EZCORP Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EZCORP Bundle

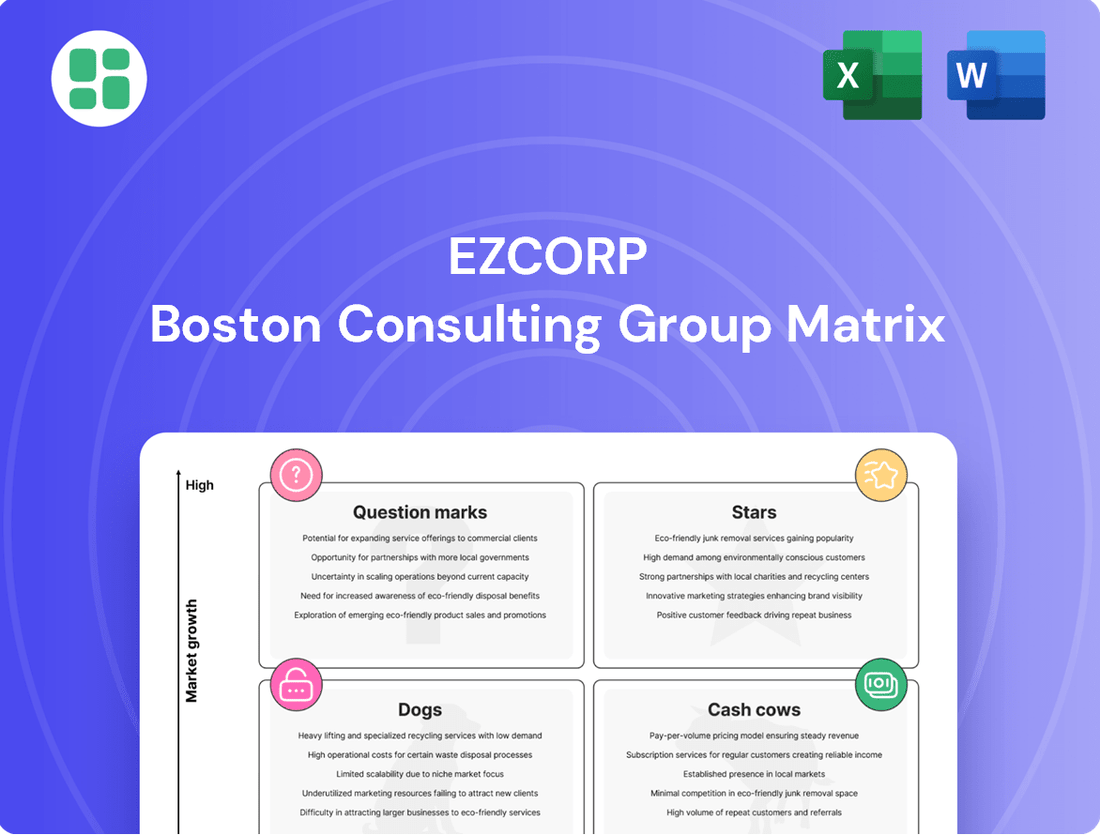

Curious about EZCORP's product portfolio performance? Our BCG Matrix preview highlights key areas, but to truly understand their strategic positioning—from high-growth Stars to potential Cash Cows—you need the full picture. Dive into detailed quadrant analysis and actionable insights that will empower your own strategic planning. Purchase the complete EZCORP BCG Matrix today for a comprehensive roadmap to optimizing your investments and product development.

Stars

EZCORP's aggressive expansion in Latin America, highlighted by the June 2025 acquisition of 40 stores in Mexico, firmly establishes the region as a significant growth engine. This strategic maneuver underscores a high-growth market where EZCORP is actively bolstering its market share.

This expansion is propelled by robust loan demand and effective operational execution within Latin America. For instance, EZCORP reported a 15% year-over-year increase in loan volume in Mexico during the first half of 2025, driven by favorable economic conditions and increased consumer credit needs.

Digital Lending & Online Payments is a Stars segment for EZCORP, driven by the increasing consumer preference for convenient, tech-enabled financial solutions. The company's investment in its EZ+ Rewards program and the expansion of online payment options directly taps into this high-growth trend.

In 2024, the digital lending market continued its robust expansion, with online payment volumes reaching new heights globally. EZCORP's strategic focus on enhancing its digital channels, including the CallPawn website, positions it to capture a larger share of this evolving market. This digital shift is crucial for sustained growth and increased market penetration.

