F5 Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

F5 Bundle

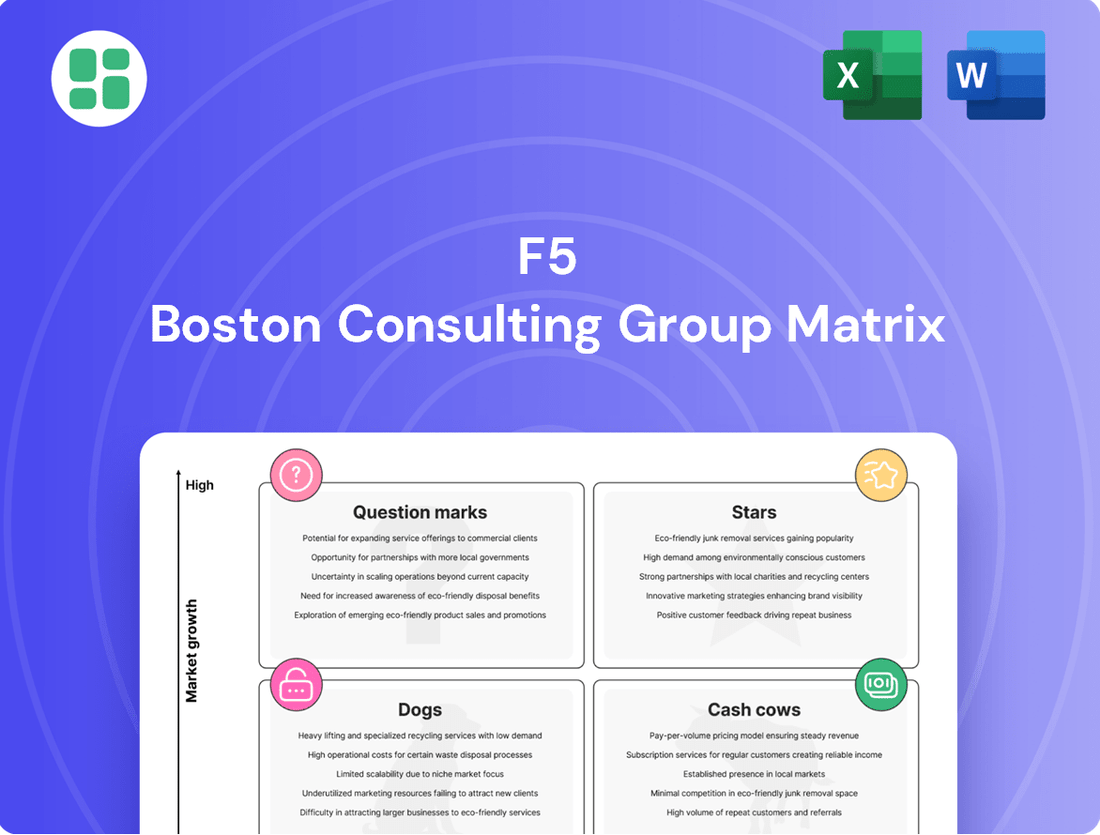

The BCG Matrix is a powerful tool for understanding a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market growth and share. This preview offers a glimpse into how these categories can illuminate your strategic direction. Purchase the full BCG Matrix for a comprehensive analysis, including actionable insights and a clear roadmap for optimizing your product investments and maximizing profitability.

Stars

F5 Distributed Cloud Services, encompassing its Web Application and API Protection (WAAP) and advanced API Security, is a significant growth driver for the company. This platform is experiencing substantial traction, having successfully blocked more than 20 billion malicious attacks in 2024 alone.

With over 1,000 customers now utilizing its services, F5 Distributed Cloud Services demonstrates strong market adoption. Its ability to secure web applications and APIs across diverse environments, including multi-cloud, on-premises, and edge locations, solidifies its leadership in a dynamic and expanding market.

