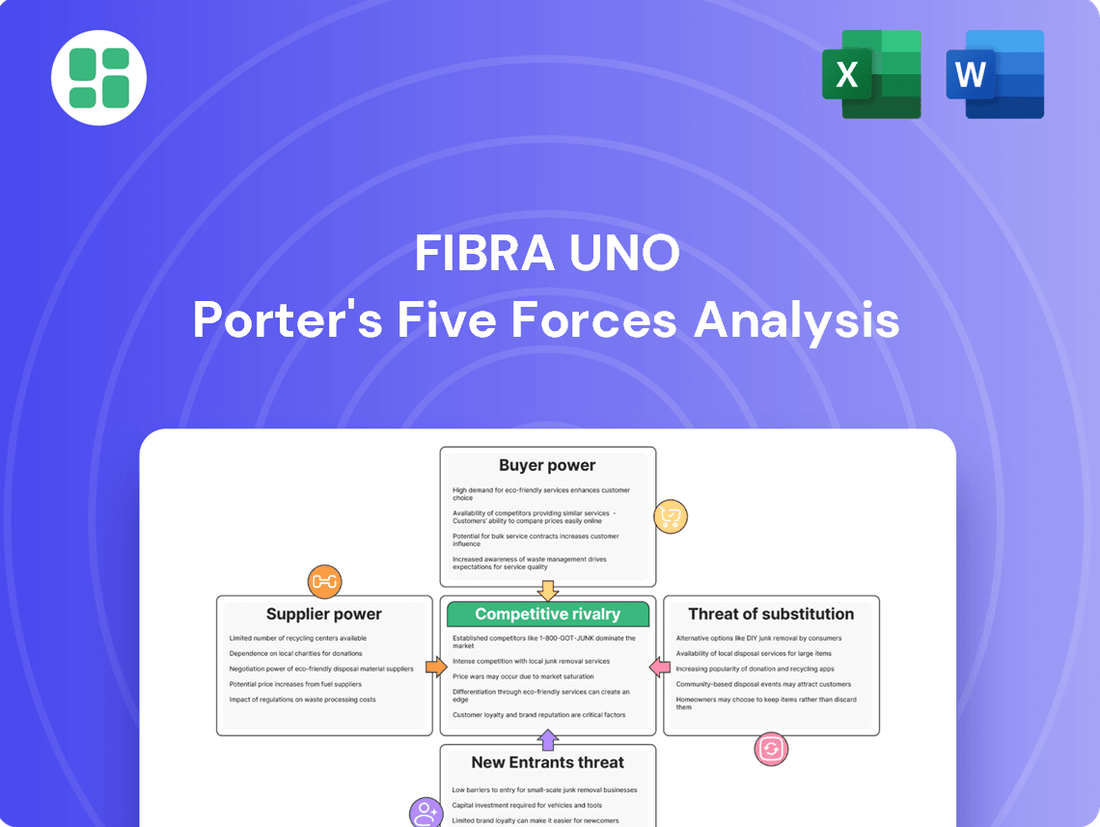

Fibra Uno Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fibra Uno Bundle

Fibra Uno operates in a dynamic real estate market, where understanding the competitive landscape is crucial. Our Porter's Five Forces analysis reveals the intricate interplay of buyer power, supplier leverage, the threat of new entrants, and the intensity of rivalry within Fibra Uno's sector.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Fibra Uno’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers to Fibra Uno, including land sellers, construction firms, and specialized service providers, hinges on their concentration and the uniqueness of their offerings. If a limited number of suppliers control essential inputs or possess specialized skills, their leverage increases, potentially impacting project costs and timelines.

For example, securing prime land parcels or engaging highly specialized construction expertise for significant developments can grant these suppliers considerable influence. Fibra Uno actively manages this by cultivating relationships with a diverse range of development partners and exploring multiple land acquisition avenues, thereby reducing reliance on any single supplier.

