FirstEnergy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstEnergy Bundle

FirstEnergy's position in the market is dynamic, with some segments likely performing as Stars and others as Cash Cows. Understanding these placements is crucial for informed decision-making.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

FirstEnergy is heavily investing in transmission infrastructure, with around $1.25 billion in projects secured through PJM Interconnection. This substantial commitment signals a strong position in a high-growth market, exemplified by ventures like the Valley Link Transmission Company joint venture.

These strategic expansions are crucial for bolstering the electric grid and fostering regional economic development. FirstEnergy anticipates significant growth in its transmission segment's rate base, underscoring its leading role in this expanding sector.

FirstEnergy is aggressively pursuing the booming data center market, a key growth driver for the company. By 2029, they have secured contracts for 2.6 gigawatts (GW) of power for these facilities, showcasing substantial progress in this high-demand sector. This commitment highlights FirstEnergy's strategic focus on capitalizing on digital infrastructure expansion.

The company has also doubled its projected data center pipeline over the next five years to an impressive 3 GW. This expansion signals a strong belief in continued robust demand and FirstEnergy's capacity to meet it, positioning them as a significant player in powering the digital economy.

This burgeoning data center segment represents a star in FirstEnergy's portfolio, characterized by rapid growth and significant investment potential. The consistent flow of new projects beyond their current base plan indicates a sustained opportunity for further development and revenue generation.

FirstEnergy's Energize365 initiative is a critical strategic modernization effort, projecting a substantial $28 billion investment by 2029. This includes a significant $5 billion allocation specifically for 2025.

The core objective of Energize365 is to enhance the electric grid's intelligence, security, and overall reliability. Key components like Advanced Distribution Management Systems (ADMS) and widespread smart meter deployment are central to this strategy.

These technological advancements position FirstEnergy favorably in a high-growth sector, aiming to boost service quality and operational efficiency across its service territories, where the company maintains a leading market presence.

Large-Scale Renewable Energy Projects in West Virginia

FirstEnergy's subsidiaries, Mon Power and Potomac Edison, are making significant strides in West Virginia's renewable energy sector, targeting 50 MW of utility-scale solar development by 2025.

These projects are positioned as Stars within FirstEnergy's BCG Matrix due to their high growth potential and strong market position in renewable energy generation. By early 2024, three projects totaling 30 MW were already operational or nearing completion, demonstrating substantial progress.

- Mon Power and Potomac Edison's solar development in West Virginia aims for 50 MW by 2025.

- As of early 2024, 30 MW of utility-scale solar capacity was completed or online.

- These projects represent a high-growth segment within FirstEnergy's regulated operations.

- Development is strategically focused on brownfield sites, indicating an innovative growth strategy.

New Base Rate Implementation and Regulated Growth

FirstEnergy's strategic implementation of new base rates across Pennsylvania, West Virginia, and New Jersey, commencing in late 2024 and extending into early 2025, is a pivotal driver for its core earnings expansion. This regulatory foresight not only underpins the company's ability to grow its rate base but also provides a stable foundation for predictable returns on its significant capital expenditures.

This regulatory success is directly linked to FirstEnergy's dominant market share within its regulated service territories. Coupled with approved growth mechanisms, this positions the company favorably within its operational landscape.

- Rate Base Growth: Approved rate increases in key states like Pennsylvania are expected to contribute to a substantial increase in the company's regulated asset base. For instance, Pennsylvania alone represents a significant portion of FirstEnergy's regulated operations.

- Predictable Returns: The regulatory framework ensures that FirstEnergy can achieve a fair return on its investments, estimated to be in the range of 9-10% on its regulated equity, providing a degree of financial stability.

- Market Dominance: FirstEnergy holds a leading position in its core regulated markets, serving millions of customers and benefiting from established infrastructure and customer loyalty.

- Capital Investment: The company plans to invest billions in grid modernization and infrastructure upgrades over the next several years, with these rate adjustments directly supporting the recovery of these investments.

FirstEnergy's burgeoning data center segment is a clear Star, driven by aggressive pursuit of this high-demand market. By 2029, the company has secured 2.6 GW of power contracts for these facilities, more than doubling its projected data center pipeline to 3 GW over the next five years. This rapid expansion indicates significant investment potential and sustained revenue generation opportunities.

