EZCORP PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EZCORP Bundle

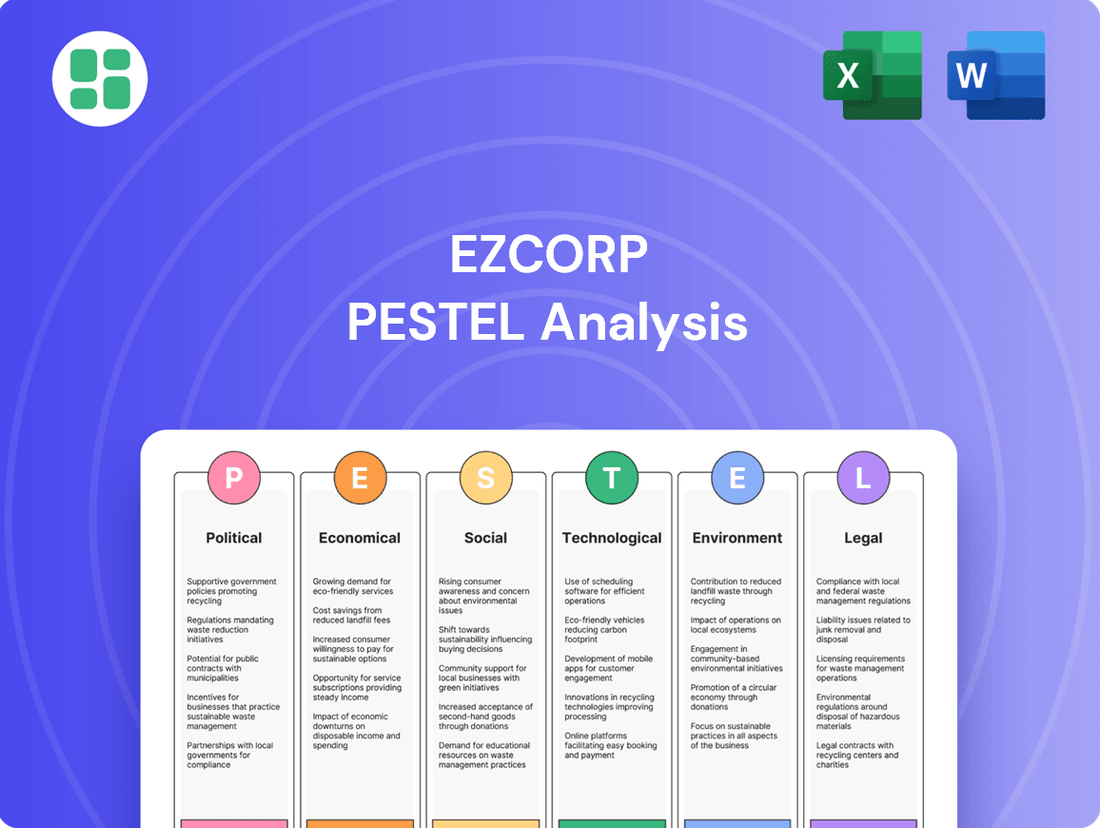

Navigate the complex external forces shaping EZCORP's trajectory with our meticulously crafted PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your investment strategy and gain a competitive edge. Purchase the full report now for a comprehensive understanding.

Political factors

Changes in political administrations, such as potential shifts in economic policy following the 2024 US election, can impact the regulatory landscape for companies like EZCORP. For instance, a new administration might prioritize consumer protection, potentially leading to stricter rules on interest rates and fees for pawn loans, which are often seen as short-term credit solutions.

Increased legislative focus on consumer lending practices, particularly after periods of economic strain, could result in new regulations. For example, if there's a perceived rise in predatory lending, lawmakers might introduce caps on Annual Percentage Rates (APRs) for pawn transactions, directly affecting EZCORP's revenue streams.

Industry advocacy groups, like the National Pawnbrokers Association, play a crucial role in shaping these regulations. Their engagement with federal lawmakers aims to highlight the essential financial services pawn shops provide, especially to underserved communities, potentially influencing the outcome of proposed legislation in 2024 and beyond.

Political pressure to bolster consumer protection is on the rise, potentially leading to more stringent requirements for transparency, detailed disclosures, and clearer dispute resolution mechanisms for lenders like EZCORP. This focus on safeguarding consumers, particularly vulnerable groups who represent a substantial segment of EZCORP's clientele, could translate into increased operational complexities and higher compliance expenditures for the company.

Government economic stimulus and welfare policies can significantly influence the demand for pawn loans. For instance, during periods of robust economic growth and strong social safety nets, like the projected stability in the US labor market through 2025 with unemployment rates anticipated to remain below 4%, individuals may have less need for short-term, non-recourse loans.

Conversely, a reduction in unemployment benefits or other welfare programs, as seen in some localized austerity measures or shifts in social spending, could lead to increased reliance on services like EZCORP’s.