The bargaining power of suppliers for Fibra Uno is influenced by switching costs. If Fibra Uno has deeply integrated specific property management software or has long-term contracts with specialized maintenance firms, the expense and disruption of changing these providers can be substantial, giving those suppliers more leverage. For instance, a significant investment in a custom-built building management system could make switching to a competitor very costly in terms of data migration and retraining staff.

The availability of substitute inputs significantly influences Fibra Uno's bargaining power against its suppliers. For instance, if Fibra Uno can readily switch between different types of construction materials, like concrete versus steel, or access a diverse pool of lenders for financing, the leverage of any single supplier is reduced. In 2024, the Mexican construction materials market saw robust competition, with numerous suppliers offering comparable products, thereby limiting the power of any one entity.

Threat of Forward Integration by Suppliers

Suppliers might move into real estate development or ownership, directly competing with Fibra Uno. This is a significant capital undertaking, but a potential long-term risk if suppliers see substantial profits in the REIT market. For instance, a major construction materials provider with substantial financial backing could consider such a move.

While the threat of forward integration from typical construction material suppliers is generally low, it's a more relevant consideration for large-scale developers who also supply materials. These entities already possess the expertise and capital to enter the property ownership and management space.

- Forward Integration Threat: Suppliers could enter the real estate development and ownership market, becoming direct competitors to Fibra Uno.

- Capital Intensity: This is a high-capital endeavor, making it a less immediate threat for most suppliers.

- Strategic Consideration: The threat is more pronounced for large developers who also act as suppliers, as they have existing capabilities.

- Sector Profitability: The perceived profitability of the REIT sector influences the likelihood of suppliers considering forward integration.

Importance of Fibra Uno to the Supplier

Fibra Uno's substantial scale as Mexico's largest REIT means it often represents a significant portion of its suppliers' revenue. This dependency on Fibra Uno's business naturally reduces a supplier's bargaining power. For instance, a local construction firm that derives a large percentage of its annual contracts from Fibra Uno projects would be hesitant to demand significantly higher prices or less favorable terms.

Conversely, if a supplier is a large, diversified entity serving numerous clients across various sectors, Fibra Uno's business might represent a smaller, less critical slice of their overall income. In such a scenario, the supplier would possess greater leverage, able to dictate terms more assertively due to their reduced reliance on Fibra Uno.

Fibra Uno's considerable purchasing volume, a direct consequence of its market leadership, positions it as a highly attractive client for many local and regional suppliers. This leverage allows Fibra Uno to negotiate more favorable pricing and terms, thereby mitigating the bargaining power of these suppliers.

- Fibra Uno's Market Dominance: As the largest REIT in Mexico, Fibra Uno commands significant market share, influencing supplier relationships.

- Supplier Dependence: The degree to which a supplier relies on Fibra Uno for revenue directly impacts their bargaining power.

- Diversification Advantage: Suppliers with diverse client bases are less susceptible to Fibra Uno's demands.

- Negotiating Leverage: Fibra Uno's scale enables it to secure better terms from its suppliers.

The bargaining power of suppliers to Fibra Uno is generally moderate, influenced by the competitive landscape of the Mexican real estate and construction sectors. Fibra Uno's significant scale as Mexico's largest REIT means it often represents a substantial portion of its suppliers' revenue, reducing supplier leverage. For instance, in 2024, the availability of multiple construction material providers in Mexico allowed Fibra Uno to negotiate competitive pricing.

| Factor | Impact on Fibra Uno | Example/Data (2024) |

|---|---|---|

| Supplier Concentration | Moderate | While some specialized services or prime land may have fewer providers, the overall market offers alternatives. |

| Switching Costs | Can be significant for integrated systems | Implementing new property management software involves training and data migration, increasing supplier power in those instances. |

| Availability of Substitutes | Lowers supplier power | In 2024, the Mexican construction materials market offered a wide array of comparable products, limiting individual supplier leverage. |

| Fibra Uno's Scale | Reduces supplier power | Fibra Uno's substantial purchasing volume makes it a key client for many suppliers, enabling favorable negotiations. |

| Supplier Dependence | Lowers supplier power when high | Local contractors heavily reliant on Fibra Uno projects have less power to dictate terms compared to diversified suppliers. |

What is included in the product

This analysis dissects the competitive forces impacting Fibra Uno, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes within the Mexican real estate market.