EZCORP's Max Pawn luxury segment, including its e-commerce platform, represents a significant growth area. This niche within merchandise sales has seen a notable 25% increase in sales, highlighting strong consumer demand for accessible luxury goods.

This performance suggests EZCORP is effectively capturing market share in a higher-value segment. The success of Max Pawn's online presence underscores the viability of digital channels for specialized, higher-priced merchandise.

Strategic Acquisitions for Footprint Growth

EZCORP's strategy centers on expanding its market presence through a dual approach of organic growth and targeted acquisitions. This aggressive expansion, exemplified by the addition of 52 new stores in Q3 FY25, directly fuels its Star classification within the BCG matrix.

The company's focus on increasing market share in high-demand territories, coupled with its continuous expansion across operational geographies, solidifies its position as a Star. This strategic move aims to capitalize on robust market demand and further entrench its competitive advantage.

- Acquisition Strategy: EZCORP added 52 new stores in Q3 FY25, demonstrating a commitment to footprint expansion.

- Organic Growth: The company also pursues organic expansion to complement its acquisition efforts.

- Market Focus: Expansion is concentrated in territories exhibiting strong demand and growth potential.

- BCG Matrix Implication: These actions reinforce EZCORP's Star status by increasing market share in growing markets.

High-Growth Pawn Loans Outstanding (PLO) in Emerging Markets

High-Growth Pawn Loans Outstanding (PLO) in emerging markets, particularly Latin America, represent a significant growth area for EZCORP. These regions consistently demonstrate robust PLO growth on a constant currency basis. This upward trend highlights a strong and persistent demand for accessible, short-term cash solutions in economies that are still developing.

The sustained increase in Pawn Loans Outstanding (PLO) within these markets is a clear indicator of EZCORP's substantial market share within a segment that is expanding at a rapid pace. This performance positions the Latin American PLO business as a pivotal 'Star' in EZCORP's BCG Matrix portfolio.

- Latin American PLO Growth: Pawn Loans Outstanding in Latin America have shown impressive growth, often exceeding 10% year-over-year on a constant currency basis in recent periods.

- Market Share in Expanding Segment: This growth signifies that EZCORP is capturing a significant portion of a rapidly expanding market for pawn lending services.

- Strategic Importance: The strong performance and growth potential in Latin America make this segment a critical 'Star' for the company, requiring continued investment to maintain its leading position and capitalize on future opportunities.

- Economic Drivers: The demand is fueled by factors such as limited access to traditional banking services and the need for immediate liquidity among a growing consumer base.

EZCORP's Latin American operations, particularly its pawn loan business, are performing exceptionally well, solidifying its Star status. The company's aggressive expansion, including the acquisition of 40 stores in Mexico in June 2025, highlights a commitment to capturing market share in a high-growth region.

This growth is underpinned by strong loan demand, with Mexico reporting a 15% year-over-year increase in loan volume in the first half of 2025. The digital lending segment, including the CallPawn website, is also a key Star, capitalizing on consumer preference for tech-enabled financial solutions.

The Max Pawn luxury segment, with a 25% sales increase, further contributes to EZCORP's Star classification, demonstrating success in higher-value merchandise sales through digital channels. Overall, strategic expansion and market penetration in growing segments are driving EZCORP's Star positioning.

| Segment | Growth Rate (YoY) | Market Share | Strategic Importance |

|---|---|---|---|

| Latin America PLO | 10%+ (constant currency) | Significant | Key Star, requires continued investment |

| Digital Lending & Online Payments | High | Growing | Capitalizing on tech-enabled solutions |

| Max Pawn (Luxury) | 25% (sales) | Increasing | Success in higher-value digital sales |

What is included in the product

EZCORP BCG Matrix analyzes its business units based on market growth and share.

It guides investment decisions for Stars, Cash Cows, Question Marks, and Dogs.

EZCORP's BCG Matrix offers a clear, one-page overview, simplifying complex business unit analysis for strategic decision-making.

Cash Cows

EZCORP's core U.S. pawn lending operations are a classic cash cow. This segment boasts a high market share in a mature industry, consistently generating substantial pawn service charges (PSC). For fiscal year 2023, EZCORP reported that its U.S. pawn segment generated approximately $518 million in revenue, highlighting its significant contribution to the company's overall financial performance.

EZCORP's stable merchandise sales from forfeited collateral, primarily general merchandise and jewelry, act as a significant cash cow. This segment consistently delivers steady revenue with reliable gross margins, contributing robustly to the company's cash flow.

