Ferrari PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrari Bundle

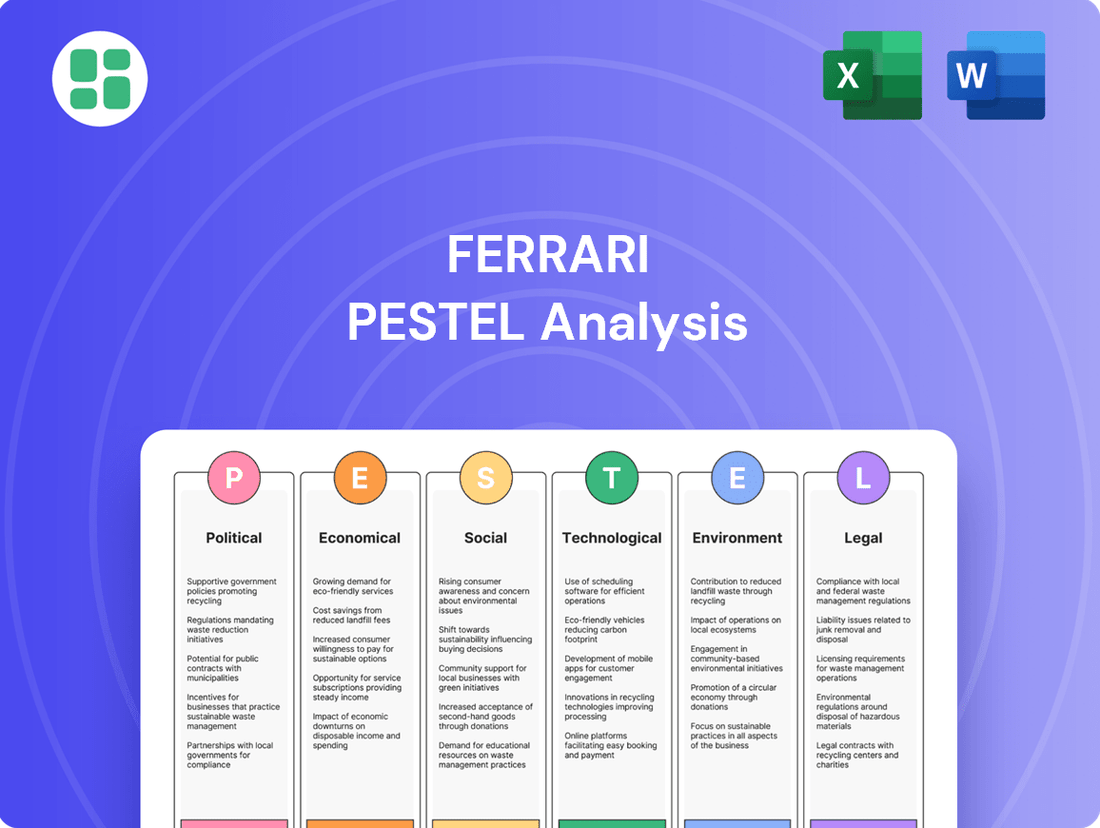

Navigate the complex world of luxury automotive with our Ferrari PESTLE Analysis. Uncover how political stability, economic fluctuations, and evolving social attitudes are shaping the brand's future. Gain a competitive advantage by understanding these critical external forces. Download the full analysis now for actionable intelligence.

Political factors

Ferrari must navigate increasingly strict government regulations on emissions, particularly within the European Union. The upcoming Euro 7 standards, for example, are set to impose significant reductions in CO2 emissions by 2030, directly impacting vehicle design and powertrain development.

Compliance with these evolving environmental mandates is not merely a legal necessity but a critical factor for Ferrari's continued market access and product innovation. These regulations are a primary driver behind the company's substantial investments in hybrid and fully electric vehicle technologies, aiming to meet future performance and sustainability benchmarks.

Shifting global trade policies and the potential for increased tariffs, particularly those impacting U.S. imports, directly influence Ferrari's pricing and profitability. For instance, Ferrari has implemented price adjustments on models such as the Purosangue SUV and the upcoming F80 hypercar, partly to mitigate the impact of these U.S. import duties.

These evolving external trade dynamics introduce a degree of unpredictability into Ferrari's international business operations, necessitating agile strategic responses to maintain market competitiveness and financial health.

Ferrari's global operations are significantly shaped by the political stability of its key markets. Geopolitical tensions, such as those observed in Eastern Europe and parts of the Middle East in 2024, can disrupt supply chains for specialized components and dampen consumer confidence in luxury goods. Ferrari's ability to navigate these diverse political landscapes, from established European economies to emerging markets, is crucial for maintaining consistent sales growth and brand reputation.

