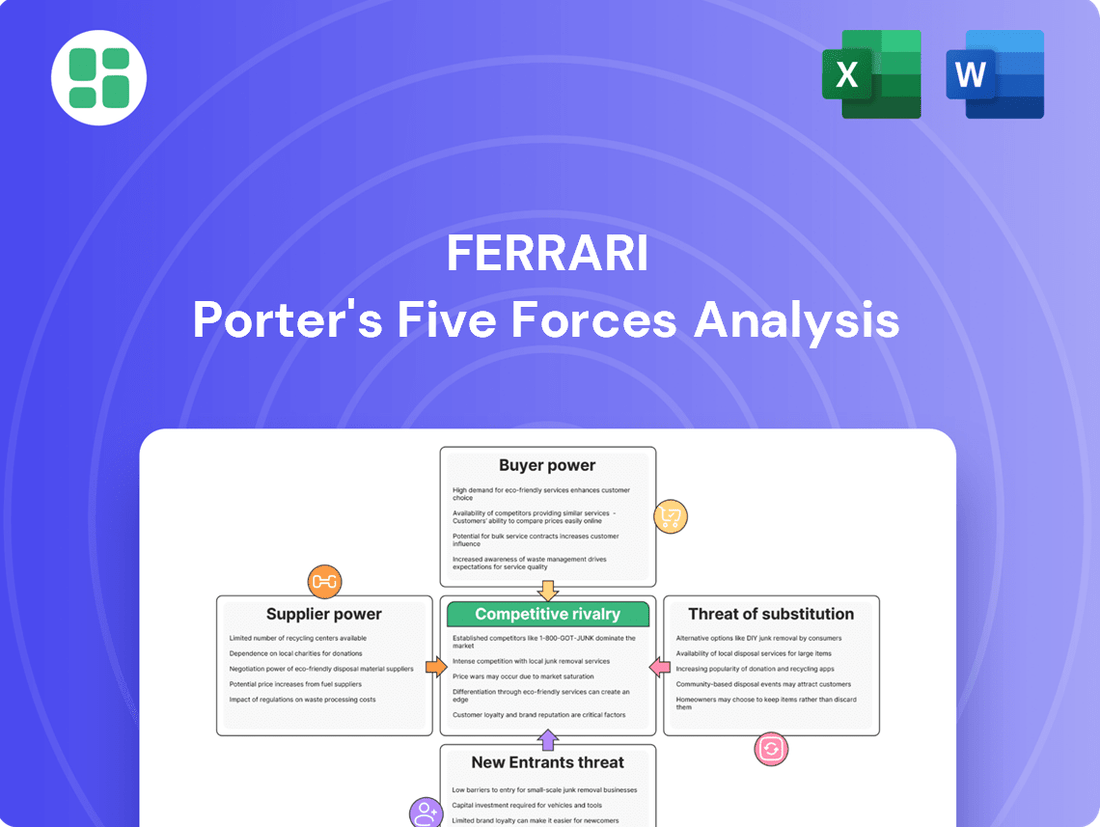

Ferrari Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrari Bundle

Ferrari navigates a landscape shaped by intense brand loyalty (low buyer power) and significant barriers to entry for new supercar manufacturers. However, the threat of substitutes, while niche, and the bargaining power of specialized suppliers present key challenges.

The complete report reveals the real forces shaping Ferrari’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ferrari's reliance on a select group of highly specialized suppliers for critical components like bespoke engines and advanced electronics significantly amplifies supplier bargaining power. These niche suppliers, often possessing proprietary technology crucial for Ferrari's performance edge, face limited competition. For instance, the development of a new, bespoke engine component could take years and cost millions, making Ferrari hesitant to alienate its existing, highly capable suppliers.

Ferrari's reliance on suppliers with proprietary technology and intellectual property for its high-performance vehicles significantly bolsters supplier bargaining power. For instance, specialized engine components or advanced aerodynamic materials often come with unique manufacturing processes that are difficult for Ferrari to replicate or source elsewhere. This dependence means Ferrari has limited options for switching suppliers without compromising its product's performance and exclusivity.

Ferrari's production, while high in value, is inherently low in volume. In 2023, Ferrari produced just over 13,600 vehicles. This limited output means that individual suppliers might not see Ferrari as their primary revenue driver, potentially weakening Ferrari's negotiating position.

