Fibra Uno Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fibra Uno Bundle

Unlock the strategic blueprint of Fibra Uno's success with our comprehensive Business Model Canvas. This detailed analysis breaks down how they create and deliver value, identify key customer segments, and manage their revenue streams. Perfect for anyone looking to understand the core mechanics of a leading real estate investment trust.

Dive into the operational excellence of Fibra Uno. Our full Business Model Canvas reveals their vital resources, key activities, and crucial partnerships that drive their market dominance. Gain actionable insights for your own strategic planning or investment decisions.

Ready to dissect Fibra Uno's competitive advantage? The complete Business Model Canvas provides a clear, section-by-section breakdown of their value proposition, cost structure, and revenue models. Download it now to gain a deeper understanding of their proven strategy.

Partnerships

Fibra Uno actively cultivates relationships with a diverse array of financial institutions, including major banks, specialized investment funds, and other capital providers. These collaborations are fundamental to securing the substantial financing needed for its ambitious property acquisition strategies, large-scale development projects, and the ongoing management of its considerable debt portfolio.

These strategic financial partnerships are absolutely vital for Fibra Uno’s capital-raising activities. They facilitate crucial mechanisms such as the issuance of corporate bonds and the establishment of credit lines, which are indispensable for funding the significant capital expenditures inherent in the real estate sector. For example, in 2024, Fibra Uno successfully raised approximately MXN 5 billion through a new bond issuance, underscoring the critical role of these financial allies.

Fibra Uno's success hinges on strong alliances with developers and construction companies. These collaborations are crucial for identifying, acquiring, and executing new income-generating properties across diverse real estate segments. For instance, in 2024, Fibra Uno continued to leverage these partnerships to advance its development pipeline, aiming to enhance its portfolio's yield and market position.

These vital relationships ensure that new projects and portfolio expansions are completed efficiently and to high standards. By working with experienced builders, Fibra Uno can navigate complex construction processes and meet market demands effectively, a strategy that proved beneficial throughout 2024 as they managed various development initiatives.

Fibra Uno's success hinges on its major tenants, which include prominent retail chains, diverse industrial companies, and established corporate offices. These anchor tenants are crucial for ensuring high occupancy rates and a consistent flow of rental income, forming the bedrock of Fibra Uno's financial stability.

The company actively cultivates long-term lease agreements with these reputable entities. For instance, as of early 2024, Fibra Uno maintained a robust portfolio with a significant portion of its rental income derived from these key relationships, underscoring their importance to the overall health and predictability of the company's revenue streams.

Real Estate Brokers and Agencies

Fibra Uno actively collaborates with a wide network of real estate brokers and agencies. These partnerships are crucial for the efficient leasing and management of its extensive property portfolio, spanning industrial, retail, and office spaces.

These intermediaries serve as vital conduits, connecting Fibra Uno with a broad spectrum of potential tenants. This strategic alliance ensures robust market penetration and optimizes occupancy rates across its diverse asset classes. For instance, in 2024, Fibra Uno's leasing efforts were significantly bolstered by these agency relationships, contributing to a healthy occupancy level across its industrial parks.

- Facilitating Leasing: Brokers and agencies streamline the process of finding and securing tenants for Fibra Uno's properties.

- Market Reach: They provide access to a wider pool of prospective tenants, enhancing market visibility.

- Occupancy Management: These partnerships are key to maintaining high occupancy rates, crucial for revenue generation.

- Segment Specialization: Many agencies offer specialized expertise within industrial, retail, or office sectors, tailoring outreach efforts.

Governmental and Regulatory Bodies

Fibra Uno’s relationships with governmental and regulatory bodies are foundational for its operations in Mexico. These partnerships are essential for securing the permits and licenses required to develop and operate its extensive real estate portfolio. Compliance with Mexican real estate and financial regulations, overseen by entities like the Comisión Nacional Bancaria y de Valores (CNBV), is paramount for maintaining investor confidence and operational legitimacy.

Specifically, large-scale acquisitions or significant portfolio adjustments necessitate engagement with antitrust commissions, such as the Comisión Federal de Competencia Económica (COFECE), to ensure fair market competition. Furthermore, adherence to the listing requirements and disclosure mandates of the Mexican Stock Exchange (BMV) is critical for Fibra Uno's status as a publicly traded entity.

- Regulatory Compliance: Ensuring adherence to all Mexican real estate and financial laws, including those from the CNBV.

- Permitting and Licensing: Obtaining necessary approvals from municipal and federal government bodies for property development and operations.

- Antitrust Review: Engaging with COFECE for significant transactions to maintain market fairness.

- Stock Exchange Requirements: Fulfilling all listing and reporting obligations with the Mexican Stock Exchange (BMV).

Fibra Uno's key partnerships extend to financial institutions, developers, and major tenants, forming the backbone of its operational and financial strategy. These alliances are crucial for capital acquisition, project execution, and consistent revenue generation, as evidenced by its 2024 activities.

In 2024, Fibra Uno continued to leverage its relationships with financial institutions, successfully raising capital through bond issuances to fund its growth. Simultaneously, collaborations with developers and construction firms were vital for advancing its development pipeline and enhancing portfolio yield.

Major tenants, including prominent retail chains and corporate entities, remain central to Fibra Uno's stability, ensuring high occupancy rates and predictable rental income. Furthermore, partnerships with real estate brokers and agencies were instrumental in optimizing leasing efforts and market reach throughout 2024.

The company also maintains critical relationships with governmental and regulatory bodies in Mexico to ensure compliance and facilitate property development. These include entities like the CNBV for financial oversight and COFECE for antitrust reviews, alongside adherence to BMV listing requirements.

| Partnership Type | Key Role | 2024 Impact/Example |

|---|---|---|

| Financial Institutions | Capital Raising, Financing | MXN 5 billion bond issuance |

| Developers & Construction Companies | Property Acquisition & Development | Advancement of development pipeline |

| Major Tenants | Rental Income, Occupancy Stability | Significant portion of rental income derived |

| Real Estate Brokers & Agencies | Leasing, Market Reach | Bolstered leasing efforts, healthy occupancy |

| Governmental & Regulatory Bodies | Permitting, Compliance, Market Access | Ensured operational legitimacy and market fairness |

What is included in the product

A comprehensive overview of Fibra Uno's real estate investment trust (REIT) business model, detailing its focus on acquiring, managing, and developing a diversified portfolio of commercial properties across Mexico.

