EZCORP Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EZCORP Bundle

EZCORP operates in a competitive landscape shaped by several key forces, including the bargaining power of its customers and the threat of substitute financial services. Understanding these dynamics is crucial for strategic planning.

The complete report reveals the real forces shaping EZCORP’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

EZCORP's access to capital, the lifeblood of its lending operations, is significantly influenced by the bargaining power of its capital suppliers. In 2024, a key factor is the concentration of these sources, whether they are large banks or institutional investors. If a few dominant lenders control a substantial portion of available capital, they can dictate more stringent terms or higher interest rates, directly impacting EZCORP's cost of funds and its ability to offer competitive loan products.

EZCORP's reliance on specialized technology suppliers for critical infrastructure, like loan management software and security systems, presents a significant bargaining power. The limited number of vendors offering these niche solutions means they can often dictate terms and pricing, potentially increasing EZCORP's operational costs. For instance, in 2024, the market for specialized fintech solutions saw consolidation, with a few key players dominating, giving them leverage over smaller clients.

EZCORP's bargaining power of suppliers is influenced by the labor market, particularly for skilled employees in store operations, compliance, and financial services. The availability of qualified personnel in these specialized areas can create wage pressures.

In 2024, the demand for skilled workers in financial services and compliance roles remained robust, potentially leading to higher recruitment costs for EZCORP. For instance, the U.S. Bureau of Labor Statistics projected continued growth in financial examiner roles, suggesting a competitive labor environment.

Supplier Power 4

EZCORP's bargaining power of suppliers is influenced by essential service providers like real estate lessors, utility companies, and professional services firms. The concentration within these supplier markets and their ability to impact EZCORP's operating costs through lease agreements, service charges, or compliance mandates are key considerations.

In 2024, the commercial real estate market, particularly for retail locations, saw continued pressure from inflation, with average rent increases in many regions exceeding 5%. This can directly impact EZCORP's occupancy costs. Similarly, utility costs have remained volatile, with electricity prices in some areas seeing year-over-year increases of 10-15% by mid-2024, affecting EZCORP's overhead.

- Real Estate Leases: Concentration of landlords in key markets can give them leverage, potentially increasing lease renewal rates for EZCORP's pawn shop locations.

- Utility Providers: As essential services, utility companies often operate with limited competition, allowing them to pass on increased energy costs.

- Professional Services: The demand for legal and accounting services, especially concerning compliance and regulatory changes affecting the financial services sector, can drive up fees for specialized expertise.

Supplier Power 5

The bargaining power of suppliers for EZCORP, particularly concerning general merchandise for retail sales, appears relatively low. EZCORP's core business involves selling forfeited pawn collateral, meaning its inventory is largely derived from customer defaults rather than traditional wholesale purchasing. This reduces reliance on external suppliers for its primary product line.

While EZCORP does require store supplies and potentially some general merchandise for its retail segment, these are likely commoditized items with numerous available vendors. The company's scale of operations might offer some leverage in negotiating prices for these ancillary goods. For instance, in 2024, many retail supply chains experienced stabilization after earlier disruptions, suggesting a more competitive supplier landscape for non-core items.

- Low Reliance on External Suppliers: EZCORP's primary inventory comes from forfeited pawn collateral, not traditional wholesale, minimizing supplier dependence for its core revenue stream.

- Commoditized Ancillary Goods: Supplies like store fixtures or basic retail items are generally sourced from a broad market with many vendors, limiting any single supplier's power.

- Potential for Bulk Purchasing Power: As a publicly traded company with numerous locations, EZCORP can likely leverage its purchasing volume for store supplies to negotiate favorable terms in 2024.

- Limited Impact on Profitability: The cost of these ancillary supplies is unlikely to represent a significant portion of EZCORP's overall cost structure, thus capping the potential impact of supplier power on retail segment profitability.

EZCORP's bargaining power of suppliers is generally moderate to low, with key exceptions in capital and specialized technology. The company's primary revenue stream, derived from forfeited pawn collateral, significantly reduces its dependence on traditional merchandise suppliers. This structure inherently limits the leverage of external vendors over EZCORP's core operations.