Suppliers catering to Ferrari's bespoke and performance-oriented demands often operate on smaller scales themselves. This specialization, coupled with the unique specifications required for Ferrari components, can lead to higher per-unit costs for Ferrari, as suppliers may not benefit from economies of scale. For example, specialized engine components or bespoke interior materials are costly to produce in small batches.

Long-Term Supplier Relationships

Ferrari's strategy of fostering long-term, strategic partnerships with its core suppliers helps to temper their bargaining power. These deep relationships are built on mutual trust and involve integrated development processes, which can lead to more favorable terms and a more reliable supply chain. For instance, Ferrari's commitment to exclusivity with certain component manufacturers, like Brembo for braking systems, ensures access to cutting-edge technology and tailored solutions.

These enduring collaborations are vital for Ferrari's ability to consistently deliver the high-quality, performance-driven vehicles its brand is known for. They also enable collaborative innovation, allowing Ferrari and its suppliers to jointly develop advanced materials and technologies. However, this interdependence also creates significant switching costs for Ferrari should any disruptions or quality issues arise within these established relationships, underscoring the importance of careful supplier management.

- Supplier Exclusivity: Ferrari often secures exclusive agreements with key suppliers for critical components, limiting their ability to supply competitors and potentially strengthening Ferrari's negotiating position.

- Integrated Development: Collaborative R&D with suppliers, as seen in the co-development of advanced powertrain components, fosters loyalty and shared investment, reducing supplier leverage.

- Switching Costs: The deep integration of suppliers into Ferrari's design and manufacturing processes creates high costs and complexities associated with changing suppliers, thereby increasing Ferrari's reliance on existing partners.

- Brand Alignment: Suppliers chosen by Ferrari are often those that align with the brand's premium image and performance standards, creating a unique value proposition that can mitigate price-based bargaining.

Supply Chain Challenges

Global supply chain disruptions have significantly amplified supplier bargaining power, particularly for specialized components essential to Ferrari's high-performance vehicles. These ongoing challenges can directly translate into increased costs for Ferrari, necessitating either absorption of higher material expenses or passing these onto consumers, potentially impacting demand for their luxury goods.

Ferrari's strategic emphasis on achieving 'zero shortages' underscores the critical nature of robust supply chain management. This focus aims to mitigate the financial impact of production delays, which can be substantial in the high-margin automotive sector. For instance, in 2023, the automotive industry experienced continued volatility in component availability, impacting production schedules across various manufacturers.

- Increased Supplier Leverage: Recent supply chain disruptions have given suppliers of critical automotive components greater leverage in negotiations.

- Cost Pass-Through: Ferrari may face pressure to absorb higher material costs or pass them on to customers, affecting profitability and pricing strategy.

- Operational Resilience: The company's 'zero shortages' initiative highlights the importance of proactive supply chain planning to prevent costly production interruptions.

Ferrari's bargaining power with suppliers is somewhat limited due to its low production volume, with just over 13,600 vehicles produced in 2023. This means suppliers may not prioritize Ferrari, weakening its negotiation stance, especially when specialized components are required. Higher per-unit costs can result as suppliers may not achieve economies of scale for these niche demands.

However, Ferrari mitigates this through strategic partnerships and integrated development, fostering loyalty and shared investment. For example, its long-standing relationship with Brembo for braking systems ensures access to cutting-edge technology. This interdependence, while beneficial for quality, also creates high switching costs for Ferrari, reinforcing its reliance on established partners.

| Supplier Factor | Impact on Ferrari | Supporting Data/Example |

|---|---|---|

| Specialized Components | Increases supplier bargaining power | Bespoke engines, advanced electronics |

| Low Production Volume | Weakens Ferrari's negotiation position | 13,667 vehicles produced in 2023 |

| Proprietary Technology | Limits sourcing options, enhances supplier power | Unique manufacturing processes for performance parts |

| Strategic Partnerships | Mitigates supplier power, fosters loyalty | Long-term collaboration with Brembo |

| High Switching Costs | Increases reliance on existing suppliers | Deep integration into design and manufacturing |

What is included in the product

This analysis of Ferrari's competitive landscape examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products, all within the context of the ultra-luxury automotive market.

Instantly understand competitive pressures with a visually impactful Porter's Five Forces analysis, allowing for rapid strategic adjustments.

