Falck Renewables Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Falck Renewables Bundle

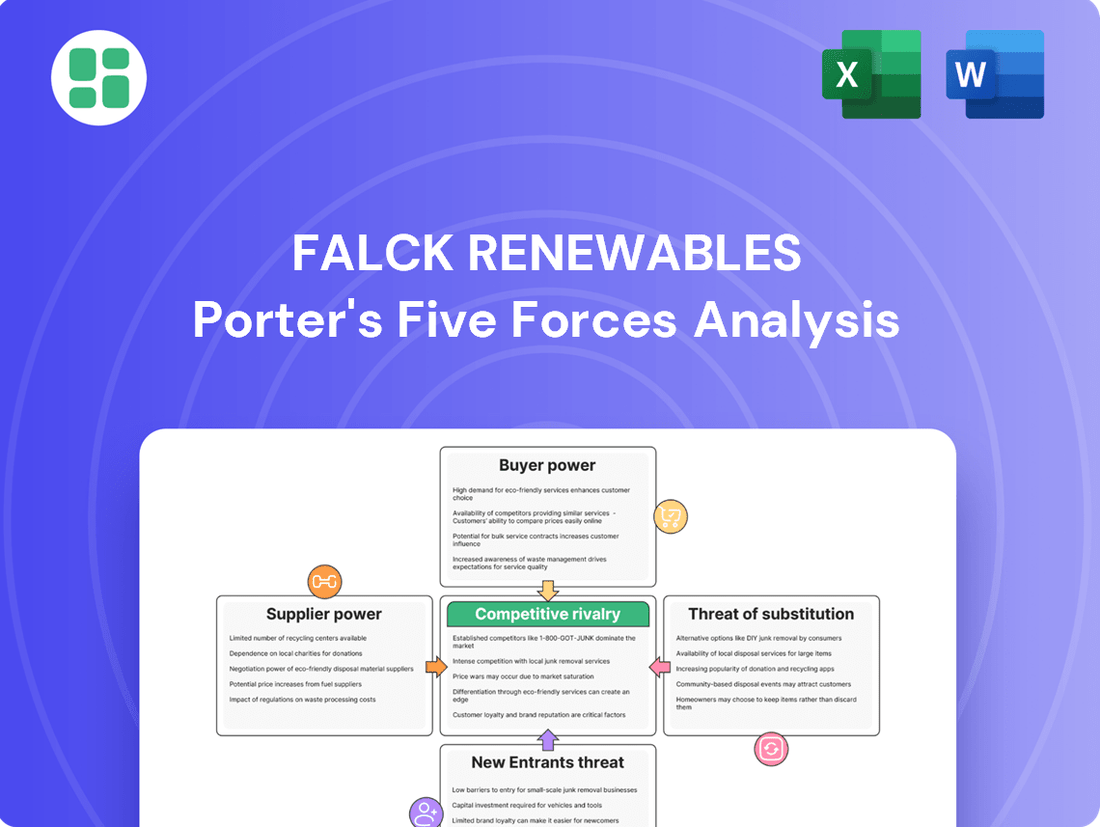

Falck Renewables operates in a dynamic sector where intense competition and evolving regulations significantly shape its landscape. Understanding the interplay of buyer power, supplier leverage, and the threat of new entrants is crucial for navigating this market. The full Porter's Five Forces Analysis delves into these critical dynamics, offering a comprehensive view of the forces impacting Falck Renewables's strategic positioning and profitability.

The complete report reveals the real forces shaping Falck Renewables’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The renewable energy sector, encompassing wind, solar, and biomass, grapples with ongoing supply chain disruptions. Shortages of essential materials such as polysilicon for solar panels and rare earth metals crucial for wind turbine magnets directly inflate input costs and cause delays for independent power producers.

This vulnerability is exacerbated by the concentrated manufacturing of key components, particularly solar photovoltaic (PV) modules, which are heavily reliant on production facilities in China. This concentration grants significant leverage to these suppliers, impacting pricing and availability for companies like Falck Renewables.