However, EZCORP's access to capital, a critical input, is subject to the influence of its lenders. In 2024, the concentration of capital sources, such as large financial institutions, can lead to more demanding terms. Similarly, specialized technology providers for its fintech operations hold considerable sway due to the niche nature of their offerings, potentially increasing operational costs for EZCORP.

The labor market also presents a factor, with demand for skilled financial and compliance personnel in 2024 potentially driving up recruitment and retention costs for EZCORP. Essential services like real estate and utilities, often with limited competition, can also exert pressure on EZCORP's operating expenses, as seen with rising commercial rents and volatile energy prices.

| Supplier Category | Bargaining Power | Key Factors Influencing Power (2024) | Potential Impact on EZCORP |

| Capital Providers (Banks, Investors) | Moderate to High | Concentration of lenders, interest rate environment, EZCORP's creditworthiness | Higher cost of funds, stricter loan covenants |

| Specialized Technology Providers | High | Niche market, few dominant players, consolidation in fintech | Increased software licensing and maintenance fees |

| Labor (Skilled Financial/Compliance) | Moderate | Demand for specialized skills, wage inflation, competition for talent | Higher recruitment and compensation costs |

| Real Estate Lessors | Moderate | Commercial real estate market conditions, location concentration | Increased occupancy costs due to rising rents |

| Utility Providers | Moderate | Limited competition for essential services, energy price volatility | Higher operating expenses due to utility costs |

| General Merchandise Suppliers | Low | Commoditized goods, numerous vendors, EZCORP's scale | Minimal impact on profitability; potential for bulk discounts |

What is included in the product

This analysis dissects EZCORP's competitive environment, detailing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and the company's strategic positioning within these forces.

Instantly identify and address competitive pressures with a dynamic, interactive Porter's Five Forces model for EZCORP.

Customers Bargaining Power

EZCORP's customer base is highly fragmented, consisting of individuals needing small, short-term loans or looking to sell personal items. While each customer's transaction is minor, their sheer volume and collective need for immediate cash create a foundational level of bargaining power, particularly if other lenders or resale options are accessible.

In 2024, the average loan amount for EZCORP's pawn services remained relatively small, underscoring the individual nature of its customer transactions. This fragmentation means no single customer can significantly influence pricing or terms, but a mass exodus to competitors could impact overall demand.

The bargaining power of EZCORP's customers is amplified by the wide availability of alternative financial services. This means consumers can easily switch to other pawn shops, online lenders, or various short-term credit providers if they find EZCORP's interest rates, fees, or appraisal values to be less attractive. For instance, the rise of digital lending platforms has provided consumers with more convenient and often more competitive options for short-term financing, directly challenging traditional players like EZCORP.

EZCORP's customers exhibit significant price sensitivity, largely driven by their immediate need for funds and their focus on loan terms. This means they closely scrutinize interest rates, fees, and the loan-to-value ratios offered. For instance, in 2024, the average interest rate for short-term loans in this sector remained a critical factor for borrowers, directly impacting their decision-making process.

This high sensitivity to pricing directly constrains EZCORP's ability to implement substantial price increases. If rates or fees become too high, customers are likely to seek alternatives, leading to potential customer attrition. This dynamic underscores the importance of competitive pricing strategies for EZCORP to retain its customer base.

Customer Power 4

The bargaining power of customers for EZCORP is relatively low, primarily due to the nature of pawn loans and the resale of pre-owned merchandise. Customers seeking pawn loans typically face standardized processes across the industry, allowing for easy comparison of offers. This ease of comparison means customers can switch providers with minimal effort or cost if they find a better rate or terms elsewhere.

Switching costs for pawn loan customers are minimal. The process of obtaining a loan or selling an item is generally straightforward and doesn't involve significant fees or lengthy procedures to change providers. This low barrier to entry for customers empowers them to shop around for the best available terms, putting pressure on EZCORP to remain competitive.

The resale market for pre-owned goods also contributes to customer bargaining power. While EZCORP aims to offer fair prices for items, customers can compare EZCORP's offers with other resale channels, including online marketplaces and other pawn shops. This broadens the competitive landscape and can influence the prices EZCORP is willing to pay for inventory.

In 2023, the average pawn loan amount in the US was approximately $150, indicating that individual transactions are often not large enough to warrant extensive customer loyalty based solely on transaction value. This reinforces the importance of competitive pricing and efficient service in retaining customers.