F5 is making substantial investments in AI-driven security, evident in its F5 AI Gateway and AI assistant integrations across its product portfolio. These innovations, like preventing data leaks within AI-generated traffic and combating unauthorized AI usage, directly tackle significant new threats in a rapidly expanding market segment. For instance, F5's commitment to AI security is underscored by its strategic acquisitions, such as Fletch, which brings advanced agentic AI capabilities to bolster proactive and intelligent defense mechanisms.

NGINX App Protect, a component of F5's portfolio, extends robust Web Application Firewall (WAF) capabilities to open-source NGINX, specifically targeting DevSecOps and cloud-native setups. This strategic offering addresses the increasing demand for embedded security within agile development, capitalizing on the burgeoning application security market. Its ability to blend developer velocity with strong security makes it a key player in this high-growth sector.

F5 Application Delivery and Security Platform (ADSP)

The F5 Application Delivery and Security Platform (ADSP) represents F5's strategic consolidation of its diverse security and delivery solutions. This unified platform aims to streamline operations and bolster application and API defenses, particularly within hybrid and multi-cloud infrastructures.

Its design caters to the intricate demands of contemporary IT environments, including the burgeoning need for AI-powered application support. F5's ADSP is positioned to capture substantial market share, driven by its comprehensive approach to modern application security and delivery challenges.

- Market Position: F5's ADSP is a key strategic offering, aiming for leadership in the evolving application delivery and security market.

- Key Features: Integrates security and delivery products for simplified management and enhanced protection in hybrid/multi-cloud settings.

- Growth Drivers: Addresses complexities of modern IT and supports AI-powered applications, indicating strong future growth potential.

- Financial Relevance: F5 reported strong performance in its fiscal year 2023, with total revenue reaching $2.7 billion, demonstrating market acceptance of its integrated solutions.

Software and Subscription Revenue Growth

F5 Networks has made a significant transition to a software-centric business. This strategic shift is clearly reflected in its impressive revenue growth from software offerings. For instance, in the first quarter of fiscal year 2025, software revenue surged by 22%, and in the third quarter of the same year, it saw a 16% increase.

The company's focus on recurring revenue streams, which include subscriptions, Software as a Service (SaaS), managed services, and maintenance agreements, now forms a substantial part of its overall income. This demonstrates a strong market acceptance of F5's software solutions.

The move towards a subscription-based model is a key indicator of F5's success in adapting to market demands. It also establishes a foundation for stable and consistently growing revenue.

- Software Revenue Growth: F5 reported a 22% increase in software revenue in Q1 FY2025 and 16% in Q3 FY2025.

- Recurring Revenue Dominance: Subscriptions, SaaS, managed services, and maintenance now constitute a significant portion of F5's total revenue.

- Market Adoption: The strong performance in software and recurring revenue highlights robust market adoption of F5's solutions.

- Revenue Stability: The subscription-based model contributes to predictable and high-growth revenue streams for the company.

Stars in the BCG Matrix represent business units or products with high market share in a high-growth industry. These are typically market leaders that require significant investment to maintain their position and capitalize on future opportunities. F5's Distributed Cloud Services, with its substantial traction and market adoption, along with its strong focus on AI-driven security and robust revenue growth from software and recurring revenue streams, positions it as a Star within the company's portfolio.

The company's investment in AI security, evidenced by acquisitions like Fletch, and the success of offerings like NGINX App Protect in the DevSecOps space, further solidify its leadership in rapidly expanding segments. F5's overall strategic shift to software and its growing recurring revenue base, exemplified by a 22% increase in software revenue in Q1 FY2025, underscore the high-growth, high-share characteristics of its key services.

The F5 Application Delivery and Security Platform (ADSP) is designed to meet the complex demands of modern IT, including AI-powered applications, indicating its potential to maintain a leading position in a growing market. With over 1,000 customers for its Distributed Cloud Services and over 20 billion malicious attacks blocked in 2024, these offerings demonstrate significant market penetration and demand in a high-growth sector.