Suppliers of critical, large-scale equipment like wind turbines and solar inverters wield considerable bargaining power. This stems from the substantial capital expenditure and specialized knowledge necessary to produce these advanced systems. For instance, Vestas, a leading wind turbine manufacturer, reported a revenue of €15.4 billion in 2023, highlighting the scale and financial clout of such suppliers.

The reliance on a limited number of manufacturers capable of delivering cutting-edge technology, such as those innovating with advanced materials for larger, more efficient wind turbines, further concentrates this power. These specialized providers can leverage their technological advantage to negotiate favorable terms.

The burgeoning global demand for renewable energy, with the International Energy Agency projecting a 50% increase in renewable capacity by 2028, empowers these suppliers. They can often command premium pricing and dictate contract conditions due to the indispensable nature of their products for project realization, impacting companies like Falck Renewables.

Specialized engineering, procurement, and construction (EPC) contractors are crucial for the development and construction of renewable energy facilities. Their expertise is indispensable, making them a significant force in the industry.

Labor shortages, especially for skilled professionals in the renewable energy field, are a growing concern. In 2024, reports indicated a persistent gap in qualified personnel, which can lead to project delays and escalated construction expenses for companies like Falck Renewables.

This scarcity of skilled labor creates a bottleneck, amplifying the bargaining power of the limited number of experienced EPC providers. Consequently, these specialized contractors can command higher prices and more favorable contract terms, directly impacting project costs and timelines.

Financiers and Investors

Financiers and investors hold considerable bargaining power as they supply the essential capital for large-scale renewable energy ventures. The significant investment required for projects like those undertaken by companies in the renewable sector means that securing funding from financial institutions and private equity is paramount. Global investment in renewable energy projects reached approximately $510 billion in 2023, highlighting the scale of capital needed.

The terms and availability of this capital are directly influenced by the financial markets. Factors such as prevailing interest rates and overall investor sentiment can significantly impact the cost of financing and, consequently, the viability of new renewable energy developments. For instance, a rise in interest rates can make borrowing more expensive, directly affecting the profitability of a project.

- Access to Capital: Financial institutions and investors are critical suppliers of funding for renewable energy projects.

- Investment Scale: The substantial capital needs of large-scale renewable projects amplify the power of financiers.

- Market Sensitivity: Fluctuations in interest rates and investor confidence directly influence the cost and availability of project finance.

- Global Investment Trends: Over $510 billion was invested globally in renewable energy projects in 2023, underscoring the importance of these capital providers.

Land and Resource Owners

For onshore wind and solar projects, the availability and cost of suitable land are critical. This gives landowners a degree of bargaining power, particularly in regions with high demand or unique geographical benefits. For instance, in 2024, land lease rates for new solar farms in prime locations could range from $500 to $1,500 per acre annually, depending on the region and lease terms.

For biomass and waste-to-energy facilities, a consistent and high-quality feedstock supply is paramount. This means suppliers of biomass fuel or waste streams can wield influence over pricing and contract terms. The fluctuating price of agricultural byproducts, a common feedstock, can significantly impact operational costs, with prices for certain biomass materials seeing increases of up to 15% in early 2024 compared to the previous year.

- Land Availability: High demand for renewable energy sites can concentrate land ownership, increasing landowner leverage.

- Geographical Advantages: Specific locations offering optimal wind speeds or solar irradiance command higher land lease values.

- Feedstock Consistency: Reliable and quality biomass or waste suppliers can negotiate more favorable terms due to the essential nature of their product.

- Market Volatility: Fluctuations in commodity prices for feedstocks directly impact the bargaining power of their suppliers.

Suppliers of critical components like solar panels and wind turbine parts hold substantial power due to concentrated manufacturing and high capital requirements for production. This is evident as Vestas, a major wind turbine manufacturer, reported €15.4 billion in revenue for 2023, showcasing their market influence.