What is included in the product

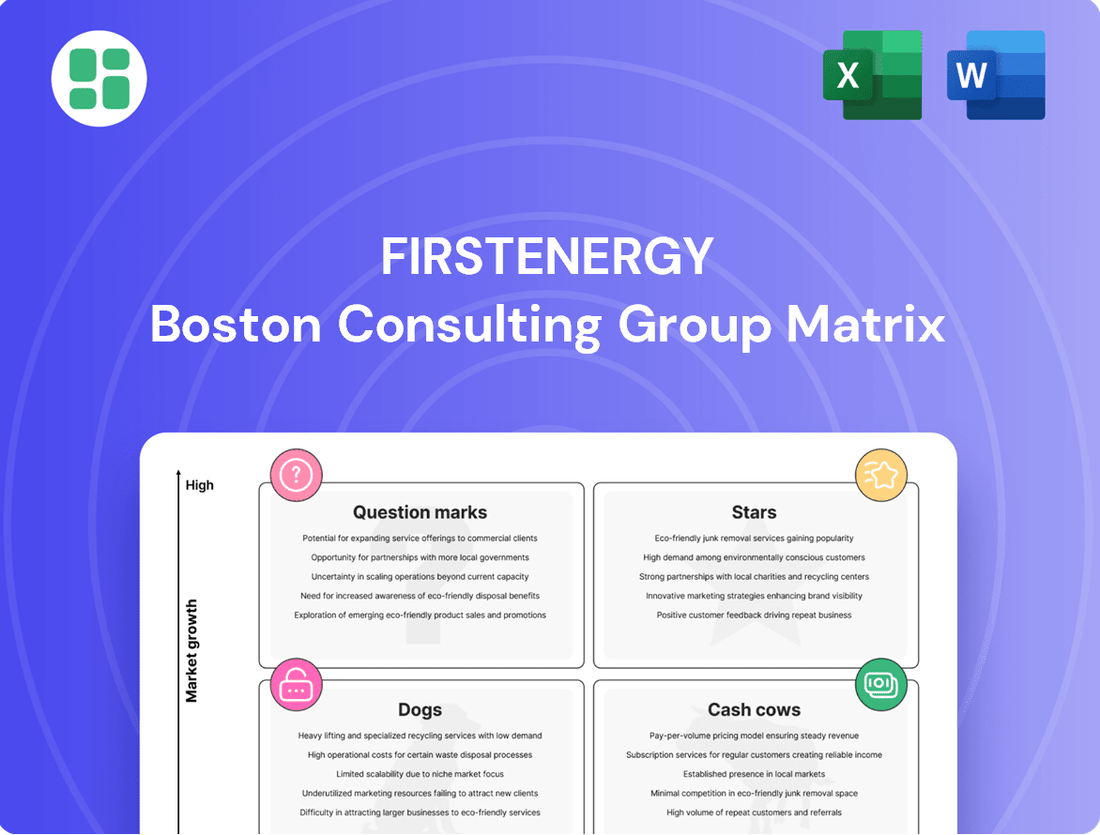

This FirstEnergy BCG Matrix analysis highlights which business units to invest in, hold, or divest based on market growth and share.

A clear BCG Matrix visualizes FirstEnergy's portfolio, easing the pain of strategic uncertainty.

Cash Cows

FirstEnergy's regulated distribution business is a classic cash cow, generating consistent revenue from its vast customer base. In 2023, this segment served over six million customers across Ohio, Pennsylvania, New Jersey, West Virginia, Maryland, and New York, solidifying its dominant position in essential utility services.

The mature nature of the electricity distribution market, coupled with FirstEnergy's high market share, ensures stable demand and predictable cash flows. The company's capital expenditures in this area are largely focused on maintaining and upgrading existing infrastructure, leading to high profit margins and minimal risk.

FirstEnergy's established transmission assets, including those managed by American Transmission Systems Inc. (ATSI), Mid-Atlantic Interstate Transmission LLC (MAIT), and Trans-Allegheny Interstate Line Company (TrAILCo), are firmly positioned as Cash Cows. These operations boast a high market share in a mature segment, generating predictable revenue through formula rate structures.

The essential nature of these transmission lines means they require minimal promotional investment, as demand is consistent and driven by grid stability and capacity needs. For instance, FirstEnergy's transmission segment reported significant revenue contributions, underscoring the stability of these assets.

FirstEnergy's extensive customer base, encompassing residential, commercial, and industrial sectors, underpins a remarkably stable demand for electricity. This consistent consumption is a bedrock for reliable cash generation, even in periods of slower economic expansion. For instance, in 2023, FirstEnergy served approximately 6 million customers across its nine-state service territory, highlighting the sheer scale of its demand base.

The essential nature of electricity ensures that demand remains resilient, acting as a powerful buffer against market fluctuations. This inherent stability directly translates into robust operational margins and predictable cash flow for the company. In 2023, FirstEnergy reported operating revenues of $11.9 billion, a testament to the consistent revenue stream generated by its vast customer network.

