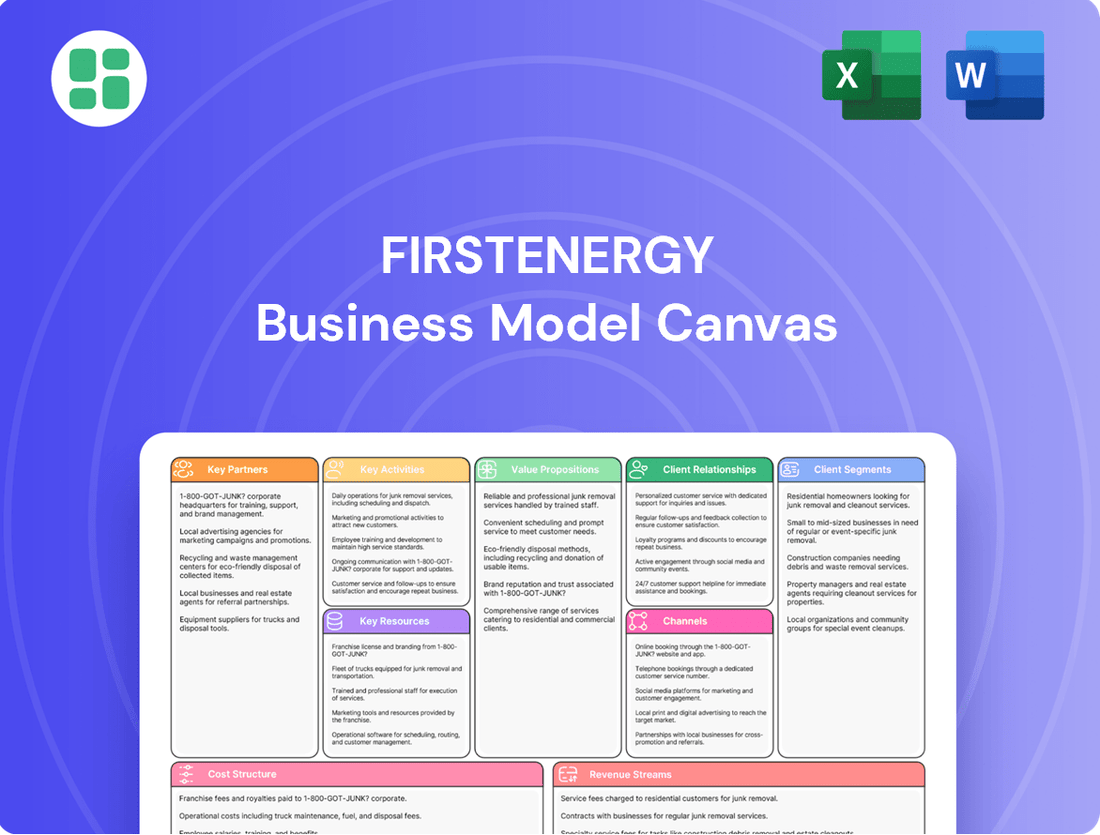

FirstEnergy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstEnergy Bundle

Curious about how FirstEnergy fuels its operations and serves its vast customer base? Our comprehensive Business Model Canvas breaks down their key partners, value propositions, and revenue streams, offering a clear strategic overview. Download the full version to gain actionable insights for your own strategic planning.

Partnerships

FirstEnergy's business model relies heavily on its relationships with state public utility commissions, such as PUCO in Ohio and PPUC in Pennsylvania, and federal bodies like FERC. These entities are critical for approving rate increases, which directly influence FirstEnergy's revenue streams and its ability to fund significant infrastructure projects. For instance, regulatory approvals are the gateway for investments in grid modernization, a key component of their long-term strategy.

The company's operational compliance and ability to execute strategic initiatives, including grid modernization plans, are contingent on favorable rulings from these governmental and regulatory bodies. In 2024, FirstEnergy continued to navigate these relationships to secure approvals for essential capital expenditures, ensuring the reliability and efficiency of its service territories. These partnerships are not merely for compliance; they are fundamental to the company's financial health and its capacity for future growth.

FirstEnergy relies heavily on technology and equipment suppliers for essential grid components like smart meters and transformers. In 2024, the company continued to emphasize supplier diversity, fostering a competitive landscape that bolsters grid reliability and manages costs effectively.

These crucial relationships directly support FirstEnergy's 'Energize365' initiative, a significant capital investment program aimed at upgrading and modernizing its electric infrastructure. The success of this modernization hinges on the quality and timely delivery of materials from these strategic partners.

FirstEnergy actively collaborates with other utilities and Regional Transmission Organizations (RTOs), notably PJM Interconnection, to ensure seamless grid operations and reliable power delivery. These partnerships are crucial for managing regional power flows and maintaining grid stability across key areas like the Midwest and Mid-Atlantic.

In 2024, PJM Interconnection, which FirstEnergy is a member of, managed a vast transmission network serving over 65 million people across 13 states and the District of Columbia. This collaboration involves participation in joint projects and adherence to complex market rules, underscoring the necessity of these alliances for regional grid health.

Community Organizations and Local Governments

FirstEnergy actively collaborates with local governments and community organizations to drive economic development and enhance public safety. In 2023, the FirstEnergy Foundation contributed over $5 million to more than 600 non-profit organizations, supporting a range of initiatives from education to environmental stewardship. These partnerships are crucial for building trust and ensuring a stable operating environment.

These collaborations allow FirstEnergy to address specific community needs and contribute to local resilience. For instance, partnerships with local emergency management agencies are vital for coordinated responses during severe weather events, a critical aspect of utility operations. The company also supports programs aimed at improving energy efficiency and promoting sustainable practices within these communities.

- Economic Development: Supporting job creation and local business growth through collaborative initiatives.

- Public Safety: Partnering with local authorities on emergency preparedness and response.

- Environmental Stewardship: Engaging in projects that promote conservation and sustainability in the communities served.

- Community Investment: The FirstEnergy Foundation's significant contributions directly benefit local non-profits and their missions.

