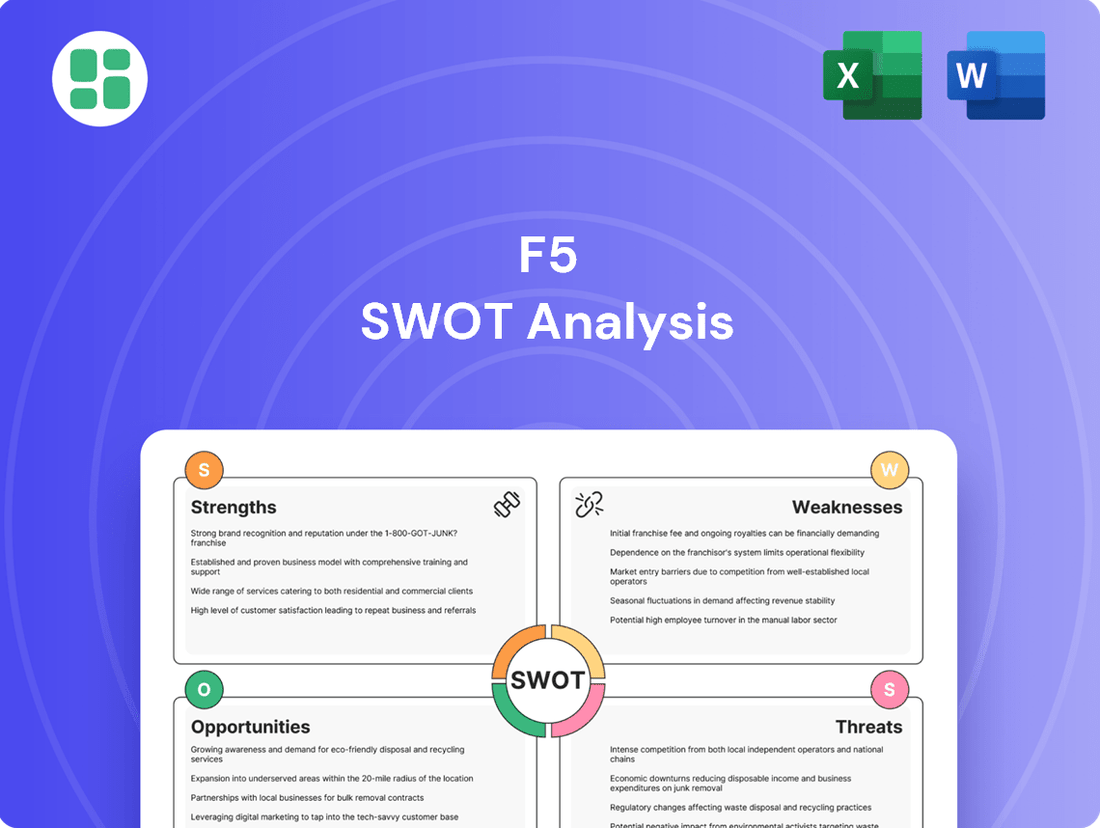

F5 SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

F5 Bundle

F5 Networks, a leader in application delivery and security, leverages its strong brand and extensive product portfolio to maintain a competitive edge. However, it faces challenges from evolving market demands and the rise of cloud-native solutions.

Want the full story behind F5's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

F5 Networks commands a dominant position in the application delivery controller (ADC) market, a testament to its robust and diverse product portfolio. Solutions like BIG-IP, F5 NGINX, and F5 Distributed Cloud Services are designed to address a wide array of application security and delivery needs, spanning both traditional and cloud-native environments. This comprehensive offering ensures F5 can adapt to evolving customer requirements, solidifying its leadership.

F5 has successfully navigated a significant strategic shift, moving away from its traditional hardware-centric approach to embrace a software and cloud-centric model. This pivot is a major strength, aligning the company with evolving market demands.

