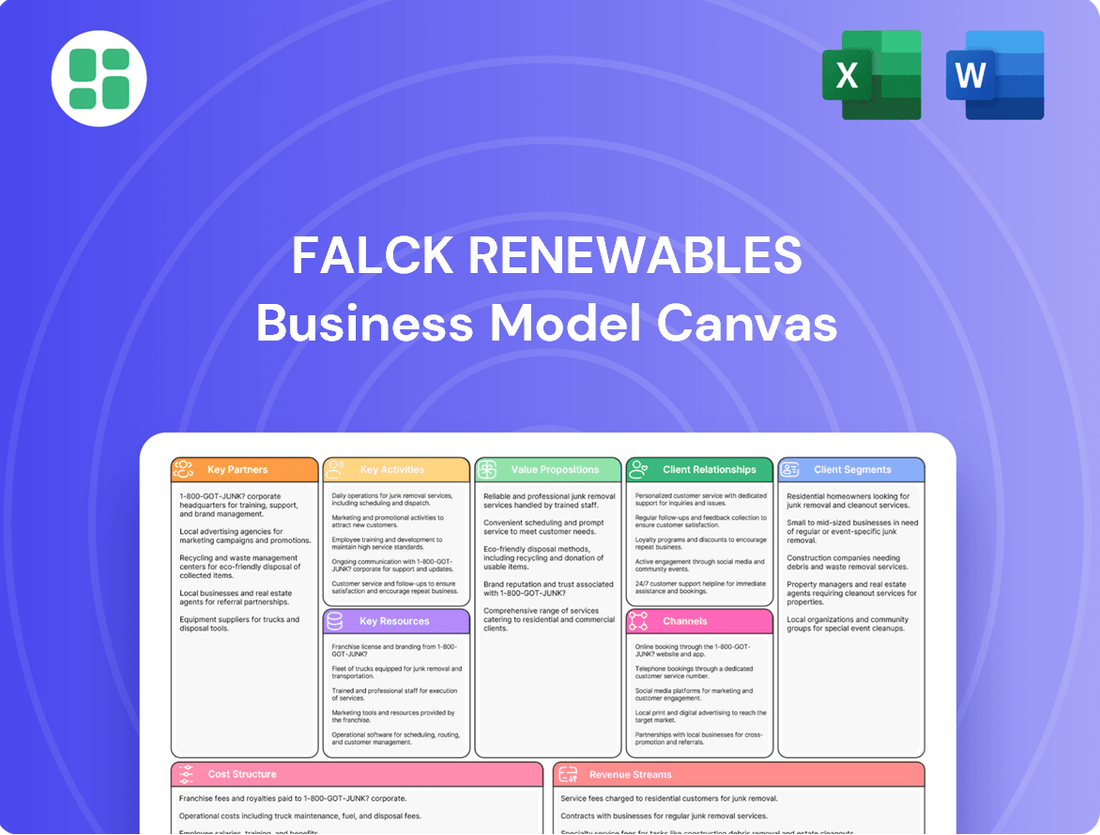

Falck Renewables Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Falck Renewables Bundle

Discover the strategic core of Falck Renewables's success with our comprehensive Business Model Canvas. This detailed analysis unpacks their approach to renewable energy generation, highlighting key partnerships and value propositions. Ready to understand how they dominate the market?

Unlock the full strategic blueprint behind Falck Renewables's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Alterra Power, formerly Falck Renewables, actively collaborates with top-tier technology providers to integrate advanced wind turbines, high-efficiency solar panels, and sophisticated biomass conversion systems into its projects. This strategic alignment ensures the company utilizes the most current, dependable, and productive equipment available for renewable energy generation, a critical factor in maintaining competitive operational performance.

These crucial alliances with manufacturers are instrumental in securing customized equipment solutions tailored to specific project needs and achieving significant cost reductions through bulk purchasing agreements. For instance, in 2024, the global renewable energy sector saw significant investment in next-generation solar PV technology, with module efficiencies reaching over 23%, a trend Alterra Power leverages through its supplier relationships.

Falck Renewables relies heavily on financial institutions and investors to secure the substantial capital needed for its renewable energy projects. These partnerships are the bedrock of project financing, providing essential debt and equity investments.

Key partners include major banks, forward-thinking private equity firms, and specialized climate investment funds. For instance, Alterra, managing a significant $30 billion fund dedicated to climate investments, exemplifies the caliber of partners essential for backing large-scale initiatives like Absolute Energy's solar and battery projects in Italy.

Falck Renewables relies heavily on Engineering, Procurement, and Construction (EPC) contractors to bring its renewable energy projects to life. These specialized firms are crucial for the physical development, handling everything from initial design to the final handover of wind, solar, biomass, and waste-to-energy facilities.

Partnering with experienced EPC contractors ensures that projects are designed efficiently, materials are procured on time, and construction meets high-quality standards. For instance, in 2024, the global renewable energy sector saw significant investment, with EPC firms playing a vital role in delivering complex projects, often managing budgets in the hundreds of millions of dollars for large-scale developments.

These collaborations are fundamental to successful project execution and effective risk management. By leveraging the expertise of established EPC partners, Falck Renewables can mitigate construction-related risks and ensure projects are completed within budget and schedule, a critical factor in the competitive renewable energy landscape.

Local Communities and Landowners

Falck Renewables prioritizes robust engagement with local communities and landowners. This is absolutely crucial for securing suitable land for renewable energy projects, navigating the complex permitting processes, and maintaining the essential social license to operate. By fostering strong, trust-based relationships through open communication and offering tangible community benefits, Falck ensures a more streamlined project development phase and fosters long-term operational stability and goodwill.

These partnerships are vital for project success, as evidenced by the fact that community acceptance can significantly impact the timeline and cost of renewable energy developments. For instance, in 2024, projects with strong community backing often experienced fewer delays in permitting and construction compared to those facing local opposition. Falck's commitment to these relationships translates into smoother operations and a more sustainable business model.

- Site Acquisition: Local communities and landowners are the gatekeepers to land necessary for wind farms, solar parks, and other renewable infrastructure.