What is included in the product

A strategic tool analyzing products/units by market share and growth, guiding investment decisions.

A clear visual roadmap for strategic resource allocation, reducing the pain of indecision.

Cash Cows

F5's traditional BIG-IP Application Delivery Controllers (ADCs) are firmly entrenched as cash cows. These hardware-based solutions continue to be a revenue powerhouse, despite the growing trend towards software-defined networking. Their critical function in maintaining the performance and availability of essential business applications ensures a consistent demand and, consequently, a stable cash flow for F5.

In 2024, F5's BIG-IP platform maintained its leadership in the ADC market, particularly in the hardware segment. This dominance translates into significant and predictable revenue streams, as organizations continue to rely on these robust solutions for their most critical applications. The mature hardware ADC market, while not experiencing rapid growth, provides a reliable foundation for F5's cash generation.

The BIG-IP Advanced WAF is a cornerstone of F5's offerings, firmly positioned as a Cash Cow. Its established leadership in the Web Application Firewall market, backed by a substantial enterprise customer base, ensures consistent, high-margin revenue streams. This mature product benefits from decades of development and a strong reputation for robust protection against evolving web threats.

F5's global services and maintenance revenue, encompassing support for its vast network of hardware and software, acts as a significant cash cow. This segment, while experiencing slower growth than new software sales, demonstrates remarkable customer stickiness due to enduring client relationships.

The consistent demand for F5's maintenance, patching, and upgrade services guarantees a reliable income stream. For instance, in fiscal year 2023, F5 reported total revenue of $2.84 billion, with services, including maintenance, forming a substantial and predictable portion of this figure.

Established On-Premises Application Security and Delivery Solutions

F5's established on-premises application security and delivery solutions represent a significant cash cow. These offerings cater to enterprises with substantial investments in traditional data centers, ensuring critical application performance and security. This segment benefits from F5's deep integration within existing IT infrastructures, fostering customer loyalty and predictable revenue streams. In 2024, F5 continued to see strong demand for these mature, yet essential, solutions.

- High Market Share: F5 holds a commanding position in the on-premises application delivery and security market.

- Stable Revenue: Despite slower growth, the on-premises segment consistently generates substantial cash flow.

- Customer Retention: Deep integration into enterprise systems leads to low churn rates.

- Resilient Demand: Many large organizations continue to rely on on-premises infrastructure, ensuring ongoing need for F5's solutions.

NGINX Plus (Commercial Edition)

NGINX Plus, F5's commercial web server and load balancer, capitalizes on the vast popularity of its open-source sibling. This strategy allows F5 to tap into a substantial enterprise market that demands enhanced performance, robust security, and reliable support. The commercial version has become a significant contributor to F5's recurring revenue, demonstrating its value to businesses.

The success of NGINX Plus is directly linked to the widespread adoption of NGINX open-source. This creates a natural pathway for converting users of the free version into paying customers for the advanced features and dedicated assistance offered by NGINX Plus. In 2023, F5 reported that its Application Services segment, which includes NGINX, saw strong growth, with NGINX Plus being a key driver.

- Market Penetration: NGINX open-source powers a significant portion of the world's websites, creating a massive install base for NGINX Plus.

- Recurring Revenue: NGINX Plus provides F5 with a predictable and growing stream of revenue through its subscription model.

- Enterprise Focus: The commercial offering targets enterprises needing advanced capabilities like enhanced security, load balancing, and application delivery networking.

- Conversion Strategy: F5 effectively leverages the trust and familiarity built by the open-source version to upsell to NGINX Plus.

F5's BIG-IP hardware ADCs are a prime example of a cash cow, generating consistent revenue through their established market presence and critical role in application delivery. These solutions continue to be a reliable revenue stream, especially within large enterprises that depend on their performance and availability.

