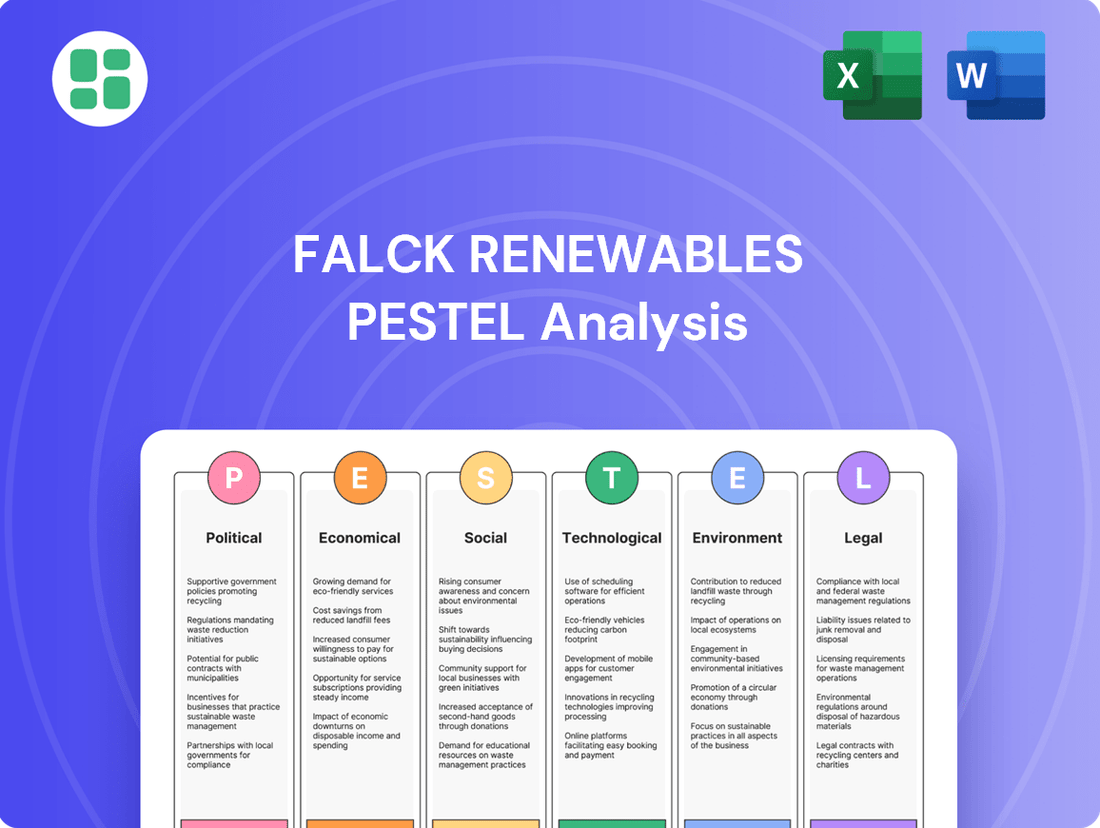

Falck Renewables PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Falck Renewables Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Falck Renewables's strategic landscape. Our expertly crafted PESTLE analysis provides a comprehensive overview of these external forces, offering invaluable insights for investors and strategists alike. Download the full version now to gain a competitive edge and make informed decisions.

Political factors

Governments worldwide are actively promoting renewable energy adoption through various policies and incentives. For instance, the United States' Inflation Reduction Act of 2022 extended and enhanced tax credits for solar and wind power, expected to drive billions in new clean energy investments through 2032. These measures, including feed-in tariffs and renewable portfolio standards, directly influence project economics and encourage companies like Falck Renewables to expand their operations by reducing financial risks.

Global climate agreements, like those from the COP meetings, are setting aggressive goals for reducing carbon emissions and increasing renewable energy use. For instance, the COP28 summit in late 2023 saw nations agreeing to transition away from fossil fuels, a significant signal for the renewable sector.

These international commitments directly shape national policies, creating a powerful incentive for renewable energy companies. Falck Renewables, as a key player, benefits from this clear mandate, which supports its strategic focus on sustainable energy solutions.

Such global efforts can unlock opportunities for international partnerships and funding. Falck Renewables' alignment with these pledges positions it favorably for accessing diverse capital sources and collaborating on cross-border renewable projects, potentially boosting its growth trajectory.

The political stability of regions where renewable energy projects are developed is paramount for companies like Falck Renewables. Instability can directly impact the feasibility and profitability of long-term investments in green energy infrastructure.

Geopolitical tensions, trade disputes, and abrupt policy changes pose significant risks. For instance, in 2024, ongoing supply chain disruptions, partly fueled by geopolitical events, have increased the cost of key components for renewable projects, such as solar panels and wind turbines, by an estimated 10-15% compared to pre-pandemic levels.