This model highlights key elements like tenant relationships, property management, and financial structuring to generate stable rental income and capital appreciation for investors.

Fibra Uno's Business Model Canvas offers a clear, one-page snapshot of its operations, simplifying complex real estate investment strategies for faster understanding and decision-making.

Activities

Fibra Uno's primary engine is its robust property acquisition and development strategy. This involves actively seeking out and purchasing income-generating real estate across Mexico, encompassing industrial, retail, office, and mixed-use segments.

In 2024, Fibra Uno continued its aggressive expansion, aiming to significantly increase its gross leasable area and solidify its market leadership. For instance, its portfolio growth reflects a commitment to strategic development projects that enhance its competitive edge and rental income streams.

Fibra Uno's property management and operations are central to its success, focusing on keeping its vast real estate portfolio running smoothly. This involves everything from routine maintenance and robust security measures to providing excellent tenant services, all aimed at ensuring properties are well-maintained and attractive to renters.

In 2024, Fibra Uno continued to emphasize operational efficiency. For instance, the company reported that its occupancy rates across its diverse portfolio remained strong, a testament to effective management. This focus directly translates into maximizing rental income and preserving the long-term value of its assets.

Fibra Uno actively manages its extensive leasing portfolio, which is crucial for generating consistent revenue. In 2024, the company focused on optimizing lease terms and ensuring high occupancy rates across its diverse properties, aiming to maintain its strong track record of stable cash flows.

Fostering robust tenant relationships is paramount. By proactively addressing tenant needs and concerns, Fibra Uno aims to reduce churn and secure long-term commitments. This includes providing excellent property management services and adapting to evolving tenant requirements, a strategy that has historically contributed to low vacancy rates.

Capital Raising and Financial Management

Fibra Uno actively pursues capital raising through various channels, including issuing new debt and equity. These activities are crucial for funding ongoing development projects, refinancing existing debt to optimize its cost, and maintaining a robust financial structure. For instance, in early 2024, Fibra Uno successfully issued MXN 5.5 billion in unsecured debt, demonstrating continued access to capital markets.

Strategic financial management is a cornerstone of Fibra Uno's operations. This involves not only raising capital but also prudently managing its existing financial obligations. The company prioritizes prepaying debt when advantageous and securing flexible credit lines to ensure it has the necessary liquidity and financial maneuverability to seize growth opportunities and navigate market fluctuations.

- Continuous Capital Raising: Fibra Uno consistently accesses capital markets through debt and equity issuances.

- Strategic Debt Management: The company engages in debt prepayments and secures credit lines to enhance financial flexibility.

- 2024 Capital Activity: Early 2024 saw Fibra Uno raise MXN 5.5 billion through unsecured debt issuance.

- Funding Growth and Refinancing: Capital raising efforts directly support project development and the refinancing of existing obligations.

Investor Relations and Dividend Distribution

Fibra Uno, as a publicly traded real estate investment trust (REIT), places a strong emphasis on investor relations. This involves consistent and transparent communication regarding financial performance and operational updates. The company actively engages with its investor base to foster trust and provide clarity on its strategic direction.

A core component of Fibra Uno's business model is the distribution of a significant portion of its rental income to shareholders. This commitment to returning value directly to investors through dividends is a key driver of its attractiveness in the market. For instance, in 2024, Fibra Uno maintained its practice of distributing a substantial percentage of its net income as dividends, reflecting its dedication to investor returns.

The company's investor relations activities aim to ensure that stakeholders have a clear understanding of the REIT's financial health and growth prospects. This proactive approach helps to support the company's valuation and maintain investor confidence.

- Transparent Financial Reporting: Fibra Uno provides regular and detailed financial reports, including quarterly and annual statements, to keep investors informed.

- Dividend Distribution Policy: The REIT adheres to a policy of distributing a large percentage of its rental income as dividends, typically exceeding regulatory requirements for REITs.

- Investor Engagement: The company conducts investor calls, webcasts, and participates in industry conferences to facilitate direct communication and address investor queries.

- Commitment to Shareholder Value: Fibra Uno's strategy is fundamentally geared towards maximizing long-term shareholder value through efficient property management and strategic acquisitions.

Fibra Uno's core activities revolve around acquiring and developing income-generating real estate, managing its extensive portfolio efficiently, and optimizing its leasing agreements to ensure consistent revenue. The company also focuses on robust tenant relationship management to maintain high occupancy and secure long-term leases.

In 2024, Fibra Uno continued its strategic property acquisitions and development, aiming to expand its gross leasable area and enhance its market position. The company also prioritized operational efficiency, with strong occupancy rates across its diverse portfolio, directly contributing to maximized rental income and asset value preservation.

Key activities include actively managing its leasing portfolio through lease term optimization and maintaining high occupancy rates, which is crucial for stable cash flows. Furthermore, fostering strong tenant relationships through excellent property management and adapting to tenant needs helps reduce churn and secure long-term commitments.

