of these customers to invest in their own generation assets is a key driver. This trend is supported by evolving technologies and favorable economics for on-site power production. As of early 2024, the levelized cost of energy for some distributed generation technologies has become competitive with traditional utility rates, further incentivizing self-generation.

- Customer Autonomy: Industrial and commercial customers can install their own generation, reducing reliance on FirstEnergy.

- Technological Advancements: Technologies like natural gas CHP and large-scale solar are making self-generation more feasible and cost-effective.

- Grid Interdependence: Despite self-generation, customers often require grid connection for backup and supplemental power, maintaining some link to FirstEnergy.

- Economic Incentives: Falling costs of distributed energy resources in 2024 make self-generation a financially attractive option for many businesses.

Alternative heating and cooling technologies

Alternative heating and cooling technologies pose a threat by potentially reducing electricity demand for FirstEnergy customers. For instance, widespread adoption of natural gas furnaces or geothermal heat pumps can directly substitute for electric resistance heating. In 2024, the U.S. Energy Information Administration reported that natural gas was used for heating in approximately 47% of U.S. households, a significant portion that could shift away from electric alternatives.

These shifts in energy consumption patterns can impact FirstEnergy's overall load growth and revenue streams. While the company benefits from increased electricity demand driven by trends like vehicle electrification, the substitution effect from alternative heating and cooling methods needs careful consideration in long-term load forecasting.

The threat is amplified as consumers seek more cost-effective or environmentally friendly options. For example, advancements in heat pump efficiency, capable of providing both heating and cooling, offer a compelling alternative to traditional electric resistance systems. This competitive pressure from substitutes requires FirstEnergy to adapt its strategies to maintain market share.

The threat of substitutes for FirstEnergy is significant, driven by distributed generation like rooftop solar and advancements in energy efficiency. These alternatives reduce the demand for electricity supplied by the traditional grid. For example, in 2024, the U.S. saw continued growth in residential solar installations, with capacity increasing by an estimated 15% over the previous year.

Furthermore, improved energy efficiency in appliances and buildings means customers can achieve the same outcomes with less electricity, directly impacting FirstEnergy's sales volume. The increasing adoption of ENERGY STAR certified appliances in 2024 highlights this trend. The rise of microgrids and battery storage also allows large customers to generate and store their own power, bypassing traditional grid services.

Alternative heating and cooling technologies, such as natural gas furnaces, also substitute for electric heating, reducing overall electricity demand. As of 2024, natural gas remains a primary heating source for a substantial portion of U.S. households, indicating a persistent substitution threat. These evolving customer choices and technological advancements necessitate strategic adaptation by FirstEnergy to maintain its revenue base.

| Substitute Category | Description | 2024 Impact/Trend | FirstEnergy Relevance |

|---|---|---|---|

| Distributed Generation (Solar) | Customers generating their own electricity | 15% estimated residential solar capacity growth in U.S. (2023 data, continuing trend into 2024) | Reduces demand from grid, impacting sales volume |

| Energy Efficiency | Using less electricity for same outcome | Continued adoption of ENERGY STAR appliances in residential sector | Lowers overall electricity consumption, dampening load growth |

| Microgrids & Battery Storage | On-site power generation and storage | Significant global investment in energy storage market (hundreds of billions projected by 2024) | Enables customer independence from grid services |

| Alternative Heating/Cooling | Non-electric heating/cooling methods | Natural gas used in ~47% of U.S. households for heating (EIA data) | Decreases electricity demand for heating purposes |

Entrants Threaten

The electric utility sector, especially in transmission and distribution, demands massive initial capital for infrastructure like power lines, substations, and advanced grid technology. FirstEnergy's Energize365 program, for example, is slated for a $28 billion investment through 2029, highlighting the substantial financial commitment needed to operate and expand.

This immense upfront cost creates a formidable barrier, effectively deterring new players from entering the market. Building new generation capacity and the necessary transmission lines also requires significant financial resources, further solidifying the high capital expenditure requirement as a major threat deterrent.

The utility sector, including companies like FirstEnergy, faces significant barriers to entry due to extensive regulatory hurdles and licensing requirements. New entrants must secure numerous permits and approvals from state and federal agencies, a process that is both time-consuming and costly. These regulations are in place to guarantee service reliability, public safety, and equitable pricing, effectively creating a substantial obstacle for potential competitors.

For instance, in 2024, the lengthy approval processes for new power generation facilities or transmission infrastructure can easily span several years, involving environmental impact studies, public hearings, and compliance with evolving energy standards. This inherent complexity and the need for deep regulatory expertise make it exceptionally difficult for new companies to establish a foothold in the market, thus protecting incumbent utilities.