The fruits of this transition are evident in F5's revenue streams. As of the first quarter of fiscal year 2024, software and services accounted for a substantial and growing portion of their total revenue, demonstrating the increasing importance of recurring revenue. This ongoing shift positions F5 favorably to capitalize on the robust growth anticipated in the SaaS, application delivery, and edge security sectors through 2025 and beyond.

F5 Networks exhibits remarkable financial strength, underscored by a robust balance sheet featuring over $1 billion in cash and investments with no outstanding debt as of its latest fiscal reports. This solid financial foundation provides significant flexibility for strategic initiatives and weathering economic downturns.

The company consistently generates substantial free cash flow, a testament to its efficient operations and sound financial stewardship. This consistent cash generation allows for reinvestment in growth, potential shareholder returns, and strategic acquisitions.

For fiscal year 2025, F5 reported impressive revenue growth and expanding operating margins. These positive financial indicators reflect strong market demand for its solutions and effective cost management, reinforcing confidence in its ongoing financial performance.

Strategic Acquisitions and Innovation Focus

F5 Networks has a proven track record of strengthening its offerings through strategic acquisitions. Notable examples include NGINX, Shape Security, Volterra, Heyhack, and Fletch, each contributing significantly to F5's software, security, and edge computing capabilities. These moves demonstrate a clear strategy to expand its technological footprint and market reach.

The company’s dedication to innovation is evident in its substantial investment in research and development. A significant portion of F5's engineering talent is dedicated to advancing its software, SaaS, and managed services. This focus ensures F5 remains competitive and responsive to the dynamic shifts in the technology sector, particularly in areas like application security and delivery.

F5's commitment to R&D is a key driver for its future growth. For instance, in fiscal year 2023, F5 reported $831 million in R&D expenses, representing approximately 16% of its total revenue. This investment fuels the development of next-generation solutions, keeping F5 at the cutting edge of the industry.

- Strategic Acquisitions: NGINX, Shape Security, Volterra, Heyhack, Fletch have enhanced software, security, and edge capabilities.

- Innovation Investment: Significant R&D spending, with a large engineering team focused on software, SaaS, and managed services.

- FY23 R&D: $831 million spent on research and development, underscoring a commitment to future-proofing its technology.

- Market Position: Continued investment in innovation helps F5 maintain its leadership in application security and delivery.

Relevance in Hybrid/Multi-Cloud and AI Integration

F5's solutions are crucial for businesses managing intricate hybrid and multi-cloud setups, ensuring seamless traffic flow and robust security across varied IT landscapes. This adaptability makes them a vital partner for companies embracing cloud-native architectures.

The company is strategically positioned to leverage the expanding AI market. F5's AI-powered security offerings and its dedicated AI Gateway are designed to simplify the deployment and safeguarding of AI applications and large language models, addressing a key need for businesses integrating these advanced technologies.

- Hybrid/Multi-Cloud Relevance: F5's platform provides essential application delivery and security services that span on-premises data centers, private clouds, and multiple public clouds, a critical capability as organizations increasingly adopt multi-cloud strategies.

- AI Integration Capabilities: The introduction of F5's AI Gateway in 2024 aims to simplify the secure deployment and management of AI workloads, including large language models, by providing unified policy enforcement and visibility.

- Market Opportunity: With the global AI market projected to grow significantly, F5's focus on AI security and integration positions it to capture a substantial share of this expanding sector. For instance, the AI market was valued at over $200 billion in 2023 and is expected to see substantial compound annual growth rates through 2030.

F5's strengths lie in its market leadership, strategic pivot to software and cloud, and robust financial health. The company's diverse product suite, including BIG-IP and NGINX, effectively addresses complex application delivery and security needs across various environments.

The successful transition to a software and cloud-centric model is a significant advantage, as evidenced by the increasing contribution of software and services to its revenue streams. This aligns F5 with future market growth trends in SaaS and edge security.

Financially, F5 is exceptionally strong, boasting over $1 billion in cash and no debt as of early fiscal year 2024. This stability, coupled with consistent free cash flow generation, provides considerable flexibility for strategic investments and acquisitions, further solidifying its competitive edge.

