Ferrari Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrari Bundle

Curious about Ferrari's strategic positioning? Our BCG Matrix analysis reveals which of their iconic models are Stars, Cash Cows, Dogs, or Question Marks in the high-performance automotive market. Understand where their revenue streams are strongest and where future investment might be most impactful.

Don't just guess about Ferrari's product portfolio—gain a definitive understanding. Purchase the full BCG Matrix for a comprehensive breakdown of each vehicle's market share and growth rate, complete with actionable insights to drive your own strategic decisions.

Unlock the secrets to Ferrari's enduring success with the complete BCG Matrix. This detailed report provides the clarity you need to navigate the competitive landscape and identify opportunities for sustained growth and market dominance.

Stars

The Ferrari Purosangue, a bold move into the burgeoning ultra-luxury SUV market, is already a standout. Despite its recent debut, the Purosangue has secured a dominant position in its segment due to its inherent exclusivity and incredibly high demand, leading to a waiting list that stretches well into 2025. Ferrari is actively investing to increase production capacity, recognizing the Purosangue as a pivotal contributor to future revenue growth.

The Ferrari Icona Series, exemplified by the Daytona SP3, caters to the pinnacle of automotive collecting, featuring ultra-limited runs and unique designs that pay homage to legendary Ferraris. These masterpieces are instantly snapped up by a select clientele, solidifying Ferrari's leadership in the hyper-exclusive hypercar market.

These vehicles represent a significant profit center for Ferrari, with the Daytona SP3, for instance, commanding a price tag of over $2 million and selling out its 599-unit production run swiftly. This strategic focus on ultra-luxury, low-volume vehicles allows Ferrari to maintain a dominant position in a high-growth, high-margin niche.

Ferrari's hybrid supercars, like the 296 GTB/GTS and SF90 Stradale, represent the brand's strategic push into electrification, aligning with the automotive industry's high-growth electrification trend. These vehicles solidify Ferrari's dominance in the premium sports car market, leveraging advanced technology and superior driving experience to capture substantial market share. For instance, the SF90 Stradale, launched in 2019, continues to be a benchmark for hybrid performance, with Ferrari investing heavily in ongoing powertrain development to maintain this edge.

Ferrari Special Series (e.g., 812 Competizione)

Ferrari Special Series, exemplified by models like the 812 Competizione, represent the pinnacle of limited-production vehicles, meticulously crafted for ultimate performance and unparalleled exclusivity.

These sought-after creations are consistently oversubscribed, attracting Ferrari's most dedicated clients and discerning collectors, thereby securing a dominant market share within their specialized, high-demand segment.

Ferrari strategically employs these special series to elevate its brand image and drive substantial profitability, channeling continuous investment into their creation to preserve their exclusive appeal and robust demand.

- 812 Competizione Production: Limited to 999 coupes and 599 Aperta versions.

- Client Demand: Pre-orders for such models often exceed available units by a significant margin.

- Profitability: Special series models typically command a premium of over 30% compared to their base counterparts, contributing disproportionately to profit margins.

- Brand Reinforcement: These vehicles act as halo products, enhancing the desirability of the entire Ferrari range.

Ferrari Tailor Made Program

The Ferrari Tailor Made program is a prime example of a Star in the BCG matrix, reflecting its high market share in a growing segment of bespoke luxury automotive experiences. This program allows clients to personalize their Ferraris with unique materials and design choices, directly addressing the increasing demand for exclusivity and individuality in the luxury market. Ferrari's commitment to investing in advanced customization technologies and unique client interactions further solidifies its position as a high-growth, high-profitability offering.

The Tailor Made service commands significant profit margins, with personalization options contributing substantially to the overall revenue per vehicle. For instance, while specific figures for the Tailor Made program's profit contribution are not publicly disclosed, the broader luxury automotive customization market is experiencing robust growth. Industry reports indicate that the global automotive personalization market is projected to reach hundreds of billions of dollars in the coming years, with bespoke services like Tailor Made being a key driver.

- High Customization: Offers clients near-limitless options for materials, colors, and finishes.

- Premium Profitability: Generates substantial profit margins due to the bespoke nature of the service.

- Growing Market Demand: Caters to the increasing consumer desire for unique and personalized luxury goods.

- Brand Enhancement: Reinforces Ferrari's image as a purveyor of ultimate luxury and exclusivity.