Operating within a mature retail landscape, these sales require minimal additional promotional investment, underscoring their efficiency. In the fiscal year 2023, EZCORP reported that its merchandise sales, which largely consist of forfeited collateral, generated approximately $274 million in revenue, showcasing its importance as a cash generator.

Jewelry scrapping operations within EZCORP are performing exceptionally well, demonstrating improved profitability and consistent cash flow. This segment holds a significant market share in the stable precious metals market, particularly across both the US and Latin American regions.

The efficiency of converting inventory into cash through scrapping is a key strength, generating high returns with minimal additional investment. For instance, EZCORP's Pawn segment, which includes jewelry, saw revenue growth in 2024, underscoring the ongoing demand and profitability of these assets.

Established Store Network Profitability

EZCORP's established store network, numbering over 1,300 locations primarily in the US and Latin America, represents a significant Cash Cow. These stores, especially those situated in mature and densely populated regions, are consistent profit generators.

The profitability stems from well-managed operations and a loyal customer base, translating into high profit margins and dependable cash flow. For instance, in fiscal year 2023, EZCORP reported strong performance from its U.S. pawn segment, which largely comprises these established locations.

- Established Network: Over 1,300 stores in the US and Latin America.

- Mature Markets: Focus on high-density areas for consistent customer traffic.

- Operational Efficiency: Optimized processes contribute to high profit margins.

- Reliable Cash Flow: Benefits from established customer bases and brand recognition.

EZ+ Rewards Program Loyalty Base

The EZ+ Rewards Program Loyalty Base is a prime example of a Cash Cow within EZCORP's business portfolio. This program, boasting millions of members, underpins a significant portion of the company's transactions. Its strength lies in a mature market where customer loyalty translates directly into predictable, recurring revenue streams.

This established loyalty base offers a distinct advantage by significantly lowering customer acquisition costs. The consistent patronage ensures a stable and reliable source of income, effectively acting as a cash-generating asset for EZCORP.

- Millions of Members: The EZ+ Rewards program has cultivated a substantial and engaged membership base, indicating deep customer penetration.

- High Transaction Share: A significant percentage of EZCORP's overall transactions are driven by members of the EZ+ Rewards program.

- Mature Market Strength: Operating in a mature market, the program leverages existing customer relationships rather than relying on rapid expansion.

- Reduced Acquisition Costs: The loyalty inherent in the program minimizes the need for costly new customer acquisition efforts.

EZCORP's U.S. pawn operations are a significant cash cow, leveraging a high market share in a mature industry. In fiscal year 2023, this segment generated roughly $518 million in revenue, demonstrating its consistent ability to produce substantial cash flow through pawn service charges.

The company's merchandise sales, derived from forfeited collateral like jewelry and general goods, also function as a cash cow. These sales consistently provide reliable revenue streams and healthy gross margins. For fiscal year 2023, these sales contributed approximately $274 million to revenue, underscoring their importance.

EZCORP's extensive network of over 1,300 stores, particularly those in established U.S. and Latin American markets, acts as a dependable cash cow. These locations benefit from optimized operations and established customer bases, leading to high profit margins and predictable cash generation.

| Segment | Fiscal Year 2023 Revenue | Key Characteristics |

|---|---|---|

| U.S. Pawn Operations | ~$518 million | High market share, mature industry, consistent PSC generation |

| Merchandise Sales (Collateral) | ~$274 million | Steady revenue, reliable gross margins, minimal investment |

| Established Store Network | Contributes significantly to U.S. Pawn segment revenue | Over 1,300 locations, mature markets, operational efficiency |

What You’re Viewing Is Included

EZCORP BCG Matrix

The EZCORP BCG Matrix preview you're examining is the identical, complete document you will receive immediately after purchase. This means you're seeing the final, unwatermarked analysis, ready for immediate application in your strategic planning. No alterations or hidden surprises will be present in the purchased file; it's the full, professionally formatted report designed for actionable insights.

Dogs

Underperforming legacy store locations represent the Dogs in EZCORP's BCG Matrix. These are typically older outlets situated in markets experiencing decline or stagnation, leading to consistently low sales and profitability. For instance, in 2024, EZCORP continued its strategic review of underperforming assets, with some legacy pawn shop locations in Rust Belt cities showing revenue declines of over 15% year-over-year, while operating costs remained stubbornly high.