Customers Bargaining Power

Ferrari's customers exhibit extreme brand loyalty, a testament to the aspirational nature of owning one of their vehicles. This deep emotional connection, rooted in prestige and success, significantly reduces their ability to bargain. For instance, in 2023, Ferrari's order book extended well into 2025 for many models, demonstrating a demand that far outstrips production capacity.

Ferrari's deliberate strategy of limiting production, often leading to extensive waiting lists for its coveted vehicles, significantly curtails customer bargaining power. This scarcity inherently shifts the dynamic, placing potential buyers in a position of eager anticipation rather than assertive negotiation.

This exclusivity model ensures that demand consistently outstrips supply, a factor that directly diminishes a customer's leverage. Ferrari's Q1 2025 performance, with shipments up a mere 0.9%, underscores this commitment to prioritizing revenue quality over sheer volume, reinforcing the desirability and thus the reduced bargaining power of its clientele.

Ferrari's customer base, predominantly ultra-high-net-worth individuals, exhibits a low bargaining power. For these discerning buyers, the allure of unparalleled performance, distinctive design, and a highly personalized ownership journey significantly outweighs price considerations. In 2024, Ferrari's continued success in maintaining strong pricing power, with average transaction prices for models like the Roma and SF90 Stradale remaining robust, underscores this dynamic.

Bespoke Customization Options

Ferrari's bespoke customization options significantly strengthen its position against customer power. By offering extensive personalization, from unique paint colors to interior finishes and performance enhancements, Ferrari creates vehicles that are deeply tailored to individual desires. This bespoke approach fosters a strong emotional connection and a sense of exclusivity, making customers less inclined to switch to competitors or demand price concessions.

The value proposition for Ferrari customers is intrinsically linked to the personalization process itself. For instance, the Tailor Made program allows clients to collaborate with designers, selecting from an array of exclusive materials and finishes. This deep engagement in crafting their unique Ferrari reduces price sensitivity, as the perceived value extends beyond the base vehicle to the entire personalized ownership experience.

- Enhanced Uniqueness: Ferrari's customization programs, like Tailor Made, allow for near-infinite combinations, ensuring each car is a singular creation.

- Customer Lock-in: The significant investment of time and personal input into bespoke options creates a strong emotional bond and discourages seeking alternatives.

- Reduced Price Negotiation: The perceived value of a uniquely personalized Ferrari outweighs standard price-based negotiations for many buyers.

- Brand Loyalty: This highly individualized service reinforces brand loyalty by making customers feel like active participants in the creation of their dream car.

Strong Resale Value

Ferrari vehicles are renowned for their exceptional resale value, a significant factor that subtly diminishes customer bargaining power. This strong residual value acts as a tangible benefit, assuring buyers that their substantial initial investment is likely to hold its worth over time, potentially even appreciating.

For instance, a 2023 Ferrari 296 GTB, initially priced around $320,000, might still command over 90% of its original value after a year of ownership, depending on mileage and condition. This resilience in the secondary market makes the high upfront cost more palatable, as the perceived risk of depreciation is significantly lower for the customer.

- Strong Resale Value: Ferrari's brand prestige and limited production ensure vehicles retain a high percentage of their original purchase price.

- Reduced Depreciation: Customers are less concerned about the initial cost when they know the car will likely be worth a significant amount in the future.

- Lower Perceived Risk: The strong resale value mitigates the financial risk associated with owning a luxury asset, thus weakening the customer's leverage during negotiation.

Ferrari customers possess minimal bargaining power due to the brand's aspirational status and production limitations. The extreme demand, often resulting in multi-year waiting lists, means buyers are eager to secure a vehicle rather than negotiate terms. For example, in 2024, Ferrari maintained its strategy of limited production, ensuring that demand consistently outstripped supply, a key factor in suppressing customer leverage.

The ultra-high-net-worth demographic that constitutes Ferrari's customer base prioritizes exclusivity, performance, and design over price. This focus on intrinsic value, coupled with the brand's prestige, significantly reduces their inclination to bargain. Ferrari's robust pricing power in 2024, with average transaction prices remaining strong across its model range, exemplifies this dynamic.

