EXp World Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EXp World Holdings Bundle

EXp World Holdings boasts a unique agent-owned model and a robust cloud-based platform, presenting significant growth opportunities. However, understanding the competitive landscape and potential regulatory shifts is crucial for navigating its path forward.

Want the full story behind EXp World Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

eXp Realty's cloud-based operating model is a significant strength, drastically cutting down on the expenses tied to physical office spaces. This efficiency translates directly into better commission splits for agents and improved profitability for the company.

This virtual setup provides remarkable scalability and adaptability, allowing eXp to enter new markets swiftly without the substantial upfront costs typically associated with establishing physical brokerage locations. The company's Q2 2025 performance underscores its ongoing commitment to enhancing the agent experience and maintaining operational efficiency.

eXp World Holdings boasts a diversified business portfolio that extends well beyond its core eXp Realty operations. This includes Virbela, a prominent player in virtual reality environments, and SUCCESS Enterprises, which concentrates on personal development and professional growth.

This strategic diversification creates multiple revenue streams, offering a significant hedge against potential downturns in any single market sector. Such a structure fosters greater business resilience and opens up opportunities for cross-synergy between its various ventures.

Glenn Sanford, the Founder, Chairman, and CEO, is actively pursuing the expansion of the SUCCESS Enterprises brand, indicating a strategic focus on leveraging this segment for future growth and revenue generation.

The agent-centric revenue share and stock equity programs are a significant strength, effectively incentivizing agents to not only join but also stay with the company. This fosters a vibrant, growth-focused ecosystem where agents are motivated to contribute to the company's expansion.

This model cultivates strong agent loyalty and a tangible sense of ownership. A testament to this is eXp Realty's impressive global agent Net Promoter Score (aNPS) of 77 recorded in Q2 2025, highlighting high agent satisfaction and advocacy.

Furthermore, this agent-centric approach has translated into market leadership. eXp Realty's consistent performance is underscored by its recognition as the No. 1 brokerage in the U.S. for transaction sides for three consecutive years, demonstrating the model's effectiveness in driving business volume.

Technological Innovation and Virtual Presence

eXp World Holdings' technological innovation, particularly through its Virbela virtual world platform, offers a significant competitive advantage. This immersive environment facilitates collaboration, training, and events, enhancing agent productivity and client engagement. Virbela's ongoing development, with new features and updates consistently released, ensures its relevance in an increasingly digital landscape.

This technological prowess translates into tangible benefits for eXp agents and clients alike. For instance, in 2023, eXp Realty reported a substantial increase in agent productivity, partly attributed to the seamless virtual tools provided. The platform's ability to host large-scale virtual events and training sessions also reduces operational costs and expands reach, a key differentiator in the real estate sector.

- Virtual Collaboration: Virbela provides a persistent virtual office space for eXp agents globally, fostering a sense of community and enabling real-time collaboration on deals and projects.

- Enhanced Training and Onboarding: The immersive nature of Virbela allows for more engaging and effective training programs, crucial for onboarding new agents and continuously developing existing ones.

- Client Engagement: Virtual open houses, client meetings, and property tours conducted within Virbela offer clients a unique and convenient way to interact with properties and agents, especially those located remotely.

- Scalability and Cost Efficiency: The virtual model significantly reduces the need for physical office spaces, leading to substantial cost savings that can be reinvested in technology and agent support.

Global Scalability and Reach

eXp Realty's virtual model offers a significant advantage in global expansion. This operational structure bypasses the substantial logistical hurdles and capital outlays typically associated with traditional real estate firms entering new international territories. The company's international presence is a testament to this scalability, with its business continuing to demonstrate robust growth and broad appeal across diverse markets.

As of the second quarter of 2025, eXp Realty boasts a significant international footprint, with approximately 81,000 agents operating across 27 countries. This widespread network underscores the platform's ability to adapt and thrive in varied global real estate environments, validating its scalable business model.

- Global Reach: Operates in 27 countries as of Q2 2025.

- Scalable Model: Virtual operations reduce international expansion costs.