In 2024, F5's BIG-IP platform maintained its strong position in the hardware ADC market, contributing significantly to the company's stable cash flow. This mature segment, while not experiencing explosive growth, provides a dependable financial foundation for F5.

The BIG-IP Advanced WAF is another key cash cow, leveraging its market leadership and substantial enterprise customer base for consistent, high-margin revenue. Its long history and reputation for strong web threat protection ensure its continued value.

F5's global services and maintenance revenue, supporting its extensive hardware and software installations, also functions as a significant cash cow. This segment, characterized by strong customer loyalty, provides a predictable income stream. In fiscal year 2023, F5 reported total revenue of $2.84 billion, with services representing a substantial and reliable portion.

| Product/Service | BCG Category | Key Characteristics | 2023 Revenue Contribution (Est.) | Outlook |

|---|---|---|---|---|

| BIG-IP Hardware ADCs | Cash Cow | High market share, stable demand, critical for enterprise apps | Significant portion of total revenue | Stable to moderate |

| BIG-IP Advanced WAF | Cash Cow | Market leader, strong enterprise adoption, recurring revenue | Substantial | Stable |

| Global Services & Maintenance | Cash Cow | Customer stickiness, predictable income, supports installed base | Large and consistent | Steady |

Delivered as Shown

F5 BCG Matrix

The F5 BCG Matrix document you are previewing is the identical, fully formatted report you will receive immediately after purchase. This comprehensive analysis, detailing Stars, Cash Cows, Question Marks, and Dogs, is ready for immediate integration into your strategic planning sessions. You can confidently expect the same level of detail and professional presentation in the downloaded file, empowering your decision-making processes without any hidden surprises or watermarks.

Dogs

The Viprion 2xxx series hardware, having reached its End of Sale in April 2023, is firmly positioned as a Question Mark within the F5 BCG Matrix. Its End of New Software Support is scheduled for April 2025, with a final End of Life in April 2030, signifying a clear move towards divestment.

This hardware line is a declining asset for F5, necessitating minimal further investment as it is actively being phased out. The strategic emphasis is on migrating customers to newer, more capable platforms such as VELOS, underscoring the diminishing importance of the 2xxx series.

BIG-IP versions 15.1 and 16.1 are positioned as Dogs in the F5 BCG Matrix. This is due to their approaching End of Life (EOL) dates, December 31, 2024, for 15.1 and July 31, 2025, for 16.1. These versions will soon cease receiving critical security patches and full support, making them unattractive for new implementations.

F5 is actively guiding customers to upgrade to more recent releases, such as BIG-IP 17.1. This strategic shift clearly labels 15.1 and 16.1 as legacy products with minimal prospects for future growth or market expansion, reflecting their declining relevance.

F5's older iSeries appliances are firmly in the Dogs category of the BCG Matrix. These products are facing an End of New Software Support (EoNSS) in January 2026 and a full End of Life (EOL) in January 2031. This signifies a product line with a shrinking market and diminishing relevance.

F5 is actively encouraging customers to move away from these aging hardware solutions. The company’s strategic focus has shifted to newer offerings like the rSeries appliances or their Virtual Editions, indicating a desire to divest resources from the iSeries. This is a classic move for products in the Dogs quadrant, where further investment is not deemed profitable.

Niche, Unintegrated Acquired Technologies

Niche, unintegrated acquired technologies within F5's portfolio represent potential 'dogs' in the BCG matrix. These are typically smaller, specialized technologies that, despite strategic acquisition, haven't found their place within the main F5 Application Delivery and Security Platform (ADSP). Their market share is likely minimal, and their growth prospects are subdued, posing a risk of becoming a drain on resources if not addressed.

These technologies might be characterized by:

- Low adoption rates post-acquisition.

- Limited synergy with F5's core product offerings.

- Failure to achieve significant market penetration independently.