The global surge in demand for renewables, projected by the IEA to increase capacity by 50% by 2028, further strengthens supplier leverage. They can often dictate terms and pricing for essential technologies, impacting companies like Falck Renewables.

Skilled labor shortages in 2024 for roles like EPC contractors amplify the bargaining power of experienced providers. This scarcity can lead to project delays and increased costs, as these specialists can command higher rates and more favorable contract conditions.

| Supplier Category | Key Factors Influencing Bargaining Power | Example/Data Point (2023-2024) |

| Component Manufacturers (e.g., Solar PV, Wind Turbines) | Concentrated production, high capital costs, technological specialization | Vestas revenue: €15.4 billion (2023) |

| Specialized EPC Contractors | Scarcity of skilled labor, project complexity | Persistent skilled personnel gap reported in 2024 |

| Landowners | High demand for sites, geographical advantages | Land lease rates for solar farms: $500-$1,500/acre annually (2024) |

| Feedstock Suppliers (e.g., Biomass) | Consistency and quality of supply, commodity price volatility | Biomass material price increases up to 15% in early 2024 |

What is included in the product

This analysis dissects the competitive forces impacting Falck Renewables, examining the threat of new entrants, the power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes within the renewable energy sector.

Understand competitive intensity with a visual breakdown of threats and opportunities across all five forces, enabling proactive strategy adjustments for Falck Renewables.

Customers Bargaining Power

Major utilities are key customers for independent power producers (IPPs) like Falck Renewables, typically buying electricity via long-term Power Purchase Agreements (PPAs). While utilities are substantial purchasers, the rising competition among renewable energy providers grants them negotiation power for reduced PPA rates. For instance, in 2024, the average PPA price for solar projects in Europe saw a slight decrease compared to previous years due to increased supply.

Corporate and industrial consumers hold significant bargaining power, especially when they aggregate their demand through Power Purchase Agreements (PPAs). Large corporations, driven by decarbonization mandates and the need for energy price stability, can leverage their purchasing volume to negotiate favorable terms. In 2023, the PPA market saw substantial growth, with corporate PPAs representing a significant portion of new renewable energy capacity additions globally, indicating their strong influence in shaping market conditions.

Governments and municipal bodies are significant customers for renewable energy, particularly in waste-to-energy projects crucial for urban waste management. Their substantial purchasing power, however, is often channeled through regulated and competitive procurement processes like auctions, which can temper the bargaining leverage of individual Independent Power Producers (IPPs).

Distributed Generation and Grid Interconnection

The rise of distributed generation, where energy is produced closer to the point of consumption, significantly impacts the bargaining power of customers. As more individuals and businesses adopt rooftop solar or community energy projects, they become less reliant on traditional utility-scale providers like Alterra Power, potentially reducing the latter's customer base and pricing leverage.

Grid operators and transmission companies also wield influence. Their control over interconnection processes and adherence to complex regulatory frameworks can create hurdles for renewable energy producers seeking to sell power. This intermediary power means that even if end-consumers want renewable energy, the grid infrastructure and its gatekeepers can shape the terms of sale.

- Interconnection Costs: The cost to connect distributed generation to the grid can be substantial, influencing the economic viability for producers and thus their negotiating position.

- Grid Stability Concerns: Grid operators may impose strict requirements on renewable energy sources to maintain grid stability, potentially limiting their output or dictating operational parameters.

- Regulatory Landscape: Evolving regulations around net metering, feed-in tariffs, and grid access create uncertainty and can shift bargaining power between generators and grid entities.

Commodity Nature of Electricity

The commodity nature of electricity means customers often prioritize price when choosing a supplier, putting pressure on Independent Power Producers (IPPs) like Falck Renewables to remain cost-competitive. In 2024, the average wholesale electricity price in Europe fluctuated significantly, but the underlying commodity aspect remained a key driver for many industrial and commercial buyers.