Instantly identify and mitigate competitive threats with a visual breakdown of Fibra Uno's market landscape, simplifying complex strategic pressures.

Customers Bargaining Power

Fibra Uno operates with a broad spectrum of tenants across retail, office, and industrial segments. The impact of customer concentration on bargaining power is directly tied to how much revenue a few key tenants generate. If a small group of major tenants were responsible for a disproportionately large share of Fibra Uno's rental income, their ability to negotiate more favorable lease terms would be significantly amplified.

For instance, if just two or three large corporate clients accounted for over 20% of Fibra Uno's annual rental revenue, they would wield considerable influence. However, Fibra Uno's strategy emphasizes tenant diversification to mitigate this risk. By serving a wide array of smaller and medium-sized businesses, the company dilutes the power of any single tenant, thereby strengthening its own negotiating position.

The ease or difficulty for tenants to switch from Fibra Uno's properties directly influences their bargaining power. If it's hard for them to move, they have less leverage.

High switching costs, like substantial relocation expenses, potential business disruption, or the need for specialized fit-outs in a new space, significantly diminish a tenant's ability to negotiate favorable terms. These costs effectively lock tenants into their current arrangements, reducing their power.

Long-term leases further act as a substantial barrier to switching. For example, Fibra Uno's lease agreements, often spanning several years, create a commitment that makes early termination or a move to a competitor financially unappealing for tenants, thereby strengthening Fibra Uno's position.

The sheer number of comparable properties available from competitors significantly amplifies the bargaining power of Fibra Uno's customers. Tenants can readily explore and compare offerings, using this as leverage to secure more favorable lease terms, including rent reductions or improved amenities. For instance, in 2024, the Mexican real estate market saw continued development, with new office and retail spaces entering the market, increasing the substitution options for potential lessees.

Customer Price Sensitivity

Customer sensitivity to rent prices significantly shapes their bargaining power. When markets are competitive or during economic slowdowns, tenants become more attuned to pricing, which enhances their leverage to negotiate lower rents or more advantageous lease agreements. For instance, in 2024, a significant portion of the real estate market experienced increased vacancy rates, giving tenants more options and thus greater negotiation strength.

Fibra Uno's strategy of diversifying its property portfolio across various sectors, such as industrial, retail, and office spaces, serves as a crucial buffer against these fluctuations. This diversification helps to mitigate the impact of demand shifts in any single sector, thereby stabilizing overall revenue streams and reducing the concentrated risk associated with high customer price sensitivity in one area.

- Increased Tenant Options: In 2024, the availability of multiple commercial spaces in key Mexican cities provided tenants with greater choice, amplifying their negotiating position.

- Economic Headwinds: Persistent inflation and interest rate hikes in 2024 made businesses more cautious with expenses, leading to heightened price sensitivity for commercial leases.

- Portfolio Resilience: Fibra Uno's exposure to resilient sectors like logistics and industrial warehousing in 2024 helped offset potential softness in more cyclical segments, demonstrating the benefit of diversification.

Threat of Backward Integration by Customers

The threat of backward integration by customers, meaning tenants could develop their own properties instead of leasing from Fibra Uno, is a significant consideration. This scenario is more probable for large corporations prioritizing long-term operational stability or requiring highly specialized facilities that are not readily available in the market. For instance, a major retail chain might explore owning its flagship stores to control location and design.