For example, if a government program that provided direct financial aid to low-income households were to be scaled back in 2025, this could potentially boost the customer base for pawn shops as individuals seek alternative funding sources for immediate needs.

International Relations and Trade Policies

EZCORP's international relations and trade policies directly impact its merchandise sales, particularly the resale of forfeited pawn collateral. Tariffs and trade agreements can alter the cost of acquiring and selling goods, potentially affecting profit margins. For instance, changes in import duties on electronics or jewelry could influence the price point at which EZCORP can profitably move inventory.

The global economic climate, heavily shaped by international trade dynamics, also indirectly influences EZCORP's core pawn operations. A robust global economy often correlates with stronger consumer spending and higher collateral values, benefiting EZCORP's loan portfolio. Conversely, trade disputes or economic slowdowns in major economies can dampen consumer confidence and reduce the perceived value of assets used as collateral.

Political stability in Latin America, where EZCORP has a significant presence, is a critical factor for its business continuity and expansion strategies. For example, in Mexico, where EZCORP operates under the name Presto, shifts in government policy or economic instability can affect regulatory frameworks and consumer purchasing power. As of early 2024, many Latin American economies are navigating inflationary pressures and varying degrees of political uncertainty, which EZCORP must closely monitor.

- Trade Policy Impact: Tariffs on imported goods, a common tool in international trade negotiations, can increase the acquisition cost of resale merchandise for EZCORP, potentially squeezing margins.

- Global Economic Influence: A strong global economy, often fostered by stable trade relations, generally supports higher consumer spending and better collateral valuations for EZCORP's pawn loans.

- Latin American Operations: Political stability in countries like Mexico is crucial; for example, regulatory changes or economic downturns can directly affect EZCORP's profitability in those regions.

- Consumer Confidence: International trade tensions can create economic uncertainty, leading to reduced consumer confidence and a potential decrease in the demand for pawn services and resale items.

Political Stability in Operating Regions

Political stability in the United States and Latin American countries where EZCORP operates significantly influences its operational security and investor confidence. Instability can trigger economic volatility, currency swings, and potential unrest, disrupting operations and demand. This is especially critical given EZCORP's expansion in Latin America.

For instance, political uncertainty in Mexico, a key market for EZCORP, can lead to shifts in consumer spending habits. In 2024, ongoing political transitions and policy debates in several Latin American nations where EZCORP has a presence create a dynamic operating landscape. These shifts can impact regulatory environments and the overall ease of doing business.

- United States: A stable political climate in the US supports consistent consumer spending, a core driver for EZCORP's pawn and credit services.

- Mexico: Political stability in Mexico is crucial, as it directly affects economic conditions and consumer purchasing power, impacting loan demand and repayment rates.

- Latin America Expansion: EZCORP's strategy to grow in Latin America necessitates careful monitoring of political developments in countries like Colombia and Peru, where policy changes can rapidly alter market dynamics.

Government policies regarding consumer protection and lending practices are a significant political factor for EZCORP. For example, potential new regulations in 2024 or 2025 could cap interest rates or mandate stricter disclosure requirements for pawn loans, impacting revenue. Industry lobbying efforts by groups like the National Pawnbrokers Association aim to influence these legislative outcomes.

International trade policies and political stability in regions like Latin America, where EZCORP operates, also play a crucial role. Tariffs can affect the cost of resale inventory, while political instability in countries such as Mexico can impact consumer spending and regulatory environments. For instance, as of early 2024, several Latin American economies are navigating inflation and political uncertainty.

| Political Factor | Impact on EZCORP | Example/Data Point (2024/2025) |

|---|---|---|

| Consumer Protection Laws | Stricter regulations on interest rates and disclosures could reduce profitability. | Potential for APR caps on pawn transactions in the US. |

| Trade Policy | Tariffs can increase the cost of acquiring resale merchandise. | Changes in import duties on electronics or jewelry. |

| Political Stability (Latin America) | Instability can affect operations, consumer spending, and regulatory frameworks. | Monitoring political transitions in Mexico and other key markets in 2024. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting EZCORP, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions, to identify strategic opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable insights.

Economic factors

Fluctuations in benchmark interest rates, like those set by the Federal Reserve, directly affect EZCORP's cost of borrowing and the overall credit landscape. While EZCORP's pawn loans are secured and non-recourse, broader interest rate movements can influence consumer willingness to take on debt and access traditional financing.

As of mid-2025, the Federal Reserve has maintained a steady benchmark interest rate, reflecting a cautious approach to inflation management. This stability provides a predictable cost of capital for EZCORP, though consumer borrowing behavior may still be influenced by the lingering effects of prior rate hikes and the anticipation of future adjustments.

The expectation of potential interest rate cuts later in 2025 could subtly alter consumer financial decisions, potentially leading some individuals to explore more traditional credit options. However, the unique, often higher, interest rate structure of pawn loans may limit the direct impact of these broader rate shifts on EZCORP's core business model.