Ferrari's extensive customization options, like the Tailor Made program, further solidify its position by creating highly personalized vehicles. This deep customer involvement in the design process fosters emotional attachment and reduces price sensitivity, as the value is derived from the unique creation experience. The strong resale values of Ferrari vehicles also mitigate depreciation concerns, further weakening customer leverage.

| Factor | Impact on Bargaining Power | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Brand Loyalty & Aspiration | Very Low | Order books extending well into 2025 for many models. |

| Production Limitations (Scarcity) | Very Low | Continued strategy of limited production to maintain exclusivity. |

| Customer Base (UHNWIs) | Very Low | Focus on performance, design, and personalization over price. |

| Customization & Bespoke Options | Very Low | Tailor Made program enhances emotional connection and reduces price sensitivity. |

| Resale Value | Low | Vehicles retain a high percentage of original purchase price, reducing depreciation concerns. |

Full Version Awaits

Ferrari Porter's Five Forces Analysis

This preview showcases the complete Ferrari Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape for the automotive giant. You're viewing the exact, professionally crafted document that will be delivered to you instantly upon purchase, providing immediate insight into Ferrari's strategic positioning.

Rivalry Among Competitors

Ferrari operates within an exceptionally narrow niche: the ultra-luxury, high-performance sports car segment. This exclusivity means direct competition comes from a very select group of prestigious manufacturers. Key rivals include Lamborghini, McLaren, and Aston Martin, along with the top-tier models from Porsche.

The intensity of competition within this confined market is significant. These established players are all vying for the attention and wallets of a limited, affluent customer base. For instance, in 2023, Ferrari delivered 13,663 vehicles, a testament to the demand within this segment, yet it highlights the focused nature of the competition.

In the ultra-luxury automotive sector, competition among brands like Ferrari, Lamborghini, and McLaren is fierce, but it’s not typically driven by price wars. Instead, rivals battle on the grounds of technological advancement, groundbreaking design, and a rich brand heritage that resonates with discerning buyers. Ferrari, for instance, consistently invests heavily in Formula 1 technology, which often trickles down to its road cars, enhancing performance and desirability. In 2023, Ferrari reported a revenue of €5.07 billion, showcasing the financial strength backing its pursuit of innovation and brand equity.

Ferrari's unparalleled Formula One racing heritage is a cornerstone of its competitive rivalry, setting it apart from other luxury automakers. This deep involvement in motorsport isn't just for show; it directly fuels innovation and performance in their road-going vehicles, creating a powerful emotional connection with customers that rivals struggle to replicate. For instance, in 2023, Ferrari's Formula 1 team, Scuderia Ferrari, continued its legacy, contributing to the brand's image of engineering excellence and speed, a key differentiator against competitors lacking such a storied racing past.

Continuous Innovation and Product Portfolio Expansion

Ferrari's competitive rivalry is intensified by its relentless pursuit of continuous innovation and product portfolio expansion. The company consistently invests heavily in research and development, a strategy that fuels the introduction of groundbreaking technologies and new vehicle variants. This commitment ensures Ferrari remains at the cutting edge of automotive performance and design, appealing to a demanding customer base.

The brand's ability to consistently launch new models, such as the 296 Speciale, and its forward-looking development of hybrid and upcoming electric vehicles, like the anticipated Ferrari elettrica, are crucial for maintaining its market position. These introductions not only showcase technological prowess but also cater to evolving consumer preferences and regulatory landscapes, keeping rivals on their toes.

- R&D Investment: Ferrari's significant R&D spending, often a substantial percentage of its revenue, directly supports its innovation pipeline. For instance, in 2023, Ferrari reported R&D expenses of €617 million, a notable increase from previous years, underscoring its dedication to technological advancement.

- Product Diversification: The expansion into hybrid powertrains, exemplified by models like the SF90 Stradale, and the strategic planning for full electric vehicles, demonstrates Ferrari's proactive approach to broadening its appeal and addressing future market demands.

- Model Launches: The successful introduction of new limited-edition and series models consistently generates excitement and drives sales, reinforcing Ferrari's exclusivity and desirability in a competitive luxury automotive market.

Brand Value and Global Recognition

Ferrari's brand value and global recognition are formidable barriers to entry and fierce competitive weapons. Often cited among the most powerful brands globally, Ferrari's equity allows it to consistently command premium pricing, a testament to its desirability and exclusivity. This strong brand perception makes it exceptionally difficult for rivals to chip away at its market share through standard competitive strategies.