However, the substantial capital outlay and the specialized management expertise needed to acquire, develop, and maintain real estate assets make this a less frequent concern for the majority of Fibra Uno's diverse tenant base. The complexities involved often outweigh the perceived benefits for smaller or medium-sized businesses. In 2024, the real estate development sector continued to see high construction costs, further increasing the barrier to entry for potential backward integration by tenants.

- Tenant Control: Large tenants might seek to own properties for greater control over location, design, and long-term operational stability.

- High Barriers: The significant capital investment and specialized management expertise required for real estate development act as a deterrent.

- Cost Factor: In 2024, elevated construction and land acquisition costs in key markets, like Mexico City, made backward integration by tenants a less economically viable option for many.

Fibra Uno's customers, particularly its tenants, possess moderate bargaining power. This power is influenced by factors like the availability of substitute properties, tenant sensitivity to price, and the potential for tenants to develop their own spaces. In 2024, increased supply in certain commercial real estate markets in Mexico gave tenants more options, thereby enhancing their leverage in lease negotiations.

The bargaining power of Fibra Uno's customers is influenced by the availability of comparable properties. In 2024, new developments in major Mexican cities increased tenant options, allowing them to negotiate more favorable terms. Additionally, economic conditions in 2024, marked by inflation, made businesses more price-sensitive, further strengthening tenant negotiation power.

While backward integration, where tenants build their own properties, is a potential threat, it's often deterred by high capital requirements and specialized management needs. In 2024, rising construction and land costs in Mexico City made this option less feasible for many businesses, thus limiting this aspect of customer bargaining power.

| Factor | Impact on Bargaining Power | 2024 Context |

|---|---|---|

| Availability of Substitutes | High | Increased new supply in key Mexican markets |

| Tenant Price Sensitivity | Moderate to High | Inflation and economic caution increased focus on lease costs |

| Threat of Backward Integration | Low to Moderate | High construction costs limited tenant development feasibility |

Same Document Delivered

Fibra Uno Porter's Five Forces Analysis

This preview showcases the complete Fibra Uno Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of this Mexican REIT. You're viewing the exact document you'll receive instantly after purchase, offering a comprehensive understanding of industry rivalry, buyer and supplier power, the threat of new entrants, and the bargaining power of substitutes. This professionally formatted analysis is ready for immediate use, providing valuable insights without any surprises.

Rivalry Among Competitors

The Mexican REIT market is characterized by a dynamic competitive landscape. Fibra Uno stands as the dominant player, but it faces robust competition from other significant FIBRAs such as Fibra Danhos, Fibra Shop, and Fibra Prologis. This presence of multiple large and mid-sized competitors means there's a constant battle for prime real estate and desirable tenants, directly impacting market share and profitability for all involved.

The overall growth rate of the Mexican real estate market significantly shapes competitive intensity. For instance, the industrial sector experienced robust expansion in 2023 and into early 2024, driven by nearshoring trends, which can temper rivalry as demand outstrips supply. Conversely, segments like office space might face slower growth or elevated vacancy rates, intensifying competition among property owners vying for desirable tenants.

Fibra Uno's ability to differentiate its real estate offerings significantly impacts the competitive rivalry within the sector. By focusing on superior locations, modern amenities, and sustainable building practices, Fibra Uno aims to reduce direct price competition. For instance, its portfolio includes prime retail spaces in high-traffic areas and modern office buildings with advanced technological features, setting them apart from competitors. In 2024, the demand for green-certified buildings continued to rise, with approximately 30% of new commercial construction in Mexico City incorporating sustainability features, a trend Fibra Uno actively embraces.

Exit Barriers

Fibra Uno, like many real estate investment trusts (FIBRAs), faces substantial exit barriers. These are largely due to the nature of its assets: significant capital investments are tied up in illiquid real estate. For instance, as of Q1 2024, Fibra Uno's total assets were approximately MXN 328.6 billion, a large portion of which comprises physical properties that cannot be quickly liquidated without substantial loss.