During economic downturns, unemployment often rises, prompting individuals to seek quick financial assistance. This trend directly benefits companies like EZCORP, whose pawn loan services become more attractive when traditional credit options are limited.

EZCORP's financial performance reflects this dynamic. For instance, in the third quarter of 2024, the company reported a significant increase in its Pawn Loans Outstanding (PLO), reaching $533.2 million, up 12% year-over-year. This growth underscores the sustained demand for their services during periods of economic strain.

Furthermore, EZCORP's revenue saw a robust increase of 10% in the same quarter, totaling $320.7 million. This financial success is largely attributed to the increased customer reliance on short-term, accessible lending solutions provided by the company, especially when facing economic uncertainties.

Rising inflation and the increasing cost of living directly impact EZCORP's customer base. As household budgets tighten, more individuals may turn to pawn loans for immediate cash to manage essential expenses. This trend was evident in late 2024 and early 2025, with reports indicating a significant uptick in demand for short-term credit solutions as consumer prices continued their ascent.

Inflation also presents a dual challenge for EZCORP: it affects the value of the merchandise they acquire and sell, while simultaneously increasing their own operational expenses. For instance, higher utility costs and increased wage demands from employees can erode profit margins. EZCORP's ability to effectively manage its inventory, adjust pricing strategies, and control operating costs is therefore paramount to maintaining profitability in this economic climate.

Consumer Credit Availability and Debt Levels

The accessibility of traditional credit significantly impacts the demand for pawn services. When banks tighten lending, or consumers carry substantial debt, pawn shops often see increased traffic as people seek quick, albeit often more expensive, financing. For instance, in late 2024, while some consumer credit access saw slight improvements, a substantial portion of the population, particularly those with lower incomes, still struggles with traditional banking relationships, making pawn services a necessary option.

Rising consumer debt levels can create a dual effect. On one hand, it might signal economic strain leading to increased demand for pawn services. On the other hand, if debt levels become unmanageable, it could also lead to reduced discretionary spending, potentially impacting the volume of goods available for pawn. As of early 2025, total U.S. consumer debt, excluding mortgages, remained elevated, with credit card debt continuing to be a significant burden for many households.

- Consumer Credit Tightening: In the first half of 2025, surveys indicated that a notable percentage of U.S. banks maintained or tightened lending standards for consumer loans, particularly for individuals with lower credit scores.

- Unbanked and Underbanked Population: Approximately 5-7% of U.S. households remained unbanked or underbanked in 2024, highlighting a persistent need for alternative financial services like pawn shops.

- Debt Burden: By mid-2025, average credit card debt per household was estimated to be over $9,000, a figure that continues to pressure household budgets and potentially drives demand for short-term credit solutions.

Disposable Income and Consumer Spending

Changes in disposable income directly influence the demand for pawn loans. For instance, if disposable income shrinks, more individuals may turn to pawn shops for immediate cash, benefiting companies like EZCORP. Conversely, strong consumer spending can invigorate EZCORP's retail segment, as people are more likely to purchase pre-owned merchandise.

In 2024, the U.S. personal saving rate, a key indicator of disposable income available for spending, saw fluctuations. While it remained elevated compared to pre-pandemic levels, shifts in inflation and employment impacted how much consumers had left after essential expenses. This dynamic creates both opportunities and challenges for EZCORP's dual business model.

- Increased Demand for Pawn Services: A decline in disposable income often correlates with a rise in customers seeking short-term liquidity through pawn loans.

- Boosted Retail Sales: Robust consumer spending environments can lead to higher sales volumes for EZCORP's retail operations, as consumers are more willing to purchase discounted goods.

- Dual Revenue Streams: EZCORP's ability to capitalize on both the lending and retail aspects of its business provides resilience, as economic conditions can favor one segment over the other at different times.

Economic factors significantly shape EZCORP's operational landscape. Fluctuations in interest rates, while not directly impacting pawn loan terms due to their secured nature, influence the broader credit environment and consumer borrowing appetite. During economic downturns, rising unemployment and tighter traditional credit access often drive increased demand for EZCORP's pawn services, as seen by the 12% year-over-year increase in Pawn Loans Outstanding to $533.2 million in Q3 2024.