For instance, if F5 acquired a niche AI-driven security analytics tool in 2023 that has seen less than 5% integration into its primary cloud security solutions by mid-2024, and its standalone revenue growth is projected at only 2% for 2024, it would fit this 'dog' classification. Such assets require careful evaluation for divestiture or a renewed, focused integration strategy to unlock their potential or mitigate losses.

Perpetual Software Licenses

Perpetual software licenses, while still contributing to F5's revenue stream, are increasingly viewed as a legacy offering. As the company pivots towards subscription and SaaS models, this segment represents a low-growth area. For instance, while F5 reported strong growth in its subscription revenue in 2024, the contribution from perpetual licenses has seen a relative decline, indicating a strategic shift.

This transition away from perpetual licenses signifies F5's commitment to recurring revenue, which offers more predictable income and opportunities for ongoing customer engagement. The company's strategic focus is on building out its Security and Systems segments through these newer, more dynamic models.

- Low Growth Segment: Perpetual licenses are categorized as a low-growth area within F5's product portfolio.

- Revenue Contribution: While still generating some revenue, their strategic importance is diminishing compared to subscription models.

- Strategic Shift: F5's focus is clearly on recurring revenue models, moving away from traditional perpetual sales.

- Industry Trend: This reflects a broader industry trend of software vendors transitioning to subscription-based services for sustained growth.

BIG-IP versions 15.1 and 16.1 are considered Dogs in F5's BCG Matrix due to their upcoming End of Life dates. Version 15.1 reaches EOL on December 31, 2024, and 16.1 on July 31, 2025. These versions will no longer receive essential security updates, making them unsuitable for new deployments.

F5 is actively encouraging customers to migrate to newer BIG-IP releases, such as 17.1, positioning 15.1 and 16.1 as legacy products. This strategic move highlights their declining market relevance and limited future growth potential.

F5's older iSeries appliances are also classified as Dogs. They face an End of New Software Support in January 2026 and a full End of Life in January 2031, indicating a shrinking market and decreasing importance.

The company is guiding customers away from these older hardware solutions, focusing instead on rSeries appliances or Virtual Editions. This strategy reflects a divestment of resources from the iSeries, a typical characteristic of products in the Dogs quadrant where further investment is not strategically beneficial.

Question Marks

F5's acquisition of Fletch in June 2025 for its agentic AI capabilities marks a strategic push into sophisticated AI for cybersecurity. This move positions F5 to leverage advanced AI for threat detection, a segment experiencing rapid growth. The company aims to integrate these capabilities to enhance its existing security offerings.

While Fletch's AI technology offers significant growth potential in the dynamic cybersecurity market, it represents a nascent addition to F5's broader portfolio. Realizing its full market potential will necessitate substantial investment in development and seamless integration. F5's ability to effectively scale and differentiate these new AI-powered solutions will be critical for capturing market share.

F5's acquisition of Heyhack in April 2024 significantly bolsters its Web Application Scanning (WAS) capabilities, now integrated into F5 Distributed Cloud Services. This move positions F5 to capitalize on the rapidly expanding market for automated security reconnaissance and penetration testing, a critical need for businesses in 2024 as cyber threats evolve.

The WAS segment represents a high-growth area, driven by the increasing demand for proactive security measures. While F5 is a recognized leader in application security, WAS is a newer addition, requiring ongoing investment to establish a dominant market position and fully leverage its potential within the F5 ecosystem.

F5 is actively preparing for the quantum computing era by incorporating post-quantum cryptography (PQC) readiness into its Advanced Security Delivery Platform (ADSP). This strategic move positions F5 to address a significant future security challenge.

While the long-term potential for PQC is substantial, driven by the evolving threat landscape, its current market penetration is still in its early stages. Enterprises are beginning to explore PQC, but widespread adoption and established market share are yet to materialize.

F5's focus on PQC readiness represents a forward-thinking investment in a high-growth, future-proof sector. However, the immediate market demand and the competitive environment for these solutions are still in a developmental phase, indicating it's a nascent but crucial area for future security.