Furthermore, long-term debt obligations act as a powerful anchor, compelling companies to remain operational even when profitability is low. Fibra Uno's consolidated debt as of the same period was around MXN 142.3 billion. Breaking these long-term commitments early often incurs significant penalties and transaction costs, effectively trapping companies within the industry.

These high exit barriers mean that Fibra Uno and its competitors are often incentivized to fight for market share rather than withdraw. This can sustain intense competitive pressure, as companies are reluctant to divest assets and concede ground, even in challenging economic conditions.

- Illiquid Real Estate: Fibra Uno's portfolio, valued in the hundreds of billions of Mexican pesos, consists of physical assets that are difficult to sell quickly without significant price concessions.

- Long-Term Debt: The company's substantial debt load, exceeding MXN 142 billion in early 2024, creates financial obligations that discourage early exit.

- Operational Necessity: High exit barriers force companies to remain in the market, potentially leading to prolonged periods of intense competition as firms strive to maintain their position.

Diversity of Competitors

The competitive landscape for Fibra Uno (FUNO) is characterized by a significant diversity in competitor strategies and objectives. Some real estate investment trusts (FIBRAs) concentrate on specific property types, like industrial or retail, while others, including FUNO, adopt a more diversified approach across multiple sectors. This strategic variation means rivalry isn't always direct; it can manifest as intense competition within niche segments or broader competition for market share across various property types.

This strategic divergence impacts rivalry by creating different competitive pressures. For instance, a FIBRA solely focused on industrial properties might compete fiercely with other industrial specialists for warehouse acquisitions and tenant leases. Conversely, a diversified player like FUNO faces a broader array of competitors, each with its own strengths and target tenant profiles, leading to a more complex and multifaceted rivalry. For example, as of early 2024, the Mexican FIBRA market includes players like Fibra Macquarie, which has a strong presence in industrial and retail, and Fibra Danhos, known for its premium retail and office developments, showcasing this strategic breadth.

- Diverse Strategies: Competitors employ varied approaches, from sector specialization (e.g., industrial, retail) to broad diversification, influencing the nature of competition.

- Niche vs. Broad Rivalry: This diversity creates both focused competition within specific property segments and wider rivalry for overall market dominance.

- Tenant Profile Targeting: Competitors' differing target tenant profiles (e.g., multinational corporations vs. local businesses) also shape competitive dynamics and market positioning.

Competitive rivalry within the Mexican REIT market is intense, with Fibra Uno (FUNO) facing significant competition from established players like Fibra Danhos, Fibra Shop, and Fibra Prologis. This rivalry is fueled by the constant pursuit of prime real estate and desirable tenants, directly impacting market share and profitability across the sector. The overall health and growth rate of the Mexican real estate market, particularly the industrial sector's expansion in 2023-2024 due to nearshoring, can either temper or intensify this competition depending on supply and demand dynamics.

Fibra Uno differentiates itself through superior locations, modern amenities, and a focus on sustainability, aiming to move beyond pure price competition. For example, its portfolio includes prime retail and advanced office spaces, appealing to tenants seeking quality. The growing demand for green-certified buildings, with around 30% of new commercial construction in Mexico City incorporating these features in 2024, highlights a key area where FUNO seeks to gain an edge.

The competitive landscape is further shaped by diverse strategies among FIBRAs. Some specialize in sectors like industrial or retail, while others, like FUNO, maintain a diversified portfolio. This strategic variation leads to both focused competition within niches and broader rivalry for overall market dominance. For instance, Fibra Macquarie's strength in industrial and retail contrasts with Fibra Danhos' focus on premium retail and office developments, illustrating the varied competitive pressures.

| Competitor | Primary Focus | Key Differentiators |

|---|---|---|

| Fibra Uno (FUNO) | Diversified (Retail, Office, Industrial, Mixed-Use) | Scale, Prime Locations, Diversified Portfolio |

| Fibra Danhos | Premium Retail, Office | High-Quality Developments, Urban Mixed-Use Projects |

| Fibra Shop | Shopping Centers | Dominant Retail Locations, Strong Tenant Mix |

| Fibra Prologis | Industrial and Logistics | Modern Industrial Facilities, Strategic Locations for Logistics |

SSubstitutes Threaten

A significant substitute for leasing space from Fibra Uno is direct property ownership. Businesses and individuals can choose to buy or develop their own real estate. This provides complete control over the asset and the potential for long-term appreciation, a key consideration in 2024's real estate market where property values can fluctuate.