- Low Switching Costs: Customers can easily move between pawn shops without incurring significant penalties.

- Price Sensitivity: The standardized nature of pawn loans encourages customers to seek the best interest rates and fees.

- Alternative Resale Channels: Customers have multiple options for selling pre-owned items, influencing EZCORP's purchasing prices.

- Fragmented Market: The presence of numerous smaller pawn shops can increase customer choice and bargaining leverage.

Customer Power 5

Customer power at EZCORP is influenced by increasing consumer awareness and access to information. Online comparison tools and growing financial literacy empower customers to scrutinize loan terms and explore alternative financing. This transparency allows them to negotiate for better rates and conditions, directly impacting EZCORP's pricing and profitability.

In 2023, the average personal loan interest rate in the US hovered around 11.16%, but could reach as high as 36% for subprime borrowers. This wide range highlights the potential for customers with better credit or more options to demand more favorable terms from lenders like EZCORP, increasing their bargaining leverage.

- Increased Information Access: Customers can readily compare EZCORP's loan products with those offered by competitors online.

- Financial Literacy Growth: Educational initiatives are making consumers more knowledgeable about financial products and their rights.

- Demand for Better Terms: Empowered customers are more likely to seek and secure more competitive interest rates and fees.

- Alternative Options: The availability of diverse lending platforms provides customers with viable alternatives if EZCORP's terms are not satisfactory.

EZCORP's customers possess moderate bargaining power, largely due to the low switching costs associated with pawn loans and the resale of goods. The fragmented nature of the market, coupled with increasing consumer access to information and comparison tools, allows customers to readily seek out more favorable terms from competitors. This necessitates that EZCORP maintains competitive pricing and efficient service to retain its clientele.

| Factor | Impact on EZCORP | 2024 Data/Trend |

| Switching Costs | Low, enabling easy customer movement | Minimal fees or lengthy procedures to change providers. |

| Price Sensitivity | High, customers scrutinize rates and fees | Average interest rates for short-term loans remain a critical decision factor. |

| Alternative Options | Numerous, providing leverage to customers | Rise of digital lending platforms offers convenient and competitive alternatives. |

| Information Access | Increased, empowering customers | Online comparison tools readily available for loan products. |