The brand's allure translates directly into financial strength. For instance, in 2024, Interbrand ranked Ferrari as one of the top global brands, underscoring its enduring appeal. This high brand valuation directly supports Ferrari's ability to maintain higher profit margins compared to less recognized luxury automotive manufacturers.

- Brand Strength: Ferrari consistently ranks among the top global brands, a key differentiator.

- Pricing Power: This recognition allows for premium pricing, enhancing profitability.

- Market Share Defense: Competitors struggle to erode Ferrari's exclusive market position through conventional means.

- Customer Loyalty: The brand fosters deep emotional connections, ensuring a loyal customer base.

Competitive rivalry for Ferrari is intense but unique, focusing on innovation and brand prestige rather than price. Key rivals like Lamborghini and McLaren compete by matching technological advancements and design flair, leveraging their own heritage. Ferrari's significant investment in R&D, with €617 million spent in 2023, fuels its ability to stay ahead in this specialized market.

Ferrari's deep Formula 1 heritage is a critical differentiator, enhancing its brand image and engineering credibility. This motorsport connection directly influences its road car development, creating a powerful emotional appeal that competitors find hard to match. The brand's consistent presence and performance in F1 contribute significantly to its desirability.

The ultra-luxury segment sees rivals battling for a select clientele through continuous product development and exclusive model launches. Ferrari's strategy of introducing new vehicles, including hybrid and upcoming electric models, keeps the competitive landscape dynamic. The company's 2023 revenue of €5.07 billion underscores its financial capacity to maintain this aggressive innovation cycle.

| Competitor | Key Differentiators | 2023 Revenue (Approx. in billions) |

|---|---|---|

| Lamborghini | Aggressive design, V10/V12 engines, strong brand heritage | €1.42 |

| McLaren | Lightweight construction, F1 technology integration, track-focused performance | €0.85 |

| Aston Martin | Elegant design, luxury focus, British heritage, F1 involvement | €1.53 |

| Porsche (Top-tier models) | Engineering excellence, broad sports car appeal, strong brand loyalty | €37.7 (Group revenue) |

SSubstitutes Threaten

The most significant threat of substitutes for Ferrari isn't other cars, but rather other luxury items and experiences competing for the same wealthy consumer's wallet. Think of it this way: a potential Ferrari buyer might instead opt for a sprawling beachfront villa, a state-of-the-art private jet, a magnificent yacht, or an investment in rare fine art. These alternatives directly siphon discretionary spending that could otherwise be directed towards a prancing horse.

For instance, the global luxury goods market, excluding automotive, was valued at approximately $300 billion in 2023 and is projected to grow steadily. This vast market encompasses everything from designer fashion to high-end jewelry and exclusive travel, all vying for the attention and expenditure of the same affluent demographic that Ferrari targets. In 2024, the demand for experiential luxury, such as bespoke travel or exclusive club memberships, has also seen a significant uptick, further diversifying the competitive landscape beyond traditional material possessions.

While Ferrari's traditional gasoline-powered sports cars have historically faced limited direct substitutes, the automotive landscape is rapidly evolving. The emergence of high-performance electric vehicles (EVs) from manufacturers such as Tesla, Rimac, Lucid, Porsche, and Mercedes-Benz poses a significant and growing threat of substitution. These EVs are increasingly offering acceleration and technological capabilities that rival or even surpass those of internal combustion engine (ICE) supercars.

The rise of high-performance luxury SUVs and crossovers presents a growing threat of substitutes for traditional sports cars. Brands like Lamborghini, with its Urus, and even Ferrari itself, with the Purosangue, are entering this segment. These vehicles blend luxury, significant power, and increased practicality, appealing to a broader demographic of affluent consumers who might otherwise opt for a pure sports car.

In 2024, the luxury SUV market continued its robust expansion. For instance, sales of luxury SUVs globally are projected to reach over $250 billion by 2025, indicating a substantial and growing consumer base. While not a direct replacement for the raw driving experience of a Ferrari sports car, the versatility and brand prestige offered by these high-riding alternatives can siphon demand from potential sports car buyers seeking a more all-encompassing premium vehicle experience.