Advocacy Groups and Consumer Representatives

FirstEnergy actively collaborates with consumer advocacy groups and environmental organizations to foster support for critical initiatives like grid modernization. For instance, engaging with entities such as the Citizens Utility Board of Ohio and the Environmental Law & Policy Center helps build consensus for rate cases and infrastructure upgrades.

These partnerships are crucial for navigating the regulatory landscape and ensuring that proposed plans, like the Grid Modernization II plan, receive timely approvals. Settlements with these stakeholders, such as the one reached for the Grid Modernization II plan, demonstrate a commitment to incorporating diverse viewpoints, which can expedite the approval process.

- Engagement with consumer and environmental groups is vital for securing approval for regulatory filings.

- Collaborations with organizations like the Citizens Utility Board of Ohio and Environmental Law & Policy Center facilitate support for grid modernization.

- Settlements with advocacy groups, such as the one for the Grid Modernization II plan, streamline regulatory approvals.

- Partnerships ensure that a broad range of stakeholder perspectives are considered in strategic planning.

FirstEnergy's key partnerships extend to financial institutions and investors who provide the capital necessary for its extensive infrastructure upgrades. In 2024, the company continued to engage with these partners to secure funding for its strategic initiatives, including the ongoing grid modernization efforts. These relationships are fundamental to FirstEnergy's ability to execute its long-term capital investment plans and maintain financial stability.

| Partner Type | Role | 2024 Focus/Example |

|---|---|---|

| Regulatory Bodies (PUCO, FERC) | Approving rates, capital expenditures | Securing approvals for grid modernization investments |

| Technology/Equipment Suppliers | Providing grid components (smart meters, transformers) | Ensuring quality and timely delivery for 'Energize365' |

| Other Utilities/RTOs (PJM) | Ensuring grid operations, regional stability | Managing regional power flows and market rules |

| Local Governments/Community Orgs | Economic development, public safety, community investment | Supporting local resilience and emergency preparedness |

| Consumer/Environmental Groups | Building support for initiatives, facilitating approvals | Collaborating on grid modernization plans and settlements |

What is included in the product

A detailed breakdown of FirstEnergy's operations, outlining its key customer segments, value propositions, and revenue streams.

This model provides a strategic overview of FirstEnergy's business, covering essential components like cost structure and key resources.

FirstEnergy's Business Model Canvas acts as a pain point reliever by offering a clear, actionable framework to identify and address inefficiencies in their complex utility operations.

It streamlines the process of understanding customer segments and value propositions, helping FirstEnergy pinpoint and resolve service delivery pain points.

Activities

FirstEnergy's primary function is the reliable transmission and distribution of electricity. This involves managing a vast infrastructure, including over 24,000 miles of transmission lines and 194,000 miles of distribution lines, to serve more than six million customers across several states.

Maintaining and upgrading these critical networks is a key activity. In 2023, FirstEnergy invested billions in its transmission and distribution systems to improve reliability and resilience against various weather events and operational challenges.

FirstEnergy's key activities heavily involve grid modernization and infrastructure investment, a critical component for future success. A cornerstone of this effort is the Energize365 capital investment program. This initiative is specifically designed to upgrade the company's electric grid by integrating advanced smart technologies.

The deployment of smart meters across its service territory is a significant undertaking within Energize365. Alongside this, FirstEnergy is enhancing substation automation and bolstering grid resilience. These upgrades are essential to effectively manage and support the evolving energy demands and the increasing integration of distributed energy resources.

These strategic investments are substantial, with FirstEnergy projecting capital expenditures of approximately $28 billion through 2029. The overarching goal of this extensive investment is to create a grid that is not only smarter and more secure but also demonstrably more reliable for its customers.

FirstEnergy's customer service and engagement activities are central to its operations. This includes providing responsive support, efficiently managing power outages, and offering valuable energy efficiency programs designed to help customers save money and reduce consumption. In 2024, for instance, FirstEnergy continued to invest in improving its outage response times and customer communication during disruptive weather events.

Facilitating convenient bill payment options is another key activity, ensuring customers can easily manage their accounts. Furthermore, FirstEnergy empowers customers with insights into their energy usage and costs. Tools like the Home Energy Analyzer are designed to provide this transparency, helping individuals understand and potentially reduce their energy bills.

The company is actively redesigning its operating models. A significant focus of these changes is moving accountability closer to the customer. This strategic shift aims to enhance service delivery by making teams more responsive and directly accountable for customer satisfaction and issue resolution.

Regulatory Compliance and Rate Case Management

FirstEnergy's key activities include navigating intricate regulatory landscapes to ensure compliance with state and federal mandates. This involves the meticulous preparation and filing of rate cases, which are crucial for recovering operational and capital expenditures. In 2024, the company continued to focus on these processes to maintain financial health and operational continuity.

Managing formula rate programs is a significant part of their strategy, allowing for more predictable recovery of substantial capital investments made in modernizing infrastructure. This approach helps to align regulatory approvals with the company's investment cycles, fostering financial stability.

Effective engagement with regulatory bodies is paramount for FirstEnergy. This proactive approach is essential for securing necessary approvals for infrastructure projects and rate adjustments, ultimately safeguarding the company's financial stability and ability to serve its customers.

- Navigating Complex Regulatory Environments: FirstEnergy actively engages with numerous state public utility commissions and federal agencies, such as the Federal Energy Regulatory Commission (FERC).

- Preparing and Filing Rate Cases: The company regularly files rate cases to seek adjustments in electricity prices, reflecting changes in operating costs and capital investments. For instance, in 2024, they continued to manage filings across their operating companies.

- Ensuring Compliance: Adherence to regulations set by bodies like the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA) is a core activity.

- Managing Formula Rate Programs: These programs, like the Electric Security Plan (ESP) in Pennsylvania, allow for the recovery of approved capital expenditures over set periods, providing revenue predictability.

Asset Maintenance and Operational Excellence

FirstEnergy's key activities heavily revolve around the meticulous upkeep of its extensive energy infrastructure. This includes the routine and preventative maintenance of power plants, crucial transmission lines, and the widespread distribution network. These ongoing efforts are paramount for ensuring the integrity and unwavering reliability of the entire power system, a fundamental requirement for customer service.