Fibra Uno's financial strategy is centered on continuous capital raising via debt and equity to fund development and refinancing, exemplified by its MXN 5.5 billion unsecured debt issuance in early 2024. This is complemented by strategic debt management, including prepayments and securing credit lines for financial maneuverability.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Property Acquisition & Development | Seeking and purchasing income-generating real estate across Mexico. | Continued aggressive expansion to increase gross leasable area. |

| Portfolio Management & Operations | Ensuring smooth running of real estate assets through maintenance and tenant services. | Emphasis on operational efficiency and maintaining strong occupancy rates. |

| Leasing & Tenant Relations | Managing leases, optimizing terms, and fostering strong tenant relationships. | Focus on optimizing lease terms and adapting to tenant needs to reduce churn. |

| Capital Raising & Financial Management | Accessing capital markets for funding and managing financial obligations prudently. | Issued MXN 5.5 billion in unsecured debt; strategic debt prepayments and credit line management. |

What You See Is What You Get

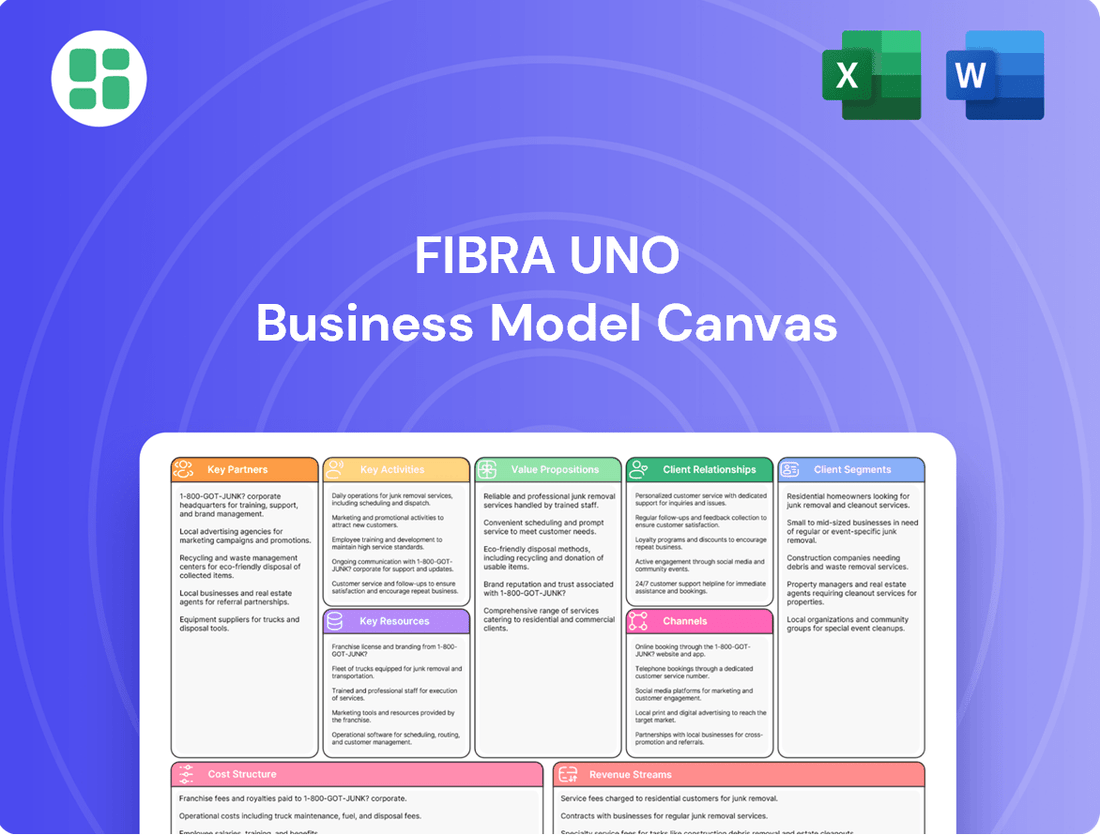

Business Model Canvas

The Fibra Uno Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you can be confident that the structure, content, and professional formatting are exactly what you will get, allowing you to immediately utilize it for your strategic planning. You're not seeing a generic template, but a direct representation of the comprehensive analysis you'll gain access to.

Resources

Fibra Uno's most significant key resource is its vast and diversified portfolio of income-producing real estate assets spread across Mexico. This includes properties in industrial, retail, office, and mixed-use sectors, offering a robust foundation for consistent rental income.

As of early 2024, Fibra Uno managed a substantial gross leasable area, estimated to be in the tens of millions of square meters. This extensive physical presence across numerous segments provides significant operational scale and revenue stability, a core strength of their business model.

Fibra Uno's business model hinges on substantial financial capital, primarily sourced from equity investors and a broad spectrum of debt markets. This financial muscle is essential for its core activities: acquiring prime real estate, undertaking development projects, and managing its extensive portfolio of properties.

A key strength is Fibra Uno's proven ability to raise significant funds through various financial instruments. For instance, in 2024, the company successfully accessed capital markets through bond issuances, demonstrating its capacity to attract diverse funding sources and maintain a healthy liquidity position to fuel its growth and operational needs.

Fibra Uno's business model heavily leverages its experienced management team, boasting over three decades of collective expertise in real estate development and operations across diverse sectors. This deep reservoir of knowledge is fundamental to their strategic decision-making, property management efficiency, and the identification of promising new investment opportunities.

Strong Brand Reputation and Market Leadership

Fibra Uno's status as the first and largest Fibra on the Mexican Stock Exchange underpins a powerful brand reputation and market leadership. This established presence is a significant draw for both high-quality tenants seeking reliable landlords and investors looking for stable, growth-oriented opportunities.

This market leadership translates into tangible competitive advantages. For instance, in 2024, Fibra Uno continued to demonstrate its strength by maintaining a robust occupancy rate across its diverse portfolio, a testament to its appeal in the dynamic Mexican real estate landscape.

- Market Leadership: As the pioneer and largest Fibra in Mexico, Fibra Uno benefits from significant brand recognition and trust.

- Tenant Attraction: Its strong reputation attracts a wide range of tenants, from multinational corporations to local businesses, ensuring consistent demand for its properties.

- Investor Confidence: The market leadership position instills confidence in investors, making Fibra Uno a preferred choice for real estate investment in Mexico.

- Competitive Edge: This established standing provides a distinct advantage in securing prime locations and favorable lease terms.