- Permitting Support: Positive community sentiment can expedite the often lengthy and intricate permitting and approval processes.

- Social License to Operate: Maintaining good relations ensures ongoing acceptance and minimizes potential disruptions during the operational life of a project.

- Community Benefits: Offering direct benefits, such as local job creation, revenue sharing, or community investment funds, strengthens these vital partnerships.

Government Bodies and Regulatory Agencies

Falck Renewables actively partners with government bodies and regulatory agencies to secure necessary permits and ensure compliance with environmental standards. These collaborations are crucial for navigating complex policy landscapes and obtaining approvals for new renewable energy projects.

Leveraging government incentives and tax credits is a key aspect of these partnerships, significantly driving the financial viability and development of renewable energy initiatives. For instance, in 2024, many countries continued to offer production tax credits (PTCs) and investment tax credits (ITCs) that directly supported renewable energy deployment.

- Permitting and Compliance: Essential for obtaining project approvals and adhering to environmental regulations.

- Policy Navigation: Facilitates understanding and compliance with evolving energy policies.

- Incentive Utilization: Accessing tax credits and subsidies to enhance project economics.

- Regulatory Engagement: Maintaining dialogue with agencies to align projects with national energy goals.

Alterra Power's key partnerships extend to technology providers, financial institutions, EPC contractors, local communities, and government bodies. These alliances are critical for sourcing advanced equipment, securing substantial project financing, ensuring efficient construction, gaining social license to operate, and navigating regulatory frameworks. For example, in 2024, the company's relationships with leading turbine manufacturers were vital for integrating high-performance wind technology, while strong ties with private equity firms facilitated the financing of large-scale solar developments.

What is included in the product

A robust business model canvas for Falck Renewables, detailing its strategy for renewable energy development and operation, focusing on customer segments, value propositions, and key partnerships.

This canvas provides a clear roadmap of Falck Renewables' operations, revenue streams, and cost structure, offering insights for strategic planning and stakeholder communication.

Falck Renewables' Business Model Canvas offers a clear, one-page snapshot of their renewable energy operations, simplifying complex strategies for stakeholders.

It acts as a powerful tool to quickly identify and address pain points in their value chain, from resource acquisition to energy distribution.

Activities

Project development and permitting are crucial for Falck Renewables, involving the meticulous identification of prime locations for wind and solar farms. This stage includes rigorous feasibility studies to assess resource availability and technical viability.

The process is intricate, demanding extensive knowledge of environmental regulations and land-use planning to secure all necessary permits. Stakeholder engagement, from local communities to governmental bodies, is paramount throughout these multi-stage approvals.

In 2024, Falck Renewables continued to advance its pipeline, with significant progress reported on projects requiring complex permitting, such as offshore wind developments in the North Sea. Securing these permits is a lengthy endeavor, often taking several years and representing a substantial upfront investment.

Engineering, Design, and Construction is where Falck Renewables brings approved projects to life, meticulously crafting the detailed blueprints for their power plants. This phase involves selecting the most efficient and reliable technologies, such as advanced solar photovoltaic panels or cutting-edge wind turbine systems, to maximize energy generation. For instance, in 2024, the company continued to emphasize the integration of high-efficiency solar modules across its portfolio, aiming to improve capacity factors and reduce the levelized cost of energy.

Managing construction timelines and ensuring strict adherence to safety and quality standards are paramount. Falck Renewables focuses on optimizing project execution to meet deadlines and budget while maintaining the highest levels of operational integrity. Their commitment to quality is reflected in their project completion rates and the long-term performance of their renewable energy assets, with a strong emphasis on minimizing environmental impact throughout the construction process.

Efficient Operation and Maintenance (O&M) is the backbone of any power plant's success, directly impacting its ability to generate revenue and its long-term viability. For Falck Renewables, this means a relentless focus on keeping their renewable energy assets, like wind turbines and solar farms, running at peak performance. In 2023, the company reported that its wind farms achieved a capacity factor of 45.6%, a testament to effective O&M practices.

This crucial activity involves a multi-faceted approach, from routine inspections that catch minor issues before they escalate, to sophisticated predictive maintenance strategies. By leveraging AI and advanced data analytics, Falck Renewables can anticipate potential equipment failures, allowing for proactive interventions. This minimizes costly downtime and ensures a consistent flow of clean energy to the grid.

The goal is not just to keep the lights on, but to optimize every kilowatt-hour produced. Timely and skilled repairs are paramount. For instance, a well-maintained solar panel array can continue to generate power efficiently for 25-30 years, and robust O&M ensures they reach that full potential. This proactive approach significantly extends the operational lifespan of the assets, thereby maximizing the return on investment.

Electricity Generation and Sales

Falck Renewables' primary activity is the generation of electricity, leveraging diverse renewable sources like wind, solar, biomass, and waste-to-energy technologies. This generated power is then sold to various customers, known as off-takers.

Sales are predominantly managed through long-term Power Purchase Agreements (PPAs), which provide stable revenue streams, but the company also participates in the spot market to capitalize on fluctuating energy prices. For instance, in 2024, Falck Renewables continued to expand its PPA portfolio, securing agreements for new wind and solar projects across Europe, contributing to its growing installed capacity.

- Core Business: Generating electricity from renewable sources (wind, solar, biomass, waste-to-energy).

- Sales Channels: Primarily through long-term Power Purchase Agreements (PPAs) and secondarily via the spot market.

- 2024 Activity: Continued expansion of PPA agreements for new wind and solar projects in Europe.

Asset Management and Optimization

Asset management and optimization go beyond just keeping the lights on. It's about actively working to make the whole collection of renewable energy projects perform as well as possible. This involves keeping a close eye on what's happening in the energy markets and finding ways to boost profits and the overall worth of these assets.

This means constantly evaluating the portfolio, identifying underperforming assets, and implementing strategies for improvement. It also includes proactive risk management, particularly concerning financial exposures, to safeguard and enhance returns.