The Ferrari Purosangue and the Icona Series exemplify Ferrari's Stars within the BCG matrix. These vehicles represent high market share in rapidly growing segments of the ultra-luxury and hyper-exclusive automotive markets, respectively. Ferrari's strategic investments in production capacity for the Purosangue and the continued success of limited-run Icona models highlight their status as key profit drivers and brand enhancers.

| Product Category | Market Share | Market Growth | Profitability | Strategic Importance |

|---|---|---|---|---|

| Purosangue (Ultra-Luxury SUV) | High (Dominant in segment) | High (Growing segment) | Very High | Key Revenue Growth Driver |

| Icona Series (Hyper-Exclusive Hypercars) | High (Pinnacle of segment) | High (Niche, but growing demand) | Extremely High | Brand Halo, Profit Center |

| Hybrid Supercars (e.g., SF90 Stradale) | High (Leader in segment) | High (Electrification trend) | High | Technological Showcase, Market Share |

| Special Series (e.g., 812 Competizione) | High (Oversubscribed) | High (Demand exceeds supply) | Very High (Premium pricing) | Brand Image, Profitability |

| Tailor Made Program (Bespoke Customization) | High (Leading bespoke service) | High (Growing personalization market) | High (Substantial margins) | Client Loyalty, Brand Experience |

What is included in the product

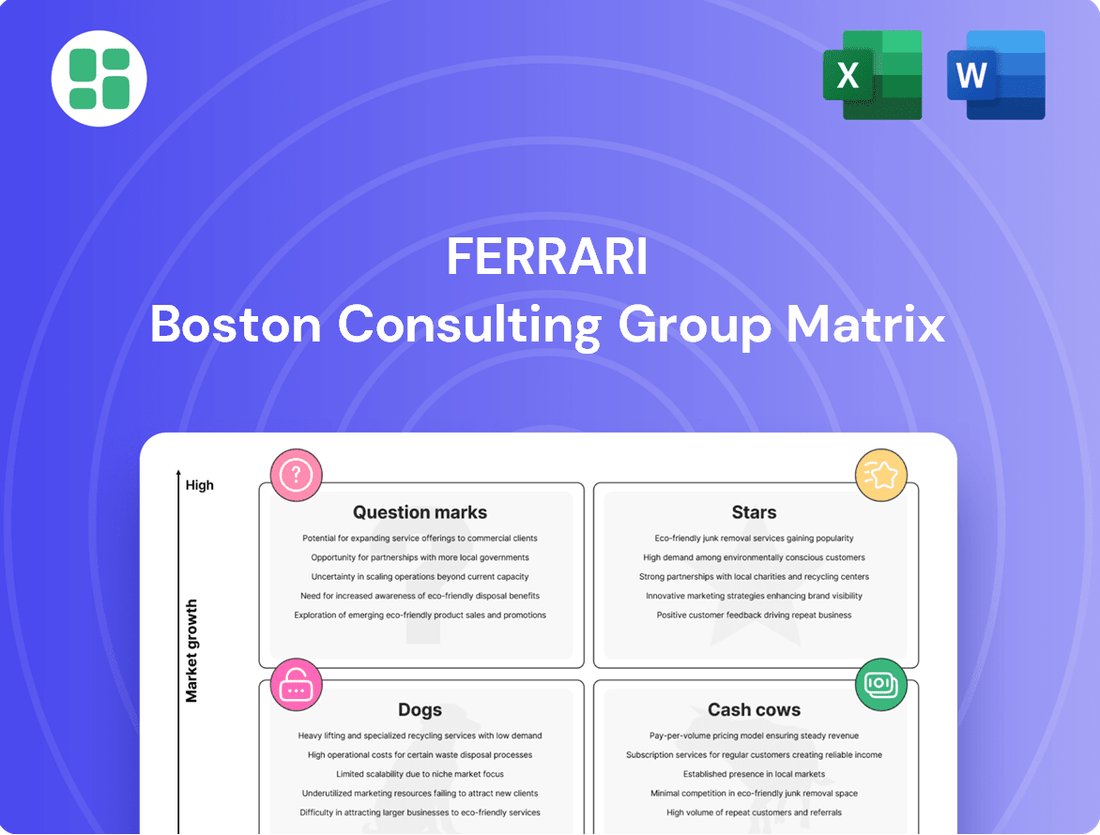

Ferrari BCG Matrix: strategic allocation of resources across its product lines.