Tenant Base and Long-Term Relationships

Fibra Uno's tenant base is a cornerstone of its business, characterized by its breadth and quality. This diverse mix of tenants across various sectors ensures resilience and stability.

Long-standing relationships with these tenants are crucial. They foster loyalty, leading to sustained occupancy and reliable income generation for Fibra Uno's extensive property portfolio.

- Diverse Tenant Mix: Fibra Uno boasts a wide array of tenants, reducing reliance on any single industry or entity.

- High Occupancy Rates: Strong tenant relationships contribute to consistently high occupancy, with figures often exceeding 95% across its core segments. For instance, as of the first quarter of 2024, Fibra Uno reported an overall occupancy rate of approximately 96.5%.

- Predictable Revenue Streams: The long-term nature of these tenant agreements provides Fibra Uno with predictable and stable revenue, essential for financial planning and investor returns.

- Tenant Retention: A focus on tenant satisfaction and long-term partnerships drives high retention rates, minimizing turnover costs and maximizing rental income.

Fibra Uno's key resources also include its proprietary property management systems and its strong relationships with brokers and real estate developers. These relationships are vital for sourcing new acquisition opportunities and for efficiently managing its extensive portfolio, ensuring properties remain attractive and well-maintained.

The company's technological infrastructure and data analytics capabilities are increasingly important, allowing for optimized leasing, operational efficiency, and informed investment decisions. This focus on leveraging technology supports its competitive positioning in the market.

Fibra Uno's portfolio diversification across various property types and geographic locations in Mexico is a critical resource, mitigating risks associated with any single sector or region. This broad asset base underpins its resilience and ability to generate stable cash flows.

As of the first quarter of 2024, Fibra Uno's portfolio comprised approximately 400 properties, demonstrating significant scale and diversification. This extensive collection of assets is the bedrock of its revenue generation and market influence.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| Real Estate Portfolio | Vast and diversified income-producing properties across Mexico (industrial, retail, office, mixed-use). | Tens of millions of square meters of gross leasable area, providing scale and revenue stability. |

| Financial Capital | Equity investors and debt markets. | Essential for acquisitions, development, and portfolio management; successful bond issuances in 2024 highlight access to capital. |

| Management Expertise | Over three decades of collective experience in real estate development and operations. | Drives strategic decisions, operational efficiency, and identification of new investment opportunities. |

| Market Leadership & Brand | First and largest Fibra on the Mexican Stock Exchange. | Attracts high-quality tenants and investors, providing a competitive edge in securing prime locations and favorable terms. |

| Tenant Base | Diverse mix of tenants across various sectors with long-standing relationships. | Ensures consistent demand and predictable revenue streams; occupancy rates often exceed 95%, with Q1 2024 figures around 96.5%. |

Value Propositions

Fibra Uno provides investors with a dependable and varied income source, mainly from rent collected across its extensive property holdings. This stability is a core draw for those seeking consistent returns.

As a Real Estate Investment Trust (REIT), Fibra Uno is mandated by law to distribute at least 90% of its taxable income to shareholders as dividends, ensuring a regular payout to its investors.

In 2024, Fibra Uno's rental income continued to be a primary driver of its financial performance, reflecting the resilience of its diversified tenant base and property types.

Fibra Uno offers investors a direct gateway to Mexico's robust real estate sector, spanning key segments like industrial, retail, and office properties. This provides a unique opportunity to capitalize on the nation's ongoing economic expansion and increasing urbanization.

By investing in Fibra Uno, individuals and institutions can align their portfolios with Mexico's growth trajectory, benefiting from the country's expanding middle class and increasing demand for modern commercial and industrial spaces. As of early 2024, Mexico's GDP growth was projected to be around 2.3%, indicating a favorable environment for real estate investment.

For tenants, Fibra Uno's professional property management ensures access to high-quality, well-maintained assets situated in prime locations. This commitment translates to operational efficiency and reliable tenant services, fostering a positive environment for businesses.

In 2024, Fibra Uno continued to emphasize its robust property management capabilities, a cornerstone of its value proposition. This focus directly supports its diverse tenant base by guaranteeing well-kept facilities and responsive operational support.

High-Quality, Strategically Located Assets

Fibra Uno’s dedication to securing and developing properties in prime locations, coupled with a commitment to maintaining high-quality assets throughout its portfolio, delivers substantial value to both its tenants and investors. This strategic approach not only boosts property valuations but also significantly enhances the overall attractiveness of its real estate offerings.

This focus on premium locations and asset quality translates into tangible benefits. For instance, as of the first quarter of 2024, Fibra Uno reported a robust occupancy rate of 97.4% across its industrial and retail segments, underscoring the desirability of its strategically positioned and well-maintained properties.

- Prime Location Advantage: Properties situated in high-demand areas benefit from greater foot traffic and accessibility, leading to higher rental income potential.

- Tenant Retention: High-quality assets reduce tenant turnover by providing desirable and functional spaces, contributing to stable revenue streams.

- Investor Appeal: A portfolio of well-located, high-quality properties attracts a wider range of investors seeking stable, long-term returns.

- Asset Appreciation: Strategic location and quality maintenance contribute to the long-term appreciation of real estate assets, enhancing portfolio value.

Liquidity and Transparency for Investors

Fibra Uno's listing on the Mexican Stock Exchange (BMV) offers investors a crucial advantage: liquidity. This means investors can readily buy or sell their shares, converting their real estate investment into cash much faster than if they owned physical property directly. For instance, as of early 2024, Fibra Uno's market capitalization provided a substantial pool of tradable shares, ensuring ease of transaction.

As a publicly traded entity, Fibra Uno operates under strict regulatory oversight, mandating rigorous reporting and transparency standards. This commitment provides investors with reliable and accessible financial information, allowing for informed decision-making. Their adherence to these standards ensures that key financial metrics are consistently disclosed, fostering trust and confidence among stakeholders.

- Enhanced Liquidity: Shares are traded on the BMV, enabling quick buying and selling of real estate investment.