Inflation presents a dual challenge, affecting both the value of inventory and operational costs for EZCORP, while also potentially increasing demand for quick cash solutions among consumers. Changes in disposable income also play a crucial role; a decline can boost pawn loan demand, whereas strong consumer spending can invigorate EZCORP's retail segment. For instance, in 2024, the U.S. personal saving rate's fluctuations directly impacted consumer spending power, influencing EZCORP's dual revenue streams.

| Economic Factor | Impact on EZCORP | Relevant Data (2024-2025) |

|---|---|---|

| Interest Rates | Influences broader credit environment and consumer borrowing. | Federal Reserve maintained steady benchmark interest rates mid-2025; potential cuts anticipated later in 2025. |

| Unemployment/Economic Downturns | Increases demand for pawn services. | Pawn Loans Outstanding (PLO) grew 12% year-over-year to $533.2 million in Q3 2024. |

| Inflation | Affects inventory value and operational costs; can increase demand for pawn services. | Consumer prices continued to ascend, impacting household budgets in late 2024/early 2025. |

| Disposable Income | Impacts demand for pawn loans and retail sales. | U.S. personal saving rate fluctuated in 2024, affecting consumer spending power. |

| Consumer Credit Access | Drives demand for alternative financial services. | 5-7% of U.S. households remained unbanked/underbanked in 2024; banks maintained/tightened lending standards in H1 2025. |

Full Version Awaits

EZCORP PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of EZCORP.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting EZCORP.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into EZCORP's strategic landscape.

Sociological factors

The traditional perception of pawn shops can unfortunately carry a social stigma, which might discourage some individuals from utilizing their services, even when in genuine need of financial assistance. This perception often stems from outdated stereotypes that don't reflect the modern reality of these businesses.

EZCORP actively works to reshape this image by emphasizing a customer-centric approach and ensuring transparency in all its dealings. They aim to build trust and demonstrate the value they provide as a legitimate financial resource.

There are ongoing industry-wide efforts to highlight the crucial role pawnbrokers play as a vital safety net for underbanked households. For instance, in 2023, it's estimated that millions of Americans rely on pawn services for short-term liquidity, underscoring their importance in the financial ecosystem.

A substantial segment of EZCORP's clientele comprises individuals who are underbanked or unbanked, meaning they have limited or no access to conventional banking services. This financial exclusion is a persistent issue, with data from 2023 showing that approximately 4.5% of U.S. households remained unbanked, and an additional 11.3% were underbanked, relying on alternative financial services. These demographic trends directly fuel the demand for alternative lending solutions that EZCORP provides.

Pawn businesses, like those operated by EZCORP, effectively address a critical market need by offering small-dollar, non-recourse transactions. These services provide immediate liquidity for individuals facing short-term financial shortfalls, acting as a vital safety net when traditional credit avenues are unavailable. The reliance on these services is particularly pronounced among lower-income households and minority groups, underscoring the sociological importance of EZCORP's business model in supporting financially vulnerable populations.

Consumers, especially younger demographics, increasingly favor digital and convenient financial services, pushing pawn operations to adapt. While physical locations are still key, the rise of mobile apps and online platforms for financial dealings shapes how people find and use lending options.

EZCORP is actively enhancing its digital presence to meet these evolving preferences. For instance, in 2024, a significant portion of their customer base engaged with their services through digital channels, indicating a clear shift in how financial transactions are initiated and managed.

Socioeconomic Inequality and Financial Stress

Persistent socioeconomic inequality and elevated levels of financial stress within communities create a consistent demand for short-term, non-recourse loans. EZCORP's business model directly addresses these acute financial needs, providing immediate cash for unexpected expenses to individuals facing economic hardship. The average pawn transaction size, often under $180, underscores the nature of these immediate, smaller-scale financial requirements.

These conditions are exacerbated by economic shifts. For instance, in 2024, a significant portion of households reported difficulty covering essential expenses, with many relying on high-cost credit options. This economic reality fuels the need for services like those offered by EZCORP, particularly in regions with lower average incomes and higher rates of underemployment.

- Socioeconomic Disparities: Continued gaps in income and wealth create a base of consumers requiring quick financial solutions.

- Financial Fragility: Many individuals operate with limited savings, making them vulnerable to unexpected costs and reliant on short-term credit.

- Demand for Access: The need for immediate liquidity for essential needs, like rent or utilities, drives consistent utilization of pawn and short-term loan services.

Cultural Attitudes Towards Borrowing and Asset Use

Cultural attitudes towards debt and borrowing significantly shape EZCORP's operating environment. In many Latin American countries, where EZCORP has a strong presence, the use of personal property as collateral for short-term loans is a more established and understood practice compared to some Western markets. This can be seen in the continued reliance on informal lending networks and pawn shops, which often cater to individuals who may have limited access to traditional banking services.

For instance, in Mexico, a key market for EZCORP, a substantial portion of the population utilizes pawn shops for immediate financial needs. Data from 2023 indicated that pawn shop lending remains a vital, albeit often unbanked, segment of the financial ecosystem. This cultural acceptance means that EZCORP’s business model, which centers on pawn lending, aligns well with existing consumer behaviors and preferences in these regions.

Understanding these nuances is crucial for effective marketing and customer engagement. EZCORP's strategies need to resonate with the cultural context, emphasizing trust and the practical utility of their services. By acknowledging and respecting these ingrained attitudes, EZCORP can build stronger customer relationships and tailor its offerings to meet specific community needs.