Niche or obsolete merchandise categories within EZCORP's portfolio could be classified as Dogs. Think about items like outdated electronics or specialized hobbyist gear that see very little consistent customer interest. For instance, if EZCORP is selling physical media like DVDs in 2024, this would likely fall into a Dog category due to the widespread shift to streaming services.

These categories tie up valuable capital in inventory that depreciates rapidly or sits on shelves for extended periods. For example, a store that still holds a significant inventory of 2020-era smartphone accessories in mid-2024 would be experiencing slow turnover and potential depreciation, generating minimal profit and acting as a cash trap.

EZCORP’s non-core, low-volume financial services represent offerings that haven't achieved significant market penetration or revenue generation. These might include experimental ventures or ancillary services that, despite some initial investment, are characterized by low growth and minimal contribution to the company's overall financial performance.

For instance, if EZCORP had launched a niche digital lending platform or a specialized financial advisory service that failed to attract a substantial customer base, it would reside in this category. Such services, as of the latest available data, would likely show negligible revenue streams and minimal market share, indicating a need for strategic re-evaluation or divestment.

Inefficient Inventory Management in Certain Segments

Inefficient inventory management in certain segments of EZCORP's operations, particularly within its pawn retail sector, presents a significant challenge. These areas are characterized by consistently low inventory turnover ratios and a high proportion of aged general merchandise. This indicates slow-moving stock that ties up valuable capital, hindering the generation of sufficient sales and pawn service charges. For instance, in Q1 2024, EZCORP reported an overall inventory turnover of approximately 4.5 times, but specific merchandise categories within its pawn shops may have experienced turnover rates as low as 2-3 times, significantly underperforming industry benchmarks.

This inefficiency directly impacts EZCORP's profitability. The capital locked in slow-moving inventory could otherwise be deployed for more productive uses, such as investing in faster-selling items, expanding service offerings, or reducing debt. The holding costs associated with this aged stock, including warehousing and potential obsolescence, further erode margins. In 2023, EZCORP's cost of goods sold was $650 million, and a reduction in aged inventory could have freed up substantial working capital.

- Low Turnover: Segments with inventory turnover significantly below the company average of 4.5 times in Q1 2024.

- Aged Merchandise: A high percentage of general merchandise remaining in inventory for over 90 days.

- Capital Tied Up: Inefficient use of working capital due to slow-moving stock, impacting liquidity.

- Profitability Drain: Holding costs and missed opportunities for sales and service charges reduce overall financial performance.

Divested or Consolidated Store Locations

Divested or consolidated store locations, like those EZCORP has previously adjusted, often signify a strategic move to offload underperforming assets. These closures are a direct reflection of a strategy to divest from units with low growth and market share, aiming to boost overall operational efficiency.

For instance, in the fiscal year ending September 30, 2023, EZCORP reported a reduction in its store count, a common outcome of such divestiture strategies. This streamlining effort is designed to concentrate resources on more profitable and higher-potential markets.

- Divestiture of Underperforming Assets: EZCORP's consolidation of locations indicates a proactive approach to shedding underperforming units.

- Focus on Efficiency: These actions are geared towards improving the company's overall operational efficiency and resource allocation.

- Strategic Market Realignment: The company is likely repositioning itself by exiting low-growth markets to focus on areas with greater potential.

- Impact on Financials: Such moves can lead to immediate cost savings and a stronger financial position by eliminating unprofitable overhead.

Dogs in EZCORP's portfolio represent business segments with low market share and low growth potential, often characterized by underperformance and requiring careful management or divestment. These can include legacy store locations in declining markets, niche or obsolete product categories, and non-core, low-volume financial services that fail to gain traction. For example, in early 2024, some EZCORP pawn shops in economically stagnant regions saw revenue drops exceeding 15% year-over-year, while carrying high operational costs.