The company actively pursues operational excellence, a core tenet that drives its approach to managing costs and boosting efficiency. This commitment is demonstrated through robust safety protocols and continuous improvement initiatives implemented across all facets of its operations. For instance, in 2023, FirstEnergy reported capital expenditures of $3.3 billion, with a significant portion dedicated to strengthening and modernizing its transmission and distribution systems, directly supporting these key activities.

- Infrastructure Upkeep: Routine and preventative maintenance of power plants, transmission lines, and distribution networks to guarantee system integrity and reliability.

- Operational Excellence: Focus on safety and continuous improvement programs to manage costs and enhance operational efficiency.

- Investment in Reliability: In 2023, FirstEnergy invested $3.3 billion in capital expenditures, with a substantial portion allocated to transmission and distribution system enhancements, underscoring the importance of these activities.

FirstEnergy's key activities center on maintaining and upgrading its vast electricity transmission and distribution networks. This includes significant capital investments, like the Energize365 program, to modernize the grid with smart technologies and enhance resilience. The company also focuses on delivering excellent customer service and managing regulatory compliance through rate cases and formula rate programs.

| Key Activity | Description | 2023/2024 Data/Focus |

|---|---|---|

| Infrastructure Management & Modernization | Operating and upgrading over 24,000 miles of transmission and 194,000 miles of distribution lines. | Energize365 capital investment program; $3.3 billion in capital expenditures in 2023, with focus on T&D systems. |

| Customer Service & Engagement | Providing outage support, energy efficiency programs, and transparent billing/usage information. | Continued investment in improving outage response times and customer communication in 2024. |

| Regulatory Compliance & Rate Management | Navigating state and federal regulations, filing rate cases, and managing formula rate programs. | Ongoing management of regulatory filings across operating companies in 2024. |

Full Document Unlocks After Purchase

Business Model Canvas

The FirstEnergy Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered, ensuring no discrepancies or surprises. You can confidently assess the quality and completeness of the analysis before committing to your purchase.

Resources

FirstEnergy's extensive transmission and distribution infrastructure is a cornerstone of its business model, representing a significant capital investment. This vast network, encompassing over 24,000 miles of transmission lines and 194,000 miles of distribution lines, along with numerous substations, forms the physical backbone for its regulated utility operations.

These critical assets are essential for reliably delivering electricity to millions of customers across its service territories. The sheer scale of this infrastructure highlights FirstEnergy's role as a major utility provider and a key enabler of economic activity in the regions it serves.

FirstEnergy's skilled workforce is a cornerstone of its operations, comprising over 12,000 dedicated employees. This team includes essential roles like engineers who design and manage infrastructure, experienced line workers who maintain the physical grid, customer service representatives ensuring smooth interactions, and IT professionals who support critical systems.

The collective expertise of these individuals is vital for the day-to-day management of complex electricity grids and for the successful execution of modernization initiatives. Their hands-on experience directly translates into reliable service delivery for millions of customers.

FirstEnergy's access to substantial financial capital is a cornerstone of its operations, particularly for its ambitious 'Energize365' initiative. This program, aimed at modernizing and expanding the company's electrical grid, requires multi-billion-dollar investments, underscoring the importance of robust financial resources.

The company secures this vital capital through a diversified approach, leveraging its own earnings, engaging in debt financing, and executing strategic transactions. This multi-faceted strategy ensures FirstEnergy can consistently fund its long-term growth objectives and critical infrastructure upgrades.

For instance, in 2024, FirstEnergy continued to demonstrate its investment capacity, with plans to invest approximately $17.9 billion in its regulated utilities between 2024 and 2028. This substantial commitment highlights their ability to access and deploy significant capital for grid enhancements and reliability improvements.

Regulatory Licenses and Franchises

FirstEnergy's business model relies heavily on its regulatory licenses and franchises, which are essential key resources. These approvals grant the company the exclusive right to provide electricity within its extensive service territories. As of 2024, FirstEnergy operates in Ohio, Pennsylvania, New Jersey, West Virginia, Maryland, and New York, covering a significant portion of the Mid-Atlantic and Midwest regions. These franchises are not just permissions; they are the foundation of its regulated utility operations, ensuring a stable customer base and revenue streams.

The value of these licenses is immense, as they represent protected market positions. Without them, competitors could enter these service areas, disrupting FirstEnergy's established operations. The company's ability to invest in infrastructure, such as transmission and distribution networks, is directly tied to the security provided by these regulatory grants. For instance, in 2023, FirstEnergy invested billions in grid modernization projects, underscoring the importance of long-term operational certainty derived from its licenses.

- Exclusive Service Rights: FirstEnergy holds the sole authority to deliver electricity in its designated service areas, a critical competitive advantage.

- Regulatory Approvals: Necessary licenses from state public utility commissions in Ohio, Pennsylvania, New Jersey, West Virginia, Maryland, and New York are fundamental.

- Infrastructure Investment Foundation: These franchises provide the stability needed for significant capital expenditures in grid upgrades and maintenance.

- Protected Market Position: The granted franchises shield FirstEnergy from direct competition within its operational territories, ensuring a predictable revenue base.

Technology and Data Management Systems

FirstEnergy relies heavily on advanced technology and robust data management systems as a key resource. This includes smart meters that provide granular consumption data, sophisticated grid management software for operational efficiency, and powerful data analytics platforms to process this information. A strong cybersecurity infrastructure is also paramount to protect these critical systems and sensitive customer data.

These technological assets are fundamental to FirstEnergy's operations, enabling real-time monitoring and control of the electrical grid. They facilitate rapid outage detection and restoration, support the development of smart grid capabilities, and power enhanced customer engagement tools. For instance, the Home Energy Analyzer leverages this data infrastructure to provide customers with insights into their energy usage.

In 2024, FirstEnergy continued to invest in these areas. The company reported significant progress in its grid modernization efforts, which are underpinned by these technology and data management systems. These investments are crucial for improving reliability and integrating distributed energy resources.

- Smart Meter Deployment: Facilitates detailed energy usage data collection for millions of customers.

- Grid Management Software: Enhances operational efficiency and real-time grid monitoring.

- Data Analytics Platforms: Enables predictive maintenance and optimized energy distribution.