- Agent Network: Serves nearly 81,000 agents worldwide.

- Growth Validation: International business expansion confirms platform appeal.

eXp World Holdings' agent-centric model, featuring revenue share and stock equity programs, is a powerful draw, fostering loyalty and incentivizing growth. This approach is validated by eXp Realty's consistent market leadership, being the No. 1 brokerage in the U.S. for transaction sides for three consecutive years. The company's Q2 2025 aNPS of 77 further highlights exceptional agent satisfaction and advocacy.

The company's diversified portfolio, including Virbela and SUCCESS Enterprises, provides multiple revenue streams and resilience. This strategic diversification, with a particular focus on expanding SUCCESS Enterprises as highlighted by CEO Glenn Sanford, creates a robust business structure.

eXp's technological innovation, particularly the Virbela virtual world platform, offers a distinct competitive edge. This immersive environment enhances collaboration, training, and client engagement, with ongoing development ensuring its relevance. This tech-forward approach contributed to a substantial increase in agent productivity in 2023.

The virtual operating model facilitates efficient and cost-effective global expansion. As of Q2 2025, eXp Realty operates in 27 countries with approximately 81,000 agents, demonstrating the scalability and broad appeal of its platform across diverse international markets.

What is included in the product

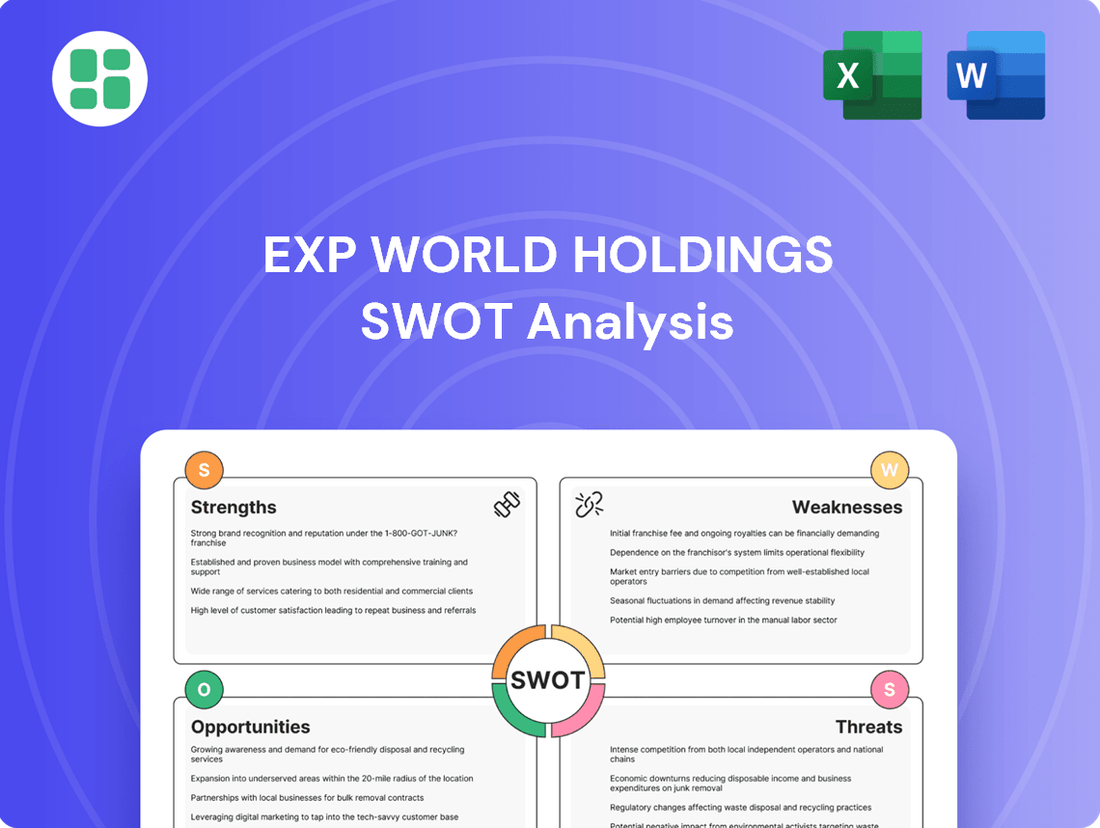

Offers a full breakdown of EXp World Holdings’s strategic business environment by analyzing its internal strengths and weaknesses alongside external market opportunities and threats.