- Portfolio Performance Enhancement: Actively managing and improving the operational and financial performance of all renewable energy assets.

- Market Monitoring and Adaptation: Continuously tracking energy market dynamics, regulatory changes, and technological advancements to adapt strategies.

- Financial Risk Management: Implementing measures to mitigate financial risks, such as hedging against price volatility and managing debt.

- Value Maximization: Employing strategies to increase the long-term profitability and market value of the renewable asset portfolio.

Falck Renewables' key activities revolve around generating clean electricity and selling it, primarily through long-term Power Purchase Agreements (PPAs). The company actively manages and optimizes its portfolio of renewable energy assets, ensuring peak performance and financial returns. This includes meticulous project development, from site identification and permitting to engineering, design, and construction, all while prioritizing safety and quality.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Project Development & Permitting | Identifying sites, feasibility studies, securing permits. | Progress on complex offshore wind permits in North Sea. |

| Engineering, Design & Construction | Blueprint creation, technology selection, project execution. | Emphasis on high-efficiency solar modules to boost capacity factors. |

| Operation & Maintenance (O&M) | Ensuring peak performance of assets, predictive maintenance. | Wind farms achieved a 45.6% capacity factor in 2023. |

| Electricity Generation & Sales | Producing power from renewables and selling via PPAs/spot market. | Expanded PPA portfolio for new wind and solar projects in Europe. |

| Asset Management & Optimization | Enhancing portfolio performance, market monitoring, risk management. | Focus on increasing long-term profitability and market value. |

Full Document Unlocks After Purchase

Business Model Canvas

The Falck Renewables Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the comprehensive analysis you'll gain access to. Once your order is complete, you'll download this same, fully detailed canvas, ready for immediate use and strategic application.

Resources

Renewable energy assets form the core of Falck Renewables' business, encompassing physical power generation plants like wind farms, solar parks, biomass facilities, and waste-to-energy operations. These are the tangible engines driving their revenue.

The key components include wind turbines, solar panels, and generators, all supported by essential grid infrastructure to connect to the power network. For instance, as of late 2023, Falck Renewables operated over 1.4 GW of installed capacity, with a significant portion coming from wind power.

These assets are not just hardware; they represent the company's ability to produce clean energy. In 2023, Falck Renewables generated a substantial amount of electricity, contributing to decarbonization efforts and providing a stable supply of renewable power to its customers.

Falck Renewables secures its operations through robust land rights and site access, primarily via long-term land leases and easements. This ensures exclusive and stable use of suitable areas for wind and solar farm development, a critical resource for sustained energy generation.

In 2024, Falck Renewables continued to expand its portfolio, with a significant portion of its operational capacity underpinned by these secure land agreements. For instance, its wind farms, like the one in the UK, rely on leases often extending for 25 years or more, providing predictable operational environments.

Falck Renewables' intellectual property and technical expertise are foundational to its business. This includes proprietary designs for wind turbines and solar panel installations, ensuring efficiency and longevity. Their operational best practices, refined over years of experience, minimize downtime and maximize energy output, a crucial factor in the competitive renewable energy market.

Deep technical knowledge across various renewable energy technologies, from onshore wind to offshore wind and solar, is a key resource. This expertise spans the entire project lifecycle, including site assessment, engineering, procurement, construction, and ongoing plant optimization. For instance, in 2024, Falck Renewables continued to leverage its engineering prowess to enhance the performance of its existing solar and wind farms, contributing to their strong operational results.

Financial Capital and Funding Mechanisms

Falck Renewables relies heavily on access to significant financial capital. This includes equity, debt, and specialized project finance crucial for developing, constructing, and acquiring renewable energy assets. For instance, in 2023, the company secured €500 million in a sustainability-linked revolving credit facility, demonstrating its ability to tap into diverse funding sources.

Leveraging government incentives is also a core financial strategy. Tax credits and subsidies play a vital role in making projects economically viable and attractive to investors. In 2024, the Inflation Reduction Act in the United States continues to provide substantial tax credits for renewable energy development, a key driver for companies like Falck Renewables.

- Equity Financing: Raising capital through the sale of company stock.

- Debt Financing: Borrowing funds from financial institutions or bond markets.

- Project Finance: Structuring debt and equity for individual projects, often non-recourse to the parent company.

- Incentive Utilization: Maximizing the benefit from government tax credits and subsidies.

Skilled Human Capital

Falck Renewables' operations rely heavily on skilled human capital. This includes engineers crucial for designing and optimizing renewable energy projects, project managers who oversee complex developments from inception to completion, and operations technicians ensuring the efficient and safe running of wind farms and solar plants.

The company also employs financial experts vital for securing funding, managing investments, and ensuring profitability. For instance, as of early 2024, Falck Renewables was actively seeking to expand its engineering teams to support its growing pipeline of offshore wind projects.

- Engineers: Expertise in wind turbine technology, solar panel efficiency, and grid integration.

- Project Managers: Skill in managing timelines, budgets, and stakeholder relations for large-scale infrastructure.

- Operations Technicians: Proficiency in maintenance, repair, and performance monitoring of renewable assets.

- Financial Experts: Knowledge in project finance, capital markets, and risk management.

Falck Renewables' key resources are its renewable energy assets, including wind farms and solar parks, which represent its primary revenue-generating capabilities. These physical assets are complemented by secure land rights, ensuring long-term operational stability. The company also possesses significant intellectual property and technical expertise, crucial for optimizing asset performance and driving innovation in the renewable energy sector.

| Key Resource | Description | 2023/2024 Data Point |

| Renewable Energy Assets | Physical power generation plants (wind, solar, biomass, waste-to-energy). | Over 1.4 GW installed capacity (late 2023). |

| Land Rights and Site Access | Long-term land leases and easements for development. | Wind farm leases often extend for 25+ years. |

| Intellectual Property & Technical Expertise | Proprietary designs, operational best practices, and deep technological knowledge. | Continued leveraging of engineering for performance enhancement in 2024. |

| Financial Capital | Equity, debt, and project finance for development and acquisition. | Secured €500 million revolving credit facility (2023). |

| Human Capital | Skilled engineers, project managers, and operations technicians. | Actively expanding engineering teams for offshore wind projects (early 2024). |

Value Propositions

Falck Renewables, now operating as Alterra Power, delivers electricity sourced entirely from renewable resources. This commitment directly translates to a substantial reduction in carbon emissions, a critical factor for environmentally conscious customers. For instance, in 2023, their operations contributed to avoiding approximately 1.2 million tons of CO2 emissions.