- Transparency and Reporting: Adherence to rigorous disclosure standards provides investors with dependable financial data.

- Investor Confidence: Public listing and transparent practices build trust for investors in the typically illiquid real estate market.

Fibra Uno offers investors a direct route into Mexico's thriving real estate market, covering industrial, retail, and office sectors. This allows participation in the nation's economic growth and increasing urbanization.

The REIT's commitment to distributing at least 90% of its taxable income as dividends ensures a consistent income stream for shareholders. This payout policy is a key feature for income-focused investors.

In 2024, Fibra Uno's performance was bolstered by its diversified rental income, demonstrating the strength of its varied tenant base and property types, a testament to its strategic portfolio management.

Fibra Uno's value proposition is further enhanced by its focus on premium locations and high-quality asset management, which drives tenant retention and asset appreciation. For instance, in Q1 2024, occupancy rates remained strong at 97.4% in industrial and retail segments, highlighting property desirability.

| Value Proposition Segment | Key Benefit | 2024 Data/Context |

|---|---|---|

| Income Generation & Stability | Dependable income from diversified rent collection. | Rental income remained a primary financial driver in 2024. |

| Dividend Distribution | Mandated payout of at least 90% of taxable income. | Ensures regular shareholder returns, a core REIT feature. |

| Market Access | Gateway to Mexico's real estate (industrial, retail, office). | Benefits from Mexico's economic expansion and urbanization trends. |

| Property Management & Quality | High-quality, well-maintained assets in prime locations. | Supported by robust management, leading to 97.4% occupancy (Q1 2024) in key segments. |

Customer Relationships

Fibra Uno (FUNO) places significant emphasis on its investor relations, ensuring unitholders receive timely and transparent communication. This includes regular updates on financial performance, strategic initiatives, and direct channels for addressing investor queries, fostering a strong foundation of trust.

In 2024, FUNO continued its commitment to open dialogue, with its investor relations team actively engaging with a diverse base of institutional and retail investors. This proactive approach is crucial for maintaining investor confidence and facilitating access to capital markets, vital for the company's ongoing growth and development.

Fibra Uno cultivates strong tenant connections via specialized property management. These teams expertly manage leasing, upkeep, and daily operations, ensuring a smooth experience for occupants. This focus on professional support is key to fostering tenant loyalty and encouraging lease renewals.

Fibra Uno actively communicates with investors and the public through press releases, quarterly earnings calls, and annual reports. These channels offer transparent updates on financial performance and strategic direction, fostering trust and understanding within the financial community.

In 2023, Fibra Uno reported total revenue of approximately MXN 22.7 billion, showcasing its operational scale. These reports are crucial for informing stakeholders about the company's progress and future plans.

Strategic Partnerships Management

Fibra Uno actively cultivates its strategic partnerships with developers, financial institutions, and government bodies. This management entails continuous dialogue, negotiation, and collaborative efforts to maintain alignment on overarching goals and project implementation.

For instance, in 2024, Fibra Uno continued to leverage its strong relationships with leading developers to secure prime real estate opportunities and drive property development projects. Its financial partnerships, including those with major banks and investment funds, were instrumental in facilitating capital raises and managing its debt portfolio effectively.

- Developer Collaboration: Ongoing joint ventures and co-investment agreements with reputable developers to expand and enhance its real estate portfolio.

- Financial Institution Alliances: Maintaining robust relationships with banks and capital markets to ensure access to diverse funding sources and favorable financing terms.

- Government and Regulatory Engagement: Proactive communication with government entities to navigate regulatory landscapes, secure necessary permits, and align with urban development plans.

Digital Engagement and Information Dissemination

Fibra Uno actively uses its corporate website as a primary channel for digital engagement, ensuring investors and stakeholders have easy access to crucial information. This includes timely updates on financial performance, investor presentations, and operational highlights. For instance, in their 2024 reports, Fibra Uno emphasized increased traffic to their investor relations section, indicating successful digital information dissemination.

- Website as a Hub: Fibra Uno's corporate website serves as the central point for all investor-related content.

- Information Accessibility: Financial reports, annual statements, and property portfolio details are readily available.

- Digital Communication: The platform facilitates direct communication channels for inquiries and feedback.

- Transparency: This digital approach underscores Fibra Uno's commitment to transparency and open communication with its stakeholders.

Fibra Uno prioritizes robust investor relations, offering transparent communication through regular financial updates and dedicated channels to build trust. In 2024, proactive engagement with both institutional and retail investors via earnings calls and press releases reinforced this commitment, vital for capital access.

Channels

The Mexican Stock Exchange (BMV) serves as the primary marketplace for investors to buy and sell Fibra Uno's Certificates of Real Estate Trust (CBFIs). This platform ensures that Fibra Uno's securities are readily available to a broad investor base, offering crucial liquidity.

In 2024, the BMV continued to be a vital conduit for capital raising and trading for Mexican companies, including FIBRAs like Fibra Uno. The exchange's infrastructure facilitates efficient transactions, making it accessible for both large institutional players and individual retail investors interested in real estate investment trusts.

Fibra Uno's investor relations portal is a crucial channel, offering detailed financial reports, presentations, and timely news. This digital hub ensures transparency and accessibility for investors seeking in-depth corporate information.

In 2024, Fibra Uno continued to leverage this platform to communicate its strategic initiatives and financial performance, providing a centralized source for all investor-related materials.

Financial advisors and brokerage firms are key channels for Fibra Uno, acting as conduits to both individual and institutional investors interested in its CBFIs (Certificados Bursátiles Fiduciarios Inmobiliarios). These professionals are instrumental in educating potential investors about Fibra Uno's portfolio and investment strategy, thereby driving demand for its securities.

In 2024, the financial advisory and brokerage sector continued to be a vital component of capital markets. Many firms reported increased client engagement, with a growing emphasis on real estate investment trusts (REITs) like Fibra Uno as a stable income-generating asset class. This trend was supported by favorable market conditions for real estate, making these channels particularly effective for Fibra Uno's distribution efforts.