What You See Is What You Get

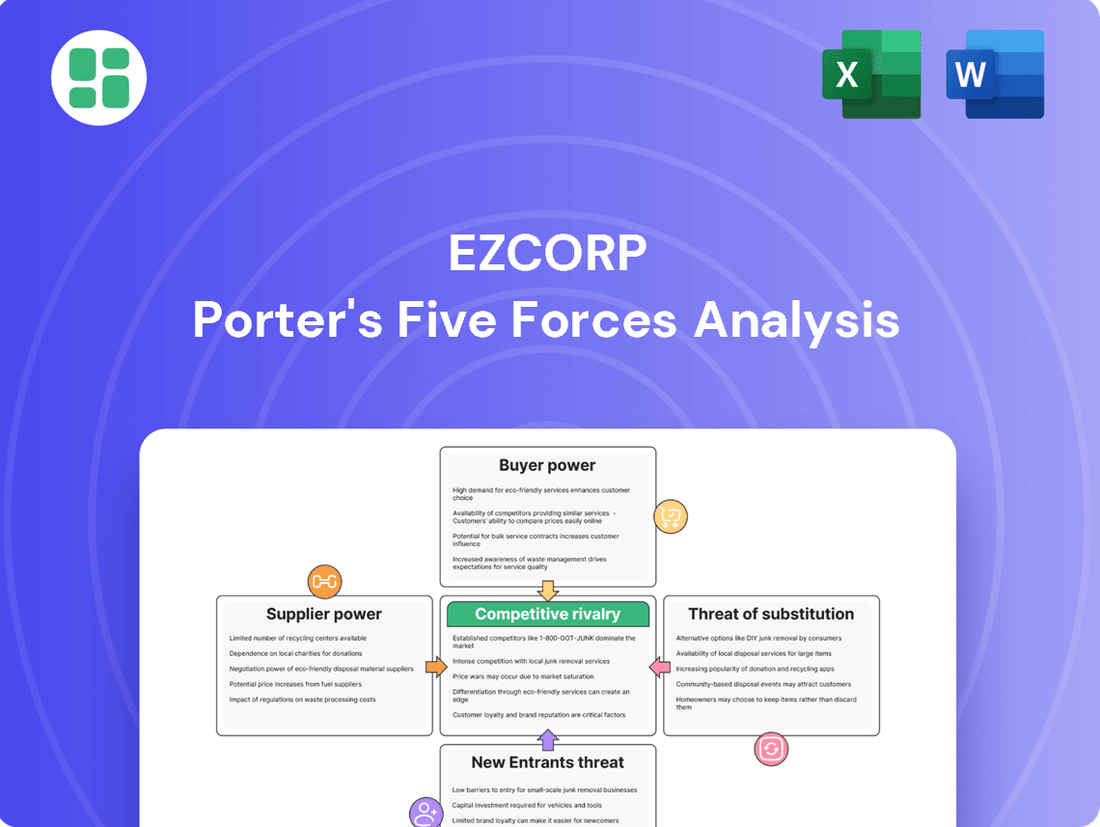

EZCORP Porter's Five Forces Analysis

This preview showcases the complete EZCORP Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. You're looking at the actual document; once purchased, you'll receive instant access to this exact, professionally formatted file, providing actionable insights into EZCORP's strategic landscape without any alterations or missing sections.

Rivalry Among Competitors

EZCORP faces significant competition from both national pawn chains, such as FirstCash, and a vast network of hundreds of smaller, independent pawn shops. This fragmented landscape, characterized by numerous players of varying sizes, intensifies the battle for market share across EZCORP's operating regions, impacting both its pawn lending and merchandise sales.

Competitive rivalry within the pawn industry, including for companies like EZCORP, is quite intense. This is largely due to the nature of pawn loans, where interest rates are often capped by regulations. This regulatory environment forces companies to compete more on factors beyond just price, such as the speed of service, the quality of customer interaction, and crucially, the amount offered for collateral. In 2023, EZCORP reported that its average loan-to-appraised-value ratio for its U.S. pawn segment was approximately 40%, indicating a significant competitive element in how much cash customers can receive for their items.

Competitive rivalry within the pawn industry, including for EZCORP, is notably intense due to the commoditized nature of pawn services. Differentiation is minimal, with most offerings being quite similar. This forces companies to compete primarily on factors like accessibility, speed, and minor adjustments to loan terms rather than unique value propositions, making it challenging to achieve premium pricing.

For instance, in 2024, the average loan-to-value ratio offered by pawn shops often hovered around 25-50% of an item's resale value, a fairly standard practice across the sector. EZCORP's ability to attract and retain customers is therefore heavily influenced by its branch network density and operational efficiency, as seen in its extensive U.S. footprint, rather than a fundamentally different service model.

Competitive Rivalry 4

The traditional pawn industry, particularly in mature markets, often experiences slow growth. This maturity means that companies like EZCORP must vie for a limited customer base, leading to heightened competition. This dynamic encourages aggressive marketing and price-based competition as firms try to capture existing market share.

This intensified rivalry can manifest in several ways:

- Aggressive Marketing: Companies may increase their advertising spend and promotional activities to stand out.

- Price Wars: To attract customers, pawnbrokers might offer more competitive interest rates on loans or better prices for purchased items.

- Customer Retention Focus: With fewer new customers entering the market, retaining existing ones becomes paramount, often through loyalty programs or superior service.

For instance, in 2024, the U.S. pawn industry continued to navigate these mature market conditions, with companies reporting steady, albeit not explosive, revenue growth, indicating a market where customer acquisition is challenging and retention is key.

Competitive Rivalry 5

Competitive rivalry within EZCORP's sector is intensified by substantial fixed costs. Maintaining physical store locations, managing inventory, and adhering to stringent regulatory compliance all demand significant capital. These high entry and operational barriers, while deterring new entrants, also act as exit barriers for existing, less profitable players.

This dynamic forces weaker competitors to persist in the market, even when facing low profitability, leading to sustained aggressive competition. For instance, the pawn shop industry, where EZCORP operates, involves considerable investment in secure facilities and inventory, estimated to be millions for larger chains. This financial commitment means businesses are reluctant to withdraw, even during economic downturns, thereby maintaining a crowded and competitive landscape.