This clean energy offering is a powerful draw for businesses and individuals aiming to shrink their environmental impact and achieve their sustainability targets. Many organizations are setting ambitious net-zero goals, and partnering with a renewable energy provider like Alterra Power is a key strategy to meet these commitments.

Falck Renewables ensures a dependable power supply by operating a diverse range of renewable energy sources, including wind, solar, biomass, and waste-to-energy. This diversification significantly reduces reliance on any single, potentially intermittent source, leading to greater overall stability.

The company further bolsters its power generation reliability through the integration of advanced energy storage solutions. These systems help to smooth out fluctuations in renewable output, ensuring a more consistent and predictable energy flow to the grid.

As of early 2024, Falck Renewables managed a portfolio with a total installed capacity of over 1.4 GW, demonstrating its significant contribution to stable, green energy production across Europe.

Falck Renewables' commitment to long-term price stability for electricity is a cornerstone of its value proposition, particularly through its Power Purchase Agreements (PPAs). These agreements offer customers, especially large industrial and commercial entities, a shield against the unpredictable swings in fossil fuel markets.

For instance, in 2023, Falck Renewables secured several significant PPAs, demonstrating its ability to provide this crucial certainty. These long-term contracts lock in electricity prices, allowing businesses to budget effectively and avoid the financial shocks that can arise from volatile energy commodity prices.

Expertise in Complex Project Delivery

Falck Renewables' deep-seated expertise in delivering complex renewable energy projects across the globe is a cornerstone of its value proposition. This encompasses the entire project lifecycle, from initial development and intricate design phases through to construction and ongoing operational management of a wide array of renewable energy assets.

This specialized knowledge ensures that projects are executed with a high degree of quality and efficiency, benefiting both clients and investors. For instance, by the end of 2023, Falck Renewables had successfully commissioned over 1.4 GW of capacity, demonstrating a proven track record in bringing challenging projects to fruition.

- Global Project Portfolio: Experience across diverse geographies and technologies.

- End-to-End Delivery: Expertise from conception through to long-term operations.

- Quality and Efficiency: Commitment to high standards in project execution and asset management.

- Proven Track Record: Successful delivery of significant renewable energy capacity.

Contribution to Energy Independence and Security

Falck Renewables significantly bolsters energy independence by developing domestic renewable energy infrastructure. This reduces a nation's vulnerability to volatile global fossil fuel markets and geopolitical instability.

By investing in and operating wind farms and solar parks within a country, Falck Renewables directly contributes to a more secure and resilient energy supply. For example, in 2024, the company continued to expand its operational capacity, contributing to the overall growth of renewable energy generation within the European Union.

- Reduced reliance on imported fuels: Falck Renewables' projects displace the need for imported oil and gas.

- Enhanced national energy security: A diversified domestic energy mix strengthens a nation's ability to meet its energy needs.

- Support for local economies: The development and operation of renewable energy assets create local jobs and stimulate economic activity.

Alterra Power, formerly Falck Renewables, offers a compelling value proposition centered on delivering clean, reliable, and cost-effective energy solutions. Their commitment to sustainability is evident in their substantial carbon emission reductions, with operations in 2023 avoiding around 1.2 million tons of CO2. This clean energy directly supports businesses and individuals in achieving their environmental goals and net-zero targets.

Customer Relationships

Falck Renewables' business model heavily relies on long-term contractual relationships, primarily through Power Purchase Agreements (PPAs). These agreements are crucial for securing predictable revenue streams, as demonstrated by their significant impact on financial stability.

For instance, in 2024, a substantial portion of Falck Renewables' energy sales were underpinned by these long-term contracts, providing a secure financial base. These PPAs often span 10-20 years, fostering deep partnerships with energy offtakers and ensuring consistent service delivery.

These relationships are more than just transactions; they involve ongoing collaboration and mutual commitment to renewable energy goals. This strategic approach to customer relationships solidifies Falck Renewables' market position and supports sustained growth.

For significant utility and industrial clients, Falck Renewables assigns dedicated account managers. These professionals offer tailored support, focusing on the unique energy demands and contractual obligations of each customer.

This personalized approach is crucial for building strong, trust-based relationships. It directly contributes to maintaining high levels of customer satisfaction, ensuring clients feel valued and understood.

In 2024, Falck Renewables reported a strong focus on client retention, with dedicated account management playing a key role. The company aims to solidify long-term partnerships by proactively addressing client needs and ensuring seamless service delivery across its renewable energy projects.

Falck Renewables prioritizes transparency in its reporting, sharing detailed information on energy generation, environmental impact, and project performance. This commitment builds crucial trust with investors, regulators, and customers who value sustainability. For instance, in 2024, the company continued to provide quarterly updates on its renewable energy output across its diverse portfolio, highlighting key metrics like MWh produced and CO2 emissions avoided.

Community Engagement and Local Support

Falck Renewables prioritizes building trust through active community engagement near its renewable energy projects. This involves open communication to address local concerns and proactively offer tangible benefits, fostering a sense of partnership.

By investing in local support, Falck Renewables aims to secure sustained community backing, which is crucial for smooth project development and ongoing operations. This proactive approach helps mitigate potential disruptions and ensures a collaborative environment.

- Community Dialogue: Regular meetings and information sessions are held to keep local residents informed about project progress and address any questions or concerns.

- Local Economic Benefits: Projects often create local employment opportunities during construction and operation, and may include community funds or local infrastructure improvements. For instance, in 2024, Falck Renewables' commitment to local employment saw a significant percentage of its workforce hired from communities surrounding its Italian wind farms.

