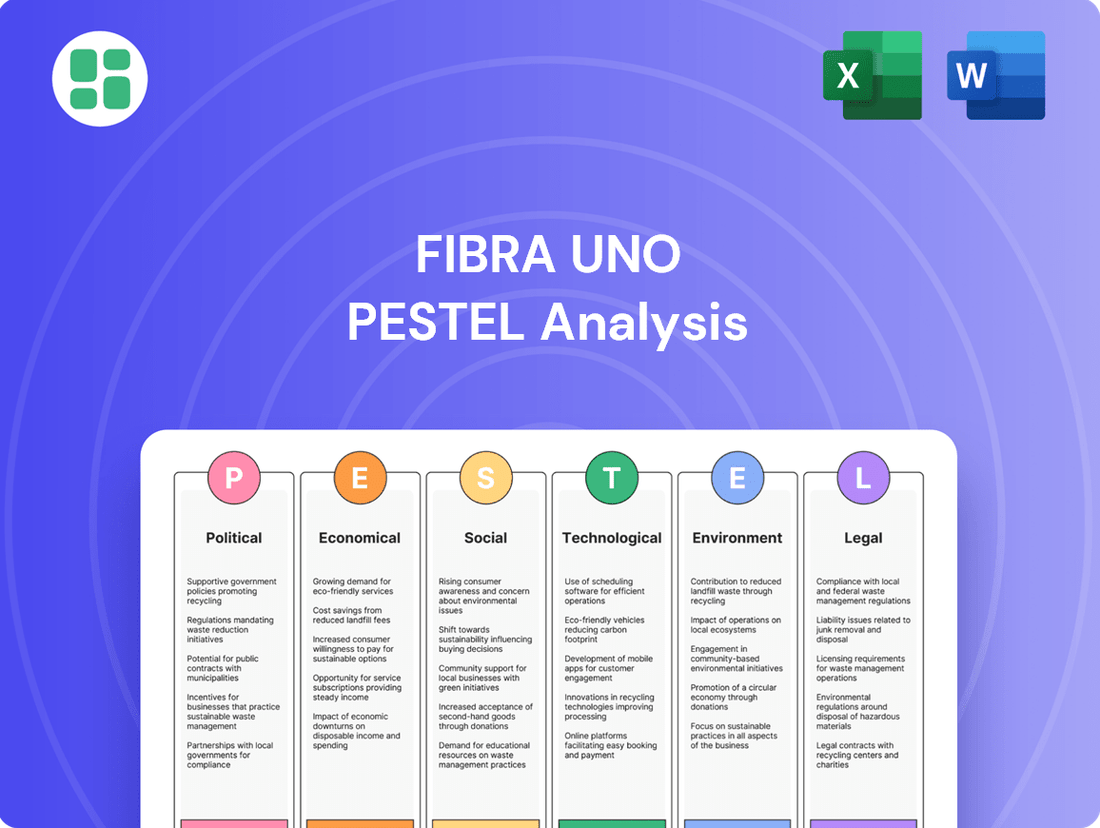

Fibra Uno PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fibra Uno Bundle

Unlock the strategic advantages Fibra Uno holds by understanding the political, economic, social, technological, legal, and environmental forces shaping its trajectory. Our meticulously researched PESTLE analysis reveals critical insights into market dynamics, regulatory shifts, and emerging trends that could impact your investments or business strategies. Don't navigate the complex landscape blindfolded; secure the full PESTLE analysis now and gain a decisive edge.

Political factors

Political stability in Mexico is a crucial element for investor confidence, particularly for long-term real estate ventures like those undertaken by Fibra Uno. A stable political environment fosters predictability, which is essential for capital allocation in the property market.

Government policies are a significant driver for Fibra Uno. Regulations concerning foreign investment, the security of property rights, and the government's commitment to infrastructure development directly shape the opportunities and challenges for the company's growth and operational framework. For example, in 2024, Mexico continued to focus on infrastructure projects, potentially benefiting real estate development.

Shifts in government administration or alterations in political priorities can introduce new regulatory landscapes or incentives. These changes, whether favorable or unfavorable, can substantially impact the real estate sector and, by extension, Fibra Uno's strategic planning and financial performance.

The regulatory landscape for FIBRAs in Mexico, including Fibra Uno, is a significant political factor. Changes to tax laws affecting REITs, such as amendments to the income tax treatment or rules on dividend distributions, could directly influence Fibra Uno's profitability and its ability to attract capital. For instance, any alterations to the current 90% dividend payout requirement or the tax exemptions on distributed income would necessitate strategic adjustments.

Urban planning and zoning regulations are critical political factors influencing Fibra Uno's operations. Local and federal initiatives dictate where and how properties can be developed, directly impacting Fibra Uno's ability to acquire land, initiate new projects, or redevelop existing assets. For instance, a city's decision to rezone industrial areas for mixed-use development could unlock new opportunities for Fibra Uno's retail or residential segments, as seen in the ongoing urban regeneration projects in Mexico City, which often involve complex zoning approvals.