Evolution of Mobility Solutions

While long-term shifts in mobility, like autonomous driving and luxury ride-sharing, present a conceptual threat, their impact on Ferrari's core market remains limited. For the discerning Ferrari owner, the intrinsic value lies in the hands-on driving engagement and the prestige of personal ownership, elements not easily supplanted by evolving transportation paradigms.

Ferrari's customer base prioritizes the unique emotional connection and the exhilarating performance that substitutes, even advanced ones, struggle to replicate. The brand's heritage and the sensory experience of driving a Ferrari are powerful deterrents to substitution.

- Limited Threat from Autonomous Driving: While autonomous technology advances, Ferrari's target demographic seeks active driving engagement, not passive transportation.

- Personal Ownership Value: The status and emotional fulfillment derived from owning a Ferrari are not easily replicated by shared mobility services.

- Experiential Differentiation: The visceral driving experience and brand heritage are key differentiators that insulate Ferrari from many substitute threats.

Lack of Direct Experiential Substitutes

The threat of substitutes for Ferrari is mitigated by the unique, almost inimitable, blend of heritage, racing pedigree, and the visceral emotional connection its vehicles evoke. While other high-performance or luxury cars can match or even exceed Ferrari in raw speed or comfort, they rarely replicate the deep-seated brand history and the distinct auditory and tactile experience that defines Ferrari ownership.

This makes direct experiential substitutes exceptionally rare. Owning a Ferrari is not just about transportation; it's about belonging to an exclusive club with a storied past. For instance, in 2023, Ferrari's brand value was estimated at $10.2 billion, underscoring the significant intangible asset that differentiates it from competitors and makes its core appeal hard to replicate.

- Heritage and Racing Pedigree: Ferrari's deep roots in Formula 1 racing, dating back to 1950, create an unparalleled brand legacy.

- Emotional and Experiential Connection: The distinctive engine sound, design, and driving dynamics foster a unique emotional bond with owners.

- Lack of True Experiential Equivalents: While performance metrics can be matched, the holistic Ferrari experience, encompassing history and passion, is difficult for rivals to substitute.

- Brand Value: Ferrari's significant brand equity, valued at over $10 billion in 2023, highlights the intangible assets that deter substitution.

The threat of substitutes for Ferrari is multifaceted, extending beyond direct automotive competitors to encompass other luxury goods and experiences. While high-performance electric vehicles and luxury SUVs present evolving challenges, the core appeal of Ferrari lies in its heritage and emotional connection, which are difficult for substitutes to replicate.

The global luxury goods market, excluding automotive, was valued at approximately $300 billion in 2023, with experiential luxury gaining traction in 2024. This broad market competes for the same affluent consumer spending. Ferrari's brand value, estimated at $10.2 billion in 2023, underscores its unique intangible assets that deter direct substitution.

| Substitute Category | Examples | 2023/2024 Relevance |

|---|---|---|

| Other Luxury Goods | Yachts, Private Jets, Fine Art | Valued at $300 billion (luxury goods market excl. auto) |

| High-Performance EVs | Tesla, Rimac, Porsche Taycan | Increasingly matching or exceeding ICE supercar performance |

| Luxury SUVs/Crossovers | Lamborghini Urus, Ferrari Purosangue | Robust market growth, projected over $250 billion by 2025 |

| Experiential Luxury | Bespoke Travel, Exclusive Memberships | Significant uptick in demand in 2024 |

Entrants Threaten

The ultra-luxury sports car segment, where Ferrari operates, presents a formidable barrier to entry due to the sheer scale of capital investment needed. Establishing the necessary research and development facilities, advanced manufacturing plants, and securing access to cutting-edge materials can easily run into billions of dollars. For instance, launching a new vehicle platform in the automotive industry, even for established players, often requires investments exceeding $1 billion, and for a niche ultra-luxury segment, this figure is likely much higher when considering brand building and bespoke customization capabilities.

Ferrari's established brand reputation and heritage, cultivated over more than 80 years of unparalleled racing success and automotive innovation, present a formidable barrier to new entrants. This legacy, deeply intertwined with motorsport victories and a commitment to performance, fosters an almost unassailable level of trust and aspirational appeal among consumers in the ultra-luxury automotive market. For instance, in 2023, Ferrari's brand value was estimated at over $10 billion, a testament to its enduring prestige, making it incredibly difficult for newcomers to quickly build comparable recognition and loyalty.