Focuses on Ferrari's Stars, Cash Cows, Question Marks, and Dogs for optimal portfolio management.

The Ferrari BCG Matrix offers a clear, visual roadmap to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

Ferrari's core V8 and V12 GT models, such as the Roma, Portofino M, and the new 12Cilindri, are the company's established cash cows. These vehicles dominate the mature luxury grand touring segment, consistently delivering robust sales and impressive profit margins thanks to their enduring brand prestige, iconic design, and high-performance engineering. For instance, Ferrari reported a significant increase in V8-powered vehicle deliveries in 2023, contributing to their overall strong financial performance.

Scuderia Ferrari, while an operational expense, functions as a premier global marketing engine for Ferrari. Its unparalleled brand recognition in motorsports directly translates to increased desirability for its road cars and licensed merchandise, making it a quintessential cash cow. This consistent presence and rich history in Formula 1 allow Ferrari to leverage its iconic status, generating substantial brand equity and indirect revenue streams.

Ferrari's brand licensing and merchandise, including apparel, accessories, and theme parks, are mature and highly profitable. This segment benefits from Ferrari's iconic status, securing a high market share in luxury automotive branding and generating consistent income with low overheads after initial agreements.

Ferrari Classiche Program

The Ferrari Classiche program is a cornerstone of Ferrari's brand heritage, focusing on the restoration, maintenance, and certification of classic Ferrari vehicles. This specialized service operates within a mature but lucrative market for vintage automobiles, where authenticity and provenance are highly valued.

This program effectively acts as a cash cow for Ferrari, generating a stable and high-margin revenue stream. It captures a significant market share among owners of historic Ferraris, leveraging the brand's enduring appeal and the scarcity of its classic models. For instance, the demand for certified classic Ferraris remains robust, with many models appreciating significantly in value, further incentivizing owners to utilize the Classiche program.

- High Market Share: The Classiche program holds a dominant position among owners seeking official Ferrari certification and restoration for their vintage vehicles.

- Stable Revenue: It provides a consistent, high-margin income due to the specialized nature of the services and the premium attached to Ferrari's heritage.

- Low Investment Needs: Primary investments are directed towards maintaining specialized expertise and state-of-the-art restoration facilities, rather than aggressive market expansion.

- Brand Enhancement: The program reinforces Ferrari's legacy and exclusivity, indirectly benefiting the sales of new vehicles by strengthening brand loyalty and desirability.

Ferrari Certified Pre-Owned Program (Ferrari Approved)

The Ferrari Approved certified pre-owned program taps into a mature luxury car market, offering a dependable resale avenue and drawing in fresh clientele. This initiative consistently generates revenue and sustains robust profit margins by guaranteeing the quality and authenticity of used Ferraris.

Operating with well-defined procedures and minimal investment for growth, the program efficiently transforms existing assets into cash. In 2024, Ferrari reported a significant increase in its pre-owned vehicle sales, contributing to overall brand value and customer loyalty.

- Revenue Generation: The Ferrari Approved program acts as a steady income stream, capitalizing on the enduring demand for certified pre-owned luxury vehicles.

- Profitability: By ensuring rigorous inspection and refurbishment standards, Ferrari maintains high profit margins on these sales, reflecting the brand's premium positioning.

- Market Position: This program solidifies Ferrari's presence in the secondary luxury market, attracting buyers who seek the marque's prestige with added assurance.

- Operational Efficiency: With established processes, the program requires limited incremental investment, making it a highly efficient cash conversion tool for the company.

Ferrari's core V8 and V12 GT models, such as the Roma, Portofino M, and the new 12Cilindri, are the company's established cash cows. These vehicles consistently deliver robust sales and impressive profit margins thanks to their enduring brand prestige and high-performance engineering. In 2023, Ferrari reported a significant increase in V8-powered vehicle deliveries, contributing to their strong financial performance.

The Ferrari Classiche program, focusing on restoration and certification of classic models, acts as a stable, high-margin revenue stream within the mature vintage automobile market. It captures a significant share among owners of historic Ferraris, leveraging the brand's enduring appeal and the scarcity of its classic models.