Direct Leasing Teams and Property Management Offices

Fibra Uno’s direct leasing teams and on-site property management offices are crucial for tenant relationships. These teams handle everything from initial property viewings to lease finalization and provide continuous support to existing occupants. This direct interaction fosters stronger tenant loyalty and ensures efficient property operations.

In 2024, Fibra Uno continued to leverage these channels to maintain high occupancy rates across its diverse portfolio. For instance, its industrial segment, which comprises a significant portion of its assets, benefits greatly from dedicated leasing professionals who understand the specific needs of industrial tenants. This hands-on approach is key to securing and retaining long-term lessees.

- Direct Tenant Engagement: Facilitates property tours, lease negotiations, and responsive support.

- Operational Efficiency: On-site offices ensure prompt handling of tenant needs and property maintenance.

- Portfolio Performance: Contributes to high occupancy rates and tenant retention across various property types.

Industry Events and Conferences

Fibra Uno actively participates in key real estate industry events and investor conferences, acting as a crucial channel for communication and engagement. These gatherings provide a platform to showcase the company's strategic direction, financial performance, and growth opportunities to a broad audience of investors and analysts.

In 2024, Fibra Uno's presence at forums like the Mexico Investor Day and various real estate summits allowed for direct dialogue with potential and existing shareholders. Such interactions are vital for building confidence and attracting capital, directly impacting the company's ability to fund its development pipeline and acquisitions.

- Industry Events: Fibra Uno's participation in events like the MIPIM Americas and the Latin American Investment Forum in 2024 facilitated networking and brand visibility within the global real estate community.

- Investor Conferences: The company presented at over 15 investor conferences in 2024, including those hosted by major financial institutions, to disseminate financial results and strategic updates.

- Analyst Calls: Regular quarterly analyst calls, a standard practice in 2024, allowed for detailed Q&A sessions, providing transparency and addressing investor queries regarding portfolio performance and market outlook.

- Direct Engagement: These channels enable Fibra Uno to directly address market perceptions, highlight competitive advantages, and foster stronger relationships with the financial ecosystem, crucial for attracting diverse investment sources.

Fibra Uno utilizes the Mexican Stock Exchange (BMV) as its primary trading venue, ensuring broad investor access to its CBFIs. This platform is crucial for liquidity and capital raising, with the BMV continuing its role in 2024 as a key facilitator for Mexican companies.

Its investor relations portal serves as a vital channel for transparency, providing detailed financial reports and news, a function that remained central to communication in 2024.

Financial advisors and brokerage firms are essential intermediaries, connecting Fibra Uno with both individual and institutional investors, a role that saw increased client engagement in 2024 due to favorable real estate market conditions.

Direct leasing teams and on-site management are critical for tenant relationships and operational efficiency, contributing to high occupancy rates, particularly in its industrial segment, throughout 2024.

Participation in industry events and investor conferences in 2024, such as MIPIM Americas and various investor days, enhances visibility and facilitates direct dialogue with the financial community.

| Channel | Role | 2024 Activity/Data |

|---|---|---|

| Mexican Stock Exchange (BMV) | Primary trading venue for CBFIs | Continued to facilitate capital raising and trading for Mexican REITs. |

| Investor Relations Portal | Information hub for financial reports and news | Centralized source for strategic initiatives and performance data. |

| Financial Advisors & Brokerage Firms | Intermediaries for investor access | Increased client engagement, with REITs a focus for income generation. |

| Direct Leasing Teams | Tenant relationship management | Supported high occupancy rates, especially in the industrial portfolio. |

| Industry Events & Conferences | Networking and strategic communication | Presented at over 15 conferences, enhancing brand visibility and investor dialogue. |

Customer Segments

Institutional investors, such as pension funds and asset managers, represent a key customer segment for Fibra Uno. These entities are drawn to Fibra Uno's portfolio for its potential to deliver stable income streams and diversification benefits within their broader investment strategies. For instance, in 2024, the demand for yield-generating assets remained robust, with many institutional investors actively seeking real estate investment trusts (REITs) like Fibra Uno to meet their return objectives.

These sophisticated investors typically deploy substantial capital and place a high premium on transparency and predictable performance. They require comprehensive financial reporting and a proven track record of operational efficiency. Fibra Uno's commitment to detailed disclosures and consistent dividend payouts is crucial for attracting and retaining this segment, which prioritizes long-term value creation and risk management.

Retail investors are drawn to Fibra Uno as a way to invest in real estate without the complexities of direct ownership. They value the potential for consistent dividend income and the ease of buying and selling shares on the stock market.

These individual investors, while often contributing smaller sums, represent a substantial pool of capital for Fibra Uno. For instance, in 2024, retail participation in the REIT market continued to be a key driver of liquidity and valuation.

Corporate tenants, encompassing businesses needing office space or industrial facilities for manufacturing, logistics, and distribution, represent a core customer segment. These entities prioritize strategic locations that offer accessibility and proximity to key markets or labor pools.

Modern infrastructure, including reliable utilities, advanced connectivity, and flexible space configurations, is crucial for supporting their operational efficiency. In 2024, the demand for well-maintained, technologically equipped office spaces remained strong, with companies investing in environments that foster productivity and employee well-being.

Professional property management is also a key consideration, as these tenants rely on efficient building operations, responsive maintenance, and comprehensive services to minimize disruptions and focus on their core business objectives. For instance, industrial tenants in 2024 continued to seek facilities with high ceilings, ample loading docks, and robust security systems to optimize their supply chain operations.

Retail Tenants (Commercial)

Retail tenants, encompassing everything from major anchor stores to smaller specialty shops and essential service providers, are the lifeblood of Fibra Uno's diverse portfolio of shopping centers and commercial properties. These businesses are driven by the need for prime locations that offer significant foot traffic and meticulously maintained environments to optimize their customer engagement and, ultimately, their sales performance. In 2024, Fibra Uno continued to attract a wide array of retailers, with its well-established properties in Mexico serving as key hubs for consumer activity.