Addresses the pain point of complex strategic analysis by offering a clear, actionable framework for understanding EXP World Holdings' market position.

Weaknesses

eXp World Holdings' significant reliance on the real estate market represents a key vulnerability. Even with efforts toward diversification, eXp Realty continues to be the main source of income, leaving the company exposed to the inherent cyclical nature of property markets.

This dependence was evident in the second quarter of 2025, where despite a modest revenue uptick, the company posted a net loss. Furthermore, real estate sales transactions saw a year-over-year decrease, signaling a challenging environment. Management has also indicated expectations for a prolonged downturn in the housing sector, underscoring this weakness.

While eXp World Holdings' revenue share model is attractive to agents, the company faces a significant challenge in retaining them within a fiercely competitive real estate market. If agents perceive diminishing benefits or if rival brokerages present more appealing compensation structures, churn risk increases.

This retention challenge was underscored in 2024 when eXp's agent count saw a 5% decrease. Management attributed this decline to the departure of less productive agents, but it still highlights the ongoing effort required to maintain a robust and engaged agent base.

EXP World Holdings' cloud-based virtual model, while innovative, presents a weakness in its potential to alienate real estate agents accustomed to traditional brokerage structures. Some agents may resist the shift away from physical office spaces, in-person collaboration, and the tangible benefits of local brand presence, thereby limiting the company's reach for talent.

This preference for conventional support and a familiar brokerage environment could shrink the pool of potential recruits. For instance, in 2023, while EXP's agent count grew to over 89,000 globally, a significant portion of the broader real estate market still operates within brick-and-mortar frameworks, highlighting a segment that might be less inclined to adopt EXP's model.

Brand Recognition Compared to Traditional Giants

While eXp World Holdings has achieved significant success, its brand recognition may still lag behind deeply entrenched traditional real estate franchises in the eyes of the general public. This can be a hurdle in attracting new clients and agents, particularly in markets where established brands have a long-standing presence and trust. For instance, while eXp reported over 100,000 agents globally by the end of 2023, a significant portion of potential homebuyers and sellers might still default to brands they've seen advertised for decades.

This disparity in brand awareness could translate into a perception gap, potentially impacting client acquisition and agent recruitment efforts. Even with eXp's innovative business model and strong agent count, the sheer familiarity of legacy brands can create a gravitational pull.

- Lower Public Awareness: Compared to legacy real estate brands with decades of advertising, eXp's brand recognition among the broader consumer base may be less pronounced.

- Agent Attraction Challenges: In markets where traditional brands are dominant, attracting agents who value established brand association might require extra effort.

- Client Perception: Some potential clients may gravitate towards brands they are more familiar with, impacting eXp's ability to capture market share in certain demographics or regions.

- Competitive Landscape: The real estate industry is highly competitive, and established brands often benefit from significant marketing budgets and historical market penetration.

Reliance on Technology Infrastructure and Security

EXP World Holdings' reliance on its technology infrastructure is a significant weakness. The company's entire operational model, including its virtual open house and agent productivity tools, is built upon these platforms. A disruption, whether from a technical glitch, a cybersecurity breach, or even widespread internet connectivity problems, could halt business activities and damage client confidence. For instance, in 2023, the real estate technology sector experienced increased scrutiny on data security following several high-profile breaches, highlighting the potential impact on companies like EXP.

This dependence creates inherent vulnerabilities:

- Platform Downtime: Any significant outage in their virtual environment directly impedes agents' ability to conduct business, potentially leading to lost transactions and revenue.