- Cultural Acceptance of Pawn Services: In markets like Mexico, pawn lending is a culturally ingrained method for accessing quick funds, with a significant percentage of the population utilizing these services.

- Trust and Familiarity: Consumers in Latin America often exhibit a higher degree of trust in pawn shops due to their long-standing presence and tangible collateral-based lending models.

- Marketing Resonance: EZCORP's outreach must acknowledge and leverage the cultural acceptance of borrowing against personal assets, framing it as a practical and accessible financial solution.

- Demographic Reach: The cultural disposition towards pawn services allows EZCORP to effectively reach a broad demographic, including those who may be underserved by conventional financial institutions.

Societal perceptions of pawn shops continue to evolve, with ongoing efforts to destigmatize these services. While a segment of the population remains hesitant due to outdated stereotypes, many recognize pawn shops as a vital financial safety net. In 2023, millions of Americans relied on pawn services for essential liquidity, highlighting their importance for underbanked households.

Demographic trends, particularly the persistent underbanking and unbanking of households, directly fuel demand for EZCORP's offerings. In 2023, approximately 4.5% of U.S. households were unbanked, and an additional 11.3% were underbanked, underscoring the need for alternative financial solutions.

Consumer preferences are shifting towards digital convenience, prompting EZCORP to enhance its online and mobile presence. By 2024, a notable portion of EZCORP's customer base engaged with services digitally, reflecting a broader trend in financial transaction management.

Persistent socioeconomic inequalities and financial stress create a consistent demand for short-term loans, with the average pawn transaction often falling under $180. This need is amplified by economic shifts, as seen in 2024 data indicating many households struggled with essential expenses, relying on high-cost credit.

| Sociological Factor | Description | Impact on EZCORP | Relevant Data (2023-2024) |

|---|---|---|---|

| Social Stigma | Negative perceptions of pawn shops | May deter some customers; requires brand building | Millions relied on pawn services for liquidity (2023) |

| Underbanked Population | Limited access to traditional banking | Directly drives demand for alternative lending | 11.3% of U.S. households were underbanked (2023) |

| Digital Preferences | Consumer shift to online and mobile services | Necessitates investment in digital channels | Significant customer engagement via digital channels (2024) |

| Socioeconomic Inequality | Income and wealth disparities | Creates consistent need for short-term credit | Average pawn transaction under $180; many households struggled with expenses (2024) |

Technological factors

The ongoing digitalization of financial services presents a significant opportunity for EZCORP to expand its offerings. By developing online pawn transaction capabilities, mobile applications, and e-commerce platforms for merchandise, EZCORP can tap into a wider customer base seeking greater convenience and efficiency. This digital shift is already showing positive results, with EZCORP reporting a notable increase in digital engagement and e-commerce sales in its recent fiscal periods, indicating strong market adoption.

Data analytics and AI are revolutionizing how companies like EZCORP operate. By leveraging these technologies, EZCORP can achieve more precise valuations of collateral, streamline inventory management, and bolster its risk assessment capabilities for lending. This leads to more efficient and profitable operations.

AI's ability to predict market trends in merchandise and personalize customer interactions offers a significant competitive edge. For instance, AI-powered recommendation engines can boost sales by suggesting relevant items to customers, mirroring the success seen in sectors where personalized experiences are key drivers of engagement.

The financial sector is a prime example of AI adoption, with institutions increasingly integrating AI to refine operations and elevate customer service. This trend suggests a broader industry shift, where AI is becoming indispensable for maintaining competitiveness and driving innovation in financial services.

As EZCORP enhances its digital services, cybersecurity and data privacy are critical. In 2024, the global cost of data breaches was projected to reach $10 trillion, highlighting the immense financial risk. Protecting customer data and financial transactions is vital for maintaining trust and preventing severe legal and reputational harm.

Regulatory scrutiny over AI use and data management is increasing. For instance, the EU's AI Act, fully applicable from mid-2025, imposes strict rules on AI systems, including those handling personal data, which EZCORP must navigate. Compliance is essential to avoid substantial fines and maintain operational integrity.

Automation of In-Store Operations

Technological advancements are increasingly enabling the automation of in-store operations for businesses like EZCORP. This includes sophisticated systems for real-time inventory tracking, streamlined customer onboarding processes, and faster transaction processing at physical pawn locations. These efficiencies directly translate to reduced labor costs and quicker service, ultimately boosting the company's profitability.

The impact of automation on operational efficiency is significant. For instance, in 2024, retail businesses that implemented advanced inventory management systems saw an average reduction of 15% in stock-outs and a 10% decrease in carrying costs. Similarly, automated customer service kiosks can handle a substantial volume of routine inquiries, freeing up human staff for more complex interactions.

- Increased Efficiency: Automation can reduce the time spent on manual tasks like inventory checks and customer data entry.

- Reduced Labor Costs: Automating repetitive in-store functions can lower the need for extensive staffing, especially during off-peak hours.