However, direct ownership demands substantial upfront capital and ongoing management, which can be a considerable barrier. For instance, the average commercial property price in Mexico City saw an increase of approximately 5-7% in early 2024, making the initial investment even more significant compared to leasing. This high capital requirement often steers many potential tenants towards leasing arrangements with established entities like Fibra Uno.

For office tenants, the growing popularity of co-working and flexible office spaces poses a significant threat of substitution to traditional office leases. These alternatives provide agility, lower initial expenses, and built-in services, making them especially attractive to emerging businesses and organizations embracing hybrid work arrangements. For instance, the flexible workspace sector saw substantial growth, with the global flexible office space market size estimated to reach USD 20.5 billion in 2024, projected to expand further.

The rise of remote work is a significant substitute for traditional office spaces. In 2024, many companies continued to embrace hybrid or fully remote models, reducing the overall demand for large, centralized office buildings. This trend directly impacts the need for office real estate, a core asset class for many REITs.

Similarly, the ongoing expansion of e-commerce presents a substitute for physical retail locations. As more consumers opt for online shopping, the demand for brick-and-mortar stores diminishes, while the need for logistics and industrial properties, such as warehouses and distribution centers, increases. This shift directly alters the competitive landscape for property types within the real estate sector.

Alternative Investment Vehicles

From an investor's viewpoint, other asset classes such as stocks, bonds, or direct private real estate investments outside of REITs can serve as substitutes for Fibra Uno's shares. These alternatives present distinct risk-reward profiles and liquidity features, influencing investment allocation decisions.

For instance, in 2024, the S&P 500 index saw significant gains, offering a potential alternative for capital seeking growth, while bond yields also remained attractive for more conservative investors. Fibra Uno's performance is thus benchmarked against these broader market movements.

- Alternative Asset Classes: Stocks, bonds, and direct private real estate offer different risk-return dynamics compared to REITs.

- Investor Preferences: Liquidity needs and risk tolerance dictate which substitute asset might be favored over Fibra Uno.

- Market Conditions (2024): Strong equity market performance and stable bond yields in 2024 provided compelling alternatives for investors.

Technological Advancements in Real Estate

Technological advancements are increasingly presenting potential substitutes for traditional physical real estate. PropTech innovations, such as virtual offices and advanced logistics software, are beginning to offer alternative solutions. For instance, the rise of remote work, accelerated by events in 2020 and continuing through 2024, has reduced the demand for traditional office space in some sectors. Furthermore, the development of sophisticated digital platforms for collaboration and business operations can diminish the necessity for physical presence, thereby impacting demand for commercial real estate.

While not direct replacements today, these evolving alternatives could significantly alter the landscape. Consider the growth in co-working spaces and flexible office solutions, which cater to a changing workforce dynamic. In 2024, the flexible office market continued its expansion, with reports indicating a substantial increase in occupied flexible space globally. This trend suggests that businesses may require less long-term, fixed physical real estate, opting instead for adaptable and technology-enabled environments.

The long-term threat also includes innovations like 3D printing for construction, which could eventually lead to more modular and adaptable building solutions, potentially reducing the reliance on conventional development models. Similarly, advanced logistics software optimizes warehousing needs, meaning companies might require less physical storage space by improving inventory management and supply chain efficiency. This ongoing technological evolution poses a strategic consideration for real estate investment trusts like Fibra Uno, as it reshapes demand drivers.

- PropTech innovations like virtual offices and advanced logistics software offer alternative solutions to traditional physical real estate needs.