Formula 1 Regulatory Framework

Ferrari's participation in Formula One is heavily influenced by the Fédération Internationale de l'Automobile's (FIA) regulations. For the 2025 and 2026 seasons, shifts in car design, engine rules, and safety protocols directly affect Scuderia Ferrari's racing approach and R&D. These regulatory changes are critical for maintaining competitiveness.

The Concorde Agreement plays a crucial role in F1's financial and governance framework, impacting Ferrari's revenue streams from the sport. This agreement outlines the distribution of commercial rights income, which is a significant factor in Ferrari's overall financial planning and investment in its F1 operations.

- 2026 Power Unit Regulations: New rules emphasizing sustainability and hybrid technology, with a focus on 100% sustainable fuels, will require substantial investment in engine development.

- Cost Cap: The ongoing implementation of the F1 cost cap, set at $135 million for 2024, influences how teams like Ferrari allocate resources for car development and operational expenses.

- Concorde Agreement Financial Structure: Ferrari, as one of the historic teams, benefits from a specific share of F1's revenue, which is subject to the terms of the Concorde Agreement, last renewed in 2020.

- Safety Standards: Evolving safety regulations, such as advancements in chassis and cockpit protection, necessitate continuous engineering updates and compliance testing.

Taxation Policies and Compliance

National taxation policies significantly influence Ferrari's financial health by impacting consumer spending power and corporate profitability. Changes in income tax rates can directly affect the disposable income of potential luxury car buyers, while corporate tax adjustments alter the company's net earnings. For instance, in 2024, many countries are reviewing their tax structures, which could lead to shifts in consumer demand for high-end goods.

Ferrari N.V. actively manages its tax obligations, notably through its participation in Italy's cooperative compliance program. This initiative fosters a more transparent and collaborative relationship with tax authorities, aiming to ensure adherence to tax laws and mitigate potential fiscal disputes. Such proactive engagement is crucial for a global luxury brand operating across various tax jurisdictions.

The company's commitment to tax compliance is a strategic imperative. By working closely with tax bodies, Ferrari can better anticipate and navigate evolving tax landscapes, thereby safeguarding its financial stability and reputation. This approach helps to reduce uncertainty and potential liabilities, allowing for more predictable financial planning.

Ferrari's financial reports often detail its tax provisions and effective tax rates, providing insights into the impact of taxation on its bottom line. For 2023, Ferrari reported an effective tax rate of approximately 21.5%, reflecting the tax regimes in its operating countries and its tax management strategies.

Ferrari faces stringent environmental regulations, such as the EU's Euro 7 standards targeting reduced CO2 emissions by 2030, driving significant investment in hybrid and electric technologies. Political stability in key markets is crucial, as geopolitical tensions in 2024 can disrupt supply chains and consumer confidence in luxury goods.

Formula One regulations, particularly the 2026 power unit rules emphasizing sustainable fuels and the $135 million cost cap for 2024, directly influence Scuderia Ferrari's R&D and operational strategies. National tax policies impact disposable income for luxury buyers and corporate profitability, with Ferrari maintaining a cooperative compliance program with Italian tax authorities and reporting an effective tax rate of around 21.5% in 2023.

| Factor | Impact on Ferrari | 2024/2025 Relevance |

|---|---|---|

| Environmental Regulations | Drives investment in EV/hybrid tech; compliance costs. | Euro 7 standards implementation timeline; stricter emissions targets. |

| Geopolitical Stability | Affects supply chains and luxury market demand. | Ongoing global tensions impacting consumer sentiment and component sourcing. |

| F1 Regulations | Shapes racing strategy, R&D spend, and revenue. | 2026 Power Unit regulations; adherence to cost cap. |

| Taxation Policies | Influences consumer spending and corporate profit. | Potential shifts in global tax structures; Ferrari's effective tax rate (approx. 21.5% in 2023). |

What is included in the product

This Ferrari PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the luxury automotive sector.

It provides a comprehensive understanding of how these external factors create challenges and opportunities for Ferrari's strategic decision-making.

A concise Ferrari PESTLE analysis highlights how understanding political and economic shifts can proactively address supply chain disruptions and currency fluctuations, easing operational anxieties.

Economic factors

The health of the global economy and the expansion of the luxury automotive sector are fundamental drivers for Ferrari. As economies grow, so does the pool of individuals with the disposable income necessary to purchase high-end vehicles.