- Improved Customer Experience: Faster transactions and more readily available inventory information can lead to higher customer satisfaction.

Mobile Technology Adoption

The increasing prevalence of smartphones and mobile internet within EZCORP's customer base presents a prime opportunity to shift towards mobile-first service models. This technological trend allows for more accessible loan applications, timely payment notifications, and streamlined browsing of merchandise directly through mobile platforms, boosting customer satisfaction and interaction.

Data indicates a substantial portion of pawn transactions are now being conducted through mobile applications, highlighting the growing reliance on digital channels for core business operations. EZCORP's strategic focus on developing intuitive mobile applications aligns with this market shift, aiming to capture a larger share of this digitally-enabled segment.

- Smartphone Penetration: Over 85% of adults in the US owned a smartphone as of early 2024, a figure expected to climb.

- Mobile Transaction Growth: Reports suggest that mobile payments and financial transactions have seen double-digit year-over-year growth since 2022.

- App-Based Pawn Services: A significant, growing percentage of pawn shops are reporting that over 30% of their new customer acquisition now comes through mobile app channels.

Technological advancements are reshaping how EZCORP operates, emphasizing digital integration and data utilization. The company's strategic move towards online pawn transactions and mobile apps directly addresses the growing demand for convenience, with digital engagement already showing positive trends. Leveraging AI for valuation and risk assessment promises enhanced operational efficiency and profitability.

The increasing adoption of AI across the financial sector underscores its importance for maintaining competitiveness. EZCORP's focus on AI-driven merchandise trend prediction and personalized customer interactions offers a distinct advantage. However, robust cybersecurity measures are paramount, especially given the projected $10 trillion global cost of data breaches in 2024, to safeguard customer data and maintain trust.

Automation in in-store operations, from inventory management to customer onboarding, is crucial for reducing costs and improving service speed. Businesses adopting such systems in 2024 saw significant benefits, like reduced stock-outs. EZCORP's investment in mobile-first strategies is also vital, as smartphone penetration exceeds 85% in the US, with mobile transactions experiencing robust growth.

| Key Technological Trend | Impact on EZCORP | Supporting Data (2024/2025) |

| Digitalization of Financial Services | Expanded customer reach via online and mobile platforms. | Increased digital engagement and e-commerce sales reported by EZCORP. |

| AI and Data Analytics | Improved collateral valuation, risk assessment, and personalized sales. | AI adoption is a key competitive differentiator in the financial sector. |

| Automation of In-Store Operations | Reduced labor costs and enhanced customer service efficiency. | Retailers saw ~15% reduction in stock-outs with advanced inventory systems in 2024. |

| Mobile-First Service Models | Greater accessibility for loan applications and merchandise browsing. | Over 85% US adult smartphone penetration; double-digit growth in mobile financial transactions. |

Legal factors

EZCORP navigates a stringent regulatory environment dictated by both state and federal lending laws. These laws, which cover aspects like permissible interest rates, fee structures, and the specific terms of pawn transactions, are crucial for the company's operations. For instance, the Military Lending Act (MLA) imposes significant limitations on interest rates and fees for covered borrowers, impacting a segment of EZCORP's potential customer base.

Failure to adhere to these complex regulations can result in severe consequences, including substantial financial penalties, costly litigation, and operational limitations that could hinder business growth. The dynamic nature of this legal landscape is highlighted by ongoing legislative efforts; for example, in 2024, several states have proposed or enacted changes to pawnbroker laws, potentially affecting fee structures or disclosure requirements.

The Consumer Financial Protection Bureau (CFPB) significantly impacts EZCORP by regulating short-term lending. New CFPB interpretive rules, which can apply credit card-like regulations to certain short-term lenders, may increase EZCORP's compliance obligations concerning disclosures, dispute resolution, and payment processing.

Furthermore, the CFPB's recent actions, such as extending compliance deadlines for small business lending data collection rules, demonstrate an evolving regulatory landscape that EZCORP must actively monitor and adapt to, potentially affecting its operational strategies and reporting requirements.

Operating pawn shops necessitates securing and maintaining a variety of state and local licenses and permits. These often include specific capital requirements, thorough background checks for principals, and adherence to stringent operational standards, impacting EZCORP's ability to launch new locations or broaden its service offerings.

In 2024, the landscape of business licensing continues to evolve, with some jurisdictions reporting average processing times for new business permits ranging from 30 to 90 days, though this can extend significantly for specialized industries like pawnbroking. Any shifts or slowdowns in these approval processes can directly impede EZCORP's expansion plans and the timely introduction of new services, highlighting regulatory licensing delays as a potential critical bottleneck for growth.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Laws

EZCORP, like other financial service providers, must adhere to Anti-Money Laundering (AML) and Know Your Customer (KYC) laws. These regulations are designed to prevent illegal financial activities, a significant concern for global regulators. For instance, the Financial Crimes Enforcement Network (FinCEN) in the U.S. actively enforces these rules, with substantial penalties for non-compliance. EZCORP’s implementation of rigorous customer identity verification and suspicious transaction reporting mechanisms directly addresses these legal mandates, ensuring operational integrity despite the added overhead.