F5's commitment to innovation, demonstrated by its substantial R&D investments, including $831 million in FY23, ensures its offerings remain cutting-edge. This focus on developing next-generation solutions, particularly in AI security and hybrid cloud, positions the company for sustained growth and market relevance through 2025 and beyond.

What is included in the product

Delivers a strategic overview of F5’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic vulnerabilities.

Weaknesses

F5's transition to a software-centric model hasn't been without its bumps. In some recent quarters, their software revenue growth has stalled, showing flat year-over-year performance. This inconsistency is a red flag for investors watching the cloud solutions market.

Analysts are concerned about F5's capacity to fully capitalize on the expanding cloud-based solutions landscape. The company faces a significant hurdle in consistently boosting its software revenue streams.

F5 Networks operates within an intensely competitive arena, where established giants and emerging players vie for market dominance. Rivals such as Citrix, A10 Networks, Radware, Fortinet, and Akamai offer a broad spectrum of application delivery and security solutions, creating a challenging environment for F5.

The market is further complicated by the rise of open-source alternatives and the vast capabilities offered by public cloud vendors. This dynamic landscape demands constant innovation from F5 to differentiate its offerings and secure its position as a technology leader.

F5's move from hardware to software and SaaS is complex. This shift can cause delays in renewing software terms, which might affect how predictable revenue is and how consistently the company grows. For example, in Q1 2024, F5 reported a 1% decrease in product revenue, partly due to the ongoing transition, even as software and services revenue grew.

Potential for Growth Deceleration in Certain Segments

While F5 Networks has demonstrated robust financial performance, its projections for fiscal year 2025 indicate a potential moderation in revenue growth for certain periods. This anticipated slowdown is largely a consequence of prevailing macroeconomic uncertainties, which may influence enterprise IT expenditure and consequently impact F5's systems and software divisions.

Specifically, F5's guidance for the first half of fiscal year 2025 has pointed towards a more measured pace of growth compared to prior periods. For instance, the company's Q1 FY25 revenue guidance, released in late 2024, suggested a year-over-year growth rate in the mid-single digits, a deceleration from the double-digit growth seen in earlier fiscal years.

- Slower Growth Projections: F5's outlook for FY25 anticipates a deceleration in revenue growth, particularly in the first half of the fiscal year.

- Macroeconomic Headwinds: Broader economic uncertainties are expected to temper enterprise IT spending, directly affecting F5's key business segments.

- Segment-Specific Impact: Both the systems and software segments within F5's portfolio are susceptible to these macroeconomic influences, potentially leading to varied growth rates.

Ongoing Security Vulnerability Management

F5's ongoing security vulnerability management presents a significant weakness. In 2025, the company faced 167 reported vulnerabilities, a considerable number, with many classified as medium to high severity. This constant stream of discovered flaws, such as those affecting HTTP/2, necessitates frequent patches and advisories from F5.

The continuous need to address security gaps can be a substantial burden for F5's customer base. This ongoing requirement for vigilance and updates can strain IT resources and potentially lead to operational disruptions for users. Furthermore, the recurring nature of these vulnerabilities could negatively impact F5's reputation as a secure solutions provider.

- High Vulnerability Count: 167 vulnerabilities reported in 2025, many with medium to high severity.

- Frequent Patching Requirements: Ongoing discovery of flaws, including HTTP/2 issues, demands continuous updates.

- Customer Burden: The need for constant vulnerability management can strain customer IT resources.

- Reputational Risk: Recurring security issues may affect F5's standing in the market.

F5's transition to a software-centric model has led to inconsistent software revenue growth, with some quarters showing flat year-over-year performance. This makes it challenging for the company to fully capitalize on the expanding cloud solutions market, especially with intense competition from established players and open-source alternatives.