- Remote work trends, prominent in 2024, have reduced demand for traditional office spaces, impacting commercial real estate.

- Flexible office solutions and co-working spaces are expanding, reflecting a shift towards adaptable, technology-enabled environments.

- 3D printing in construction and optimized logistics software represent future potential substitutes that could reshape real estate demand.

The threat of substitutes for Fibra Uno's offerings is multifaceted, encompassing direct property ownership, flexible office solutions, and alternative investment classes. Direct ownership provides control but demands significant capital, a barrier highlighted by the 5-7% increase in commercial property prices in Mexico City in early 2024. Similarly, the burgeoning flexible office market, projected to reach USD 20.5 billion globally in 2024, offers agility that can draw tenants away from traditional leases.

For investors, other asset classes like stocks and bonds present viable alternatives. In 2024, the S&P 500's performance and attractive bond yields provided strong competition for capital seeking returns, influencing investment decisions concerning REITs like Fibra Uno.

Technological advancements, particularly PropTech, are also introducing substitutes. The continued prevalence of remote and hybrid work models in 2024 reduces the need for traditional office spaces, while innovations in logistics software can optimize warehousing requirements, potentially lessening demand for physical storage.

| Substitute Category | Examples | 2024 Market Trend/Data Point | Impact on Fibra Uno |

|---|---|---|---|

| Direct Property Ownership | Buying or developing own real estate | Avg. commercial property price increase in Mexico City: 5-7% (early 2024) | High capital requirement deters some from ownership, favoring leasing. |

| Flexible Office Solutions | Co-working spaces, serviced offices | Global flexible office space market size: USD 20.5 billion (2024 estimate) | Offers agility and lower upfront costs, attracting businesses seeking flexibility. |

| Alternative Investment Classes | Stocks, bonds, direct private real estate | S&P 500 gains, attractive bond yields (2024) | Provides alternative avenues for investor capital, competing for allocation. |

| Technological Substitutes | Virtual offices, logistics software, remote work | Continued adoption of hybrid/remote work models (2024) | Reduces demand for traditional office and retail spaces; optimizes industrial needs. |

Entrants Threaten

Entering the real estate investment trust (REIT) market, particularly at the scale of a major player like Fibra Uno, demands immense financial resources. Acquiring prime real estate, funding new developments, and managing a vast portfolio necessitate significant upfront investment, often in the billions of dollars. This high capital requirement acts as a formidable barrier, effectively deterring many potential new entrants who lack the necessary financial backing to compete.

Established players like Fibra Uno leverage significant economies of scale in property management, financing, and procurement, allowing for cost efficiencies that new entrants cannot easily replicate. For instance, Fibra Uno's extensive portfolio of over 600 properties across Mexico provides substantial bargaining power with suppliers and lenders.

Furthermore, Fibra Uno's decades of experience navigating various market cycles and building strong tenant relationships create a barrier to entry. Newcomers would find it challenging to match this operational expertise and market knowledge in the short term, making it difficult to achieve comparable cost advantages or secure prime real estate.

New real estate investment trusts (REITs) face a significant hurdle in securing prime, high-demand locations for retail, office, and industrial properties. These desirable spots are the lifeblood of a REIT's success, directly impacting rental income and property value.

Fibra Uno, as the first and largest Fibra in Mexico, has a substantial advantage due to its established portfolio. By 2024, Fibra Uno's portfolio was valued at over MXN 250 billion, encompassing a vast array of strategically located assets. This means new entrants would struggle to acquire comparable, high-quality properties, as many of the best locations are already occupied by Fibra Uno.

Regulatory Hurdles and Legal Framework

The regulatory environment for FIBRAs in Mexico, including legal requirements for trusts (fideicomisos) and stock exchange listings on the Bolsa Mexicana de Valores (BMV), creates a significant barrier to entry. These stringent regulations demand substantial legal and financial expertise to navigate, thereby increasing both the cost and time investment required for new players to establish themselves.