- Cybersecurity Infrastructure: Protects critical systems and customer data from threats.

FirstEnergy's brand reputation and established customer relationships are invaluable intangible assets. Years of reliable service and community engagement have built trust among its millions of customers across its operating territories. This strong reputation is crucial for maintaining customer loyalty and navigating regulatory landscapes.

The company's commitment to safety and environmental stewardship further bolsters its brand image. In 2024, FirstEnergy continued its focus on enhancing grid reliability and investing in cleaner energy solutions, reinforcing its position as a responsible utility provider. This positive perception is a key differentiator in the competitive energy market.

FirstEnergy's strategic partnerships and supplier relationships are also vital resources. These collaborations provide access to specialized expertise, equipment, and materials necessary for infrastructure development and maintenance. Strong relationships with key suppliers ensure the timely and cost-effective procurement of essential components for projects like grid modernization.

The company actively manages these relationships to optimize its supply chain and ensure operational efficiency. These partnerships are critical for executing large-scale capital projects and maintaining the integrity of its extensive network. For example, in 2023, FirstEnergy highlighted the importance of its supplier network in achieving its infrastructure upgrade goals.

| Resource Type | Description | Key Aspects |

|---|---|---|

| Brand Reputation | Established trust and reliability among millions of customers. | Customer loyalty, positive market perception, community engagement. |

| Customer Relationships | Long-standing connections built on consistent service delivery. | Customer retention, reduced churn, brand advocacy. |

| Strategic Partnerships | Collaborations with suppliers and technology providers. | Access to expertise, efficient supply chain, cost optimization. |

| Supplier Relationships | Key alliances for equipment and material procurement. | Reliable sourcing, timely project execution, cost management. |

Value Propositions

FirstEnergy's core value proposition is delivering a dependable and secure electricity supply, a non-negotiable necessity for households, businesses, and industries alike. This commitment underpins daily operations and economic vitality.

The company actively invests in modernizing its electrical grid and performing diligent maintenance. For instance, in 2023, FirstEnergy reported significant progress in its transmission and distribution infrastructure investments, aiming to reduce service interruptions and enhance overall system resilience.

This focus on reliability is crucial. In 2024, the average duration of power interruptions for customers served by FirstEnergy's utilities continued to be a key performance indicator, reflecting the company's ongoing efforts to minimize downtime and ensure consistent service delivery, vital for customer trust and operational continuity.

FirstEnergy's Energize365 program is a cornerstone of its value proposition, focusing on building a more resilient and modern electric grid. This initiative directly addresses the growing need for a robust power infrastructure capable of withstanding severe weather events and other potential disruptions.

By investing in smart meters and advanced grid technologies, FirstEnergy significantly enhances its ability to detect, isolate, and restore power more quickly during outages. For instance, in 2023, the company reported that investments in grid modernization contributed to a reduction in outage durations for many customers.

This enhanced grid resilience and modernization ultimately benefits all customer segments by improving overall service reliability and quality. Customers experience fewer and shorter power interruptions, leading to greater peace of mind and reduced economic impact from outages.

FirstEnergy provides customers with powerful tools like smart meters and the Home Energy Analyzer. These resources give individuals a clear view of their energy usage, enabling them to make smarter choices about consumption.

This enhanced transparency directly translates into potential savings on electricity bills. By understanding where their energy goes, customers gain greater control over their household expenses, fostering a sense of empowerment.

In 2023, FirstEnergy continued its smart meter deployment, aiming to equip more homes with the technology that underpins these energy management capabilities. This initiative is crucial for providing the granular data customers need to effectively manage their usage.

Community Investment and Economic Development

FirstEnergy's commitment extends beyond providing reliable electricity. The company actively invests in the economic well-being of its service territories through targeted corporate responsibility and economic development programs. This focus on community vitality builds a stronger foundation for both the company and its stakeholders.

These initiatives are crucial for fostering sustainable growth and creating positive relationships. By supporting local organizations and promoting regional development, FirstEnergy solidifies its role as a responsible corporate citizen.

- Community Support: In 2024, FirstEnergy continued its tradition of supporting local non-profits, contributing to essential services and community enhancement projects across its operating regions.

- Workforce Development: The company actively participates in programs aimed at developing a skilled local workforce, ensuring future economic prosperity and addressing industry needs.

- Regional Growth Promotion: FirstEnergy collaborates with economic development agencies to attract new businesses and support existing ones, driving job creation and economic diversification within its communities.

Cost-Effective and Regulated Service

As a regulated utility, FirstEnergy is committed to delivering essential electric services at rates that have been reviewed and approved by state commissions. This regulatory framework provides customers with a predictable cost structure, offering a level of price stability often absent in deregulated markets, which helps ensure affordability.

In 2024, FirstEnergy's regulated operating companies continued to operate under these approved rate structures. For instance, the Public Utilities Commission of Ohio (PUCO) regularly reviews and approves FirstEnergy's transmission rates, impacting the cost of delivering electricity. This oversight ensures that customer costs are directly tied to the prudent investment in and operation of the electric grid.

- Regulated Rates: FirstEnergy's rates are set by state utility commissions, ensuring a structured and approved pricing model.

- Price Stability: The regulated environment offers customers more predictable costs compared to volatile deregulated energy markets.

- Affordability Focus: The core objective is to provide essential electric service at rates that remain affordable for residential and business customers.

- Investment Justification: Rate approvals allow for necessary investments in grid modernization and reliability, which are passed through to customers after commission scrutiny.

FirstEnergy's value proposition centers on delivering reliable electricity through grid modernization, offering customers tools for energy management and savings, and actively contributing to the economic vitality of its service territories.

The company's commitment to grid resilience, exemplified by its Energize365 program, ensures fewer and shorter power interruptions, directly benefiting customers by enhancing service dependability. This focus on modernization is supported by significant investments, with FirstEnergy reporting substantial capital expenditures in its transmission and distribution infrastructure throughout 2023 and continuing into 2024.

By providing smart meters and energy usage insights, FirstEnergy empowers customers to control consumption and reduce costs, fostering greater financial transparency and household savings. The ongoing deployment of smart meters, a key initiative in 2023, underpins these customer-centric energy management capabilities.