The company's projections for fiscal year 2025 indicate a moderation in revenue growth, particularly in the first half, due to macroeconomic uncertainties impacting enterprise IT spending. F5's Q1 FY25 guidance, for instance, suggested mid-single-digit year-over-year growth, a slowdown from previous double-digit performance.

F5 faces ongoing challenges with security vulnerability management, reporting 167 vulnerabilities in 2025, many of high severity. This necessitates frequent patching and updates, which can strain customer IT resources and potentially damage F5's reputation as a secure solutions provider.

| Weakness | Description | Impact |

|---|---|---|

| Inconsistent Software Revenue Growth | Flat year-over-year software revenue in some quarters. | Hinders full capitalization on cloud market expansion. |

| Slower Growth Projections (FY25) | Mid-single-digit growth guidance for H1 FY25. | Reflects macroeconomic headwinds affecting IT spending. |

| Security Vulnerability Management | 167 reported vulnerabilities in 2025, many high severity. | Requires continuous patching, strains customer resources, and risks reputation. |

Preview Before You Purchase

F5 SWOT Analysis

You are viewing an actual excerpt from the complete F5 SWOT analysis. The full, detailed report will be delivered to you immediately after purchase.

This preview is taken directly from the full SWOT analysis document. Purchasing the item will unlock the entire in-depth report for your use.

The file shown below is not a sample; it's the real F5 SWOT analysis you'll download post-purchase, in full detail and ready for implementation.

Opportunities

Enterprises are increasingly integrating artificial intelligence across their operations, creating a substantial opportunity for F5 to bolster the security and performance of these AI-driven applications and the underlying infrastructure. This trend is particularly relevant as businesses grapple with securing sensitive AI models and the vast datasets they process.

F5's existing AI Gateway and its suite of AI-powered security solutions are directly aligned with these emerging needs, positioning the company to offer critical protection and optimization services. For instance, F5's focus on AI model security addresses a growing concern for organizations deploying machine learning, a key component of enterprise AI adoption.

This growing demand translates into significant new revenue streams for F5. Analysts project the global AI cybersecurity market to reach over $30 billion by 2027, with F5 poised to capture a share by providing specialized solutions for AI workloads.

F5's strategic expansion into Software as a Service (SaaS) and edge computing presents a compelling growth avenue. The acquisition of Volterra in 2021, for instance, significantly bolstered F5's capabilities in edge presence and as-a-service security, aligning perfectly with the increasing demand for distributed cloud solutions.

This focus on edge computing and SaaS allows F5 to tap into new market segments and establish more predictable, recurring revenue streams. As organizations increasingly adopt distributed architectures, F5 is well-positioned to offer integrated security and application delivery services at the network edge, a market projected for substantial growth through 2025 and beyond.

Enterprises are heavily investing in updating their IT infrastructure, a trend that directly benefits F5. This ongoing datacenter refresh cycle means a consistent need for advanced networking and security solutions, which F5 provides. For instance, spending on IT infrastructure upgrades for data centers is projected to see significant growth through 2025, creating a robust market for F5's offerings.

Increasing Complexity of Hybrid and Multi-Cloud Environments

The growing intricacy of hybrid, multi-cloud, and edge computing setups presents a significant opportunity for F5. As businesses distribute their applications across a wider, more fragmented digital landscape, the demand for integrated solutions that can manage and secure these diverse environments is escalating. F5's established expertise in application delivery and security is perfectly positioned to address this growing need.

F5's ability to simplify and secure these complex deployments is a key differentiator. This value proposition is particularly attractive as organizations grapple with managing disparate cloud platforms and on-premises infrastructure. For instance, Gartner predicted in 2024 that organizations utilizing multi-cloud strategies would increase by 15% compared to the previous year, highlighting the growing market for unified solutions.

- Growing Multi-Cloud Adoption: Businesses are increasingly adopting multi-cloud strategies, leading to more complex IT infrastructures that require unified management.

- Demand for Unified Security: The need for consistent security policies across diverse environments drives demand for integrated application security solutions.

- Edge Computing Expansion: The proliferation of edge computing further complicates application delivery and security, creating a market for F5's specialized offerings.