The financial sector's commitment to combating financial crime is a primary focus for regulatory bodies worldwide. In 2023 alone, FinCEN reported a significant increase in Suspicious Activity Reports (SARs) filed by financial institutions, underscoring the ongoing effort to detect and deter illicit financial flows. EZCORP’s proactive approach to AML/KYC compliance is therefore not just a legal necessity but a critical component of maintaining trust and operational legitimacy.

- Regulatory Scrutiny: Financial institutions face increasing scrutiny from regulators like FinCEN regarding AML/KYC compliance.

- Operational Costs: Implementing robust verification and reporting systems adds to operational expenses for companies like EZCORP.

- Financial Crime Prevention: These laws are essential tools for combating money laundering, terrorist financing, and other illicit financial activities.

- Reputational Risk: Failure to comply can lead to significant fines and damage a company's reputation.

Data Privacy and Security Laws

EZCORP must navigate a complex web of data privacy and security laws, including state-level regulations like the California Consumer Privacy Act (CCPA). These laws dictate how the company handles customer data, from collection to storage and usage, making compliance a critical factor in avoiding significant penalties and preserving customer confidence.

The increasing digitalization of EZCORP's services amplifies the importance of adhering to these regulations. Regulators are actively promoting enhanced transparency and disclosure requirements throughout the financial sector, requiring businesses to be more open about their data practices.

- CCPA Enforcement: In 2023, California continued to actively enforce the CCPA, with fines for non-compliance potentially reaching $7,500 per violation.

- GDPR Impact: While not directly applicable to all EZCORP operations, the principles of the EU's General Data Protection Regulation (GDPR) often influence global data privacy standards, pushing for stronger consumer rights.

- Data Breach Costs: The average cost of a data breach in the financial sector reached $5.90 million in 2023, highlighting the financial implications of security lapses.

EZCORP operates under a strict legal framework, encompassing lending regulations, licensing requirements, and data privacy laws. The Military Lending Act (MLA) directly impacts interest rate caps for military borrowers, while state-level legislative changes in 2024 continue to reshape pawnbroker operations. The Consumer Financial Protection Bureau (CFPB) also plays a significant role, with evolving rules potentially extending credit card-like regulations to short-term lenders.

Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) laws is paramount, with FinCEN actively enforcing these rules. Data privacy laws like the CCPA, with potential fines of $7,500 per violation as seen in 2023, necessitate robust data handling practices. The average cost of a data breach in the financial sector reached $5.90 million in 2023, underscoring the financial risks of non-compliance.

| Legal Area | Key Regulations/Laws | Impact on EZCORP | 2023/2024 Data/Trends |

|---|---|---|---|

| Lending Laws | Military Lending Act (MLA), State Pawnbroker Laws | Interest rate caps, fee structures, transaction terms | Several states proposed/enacted changes to pawnbroker laws in 2024. |

| Consumer Protection | CFPB Regulations | Disclosure requirements, dispute resolution, payment processing | CFPB may apply credit card-like rules to short-term lenders. |

| Financial Crime | AML/KYC Laws | Customer verification, suspicious transaction reporting | FinCEN reported increased SAR filings in 2023; penalties for non-compliance are substantial. |

| Data Privacy | CCPA, GDPR Principles | Customer data handling, storage, usage | CCPA enforcement continued in 2023; average data breach cost in finance was $5.90 million. |

Environmental factors

EZCORP, like many companies, is experiencing heightened scrutiny on its Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) performance, even in sectors not directly tied to heavy manufacturing. Investors and consumers alike are demanding more than just financial returns; they want to see ethical operations, positive community impact, and responsible business conduct. This trend is particularly strong in the financial services sector, where sustainability is becoming a core strategic pillar for many institutions.

The financial industry's embrace of ESG is accelerating. For instance, a significant portion of global assets under management are now influenced by ESG considerations. By the end of 2024, it's projected that ESG-focused investments could reach $30 trillion globally, demonstrating a clear market signal that companies like EZCORP must align their practices with these evolving expectations to attract capital and maintain stakeholder trust.

EZCORP's retail model, centered on pre-owned goods, inherently creates waste streams from packaging, unsold inventory, and electronics. For instance, the disposal of electronics, a significant component of their inventory, requires careful handling to meet environmental regulations. By 2024, the global waste management market was valued at over $1.5 trillion, highlighting the scale of this industry and the increasing focus on sustainable practices.

Implementing robust waste management and recycling initiatives offers EZCORP a dual benefit: reducing its environmental impact and enhancing its brand image. Consumers, particularly in 2024, are increasingly factoring sustainability into their purchasing decisions, with studies showing a significant percentage willing to pay more for eco-friendly products and services. This presents an opportunity for EZCORP to differentiate itself.