However, the growing demand for certified green energy offers a crucial avenue for differentiation. Customers are increasingly willing to pay a premium for renewable attributes, allowing companies that can reliably supply and certify such energy to mitigate some of the price-based bargaining power.

- Commodity Pricing Pressure: Electricity's largely undifferentiated status forces suppliers to compete heavily on price.

- Green Energy Premium: Demand for certified renewable energy allows for price differentiation, lessening pure commodity pressure.

- Customer Choice: Without green certification, customers have significant leverage to switch based on cost alone.

- Market Trends: By 2024, the market saw a clear split between price-sensitive buyers and those willing to pay more for sustainable energy sources.

Major utilities and large corporations, through their substantial purchasing power and demand for stable energy prices, exert considerable influence over renewable energy providers like Falck Renewables. This leverage is evident in the increasing prevalence of corporate Power Purchase Agreements (PPAs) in 2023, which accounted for a significant portion of new renewable capacity. While the commodity nature of electricity in 2024 continued to drive price-sensitive negotiations, the growing demand for certified green energy offers a counter-balance, allowing some providers to command a premium.

| Customer Segment | Bargaining Power Drivers | Impact on Falck Renewables | 2023/2024 Data Point |

|---|---|---|---|

| Utilities | Large purchase volumes, competition among IPPs | Pressure on PPA rates | Average European solar PPA prices saw slight decreases in 2024 due to increased supply. |

| Corporates/Industrials | Aggregated demand, decarbonization goals, price stability needs | Negotiation leverage for favorable PPA terms | Corporate PPAs formed a substantial part of global renewable additions in 2023. |

| Government/Municipal | Procurement processes (e.g., auctions), waste management needs | Can temper individual IPP leverage through structured processes | Auctions remain a primary mechanism for securing renewable energy contracts in many European nations. |

Same Document Delivered

Falck Renewables Porter's Five Forces Analysis

This preview showcases the comprehensive Falck Renewables Porter's Five Forces Analysis, detailing the competitive landscape of the renewable energy sector. You're viewing the exact, professionally formatted document you'll receive instantly upon purchase, providing actionable insights into industry rivalry, buyer and supplier power, the threat of new entrants, and substitute products. This is the complete, ready-to-use analysis file; what you're previewing is precisely what you get, ensuring no surprises and immediate utility for your strategic planning.

Rivalry Among Competitors

The renewable energy sector, especially solar and wind, is booming. In 2024, global investment in clean energy is projected to exceed $2 trillion, a significant jump from previous years, fueling massive capacity additions. This surge attracts a multitude of independent power producers (IPPs) worldwide, making the market highly fragmented with countless participants.

This intense fragmentation, despite the overall market growth, heightens competition. Companies are vying fiercely for prime development sites, crucial grid connection agreements, and favorable power purchase agreements (PPAs). For instance, in 2023, the average PPA price for new solar projects in Europe saw a slight decrease due to this increased competition, indicating the pressure on developers.

The renewable energy sector, particularly solar and wind power, is experiencing intense rivalry driven by cost competitiveness. In 2024, the levelized cost of electricity (LCOE) for new solar and wind installations is often lower than that of new fossil fuel plants, putting significant pressure on independent power producers (IPPs) like Falck Renewables to maintain efficiency across all project phases.

This cost pressure necessitates continuous optimization in project development, construction, and ongoing operations. Companies must innovate to reduce capital expenditures and improve operational performance to remain competitive in this dynamic market.

Further intensifying this rivalry are rapid technological advancements. Improvements in solar panel efficiency and wind turbine design are consistently lowering LCOE, creating a perpetual need for companies to adopt and integrate the latest technologies to stay ahead of competitors.

Government policies, incentives, and renewable energy targets are major drivers of competition in the renewable energy sector. For instance, the European Union’s Renewable Energy Directive sets ambitious goals, pushing countries to increase their renewable energy share, which in turn fuels investment and competition among developers like Falck Renewables. These policy frameworks can create significant opportunities but also intensify the race for government support and favorable regulatory conditions.