- Simplification as a Value Proposition: F5's core strength in simplifying complex hybrid and multi-cloud environments offers a clear advantage in capturing market share.

Strategic Partnerships and Cross-Selling

F5's established brand and extensive customer base present a prime opportunity for cross-selling its expanding portfolio of software and security solutions. This leverages existing trust and infrastructure, making it easier to introduce new products. For instance, a customer already using F5's application delivery controllers can be readily offered advanced security analytics or cloud-native application protection services.

Strategic partnerships are also key. Collaborations like the one with NVIDIA to integrate AI into security solutions aim to enhance threat detection and response capabilities. These alliances not only broaden F5's technological reach but also tap into new market segments, potentially driving substantial revenue growth. In 2024, F5 reported that its software and services revenue grew by 14% year-over-year, highlighting the success of this strategy.

- Cross-selling potential: Leverage existing relationships to introduce new software and security products.

- Strategic alliances: Partner with tech leaders like NVIDIA and Intel to enhance AI security and performance.

- Market expansion: Utilize partnerships to reach new customer segments and drive incremental revenue.

- Revenue growth: F5's software and services revenue increased 14% in 2024, demonstrating the effectiveness of these strategies.

F5 is well-positioned to capitalize on the growing demand for AI-driven security and performance solutions. The company's existing AI Gateway and specialized offerings directly address the need to secure AI models and their associated data, a critical concern for businesses in 2024 and beyond. This strategic alignment with the burgeoning AI cybersecurity market, projected to exceed $30 billion by 2027, presents a significant opportunity for F5 to expand its revenue streams.

The company's strategic push into SaaS and edge computing, amplified by the Volterra acquisition, opens up new markets and fosters predictable recurring revenue. As distributed architectures become the norm, F5's ability to provide integrated security and application delivery at the network edge is a key advantage in a market expected to see substantial growth through 2025.

F5's strength in simplifying complex hybrid, multi-cloud, and edge environments is a major draw for enterprises. With Gartner predicting a 15% increase in multi-cloud strategy adoption by organizations in 2024, F5's unified solutions are increasingly valuable. This trend, coupled with ongoing IT infrastructure refresh cycles, creates a robust demand for F5's advanced networking and security capabilities.

Leveraging its established brand, F5 can effectively cross-sell its expanded software and security portfolio to its existing customer base. Furthermore, strategic partnerships, such as the one with NVIDIA for AI-enhanced security, broaden F5's technological reach and tap into new market segments. This strategy is already yielding results, with F5 reporting a 14% year-over-year increase in software and services revenue in 2024.

Threats

The application delivery and security market is intensely competitive, with many companies vying for dominance. F5 faces a constant challenge from both established rivals offering comparable services and nimble new players, including those leveraging open-source solutions. This dynamic market means F5 must continually innovate to maintain its position.

This intense competition directly threatens F5's market share. For instance, in 2024, the cybersecurity market, which F5 operates within, saw significant growth, attracting more vendors and increasing the pressure on existing players. This can lead to pricing wars and necessitate substantial investments in research and development to stay ahead.

Global economic volatility, including potential tariff impacts and broader macroeconomic uncertainties, poses a significant threat to F5's growth prospects. For instance, the International Monetary Fund (IMF) projected global growth to be 3.1% in 2024, a slight slowdown from previous expectations, indicating a cautious economic environment that could curb enterprise IT investments.

These conditions can lead to delayed or reduced IT spending by enterprises, directly impacting F5's revenue across both its systems and software segments. Many businesses, facing tighter budgets and economic uncertainty, might postpone upgrades or new deployments of network security and application delivery solutions, F5's core offerings.

The relentless pace of technological change, particularly in cloud-native, serverless, and evolving cybersecurity, poses a significant threat. F5 faces the challenge of staying ahead of disruptive innovations that could render existing solutions obsolete.