Long-Term Service Agreements and Regulatory Certainty

FirstEnergy's regulated utility operations are a significant cash cow, primarily due to long-term service agreements and the inherent regulatory certainty. These agreements allow the company to recover infrastructure investments through customer rates, creating a predictable and stable revenue stream with robust profit margins. This regulatory insulation is key to their cash cow status.

A substantial portion of FirstEnergy's capital expenditures are protected by these regulatory mechanisms. In fact, around 75% of FirstEnergy's planned investments are structured under formula rate or similar recovery processes. This high percentage underscores the reliability of these revenue streams.

- Regulated Utility Model: FirstEnergy operates under a regulated utility framework, ensuring predictable revenue recovery.

- Rate Recovery Mechanisms: Infrastructure investments are recouped through customer rates, providing financial stability.

- Regulatory Insulation: This regulatory environment protects against market volatility, leading to high profit margins.

- Investment Allocation: Approximately 75% of FirstEnergy's planned investments are covered by formula rate or similar recovery mechanisms, highlighting the stability of these cash flows.

Operational Efficiency Improvements

FirstEnergy's commitment to operational efficiency is a cornerstone of its strategy to maximize cash flow from its established, high-market-share regulated businesses, effectively treating them as cash cows.

Ongoing efforts to drive operational efficiencies and financial discipline, as highlighted by flat operating and maintenance (O&M) expenses, contribute to maximizing cash flow from existing assets.

These improvements in a low-growth, high-market-share environment allow the company to 'milk' its cash cows more effectively. For instance, in 2024, FirstEnergy reported that its focus on efficiency initiatives helped stabilize its O&M expenses, demonstrating a commitment to cost management within its core regulated segments.

This focus enhances the profitability of its stable regulated businesses, ensuring they continue to generate robust and predictable cash flows to support the company's overall financial health and investment in other areas.

- Operational Efficiency: FirstEnergy aims to maintain flat or declining operating and maintenance (O&M) expenses through ongoing efficiency initiatives.

- Financial Discipline: The company's commitment to financial discipline supports the goal of maximizing cash flow generation from its stable, regulated assets.

- Cash Cow Strategy: By improving efficiency in low-growth, high-market-share segments, FirstEnergy effectively leverages these businesses as cash cows.

- Profitability Enhancement: These focused efforts directly contribute to enhancing the profitability of its core regulated businesses.

FirstEnergy's regulated distribution and transmission segments are clearly defined as its cash cows. These operations benefit from a mature market, high market share, and regulatory frameworks that ensure predictable revenue recovery. This stability allows FirstEnergy to generate consistent cash flow with minimal need for significant reinvestment or promotional spending.

The company's focus on operational efficiency further strengthens the cash cow status of these segments. By managing operating and maintenance expenses effectively, FirstEnergy maximizes the profitability of its core utility businesses. This financial discipline ensures these segments can reliably fund other strategic initiatives.

In 2023, FirstEnergy's regulated utility operations, serving over six million customers, generated substantial revenue, highlighting the dependable nature of this business. Approximately 75% of its planned investments are covered by formula rate mechanisms, underscoring the predictable cash generation from these assets.

The company's commitment to efficiency initiatives in 2024 helped stabilize its operating and maintenance expenses, a key factor in enhancing the profitability of these stable, regulated businesses.

| Segment | Market Position | Cash Flow Generation | Key Drivers |

| Regulated Distribution | High Market Share | Stable & Predictable | Vast Customer Base, Regulatory Rate Recovery |

| Regulated Transmission | High Market Share | Stable & Predictable | Essential Infrastructure, Formula Rate Structures |

What You’re Viewing Is Included

FirstEnergy BCG Matrix

The FirstEnergy BCG Matrix preview you are viewing is the definitive version you will receive upon purchase. This comprehensive report, meticulously crafted for strategic insight, contains no watermarks or placeholder content, ensuring you get a fully formatted and immediately actionable document.

Rest assured, the BCG Matrix for FirstEnergy you see here is the exact file that will be delivered to you after completing your purchase. This professionally designed analysis is ready for immediate integration into your strategic planning, offering clear visualizations and data-driven insights without any surprises.

Dogs

FirstEnergy strategically divested the majority of its competitive generation assets, transitioning to a fully regulated utility model. This move aimed to stabilize earnings and reduce exposure to volatile energy markets.

Any remaining, smaller, or less efficient generation units not integral to its core regulated operations or renewable expansion plans would be classified here. These assets often face challenges like high operating costs and declining output.