- Environmental Stewardship: Demonstrating a commitment to environmental protection through best practices in site management helps build confidence and reduce community apprehension regarding renewable energy development.

- Stakeholder Collaboration: Working closely with local authorities, community leaders, and environmental groups ensures that project plans align with local needs and aspirations, promoting mutual understanding and support.

Investor Relations and Stakeholder Communication

Falck Renewables prioritizes robust investor relations and stakeholder communication to foster trust and ensure continued financial support. This involves consistent engagement with financial institutions and investors through regular updates on strategic progress and financial performance.

- Regular Financial Disclosures: Timely and transparent reporting of financial results, including key performance indicators and project development milestones, is essential. For instance, in 2024, Falck Renewables continued to provide quarterly earnings reports, detailing operational efficiency and new project pipelines.

- Strategic Updates: Communicating the company's long-term vision, expansion plans, and responses to market dynamics reassures stakeholders. This includes highlighting advancements in renewable energy technologies and market penetration strategies.

- Access to Capital: Maintaining strong relationships directly impacts Falck Renewables' ability to secure capital for future investments, such as expanding its wind and solar portfolios. This access is crucial for funding large-scale projects and driving sustainable growth in the evolving energy sector.

Falck Renewables cultivates deep customer relationships primarily through long-term Power Purchase Agreements (PPAs), securing predictable revenue and fostering partnerships with energy offtakers. Dedicated account managers provide tailored support to key utility and industrial clients, ensuring high satisfaction and retention.

The company also prioritizes transparency in reporting, sharing detailed energy generation and environmental impact data, which builds trust with investors and customers. Proactive community engagement near project sites, including dialogue and local benefit initiatives, further solidifies relationships and ensures operational support.

Strong investor relations, marked by regular financial disclosures and strategic updates, are vital for securing capital for expansion. In 2024, Falck Renewables continued its commitment to these relationships, highlighting operational efficiency and new project pipelines in its quarterly reports.

| Relationship Type | Key Engagement Strategy | 2024 Focus/Data Point |

|---|---|---|

| Energy Offtakers (via PPAs) | Long-term contracts, predictable revenue | Substantial portion of energy sales underpinned by PPAs (10-20 year terms) |

| Key Industrial/Utility Clients | Dedicated Account Management, tailored support | Strong client retention, proactive needs addressing |

| Investors & Financial Institutions | Transparent financial disclosures, strategic updates | Continued quarterly earnings reports, detailing operational efficiency and project pipelines |

| Local Communities | Community dialogue, local economic benefits, environmental stewardship | Significant local workforce hiring near Italian wind farms |

Channels

Direct sales and business development teams are crucial for Falck Renewables, acting as the primary conduit for securing Power Purchase Agreements (PPAs) and large-scale project contracts. These specialized teams directly engage with key entities such as utilities, industrial clients, and corporate off-takers, meticulously identifying opportunities and negotiating favorable terms for renewable energy projects.

In 2024, the focus on these direct channels intensified as companies increasingly sought to lock in stable, long-term energy prices and meet their sustainability targets. For instance, Falck Renewables' successful development of projects often hinges on the ability of its business development teams to forge strong relationships and present compelling financial and environmental benefits to potential partners, reflecting the ongoing demand for green energy solutions.

Falck Renewables actively participates in competitive government-led tender processes and energy auctions. These are crucial channels for securing project allocations and long-term power purchase agreements, especially for large-scale renewable energy projects. For instance, in 2024, many European countries continued to utilize auctions as a primary mechanism for awarding renewable energy capacity, with governments setting targets and inviting developers to bid on price and project specifics.

These government auctions are instrumental in driving down the cost of renewable energy through competition. In 2024, we saw continued success in securing contracts through these competitive frameworks, which provide the revenue certainty needed to finance significant capital investments. The volume and terms of these tenders directly influence the pace of new project development and the overall growth trajectory for utility-scale renewable assets.

Falck Renewables actively participates in key industry conferences like WindEurope’s annual event and RE+ to connect with stakeholders, demonstrate its technological advancements, and explore potential collaborations. These events are crucial for gaining market intelligence and understanding emerging trends in the renewable energy sector.

Digital Presence and Corporate Website

Falck Renewables leverages its digital presence and corporate website as a primary channel for communicating its brand identity and core values to a global audience. This platform is crucial for disseminating detailed investor relations information, including financial reports and strategic updates, fostering transparency and trust with stakeholders. In 2024, the company continued to emphasize its commitment to sustainability, showcasing its extensive portfolio of renewable energy projects and their positive environmental impact.

The corporate website acts as a vital hub for public relations, offering easy access to news releases, corporate governance policies, and information about the company's operational footprint. It serves to build and maintain the company's reputation as a leader in the renewable energy sector, highlighting its contributions to the energy transition. For instance, Falck Renewables actively updates its site with details on new project developments and milestones achieved in its various markets.

- Corporate Branding: The website is the cornerstone of Falck Renewables' brand narrative, conveying its mission and vision in the renewable energy space.

- Investor Information: It provides a comprehensive repository for financial statements, annual reports, and investor presentations, crucial for informed investment decisions.

- Project Showcase: A key function is to detail the company's diverse project portfolio, illustrating its operational scale and technological capabilities across wind, solar, and other renewable sources.

- Sustainability Commitments: The digital platform prominently features Falck Renewables' dedication to environmental, social, and governance (ESG) principles, detailing its sustainability targets and achievements.

Strategic Partnerships and Joint Ventures

Falck Renewables actively pursues strategic partnerships and joint ventures to broaden its market access and accelerate project development. By teaming up with experienced developers, Falck Renewables can leverage their local expertise and established networks, facilitating smoother entry into new territories. In 2024, the company continued to explore these collaborations, recognizing their crucial role in diversifying its project pipeline and sharing development risks.

Financial partners are essential for funding the capital-intensive nature of renewable energy projects. Falck Renewables engages with institutional investors and banks through co-investment structures and project financing agreements. This approach allows for the scaling of operations and the undertaking of larger, more impactful projects, ensuring financial stability and growth. For instance, in early 2024, Falck Renewables secured significant financing for several new solar and wind farm developments through strategic alliances with major financial institutions.