For instance, establishing a FIBRA involves complex legal structuring and adherence to specific capitalization and governance rules set forth by Mexican financial authorities like the Comisión Nacional Bancaria y de Valores (CNBV). In 2024, the ongoing evolution of these regulations, coupled with the capital intensity of acquiring and developing real estate assets, means that only well-capitalized entities with a deep understanding of the Mexican legal and financial landscape can realistically consider entering the market.

- Regulatory Complexity: Mexican financial laws governing real estate investment trusts (FIBRAs) necessitate specialized legal knowledge.

- Capital Requirements: Significant upfront capital is needed for asset acquisition and to meet listing requirements on the BMV.

- Expertise Demand: Navigating the legal and financial intricacies requires a highly skilled team, adding to operational costs.

Brand Loyalty and Tenant Relationships

Fibra Uno's formidable brand loyalty and deeply entrenched tenant relationships present a significant barrier to new entrants. Building comparable trust and securing a diverse, high-quality tenant base requires substantial capital investment and time, making it difficult for newcomers to gain immediate traction in a market that prioritizes established reliability and performance.

New competitors face the daunting task of replicating Fibra Uno's established reputation and the strong, often long-term, relationships it maintains with its tenants. This loyalty, cultivated over years of consistent service and value delivery, means that new entrants must offer compelling incentives or a demonstrably superior value proposition to lure existing tenants away.

Consider the impact on a property portfolio: If a new entrant were to target Fibra Uno's retail segment, they would need to overcome the existing retailer confidence in Fibra Uno's ability to drive foot traffic and sales, a factor often built on years of successful collaborations and data-driven insights. For instance, in 2023, Fibra Uno reported a robust occupancy rate of 95.6% across its retail properties, underscoring the strength of its tenant base and the difficulty new entrants would face in replicating this level of market penetration.

- Brand Strength: Fibra Uno's established brand name acts as a magnet for quality tenants, creating a significant hurdle for new market entrants.

- Tenant Relationships: Long-standing, trust-based relationships with a diverse tenant roster are difficult and costly for new players to replicate.

- Market Penetration Difficulty: New entrants must overcome Fibra Uno's high occupancy rates and proven ability to attract and retain tenants.

The threat of new entrants for Fibra Uno is generally low due to substantial capital requirements, regulatory hurdles, and the need for extensive market expertise. Acquiring prime real estate and navigating complex Mexican financial regulations, such as those overseen by the CNBV, demand significant financial and legal resources. By 2024, Fibra Uno's portfolio was valued at over MXN 250 billion, illustrating the immense scale of investment required to compete effectively.

Established players like Fibra Uno benefit from economies of scale and long-standing tenant relationships, which are difficult for newcomers to replicate. For instance, Fibra Uno's 2023 retail occupancy rate of 95.6% highlights its strong market position and tenant loyalty. New entrants would need considerable time and investment to build similar brand recognition and secure a comparable tenant base.

| Barrier | Description | Impact on New Entrants |

| Capital Requirements | Acquiring and developing properties, especially prime locations, requires billions of dollars. | Deters smaller or less-funded entities. |

| Regulatory Complexity | Navigating Mexican FIBRA laws and BMV listing rules demands specialized legal and financial expertise. | Increases cost and time to market entry. |

| Economies of Scale | Fibra Uno's large portfolio allows for cost efficiencies in management and procurement. | New entrants struggle to match cost advantages. |

| Brand Loyalty & Tenant Relationships | Fibra Uno's established reputation and long-term tenant partnerships are hard to replicate. | New entrants face difficulty attracting and retaining tenants. |

Porter's Five Forces Analysis Data Sources

Our Fibra Uno Porter's Five Forces analysis leverages data from Fibra Uno's annual reports, investor presentations, and public filings, supplemented by industry research from firms like S&P Global and IBISWorld to provide a comprehensive view of the Mexican real estate investment trust landscape.