Fibra Uno's retail tenant segment is characterized by its variety and its reliance on the strategic advantages provided by the company's real estate assets. These tenants understand that visibility and accessibility are paramount for success in the competitive retail landscape. By leasing space within Fibra Uno's well-positioned centers, they gain access to a ready customer base, benefiting from the synergistic effect of a curated tenant mix designed to draw shoppers.

- Diverse Tenant Mix: Fibra Uno serves a broad spectrum of retailers, from large department stores that act as traffic generators to smaller, niche boutiques and service-oriented businesses like banks and pharmacies.

- Location is Key: Retail tenants prioritize locations within Fibra Uno's properties that offer high visibility, easy access, and ample parking to maximize customer convenience and potential sales.

- Operational Support: These tenants rely on Fibra Uno for the upkeep and management of common areas, security, and marketing initiatives that contribute to the overall appeal and success of the shopping center.

- Performance Driven: Ultimately, retail tenants are focused on driving sales and profitability, making their leasing decisions based on the projected foot traffic, demographic profiles, and the overall economic health of the areas where Fibra Uno's properties are situated.

Real Estate Developers and Partners

Real estate developers and construction companies are key partners for Fibra Uno. These entities might collaborate on developing new properties or acquiring existing ones, sharing the risks and rewards. For instance, in 2024, Fibra Uno continued to leverage strategic partnerships to expand its diverse portfolio across Mexico, which includes industrial, commercial, and office spaces.

These partners can also contribute their own land or existing properties, effectively co-investing to grow Fibra Uno's asset base. This approach allows Fibra Uno to access prime locations and development expertise it might not possess internally. The company's strategy often involves joint ventures where developers bring shovel-ready projects or valuable land parcels, enhancing the speed and scale of portfolio growth.

Key aspects of this customer segment include:

- Partnerships for New Developments: Collaborating on the creation of new commercial, industrial, or mixed-use properties.

- Asset Contributions: Developers may contribute land or existing buildings as part of a co-investment or acquisition deal.

- Expertise and Execution: Leveraging the development and construction know-how of specialized firms.

- Portfolio Expansion: Jointly identifying and executing opportunities to increase Fibra Uno's real estate holdings.

Fibra Uno serves a multifaceted customer base, encompassing institutional investors like pension funds and asset managers seeking stable income and diversification. Additionally, retail investors are attracted to the accessibility and dividend potential of REITs. Corporate and retail tenants form the backbone of its property income, prioritizing strategic locations and operational efficiency.

Developers and construction companies act as crucial partners, collaborating on new projects and asset expansion. This diverse clientele highlights Fibra Uno's strategy of catering to varied investment appetites and operational needs within the real estate sector.

| Customer Segment | Key Motivations | 2024 Relevance |

|---|---|---|

| Institutional Investors | Stable income, diversification, long-term value | Continued strong demand for yield-generating assets |

| Retail Investors | Accessibility, dividend income, ease of trading | Ongoing participation driving REIT market liquidity |

| Corporate Tenants | Strategic locations, modern infrastructure, operational efficiency | Demand for productive, well-equipped office and industrial spaces |

| Retail Tenants | High foot traffic, prime locations, customer engagement | Reliance on well-positioned centers for sales and visibility |

| Developers/Construction Companies | Partnerships for growth, asset expansion, development expertise | Leveraging partnerships for portfolio expansion across Mexico |

Cost Structure

Fibra Uno's property acquisition and development costs represent a substantial investment, fueling portfolio growth and modernization. These capital expenditures are crucial for expanding their real estate holdings and improving existing assets.

In 2024, Fibra Uno continued its strategic property acquisitions and development projects, reflecting ongoing investment in its diverse portfolio. These outlays are fundamental to maintaining and enhancing the value and income-generating potential of their real estate assets.

Fibra Uno's property operating and maintenance expenses are critical for maintaining its extensive portfolio. These ongoing costs, including property taxes, insurance, utilities, and general upkeep, are vital for preserving asset value and ensuring tenant satisfaction across its industrial, retail, and office properties.

For example, in 2023, Fibra Uno reported significant expenditures in this category, reflecting the scale of its operations. These costs are directly tied to the performance and attractiveness of its real estate assets, directly impacting its ability to generate rental income and maintain occupancy rates.

Fibra Uno, as a real estate investment trust (REIT), relies on leverage, leading to significant financing and debt service costs. These include interest payments on its various bonds and credit facilities, alongside other associated financing fees. For example, in 2023, Fibra Uno reported financing expenses of approximately MXN 3,500 million, highlighting the impact of its debt structure on profitability.

Managing these liabilities effectively is paramount for controlling costs and maintaining financial health. Fibra Uno actively works to optimize its debt maturity profile and interest rates to mitigate the financial burden of its leverage. This proactive approach is essential for ensuring the REIT's ability to service its debt obligations and generate consistent returns for its investors.

Administrative and Management Expenses

Fibra Uno's administrative and management expenses are crucial for overseeing its vast real estate portfolio. These costs encompass salaries for its executive team and support staff, ensuring efficient day-to-day operations and strategic direction. For instance, in 2024, such expenses are projected to be a significant component of its overall operational budget, reflecting the complexity of managing a diverse range of properties across Mexico.

Professional fees are also a substantial part of this cost structure. This includes payments to legal counsel for property transactions and compliance, accounting firms for financial reporting and audits, and various advisory services to navigate market dynamics and investment opportunities. These services are vital for maintaining transparency and adhering to regulatory requirements.

General corporate overheads cover a broad spectrum of necessary administrative functions. This includes office rent, utilities, technology infrastructure, and insurance, all essential for the smooth functioning of the company. These expenses are meticulously managed to ensure they remain proportionate to the scale of Fibra Uno's operations and its commitment to delivering value to its stakeholders.

- Salaries and Benefits: Compensation for the management team and administrative staff.