Projections indicate robust growth for the luxury car market, fueled by rising disposable incomes, especially among the ultra-high-net-worth demographic. This trend directly translates into increased demand for Ferrari's specialized offerings.

Ferrari's performance in 2024 underscored this connection, with the company reporting substantial increases in net revenues and profits, surpassing its own financial expectations.

Ferrari's success is intrinsically linked to the financial health of its ultra-high-net-worth clientele. As disposable income and accumulated wealth grow within this demographic, so too does the appetite for exclusive luxury vehicles and bespoke customization, directly benefiting Ferrari's sales and profitability.

The robust demand for Ferrari vehicles is clearly demonstrated by its order book, which extends through 2026. This sustained interest underscores the resilience of the luxury market and the purchasing power of Ferrari's target customers, even amidst broader economic fluctuations.

Fluctuations in exchange rates present a significant economic factor for Ferrari. For instance, in the first quarter of 2024, Ferrari reported a net profit of €294 million, and a substantial portion of its sales occur outside the Eurozone. A stronger Euro against currencies like the US Dollar or British Pound could reduce the reported value of these overseas sales when translated back into Euros, impacting Ferrari's top-line revenue. Conversely, a weaker Euro could offer a tailwind.

Inflationary pressures in 2024 and 2025 are also a key concern. Rising costs for high-quality materials, specialized labor, and energy directly affect Ferrari's manufacturing expenses. While Ferrari's strong brand and pricing power allow for some cost pass-through, persistent high inflation could still compress its impressive operating margins, which stood at approximately 25% in recent reporting periods. Managing these economic variables through hedging and efficient supply chain management is crucial for maintaining profitability.

Company Financial Performance and Outlook

Ferrari's financial performance in 2024 was exceptionally strong, with net revenues climbing 11.8% to €6,677 million and net profit hitting €1,526 million. This robust top-line growth translated into impressive profitability, as evidenced by an EBITDA margin of 38.3%.

Looking ahead, the company projects continued positive momentum into 2025. Ferrari anticipates exceeding its profitability targets earlier than planned, signaling sustained financial health and a positive outlook for investors and stakeholders.

- 2024 Net Revenues: €6,677 million (up 11.8%)

- 2024 Net Profit: €1,526 million

- 2024 EBITDA Margin: 38.3%

- 2025 Outlook: Forecasts continued robust growth and early achievement of profitability targets.

Impact of Tariffs and Trade Tensions

Trade tensions and the imposition of tariffs, such as those between the US and China, can directly affect Ferrari's pricing and market access for its luxury vehicles. These tariffs can increase the cost of imported components or finished vehicles, potentially impacting Ferrari's profitability and sales volumes in affected markets. For instance, during periods of heightened trade friction, Ferrari, like other automakers, might face increased duties on parts or finished cars, necessitating strategic adjustments.

Ferrari has demonstrated an ability to adapt to such challenges. The company has historically adjusted prices for some models to account for import tariffs, a strategy that helps mitigate the direct financial impact. This approach is feasible due to Ferrari's high-net-worth customer base, which often exhibits less price sensitivity for ultra-luxury goods compared to mass-market consumers. This allows Ferrari to pass on some of the increased costs without significantly deterring demand.

However, sustained or escalating trade disputes can still influence sales volumes and competitive positioning. While Ferrari's brand cachet provides a buffer, prolonged trade barriers could lead to shifts in consumer purchasing behavior or encourage competitors to establish more localized production facilities. The company's global supply chain and distribution network are also subject to these geopolitical risks, requiring continuous monitoring and strategic planning to maintain market access and operational efficiency.

Key considerations for Ferrari regarding tariffs and trade tensions include:

- Impact on Cost of Goods Sold: Tariffs on imported components or finished vehicles can increase production costs.

- Pricing Power Mitigation: While Ferrari has pricing power, significant tariff increases may still affect sales volumes.

- Market Access Restrictions: Trade barriers can limit access to key luxury markets or increase the cost of entry.

- Supply Chain Vulnerability: Global trade disputes can disrupt the complex supply chains essential for automotive manufacturing.

Economic factors significantly shape Ferrari's performance, with global economic health directly influencing the demand for luxury automobiles. Rising disposable incomes among the ultra-high-net-worth demographic, a key customer base for Ferrari, are crucial. Ferrari's robust 2024 results, with net revenues reaching €6,677 million and net profit €1,526 million, highlight this strong correlation.