FirstEnergy benefits from an extensive, established transmission and distribution network and a vast customer base built over decades, serving over 6 million customers across multiple states. This significant existing infrastructure and customer loyalty present a formidable barrier to new entrants.

New companies would face immense capital requirements and logistical hurdles to replicate FirstEnergy's widespread infrastructure or secure access to it. The sheer scale of FirstEnergy's operations, developed through years of investment and strategic expansion, makes it exceptionally difficult for newcomers to compete on a level playing field.

Economies of scale and scope

FirstEnergy, like other established utilities, benefits immensely from economies of scale and scope. This means they can spread the costs of operations, maintenance, and customer service across a vast customer base, leading to lower per-unit costs. For instance, in 2024, FirstEnergy reported significant operational efficiencies driven by their ongoing grid modernization efforts, which inherently leverage their existing scale.

A new entrant would find it incredibly challenging to match these cost advantages. Without a similar scale of operations, a new competitor would likely face higher per-unit costs, making it difficult to offer competitive pricing, even if certain generation markets were deregulated. This cost barrier is a substantial deterrent.

- Economies of Scale: FirstEnergy's large operational footprint allows for cost absorption across a wide customer base, a hurdle for new, smaller competitors.

- Operational Efficiencies: Investments in grid modernization by FirstEnergy in 2024 aim to further enhance these economies of scale through improved reliability and reduced maintenance costs.

- Competitive Pricing Barrier: The cost structure inherent in scale makes it difficult for new entrants to compete on price in the energy market.

Public service obligation and reliability standards

The threat of new entrants for electric utilities like FirstEnergy is significantly mitigated by their public service obligation and stringent reliability standards. These entities are legally bound to provide consistent and dependable power, a task that demands immense operational expertise and substantial capital investment in infrastructure and emergency response capabilities. For any new player to enter this market, they would need to prove they can meet these rigorous demands, particularly during extreme weather events, which are becoming more frequent.

Meeting these reliability benchmarks isn't a minor hurdle. New entrants must demonstrate a proven track record of resilience and the capacity for rapid restoration of service. This is a significant barrier because it requires not just financial backing but also deep-seated operational knowledge and established emergency management protocols. FirstEnergy, for instance, has invested heavily in programs like Energize365, which specifically aims to bolster system reliability and resilience, showcasing the ongoing commitment and resources needed to maintain these standards.

- Public Service Obligation: Utilities must ensure reliable power delivery, a core mandate that new entrants would struggle to replicate without extensive experience and infrastructure.

- Stringent Reliability Standards: Meeting regulatory requirements for uptime and rapid outage restoration demands significant operational maturity and investment.

- Emergency Response Capacity: The ability to manage and recover from extreme weather events requires specialized resources and well-tested protocols, a high barrier for newcomers.

- FirstEnergy's Energize365: This program highlights the continuous investment and strategic focus required to enhance and maintain system reliability, a costly endeavor for potential entrants.

The threat of new entrants for FirstEnergy is significantly low due to the immense capital required for infrastructure development, estimated in the billions for grid modernization and expansion. For example, FirstEnergy's Energize365 program alone is a $28 billion investment through 2029.

Regulatory barriers and licensing requirements further deter new companies, demanding years of approvals and deep expertise. FirstEnergy's established network, serving over 6 million customers, provides substantial economies of scale, making it difficult for newcomers to match their cost efficiencies and competitive pricing.

Moreover, stringent public service obligations and reliability standards, exemplified by FirstEnergy's focus on resilience through programs like Energize365, necessitate proven operational maturity and significant investment in emergency response capabilities, creating a high barrier to entry.

| Barrier Type | Description | Impact on New Entrants | FirstEnergy Example/Data |

|---|---|---|---|

| Capital Requirements | Massive upfront investment for infrastructure. | Extremely High | Energize365: $28 billion investment through 2029. |

| Regulatory Hurdles | Extensive permits, licenses, and compliance. | High | Approval processes can span several years in 2024. |

| Economies of Scale | Cost advantages from large-scale operations. | High | Serves over 6 million customers; operational efficiencies from grid modernization. |

| Reliability Standards | Meeting public service obligations and uptime requirements. | High | Focus on system reliability and resilience through ongoing programs. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for FirstEnergy leverages data from SEC filings, annual reports, and industry-specific trade publications to assess competitive intensity and market dynamics.