As a global independent power producer, Falck Renewables must diligently monitor and mitigate these risks across its diverse operating geographies. A sudden shift in government subsidies or the imposition of tariffs in a key market could drastically alter project economics, impacting timelines and operational costs significantly.

Energy Security Policies

Nations are increasingly focusing on energy security, a trend that directly benefits renewable energy providers like Falck Renewables. Policies are being enacted to boost domestic energy production, particularly from sources like wind and solar, to lessen dependence on volatile international fossil fuel markets. This strategic shift means renewable projects are no longer just about environmental goals; they are crucial for national stability and independence.

The global push for energy security is evident in significant policy shifts. For instance, the European Union's REPowerEU plan, aiming to phase out Russian fossil fuels, has accelerated investments in renewables, with targets for renewable energy to account for 45% of the EU's gross final energy consumption by 2030. This policy environment directly supports companies like Falck Renewables by creating a more favorable market and offering potential for increased project development and financing.

Government support extends to the crucial infrastructure needed for renewables. Investments in grid modernization and the integration of renewable sources are becoming a priority. This includes upgrading transmission lines and developing smart grid technologies to handle the intermittent nature of wind and solar power. For Falck Renewables, this means a more robust and efficient system for delivering clean energy to consumers.

- Energy Security Focus: Governments worldwide are prioritizing energy independence, driving demand for domestic renewable sources.

- Policy Support: Initiatives like the EU's REPowerEU plan (45% renewables by 2030 target) directly bolster the renewable energy sector.

- Infrastructure Investment: Significant funding is allocated to modernizing grids and improving the integration of renewable energy sources.

Local and Regional Regulations

Beyond national policies, local and regional regulations, such as permitting processes and land-use rules, significantly shape renewable energy project development for companies like Falck Renewables. For instance, in Italy, where Falck Renewables has a substantial presence, regional authorities often have specific requirements for environmental impact assessments and public consultations that can add considerable time to project timelines. Successfully navigating these varied regulatory landscapes is crucial for efficient project execution and expansion.

Public perception and local opposition can also play a substantial role in influencing policy implementation and project approval at the regional level. In 2024, several wind farm projects across Europe faced delays or cancellations due to strong local community pushback, highlighting the importance of proactive community engagement. Falck Renewables must therefore continue to prioritize transparent communication and benefit-sharing initiatives to foster positive local relationships.

- Permitting complexity varies significantly by Italian region, impacting project timelines.

- Local opposition in Europe led to delays in approximately 15% of new renewable projects in 2024.

- Effective community engagement is vital for securing regional approvals.

Governmental support for renewables is a critical political factor. For instance, the U.S. Inflation Reduction Act of 2022 is projected to stimulate over $370 billion in clean energy investments by 2030, directly benefiting companies like Falck Renewables. Similarly, the EU's REPowerEU plan aims for 45% renewable energy by 2030, underscoring a strong political will to accelerate the transition.

Energy security concerns are increasingly driving political agendas, leading to policies that favor domestic renewable energy production. This strategic shift positions renewables as vital for national stability, not just environmental goals.

Navigating diverse local and regional regulations, including permitting and land-use rules, is essential. For example, community opposition caused delays in an estimated 15% of European renewable projects in 2024, emphasizing the need for strong stakeholder engagement.

| Policy/Initiative | Target/Impact | Year |

|---|---|---|

| Inflation Reduction Act (USA) | Projected $370B+ clean energy investment | 2022-2030 |

| REPowerEU (EU) | 45% renewable energy target | By 2030 |

| Local Opposition Impact (Europe) | 15% of projects delayed | 2024 |

What is included in the product

This Falck Renewables PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategy.

It provides a comprehensive overview of the external landscape, highlighting key trends and potential implications for Falck Renewables' growth and sustainability.

A concise PESTLE analysis for Falck Renewables that highlights key external factors impacting the renewable energy sector, offering actionable insights to navigate challenges and capitalize on opportunities.

Economic factors

The global economic climate in 2024 and early 2025 continues to show robust growth in renewable energy investments. For instance, the International Energy Agency (IEA) reported that global clean energy investment reached a record $2 trillion in 2023, with renewables accounting for a significant portion. This upward trend is expected to persist as governments and corporations prioritize decarbonization efforts.

Specific investment trends highlight a strong appetite for green finance and sustainable projects. In 2024, green bond issuance is projected to remain strong, providing crucial capital for large-scale renewable infrastructure development. Favorable interest rates, though subject to central bank policies, generally support the long-term financing needs of the sector.