Shifts in policy, such as the introduction or phasing out of feed-in tariffs or specific tax credits, can dramatically alter competitive advantages. For example, a change in a nation's solar panel import tariffs could immediately benefit domestic manufacturers and developers who rely less on imported components, potentially impacting Falck Renewables' cost structure and regional competitiveness. These policy dynamics necessitate constant adaptation and strategic positioning.

Access to Capital and Project Development Expertise

Developing large-scale renewable energy projects is a capital-intensive endeavor, demanding substantial financial resources and specialized knowledge in areas like site selection, navigating complex permitting processes, securing financing, and managing construction. Companies possessing robust financial backing and a history of successful project execution, such as Alterra Power, which evolved from Falck Renewables' operations, inherently hold a competitive edge in this arena.

The competitive landscape is also being reshaped by the emergence of smaller, agile developers and innovative startups. These newer entrants are contributing to an overall intensification of rivalry, challenging established players and bringing fresh approaches to project development. This dynamic suggests that while deep pockets and experience are valuable, market access and innovation are increasingly important differentiators.

- Capital Intensity: Large renewable projects can require hundreds of millions of dollars in upfront investment.

- Expertise Requirements: Success hinges on specialized skills in engineering, environmental assessment, and regulatory compliance.

- Established Player Advantage: Companies with a proven track record and strong financial relationships, like Alterra Power, benefit from easier capital access.

- Emerging Competition: The rise of smaller developers and startups introduces new competitive pressures and innovation.

Mergers, Acquisitions, and Consolidation

The renewable energy landscape is characterized by significant consolidation, driven by companies aiming to bolster their project pipelines and operational efficiencies. This trend is evident in the numerous mergers and acquisitions (M&A) that reshape the competitive environment. For instance, in 2024, the renewable energy sector continued to witness substantial M&A activity, with deal volumes remaining robust, reflecting a strategic push for scale.

Falck Renewables' transformation into Alterra Power exemplifies this industry-wide consolidation. Such strategic moves allow companies to gain a stronger market position, enhance technological capabilities, and achieve greater cost competitiveness. By integrating operations and expanding geographical reach, these consolidated entities often emerge as more formidable competitors, capable of undertaking larger-scale projects and influencing market dynamics more significantly.

- Increased Scale: Consolidation leads to larger entities with greater capacity to develop and manage renewable energy projects.

- Economies of Scale: Mergers can unlock cost savings through shared resources, optimized operations, and improved purchasing power.

- Market Power: A smaller number of larger players can exert more influence on pricing and project development within specific markets.

- Falck Renewables to Alterra Power: This rebranding signifies a strategic consolidation and repositioning within the sector.

The renewable energy sector, particularly solar and wind, is experiencing intense rivalry driven by cost competitiveness. In 2024, the levelized cost of electricity (LCOE) for new solar and wind installations is often lower than that of new fossil fuel plants, putting significant pressure on independent power producers (IPPs) like Falck Renewables to maintain efficiency across all project phases.

This cost pressure necessitates continuous optimization in project development, construction, and ongoing operations. Companies must innovate to reduce capital expenditures and improve operational performance to remain competitive in this dynamic market. Further intensifying this rivalry are rapid technological advancements, with improvements in solar panel efficiency and wind turbine design consistently lowering LCOE.

The competitive landscape is also being reshaped by the emergence of smaller, agile developers and innovative startups, contributing to an overall intensification of rivalry. Falck Renewables' transformation into Alterra Power exemplifies industry-wide consolidation, driven by companies aiming to bolster project pipelines and operational efficiencies, with robust M&A activity continuing in 2024.