For instance, the increasing adoption of edge computing and AI-driven security solutions by competitors could erode F5's market share if its own offerings don't keep pace. In 2024, the cybersecurity market alone was projected to reach over $200 billion, highlighting the intense competition and rapid innovation within the broader tech landscape F5 operates in.

Persistent Cybersecurity and Vulnerabilities

The threat landscape is constantly shifting, with cyberattacks like ransomware and DDoS becoming more sophisticated. For F5, this means a continuous need to adapt its defenses. In 2023, the average cost of a data breach reached $4.45 million globally, highlighting the stakes involved.

Even with F5's strong security posture, new vulnerabilities in their own products can emerge. For instance, in late 2023, F5 addressed critical vulnerabilities in its BIG-IP products, requiring immediate patching by customers. Such incidents can erode customer confidence and divert significant engineering resources towards remediation rather than innovation.

- Sophistication of Attacks: Cybercriminals are employing advanced techniques, making it harder to detect and prevent breaches.

- Vulnerability Discovery: Internal product vulnerabilities can lead to reputational damage and costly fixes.

- Resource Diversion: Addressing security flaws pulls resources away from new product development.

- Customer Trust: Security incidents can impact customer loyalty and market perception.

Challenges in Talent Retention and Acquisition

The intense competition for skilled software engineers and cybersecurity professionals presents a significant hurdle for F5. In 2024, the tech industry continued to see high demand for these specialized roles, with average salaries for senior software engineers often exceeding $150,000 annually. This competitive landscape makes attracting and retaining top-tier talent a constant challenge.

Recent workforce adjustments, even amidst F5's otherwise robust financial standing, could inadvertently affect employee morale. For instance, while F5 reported strong revenue growth in its fiscal year 2023, reaching $2.8 billion, any perceived instability might deter potential hires or prompt existing key personnel to seek opportunities elsewhere. This is particularly concerning given the critical need for specialized expertise to fuel F5's ongoing innovation and expansion efforts.

- Highly competitive tech talent market

- High demand for software engineers and cybersecurity experts

- Potential impact of workforce reductions on morale and recruitment

- Need for specialized talent to drive innovation

F5 faces a significant threat from the rapid evolution of cloud-native architectures and serverless computing, which can diminish the relevance of traditional hardware-centric solutions. Competitors offering integrated cloud security platforms are gaining traction, potentially capturing market share. For example, in 2024, cloud security spending was projected to exceed $30 billion globally, indicating a strong shift towards cloud-native solutions.

The increasing sophistication of cyberattacks, such as advanced persistent threats (APTs) and AI-powered malware, demands continuous innovation in F5's security offerings. The average cost of a data breach in 2023 was $4.45 million globally, underscoring the critical need for robust and adaptive security measures. Failure to keep pace with these evolving threats could lead to customer churn and reputational damage.

Global economic headwinds, including inflation and potential recessions, could lead to reduced IT spending by enterprises, directly impacting F5's revenue. The International Monetary Fund (IMF) projected global growth at 3.1% for 2024, a figure that signals a cautious economic climate. This could result in delayed projects and a slowdown in demand for F5's application delivery and security solutions.

| Threat Category | Specific Threat | Impact on F5 | Supporting Data/Trend (2023-2025) |

| Market Competition | Cloud-native and serverless adoption | Reduced demand for traditional hardware solutions | Global cloud security spending projected to exceed $30 billion in 2024. |

| Technological Evolution | Sophisticated cyberattacks (APTs, AI malware) | Need for continuous innovation, risk of customer churn | Average cost of data breach reached $4.45 million globally in 2023. |

| Macroeconomic Factors | Economic slowdown and reduced IT budgets | Decreased enterprise spending on F5 solutions | IMF projected global growth at 3.1% for 2024, indicating economic caution. |

SWOT Analysis Data Sources

This F5 SWOT analysis is built upon a foundation of robust data, including their latest financial filings, comprehensive market intelligence reports, and insights from industry analysts and cybersecurity experts to ensure a well-rounded and accurate assessment.