- Professional Fees: Costs associated with legal, accounting, and advisory services.

- Corporate Overheads: Expenses related to office space, utilities, and technology.

- Compliance and Reporting: Costs incurred for regulatory adherence and financial disclosures.

Marketing and Leasing Expenses

Fibra Uno incurs significant costs to attract and keep tenants. These include marketing campaigns to fill vacant properties, brokerage commissions, and expenses for lease negotiations and tenant improvements. For instance, in 2024, Fibra Uno's leasing and marketing expenses were a key component of its operational costs, directly impacting its ability to maintain high occupancy rates across its diverse portfolio of retail, industrial, and office spaces.

These expenditures are crucial for ensuring the continuous flow of revenue by minimizing vacancies. Effective marketing directly translates to faster lease-ups, while well-managed tenant improvement allowances can secure long-term, valuable tenants. The company strategically allocates resources here to optimize its property performance.

- Marketing Campaigns: Costs for advertising vacant spaces through various channels.

- Broker Commissions: Payments to real estate agents for securing new tenants.

- Lease Negotiation Costs: Expenses associated with legal and administrative aspects of finalizing leases.

- Tenant Improvement Allowances: Funds provided to tenants for customizing their leased spaces.

Fibra Uno's cost structure is dominated by property operating expenses and financing costs, reflecting the capital-intensive nature of real estate investment. In 2023, property operating expenses were MXN 3,547.5 million, while financing expenses reached MXN 3,500 million, highlighting the significant impact of debt servicing and property upkeep on profitability.

Acquisition and development costs are also substantial, as seen in their ongoing portfolio expansion. Administrative and leasing expenses, while smaller, are crucial for operational efficiency and tenant retention. For instance, administrative and general expenses in 2023 were MXN 1,029.7 million, and leasing and marketing expenses were MXN 577.1 million.

| Cost Category | 2023 (MXN Millions) | Significance |

|---|---|---|

| Property Operating Expenses | 3,547.5 | Essential for maintaining asset value and tenant satisfaction. |

| Financing Expenses | 3,500.0 | Reflects the cost of leverage and debt servicing. |

| Acquisition & Development Costs | Variable (significant) | Drives portfolio growth and modernization. |

| Administrative & General Expenses | 1,029.7 | Covers operational oversight and strategic management. |

| Leasing & Marketing Expenses | 577.1 | Crucial for tenant acquisition and retention to minimize vacancies. |

Revenue Streams

Fibra Uno's core revenue engine is the steady stream of rental income collected from its extensive and varied real estate holdings. This includes everything from bustling shopping centers and prime office spaces to essential industrial facilities and dynamic mixed-use developments across Mexico.

In 2024, Fibra Uno's robust leasing strategy continued to fuel its financial performance, with a significant portion of its income directly attributable to these rental agreements. The company’s ability to maintain high occupancy rates across its diverse property types is a testament to its strong tenant relationships and strategic property management.

Fibra Uno's internalization of property management services, a key move for efficiency, could still generate revenue through specialized services offered to joint ventures or individual assets. For instance, if a specific development within a joint venture requires unique leasing expertise not covered by the general internal team, a fee for that specialized service would flow back to Fibra Uno.

Fibra Uno can generate revenue through development and construction fees, especially when engaging in build-to-suit projects for particular clients or collaborators. These fees act as a valuable addition to its primary rental income.

For instance, during the 2023 fiscal year, Fibra Uno reported significant progress on its development pipeline, which often involves these fee-based structures. While specific fee amounts are not always itemized separately from project gains, the company's active development strategy indicates a consistent potential for such income streams.

Sale of Non-Strategic Assets

While Fibra Uno primarily focuses on long-term property ownership, it can generate revenue through the divestment of non-strategic or underperforming assets. This strategy allows for capital recycling to fund new acquisitions or strengthen the balance sheet.

In 2024, Fibra Uno continued to optimize its portfolio by strategically divesting certain assets. For instance, the company has historically sold properties that no longer align with its core investment strategy, freeing up capital. These sales are crucial for maintaining portfolio quality and financial flexibility.

- Portfolio Optimization: Sales of non-core assets enhance the overall quality and performance of Fibra Uno's real estate portfolio.

- Capital Generation: Divestitures provide immediate capital for debt reduction or funding new, strategic property acquisitions.

- Financial Flexibility: The ability to sell assets offers a crucial lever for managing financial obligations and pursuing growth opportunities.

- Strategic Realignment: This revenue stream supports Fibra Uno's long-term vision by ensuring its holdings remain aligned with market demand and growth potential.

Other Service-Related Income

Fibra Uno's "Other Service-Related Income" encompasses diverse revenue streams generated from its extensive property portfolio. This includes income from parking fees, advertising space rentals within its commercial and industrial centers, and various amenity-related charges for tenants and visitors.

These ancillary services are crucial for maximizing property utilization and enhancing tenant experience, thereby contributing to a more robust and diversified revenue base. For instance, in 2024, Fibra Uno continued to leverage its prime locations for advertising opportunities, generating significant income.

Key components of this revenue stream include:

- Parking Fees: Revenue collected from parking services offered at shopping malls, office buildings, and other accessible properties.

- Advertising Space: Income generated from leasing advertising billboards, digital screens, and other promotional spaces within Fibra Uno's properties.

- Amenity Charges: Fees for services like event space rentals, specialized facility usage, or other value-added amenities provided to tenants and customers.

Beyond rental income, Fibra Uno generates revenue through development and construction fees, particularly for build-to-suit projects. This strategy adds to its core earnings by directly charging for specialized construction services. The company's active development pipeline in 2023 and 2024 highlights the consistent potential for this income source, even if not always itemized separately from project gains.

Business Model Canvas Data Sources

The Fibra Uno Business Model Canvas is built upon a foundation of financial disclosures, real estate market analysis, and operational performance data. This ensures each component, from revenue streams to cost structures, is grounded in verifiable information.