Government policies, incentives, and renewable energy targets are major drivers of competition, pushing countries to increase their renewable energy share, which fuels investment and competition among developers. Shifts in policy, such as changes in feed-in tariffs or tax credits, can dramatically alter competitive advantages and necessitate constant adaptation.

| Metric | 2023 (Est.) | 2024 (Proj.) | Impact on Rivalry |

|---|---|---|---|

| Global Clean Energy Investment | ~$1.8 Trillion | > $2 Trillion | Increased new entrants and project development. |

| LCOE for Solar PV (New Utility Scale) | ~$35-45/MWh | ~$30-40/MWh | Heightened pressure on operational efficiency and cost management. |

| M&A Deal Volume in Renewables | High | Robust | Consolidation creates larger, more dominant competitors. |

SSubstitutes Threaten

The primary threat of substitutes for renewable electricity, like that generated by Falck Renewables, comes from fossil fuel-based power generation, including coal, natural gas, and oil. These traditional sources have historically offered a reliable baseload power supply, crucial for grid stability, particularly in regions with significant renewable intermittency challenges. For instance, in 2024, natural gas still accounted for a substantial portion of global electricity generation, providing a readily available alternative.

Nuclear power stands as a significant substitute for renewable energy sources like those Falck Renewables develops, offering consistent, low-carbon baseload electricity. While the upfront costs and lengthy construction timelines for new nuclear facilities, such as the Hinkley Point C project in the UK which has seen its budget increase significantly, can be substantial, its ability to provide reliable power regardless of weather conditions makes it attractive for energy security and decarbonization goals.

Large-scale hydropower presents a significant threat of substitution for renewable energy companies like Falck Renewables in certain markets. In regions with abundant water resources and existing infrastructure, hydropower is a mature and dependable source of clean electricity. For instance, as of 2023, hydropower accounted for approximately 15% of global electricity generation, demonstrating its established presence.

However, the expansion of new large-scale hydropower projects faces considerable hurdles in many developed economies. Geographical limitations, such as the availability of suitable river systems, and growing environmental concerns, including impacts on ecosystems and displacement of communities, restrict its growth potential.

Despite these limitations, hydropower remains a crucial component of the global renewable energy mix. Its reliability and established nature make it a competitive alternative, especially in areas where solar and wind power might face intermittency challenges or require significant grid upgrades.

Energy Efficiency and Demand-Side Management

Investments in energy efficiency and demand-side management technologies present a significant threat of substitutes for new power generation, including renewables. These initiatives can curtail the overall demand for electricity, thereby diminishing the market need for new power plants. For instance, smart grid technologies and improved building insulation reduce consumption, directly impacting the volume of electricity that needs to be supplied.

This substitution effect means that even as renewable energy capacity grows, the underlying demand it serves might be shrinking. By optimizing energy usage, consumers and businesses effectively reduce their reliance on traditional and new energy sources alike. This trend is supported by increasing adoption rates of energy-saving appliances and smart home systems, which collectively lower the overall energy footprint.

Data from 2024 highlights this trend. For example, the International Energy Agency (IEA) reported that energy efficiency measures saved the equivalent of global electricity demand from China in 2023, a trend projected to continue. This translates to a reduced need for new generation capacity, impacting all energy providers, including those in the renewable sector like Falck Renewables, by lessening the overall market size for new electricity supply.

- Reduced Demand: Energy efficiency and demand-side management directly lower the need for electricity, acting as a substitute for new power production.

- Market Shrinkage: This trend can decrease the overall market size for new power plants, including renewable energy projects.

- Technological Advancement: Investments in smart grids, efficient appliances, and building retrofits are key drivers of this substitution threat.

- IEA Data: The IEA noted that energy efficiency measures saved global electricity demand equivalent to China's in 2023, indicating a substantial impact on the energy supply market.

Emerging Energy Technologies

Emerging energy technologies represent a significant future threat of substitutes for companies like Falck Renewables. Innovations in advanced geothermal, wave, and tidal power are progressing, and while not yet broadly commercialized, they offer alternative decarbonization routes. For instance, the global wave energy market was valued at approximately USD 300 million in 2023 and is projected to grow substantially, indicating its potential as a future substitute.