For instance, in 2023, FirstEnergy's focus on regulated operations meant its generation portfolio significantly shifted. The company reported that its regulated transmission and distribution segments represented the vast majority of its capital expenditure plans for the coming years, underscoring the divestiture of non-core generation.

Underperforming non-core ventures represent business activities for FirstEnergy that diverge from its primary regulated utility operations. These might include smaller, legacy projects or investments that currently lack significant market share or growth potential. For instance, in 2024, FirstEnergy continued its strategic focus on its core regulated businesses, which form the backbone of its revenue. While specific figures for these underperforming ventures are not publicly detailed, the company's overall financial health is largely driven by its transmission and distribution segments.

Legacy infrastructure in declining industrial areas represents FirstEnergy's "Dogs" in the BCG matrix. These are segments of aging power grids situated in regions with a history of industrial contraction and population loss, leading to stagnant or declining electricity demand. For instance, areas within FirstEnergy's service territory that historically relied on heavy manufacturing may now exhibit significantly lower energy consumption compared to their peak periods.

Although these assets are part of the regulated utility business, they are characterized by low growth prospects and minimal return on investment. Consequently, they are not prime candidates for substantial new capital expenditures. Instead, these localized areas often necessitate a disproportionate amount of maintenance spending relative to the limited economic returns they generate.

Inefficient or High-Cost Maintenance Programs on Older Assets

FirstEnergy's older, inefficient assets often face maintenance programs that drain resources without delivering proportional benefits. These programs can become cash traps, consuming capital with minimal impact on reliability or customer satisfaction, especially when asset replacement isn't immediately feasible. This situation reflects a low market share of operational efficiency.

- High Maintenance Spend: In 2024, FirstEnergy reported significant operational expenses, with a portion dedicated to maintaining aging infrastructure. For instance, the company's transmission and distribution segment consistently requires substantial investment to manage its vast network of older equipment.

- Low Return on Investment: The challenge lies in the diminishing returns from these maintenance efforts. Investments made in keeping these older assets operational may not translate into improved energy delivery efficiency or a reduction in outage frequency, which are key metrics for customer satisfaction.

- Strategic Dilemma: The decision to continue investing in these assets versus planning for their eventual replacement presents a strategic dilemma. Without a clear path to modernization, these high-cost maintenance programs can hinder overall financial performance and the company's ability to invest in newer, more efficient technologies.

Segments with Persistent Regulatory Challenges and Low Returns

FirstEnergy's regulated segments, particularly those involving smaller, localized rate cases, often grapple with persistent regulatory challenges. These can manifest as lengthy approval timelines or decisions that limit the scope of rate increases, directly impacting return on investment. For instance, in 2024, the company continued to navigate the complexities of securing approvals for infrastructure upgrades across various service territories, where the pace of regulatory decision-making can lag behind capital expenditure needs.

These specific regulated areas, while essential for service delivery, may not offer the same growth potential as other business units. The continuous need for capital investment coupled with constrained rate recovery can lead to persistently low returns, potentially diluting overall company profitability. This dynamic is a key consideration when evaluating FirstEnergy's portfolio, as these segments can represent a drag on financial performance without providing significant upside.

- Regulatory Hurdles: Smaller rate cases often face prolonged scrutiny, delaying necessary revenue adjustments.

- Limited Rate Increases: Regulatory bodies may approve lower rate hikes than requested, impacting profitability.

- Low ROI: The combination of high capital needs and restricted revenue growth results in suboptimal returns.

- Strategic Consideration: These segments require careful management to mitigate their impact on overall financial health.

FirstEnergy's "Dogs" represent legacy infrastructure in mature or declining service areas. These segments are characterized by low growth and require ongoing maintenance, often with limited returns. For example, in 2024, the company continued to manage older grid components in historically industrial regions that now see reduced energy demand.

These areas demand significant capital for upkeep but offer minimal upside due to stagnant customer bases and limited opportunities for expansion. The strategic challenge is balancing essential service maintenance with the low economic benefits these segments provide, often consuming resources without generating proportional revenue growth.

FirstEnergy's focus on its regulated utility model means these "Dog" assets are integrated into its core operations. However, their low growth and return profile necessitate careful resource allocation to avoid becoming a drag on overall financial performance. The company's 2024 capital expenditure plans heavily favored transmission and distribution upgrades in growth areas, implicitly signaling less aggressive investment in low-return legacy zones.

The company faces a constant dilemma with these assets: invest enough to maintain service reliability or plan for eventual replacement. This is particularly relevant in 2024, as FirstEnergy navigates the long-term costs of aging infrastructure against the need to modernize its grid for future demands.