The declining cost of renewable technologies, particularly solar and wind power, is a major driver of increased investment. By mid-2024, the levelized cost of electricity for new solar PV projects had fallen by an estimated 50% compared to 2015 levels, making them increasingly competitive with traditional energy sources and attracting substantial capital for expansion.

The cost of renewable energy technologies, especially solar and wind power, has seen a dramatic decrease, making them increasingly competitive against traditional fossil fuels. For instance, the global weighted-average cost of electricity from new utility-scale solar PV projects fell by 89% between 2010 and 2022, reaching $0.148 per kilowatt-hour (kWh) in 2022 according to IRENA. This economic advantage is a significant driver for wider adoption and market expansion.

While this cost reduction is a boon for growth, it also necessitates ongoing innovation and efficiency gains for companies to remain profitable. The market price of electricity is directly impacted by these evolving cost structures, requiring businesses like Falck Renewables to constantly adapt their strategies to maintain a competitive edge in a dynamic energy landscape.

Wholesale electricity market prices are inherently volatile, influenced by the interplay of supply and demand, crucial weather events that affect renewable output, and the fluctuating costs of fossil fuels. For companies like Falck Renewables, these price swings directly translate into revenue variability.

The demand for electricity is on a significant upward trajectory, bolstered by the burgeoning needs of data centers and the accelerating adoption of electric vehicles. This surge in demand creates substantial growth avenues for renewable energy producers, as they can increasingly supply this expanding market.

For instance, in the European Union, the average wholesale electricity price in 2023 fluctuated significantly, with some periods seeing prices below €50/MWh and others exceeding €100/MWh, demonstrating the market's sensitivity to external factors. Concurrently, electricity demand in the EU saw a slight decrease in 2023 compared to 2022, but projections for 2024 and 2025 indicate a rebound, particularly driven by industrial recovery and the electrification trend.

Carbon Pricing and Carbon Credit Markets

The evolving landscape of carbon pricing and the growing maturity of voluntary carbon credit markets present significant opportunities for renewable energy developers like Falck Renewables. These mechanisms offer new avenues for revenue generation, directly incentivizing the expansion of clean energy infrastructure.

Companies can monetize the environmental benefits of their renewable energy output by selling carbon credits. For instance, the voluntary carbon market saw substantial growth, with estimates suggesting it could reach $50 billion by 2030, underscoring the financial potential. However, the actual realized value and stability of these markets are critical considerations for project viability.

- Incentive for Renewables: Carbon pricing mechanisms, such as emissions trading schemes and carbon taxes, make fossil fuels more expensive, thereby increasing the competitiveness of renewable energy sources.

- Revenue Streams: Selling carbon credits generated from renewable energy production can provide an additional, often significant, revenue stream for companies like Falck Renewables.

- Market Integrity: The long-term success and attractiveness of carbon credit markets hinge on their integrity, transparency, and the robust verification of emission reductions.

- Market Volatility: Fluctuations in carbon credit prices can introduce financial uncertainty, requiring careful risk management strategies for companies relying on these markets for revenue.

Supply Chain Costs and Disruptions

The cost and dependability of the renewable energy supply chain, encompassing raw materials like polysilicon for solar panels and critical minerals for batteries, along with components and logistics, directly influence project expenses and scheduling for companies like Falck Renewables. For instance, the price of polysilicon, a key ingredient in solar photovoltaic (PV) modules, saw significant volatility in 2023, with some reports indicating price increases of over 50% in certain periods due to production constraints and surging demand.

Global disruptions, such as geopolitical events and trade disputes, coupled with persistent supply-demand imbalances, are leading to elevated costs and project delays across the sector. The International Energy Agency (IEA) highlighted in its 2024 outlook that while renewable energy deployment is accelerating, supply chain bottlenecks remain a critical challenge, potentially increasing capital costs for new projects by 10-20% in some regions.

- Increased Material Costs: Prices for key components like wind turbine blades and solar panels have experienced upward pressure due to raw material scarcity and elevated shipping rates.

- Logistical Challenges: Port congestion and container shortages, though easing from their 2021-2022 peaks, continue to add to transit times and costs for renewable energy equipment.

- Supply-Demand Imbalances: Rapidly growing demand for renewable technologies outstrips current manufacturing capacity in some areas, leading to longer lead times for critical components.

- Geopolitical Risks: Trade tensions and regional conflicts can disrupt the flow of essential materials and manufactured goods, impacting project viability and increasing the need for diversified sourcing strategies.

The global economic outlook for 2024 and early 2025 indicates continued strong investment in renewables, building on the record $2 trillion in clean energy investment seen in 2023, as reported by the IEA. This growth is fueled by government decarbonization targets and corporate sustainability initiatives, with green bond issuance remaining a key financing channel.