Green hydrogen, particularly when used directly as fuel rather than solely for electricity generation, also poses a long-term threat. The European Union's hydrogen strategy aims for 40 GW of electrolyzers by 2030, signaling a significant push towards this alternative energy carrier. This development could divert investment and market share from traditional renewable electricity sources.

- Advanced Geothermal: Potential to provide baseload renewable power, reducing reliance on intermittent sources.

- Wave and Tidal Energy: Harnessing ocean power offers predictable and consistent energy generation.

- Green Hydrogen: Direct use as fuel in transportation and industry bypasses electricity generation entirely.

- Market Growth: The global wave energy market is expected to see significant expansion, highlighting the increasing viability of these substitutes.

The threat of substitutes for renewable electricity, like that from Falck Renewables, is multifaceted. Fossil fuels remain a primary substitute, with natural gas continuing to play a significant role in global electricity generation as of 2024, ensuring grid stability. Nuclear power also offers a consistent, low-carbon baseload alternative, despite high upfront costs and lengthy development cycles for new projects.

Large-scale hydropower, a mature renewable source, accounted for about 15% of global electricity generation in 2023, presenting a competitive alternative where geographically feasible. However, its expansion is often limited by environmental concerns and site availability. Energy efficiency measures and demand-side management are also potent substitutes, reducing overall electricity demand and thus the market for new generation capacity. The IEA reported that energy efficiency saved electricity demand equivalent to China's in 2023, underscoring its impact.

Emerging technologies like advanced geothermal, wave, and tidal power, alongside green hydrogen used directly as fuel, represent future substitution threats. The global wave energy market, valued around USD 300 million in 2023, is poised for substantial growth, indicating its increasing viability as an alternative energy solution.

| Substitute Type | Key Characteristics | 2023/2024 Relevance | Potential Impact |

|---|---|---|---|

| Fossil Fuels (Natural Gas) | Baseload power, established infrastructure | Significant portion of global generation in 2024 | Continued competition for baseload demand |

| Nuclear Power | Low-carbon baseload, high upfront cost | Ongoing development of new projects (e.g., Hinkley Point C budget increases) | Provides reliable, consistent power alternative |

| Hydropower | Mature renewable, reliable | ~15% of global generation (2023) | Established competitor, limited growth potential in some regions |

| Energy Efficiency/Demand Management | Reduces overall electricity need | IEA: Saved China's 2023 electricity demand equivalent | Shrinks market for new generation capacity |

| Emerging Technologies (Wave, Hydrogen) | Innovative, potential for decarbonization | Wave market ~USD 300 million (2023), EU hydrogen strategy targets | Future competition, diversification of energy sources |

Entrants Threaten

The renewable energy sector, particularly for utility-scale wind, solar, biomass, and waste-to-energy projects, demands significant upfront capital. For instance, a single large offshore wind farm can easily cost billions of dollars to develop and construct. This immense financial commitment acts as a formidable barrier, deterring many potential new competitors from entering the market.

Securing the necessary financing for these multi-million or even billion-dollar ventures is a complex and challenging process. Lenders and investors often require a proven track record and substantial collateral, making it difficult for new, unestablished companies to gain access to the required capital. This financial hurdle effectively limits the number of new entrants capable of competing with established players like Falck Renewables.

The complex regulatory and permitting landscape presents a substantial hurdle for new entrants in the renewable energy sector. Navigating intricate environmental regulations, securing necessary permits, and managing grid interconnection procedures are often lengthy, expensive, and demand specialized legal and technical knowledge. For instance, in 2024, the average time to obtain all permits for a new solar farm in the United States could extend over 18 months, with associated costs frequently reaching hundreds of thousands of dollars, effectively deterring smaller or less capitalized new players.

New companies looking to enter the renewable energy sector, like Falck Renewables, face significant challenges in securing access to essential grid infrastructure. This involves navigating complex regulations and often lengthy processes to connect their generation facilities to the national transmission network. For instance, in 2024, the average time for grid connection approval in many European countries remained over 18 months, a substantial barrier for new players.