- High Fixed Costs: Significant investments in physical stores, inventory, and regulatory compliance create substantial operational overhead.

- Exit Barriers: These high costs make it difficult and costly for struggling businesses to leave the market, prolonging their presence.

- Sustained Rivalry: Weaker competitors remain active, even with low profits, contributing to an intensely competitive environment for all players.

EZCORP faces intense competition from both large national chains like FirstCash and a multitude of smaller, independent pawn shops. This fragmented market structure, where differentiation is minimal and services are largely commoditized, forces companies to compete on factors such as service speed, customer interaction, and loan-to-value ratios. In 2024, the average loan-to-value ratio in the U.S. pawn industry often ranged between 25% and 50% of an item's resale value, highlighting the pressure to offer attractive terms.

The maturity of the pawn industry in many regions means EZCORP must actively fight for a limited customer base, leading to aggressive marketing and price competition. High fixed costs associated with physical locations, inventory, and regulatory compliance also act as exit barriers for struggling businesses, ensuring sustained rivalry. For example, maintaining a network of hundreds of stores requires significant ongoing investment, keeping competition fierce even during economic slowdowns.

| Competitive Factor | Description | 2024 Industry Trend |

|---|---|---|

| Market Structure | Fragmented with national chains and independent shops | Continued presence of both large and small operators |

| Differentiation | Low; services are largely commoditized | Focus on operational efficiency and customer service |

| Key Competitive Levers | Loan-to-value ratios, interest rates, speed of service | Average loan-to-value often 25-50% of resale value |

| Growth Environment | Mature markets with slow growth | Emphasis on customer retention and market share defense |

SSubstitutes Threaten

The threat of substitutes for EZCORP's pawn services is significant, with options like payday loans, title loans, and online installment loans directly competing for customers needing quick cash. These alternatives are becoming increasingly accessible, often with faster approval processes, which can divert potential clients away from traditional pawn shops.

For instance, the payday loan industry, though facing regulatory scrutiny, continues to serve millions. In 2023, it was estimated that over 12 million Americans used payday loans. Similarly, the online installment loan market has seen robust growth, offering longer repayment terms than traditional payday loans, making them an attractive substitute for a broader segment of financially distressed individuals.

Fintech innovations present a growing threat to EZCORP's traditional pawn model. Online micro-lenders, peer-to-peer platforms, and earned wage access programs offer faster, more convenient digital alternatives for short-term cash needs. For instance, the earned wage access market, projected to reach $6.4 billion by 2027, provides employees with immediate access to earned wages, bypassing the need for pawn services.

Customers have numerous alternatives for liquidating personal property, bypassing traditional pawn shops. Online marketplaces like eBay and Facebook Marketplace allow individuals to sell items directly, often achieving better prices and avoiding interest charges. In 2024, the global e-commerce market continued its robust growth, with platforms facilitating peer-to-peer transactions, directly impacting the volume of goods entering the pawn market.

Threat of Substitutes 4

Traditional financial products like credit cards, personal bank loans, and lines of credit serve as potential substitutes for EZCORP's offerings. While these are often less accessible to EZCORP's core demographic, individuals with stronger credit histories or existing banking relationships might opt for these alternatives. For instance, in 2024, the average credit card APR remained elevated, but for those with good credit, these options can still be more cost-effective than short-term loans.

Improvements in financial inclusion could broaden access to these traditional financial services for a wider segment of the population. This would present a more significant threat as more consumers could qualify for and utilize these often lower-cost alternatives. The expansion of digital banking platforms in 2024 has indeed made it easier for some previously underserved individuals to access credit, though significant gaps remain.

- Credit Cards: While often carrying higher interest rates, they offer convenience and rewards for those with good credit.

- Personal Bank Loans: These provide fixed repayment terms and can be more cost-effective than short-term loans for qualified borrowers.

- Lines of Credit: Offering flexibility, these allow borrowers to draw funds as needed up to a certain limit, suitable for ongoing expenses.