Security and Rule of Law

Mexico's public security situation and the robustness of its legal system significantly influence Fibra Uno's property appeal and the broader investment environment. Elevated crime rates or a sense of instability can discourage businesses and individuals from leasing properties, directly impacting occupancy levels and rental revenue across Fibra Uno's diverse real estate holdings.

A strong legal framework is crucial for safeguarding property rights and enforcing contracts, which are fundamental to successful real estate operations. For instance, in 2023, Mexico's homicide rate saw a slight decrease, yet remained a concern for foreign investment, with reports indicating that certain regions experienced higher levels of insecurity impacting business operations.

- Security Concerns: While overall crime rates may fluctuate, localized security issues can still deter tenants, particularly in retail and industrial sectors.

- Rule of Law Impact: A predictable legal environment is essential for contract enforcement and property rights, bolstering investor confidence.

- Investment Climate: Perceptions of safety and legal stability directly correlate with the attractiveness of Mexico as an investment destination for real estate.

- Tenant Confidence: Businesses and individuals prioritize secure locations, making public safety a key factor in leasing decisions for Fibra Uno's properties.

Infrastructure Development Plans

Government investment in infrastructure is a key political factor influencing Fibra Uno's real estate portfolio. For instance, Mexico's National Infrastructure Program (PNI) for 2020-2024 allocated significant resources to transportation projects, aiming to improve connectivity across the country. This focus on new roads, ports, and logistics hubs directly benefits Fibra Uno's industrial and retail properties by enhancing accessibility and reducing transportation costs for tenants.

These infrastructure developments can unlock new growth corridors, making previously less accessible locations more attractive for commercial and industrial expansion. For example, the expansion of airport capacity or the creation of new industrial corridors can spur demand for warehouse and manufacturing spaces, areas where Fibra Uno has a substantial presence. Such initiatives can lead to increased property valuations and rental income.

Conversely, a lack of sufficient infrastructure investment in certain regions can act as a constraint on growth. If key transportation networks are underdeveloped or absent, it can limit the potential for businesses to operate efficiently, thereby dampening demand for commercial and industrial real estate in those areas. Fibra Uno's strategic planning must account for these regional infrastructure disparities.

Key infrastructure development impacts include:

- Increased property accessibility: New roads and improved public transport directly enhance the value of Fibra Uno's holdings.

- Stimulated economic activity: Infrastructure projects often lead to job creation and business growth, boosting demand for commercial spaces.

- Reduced operational costs for tenants: Better logistics infrastructure lowers costs for businesses, making Fibra Uno's properties more attractive.

- Regional development disparities: Uneven infrastructure investment can create opportunities in some areas while limiting growth in others.

Political stability remains a cornerstone for Fibra Uno's investment strategy, with the Mexican government's commitment to predictable policy frameworks directly influencing investor sentiment. In 2024, the government continued its focus on infrastructure development, a key driver for real estate, with projects aimed at enhancing connectivity across the nation. These initiatives, like the expansion of logistics corridors, directly benefit Fibra Uno's industrial and retail portfolios by improving accessibility and reducing operational costs for tenants, thereby bolstering property valuations.

| Political Factor | Impact on Fibra Uno | 2024/2025 Relevance |

|---|---|---|

| Government Infrastructure Spending | Enhances property accessibility & tenant attractiveness | Mexico's National Infrastructure Program (PNI) continues to prioritize transportation and logistics, directly supporting Fibra Uno's industrial and retail assets. |

| Regulatory Environment (REITs) | Affects profitability and capital attraction | Potential adjustments to tax laws or dividend distribution rules remain a key consideration for Fibra Uno's financial planning. |

| Public Security & Legal System | Influences tenant confidence and property appeal | While improvements are noted, localized security concerns persist, impacting leasing decisions and rental revenue for Fibra Uno's properties. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Fibra Uno, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by highlighting key trends and their implications for Fibra Uno's operations and future growth.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a quick understanding of Fibra Uno's external environment to navigate challenges.

Economic factors

Interest rate changes by Banxico significantly affect Fibra Uno's financing costs for new projects and property acquisitions. For instance, if Banxico maintains its benchmark interest rate at 11.00% in early 2024, as it did for several months, Fibra Uno's debt servicing expenses could remain elevated, potentially impacting its distributable income and the attractiveness of new development opportunities.

Conversely, a decrease in interest rates, a possibility anticipated by some analysts for late 2024 or 2025, would likely lower Fibra Uno's borrowing costs. This reduction in financial burden can stimulate expansion by making new investments more feasible and improve profitability by decreasing interest expenses on existing variable-rate debt.