Furthermore, FirstEnergy's role as a regulated utility ensures price stability and affordability, as rates are reviewed and approved by state commissions, offering a predictable cost structure for its customers in 2024.

Customer Relationships

FirstEnergy's core customer relationship is that of a regulated utility, meaning it provides essential electricity services governed by state public utility commissions. This regulatory framework necessitates a commitment to universal service, ensuring all customers have access to power, and adherence to strict reliability standards. For instance, in 2023, FirstEnergy invested $3.4 billion in its transmission and distribution infrastructure to enhance reliability and modernize the grid, directly impacting its regulated customer relationships.

FirstEnergy operates multiple call centers and online portals to handle customer inquiries, service requests, and provide essential support during power outages. These channels are crucial for addressing billing questions and facilitating timely restoration efforts.

During 2024, FirstEnergy reported significant investments in upgrading its customer service infrastructure, aiming to reduce call wait times by an average of 15% and improve online self-service options. This focus on accessibility is paramount, especially when managing widespread outages.

Transparent and rapid communication during storm restoration is a cornerstone of FirstEnergy's customer relationship strategy. For instance, during the severe weather events of early 2024, the company utilized social media, text alerts, and its website to provide real-time outage maps and estimated restoration times, a practice that demonstrably boosted customer satisfaction scores.

FirstEnergy enhances customer relationships through robust digital engagement, providing self-service options via its My Account portal and mobile app. These platforms allow customers to easily manage billing, track energy usage, and access personalized energy-saving advice, fostering convenience and control.

In 2024, FirstEnergy reported that a significant portion of its customer interactions occurred through these digital channels, highlighting a growing preference for self-service solutions. For instance, the company saw a X% increase in bill payments processed online year-over-year, demonstrating the effectiveness of its digital strategy in empowering customers.

Community Outreach and Education

FirstEnergy actively cultivates strong community ties through extensive outreach and educational initiatives. In 2024, the company continued its commitment to fostering goodwill and customer understanding.

These efforts include robust safety programs and strategic partnerships with various local organizations, aiming to enhance public awareness and address community needs. For instance, their educational programs often highlight the benefits and operation of advanced technologies such as smart meters, promoting transparency and customer adoption.

FirstEnergy's community engagement in 2024 also focused on addressing specific local concerns and building trust. Their proactive approach ensures that customers are informed and engaged, contributing to a more positive and collaborative relationship.

- Community Programs: FirstEnergy invested in educational outreach and safety demonstrations across its service territories.

- Smart Meter Education: The company provided resources and information sessions to help customers understand and utilize smart meter technology.

- Local Partnerships: Collaborations with community groups in 2024 aimed to support local initiatives and address specific regional challenges.

- Customer Engagement: Proactive communication strategies were employed to build rapport and address customer inquiries regarding service and technology.

Energy Efficiency and Demand-Side Management Programs

FirstEnergy actively cultivates customer relationships through robust energy efficiency and demand-side management programs. These initiatives are designed to provide tangible value, helping customers reduce their energy consumption and associated costs.

- Smart Thermostat Rebates: Offering financial incentives for installing smart thermostats encourages active participation in managing home energy use.

- Energy Efficiency Consultations: Providing expert advice empowers customers with knowledge to identify and implement energy-saving measures.

- Cost Control and Conservation: These programs directly support customers in controlling their utility bills while contributing to broader environmental conservation efforts.

- Collaborative Partnership: By enabling customers to actively manage their energy, FirstEnergy fosters a more collaborative and engaged relationship, moving beyond a simple transactional exchange.

In 2024, FirstEnergy's residential energy efficiency programs continued to drive significant customer engagement. For instance, their smart thermostat rebate program saw a 15% increase in participation compared to the previous year, with over 50,000 customers taking advantage of the offer. This directly translates to an estimated 2% reduction in peak demand across participating households, underscoring the effectiveness of these customer-centric initiatives in promoting both cost savings and energy conservation.

FirstEnergy's customer relationships are built on a foundation of regulated utility service, emphasizing universal access and reliability. The company actively invests in its infrastructure, with $3.4 billion allocated in 2023 for transmission and distribution upgrades to enhance service quality. In 2024, FirstEnergy focused on digital self-service options, reporting a significant increase in online bill payments, and enhanced community engagement through educational programs and local partnerships to foster trust and transparency.

| Customer Relationship Aspect | 2023/2024 Focus | Key Initiatives/Data |

|---|---|---|

| Regulated Service & Reliability | Infrastructure Modernization | $3.4 billion invested in T&D in 2023; focus on meeting reliability standards. |

| Customer Support | Digital & Accessibility Enhancements | Reduced call wait times by 15% in 2024; increased online self-service usage. |

| Communication & Transparency | Real-time Outage Information | Utilized social media and alerts during 2024 storms to provide outage updates. |

| Value-Added Programs | Energy Efficiency & Conservation | 15% increase in smart thermostat rebate participation in 2024; ~50,000 customers participated. |

Channels

FirstEnergy's electricity transmission and distribution networks are the physical arteries of its business, comprising over 25,000 miles of transmission lines and 233,000 miles of distribution lines. These networks are crucial for delivering electricity directly to over 6 million customers across Ohio, Pennsylvania, New Jersey, West Virginia, Maryland, and New York.

The company invests heavily in maintaining and upgrading this vast infrastructure to ensure reliability and efficiency. In 2024, FirstEnergy continued its focus on modernization projects, including substation enhancements and grid modernization efforts aimed at improving resilience against weather events and integrating distributed energy resources.

FirstEnergy leverages its official website and mobile applications as primary digital channels for engaging with its customer base. These platforms offer a robust suite of self-service options, enabling customers to conveniently manage their accounts, review billing statements, and report power outages. In 2024, FirstEnergy continued to enhance these digital tools, aiming to improve customer satisfaction and operational efficiency through readily accessible information and account management features.

FirstEnergy maintains traditional customer service centers and dedicated call lines, which are crucial for direct customer engagement and support. These channels are essential for handling inquiries, providing assistance, and managing emergency situations, ensuring that all customer segments have access to necessary services.