Inflationary pressures in 2024 and 2025 present a challenge, increasing manufacturing costs for materials and labor. Ferrari's impressive EBITDA margin of 38.3% in 2024 indicates strong pricing power, but sustained inflation could still impact profitability. Exchange rate fluctuations also play a role, with a stronger Euro potentially reducing the value of overseas sales when converted back to the company's reporting currency.

| Economic Factor | Impact on Ferrari | 2024 Data/Outlook |

|---|---|---|

| Global Economic Growth | Drives demand for luxury goods. | Positive correlation with Ferrari's sales. |

| Disposable Income (UHNW) | Directly fuels purchases of high-end vehicles. | Strong growth supporting Ferrari's order book through 2026. |

| Inflation | Increases manufacturing and operational costs. | EBITDA margin of 38.3% shows pricing power, but margins could be compressed. |

| Exchange Rates | Affects reported revenue from international sales. | Fluctuations can impact reported profits (e.g., Q1 2024 Net Profit: €294 million). |

What You See Is What You Get

Ferrari PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ferrari PESTLE analysis explores the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the luxury automotive giant. Gain valuable insights into market dynamics and strategic considerations.

Sociological factors

Consumer preferences are increasingly leaning towards sustainability, even in the high-end automotive market. This means buyers are looking for brands that align with their environmental values, pushing luxury manufacturers to adapt.

Ferrari is actively addressing this by investing heavily in electrification. Their strategy includes hybrid models, with a significant milestone being the planned launch of their first all-electric vehicle in 2025, signaling a commitment to a greener future for performance cars.

This evolution mirrors a wider societal shift where environmental awareness plays a crucial role in purchasing decisions, impacting even the most exclusive luxury goods and services.

Ferrari's core business thrives on an aura of exclusivity, high performance, and a rich brand history, all of which fuel its luxury status. The company deliberately keeps production numbers low, a strategy that underpins its brand prestige and ensures sustained demand for its vehicles.

The growing consumer appetite for individuality and bespoke features is a significant trend in the luxury automotive sector. Ferrari actively addresses this by offering extensive personalization options through its Tailor Made program, allowing customers to create truly unique vehicles.

Ferrari is experiencing a noticeable shift in its customer base, with younger affluent consumers increasingly entering the luxury car market. The average age of a Ferrari customer has been declining, indicating a successful appeal to newer generations.

Millennial and Gen Z buyers are becoming a more significant portion of Ferrari's clientele, reflecting a broader trend in luxury goods consumption. This demographic's preferences, particularly their emphasis on technology integration and environmental consciousness, are crucial for Ferrari's future strategy.

Brand Loyalty and Heritage

Ferrari's brand loyalty is deeply intertwined with its rich heritage, especially its unparalleled success in Formula 1. This connection fosters a powerful global brand presence and a dedicated following known as the tifosi. The brand's legacy evokes associations with speed, luxury, and Italian craftsmanship, creating a strong emotional bond with customers.

This enduring brand heritage acts as a significant competitive moat, translating into strong demand and premium pricing power. For instance, Ferrari's ability to maintain high resale values on its vehicles underscores this deep-seated loyalty. The brand's strategy of offering exclusive lifestyle experiences further solidifies this connection, reinforcing its premium positioning.

- Formula 1 Dominance: Ferrari holds the record for the most Constructors' Championships (16) and Drivers' Championships (15) in Formula 1 history.

- Tifosi Community: The passionate global fanbase, the tifosi, actively engages with the brand through events and merchandise, contributing to brand equity.

- Resale Value: Many Ferrari models consistently achieve resale values significantly higher than their original purchase price, a testament to sustained demand and brand desirability.

Corporate Social Responsibility and DEI Initiatives

Consumers and stakeholders are increasingly demanding that companies actively engage in social responsibility and champion diversity, equity, and inclusion (DEI). Ferrari has been making strides in this area, notably becoming the first luxury group worldwide to achieve Equal Salary Certification. This commitment extends to prioritizing employee well-being, offering extensive training, and supporting educational initiatives, all of which underscore their humanistic philosophy.

Ferrari's dedication to DEI is further evidenced by specific initiatives and recognitions. For instance, in 2023, Ferrari was recognized as one of the top employers in Italy, highlighting its focus on creating a positive and inclusive work environment. The company also actively supports community projects and philanthropic endeavors, aligning its business practices with broader societal expectations.

- Equal Salary Certification: Ferrari is the first luxury group globally to receive this certification, signaling a commitment to fair pay practices.