Threat of Substitutes 5

Government assistance programs and charitable organizations can act as substitutes for EZCORP’s services by offering financial relief. These entities can reduce the immediate demand for high-cost short-term loans. For instance, in 2024, various federal and state programs continued to provide emergency financial aid to low-income households, potentially offsetting the need for payday loans.

Community-based financial aid and credit counseling services also present a threat. These alternatives often offer lower-cost solutions or pathways to financial stability, directly competing with the short-term lending model. The increasing availability of such programs, often supported by grants and donations, can divert customers from traditional lenders.

- Government assistance programs: These can include unemployment benefits, food stamps, and housing subsidies, providing a safety net that reduces reliance on predatory lending.

- Charitable organizations: Many non-profits offer emergency financial assistance, debt management services, and financial literacy education, presenting a more sustainable alternative.

- Community credit unions: These member-owned institutions often provide more favorable loan terms and financial services compared to payday lenders.

- Peer-to-peer lending platforms: While still a form of credit, some P2P platforms may offer more competitive rates and flexible repayment options than traditional short-term lenders.

The threat of substitutes for EZCORP's services remains substantial, with a growing array of financial products and digital platforms offering alternatives for consumers needing quick cash. These substitutes often provide greater convenience or more favorable terms, directly impacting EZCORP's customer base.

Fintech innovations and online marketplaces continue to expand, offering faster and more accessible solutions. For example, the earned wage access market, projected to reach $6.4 billion by 2027, provides immediate access to wages, bypassing traditional pawn services. Similarly, online platforms facilitate direct selling of goods, allowing individuals to bypass pawn shops for liquidity.

Traditional financial institutions, while sometimes less accessible to EZCORP's core demographic, also pose a threat. In 2024, despite elevated APRs on credit cards, these remained a viable, often more cost-effective, substitute for individuals with good credit. Government assistance programs and community credit unions further offer lower-cost alternatives, potentially reducing demand for high-cost short-term loans.

| Substitute Category | Examples | Key Advantages | 2024 Relevance/Data Point |

|---|---|---|---|

| Short-Term Loans | Payday loans, Title loans, Online installment loans | Quick access to cash, often less stringent credit checks | Over 12 million Americans used payday loans in 2023. |

| Fintech & Digital Platforms | Earned Wage Access, P2P lending, Online marketplaces (eBay, Facebook Marketplace) | Convenience, speed, potential for better prices (selling), direct access to earned wages | Earned Wage Access market projected to reach $6.4 billion by 2027. Global e-commerce continued robust growth in 2024. |

| Traditional Financial Products | Credit Cards, Personal Bank Loans, Lines of Credit | Potentially lower costs (for qualified borrowers), rewards, flexibility | Average credit card APR remained elevated in 2024, but still competitive for good credit. |

| Government & Community Aid | Government assistance programs, Charitable organizations, Credit unions | Lower cost, financial stability focus, safety net | Continued federal and state emergency aid programs in 2024. |

Entrants Threaten

The pawn industry, including companies like EZCORP, faces substantial regulatory barriers that deter new entrants. Federal, state, and local governments impose strict rules on licensing, interest rates, and operational practices. For instance, the federal Truth in Lending Act mandates disclosures, while state usury laws cap the interest pawnshops can charge. Navigating this complex web of compliance, which can involve significant legal and administrative costs, acts as a powerful deterrent.

Entering the pawn shop industry, like EZCORP operates in, demands considerable financial resources. Start-up costs can be substantial, encompassing everything from securing adequate capital for loans and acquiring a diverse inventory of goods to investing in secure physical locations and necessary technology. For instance, establishing a single, well-equipped pawn shop could easily require hundreds of thousands of dollars in initial investment.

This high capital requirement acts as a significant barrier, discouraging many potential new entrants. Without substantial funding, it's challenging for newcomers to compete effectively with established players like EZCORP, who have the financial muscle to offer competitive loan rates and maintain a broad selection of merchandise. This financial hurdle is a key factor limiting the threat of new competition.

The pawn industry, particularly for companies like EZCORP, relies heavily on established brand recognition and deep customer trust. Newcomers face a significant hurdle in replicating the credibility built by existing players over time, as customers often prefer to do business with familiar and reputable establishments for their financial needs.