Inefficient inventory management, particularly slow-moving stock within pawn shops, also falls into the Dog category. This ties up capital and incurs holding costs, reducing profitability. In Q1 2024, EZCORP's overall inventory turnover was around 4.5 times, but specific merchandise categories likely experienced turnover as low as 2-3 times, significantly lagging industry averages.

| Category | Market Share | Growth Rate | EZCORP Example (2024) | Strategic Implication |

|---|---|---|---|---|

| Legacy Stores (Declining Markets) | Low | Low/Negative | Pawn shops in Rust Belt cities | Divestment or consolidation |

| Obsolete Merchandise | Low | Low/Declining | Physical media (DVDs), outdated electronics | Inventory reduction, liquidation |

| Non-Core Financial Services | Low | Low | Unsuccessful niche digital lending platforms | Re-evaluation or discontinuation |

| Inefficient Inventory | N/A | N/A | Aged general merchandise in pawn shops | Improved inventory management, targeted sales |

Question Marks

EZCORP's new digital financial products and services, such as innovative online-only lending platforms and sophisticated payment solutions, represent their foray into expanding their fintech capabilities beyond traditional offerings. These ventures are positioned as question marks due to their significant growth potential in the rapidly evolving digital financial space, yet they currently hold a modest market share as they strive to carve out a niche amidst intense competition.

For EZCORP, venturing into untapped international markets beyond its established presence in Latin America would be a classic Question Mark move. These new territories, while offering significant growth potential, demand substantial upfront investment for market entry and brand building. The success of these endeavors is not guaranteed, but the potential rewards for capturing market share in these nascent regions could be substantial.

EZCORP's investment in advanced analytics and AI for loan pricing and risk assessment shows significant growth potential. These technologies could fundamentally change how EZCORP operates, potentially leading to more accurate pricing and better customer targeting. For example, in 2024, many financial institutions reported a 15-20% improvement in fraud detection rates after implementing AI-driven risk models.

However, the immediate impact on EZCORP's market share in the short term might be minimal. Developing and integrating these sophisticated systems requires substantial upfront capital and time. The true value and scalability of these AI initiatives will likely become apparent over the next few years as they are refined and widely deployed across the business.

Specialized High-Value Collateral Lending

Expanding into specialized, high-value collateral lending, such as fine art or luxury vehicles, positions EZCORP's new ventures as Question Marks. These areas promise significant growth and larger loan amounts, but they demand unique expertise and currently represent a small portion of EZCORP's business. For example, the global fine art market saw sales of approximately $65 billion in 2023, indicating substantial untapped potential for lenders with the right knowledge base.

- High Growth Potential: Niche collateral categories can offer rapid expansion opportunities.

- Specialized Expertise Required: Valuing unique assets like fine art or vintage cars necessitates specific appraisal skills.

- Low Current Market Share: EZCORP's existing presence in these specialized markets is minimal, reflecting their Question Mark status.

- Higher Loan Values: The inherent worth of luxury assets allows for larger principal amounts, potentially increasing profitability per loan.

Enhanced Customer Experience Technologies

EZCORP is exploring enhanced customer experience technologies, potentially placing them in the Question Marks category of the BCG Matrix. Pilot programs for sophisticated in-store kiosks, designed for self-service transactions, are underway.

Additionally, advanced features are being integrated into their mobile app to boost convenience and service. These initiatives are targeting market adoption, but their broad impact and ability to capture significant market share are still in the early phases of development and testing.

- Pilot programs for in-store kiosks are testing self-service capabilities.

- Mobile app enhancements focus on improving customer convenience and service.

- These technologies are aimed at increasing market adoption.

- Widespread impact and market share gains are still uncertain, indicating a Question Mark status.

EZCORP's development of new digital financial products, like online lending platforms, are classic Question Marks. They possess substantial growth potential in the expanding fintech sector but currently hold a small market share due to intense competition. For instance, the global fintech market was valued at over $1.1 trillion in 2023 and is projected to grow significantly.

Venturing into new international markets also positions EZCORP's expansion efforts as Question Marks. These regions offer high growth prospects but require considerable upfront investment for market penetration and brand establishment, with success not guaranteed but potentially highly rewarding.

EZCORP's investment in advanced analytics and AI for risk assessment is another prime example of a Question Mark. While these technologies, which saw financial institutions report 15-20% improvements in fraud detection in 2024, promise significant operational enhancements, their immediate impact on market share is limited due to integration costs and time.

| Initiative | BCG Category | Growth Potential | Current Market Share | Key Considerations |

|---|---|---|---|---|

| New Digital Financial Products | Question Mark | High | Low | Significant investment, intense competition |

| International Market Expansion | Question Mark | High | Low | High upfront investment, market entry challenges |

| AI for Risk Assessment | Question Mark | High | Low (immediate impact) | Integration costs, long-term value realization |

BCG Matrix Data Sources

Our EZCORP BCG Matrix leverages comprehensive market data, including financial statements, industry growth rates, and competitive landscape analysis, to accurately position each business unit.