- Employee Well-being Programs: The company invests in initiatives aimed at supporting the physical and mental health of its workforce.

- Training and Development: Comprehensive programs are in place to foster employee growth and skill enhancement.

- Community Engagement: Ferrari actively participates in educational projects and social initiatives, demonstrating a broader societal commitment.

Societal expectations are increasingly emphasizing sustainability and ethical business practices, influencing luxury consumer choices. Ferrari's commitment to electrification, with its first all-electric model slated for 2025, directly addresses this evolving consumer mindset.

The brand's appeal to younger, affluent demographics, including millennials and Gen Z, is evident in the declining average age of its customers, signaling a successful adaptation to changing consumer preferences for technology and environmental consciousness.

Ferrari's deep-rooted heritage, particularly its Formula 1 success, fosters immense brand loyalty and allows for premium pricing, as demonstrated by the consistently high resale values of its vehicles, a testament to its desirability.

Furthermore, Ferrari's focus on diversity, equity, and inclusion, underscored by its Equal Salary Certification, aligns with growing societal demands for corporate social responsibility, enhancing its brand reputation and appeal.

Technological factors

Technological advancements in electric and hybrid vehicle (EV/HEV) technology are profoundly impacting Ferrari's strategic direction. The company is channeling significant investment into research and development for electrification, with a concrete plan to introduce its first all-electric model in 2025.

Ferrari's ambitious targets include achieving a substantial percentage of sales from hybrid or electric models by both 2026 and 2030, demonstrating a clear commitment to this evolving automotive landscape. This transition is underpinned by the development of high power density electric engines, leveraging Ferrari's extensive expertise gained from its successful racing endeavors.

Ferrari's strategic push into electrification is significantly bolstered by the 2024 opening of its new 'e-building' at its Maranello headquarters. This state-of-the-art facility is dedicated to the in-house design, meticulous handcrafting, and assembly of crucial electric powertrains, inverters, and batteries, signaling a deep commitment to controlling its technological destiny in the EV space.

Further enhancing its electrochemical capabilities, Ferrari also launched the E-Cells Lab, a collaborative venture with the University of Bologna and NXP. This specialized lab is actively engaged in cutting-edge electrochemical research, with a primary focus on advancing lithium battery technology, a critical component for high-performance electric vehicles.

Scuderia Ferrari's Formula 1 division is a powerhouse of technological advancement, with significant shifts anticipated for the 2025 and 2026 seasons. These include new aerodynamic rules designed to improve racing and the introduction of more potent hybrid power units with increased battery capacity.

A major technological leap will occur in 2026 when Formula 1 mandates the use of 100% sustainable fuels, a move that will significantly impact engine design and performance. Ferrari's F1 program acts as a vital proving ground for cutting-edge automotive technologies, many of which are eventually integrated into their road-going supercars, enhancing efficiency and performance.

Integration of Advanced Driver Assistance Systems (ADAS) and AI

Ferrari is actively integrating advanced driver assistance systems (ADAS) to elevate both safety and vehicle dynamics, a key technological trend. These systems are designed to offer a more refined and secure driving experience, aligning with the brand's performance heritage.

Looking ahead, Ferrari plans to incorporate augmented reality (AR) displays for real-time information and artificial intelligence (AI) to create a personalized driving environment. This focus on sophisticated in-car technology directly addresses the increasing demands of luxury automotive consumers for cutting-edge digital integration.

- ADAS Deployment: Ferrari's commitment to ADAS enhances safety and performance, a crucial factor in the luxury segment.

- AR & AI Integration: The planned adoption of AR displays and AI systems will offer drivers real-time data and personalized experiences.

- Consumer Expectations: These technological advancements are designed to meet the growing demand for sophisticated and connected luxury vehicles.

Innovative Manufacturing Processes and Materials

Ferrari’s dedication to cutting-edge manufacturing is evident in its adoption of advanced materials and processes. The company actively integrates lightweight composites and alloys to enhance performance and fuel efficiency, a critical aspect in the evolving automotive landscape. This focus on material science is crucial for maintaining Ferrari's competitive edge.

Investment in research and development remains a cornerstone of Ferrari's strategy, ensuring each new model pushes the boundaries of automotive engineering. For instance, their ongoing exploration into sustainable materials and greener manufacturing methods reflects a forward-looking approach to production. This commitment to innovation is not just about performance; it's also about environmental responsibility.

- Lightweight Materials: Ferrari consistently utilizes carbon fiber and advanced aluminum alloys, contributing to significant weight reduction in models like the SF90 Stradale.