The Ferrari Approved certified pre-owned program generates consistent revenue and sustains robust profit margins by guaranteeing the quality and authenticity of used Ferraris. In 2024, Ferrari reported a significant increase in its pre-owned vehicle sales, contributing to overall brand value and customer loyalty.

| Business Unit | Market Share | Profit Margin | Investment Needs | Revenue Contribution (2023 Est.) |

|---|---|---|---|---|

| Core GT Models (V8/V12) | High | Very High | Low (for established models) | Significant |

| Ferrari Classiche | Dominant | High | Low | Moderate |

| Ferrari Approved (Pre-Owned) | Strong | High | Low | Growing |

What You See Is What You Get

Ferrari BCG Matrix

The Ferrari BCG Matrix preview you see is the exact, unwatermarked document you will receive upon purchase, meticulously crafted for strategic insight. This comprehensive analysis, ready for immediate application, will be delivered directly to you, ensuring no hidden surprises or demo content. You're getting the full, professionally formatted report, perfect for informing your business planning and competitive strategy. This is your final, actionable tool for understanding Ferrari's market position.

Dogs

Specific legacy licensed merchandise lines, like certain apparel collections or accessory items that haven't connected with consumers, can be viewed as potential Dogs in Ferrari's BCG Matrix. These products often show low sales volumes and stagnant or declining growth, struggling to gain meaningful market share against more popular brand extensions.

Ferrari's older digital initiatives, like a less popular mobile app or an outdated online platform that hasn't seen updates since, would likely fall into the Dogs category. These ventures struggle with low user engagement and a shrinking market presence, especially as digital trends move so quickly.

For instance, if a Ferrari-branded gaming app launched in 2018 only had 50,000 downloads by mid-2024 and minimal active users, it would be a prime example. Such initiatives often consume valuable resources without generating substantial returns, indicating they might be better off being phased out or significantly redeveloped to meet current market expectations.

Within the broader classic Ferrari market, some older, more niche models might be considered 'dogs'. These are cars that, despite the legendary Ferrari name, haven't captured significant collector attention or seen substantial value appreciation over the years. Think of a specific, limited-production model from the 1970s that wasn't a major racing success or design icon.

These particular Ferraris may hold a very small share of the overall classic car collector market, and their value growth has been sluggish, perhaps only seeing a 2-3% annual increase in recent years, significantly below the 8-10% seen for more desirable models. While Ferrari itself doesn't focus marketing on these, for owners, they represent capital that isn't growing as effectively and could even slightly dilute the brand's prestige if not carefully managed.

Discontinued or Low-Demand Aftermarket Accessories

Discontinued or low-demand aftermarket accessories for Ferrari, such as specific older model body kits or specialized interior trim pieces, would likely be classified as cash cows or potentially dogs within the BCG matrix. These items, while perhaps once popular, now represent a low market share with minimal growth prospects. For instance, a specialized exhaust system for a 2010 Ferrari 458 Italia might have seen its demand plummet as newer models and aftermarket options emerged.

Ferrari would likely manage these low-demand items by focusing on efficient inventory liquidation.

- Low Market Share: Accessories for older, less common Ferrari models, or those that were niche even at launch, would have a very small slice of the current aftermarket accessory market.

- No Growth Potential: With the focus shifting to newer vehicles and evolving consumer tastes, these accessories are unlikely to see any resurgence in demand.

- Inventory and Capital Tie-up: Holding onto significant stock of these items ties up valuable warehouse space and capital that could be deployed more effectively elsewhere.

- Strategic Decision: Ferrari's strategy would likely involve either a clearance sale to move remaining inventory or a complete discontinuation of production to cut losses and reallocate resources to more promising product lines.

Less Successful Past Experiential Ventures

Ferrari's history includes ventures that didn't quite hit the mark, fitting into the 'Dogs' category of the BCG Matrix. These are often characterized by limited reach and minimal impact on their overall market presence. For instance, a one-off, highly exclusive track day event catering to a very niche segment might not have generated significant revenue or brand expansion beyond its immediate participants. Such initiatives, while perhaps offering a premium experience, would likely have low market share in the broader luxury experiential market and no discernible ongoing growth trajectory.