- Cybersecurity Threats: Protecting sensitive client and agent data is paramount. A successful cyberattack could result in financial penalties, reputational damage, and a loss of trust.

- Internet Dependency: While widespread, internet connectivity issues can still affect agent performance and client access to services in specific regions, impacting the seamlessness of operations.

eXp World Holdings' significant reliance on the real estate market remains a core weakness. While efforts to diversify are ongoing, eXp Realty continues to be the primary revenue driver, leaving the company susceptible to the inherent cyclicality of property markets. This dependence was highlighted in Q2 2025, where a net loss was reported despite a modest revenue increase, and real estate sales transactions declined year-over-year.

The company faces a considerable challenge in retaining its agents within the highly competitive real estate landscape. If agents perceive a decline in benefits or if rival brokerages offer more attractive compensation, the risk of agent churn increases. This was evident in 2024 when eXp's agent count experienced a 5% decrease, underscoring the continuous effort needed to maintain a engaged agent base.

eXp's virtual, cloud-based model, while innovative, may alienate agents accustomed to traditional brokerage structures. Some agents may resist the transition away from physical offices, in-person collaboration, and the tangible benefits of a local brand presence, potentially limiting talent acquisition. This preference for conventional support could shrink the pool of potential recruits, especially considering that in 2023, a significant portion of the broader real estate market still operated within brick-and-mortar frameworks.

Compared to legacy real estate brands with decades of established advertising and market penetration, eXp's brand recognition among the general public may be less pronounced. This can pose a hurdle in attracting new clients and agents, particularly in markets where established brands have a long-standing presence and trust. This disparity in brand awareness could impact client acquisition and agent recruitment efforts, as potential clients may gravitate towards more familiar brands.

Full Version Awaits

EXp World Holdings SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment. You'll receive a comprehensive breakdown of EXP World Holdings' Strengths, Weaknesses, Opportunities, and Threats, providing actionable insights for strategic planning.

Opportunities

eXp Realty's cloud-based model offers significant advantages for geographic expansion, allowing it to enter new domestic and international markets with considerably lower overhead than traditional brick-and-mortar brokerages. This inherent scalability means faster market penetration and reduced initial investment.

The company is actively pursuing this opportunity, with ongoing plans to establish a presence in additional countries. Demonstrating this commitment, eXp Realty recently launched operations in Peru and Turkey, further broadening its global footprint and tapping into new agent pools and client bases.

Virbela's advanced virtual reality capabilities present a significant opportunity to expand its enterprise solutions beyond real estate. By leveraging its expertise in creating immersive virtual environments, the company can offer tailored solutions for corporate training, virtual conferences, and enhanced remote collaboration, catering to a diverse range of industries. This diversification taps into the rapidly growing global virtual collaboration market, which was projected to reach $23.7 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 13.4% from 2024 to 2030.

EXp World Holdings can significantly boost value by cross-selling SUCCESS Enterprises' personal development resources to eXp Realty's vast agent network, estimated at over 100,000 agents globally as of early 2024. This integration leverages existing customer bases for mutual growth.

The synergy between SUCCESS Enterprises' content, eXp Realty's real estate professionals, and Virbela's virtual collaboration spaces offers a powerful platform for enhanced agent training and engagement. Glenn Sanford's strategic emphasis on revitalizing SUCCESS Enterprises underscores its role as a central value-creation engine for the conglomerate.

Technological Advancements in Virtual Real Estate

Continued advancements in virtual reality (VR), augmented reality (AR), and artificial intelligence (AI) present significant opportunities for eXp World Holdings. These technologies can elevate the virtual brokerage experience, providing agents and clients with more immersive and interactive tools. For instance, AI-powered virtual tours and personalized client interactions can streamline the buying and selling process.

The integration of AI and automation is poised to be a cornerstone of business strategy in 2025, driving more informed decision-making through enhanced data analytics. eXp Realty can leverage these capabilities to gain deeper insights into market trends, agent performance, and client behavior. This data-driven approach is crucial for optimizing operations and identifying new growth avenues.