Inflation directly impacts Fibra Uno's operational costs, from property maintenance and utilities to new construction expenses. For instance, rising material costs in 2024 could significantly increase capital expenditures for property upgrades or new developments. This inflationary pressure necessitates careful cost management to preserve profitability.

The purchasing power of tenants is also affected by inflation, potentially impacting their ability to afford rent increases. Fibra Uno's strategy for adjusting rental rates must therefore balance the need to keep pace with inflation with tenant affordability. A lag in rent adjustments, as seen when Mexico's CPI rose by 4.88% year-on-year in April 2024, could lead to a decline in real rental income.

Maintaining real income and property values hinges on Fibra Uno's capacity to pass on inflationary cost increases through rental rate adjustments. If rental income does not keep pace with inflation, the real value of the company's earnings and asset base can be significantly eroded, impacting investor returns and the company's financial health.

Mexico's economic performance, measured by its Gross Domestic Product (GDP) growth, directly influences Fibra Uno's real estate demand. A healthy GDP signals a vibrant economy, encouraging business expansion and job creation, which in turn boosts occupancy and rental income for Fibra Uno's properties. For instance, Mexico's GDP grew by an estimated 3.1% in 2023, indicating a positive environment for real estate investment.

Conversely, economic downturns pose risks. A slowdown in GDP growth can lead to reduced business investment, hiring freezes, and decreased consumer spending, potentially lowering occupancy rates and rental growth across Fibra Uno's diverse portfolio. Projections for Mexico's GDP growth in 2024 hover around 2.3%, suggesting continued, albeit potentially moderating, economic activity.

Consumer Spending and Retail Sector Performance

Consumer spending and retail sector performance are critical for Fibra Uno, given its substantial retail property holdings. Economic confidence, disposable income, and the growing influence of e-commerce directly impact foot traffic and sales within its retail centers, affecting tenant stability and rental revenue. For instance, in early 2024, Mexico's retail sales saw a notable increase, with some reports indicating year-over-year growth of over 5%, demonstrating a positive, albeit varied, consumer sentiment.

Shifts in how consumers shop and what they prioritize require flexible retail strategies. The ongoing expansion of e-commerce, which saw significant acceleration during the pandemic and continued its upward trajectory through 2024, presents both challenges and opportunities for physical retail spaces. Adapting to omnichannel approaches and enhancing in-store experiences are key to maintaining tenant success and attracting shoppers.

- Consumer Confidence: Fluctuations in consumer confidence directly correlate with spending on non-essential goods, impacting sales at Fibra Uno's retail assets.

- Disposable Income: Higher disposable income generally translates to increased retail spending, benefiting property occupancy and rental income.

- E-commerce Growth: The increasing penetration of online shopping necessitates that physical retail spaces offer compelling experiences to remain competitive.

- Retail Sales Data: Monitoring national retail sales figures, such as those released by Mexico's INEGI, provides a direct indicator of the health of the retail sector.

Foreign Exchange Rate Volatility

Foreign exchange rate volatility significantly impacts Fibra Uno, a Mexican REIT. Fluctuations in the Mexican Peso (MXN) against major currencies, especially the US Dollar, can affect its financial reporting and the returns for international investors. For instance, a weaker peso can make Mexican assets appear cheaper to foreign buyers, potentially boosting investment, but it also increases the cost of any dollar-denominated debt or capital expenditures.

While Fibra Uno's primary income stream is in MXN, managing exposure to foreign currency debt or investments is crucial. For example, in early 2024, the MXN experienced periods of strength against the USD, which could reduce the peso equivalent of dollar-denominated liabilities. However, the peso's performance remains subject to global economic sentiment and domestic policy, creating ongoing uncertainty.

The strength of the Mexican Peso can directly influence foreign direct investment in the country's real estate sector. A stronger peso might deter some foreign capital due to higher acquisition costs in their home currency, while a weaker peso could attract more investment. This dynamic directly affects demand for Fibra Uno's properties and its ability to secure favorable financing.

- MXN/USD Exchange Rate Impact: In 2024, the MXN has shown resilience, trading around 16-17 MXN per USD for much of the year, a level that generally supports domestic economic activity but requires careful management of any foreign currency obligations.

- Debt Denomination Risk: Fibra Uno's exposure to dollar-denominated debt means that a depreciation of the MXN would increase the peso cost of servicing that debt.

- Investor Returns: For international investors, currency gains or losses on their MXN-denominated holdings (like Fibra Uno shares) are a significant component of their total return.

- Capital Expenditure Costs: If Fibra Uno undertakes capital projects financed with USD, a weaker peso directly translates to higher project costs in local currency terms.