The sheer complexity and cost of replicating Ferrari's established global distribution and servicing network present a significant barrier. Building an exclusive dealership footprint, along with the necessary specialized service centers and highly trained technicians for ultra-luxury vehicles, requires immense capital and time.

Ferrari's carefully curated and exclusive distribution model, which emphasizes brand experience and customer intimacy, is exceptionally difficult for newcomers to penetrate or replicate effectively. This existing infrastructure and brand loyalty make it challenging for new entrants to gain market access and build comparable customer trust.

Stringent Regulatory and Certification Hurdles

New entrants into the luxury automotive sector, especially for high-performance vehicles like those produced by Ferrari, encounter formidable regulatory and certification barriers. These include stringent global emissions standards, rigorous safety regulations, and complex homologation processes that are both time-consuming and capital-intensive. For instance, meeting Euro 7 emissions standards, which are progressively being implemented, requires substantial investment in advanced powertrain technology and exhaust after-treatment systems.

Navigating these multifaceted requirements demands significant financial outlay and specialized technical expertise, acting as a powerful deterrent to potential new competitors. The cost associated with research and development to ensure compliance with evolving environmental and safety mandates, such as those mandated by the European Union and national bodies like the NHTSA in the United States, can easily run into hundreds of millions of dollars.

- Global Emissions Standards: Adherence to strict emissions targets, like those set by the EU's CO2 fleet average regulations, necessitates advanced and costly engineering solutions.

- Safety Regulations: Compliance with diverse international safety standards, including crashworthiness and pedestrian protection, requires extensive testing and design modifications.

- Certification Processes: Obtaining type approval and individual vehicle certifications in various markets involves lengthy administrative procedures and substantial fees.

- R&D Investment: The continuous need for innovation in areas like electrification and autonomous driving, driven by regulatory pressures, adds to the already high cost of entry.

Proprietary Technology and Intellectual Property

Ferrari's extensive proprietary technology, including decades of engine design, aerodynamics, and vehicle dynamics expertise, creates a significant barrier to entry. This intellectual property, protected by design patents and manufacturing know-how, makes it incredibly difficult for new competitors to replicate the brand's distinctive performance and characteristics without massive R&D investment.

For instance, Ferrari's continuous innovation in hybrid powertrains, as seen in models like the SF90 Stradale, requires specialized knowledge and significant capital expenditure to develop comparable systems. This deep technological moat, evidenced by their consistent track performance and luxury market positioning, deters potential entrants who lack the necessary resources and expertise.

- Proprietary Technology: Ferrari holds patents on numerous engine technologies and aerodynamic designs.

- Intellectual Property: Decades of accumulated design patents and manufacturing processes are key barriers.

- R&D Investment: New entrants would need to invest billions to match Ferrari's technological capabilities.

The threat of new entrants for Ferrari is exceptionally low, primarily due to the immense capital required to establish a brand in the ultra-luxury automotive sector. Building the necessary infrastructure, from advanced manufacturing to global distribution networks, demands billions of dollars. For example, developing a new vehicle platform can easily exceed $1 billion, a figure likely much higher for a niche segment requiring bespoke customization and extensive brand building.

Ferrari's deeply entrenched brand heritage and its association with racing excellence create a powerful barrier. In 2023, Ferrari's brand value was estimated at over $10 billion, reflecting decades of motorsport success and aspirational appeal that newcomers struggle to match. This makes it incredibly difficult for new players to quickly build comparable recognition and customer loyalty in the high-end market.

The complexity and cost of replicating Ferrari's exclusive global distribution and servicing network are significant deterrents. Establishing specialized dealerships and service centers, staffed by highly trained technicians, requires substantial capital and time, further limiting the appeal for potential new entrants.

Regulatory hurdles, including stringent emissions and safety standards, add another layer of difficulty. Meeting evolving environmental mandates, such as EU emissions targets, necessitates massive investments in advanced powertrain technology and extensive research and development, acting as a strong deterrent to new competitors.

Porter's Five Forces Analysis Data Sources

Our Ferrari Porter's Five Forces analysis is built upon a foundation of verified data, including Ferrari's annual reports, investor presentations, and official press releases. We also incorporate insights from reputable automotive industry research firms and market analysis reports to capture the competitive landscape.