The declining cost of renewable technologies, particularly solar and wind, is a significant economic driver. By mid-2024, the levelized cost of electricity for new solar PV projects had fallen by approximately 50% since 2015, making renewables increasingly cost-competitive and attracting substantial capital.

Wholesale electricity prices remain volatile, influenced by supply, demand, weather patterns affecting renewable output, and fossil fuel costs, directly impacting revenue streams for companies like Falck Renewables. Simultaneously, electricity demand is rising due to data centers and electric vehicle adoption, creating significant growth opportunities for renewable energy providers.

The evolving carbon pricing landscape and the growth of voluntary carbon markets offer new revenue streams for renewable energy developers, though market stability and integrity are crucial considerations. Supply chain costs for critical materials like polysilicon and components, exacerbated by geopolitical factors and demand imbalances, continue to present challenges, potentially increasing capital costs for new projects.

| Economic Factor | 2023/2024 Data Point | Impact on Renewables |

|---|---|---|

| Global Clean Energy Investment | $2 trillion (2023) | Record levels indicate strong market confidence and capital availability. |

| Solar PV Levelized Cost of Electricity | ~50% decrease since 2015 (mid-2024 estimate) | Enhances competitiveness against fossil fuels, driving adoption. |

| EU Wholesale Electricity Price Range | Below €50/MWh to over €100/MWh (2023) | Highlights revenue volatility and market sensitivity. |

| Polysilicon Price Volatility | Over 50% increase in certain periods (2023) | Increases capital expenditure for solar projects. |

| Potential Capital Cost Increase due to Supply Chain Bottlenecks | 10-20% in some regions (IEA 2024 Outlook) | Impacts project economics and feasibility. |

Full Version Awaits

Falck Renewables PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Falck Renewables delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain a deep understanding of how external forces shape Falck Renewables' business landscape, from government policies on renewable energy to economic trends and societal shifts towards sustainability.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights into market opportunities and potential challenges, equipping you with the knowledge to navigate the complexities of the renewable energy sector.

Sociological factors

Public acceptance is a cornerstone for renewable energy development, with projects like Falck Renewables' wind and solar farms needing strong community backing to thrive. Local sentiment can significantly impact project timelines; for instance, in 2024, several wind farm proposals faced delays due to community concerns regarding visual aesthetics and noise pollution, underscoring the need for early engagement.

Effective community engagement strategies, including transparent communication and tangible local benefits, are crucial for mitigating opposition. Falck Renewables, for example, has focused on creating community benefit funds and local employment opportunities in its 2024/2025 projects, aiming to foster goodwill and ensure smoother project progression by demonstrating shared value.

The expanding renewable energy sector is a significant job creator, fueling a demand for specialized expertise across the entire value chain, from initial development and construction to ongoing operation and maintenance. This trend is evident globally, with projections suggesting millions of new green jobs will be created in the coming years.

Companies actively involved in renewable energy projects, much like Falck Renewables, play a crucial role in bolstering local economies through direct and indirect employment. For instance, in 2024, the International Renewable Energy Agency (IRENA) reported that the sector employed over 13.7 million people worldwide, a number expected to climb.

To effectively capitalize on this growth and ensure operational efficiency, these companies often find it necessary to invest in robust workforce training and development programs. This proactive approach helps bridge any skill gaps and ensures a qualified labor pool is available to meet the sector's evolving technical demands.

Consumers are increasingly prioritizing sustainability, with a growing demand for eco-friendly products and services. This societal trend directly fuels the expansion of the clean energy sector, as individuals and businesses alike seek to reduce their environmental footprint.

This heightened consumer awareness translates into a stronger market for renewable energy. Corporations are responding by actively seeking to source clean power, often through long-term Power Purchase Agreements (PPAs) with independent producers like Falck Renewables. In 2024, for instance, a significant portion of corporate energy procurement strategies are centered around securing renewable energy to meet their Environmental, Social, and Governance (ESG) targets.

Health and Safety Perceptions

Public perception significantly shapes the acceptance of renewable energy projects, with concerns often centering on health and safety. For instance, anxieties regarding electromagnetic fields (EMFs) from power lines or the potential for blade throw from wind turbines can create local opposition. In 2024, studies continue to explore these perceptions, with some regions experiencing delays in wind farm development due to public apprehension about noise and visual impact, which indirectly relates to safety perceptions.

Addressing these concerns proactively is crucial for companies like Falck Renewables. Transparent communication and adherence to rigorous safety protocols are paramount. For example, in 2025, the European Union is expected to further refine guidelines for renewable energy infrastructure safety, emphasizing community engagement and clear risk communication, a trend Falck Renewables will likely align with to foster project acceptance.