Furthermore, establishing reliable off-take agreements, typically through Power Purchase Agreements (PPAs), is critical for revenue certainty. Established players, like Falck Renewables, have built strong relationships with utilities and corporate buyers over years, giving them an advantage in negotiating favorable terms. In 2024, the PPA market saw increased competition, with corporate demand for renewable energy rising, but securing these contracts still requires a proven track record and significant scale.

Technological Expertise and Project Development Experience

The renewable energy sector requires significant technological expertise and a proven track record in project development. Newcomers often struggle to match the established players' in-depth knowledge of designing, constructing, and operating complex renewable energy facilities. For instance, as of early 2024, the global average cost for utility-scale solar PV projects remained substantial, requiring efficient capital deployment and execution capabilities that new entrants might not possess.

Developing and managing intricate renewable energy projects demands specialized teams and extensive experience. Without this, new entrants face higher risks of delays, cost overruns, and operational inefficiencies. Falck Renewables, for example, has a history of successfully managing large-scale wind and solar farms, a critical differentiator in a market where reliable performance is paramount.

Key challenges for new entrants include:

- Acquiring specialized engineering and operational talent.

- Securing financing for capital-intensive projects.

- Navigating complex regulatory and permitting processes.

- Demonstrating a reliable project execution history.

Intensifying Competition for Resources and Sites

The renewable energy sector is experiencing a boom, leading to a fierce competition for the best locations. This means prime spots with excellent wind speeds or solar irradiation are becoming scarce, driving up acquisition costs. For instance, in 2024, the global installed capacity for solar PV alone reached over 1,500 GW, a significant jump that highlights the demand for suitable land.

This intense competition for optimal sites and resources, including biomass and waste feedstock, presents a substantial barrier for new entrants. New companies find it increasingly difficult and costly to secure the necessary land and materials to establish a competitive presence. The scarcity of ideal development areas directly translates to higher upfront investment and a longer time-to-market for emerging players.

- Scarcity of Prime Locations: High demand for land with optimal wind, solar, or biomass resources.

- Increased Acquisition Costs: Competition drives up the price of desirable development sites.

- Feedstock Competition: New entrants face challenges securing consistent and cost-effective biomass or waste materials.

- Barrier to Entry: The difficulty in accessing resources makes it harder for new companies to establish themselves.

The threat of new entrants in the renewable energy sector, impacting companies like Falck Renewables, is generally considered moderate to low. This is primarily due to the substantial capital requirements, complex regulatory environments, and the need for specialized expertise. For instance, in 2024, the average cost to develop a utility-scale solar project could range from $1 million to $1.5 million per megawatt, a significant investment for newcomers.

New entrants face considerable challenges in securing financing and navigating intricate permitting processes, which can take over 18 months in many regions as of 2024. Furthermore, establishing reliable Power Purchase Agreements (PPAs) requires a proven track record, which startups typically lack. The scarcity of prime development locations and the intense competition for resources further elevate the barriers to entry.

| Barrier to Entry | Description | Impact on New Entrants (2024) |

|---|---|---|

| Capital Requirements | High upfront investment for project development and construction. | Significant hurdle; utility-scale projects can cost hundreds of millions to billions. |

| Regulatory & Permitting | Complex and lengthy approval processes. | Average 18+ months for permits; high legal and technical costs. |

| Grid Access | Securing connection to transmission networks. | Average 18+ months for approval in many European countries. |

| Off-take Agreements (PPAs) | Need for long-term revenue certainty. | Requires proven track record and scale; corporate demand is high but contracts are competitive. |

| Site & Resource Availability | Competition for prime locations and feedstock. | Scarcity of ideal sites drives up acquisition costs; feedstock competition for biomass/waste. |

Porter's Five Forces Analysis Data Sources

Our Falck Renewables Porter's Five Forces analysis is built upon a foundation of verified data, including the company's annual reports, industry-specific publications from renewable energy associations, and relevant regulatory filings from governmental bodies overseeing the sector.