Banxico's monetary policy, particularly its benchmark interest rate, directly influences Fibra Uno's cost of capital. With the benchmark rate holding at 11.00% for much of early 2024, financing new acquisitions and developments for Fibra Uno remained relatively expensive, potentially impacting profitability and expansion plans. A potential rate cut later in 2024 or into 2025 could alleviate this pressure, making debt financing more attractive and boosting distributable income.

Inflation impacts Fibra Uno's operational expenses, from property maintenance to construction materials, necessitating robust cost management. For instance, the 4.88% year-on-year CPI increase in April 2024 highlights the pressure on real estate operating costs. Balancing rent increases with tenant affordability is crucial to maintain real rental income, as seen when inflation outpaces rent adjustments.

Mexico's economic growth, reflected in its GDP, is a key driver for real estate demand. An estimated 3.1% GDP growth in 2023 provided a favorable backdrop, but projections for 2024 around 2.3% suggest a moderating but still positive economic environment. Consumer spending and retail sector health are vital for Fibra Uno's retail portfolio, with early 2024 retail sales showing growth of over 5% in some reports.

The MXN/USD exchange rate is a critical factor for Fibra Uno, especially concerning international investors and dollar-denominated debt. The peso's stability in early 2024, trading around 16-17 MXN per USD, generally supported domestic activity but required careful management of foreign currency obligations. Currency fluctuations can significantly impact the cost of capital expenditures and the overall return for foreign investors.

| Economic Factor | Impact on Fibra Uno | 2024/2025 Data/Projections |

|---|---|---|

| Interest Rates (Banxico Benchmark) | Affects financing costs for debt and development. Higher rates increase borrowing costs; lower rates decrease them. | Maintained at 11.00% through much of early 2024. Potential for cuts anticipated late 2024/2025. |

| Inflation (CPI) | Impacts operational costs (maintenance, materials) and real rental income if rents don't keep pace. | April 2024 YoY CPI: 4.88%. Requires careful cost management and rent adjustment strategies. |

| GDP Growth | Drives real estate demand, occupancy rates, and rental growth. | 2023 Growth: ~3.1%. 2024 Projections: ~2.3%. Indicates continued, albeit moderating, economic expansion. |

| Consumer Spending & Retail Sales | Crucial for Fibra Uno's retail portfolio performance, affecting foot traffic and tenant stability. | Early 2024 retail sales showed notable growth (e.g., >5% YoY in some reports). E-commerce growth continues to be a significant trend. |

| Exchange Rate (MXN/USD) | Affects cost of dollar-denominated debt, capital expenditures, and international investor returns. | MXN traded around 16-17 MXN/USD in early 2024, showing resilience. Volatility remains a factor. |

What You See Is What You Get

Fibra Uno PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Fibra Uno provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape facing Fibra Uno.

Sociological factors

Mexico's ongoing urbanization continues to fuel demand for real estate in its key metropolitan areas, a trend that strongly benefits Fibra Uno, given its significant footprint in these locations. As of 2024, over 80% of Mexico's population resides in urban centers, a figure projected to climb, directly impacting the need for residential, office, and retail properties.

Demographic shifts, including evolving population growth rates and age distributions, are critical indicators for Fibra Uno's long-term portfolio strategy. For instance, a growing middle class and increasing household formation in urban hubs like Mexico City and Guadalajara will likely sustain and elevate demand for diverse property types within Fibra Uno's extensive holdings.

The shift towards hybrid and remote work is significantly reshaping office space demand. By early 2024, many companies reported maintaining hybrid models, with employees spending an average of 2.5 days per week in the office, according to industry surveys. This trend directly affects real estate investment trusts like Fibra Uno, which own substantial office portfolios.

Fibra Uno needs to adapt its office assets to meet new tenant expectations. This includes offering more flexible lease terms, incorporating collaborative zones, and enhancing amenities like advanced technology and wellness facilities. For instance, a 2024 market analysis indicated that buildings with high-quality amenities and flexible layouts commanded higher occupancy rates and rental premiums compared to older, less adaptable properties.

The strategic repositioning of existing office spaces is crucial for Fibra Uno to remain competitive. Properties that are updated to support diverse work styles and employee well-being are better positioned to attract and retain tenants. This adaptation is essential for maintaining occupancy and rental income in a dynamic market environment influenced by evolving work habits.

Consumer preferences in retail are increasingly leaning towards experiences over mere transactions. In 2024, reports indicate that a significant percentage of consumers are willing to pay more for products and services that offer a superior experience. This trend necessitates that retail properties, like those managed by Fibra Uno, adapt by integrating entertainment, dining, and service-oriented tenants to create destinations that draw in shoppers.

The demand for convenience and seamless omnichannel integration continues to shape retail environments. By 2025, it's projected that a majority of retail sales will involve some form of online-offline interaction, highlighting the need for physical spaces to complement digital offerings. Fibra Uno's portfolio must therefore facilitate easy access, flexible pickup options, and a cohesive brand presence across all customer touchpoints to remain competitive.