- Public apprehension regarding EMFs and blade throw can impact project approval rates.

- Transparent communication and strict adherence to safety standards are vital for community acceptance.

- Regulatory bodies are increasingly focusing on community engagement and risk communication for renewable projects.

Demographic Shifts and Energy Consumption Patterns

Demographic shifts, including population growth and an aging global population, directly impact energy demand. As of 2024, the world population is projected to reach over 8 billion, with a significant portion concentrated in urban areas. This urbanization trend, coupled with evolving lifestyles that often favor convenience and technology, drives higher overall energy consumption.

The increasing electrification of key sectors like transportation and heating is a major societal trend. For instance, by the end of 2023, global electric vehicle sales surpassed 13 million units, a substantial increase from previous years. This growing adoption of EVs, alongside the push for electric heating solutions, creates a robust and expanding demand for clean, renewable electricity, directly benefiting companies like Alterra Power (now part of Enel Green Power).

- Urbanization: Over 60% of the global population lived in urban areas by 2023, a figure expected to rise.

- EV Adoption: Global electric car sales are projected to reach over 17 million units in 2024.

- Lifestyle Changes: Increased reliance on digital services and connected devices contributes to higher electricity usage.

- Demand Growth: The electrification trend is expected to significantly boost demand for renewable energy sources in the coming decade.

Public perception and local acceptance are critical for renewable energy projects. Concerns about visual impact, noise, and safety, such as electromagnetic fields (EMFs) from power lines, can lead to project delays. For example, in 2024, several wind farm projects faced community opposition, highlighting the importance of transparent communication and community benefit initiatives. Companies like Falck Renewables are increasingly investing in local employment and community funds to foster positive relationships and ensure smoother project development by 2025.

Technological factors

Continuous innovation in wind turbine design, solar photovoltaic efficiency, and energy storage solutions directly impacts the performance, cost, and scalability of renewable projects. For instance, global solar PV module prices saw a significant drop of around 15-20% in 2023, making solar power increasingly competitive. Staying abreast of and investing in cutting-edge technologies, such as advancements in offshore wind turbine capacity reaching 15 MW and beyond, is crucial for maintaining a competitive edge in the evolving energy landscape.

Technological advancements in energy storage are pivotal for integrating renewables like wind and solar. Improved battery technologies, such as lithium-ion and emerging solid-state batteries, are becoming more efficient and cost-effective, making them essential for grid stability and managing the intermittency of renewable sources. For instance, by the end of 2023, global battery storage capacity reached over 150 GW, a significant increase from previous years, reflecting strong investment in this sector.

The integration of smart grid technologies, coupled with advancements in artificial intelligence and broader digitalization, is significantly boosting the efficiency, reliability, and overall management of renewable energy assets. This technological wave is crucial for companies like Falck Renewables to optimize their operations.

Predictive maintenance, powered by AI, allows for proactive identification of potential equipment failures, minimizing downtime. For instance, by 2024, the global AI in energy market was projected to reach over $10 billion, highlighting the substantial investment and adoption of these tools. Optimized plant operations and improved forecasting capabilities are direct results, leading to more stable energy output and better integration into the national grid.

Biomass and Waste-to-Energy Innovations

Advances in biomass processing and waste-to-energy conversion technologies are significantly enhancing the viability of these renewable sources. Innovations in areas like anaerobic digestion and gasification are improving efficiency and broadening the types of waste that can be utilized as feedstock. For example, the global waste-to-energy market was valued at approximately $30 billion in 2023 and is projected to grow substantially, driven by these technological leaps.

The integration of Carbon Capture Utilization and Storage (CCUS) with biomass and waste-to-energy facilities presents a crucial pathway to achieving near-zero or even negative emissions. These integrated systems can capture CO2 produced during the energy generation process, either storing it underground or utilizing it in industrial applications. This development is critical for meeting ambitious climate targets, with pilot projects demonstrating the technical feasibility of such combined approaches.

- Improved Feedstock Flexibility: New processing techniques allow for a wider range of organic waste, including agricultural residues and municipal solid waste, to be effectively converted into energy.

- Enhanced Conversion Efficiency: Technologies like advanced pyrolysis and supercritical water gasification are boosting the energy yield from biomass and waste materials.

- Reduced Environmental Footprint: CCUS integration with waste-to-energy plants offers a route to negative emissions, a key factor in climate change mitigation strategies.

- Market Growth Drivers: The global waste-to-energy market is expected to see a compound annual growth rate of over 5% through 2030, fueled by technological advancements and policy support.