Specific opportunities include:

- Enhanced Virtual Open Houses: Utilizing VR/AR to create realistic virtual property tours that allow potential buyers to explore homes remotely with greater immersion.

- AI-Powered Agent Support: Deploying AI chatbots and virtual assistants to provide real-time support to agents, answering queries and assisting with administrative tasks, thereby increasing efficiency.

- Predictive Market Analytics: Leveraging AI to analyze vast datasets for predictive insights into market shifts, property valuations, and client needs, enabling proactive strategic planning.

- Personalized Client Experiences: Employing AI to tailor property recommendations and communication based on individual client preferences and past interactions, improving client satisfaction and conversion rates.

Strategic Acquisitions and Partnerships

EXp World Holdings can significantly bolster its market position through strategic acquisitions. This could involve integrating smaller brokerages to broaden its reach, acquiring technology firms to upgrade its digital infrastructure, or purchasing educational platforms to enhance agent training and development. The real estate industry is indeed experiencing a consolidation trend, partly due to economic pressures, making such moves opportune.

For instance, the ongoing consolidation in the real estate brokerage sector, as evidenced by various industry reports throughout 2024 and early 2025, presents a fertile ground for EXp to absorb competitors. This strategy allows EXp to quickly gain market share and leverage economies of scale. Furthermore, partnerships with proptech companies could provide access to innovative tools and data analytics, crucial for competitive advantage in the evolving market landscape.

- Acquire smaller brokerages: To rapidly expand geographic footprint and agent count.

- Integrate technology companies: To enhance proprietary software and data analytics capabilities.

- Partner with educational platforms: To elevate agent training and retention rates.

- Leverage industry consolidation: To capitalize on market opportunities presented by economic pressures on smaller competitors.

EXp World Holdings is well-positioned to capitalize on technological advancements, particularly in VR, AR, and AI, to enhance its virtual brokerage experience. AI-powered tools can streamline operations, improve agent efficiency, and create more personalized client interactions, driving better decision-making through advanced data analytics. The company can also leverage industry consolidation through strategic acquisitions to expand its market share and integrate new technologies.

The company's cloud-based model facilitates rapid global expansion, with recent launches in Peru and Turkey demonstrating this potential. Furthermore, the synergy between its subsidiaries, eXp Realty, SUCCESS Enterprises, and Virbela, offers unique cross-selling opportunities and a robust platform for agent training and engagement, all while tapping into the growing virtual collaboration market.

Threats

eXp Realty's innovative cloud-based model has spurred a surge in competition. Traditional brokerages are increasingly adopting hybrid approaches, while new virtual-first platforms are emerging, intensifying the market. This heightened rivalry could force eXp to spend more on marketing and agent recruitment, potentially squeezing profit margins.

The escalating competitive environment may also necessitate higher agent incentives and put downward pressure on commission splits. For instance, as of the first quarter of 2024, the U.S. housing market saw a slight increase in inventory, which could further empower buyers and intensify the need for competitive agent offerings. This dynamic directly impacts eXp's ability to maintain its market share and profitability.

Economic downturns, characterized by significant recessions or prolonged periods of high inflation, present a substantial threat to EXp World Holdings. These conditions can lead to reduced consumer spending and investment, directly impacting the volume and value of real estate transactions. For instance, if the US experiences a recession in late 2024 or 2025, as some economists predict, it could significantly dampen the housing market.

Rising interest rates, a common tool to combat inflation, also pose a considerable risk. Higher mortgage rates make homeownership less affordable, decreasing demand and potentially leading to housing market corrections. As of mid-2024, interest rates remain elevated, a trend that could continue, further pressuring transaction volumes for EXp World Holdings.

Housing market volatility, including sharp price declines or prolonged periods of low transaction counts, directly affects EXp World Holdings' core business. A significant housing market correction, following the rapid appreciation seen in prior years, could lead to fewer agents actively participating and reduced commission revenue. The anticipation of a prolonged period of low transaction counts underscores this threat.