This trust factor directly impacts customer acquisition costs for new entrants. Without a proven track record, new pawn shops must invest more in marketing and customer service to overcome skepticism, a challenge amplified in a sector where personal relationships and reliability are paramount. For instance, EZCORP's long-standing presence allows it to leverage existing customer loyalty, making it harder for nascent competitors to gain market share quickly.

Threat of New Entrants 4

The threat of new entrants for EZCORP is moderate, primarily due to the complexities in establishing efficient operational processes and a robust supply chain for pawn collateral and retail merchandise. New players must navigate a steep learning curve in accurately appraising collateral, managing inventory effectively, and implementing strong loss prevention strategies. This expertise, honed over time, represents a significant barrier.

Developing the necessary skills for pawn operations, such as collateral appraisal and inventory control, requires substantial time and hands-on experience. For instance, the average employee tenure in the pawn industry can contribute to this barrier, as experienced staff are crucial for minimizing risk and maximizing profitability. In 2024, the industry continued to rely on seasoned professionals to navigate fluctuating market values of collateralized goods.

- Operational Efficiency: New entrants struggle to replicate EZCORP's established processes for acquiring, valuing, and selling pawned items and retail merchandise, a core competency built over years.

- Supply Chain Mastery: Building a reliable supply chain for diverse collateral, from jewelry to electronics, and managing the associated risks is a significant hurdle for newcomers.

- Expertise in Appraisal and Loss Prevention: The nuanced skill of accurately valuing a wide range of collateral and preventing losses through theft or damage requires specialized knowledge that new entrants lack initially.

Threat of New Entrants 5

The threat of new entrants for EZCORP, particularly from the fintech sector, is a notable concern. These companies can leverage technology to offer streamlined, digital-first lending solutions that bypass the physical infrastructure of traditional pawn shops. For instance, many fintech lenders in 2024 offer instant online approvals for personal loans, a stark contrast to the in-person process at a pawn shop.

These digital platforms can attract customers by emphasizing convenience and potentially lower overhead costs, which could translate to more competitive interest rates or fees. Consider the rise of buy-now-pay-later services, which, while not direct competitors, demonstrate consumer appetite for quick, accessible credit. In 2023, the global BNPL market was valued at over $12 billion and is projected to grow significantly, indicating a strong market for alternative credit solutions.

- Fintech Disruption: Digital lenders can offer faster, more convenient loan applications and approvals compared to traditional pawn shop models.

- Market Share Capture: Innovative fintechs may attract customers seeking flexible, technology-driven financial services, potentially siphoning off market share from established players like EZCORP.

- Lower Overhead: Digital-native companies often have lower operational costs, enabling them to offer more competitive pricing.

- Consumer Preference Shift: Growing consumer comfort with online transactions and digital financial tools favors new entrants.

The threat of new entrants for EZCORP is generally considered moderate. Significant barriers exist, including stringent regulatory requirements, substantial capital needs for inventory and operations, and the necessity of building strong brand trust. These factors, alongside the specialized operational expertise required in collateral appraisal and loss prevention, make it challenging for newcomers to compete effectively.

Fintech companies present a growing, albeit different, challenge. Their digital-first approach offers convenience and potentially lower overheads, attracting consumers accustomed to online financial services. While not directly replicating the pawn model, these alternatives tap into a similar demand for accessible credit, as evidenced by the robust growth in markets like buy-now-pay-later services.

| Barrier Type | Impact on New Entrants | Relevance to EZCORP |

|---|---|---|

| Regulatory Compliance | High Cost & Complexity | Significant deterrent due to licensing, interest rate caps, and disclosure laws. |

| Capital Requirements | Substantial Initial Investment | Needed for inventory, secure locations, and loan capital, favoring established players. |

| Brand Recognition & Trust | Difficult to Replicate | Customers prefer established, reputable businesses for financial transactions. |

| Operational Expertise | Steep Learning Curve | Accurate collateral appraisal, inventory management, and loss prevention require specialized skills. |

| Fintech Competition | Disruptive Potential | Digital lenders offer convenience and speed, potentially capturing market share from traditional pawn shops. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for EZCORP leverages data from annual reports, investor presentations, and SEC filings to understand the company's financial health and strategic positioning. We also incorporate industry research reports and market share data to assess competitive dynamics and market trends.