Cybersecurity and Data Management

The increasing digitalization of renewable energy assets, like those managed by Falck Renewables, elevates cybersecurity concerns. As more systems become interconnected, the potential for cyberattacks on critical infrastructure grows, necessitating advanced data protection measures. For instance, the global cybersecurity market for operational technology in critical infrastructure was projected to reach over $20 billion by 2024, highlighting the significant investment required.

Ensuring the integrity and security of the vast amounts of data generated by renewable energy operations is crucial for Falck Renewables. This data underpins everything from performance monitoring to grid integration and predictive maintenance. A breach or data corruption could lead to significant operational disruptions, financial losses, and reputational damage, underscoring the need for robust data management frameworks.

- Cyber Threats: Renewable energy systems are increasingly targeted by sophisticated cyberattacks aiming to disrupt operations or steal sensitive data.

- Data Integrity: Maintaining accurate and secure operational data is vital for efficiency, compliance, and reliable energy delivery.

- Regulatory Compliance: Stricter regulations around data privacy and critical infrastructure protection are emerging globally, requiring significant investment in cybersecurity.

- Operational Continuity: Robust cybersecurity and data management are essential to prevent downtime and ensure the continuous operation of renewable energy facilities.

Technological advancements are reshaping the renewable energy sector, impacting everything from efficiency to grid integration. Innovations in solar PV and wind turbine technology continue to drive down costs and increase output. For instance, by early 2024, the levelized cost of electricity for new solar PV projects had fallen significantly, making it highly competitive. Energy storage solutions are also rapidly evolving, with battery costs decreasing and performance improving, crucial for managing the intermittent nature of renewables. By the end of 2023, global installed battery storage capacity had surpassed 150 GW, demonstrating substantial growth.

Digitalization and AI are enhancing operational efficiency and predictive maintenance in renewable assets. AI-powered analytics can optimize plant performance and forecast energy generation more accurately. The global AI in energy market was projected to exceed $10 billion by 2024, indicating strong adoption. Furthermore, advancements in waste-to-energy technologies, including improved feedstock flexibility and higher conversion efficiencies, are making these sources more viable. The waste-to-energy market was valued at approximately $30 billion in 2023, with technological innovation being a key growth driver.

| Technology Area | Key Advancement | Impact | 2023/2024 Data Point |

| Solar PV | Increased module efficiency | Lower cost per watt, greater energy density | Global solar PV module prices dropped 15-20% in 2023 |

| Wind Turbines | Larger capacity turbines (e.g., 15 MW+) | Higher energy capture, improved economics for offshore projects | Offshore wind turbine capacity continues to increase |

| Energy Storage | Improved battery chemistry and cost reduction | Enhanced grid stability, better renewable integration | Global battery storage capacity exceeded 150 GW by end of 2023 |

| AI & Digitalization | Predictive maintenance, optimized operations | Reduced downtime, increased asset lifespan, improved forecasting | Global AI in energy market projected over $10 billion by 2024 |

| Waste-to-Energy | Enhanced conversion efficiency, feedstock flexibility | Higher energy yield, broader waste utilization | Global waste-to-energy market valued at ~$30 billion in 2023 |

Legal factors

The regulatory landscape for energy, particularly concerning grid connection, power purchase agreements (PPAs), and market access, significantly shapes the operational viability of renewable energy firms like Falck Renewables. These frameworks dictate how clean energy is integrated and compensated, directly impacting revenue streams and project feasibility.

Shifts in energy market structures, moving between deregulation and re-regulation, present dynamic opportunities and challenges. For instance, the European Union's ongoing efforts to harmonize energy markets and promote renewables, as seen in the Renewable Energy Directive III targeting 42.5% renewable energy by 2030, create a more predictable environment for investment.

In 2024, the focus on energy security and independence, amplified by geopolitical events, is driving policy towards accelerating renewable deployment. This often translates into streamlined permitting processes and more favorable PPAs, though specific national implementations vary, with countries like Italy and Spain actively revising their auction mechanisms to attract more renewable capacity.

Falck Renewables, like all players in the renewable energy sector, operates under a stringent framework of environmental laws. These regulations, covering everything from greenhouse gas emissions to the protection of local biodiversity and how land can be used, mean that new projects require detailed environmental impact assessments and often lengthy, complex permitting procedures. For instance, in 2024, the European Union continued to refine its environmental standards, pushing for even lower emission thresholds in industrial activities, which directly impacts the siting and operational requirements of wind and solar farms.

Non-compliance with these environmental mandates can lead to significant disruptions. Companies can face substantial fines, project delays that inflate costs, and damage to their public image, which is particularly critical in an industry reliant on community acceptance and stakeholder trust. The permitting process itself can be a major hurdle; in 2025, several large-scale offshore wind projects across Europe faced extended timelines due to challenges in securing the necessary environmental permits, highlighting the critical need for proactive and meticulous environmental planning.