- Aerodynamic Efficiency: Active aerodynamics, such as the Drag Reduction System (DRS) derived from Formula 1, are increasingly incorporated into road cars to optimize airflow and downforce.

- Sustainable Manufacturing: Ferrari is exploring the use of recycled materials and investing in energy-efficient production techniques at its Maranello facility.

- R&D Investment: In 2023, Ferrari reported significant R&D expenditure, underscoring its commitment to technological advancement across all aspects of vehicle development and production.

Ferrari is aggressively pursuing electrification, with its first all-electric model slated for 2025 and ambitious targets for hybrid/electric sales by 2026 and 2030. The company's new e-building, opened in 2024, is central to its in-house development of electric powertrains, batteries, and inverters, underscoring a strategic move towards controlling key EV technologies.

The brand's Formula 1 division serves as a critical innovation hub, testing advanced hybrid power units and sustainable fuels, with significant rule changes for 2025 and 2026. Technologies proven on the track are increasingly integrated into road cars, enhancing both performance and efficiency.

Ferrari is also integrating advanced driver-assistance systems (ADAS) and planning for augmented reality (AR) displays and artificial intelligence (AI) in its vehicles to meet evolving consumer expectations for sophisticated digital experiences.

The company's commitment to advanced materials, such as lightweight composites, and sustainable manufacturing processes further solidifies its technological leadership and competitive edge in the luxury automotive market.

| Technology Focus | Key Developments & Impact | Timeline/Status |

| Electrification | First all-electric model, hybrid/EV sales targets (e.g., 40% by 2026, 80% by 2030), advanced electric powertrains. | EV launch 2025; e-building operational 2024. |

| Formula 1 Technology Transfer | Hybrid power unit upgrades, sustainable fuels (100% from 2026), aerodynamic advancements. | Impacts 2025/2026 F1 seasons; informs road car tech. |

| In-Car Technology | ADAS integration, AR displays, AI for personalized driving. | Ongoing integration, future models planned. |

| Materials & Manufacturing | Lightweight composites, sustainable materials, energy-efficient production. | Continuous adoption in new models; R&D investment. |

Legal factors

Ferrari, like all automakers, faces a complex web of evolving emissions standards globally. Regulations such as the upcoming Euro 7 standards in the European Union are pushing for substantial reductions in CO2 and other pollutants. For instance, the EU aims for a 55% reduction in CO2 emissions for new cars by 2030 compared to 1990 levels, a target that significantly impacts performance vehicle manufacturers.

Meeting these increasingly stringent environmental mandates is not optional; it's a prerequisite for market access in key regions like Europe and North America. Ferrari's commitment to developing advanced powertrain technologies, including hybrid and potentially fully electric solutions, is a direct response to these regulatory pressures. These investments are substantial, reflecting the high cost of compliance.

Non-compliance carries severe financial and reputational risks. Fines for exceeding emission limits can be significant, impacting profitability. Beyond financial penalties, a failure to align with environmental expectations can lead to brand damage, particularly among a customer base that is increasingly aware of sustainability issues.

Ferrari, as a high-performance luxury car manufacturer, navigates a complex web of automotive safety regulations across its global markets. These standards dictate everything from how a car performs in a crash to the safety of individual parts. For instance, the European Union’s General Safety Regulation (GSR) mandates advanced driver-assistance systems (ADAS) like automatic emergency braking and lane keeping assist, which Ferrari must integrate into its models.

Adherence to these stringent requirements impacts vehicle design and development significantly. Regulations concerning occupant protection, such as side-impact protection and rollover safety, necessitate robust structural engineering. The ongoing evolution of these rules, exemplified by Formula 1's continuous refinement of safety structures like revised front impact zones, underscores the industry's commitment to enhancing driver and spectator safety, a principle that trickles down to Ferrari's road car development.

Ferrari's distinctive product designs, groundbreaking engineering, and powerful brand equity rely heavily on strong intellectual property (IP) protection. Safeguarding its patents, trademarks, and design rights across international markets is crucial to combatting counterfeiting and preserving its premium market standing.

The company actively pursues legal avenues to protect its innovations; for instance, in 2023, Ferrari was involved in several legal actions concerning trademark infringement and the protection of its iconic Prancing Horse logo. Failure to adequately protect its IP could lead to diluted brand value and increased competition from unauthorized replicas, impacting its exclusive market position.