Industrialization and Nearshoring Trends

The global shift towards nearshoring, especially for manufacturing and supply chains to be closer to North America, is a significant tailwind for Mexico's industrial and logistics real estate sector. This trend is expected to drive substantial demand for modern, strategically located facilities, directly benefiting Fibra Uno's extensive industrial portfolio.

Fibra Uno is well-positioned to capitalize on this opportunity. For instance, in 2024, Mexico saw a notable increase in foreign direct investment (FDI) in manufacturing, with sectors like automotive and electronics leading the charge, directly correlating with the need for advanced logistics and production spaces.

- Nearshoring Demand: Mexico's industrial property occupancy rates remained robust through late 2024 and early 2025, driven by companies relocating operations from Asia.

- Investment Opportunities: Fibra Uno's strategy involves acquiring and developing state-of-the-art industrial parks to accommodate this influx, focusing on key manufacturing hubs.

- Economic Impact: The nearshoring trend is projected to contribute significantly to Mexico's GDP growth in 2025, further stimulating demand for industrial real estate services and infrastructure.

Lifestyle and Housing Trends

Societal shifts are fundamentally altering how people want to live and work, driving a significant demand for mixed-use developments. This trend favors properties that seamlessly blend residential, commercial, and recreational spaces, offering convenience and a vibrant community feel. For instance, by 2025, urban centers are expected to see continued growth in demand for these integrated environments.

Fibra Uno's strategic focus on developing and managing properties that cater to these evolving lifestyle preferences is crucial. Their ability to provide versatile spaces that accommodate living, working, and leisure activities directly impacts portfolio attractiveness and value. This adaptability is particularly important in densely populated urban areas where residents seek efficient and engaging environments.

Consider these key influences on housing and lifestyle trends:

- Increased demand for walkability and access to amenities: Consumers increasingly value communities where daily needs are within walking distance.

- Growth in remote and hybrid work models: This necessitates flexible living spaces that can also accommodate home offices.

- Desire for experiential retail and entertainment: Mixed-use developments offering curated experiences are more appealing than traditional retail centers.

- Focus on sustainability and community: Properties that promote sustainable living and foster a sense of community are gaining traction.

Societal expectations are increasingly prioritizing convenience and integrated living experiences, directly benefiting Fibra Uno's mixed-use developments. By 2025, urban dwellers are showing a pronounced preference for environments that offer seamless access to residential, commercial, and recreational amenities within close proximity. This trend underscores the growing importance of properties that foster community and reduce commute times, aligning with evolving lifestyle demands.

The continued emphasis on sustainability and community engagement within real estate is a significant sociological factor influencing tenant and investor decisions. Properties that incorporate green building practices and foster social interaction are becoming more attractive. For instance, by early 2025, a notable portion of new developments are being designed with shared spaces and eco-friendly features to meet these evolving societal values.

Evolving work-life balance expectations are reshaping demand for both residential and commercial spaces. The rise of hybrid work models, as observed throughout 2024 and into 2025, means that residential properties need to offer more than just living quarters; they must accommodate home offices and flexible layouts. Similarly, office spaces are being re-evaluated for their ability to support collaboration and employee well-being, rather than just providing desks.

Consumer preferences are shifting towards experiences and personalized services, impacting retail and entertainment sectors. By 2025, retail centers that offer curated events, diverse dining options, and unique leisure activities are expected to outperform those focused solely on traditional retail transactions. This necessitates that Fibra Uno's retail assets adapt to become lifestyle destinations.

Technological factors

Fibra Uno's strategic embrace of proptech, including smart building technologies and IoT devices, is poised to significantly boost operational efficiency and tenant satisfaction. For instance, by 2024, the global smart building market was projected to reach over $30 billion, indicating a strong trend towards these integrated solutions.

Adoption of AI-driven property management platforms can streamline operations for Fibra Uno, enabling predictive maintenance and optimized energy consumption. This technological integration directly addresses cost reduction and enhances the overall value proposition for tenants by improving comfort and security across their diverse portfolio.

Fibra Uno is increasingly leveraging advanced data analytics and business intelligence tools to refine its portfolio. This allows for deeper insights into market dynamics, tenant preferences, and the performance of individual properties within its extensive real estate holdings.

This data-driven strategy empowers Fibra Uno to make more strategic decisions concerning property acquisitions, sales, rental rate adjustments, and capital investments. For example, by analyzing tenant payment patterns and lease renewal probabilities, Fibra Uno can more accurately forecast revenue and identify underperforming assets, ultimately aiming for optimized portfolio returns.

In 2024, the real estate investment trust sector, including companies like Fibra Uno, has seen a significant push towards data-driven decision-making. While specific 2024/2025 data for Fibra Uno's analytics adoption is still emerging, industry trends show a growing reliance on AI and machine learning for predictive modeling in property management and investment strategy.