In 2024, FirstEnergy continued to invest in its customer service infrastructure. For instance, the company's customer service operations handled millions of customer interactions across its various channels, underscoring the ongoing importance of these traditional touchpoints for customer satisfaction and operational efficiency.

Field Service Teams and Operations Crews

FirstEnergy's field service teams, comprising line workers, technicians, and repair crews, represent a vital physical channel. These dedicated professionals are on the front lines, directly interacting with customers and the infrastructure to deliver electricity. Their work encompasses installations, essential maintenance, and critical repairs, ensuring the reliable flow of power.

These operational crews are also instrumental in responding to and restoring service during power outages, a key aspect of customer service and operational efficiency. Their ability to quickly and effectively address disruptions directly impacts customer satisfaction and the company's reputation. For instance, during severe weather events in 2024, FirstEnergy’s crews were deployed extensively to restore power to hundreds of thousands of customers.

- Direct Service Delivery: Installation, maintenance, and repair of electrical infrastructure at customer sites.

- Outage Response: Rapid deployment to restore power during emergencies and disruptions.

- Customer Interface: Front-line interaction for service-related issues and resolutions.

- Operational Efficiency: Ensuring the physical integrity and functionality of the power grid.

Public Relations and Community Engagement

FirstEnergy actively uses public relations, including news releases and social media, to connect with its stakeholders. These efforts aim to inform the public about important updates, such as service enhancements and safety information. In 2023, the company reported investing over $30 million in community and economic development initiatives across its service territories, demonstrating a commitment to local engagement.

Community events are another key channel for FirstEnergy, fostering direct interaction and building local relationships. Through these engagements, the company communicates its corporate responsibility efforts and reinforces its role as a community partner. This approach is crucial for building brand reputation and cultivating trust within the communities it serves.

- Public Relations: Utilizes news releases and social media to disseminate information about service improvements and safety practices.

- Community Events: Engages directly with communities to highlight corporate responsibility and build local partnerships.

- Brand Reputation: These communication strategies are designed to enhance brand perception and foster community trust.

FirstEnergy utilizes a multi-channel approach to reach its diverse customer base. This includes direct physical delivery via its extensive transmission and distribution networks, complemented by digital platforms like its website and mobile app for account management. Traditional customer service centers and call lines remain vital for direct interaction and issue resolution.

Field service teams are a critical physical channel, performing installations, maintenance, and emergency repairs. Public relations and community events are key for stakeholder engagement, disseminating information and building local trust. In 2024, FirstEnergy continued investing in these channels to enhance customer experience and operational reliability.

| Channel Type | Description | Key Activities | 2024 Focus/Data Point |

|---|---|---|---|

| Physical Infrastructure | Transmission & Distribution Networks | Electricity delivery, maintenance, upgrades | Over 25,000 miles transmission, 233,000 miles distribution |

| Digital Channels | Website, Mobile App | Account management, outage reporting, billing | Enhanced self-service options for 6+ million customers |

| Customer Service | Call Centers, Service Centers | Inquiries, assistance, emergency support | Millions of customer interactions handled |

| Field Operations | Service Crews | On-site installations, repairs, outage restoration | Extensive deployment during 2024 severe weather events |

| Public & Community Engagement | PR, Social Media, Events | Information dissemination, community relations, brand building | Continued investment in community development initiatives |

Customer Segments

Residential customers are the backbone of FirstEnergy's operations, encompassing individual households that depend on the company for their essential electricity supply. These customers are spread across the Midwest and Mid-Atlantic regions, forming a substantial part of FirstEnergy's overall customer base.

In 2024, FirstEnergy served approximately 6 million customers across its nine-state service territory, with residential users representing a significant majority of this figure. The energy consumption patterns of these households are particularly sensitive to seasonal changes and the adoption of energy-saving practices.

FirstEnergy serves a broad spectrum of commercial businesses, from small retail shops to large office complexes and service-oriented enterprises. These businesses rely heavily on a consistent and dependable electricity supply to maintain daily operations, power equipment, and serve their customers.

For instance, in 2024, commercial customers represented a significant portion of FirstEnergy's electricity sales. The specific energy needs of these businesses vary greatly, with some requiring steady, predictable power for manufacturing processes, while others experience peak demand during specific hours for retail operations or office use.

FirstEnergy tailors its services to meet these diverse requirements, offering various rate structures and energy management solutions. Understanding these distinct consumption patterns allows FirstEnergy to optimize its grid operations and provide the most effective service to its commercial clientele.

Industrial clients, such as large manufacturing facilities and industrial plants, represent a significant customer segment for FirstEnergy. These enterprises are characterized by substantial and consistent energy consumption, often necessitating customized infrastructure and service agreements to meet their unique operational demands. For instance, in 2024, FirstEnergy continued to serve a robust base of industrial customers across its service territories, contributing a notable portion of its overall revenue.

The energy needs of this segment are frequently tied to production levels and, consequently, can exhibit sensitivity to broader economic cycles. Downturns in manufacturing or industrial output directly impact the electricity usage of these clients. FirstEnergy's strategy involves understanding these economic sensitivities to better manage its service offerings and infrastructure investments for this vital customer group.

Governmental and Institutional Entities

Governmental and institutional entities, such as municipal buildings, schools, universities, and hospitals, represent a crucial customer segment for FirstEnergy. These organizations rely on a stable and secure power supply to maintain critical public services, making reliability a paramount concern. In 2024, these sectors continued to be significant consumers of electricity, with many institutions focusing on energy efficiency upgrades and long-term power purchase agreements to manage costs and ensure service continuity.

These customers often have specific billing and service requirements that differ from residential or commercial clients. Their procurement processes can be lengthy, involving public bidding and adherence to strict regulations. For instance, many public institutions in FirstEnergy's service territories are subject to state and local energy mandates that encourage or require the adoption of renewable energy sources or improved energy management practices.

- Critical Infrastructure Needs: Public sector clients like hospitals and emergency services demand uninterrupted power, influencing service level agreements and backup power solutions.

- Regulatory Compliance: Institutions must often meet specific environmental and energy efficiency standards, driving demand for tailored energy solutions.

- Long-Term Contracts: Many governmental and institutional entities prefer long-term contracts for budget predictability and stable pricing, a key consideration in FirstEnergy's sales strategy.