Niche Edge Computing Deployments for AI Workloads

F5's strategic expansion with Equinix to facilitate AI workload deployment at the edge, especially within hybrid multicloud setups, signals a significant growth avenue. This collaboration aims to streamline the complex process of bringing AI capabilities closer to data sources, a critical factor for real-time processing.

While the potential is vast, niche edge computing deployments for AI, such as those focused on AI inference and retrieval-augmented generation (RAG), are currently in nascent adoption stages for many businesses. These specialized applications, though holding immense promise, represent a smaller, albeit growing, segment of the overall market that F5 is actively cultivating.

- Market Potential: The global edge computing market is projected to reach $151.9 billion by 2030, growing at a CAGR of 37.4% from 2023 to 2030, according to Grand View Research. AI workloads are a key driver of this expansion.

- Early Adoption: Enterprises are still navigating the complexities of integrating AI inference and RAG at the edge, leading to a current lower market share for these specific niche solutions.

- F5's Role: F5's partnership with Equinix positions them to capitalize on this emerging market by simplifying deployment and security, thereby accelerating enterprise adoption of edge AI.

Emerging SaaS Offerings Beyond Established Cloud Services

Beyond its robust F5 Distributed Cloud Services, F5 is actively developing and introducing newer Software-as-a-Service (SaaS) offerings. These emerging solutions, while promising, are currently in their nascent stages of market adoption and penetration.

These specific SaaS modules, by virtue of their early market entry, command a relatively low market share within their respective specialized segments. This positions them as potential Question Marks within the F5 BCG Matrix, necessitating strategic investment in focused marketing and sales initiatives to cultivate growth and elevate their market standing.

- Emerging SaaS Portfolio: F5 is expanding its SaaS footprint beyond core cloud services, targeting niche areas with specialized application delivery and security functionalities.

- Low Market Share: These new SaaS offerings, while innovative, currently represent a small fraction of their target markets, indicating significant room for expansion. For instance, a new API security SaaS module might have captured only 1-2% of its addressable market in early 2024.

- Strategic Focus Required: To transition these offerings from Question Marks to Stars, F5 must allocate dedicated resources for market education, channel partner enablement, and targeted customer acquisition campaigns.

- Growth Potential: The overall SaaS market continues its upward trajectory, with projections indicating continued double-digit growth through 2025, providing a fertile ground for these emerging F5 solutions to gain traction.

F5's emerging SaaS offerings, while innovative, currently hold a small market share in their respective specialized segments. These represent potential Question Marks, requiring strategic investment to cultivate growth and improve their market standing.

The nascent nature of these new SaaS solutions means they are in the early stages of adoption, necessitating focused marketing and sales efforts to build awareness and capture market share. Their success hinges on F5's ability to effectively position and scale these offerings in a competitive landscape.

The overall SaaS market continues its strong growth trajectory, providing a favorable environment for these emerging F5 solutions to gain traction and potentially transition into Stars within the BCG matrix.

| F5 BCG Matrix: Question Marks | Current Market Share | Market Growth Potential | Strategic Implication |

|---|---|---|---|

| Emerging SaaS Offerings (e.g., API Security, new WAF modules) | Low (e.g., 1-3% in early 2024 for specific modules) | High (SaaS market projected to grow significantly through 2025) | Requires investment in marketing, sales, and product development to increase market share. |

| AI-powered Edge Solutions (e.g., AI inference, RAG) | Nascent (Niche adoption stages for many businesses) | Very High (Edge computing market projected to reach $151.9B by 2030) | Focus on simplifying deployment and demonstrating value to accelerate enterprise adoption. |

| Post-Quantum Cryptography (PQC) Readiness | Early Stages (Exploratory phase for most enterprises) | Substantial (Long-term security imperative) | Positioning as a future-proof solution, requiring market education and building early adopter confidence. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.