The relentless expansion of e-commerce continues to reshape the retail sector, presenting a dual challenge and opportunity for Fibra Uno. While traditional brick-and-mortar retail spaces, particularly enclosed malls, may experience diminished foot traffic as consumers increasingly opt for online purchases, this trend simultaneously fuels a robust demand for modern logistics facilities and last-mile distribution centers. For instance, in 2024, global e-commerce sales were projected to reach over $6.3 trillion, underscoring the scale of this shift.

Fibra Uno's strategic imperative lies in its ability to adapt and diversify its real estate holdings. By carefully balancing its investments in established retail properties with a proactive expansion into industrial and logistics assets, the company can effectively capitalize on the evolving consumer behavior. This approach ensures that Fibra Uno remains well-positioned to benefit from the growing need for warehousing and distribution infrastructure that supports online retail operations.

Advanced Construction Technologies

Fibra Uno can significantly benefit from the increasing adoption of advanced construction technologies. Innovations like modular construction and 3D printing are transforming the industry, promising quicker project completion and lower costs. For instance, modular construction can reduce project timelines by up to 50%, as reported by various industry studies in 2023-2024, while 3D printing offers potential material waste reduction of up to 90% in certain applications.

By integrating these cutting-edge methods, Fibra Uno can boost the efficiency of its development pipeline. This not only translates to faster returns on investment but also allows for the creation of more durable and environmentally friendly buildings. The real estate sector's growing emphasis on sustainability, highlighted by a 2024 survey showing a 30% increase in demand for green buildings, makes these technologies particularly attractive.

- Faster Development: Modular construction can cut project timelines by up to half, accelerating revenue generation.

- Cost Reduction: Technologies like 3D printing can decrease material waste significantly, leading to lower overall construction expenses.

- Enhanced Quality and Sustainability: Advanced materials and precise construction methods result in more resilient and eco-friendly properties, meeting growing market demand.

Cybersecurity and Data Privacy

Fibra Uno's increasing reliance on digital platforms for property management, tenant communication, and financial operations makes robust cybersecurity and data privacy paramount. The company must protect sensitive tenant and operational data to maintain trust and prevent disruptions.

Compliance with evolving data privacy regulations, such as Mexico's Federal Law on Protection of Personal Data Held by Private Parties, is crucial. Failure to do so can result in significant fines and reputational damage.

- Increased cyber threats: Global cybersecurity spending is projected to reach $231.7 billion in 2024, reflecting the growing threat landscape that Fibra Uno must navigate.

- Data breach impact: The average cost of a data breach in 2024 is estimated at $4.73 million globally, highlighting the financial and operational risks associated with inadequate security.

- Tenant expectations: Tenants increasingly expect their personal and financial information to be handled with the utmost care and security.

- Regulatory landscape: Staying abreast of and complying with data privacy laws is essential to avoid penalties and maintain operational continuity.

Fibra Uno's integration of proptech, including AI and IoT, is enhancing operational efficiency and tenant experience, with the global smart building market projected to exceed $30 billion in 2024. Advanced data analytics are also being leveraged to refine portfolio performance, with industry-wide adoption of AI and machine learning for predictive modeling accelerating in 2024-2025.

Legal factors

The legal framework for property and land ownership in Mexico is critical for Fibra Uno, influencing its real estate acquisitions and development. Recent legislative discussions in 2024 and 2025 regarding land use regulations and foreign investment in real estate could introduce new compliance requirements or opportunities for the company.

Changes in property law, such as potential amendments to eminent domain statutes or foreign ownership limitations, pose a direct risk to Fibra Uno's core business model of owning and managing diverse real estate assets. The stability of these laws directly correlates with the security and potential returns of its long-term property investments.

Taxation laws are crucial for Fibra Uno (FIBRAs). Income tax, value-added tax (VAT), and property taxes directly impact its profitability and how much it can distribute to investors. For instance, changes in corporate tax rates can affect the net income available for dividends.

Any shifts in property tax assessments or the introduction of new levies on real estate investments can increase Fibra Uno's operating expenses. In 2023, Mexico's corporate tax rate remained at 30%, a key figure for FIBRAs like Fibra Uno when calculating their taxable income and dividend payouts.

Fibra Uno must strictly adhere to environmental laws governing construction permits, waste disposal, emissions, and land contamination. Failure to comply can result in substantial penalties, project setbacks, and damage to its public image. For instance, Mexico's environmental impact assessment process, regulated by SEMARNAT, can add significant time and cost to new developments if not managed proactively.