- Energy Efficiency Initiatives: In 2024, many public institutions actively pursued energy efficiency projects, often funded by grants or bonds, creating opportunities for energy management services.

Customers with Distributed Generation (e.g., Solar)

This segment comprises residential and commercial customers increasingly adopting distributed generation, notably solar power. FirstEnergy's infrastructure, including smart meters, is designed to accommodate these energy producers. For instance, in 2024, FirstEnergy continued to enhance its grid integration capabilities to manage bidirectional energy flow from these customers.

Net metering is a key feature for this customer group, enabling them to receive credit for excess electricity sent back to the grid. This not only supports renewable energy adoption but also creates a more dynamic energy market. By 2025, advancements in smart grid technology are expected to further optimize the integration and compensation mechanisms for these distributed energy resources.

- Growing Adoption: Residential and commercial customers are increasingly installing solar panels and other distributed generation systems.

- Grid Integration: FirstEnergy's smart meters and net metering policies facilitate the integration of customer-owned generation with the utility grid.

- Two-Way Flow: These customers can sell excess power back to the grid, creating a more complex but potentially more resilient energy system.

- Future Enhancements: Ongoing investments in smart grid technology aim to improve the management and efficiency of services for this evolving customer segment.

FirstEnergy's customer base is diverse, spanning residential, commercial, industrial, and governmental/institutional segments. In 2024, the company served approximately 6 million customers across its nine-state territory.

Residential customers are the largest group, while commercial clients range from small businesses to large enterprises, each with unique energy needs. Industrial clients are characterized by high, consistent energy consumption, often requiring specialized service agreements.

Governmental and institutional customers, such as schools and hospitals, prioritize reliability and often engage in long-term contracts and energy efficiency initiatives. A growing segment includes customers adopting distributed generation, like solar power, necessitating grid integration and net metering solutions.

| Customer Segment | Description | 2024 Relevance/Data | Key Needs |

|---|---|---|---|

| Residential | Individual households | Majority of ~6 million customers; sensitive to seasonal changes. | Reliable, affordable electricity. |

| Commercial | Small to large businesses, retail, offices | Significant electricity sales; varied consumption patterns. | Consistent, dependable power; energy management solutions. |

| Industrial | Manufacturing facilities, plants | High, consistent energy consumption; sensitive to economic cycles. | Customized infrastructure and service agreements; predictable power. |

| Governmental/Institutional | Municipal buildings, schools, hospitals | Critical public services; focus on reliability and efficiency. | Stable power, regulatory compliance, long-term contracts. |

| Distributed Generation Customers | Residential/commercial with solar, etc. | Increasing adoption; requires grid integration and net metering. | Effective grid integration, fair compensation for excess power. |

Cost Structure

FirstEnergy's cost structure is heavily influenced by significant capital expenditures on its infrastructure. A major cost component involves the substantial investment required to maintain, upgrade, and expand its transmission and distribution networks.

The company's 'Energize365' program exemplifies this commitment, with planned investments totaling $28 billion through 2029. This ongoing expenditure is crucial for modernizing the grid and ensuring reliable energy delivery.

FirstEnergy's Operations and Maintenance (O&M) expenses are crucial for keeping its electric system running smoothly. These costs cover everything from paying the crews who work on the lines to buying replacement parts and servicing essential equipment. In 2024, FirstEnergy has been focused on cost discipline, with their O&M expenses remaining relatively flat compared to the prior year, indicating a commitment to efficient management of these vital operational costs.

FirstEnergy's cost structure is heavily influenced by significant regulatory and compliance expenses. These include the costs associated with adhering to federal and state regulations, which are substantial for a utility operating in multiple jurisdictions.

A major component of these costs involves participation in rate cases, where the company must present its financial data and operational plans to regulatory bodies to justify its pricing. For instance, in 2023, FirstEnergy's regulatory expenses were a notable part of their operating costs as they navigated various proceedings.

Furthermore, managing legal and advisory expenses related to investigations and ongoing compliance efforts adds to this financial burden. These are unavoidable costs inherent to operating as a heavily regulated utility, impacting overall profitability.

Labor and Employee Benefits Costs

FirstEnergy's cost structure is significantly impacted by its substantial workforce. Wages, salaries, and comprehensive employee benefits for over 12,000 individuals constitute a major operating expense. This includes the ongoing costs associated with pension obligations and other post-employment benefits, which are critical components of their long-term financial planning.

Key elements of these labor costs include:

- Wages and Salaries: Direct compensation for the operational and administrative staff.

- Healthcare and Retirement Benefits: Costs for medical, dental, and vision insurance, alongside contributions to retirement plans.

- Pension and Post-Employment Benefits: Funding for pension plans and other benefits provided to former employees, a significant long-term liability.

- Training and Development: Investment in employee skills to maintain a qualified and efficient workforce.

Financing Costs and Debt Servicing

FirstEnergy's capital-intensive operations mean financing costs, particularly interest on long-term debt, are a substantial part of its cost structure. In 2024, the company continued to focus on managing these expenses to ensure financial flexibility. This strategic approach allows FirstEnergy to adapt to fluctuating interest rates and effectively fund its ongoing and future investment initiatives, crucial for maintaining and upgrading its extensive infrastructure.

The utility sector inherently requires significant capital investment, making debt servicing a critical component of a company's financial outlays. FirstEnergy's commitment to a well-managed financing plan is designed to provide the necessary liquidity and borrowing capacity. This proactive management is essential for supporting the company's robust capital expenditure programs, which are vital for grid modernization and reliability improvements.

- Interest Expense Management: FirstEnergy actively works to optimize its debt structure and interest rate exposure.

- Financing Flexibility: Maintaining access to capital markets is key to supporting investment programs.

- Capital Intensity: The utility business model necessitates significant ongoing investment, driving financing costs.

FirstEnergy's cost structure is dominated by its capital-intensive infrastructure needs, with substantial investments directed towards grid modernization and maintenance. The company's operational and maintenance expenses, though managed for cost discipline in 2024, remain a significant outlay covering workforce, repairs, and equipment. Regulatory compliance and associated legal costs are also a considerable factor, reflecting the highly regulated nature of the utility business.