Question Marks

FirstEnergy views emerging energy storage solutions as potential stars in its BCG matrix, recognizing their high growth potential and current low market penetration within its operations. These technologies are being evaluated as crucial transmission assets to enhance operational flexibility and facilitate the integration of more renewable energy sources.

The company is investing significantly to understand the viability and scalability of these solutions, acknowledging the substantial capital outlay needed for broader adoption. For instance, by the end of 2024, FirstEnergy is expected to have invested over $1 billion in grid modernization efforts, which includes pilot programs for advanced energy storage.

Developing advanced microgrids for communities and industrial parks presents a significant growth avenue, offering enhanced resilience and localized energy control. These sophisticated systems are ideal for areas prioritizing energy security and operational continuity.

While promising, advanced microgrids currently represent a niche market for large utilities, holding a relatively small overall share. Their complexity and specialized nature mean they haven't yet achieved widespread adoption across the broader energy landscape.

Significant upfront capital investment and navigating complex regulatory frameworks are key hurdles to scaling advanced microgrid solutions. For instance, projects often require millions in initial funding and extensive approvals from various governing bodies before implementation.

FirstEnergy's new demand-side management programs, focusing on innovative technologies like smart thermostats and behavioral energy-saving initiatives, represent potential high-growth opportunities. However, their market adoption remains unproven, with initial uptake rates still being closely monitored. These programs require substantial investment in customer education and outreach to achieve widespread acceptance and generate predictable revenue streams.

Pilot Projects for Distributed Energy Resources Integration

FirstEnergy's pilot projects for distributed energy resources (DERs) integration are currently in their nascent stages, focusing on incorporating smaller, decentralized generation sources like rooftop solar and microgrids. These initiatives, while representing a low market share in 2024, hold substantial growth potential as the energy landscape shifts towards a more distributed model.

These pilot programs are crucial for testing the technical and economic feasibility of managing a more complex grid with numerous distributed assets. For instance, FirstEnergy's involvement in projects like the Ohio River Valley Microgrid initiative aims to demonstrate how these smaller systems can enhance grid resilience and reliability, potentially reducing reliance on traditional, large-scale power plants.

- Exploratory Phase: Pilot projects are in an early stage, testing integration methods for DERs.

- High Growth Potential: These initiatives are positioned to capitalize on the growing trend of decentralized energy.

- Low Current Market Share: DER integration currently represents a small fraction of FirstEnergy's overall operations.

- Future Opportunity: Successful pilots can unlock significant future revenue streams and operational efficiencies.

Expansion into New, Untapped Service Offerings

FirstEnergy is exploring new service avenues, moving beyond basic electricity provision. This includes offering advanced energy consulting to major commercial clients and developing specialized smart city infrastructure. These initiatives represent potential growth areas but are currently in their early phases.

These nascent ventures face the classic challenge of new market entrants: low market share despite high potential. Significant investment is needed to validate their business models and gain traction. For instance, the burgeoning smart city market, projected to reach $2.5 trillion globally by 2026, offers a glimpse into the scale of opportunity, though FirstEnergy's current share is minimal.

- Exploration of New Services: Advanced energy consulting and smart city infrastructure development.

- Market Position: Nascent stages, low market share, high growth potential.

- Investment Needs: Significant capital required to prove business models.

- Industry Context: Smart city market growth highlights opportunity, with global projections reaching $2.5 trillion by 2026.

FirstEnergy's emerging energy storage solutions and advanced microgrids are being positioned as potential Stars in their BCG matrix. These represent high-growth opportunities with currently low market share, requiring significant investment to scale. For example, FirstEnergy's investments in grid modernization, exceeding $1 billion by the end of 2024, include pilot programs for advanced energy storage, underscoring their commitment to these high-potential areas.

| Category | Market Growth | Market Share | FirstEnergy's Position | Strategic Implication |

| Energy Storage Solutions | High | Low | Potential Star | Invest for growth, build market share. |

| Advanced Microgrids | High | Low | Potential Star | Develop and scale to capture market. |

| Demand-Side Management | High | Unproven | Potential Star/Question Mark | Invest in customer education and outreach. |

| DER Integration Pilots | High | Low (2024) | Potential Star | Test feasibility, prepare for future grid. |

| New Service Avenues (Consulting, Smart City) | High | Minimal | Question Mark | Validate business models, require significant investment. |

BCG Matrix Data Sources

Our FirstEnergy BCG Matrix is informed by a robust blend of internal financial disclosures, industry-specific market research, and publicly available regulatory filings to ensure accurate strategic assessments.