Tenant and Lease Contract Laws

Tenant and lease contract laws are critical for Fibra Uno's operational stability. Regulations concerning landlord-tenant relations, lease terms, and eviction processes directly influence how Fibra Uno manages its properties and collects rent. For instance, in Mexico, where Fibra Uno operates extensively, the Civil Code and specific rental laws dictate the rights and responsibilities of both parties. In 2024, understanding these legal frameworks is paramount to mitigating risks associated with tenant defaults or disputes, ensuring consistent revenue streams.

Compliance with these legal stipulations is not merely a formality but a core business necessity. It safeguards Fibra Uno's contractual agreements, minimizes potential legal challenges, and ensures the efficient resolution of any tenant-related issues. As of early 2025, proactive legal counsel and robust lease management practices remain key to maintaining a healthy tenant portfolio and protecting asset value.

- Tenant Protection Laws: These laws vary by jurisdiction and can influence lease renewal terms, rent increase limitations, and grounds for eviction, impacting Fibra Uno's revenue predictability.

- Lease Agreement Enforceability: The legality and specific clauses within lease contracts, such as duration, rent payment schedules, and maintenance responsibilities, are subject to national and local legal frameworks.

- Eviction Procedures: Strict legal procedures must be followed for tenant eviction, which can be time-consuming and costly if not handled correctly, directly affecting occupancy rates and cash flow.

- Regulatory Compliance Costs: Adhering to evolving tenant and lease laws may necessitate ongoing legal consultation and updates to property management practices, adding to operational expenses.

Corporate Governance and Securities Regulations

Fibra Uno, as a publicly traded entity on the Mexican Stock Exchange (BMV), operates under rigorous corporate governance and securities regulations. These rules are designed to ensure fairness and transparency for all investors. For instance, in 2024, the BMV continued to emphasize adherence to listing requirements, which include timely financial reporting and disclosure of material information.

Compliance with these mandates is not just a legal obligation but a cornerstone of maintaining investor trust. For Fibra Uno, this means adhering to rules set by bodies like the Comisión Nacional Bancaria y de Valores (CNBV), which oversees financial institutions and markets in Mexico. Failure to comply can lead to penalties and negatively impact share price. For example, in 2023, several companies faced scrutiny for disclosure lapses, highlighting the importance of robust compliance frameworks.

- Reporting Obligations: Fibra Uno must file quarterly and annual financial statements in accordance with Mexican Financial Reporting Standards (NIF) and IFRS, ensuring transparency on its operational and financial performance.

- Investor Protection: Regulations safeguard investors by mandating fair treatment and providing mechanisms for recourse in case of misconduct, fostering a stable investment environment.

- Market Access: Consistent adherence to securities laws and governance best practices is critical for Fibra Uno to access capital markets for future financing and growth opportunities.

- CNBV Oversight: The Mexican National Banking and Securities Commission (CNBV) actively monitors listed companies, enforcing regulations related to insider trading, market manipulation, and corporate conduct.

Fibra Uno's operations are significantly shaped by Mexican labor laws, which dictate hiring practices, employee benefits, and termination procedures. In 2024, ongoing discussions around minimum wage adjustments and worker protections could impact operational costs and human resource management. Compliance with these regulations is essential to avoid disputes and maintain a stable workforce across its extensive property portfolio.

The legal landscape surrounding real estate development and property management in Mexico presents both opportunities and challenges for Fibra Uno. Adherence to building codes, zoning laws, and environmental impact regulations, overseen by entities like SEMARNAT, is paramount for project execution and long-term asset viability. For instance, in 2023, Mexico's commitment to sustainable development continued to influence construction standards, requiring careful planning for new developments.

As a significant player in the Mexican real estate market, Fibra Uno must navigate a complex web of regulations governing its financial activities and corporate governance. Adherence to rules set by the Comisión Nacional Bancaria y de Valores (CNBV) and the Mexican Stock Exchange (BMV) is critical for maintaining investor confidence and market access. For example, in 2024, the BMV continued to enforce strict disclosure requirements for listed entities, impacting Fibra Uno's reporting obligations.

Legal frameworks governing tenant relations and lease agreements directly influence Fibra Uno's revenue streams and operational efficiency. Understanding and complying with local civil codes and rental laws ensures the enforceability of contracts and smooth property management. In 2025, proactive legal counsel remains vital for mitigating risks associated with tenant disputes and ensuring consistent cash flow from its leased properties.

Environmental factors

Fibra Uno's extensive property portfolio faces significant physical risks stemming from climate change. The increasing frequency and intensity of extreme weather events, such as hurricanes impacting coastal assets or prolonged droughts affecting water availability for operations, pose a direct threat to asset value and operational continuity.

For instance, Mexico, where Fibra Uno holds a substantial presence, is particularly vulnerable to a range of climate-related hazards. In 2023, the country experienced a notable increase in extreme weather events, including severe droughts in northern regions and heavy rainfall leading to localized flooding in urban centers. This underscores the need for robust risk assessment and mitigation strategies across Fibra Uno's diverse geographical footprint.