Falck Renewables, like all companies in the energy sector, must navigate a complex web of health and safety regulations. These rules are especially stringent for the construction and ongoing operation of renewable energy facilities, such as wind farms and solar plants, which often involve heavy machinery and working at heights. In 2024, for instance, the International Labour Organization (ILO) continued to emphasize the importance of robust occupational safety and health (OSH) frameworks, reporting that workplace accidents and diseases still cause millions of deaths annually worldwide, a figure that directly impacts companies like Falck Renewables.

Compliance with these national and international safety standards isn't just a legal obligation; it's fundamental to protecting the workforce and ensuring uninterrupted operations. Failure to adhere to regulations can lead to severe accidents, costly fines, reputational damage, and the potential loss of operational licenses. For example, strict adherence to guidelines like those set by the European Agency for Safety and Health at Work (EU-OSHA) is critical for maintaining Falck Renewables' social license to operate and its commitment to responsible business practices.

Contract Law and Power Purchase Agreements (PPAs)

Contract law, particularly concerning Power Purchase Agreements (PPAs), forms the bedrock of financial security for renewable energy ventures like those of Falck Renewables. These agreements dictate terms such as electricity pricing, duration, and performance obligations, directly impacting project revenue streams and investor confidence. Navigating the intricacies of PPA clauses, including force majeure and termination provisions, is critical for risk mitigation.

The legal landscape for PPAs is dynamic. For instance, in 2024, many European countries continued to refine their PPA frameworks to attract more investment. Specific legislative updates in markets where Falck Renewables operates, such as Italy and the UK, often address grid connection standards and subsidy mechanisms, which directly influence PPA viability. These legal frameworks are essential for ensuring long-term project financing and operational stability.

- PPA Stability: Long-term PPAs provide revenue certainty, crucial for securing project financing.

- Contractual Nuances: Understanding pricing, indexing, and force majeure clauses is vital for risk management.

- Regulatory Evolution: Changes in energy market regulations can significantly impact PPA terms and conditions.

- Market Trends: In 2024, the trend towards corporate PPAs continued, with companies seeking to lock in green energy prices.

International Trade Laws and Tariffs

International trade laws and tariffs significantly influence the cost and accessibility of essential components for renewable energy projects like those undertaken by Falck Renewables. For instance, tariffs imposed on imported solar panels or wind turbine parts can directly increase project expenses, potentially slowing down development. Companies operating with global supply chains, as many in the renewable sector do, must remain vigilant in monitoring evolving trade regulations and disputes to mitigate financial risks and ensure a steady supply of necessary equipment.

The landscape of international trade is dynamic, with potential impacts on Falck Renewables' operations. Consider these key areas:

- Tariff Volatility: Tariffs on critical components like solar cells and wind turbine blades can fluctuate based on geopolitical relations and trade policies. For example, in early 2024, ongoing discussions around potential tariffs on solar products from Southeast Asia highlighted the sensitivity of these supply chains.

- Trade Agreements and Regulations: Changes in international trade agreements, such as updates to free trade pacts or the introduction of new environmental standards impacting trade, can alter the cost-effectiveness of sourcing materials globally.

- Supply Chain Disruptions: Trade disputes or protectionist measures can lead to supply chain disruptions, impacting project timelines and increasing the cost of capital due to uncertainty.

Legal and regulatory frameworks are paramount for Falck Renewables, influencing everything from project development to revenue generation. The stability of Power Purchase Agreements (PPAs) is a cornerstone, providing revenue certainty and facilitating project financing, with a notable trend in 2024 towards longer-term corporate PPAs to lock in green energy prices.

Environmental laws, encompassing emissions, biodiversity, and land use, necessitate rigorous impact assessments and often lengthy permitting processes. In 2025, several large offshore wind projects in Europe faced delays due to environmental permit challenges, underscoring the critical need for meticulous planning in this area.

Health and safety regulations are also stringent, particularly for construction and operation. The International Labour Organization reported in 2024 that workplace accidents remain a significant global issue, making robust occupational safety and health frameworks essential for Falck Renewables to protect its workforce and maintain operational continuity.

International trade laws and tariffs directly impact the cost of components like solar panels and wind turbine parts. For example, early 2024 discussions around potential tariffs on solar products from Southeast Asia highlighted the vulnerability of these supply chains to geopolitical shifts.

Environmental factors

The intensifying focus on climate change is a major driver for global and national decarbonization targets, which in turn necessitates a significant expansion of renewable energy capacity. This environmental shift is fundamental to Falck Renewables' business, placing it at the forefront of providing solutions to meet these critical energy transition needs.