These less successful ventures serve as valuable learning opportunities for Ferrari. The company can analyze why these specific experiential initiatives failed to gain traction or meet their objectives. This analysis helps inform future strategy, guiding Ferrari to avoid replicating similar approaches that lack scalability or broad appeal. For example, if a particular partnership for a limited-edition merchandise line tied to an event saw very low sales, the data would indicate a need to re-evaluate the product offering or the marketing strategy for future collaborations.

- Limited Reach: Experiential ventures that only engage a small, select group of individuals, failing to capture a wider audience.

- Minimal Market Share: Initiatives that do not significantly contribute to Ferrari's presence in the broader luxury experience market.

- No Ongoing Growth: Projects that do not foster continued engagement or revenue streams beyond their initial execution.

- Learning Opportunities: These ventures provide critical data for refining future experiential marketing and partnership strategies.

Ferrari's 'Dogs' represent product lines or ventures with low market share and minimal growth prospects. These can include older, less sought-after licensed merchandise or digital platforms that have failed to gain traction. For example, a specific apparel line from the early 2020s that saw consistently low sales, perhaps only moving 5,000 units annually by mid-2024, would fit this category. These items often consume resources without delivering significant returns, prompting strategic decisions about their future.

These underperforming assets tie up capital and can detract from the brand's overall premium image. Ferrari's approach would likely involve either a focused liquidation strategy, such as clearance sales to offload remaining inventory, or a complete discontinuation to reallocate resources more effectively. The goal is to streamline operations and concentrate on areas with higher growth potential and market appeal.

Consider a hypothetical Ferrari-branded smartwatch launched in 2021. If by mid-2024 it had only achieved 15,000 sales globally and faced intense competition from established tech giants with superior features and lower price points, it would be a clear 'Dog'. Its limited market penetration and lack of significant sales growth would necessitate a strategic review.

The financial implications are straightforward: these 'Dogs' represent invested capital that is not generating adequate returns. For instance, if the development and marketing budget for such an item was $5 million, but it only generated $500,000 in revenue by mid-2024, the net loss highlights the inefficiency. Ferrari's management would analyze these figures to justify phasing out such products.

Question Marks

The forthcoming all-electric Ferrari, slated for a 2025 debut, is a classic Question Mark in the BCG matrix. Ferrari is venturing into the burgeoning electric vehicle (EV) market, which saw global sales surpass 10 million units in 2023, a significant jump from previous years. This move requires considerable investment in research and development, as well as marketing, to establish a foothold in a sector where Ferrari currently has no presence.

The success of this electric offering is pivotal. Ferrari's ability to capture market share and achieve strong sales growth in the EV segment will determine if this product can evolve from a high-investment, low-share entity into a future Star performer for the company. The automotive industry's shift towards electrification, with projections indicating EVs could represent over 50% of new car sales by 2030 in many key markets, underscores the strategic importance of this transition.

Ferrari's venture into advanced digital connectivity services, encompassing subscription-based features and enhanced in-car experiences, positions it as a Question Mark in the BCG matrix. The global automotive connectivity market is projected to reach $225.9 billion by 2027, showcasing substantial growth potential.

Ferrari's current penetration in this segment is minimal, especially when contrasted with established technology firms that dominate the digital services landscape. This presents both a challenge and an opportunity for the luxury automaker.

To gain traction, Ferrari must commit substantial capital to software engineering, forge strategic alliances with technology providers, and build robust digital infrastructure. Success in this area could unlock significant recurring revenue streams, diversifying its business model beyond traditional vehicle sales.

Ferrari's exploration into hydrogen fuel cell powertrains, alongside advanced hybrid and electric vehicle research, places it in a potentially significant future market for sustainable luxury performance. This diversification is crucial for long-term relevance in an evolving automotive landscape.

Despite the high growth potential, hydrogen technology remains in its early stages, with Ferrari currently having no market share in this segment. This necessitates considerable, sustained investment with uncertain near-term financial returns, classifying it as a high-risk, high-reward venture.

Enhanced Autonomous Driving Features (Level 3+)

While Ferrari's core identity revolves around the thrill of driving, the automotive landscape is rapidly evolving with advanced autonomous features. The global market for advanced driver-assistance systems (ADAS), a precursor to higher levels of autonomy, was projected to reach over $40 billion in 2024, with significant growth expected in Level 3 and above capabilities.