Collaborations with other industry players, such as technology providers or complementary service companies, create synergistic opportunities. These alliances can enhance operational efficiency, introduce innovative solutions, and expand the overall service offering. Such partnerships are vital for staying competitive in the rapidly evolving renewable energy sector, enabling Falck Renewables to offer integrated solutions and capture greater market share.

- Market Entry: Partnerships with local developers in regions like Italy and Spain have been instrumental in establishing Falck Renewables' presence.

- Project Development: Joint ventures allow for the sharing of technical expertise and risk mitigation in complex projects, such as offshore wind farms.

- Financial Capacity: Co-investment deals with financial partners in 2024 helped Falck Renewables raise over €500 million for its development pipeline.

- Industry Synergies: Collaborations with technology firms aim to integrate advanced energy storage solutions into existing renewable portfolios.

Falck Renewables utilizes a multi-faceted channel strategy, combining direct engagement with strategic partnerships and digital outreach. Direct sales teams are pivotal for securing large Power Purchase Agreements (PPAs) with utilities and corporations, a trend that gained momentum in 2024 as businesses prioritized long-term energy price stability and sustainability goals.

Government tenders and auctions represent another critical channel, particularly for large-scale projects. These competitive processes, actively pursued by Falck Renewables in 2024, are instrumental in securing project allocations and driving down renewable energy costs, providing the revenue certainty needed for significant capital investments.

The company also leverages industry conferences and its digital presence, particularly its corporate website, to build brand awareness, disseminate investor information, and showcase its project portfolio. This digital channel is vital for maintaining transparency and communicating its commitment to sustainability, a key focus in 2024.

Strategic partnerships and financial collaborations are essential for market access and funding. In 2024, Falck Renewables actively pursued joint ventures with experienced local developers and secured substantial financing, raising over €500 million for its development pipeline through co-investment deals with major financial institutions.

| Channel | Key Activities | 2024 Focus/Data |

|---|---|---|

| Direct Sales & Business Development | Securing PPAs, negotiating contracts with utilities and corporates | Intensified focus on long-term energy price stability and sustainability targets. |

| Government Tenders & Auctions | Winning project allocations, securing long-term agreements through competitive bidding | Crucial for large-scale projects; European countries continued to utilize auctions extensively. |

| Industry Conferences | Networking, market intelligence, showcasing technology, exploring collaborations | Participation in key events like WindEurope and RE+ to stay abreast of emerging trends. |

| Digital Presence (Website) | Brand communication, investor relations, project showcase, sustainability reporting | Continued emphasis on sustainability, detailed project portfolio updates. |

| Strategic Partnerships & Joint Ventures | Market access, risk sharing, local expertise leverage | Exploration of collaborations to diversify project pipeline and share development risks. |

| Financial Partnerships | Project financing, co-investment structures | Secured over €500 million in financing for new solar and wind developments through alliances with financial institutions. |

Customer Segments

Electric utilities and grid operators are crucial customers, buying substantial amounts of electricity for their national or regional distribution networks. These entities prioritize long-term, stable, and varied sources of renewable energy to satisfy consumer demand and adhere to regulatory mandates. For instance, in 2024, many European utilities are actively seeking to secure Power Purchase Agreements (PPAs) for wind and solar projects to meet ambitious decarbonization targets.

Large industrial and commercial consumers, including data centers and manufacturing facilities, are prime targets for renewable energy solutions. These entities often have substantial energy demands, making the pursuit of stable, cost-effective, and sustainable power sources a high priority. For instance, in 2024, the demand for Power Purchase Agreements (PPAs) from large corporations looking to secure renewable energy continued to grow significantly, driven by both environmental, social, and governance (ESG) mandates and the desire for long-term energy price predictability.

Businesses like large corporate campuses and industrial plants are actively seeking direct renewable energy supply. This trend is fueled by a dual objective: meeting ambitious sustainability targets and gaining better control over volatile energy expenditures. By entering into PPAs, these consumers can lock in electricity prices, hedging against market fluctuations and ensuring a consistent supply of clean energy, which is increasingly becoming a competitive advantage.

Government entities and municipalities are key customers, actively seeking to transition their energy sources to renewables to meet ambitious climate goals. For instance, the European Union's renewable energy directive sets targets for member states, driving demand for clean energy projects. These public bodies often engage in competitive tender processes to secure long-term power purchase agreements, ensuring stable revenue streams for renewable energy developers.

Institutional Investors and Project Developers (for asset sales)

Falck Renewables, beyond its core power generation, acts as a project developer, offering fully permitted or operational renewable energy assets for sale. This segment targets institutional investors, such as pension funds and infrastructure funds, seeking stable, long-term returns from the renewable energy sector. For instance, in 2024, the company continued to advance its pipeline of solar and wind projects, with a focus on de-risking assets through permitting and early-stage development before bringing them to market.

These institutional investors are attracted to the predictable cash flows generated by operational renewable energy projects, often supported by long-term power purchase agreements (PPAs). Project developers also represent a key customer group, acquiring projects at various stages of development to integrate into their own portfolios. This strategy allows Falck Renewables to recycle capital and focus on new development opportunities.

- Project Sales: Falck Renewables sells developed and permitted renewable energy projects.

- Target Customers: Institutional investors and other independent power producers.

- Investor Appeal: Stable, long-term returns from operational renewable assets with PPAs.

- Strategic Benefit: Capital recycling for continued development.

Waste Management Companies and Agricultural Sector (for biomass/waste-to-energy feedstock)

Falck Renewables engages with waste management companies as a crucial customer segment for its biomass and waste-to-energy facilities. These companies are the primary suppliers of the essential feedstock, such as municipal solid waste and industrial by-products, that fuels these renewable energy projects. For instance, in 2024, the European Union continued to focus on circular economy principles, increasing the availability of suitable waste streams for energy recovery, a trend directly benefiting Falck's operations.