EZCORP's extensive network of retail locations across the U.S. and Latin America necessitates substantial energy for lighting, climate control, and operations. This energy usage directly impacts its carbon footprint, a growing concern for consumers and regulators alike.

The company's commitment to environmental sustainability is increasingly tied to its ability to reduce energy consumption and explore renewable energy alternatives. For instance, in 2023, the retail sector in the U.S. accounted for approximately 17% of total energy consumption, highlighting the scale of potential impact.

By actively monitoring and managing its carbon emissions, EZCORP can align with industry-wide shifts towards more environmentally conscious business practices, potentially enhancing its brand reputation and operational efficiency.

Supply Chain Ethics and Sourcing of Merchandise

EZCORP's primary business involves pawned collateral, but the ethical sourcing of certain high-value items, especially jewelry, presents environmental and social considerations. Ensuring compliance with ethical sourcing standards, such as conflict-free diamonds, is crucial for maintaining EZCORP's reputation and fostering consumer trust. For instance, the Responsible Jewellery Council (RJC) reports continued industry focus on supply chain transparency, with member companies increasingly audited for adherence to ethical and environmental practices throughout 2024.

The provenance of precious metals and gemstones is a growing concern for consumers and regulators alike. EZCORP must navigate these expectations to avoid reputational damage and potential legal challenges. In 2024, global efforts to combat illicit trade in precious metals, often linked to environmental degradation and human rights abuses, intensified, with several countries implementing stricter import controls and due diligence requirements.

- Supply Chain Transparency: Increasing consumer demand for ethically sourced goods pressures companies like EZCORP to demonstrate the origin of their merchandise.

- Conflict Minerals: Ensuring that gold, diamonds, and other precious materials are not sourced from conflict zones is a key ethical consideration.

- Regulatory Scrutiny: Governments worldwide are enhancing regulations around the sourcing of raw materials, impacting businesses that handle high-value goods.

- Reputational Risk: Failure to address ethical sourcing can lead to negative publicity and a loss of customer confidence, impacting EZCORP's brand image.

Climate Change and Natural Disaster Preparedness

EZCORP's physical store locations are increasingly vulnerable to the escalating impacts of climate change, including more frequent and intense extreme weather events like hurricanes, floods, and wildfires. This necessitates robust preparedness and response strategies to ensure business continuity, safeguard assets, and prioritize the safety of its employees and customers. For instance, in 2024, the National Oceanic and Atmospheric Administration (NOAA) reported a significant increase in billion-dollar weather and climate disasters across the United States, highlighting the growing risk for businesses with extensive physical footprints.

The company must develop comprehensive plans to mitigate the effects of these environmental shifts. This includes investing in resilient infrastructure, securing supply chains against disruptions, and establishing clear protocols for emergency situations. As of early 2025, the insurance industry is also factoring in climate risk more heavily, potentially impacting EZCORP's operational costs and insurance premiums.

Key considerations for EZCORP's climate change preparedness include:

- Assessing location-specific climate risks: Understanding the particular threats each store faces, from coastal flooding to inland drought.

- Developing business continuity plans: Outlining procedures for temporary store closures, inventory management during disruptions, and alternative service delivery methods.

- Investing in resilient infrastructure: Implementing measures such as flood barriers, reinforced roofing, and backup power systems where appropriate.

- Employee training and safety protocols: Ensuring staff are prepared to respond to emergencies and have access to necessary safety equipment and information.

EZCORP faces environmental pressures related to waste management, particularly from electronics and packaging, as the global waste market exceeded $1.5 trillion in 2024. The company's significant energy consumption across its retail locations, which contributed to the U.S. retail sector's 17% energy use in 2023, also impacts its carbon footprint. Furthermore, ethical sourcing of high-value items like jewelry is critical, with intensified global efforts in 2024 to combat illicit trade in precious metals, often linked to environmental damage.

Climate change presents physical risks to EZCORP's numerous stores, with a notable increase in billion-dollar weather disasters across the U.S. in 2024. This necessitates investments in resilient infrastructure and robust business continuity plans, especially as the insurance industry, as of early 2025, is increasingly factoring climate risk into premiums.

| Environmental Factor | Relevance to EZCORP | Data Point/Trend |

|---|---|---|

| Waste Management | Disposal of electronics, packaging | Global waste management market > $1.5 trillion (2024) |

| Energy Consumption | Retail store operations | U.S. retail sector energy consumption ~17% (2023) |

| Ethical Sourcing | Precious metals, gemstones | Increased focus on illicit trade in precious metals (2024) |

| Climate Change Impact | Extreme weather events on physical stores | Increase in U.S. billion-dollar weather disasters (2024) |

PESTLE Analysis Data Sources

Our EZCORP PESTLE Analysis is built on a robust foundation of data, drawing from official government publications, leading financial news outlets, and reputable market research firms. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in current and reliable information.