Consumer Protection and Product Liability Laws

Ferrari must navigate a complex web of consumer protection laws globally, ensuring fair practices and high product quality for its discerning clientele. These regulations, which vary by jurisdiction, demand rigorous quality control and clear communication regarding vehicle specifications and warranties. For instance, in the European Union, the General Product Safety Regulation (2001/95/EC) mandates that products placed on the market must be safe, impacting Ferrari's design and manufacturing processes.

Product liability laws are particularly critical for a high-performance automotive manufacturer like Ferrari. These laws hold the company accountable for any harm or defects stemming from its vehicles. Ferrari's commitment to safety is underscored by its adherence to stringent international standards and extensive testing protocols. In 2023, the automotive industry saw ongoing scrutiny of advanced driver-assistance systems (ADAS), a key area for luxury car manufacturers, with regulatory bodies like the NHTSA in the US continuing to refine safety guidelines.

- Global Regulatory Landscape: Ferrari operates in over 60 countries, each with its own consumer protection statutes, necessitating a robust compliance framework.

- Product Safety Standards: Adherence to standards such as ISO 26262 for functional safety is paramount, ensuring vehicle reliability and minimizing liability risks.

- Transparency and Disclosure: Regulations often mandate clear communication regarding vehicle performance, maintenance, and potential risks, impacting marketing and sales practices.

- Recall Management: Effective recall procedures are legally required and crucial for maintaining consumer trust and mitigating product liability claims, as seen with industry-wide recalls affecting various manufacturers in recent years.

Labor and Employment Laws

Ferrari must navigate a complex web of labor and employment laws across its global operations, impacting everything from working conditions and wages to fundamental employee rights. Staying compliant is essential for avoiding costly legal battles and fostering a positive workplace culture, a commitment underscored by Ferrari's achievement of Equal Salary Certification in Italy, recognizing their dedication to fair pay practices. The varying labor regulations from one region to another present a significant challenge, requiring meticulous attention to detail for seamless international management. For instance, in 2023, Ferrari reported that 99.5% of its employees in Italy were covered by collective bargaining agreements, demonstrating a structured approach to labor relations.

Key aspects of Ferrari's compliance include:

- Adherence to local wage and hour regulations: Ensuring all employees are compensated according to the minimum wage and overtime laws specific to their country of employment.

- Upholding employee rights: Guaranteeing protections against discrimination, ensuring safe working environments, and respecting the right to organize.

- Managing diverse employment contracts: Tailoring employment agreements to comply with the distinct legal frameworks in Italy, the United States, and other operational territories.

- Navigating collective bargaining: Engaging with employee representatives and unions where applicable, as evidenced by the high percentage of employees covered by collective agreements in Italy.

Ferrari must navigate a landscape of evolving tax regulations globally, impacting its profitability and financial planning. Changes in corporate tax rates, import duties, and VAT policies in key markets like the EU and the US require constant vigilance. For example, the EU's digital services tax proposals, while not directly targeting car sales, could affect how Ferrari's digital operations are taxed.

Compliance with international tax treaties and transfer pricing regulations is also critical for a multinational corporation like Ferrari. Ensuring fair taxation across different jurisdictions and avoiding double taxation is a complex but essential undertaking. The company's financial reports for 2023 indicated a consolidated net profit of €1.229 billion, with effective tax rates carefully managed within these complex legal frameworks.

Tax incentives for research and development, particularly in areas like electric vehicle technology, can also play a significant role in Ferrari's strategic financial decisions. By leveraging these incentives, Ferrari can offset some of the substantial costs associated with developing next-generation powertrains, as it continues to invest in innovation to meet future market demands.

Environmental factors

Ferrari is aggressively pursuing carbon neutrality by 2030, a critical element of its environmental strategy. This ambitious target underscores their dedication to minimizing their ecological impact across all operations.

To achieve this, Ferrari is investing in renewable energy sources and refining its manufacturing processes. For instance, their Maranello facility has seen significant upgrades in energy efficiency, contributing to a reduction in their carbon emissions.

Ferrari is significantly investing in its environmental strategy, with substantial resources allocated to developing low-emission and fully electric vehicles. This commitment is evident in their forward-looking product roadmap.

The company aims for a considerable percentage of its future vehicle lineup to feature hybrid or all-electric powertrains, signaling a clear pivot towards more sustainable transportation options. This strategic shift is crucial for meeting evolving regulatory demands and consumer preferences.

A key milestone in this transition is the planned launch of Ferrari's first all-electric vehicle in 2025. This move underscores the company's dedication to embracing electrification, with projections indicating that by 2030, over 60% of Ferrari's sales could be from hybrid or electric models, reflecting a substantial market adaptation.