EXp World Holdings faces significant threats from evolving real estate regulations and compliance burdens, particularly given its global operations. The industry is constantly adapting, and navigating these changes across multiple jurisdictions requires substantial resources and vigilance.

Recent legal challenges and shifts in agent compensation models, such as those impacting buyer and seller agent fees, present a direct threat. These developments could force EXp World Holdings into costly operational overhauls and necessitate significant investment in ensuring ongoing compliance with new industry standards.

Cybersecurity Breaches and Data Privacy Concerns

As a technology-centric real estate brokerage, eXp World Holdings is a prime target for cybersecurity threats, with the potential for significant financial and reputational damage. The increasing sophistication of cyberattacks means that even robust security measures can be challenged. For instance, the global cost of data breaches reached an average of $4.35 million in 2022, a figure that is expected to rise, underscoring the financial exposure for companies like eXp.

A successful breach could compromise sensitive client and agent information, leading to a severe erosion of trust. This loss of confidence can directly impact agent retention and client acquisition, key drivers of eXp's business model. Regulatory bodies are also imposing stricter data privacy laws, such as GDPR and CCPA, with substantial penalties for non-compliance, adding another layer of risk.

- Increased Risk of Cyberattacks: Technology-driven operations inherently attract malicious actors.

- Financial Penalties: Non-compliance with data privacy regulations can result in significant fines.

- Reputational Damage: A data breach can severely harm public perception and trust.

- Loss of Agent and Client Confidence: Security incidents can lead to a decline in user engagement and loyalty.

Rapid Technological Obsolescence and Disruption

The rapid pace of technological evolution poses a significant threat to eXp World Holdings. Its reliance on virtual platforms means that if these systems aren't consistently updated and improved, they risk becoming outdated. For instance, while eXp pioneered a virtual brokerage model, competitors could develop even more immersive or efficient technologies.

Emerging technologies or disruptive business models from rivals could quickly diminish eXp's competitive edge. The company must remain agile and invest heavily in research and development to stay ahead. Consider the potential impact of AI-driven real estate matchmaking or advanced virtual reality tours that offer an even more realistic experience than current offerings.

- Technological Obsolescence: eXp's virtual platform could become outdated if not continuously innovated, potentially losing its appeal to agents and clients.

- Disruptive Competition: New technologies or business models from competitors could quickly erode eXp's market share and unique selling proposition.

- Investment in R&D: eXp's ability to maintain its advantage hinges on substantial and ongoing investment in research and development to anticipate and integrate new technologies.

The real estate market's inherent cyclicality, influenced by economic factors, presents a persistent threat. A downturn in the housing market, potentially triggered by recessionary pressures or elevated interest rates, could significantly reduce transaction volumes and commission revenues for eXp World Holdings. For example, if the Federal Reserve maintains higher interest rates through 2025, as some projections suggest, it will continue to impact affordability and market activity.

Intensifying competition from both traditional brokerages adopting hybrid models and new virtual-first platforms demands continuous innovation and potentially higher spending on agent acquisition and retention. This competitive pressure could also lead to downward pressure on commission splits, impacting profitability. As of Q1 2024, the U.S. housing market saw a slight inventory increase, which could empower buyers and necessitate more competitive agent offerings.

Regulatory changes and evolving compliance requirements, particularly across eXp's international operations, pose a significant challenge. Navigating these diverse legal landscapes requires substantial resources and vigilance, with recent legal challenges impacting agent compensation models highlighting the potential for costly operational adjustments and compliance investments.

Cybersecurity threats are a critical concern for a technology-centric firm like eXp. The increasing sophistication of cyberattacks, with global data breach costs averaging $4.35 million in 2022 and expected to rise, exposes eXp to substantial financial and reputational risks. A breach could erode client and agent trust, impacting retention and acquisition, while stricter data privacy laws like GDPR and CCPA carry hefty penalties for non-compliance.

SWOT Analysis Data Sources

This SWOT analysis draws from a robust foundation of financial statements, comprehensive market research, and expert industry commentary to provide a well-rounded and accurate assessment.