To safeguard its assets, Fibra Uno must prioritize resilient building designs and secure adequate insurance coverage. This proactive approach is essential for protecting the long-term value of its real estate holdings against the escalating impacts of a changing climate. Investing in climate-resilient infrastructure can also lead to operational efficiencies and reduced long-term maintenance costs.

The increasing demand for energy-efficient and green-certified buildings is a significant environmental factor shaping tenant preferences and regulatory landscapes. This trend directly impacts real estate investment trusts like Fibra Uno.

By investing in energy-efficient technologies and pursuing certifications such as LEED or EDGE, Fibra Uno can boost its portfolio's appeal and operational cost savings. For instance, many companies are setting ambitious sustainability targets, with a growing number of corporate leases now requiring green building certifications, a trend that is expected to accelerate through 2025.

Water availability is a growing environmental challenge, especially in parts of Mexico where Fibra Uno operates. For instance, Mexico City, a key market for Fibra Uno's retail and office spaces, faces significant water stress, with aquifer depletion rates exceeding recharge. This necessitates proactive water management.

Fibra Uno is implementing strategies like rainwater harvesting and greywater recycling across its portfolio to ensure efficient water use. These measures not only address potential scarcity but also help the company comply with Mexico's evolving water conservation regulations, which aim to protect this vital resource.

Waste Management and Circular Economy Principles

Effective waste management is crucial for Fibra Uno's environmental compliance and operational efficiency. In 2023, Mexico's National Institute of Statistics and Geography (INEGI) reported that industrial and commercial sectors generated over 150 million tons of solid waste, highlighting the scale of the challenge. Fibra Uno's commitment to waste reduction, recycling, and responsible disposal directly impacts its environmental footprint and adherence to regulations.

Adopting circular economy principles offers significant benefits for Fibra Uno's property development and management. By prioritizing waste minimization and maximizing resource reuse, such as through recycled building materials or efficient energy recovery systems, the company can improve its environmental performance. For instance, a focus on deconstruction and material salvage in redevelopment projects can divert substantial waste from landfills, aligning with a more sustainable operational model.

- Waste Reduction Initiatives: Fibra Uno can implement stricter waste sorting protocols across its portfolio to increase recycling rates.

- Circular Economy Integration: Exploring partnerships for the reuse of construction and demolition waste in new projects can reduce virgin material consumption.

- Resource Efficiency: Investing in technologies that enable better waste-to-energy conversion or material reprocessing can further enhance environmental performance.

- Regulatory Compliance: Staying abreast of evolving waste management regulations in Mexico, such as those related to extended producer responsibility, is vital for continued operational integrity.

Biodiversity and Land Use Impact

Fibra Uno's real estate development and management activities directly influence local biodiversity and ecosystems. The company must actively assess and mitigate the ecological footprint of its projects. This involves implementing robust strategies to minimize habitat disruption and protect natural areas, particularly for new developments or expansions planned for 2024 and 2025.

Key considerations for Fibra Uno include:

- Habitat Preservation: Identifying and safeguarding sensitive ecosystems within or adjacent to development sites.

- Biodiversity Enhancement: Incorporating green infrastructure and native plantings to support local flora and fauna.

- Sustainable Land Management: Adopting practices that reduce soil erosion, water pollution, and the use of harmful chemicals.

- Regulatory Compliance: Ensuring all projects adhere to national and international biodiversity protection standards and land use regulations.

For instance, in 2024, Mexico's National Commission for the Knowledge and Use of Biodiversity (CONABIO) reported that urbanization continues to be a significant driver of habitat loss, underscoring the critical need for responsible land use by entities like Fibra Uno.

Climate change poses physical risks to Fibra Uno's portfolio, with extreme weather events like hurricanes and droughts impacting asset value and operations, a concern heightened by Mexico's vulnerability to such hazards, as seen in 2023's increased weather volatility.

The growing demand for green-certified buildings is a key environmental factor, with corporate leases increasingly requiring sustainability credentials, a trend expected to accelerate through 2025, making energy efficiency crucial for Fibra Uno's portfolio appeal.

Water scarcity, particularly in markets like Mexico City, necessitates proactive management, with Fibra Uno implementing strategies such as rainwater harvesting and greywater recycling to ensure efficient water use and comply with evolving conservation regulations.

Effective waste management is vital, especially considering Mexico's significant industrial and commercial waste generation, reported by INEGI in 2023 at over 150 million tons, pushing Fibra Uno towards circular economy principles and waste reduction initiatives.

PESTLE Analysis Data Sources

Our Fibra Uno PESTLE Analysis is grounded in a comprehensive review of publicly available financial reports, regulatory filings from Mexican government bodies, and reputable real estate market research from industry associations. This ensures a robust understanding of the political, economic, and legal landscape impacting Fibra Uno.