The agricultural sector also forms a vital part of this customer segment, particularly for biomass-based energy generation. Farmers and agricultural cooperatives provide organic materials like crop residues, animal manure, and energy crops that serve as feedstock. In 2024, advancements in agricultural technology and a growing emphasis on sustainable farming practices led to more efficient collection and processing of these biomass resources, enhancing their suitability for waste-to-energy applications.

- Waste Management Companies: These entities are key suppliers of processed and raw waste materials, including sorted recyclables and non-recyclable fractions, essential for waste-to-energy plants.

- Agricultural Sector: This segment provides biomass feedstock such as agricultural residues, energy crops, and animal by-products, crucial for biomass power generation.

- Feedstock Quality and Availability: The consistent supply of high-quality, segregated feedstock from both waste management and agricultural sources is paramount for optimizing the efficiency and economic viability of Falck's operations.

- Regulatory Environment: Evolving waste management regulations and agricultural support schemes in 2024 influenced the availability and cost of feedstock, impacting the strategic sourcing for Falck's facilities.

Falck Renewables serves a diverse customer base, including electric utilities and grid operators who require stable, renewable energy sources. Large industrial and commercial consumers, such as data centers and manufacturers, are also key clients, seeking predictable and sustainable power through Power Purchase Agreements (PPAs). Additionally, government entities and municipalities are important customers, driven by climate goals and often participating in tenders for long-term clean energy supply.

The company also targets institutional investors and project developers by selling fully permitted or operational renewable energy assets. These investors are drawn to the stable, long-term returns offered by assets with PPAs. Furthermore, Falck Renewables partners with waste management companies and the agricultural sector, which supply essential feedstock like municipal waste and biomass for its waste-to-energy and biomass facilities.

| Customer Segment | Needs/Motivations | Falck Renewables Offering | 2024 Trend/Example |

|---|---|---|---|

| Electric Utilities | Stable, varied renewable energy supply; regulatory compliance | Wholesale electricity sales, PPAs | Securing PPAs for wind/solar to meet decarbonization targets |

| Industrial/Commercial Consumers | Cost-effective, sustainable power; price predictability | PPAs, direct energy supply | Growing PPA demand driven by ESG and price stability |

| Government/Municipalities | Meeting climate goals; secure long-term clean energy | PPAs via tender processes | EU directives driving demand for clean energy projects |

| Institutional Investors | Stable, long-term returns from renewables | Sale of developed/permitted projects | Continued pipeline advancement for solar and wind projects |

| Waste Management/Agri Sector | Feedstock supply for waste-to-energy/biomass | Purchasing waste and biomass materials | Circular economy focus increasing waste stream availability |

Cost Structure

The most significant cost for Falck Renewables within its business model is the substantial capital expenditure (CAPEX) required for plant construction. This involves the upfront investment in acquiring and installing essential components like wind turbines, solar panels, and the necessary supporting infrastructure to establish new renewable energy facilities.

For example, in 2024, large-scale solar farm projects can easily exceed $1 million per megawatt of capacity, while offshore wind farms can range from $3 million to $5 million per megawatt, highlighting the immense capital intensity of this segment.

Operations and Maintenance (O&M) costs are the ongoing expenses Falck Renewables incurs to keep its renewable energy power plants running smoothly. These include everything from regular check-ups and fixing any issues that pop up to stocking necessary spare parts and paying the skilled staff who manage the facilities. For example, in 2023, the company reported O&M expenses of €175.5 million, highlighting their significance to the overall cost structure.

Effectively managing these O&M costs is absolutely vital for Falck Renewables' profitability. Lowering these expenses, perhaps through more efficient maintenance schedules or better spare parts management, directly boosts the bottom line. The company's focus on operational efficiency aims to keep these costs competitive while ensuring plant reliability and maximizing energy output.

Financing costs are a significant expense for Falck Renewables due to the capital-intensive nature of renewable energy projects. In 2024, managing interest payments on substantial debt and other financing charges remains critical for profitability.

The company's ability to secure favorable interest rates and optimize its debt structure directly impacts its bottom line. For instance, a slight increase in interest rates can substantially raise the cost of servicing its extensive project financing.

Land Acquisition/Lease and Permitting Costs

Securing the necessary land for renewable energy projects, such as wind or solar farms, involves substantial upfront costs. These include not only the purchase or long-term lease of land but also the intricate processes of obtaining permits and navigating regulatory approvals. For Falck Renewables, these expenses are critical to project viability.

The costs associated with land acquisition and permitting can be highly variable, influenced by geographical location, land use regulations, and the specific type of renewable technology being deployed. Environmental impact assessments, legal counsel for contract negotiations, and the fees for various licenses and permits all contribute to this significant component of the cost structure.

- Land Acquisition/Lease: Costs vary widely based on region and land value. For instance, in 2024, prime agricultural land suitable for solar development in certain European countries could range from €10,000 to €30,000 per hectare.

- Permitting and Licensing: Fees for environmental impact studies, grid connection permits, and local planning permissions can add up, sometimes reaching hundreds of thousands of euros per project depending on complexity and jurisdiction.

- Legal and Consultancy Fees: Engaging legal experts for land rights, contract reviews, and environmental consultants for impact assessments are essential, representing a notable portion of these initial costs.

- Environmental Impact Assessments (EIAs): These studies, crucial for understanding and mitigating project effects on the environment, can cost anywhere from €20,000 to over €100,000, depending on the project's scale and potential ecological sensitivity.

Fuel Costs (for Biomass/Waste-to-Energy) and Grid Connection Fees

While wind and solar power generation inherently have no direct fuel expenses, biomass and waste-to-energy facilities operated by companies like Falck Renewables must account for the cost of acquiring their primary feedstock. This includes sourcing biomass materials or managing the collection and processing of waste streams, which represent a significant operational expenditure.

Beyond feedstock, ongoing expenses for connecting to and utilizing the electricity grid are a crucial component of the cost structure. These grid connection fees, along with charges for transmitting and distributing generated power, are essential for bringing renewable energy to market. For instance, in 2024, grid connection costs can vary significantly based on location and the capacity of the connection, often running into hundreds of thousands or even millions of euros for large-scale projects.