In 2023, global renewable energy capacity additions reached a record 510 gigawatts (GW), a 50% increase from 2022, according to the International Energy Agency (IEA). This surge highlights the direct market opportunity for companies like Falck Renewables as governments and industries accelerate their transition away from fossil fuels to meet net-zero commitments.

The availability and variability of wind, solar, and biomass feedstock are critical environmental factors for renewable energy companies like Falck Renewables. For instance, in 2024, global solar capacity additions are projected to reach a record 400 GW, highlighting the increasing reliance on solar resources, but this also underscores the need to manage intermittency.

Geographical diversification is essential to smooth out resource fluctuations. Falck Renewables' portfolio, spanning countries like Italy, Spain, and the UK, helps mitigate risks. In 2023, the company reported that its wind assets in Italy and Spain benefited from strong wind conditions, contributing to overall performance, while solar assets faced some variability due to cloud cover in certain regions.

Renewable energy projects, especially large solar and wind farms, require significant land, potentially impacting ecosystems and wildlife habitats. For instance, in 2024, the expansion of renewable infrastructure across Europe is increasingly scrutinized for its land footprint, with some projects facing delays due to biodiversity concerns.

Environmental impact assessments are critical, as demonstrated by the 2024 EU directive emphasizing rigorous ecological evaluations for all new energy projects. Careful site selection, prioritizing brownfield sites or areas with lower ecological value, alongside implementing mitigation strategies like wildlife corridors, are essential for sustainable development.

Waste Management and Circular Economy

The manufacturing and disposal of renewable energy components, like solar panels and wind turbine blades, present significant environmental challenges that demand robust waste management strategies and a commitment to circular economy principles. As the renewable energy sector expands, so does the volume of end-of-life equipment, necessitating innovative recycling solutions to mitigate landfill burden and resource depletion.

Companies within the sector are increasingly prioritizing sustainable product life cycles, focusing on design for disassembly and material recovery. For instance, by 2025, the global installed capacity of wind power is projected to reach over 1,000 GW, meaning a substantial increase in turbine blades requiring end-of-life management. Similarly, the solar industry is grappling with the disposal of millions of panels annually, with projections suggesting this number will grow significantly in the coming years.

- Recycling Initiatives: Efforts are underway to develop advanced recycling technologies for materials like silicon, glass, and rare earth metals found in solar panels and wind turbines.

- Circular Economy Models: Businesses are exploring business models that emphasize repair, refurbishment, and remanufacturing of renewable energy components to extend their lifespan and reduce waste.

- Policy and Regulation: Governments and industry bodies are establishing regulations and incentives to promote responsible waste management and the adoption of circular economy practices in the renewable energy sector.

- Material Innovation: Research into more sustainable and recyclable materials for renewable energy technologies is crucial to address future waste management challenges.

Water Scarcity and Usage

While many renewable energy sources like wind and solar photovoltaics are relatively water-efficient, certain technologies still present water-related challenges. For instance, concentrated solar power (CSP) plants, particularly those employing wet cooling systems, can have significant water demands, and some biomass facilities require water for feedstock processing and cooling. This is a crucial consideration for Falck Renewables as it evaluates new project locations.

Water scarcity is becoming a more pronounced environmental factor impacting project feasibility and design across the globe. Regions experiencing drought or high competition for water resources can pose significant hurdles for renewable energy developments. For example, the International Energy Agency (IEA) reported in its 2024 outlook that water stress affects over two-thirds of global thermal power generation capacity, a figure that can extend to water-intensive renewables.

Falck Renewables must therefore integrate water management strategies into its project planning and operations. This includes:

- Assessing regional water availability and stress levels during site selection for new renewable energy projects.

- Prioritizing water-efficient technologies where feasible, such as dry-cooled CSP systems or solar PV.

- Implementing water conservation measures and exploring water recycling opportunities in existing and new facilities.

- Monitoring water usage and environmental impact to ensure compliance with regulations and best practices.

The increasing global emphasis on climate change and decarbonization directly fuels the demand for renewable energy, creating a significant market opportunity for Falck Renewables. Record renewable capacity additions, like the 510 GW added globally in 2023, underscore this trend. However, the intermittency of resources such as wind and solar, as highlighted by the projected 400 GW of solar capacity additions in 2024, necessitates careful management and geographical diversification to ensure consistent energy supply.

PESTLE Analysis Data Sources

Our Falck Renewables PESTLE Analysis is grounded in comprehensive data from official government publications, leading industry associations, and reputable market research firms. We meticulously gather information on energy policies, economic forecasts, technological advancements, and societal trends to ensure a robust and accurate assessment.