Ferrari is actively embracing eco-friendly manufacturing, incorporating sustainable and recycled materials into its production. This commitment is evident as the company has doubled its self-produced renewable energy compared to 2023, aiming to stabilize CO2 emissions even with business expansion.

A prime example of this dedication is Ferrari's initiative to switch off its trigeneration plant at the Maranello factory, prioritizing the use of renewable energy sources. This strategic shift underscores their focus on reducing environmental impact within their operational framework.

Sustainability Reporting and Transparency

Ferrari places significant emphasis on sustainability reporting, publishing an annual Sustainability Report. This report adheres to stringent standards such as the European Sustainability Reporting Standard (ESRS) and the Global Reporting Initiative (GRI), ensuring a high level of transparency regarding its environmental, social, and governance (ESG) performance. This dedication to open communication builds crucial trust with investors, customers, and other stakeholders.

The company's commitment is evident in its 2024 Annual Report, which includes its comprehensive 2024 Sustainability Statement. This document details Ferrari's progress and future plans in key ESG areas, reflecting a proactive approach to managing environmental impact and social responsibility.

- Annual Sustainability Report: Ferrari publishes a detailed report annually, aligning with ESRS and GRI standards.

- Transparency and Trust: This transparent communication about ESG activities is vital for building stakeholder confidence.

- 2024 Sustainability Statement: Integrated within the 2024 Annual Report, it outlines current ESG performance and objectives.

Waste Management and Resource Efficiency

Ferrari is committed to responsible waste management and robust recycling initiatives as a core component of its environmental stewardship. The company’s sustainability roadmap emphasizes fostering greater environmental consciousness and deploying strategies to maximize resource utilization.

These proactive measures are designed to bolster long-term ecological viability and diminish dependence on increasingly scarce raw materials. For instance, Ferrari's Maranello plant achieved the ISO 14001 certification for its environmental management system, underscoring its dedication to efficient resource handling and waste reduction.

- Waste Reduction Targets: Ferrari aims to progressively reduce waste generation per vehicle produced, with specific targets set for 2025 and beyond.

- Recycling Rate: The company actively works to increase its recycling rate for production waste, aiming for over 90% of non-hazardous waste to be recycled or recovered.

- Resource Optimization: Implementation of circular economy principles in manufacturing processes helps optimize the use of materials and energy.

- Sustainable Sourcing: Ferrari is increasing its focus on sourcing materials from suppliers with strong environmental credentials and recycling programs.

Ferrari's environmental strategy is centered on achieving carbon neutrality by 2030, a significant undertaking that involves substantial investments in renewable energy and process optimization. The company is actively transitioning its product line, with a substantial portion of its future sales expected from hybrid and electric models by 2030, including the launch of its first all-electric vehicle in 2025.

Ferrari is also focusing on sustainable manufacturing, incorporating recycled materials and increasing its use of self-produced renewable energy, which doubled compared to 2023. This is further supported by initiatives like switching off its trigeneration plant at the Maranello factory to prioritize renewable sources.

Transparency in its environmental efforts is key, as demonstrated by its annual Sustainability Report, which adheres to ESRS and GRI standards. The 2024 Annual Report includes a detailed Sustainability Statement, outlining progress and objectives in ESG areas.

Responsible waste management and recycling are integral to Ferrari's environmental stewardship, with targets to reduce waste per vehicle and increase recycling rates for production waste to over 90%. The Maranello plant's ISO 14001 certification highlights its commitment to efficient resource handling.

| Environmental Focus | Key Initiatives/Targets | Data/Progress |

|---|---|---|

| Carbon Neutrality | Achieve by 2030 | Aggressive pursuit underway |

| Electrification | First EV launch in 2025; >60% hybrid/EV sales by 2030 | Significant investment in EV development |

| Renewable Energy | Increase self-produced renewable energy | Doubled compared to 2023 |

| Manufacturing | Eco-friendly processes, recycled materials | ISO 14001 certification for Maranello plant |

| Waste Management | Reduce waste per vehicle, increase recycling | Target >90% recycling for non-hazardous waste |

PESTLE Analysis Data Sources

Our Ferrari PESTLE analysis is meticulously constructed using data from reputable sources such as the International Organization of Motor Vehicle Manufacturers (OICA), industry-specific market research firms, and official government reports on automotive regulations and economic trends.

We integrate economic indicators from the IMF and World Bank, political and legal updates from EU and national government bodies, and technological forecasts from leading automotive and innovation consultancies to provide a comprehensive view.