- Feedstock Acquisition: Costs associated with sourcing biomass or waste materials are a direct operational expense for waste-to-energy plants.

- Grid Connection Fees: Initial and ongoing charges for connecting to and utilizing the national electricity grid are a necessary cost.

- Transmission and Distribution Charges: Fees for moving electricity from the plant to consumers are part of the operational cost structure.

The cost structure for Falck Renewables is heavily weighted towards capital expenditures for plant construction, with significant ongoing operational and maintenance expenses. Financing costs are also a major factor due to the capital-intensive nature of renewable projects, alongside land acquisition and permitting fees. While wind and solar have no fuel costs, biomass facilities incur feedstock expenses, and all projects face grid connection and transmission charges.

| Cost Category | Description | Example Data (2023-2024) |

|---|---|---|

| Capital Expenditure (CAPEX) | Upfront investment in plant construction (turbines, panels, infrastructure) | Offshore wind: $3-5 million per MW (2024 estimate) |

| Operations & Maintenance (O&M) | Ongoing costs to keep plants running | €175.5 million (reported O&M expenses in 2023) |

| Financing Costs | Interest payments on debt and other financing charges | Highly sensitive to interest rate fluctuations (2024 market conditions) |

| Land Acquisition & Permitting | Securing land, permits, licenses, and legal fees | Land lease: €10,000-€30,000/hectare (prime European land, 2024) |

| Feedstock Costs (Biomass/Waste-to-Energy) | Acquisition of biomass or waste materials | Variable based on sourcing and market availability |

| Grid Connection & Transmission | Fees for connecting to and using the electricity grid | Grid connection: Hundreds of thousands to millions of euros for large projects (2024) |

Revenue Streams

Falck Renewables' primary revenue stream originates from Power Purchase Agreements (PPAs). These are long-term contracts where the company sells electricity generated from its renewable assets to utilities, corporations, or other buyers. These agreements are crucial as they lock in a predetermined price for the electricity, ensuring stable and predictable income for the company.

In 2024, Falck Renewables continued to leverage PPAs to secure its financial future. For instance, their portfolio often features PPAs with durations of 10-15 years, providing a solid foundation for revenue forecasting. This contractual certainty is a cornerstone of their business model, mitigating exposure to volatile wholesale electricity market prices.

Spot market electricity sales represent revenue earned by selling surplus power directly onto the wholesale market. This strategy allows Falck Renewables to capitalize on immediate demand and prevailing prices, offering a degree of operational flexibility.

While this stream can be lucrative, it exposes the company to the inherent price volatility of the electricity market. For instance, in 2024, average wholesale electricity prices in Europe experienced significant fluctuations, influenced by factors such as gas prices and renewable energy generation levels, impacting the revenue generated from these spot sales.

Falck Renewables benefits from government incentives and subsidies, which are crucial for its revenue. These include feed-in tariffs, tax credits, and renewable energy certificates that directly boost project profitability.

For instance, in 2024, the European Union continued to emphasize renewable energy deployment through various support schemes. While specific figures for Falck Renewables are proprietary, the broader market saw significant uptake of these incentives, with Italy, a key market for Falck, offering competitive feed-in tariffs for solar and wind projects, driving substantial revenue generation.

Carbon Credit Sales

Falck Renewables generates revenue by selling carbon credits, which are essentially permits representing the right to emit a certain amount of greenhouse gases. These credits are earned by producing renewable energy, thereby reducing overall emissions.

This revenue stream directly monetizes the positive environmental impact of their operations. For instance, in 2024, the increasing global focus on climate action and stricter emission regulations are expected to drive demand and potentially higher prices for carbon credits. Falck Renewables' participation in various carbon offset programs allows them to capture value from their emission reduction efforts.

- Monetization of Environmental Benefits: Revenue from selling carbon credits directly reflects the company's contribution to reducing greenhouse gas emissions.

- Market Volatility: The value of carbon credits can fluctuate based on regulatory changes, market demand, and the overall supply of emission allowances.

- Contribution to Profitability: This stream adds a financial layer to sustainability, bolstering the company's bottom line through its green initiatives.

Asset Divestment and Project Sales

Falck Renewables generates occasional revenue by divesting mature or fully developed renewable energy projects. This strategic move allows the company to recycle capital efficiently, freeing up funds to reinvest in new development opportunities and maintain a dynamic project pipeline.

This divestment strategy is crucial for managing capital allocation. For instance, in 2023, Falck Renewables completed the sale of its stake in a wind farm, a transaction that significantly contributed to its financial flexibility and capacity for future investments.

- Project Divestment: Selling completed or near-completion renewable energy assets to third parties.

- Capital Recycling: Reinvesting proceeds from sales into new project development and expansion.

- Portfolio Optimization: Managing the lifecycle of assets to maximize returns and strategic focus.

Beyond core PPAs, Falck Renewables also benefits from government incentives and subsidies. These can include feed-in tariffs, tax credits, and renewable energy certificates, all of which directly improve project profitability. For example, in 2024, Italy, a key market for Falck, continued to offer competitive support schemes for solar and wind projects, bolstering revenue generation from these initiatives.

The company also monetizes its environmental impact through the sale of carbon credits. These credits represent the right to emit greenhouse gases and are earned by reducing emissions through renewable energy generation. With a growing global emphasis on climate action in 2024, the demand and value of these credits are expected to rise, providing an additional revenue stream for Falck Renewables.

Occasionally, Falck Renewables generates revenue by divesting mature or fully developed renewable energy projects. This strategic capital recycling allows the company to reinvest funds into new development opportunities. For instance, in 2023, they successfully divested a stake in a wind farm, enhancing their financial flexibility for future growth.

Business Model Canvas Data Sources

The Falck Renewables Business Model Canvas is built upon a foundation of robust financial reports, comprehensive market research, and internal strategic planning documents. These diverse sources ensure each segment of the canvas is grounded in factual data and informed decision-making.