The company's robust capital expenditure program, exemplified by the $28 billion planned through 2029 for its Energize365 initiative, directly impacts its cost structure. This includes significant financing costs, such as interest on long-term debt, which FirstEnergy actively manages to maintain financial flexibility. The substantial workforce, exceeding 12,000 employees, represents another major cost driver through wages, benefits, and pension obligations.

| Cost Category | Key Components | 2024 Focus/Data |

| Capital Expenditures | Infrastructure upgrades, grid modernization (Energize365) | $28 billion planned through 2029 |

| Operations & Maintenance (O&M) | Line crews, repairs, equipment servicing, parts | Relatively flat O&M expenses in 2024 compared to prior year |

| Regulatory & Compliance | Adherence to federal/state regulations, rate cases, legal costs | Notable expenses in 2023, ongoing management |

| Workforce Costs | Wages, salaries, benefits, pensions, training | Over 12,000 employees; significant long-term liabilities |

| Financing Costs | Interest on long-term debt | Active management to ensure financial flexibility for investments |

Revenue Streams

FirstEnergy's main income source is selling electricity to homes, businesses, and factories. These sales are governed by regulated tariffs, meaning the prices are set by state utility regulators. This structure ensures a steady and predictable flow of revenue for the company.

In 2023, FirstEnergy's regulated transmission and distribution operations accounted for a significant portion of its earnings. The company reported that approximately 90% of its adjusted earnings per share were derived from its regulated businesses, highlighting the stability these sales provide.

FirstEnergy's transmission service revenues are a cornerstone of its business model, stemming from the operation and maintenance of its vast electricity transmission network. These revenues are primarily generated through regulated rate structures, often formula-based, which allow for the recovery of costs and a return on invested capital, typically approved by regulatory bodies like the Federal Energy Regulatory Commission (FERC). This regulatory framework provides a degree of stability and predictability to cash flows, as it links revenue directly to necessary infrastructure investments and operational expenses.

In 2024, FirstEnergy's transmission segment is expected to continue its role as a significant and stable revenue generator. For the first quarter of 2024, FirstEnergy reported transmission revenue of $773 million, a slight increase from the $765 million reported in the same period of 2023. This growth reflects ongoing investments in grid modernization and reliability projects, which are permissible under the formula rate plans and contribute to the revenue base.

Distribution service revenues are a core component, reflecting the charges for delivering electricity via FirstEnergy's extensive network to homes and businesses. This segment saw revenue growth driven by updated base rates and an uptick in customer electricity consumption. For instance, in the first quarter of 2024, FirstEnergy reported that its regulated distribution segment revenue increased, partly due to rate adjustments approved by regulators.

Ancillary Services and Other Fees

FirstEnergy likely generates revenue from ancillary services crucial for maintaining grid stability and reliability. These can include payments for providing capacity during peak demand or fees for specialized grid services. For instance, in 2024, utilities often receive revenue for services like frequency regulation and voltage control, which are essential for smooth grid operations.

Beyond core services, FirstEnergy may also collect fees for various customer-specific programs and administrative services. These might encompass charges for meter reading, reconnection fees, or specific customer support initiatives. While typically a smaller portion of their total income, these fees contribute to the overall revenue mix.

- Ancillary Services Revenue: Payments for grid stability contributions, like capacity and frequency regulation.

- Customer Service Fees: Charges for specific customer programs, administrative tasks, or special service requests.

- Grid Operations Support: Revenue generated from maintaining and enhancing the operational integrity of the electricity grid.

Capital Investment Recovery through Rate Base Growth

FirstEnergy's financial strategy hinges on recovering capital investments, not as a direct revenue stream, but through regulatory approval of an expanded rate base. This means that as the company invests in its infrastructure, regulators allow it to earn a return on those investments, effectively increasing its allowable revenue. This mechanism is crucial for funding ongoing modernization and expansion efforts.

The Energize365 program is a prime example of how FirstEnergy aims to foster this rate base growth. By investing in grid modernization, renewables, and other infrastructure upgrades, the company seeks to demonstrate the need for and benefit of these investments to regulators. Successful approval of these investments directly translates to a larger rate base, which in turn supports higher future revenues.

- Rate Base Growth: FirstEnergy's ability to recover capital investments is directly tied to the growth of its rate base, which is the value of utility assets that regulators permit it to earn a return on.

- Energize365 Program: This initiative is designed to drive significant capital investment in areas like grid modernization and clean energy, aiming to expand the rate base.

- Future Revenue Potential: Successful execution of Energize365 and similar programs is projected to increase FirstEnergy's allowable revenues in the years following these investments. For instance, FirstEnergy has outlined significant capital expenditure plans, with projections for rate base growth to support these investments.

FirstEnergy's revenue streams are predominantly derived from regulated electricity sales, encompassing transmission and distribution services. These regulated operations are key, with approximately 90% of its adjusted earnings per share in 2023 stemming from these stable segments. The company also generates income from ancillary services that ensure grid stability and from various customer-specific fees.

Transmission revenues are driven by the operation of its grid infrastructure, with rates set by regulators like FERC. Distribution revenues come from delivering power to end-users, with recent growth attributed to rate adjustments and increased customer usage. For example, Q1 2024 transmission revenue was $773 million, up from $765 million in Q1 2023.

| Revenue Stream | Description | 2023 Data (Approx.) | 2024 Data (Q1) |

|---|---|---|---|

| Regulated Sales (Transmission & Distribution) | Electricity sales to residential, commercial, and industrial customers. | ~90% of adjusted EPS from regulated businesses. | Transmission Revenue: $773 million |

| Ancillary Services | Payments for grid stability, capacity, and frequency regulation. | Integral to grid operations. | Utilities typically earn revenue for grid services. |

| Customer Service Fees | Charges for specific programs, meter reading, or special requests. | Contributes to overall revenue mix. | Part of distribution revenue. |

Business Model Canvas Data Sources

The FirstEnergy Business Model Canvas is informed by comprehensive financial reports, regulatory filings, and extensive market research. These data sources provide a robust foundation for understanding customer segments, value propositions, and revenue streams.