Ferrari's current participation in these highly automated systems is minimal. Their strategic focus remains on delivering an uncompromised, driver-engaged experience, meaning their market share in Level 3+ autonomous driving is effectively negligible. This presents a clear "Question Mark" in the BCG matrix.

Developing and integrating sophisticated autonomous technologies requires substantial R&D investment. For Ferrari, the challenge lies not only in the technical hurdles but also in gauging customer acceptance for such features within their performance-oriented, exclusive clientele. For instance, the development costs for a Level 4 autonomous system can run into hundreds of millions of dollars.

Key considerations for Ferrari regarding enhanced autonomous driving:

- Market Trend: The automotive industry is heavily investing in autonomous driving, with projections indicating widespread adoption of Level 3 and higher by the late 2020s.

- Ferrari's Position: Currently holds a very small market share in advanced autonomous systems, prioritizing driver engagement.

- Investment Needs: Significant capital expenditure is necessary for R&D and integration of these complex technologies.

- Customer Acceptance: Uncertainty exists regarding how Ferrari's core customer base will respond to and adopt higher levels of vehicle autonomy.

New Exclusive Lifestyle & Hospitality Ventures

Ferrari's foray into new, exclusive lifestyle and hospitality ventures, such as ultra-luxury hotels or private member clubs, positions them as Question Marks within the BCG framework. While the global luxury experiential market is projected to reach $1.5 trillion by 2028, Ferrari's presence in these specific segments is nascent.

These ventures demand significant capital expenditure and strategic alliances to establish a foothold. For instance, developing a single luxury hotel can cost hundreds of millions of dollars. Ferrari's current market share in this niche is negligible compared to established players like Four Seasons or Aman Resorts, who have decades of experience and brand loyalty in hospitality.

- Market Potential: The luxury travel market saw a 10% year-over-year growth in 2023, indicating strong demand for exclusive experiences.

- Investment Needs: High upfront costs for property acquisition, development, and brand building are substantial.

- Competitive Landscape: Ferrari faces established luxury hospitality brands with proven track records and customer bases.

- Uncertainty: The success of these ventures hinges on Ferrari's ability to translate its automotive brand equity into a compelling hospitality offering and achieve scalability.

Ferrari's expansion into advanced driver-assistance systems (ADAS) and higher levels of autonomous driving functions represents a significant Question Mark. While the global ADAS market was valued at over $40 billion in 2024, Ferrari's current share in sophisticated autonomous capabilities (Level 3+) is negligible, as the brand prioritizes driver engagement.

The substantial investment required for R&D and integration of these complex technologies poses a challenge. Gauging customer acceptance among Ferrari's performance-focused clientele for advanced autonomy remains a key uncertainty, with development costs for Level 4 systems potentially reaching hundreds of millions of dollars.

Ferrari's ventures into new lifestyle and hospitality segments, such as luxury hotels and private clubs, also fall into the Question Mark category. The global luxury experiential market is projected to reach $1.5 trillion by 2028, but Ferrari's presence is nascent, requiring significant capital and strategic alliances.

These hospitality ventures face established luxury brands and demand substantial upfront costs for property and brand building, with success dependent on translating automotive brand equity into a compelling hospitality offering.

| Initiative | BCG Category | Market Size/Growth (Approx.) | Ferrari's Current Share | Investment/Risk Factor |

|---|---|---|---|---|

| All-Electric Ferrari | Question Mark | Global EV sales > 10 million units (2023) | Negligible | High R&D, marketing investment; uncertain market penetration |

| Digital Connectivity Services | Question Mark | Global market projected $225.9 billion by 2027 | Minimal | Requires substantial software engineering and tech partnerships |

| Hydrogen Fuel Cell Powertrains | Question Mark | Early stage, high growth potential | Negligible | Significant, sustained investment with uncertain near-term returns |

| Advanced Autonomous Driving (Level 3+) | Question Mark | ADAS market > $40 billion (2024) | Negligible | High R&D costs (hundreds of millions for L4); customer acceptance uncertainty |

| Lifestyle/Hospitality Ventures | Question Mark | Luxury experiential market $1.5 trillion by 2028 | Nascent | High upfront costs; competition from established brands; scalability risk |

BCG Matrix Data Sources

Our Ferrari BCG Matrix leverages comprehensive market data, including sales figures, production volumes, and competitor analysis, alongside economic indicators and automotive industry trends.