EXp World Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EXp World Holdings Bundle

Curious about EXp World Holdings' strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Unlock the full potential of this analysis by purchasing the complete BCG Matrix for a comprehensive breakdown and actionable insights to guide your investment decisions.

Stars

eXp Realty's international segment is a clear star in the BCG matrix, showcasing exceptional growth. Revenue surged by 103% year-over-year in Q1 2025 and continued its strong trajectory with a 59% increase in Q2 2025.

This impressive performance is fueled by strategic market entries, including recent launches in Peru, Turkey, Egypt, Japan, and Ecuador, all identified as high-growth regions.

The company's ambitious target of 50,000 international agents across 50 countries by 2030 underscores its commitment to aggressively capturing market share in these dynamic, expanding territories.

eXp Realty, recognized as the largest independent brokerage by transaction sides in the 2024 RealTrends 500, demonstrates a dominant market share within its sector. This strong positioning is underpinned by its distinctive cloud-based operational model.

The company's innovative cloud-based platform provides a significant competitive edge, proving highly effective in attracting and retaining top-performing real estate agents. This technological advantage fosters a more efficient and scalable business structure.

This efficient and scalable cloud-based model allows eXp Realty to adapt readily to market shifts and maintain a leadership stance in the dynamic real estate landscape. Its ability to grow without the constraints of traditional brick-and-mortar infrastructure is a key differentiator.

Despite a slight decrease in its overall agent count in 2024, eXp Realty is strategically prioritizing the acquisition and retention of its most productive agents and teams. This focus is yielding tangible results, with a notable increase in sales transactions per agent, signaling a more efficient and higher-performing agent base.

The company's commitment to its agent-centric model and compelling value proposition continues to attract and keep top-tier talent. This strategy ensures that eXp Realty maintains a strong core of high-producing professionals, driving sustained productivity and market presence.

Continuous Technological Innovation

eXp World Holdings' commitment to continuous technological innovation fuels its position within the BCG matrix. The company's substantial investments in advanced technology and artificial intelligence, exemplified by the development of its AI-powered chatbot 'Luna,' are strategically designed to enhance agent productivity and streamline operations. These are not fleeting expenditures but rather foundational elements for sustained growth and market leadership.

This dedication to cutting-edge solutions directly impacts eXp's competitive advantage. By integrating AI and other advanced tools, eXp Realty aims to automate processes, improve efficiency, and provide a superior platform for its agents, thereby driving long-term value and platform leverage.

- AI Integration: Development of AI-powered tools like 'Luna' to assist agents.

- Productivity Enhancement: Focus on driving long-term productivity gains through technology.

- Automation: Implementing automation to streamline real estate transactions and agent workflows.

- Platform Leverage: Utilizing technology to maximize the benefits of its cloud-based business model.

Strong Brand Recognition and Agent Satisfaction

eXp Realty's brand strength is significantly bolstered by its exceptional agent satisfaction. The company consistently reports a high global agent Net Promoter Score (aNPS), often in the range of 77-78. This indicates a deeply loyal and satisfied agent base.

This strong agent satisfaction directly translates into tangible business benefits. High agent retention reduces recruitment costs and ensures a stable, experienced workforce. Furthermore, satisfied agents act as powerful brand ambassadors, driving positive word-of-mouth referrals that attract new talent to the company.

eXp Realty's commitment to agent experience is further validated by its repeated recognition as a top workplace. These accolades reinforce the company's positive image and appeal within the competitive real estate industry, contributing to its strong brand equity.

- Agent Net Promoter Score (aNPS): 77-78 (global average)

- Impact of Satisfaction: Drives agent retention and positive word-of-mouth referrals.

- Brand Reinforcement: Consistent recognition as a top place to work.

- Benefit: Attracts new talent and strengthens brand appeal.

eXp Realty's international segment is a clear star, demonstrating robust growth with a 103% year-over-year revenue increase in Q1 2025 and a 59% rise in Q2 2025. This expansion is supported by strategic market entries in high-growth regions like Peru and Japan, with an ambitious goal of 50,000 international agents by 2030.

The company's cloud-based model, a key differentiator, enhances agent productivity and scalability. Despite a slight dip in overall agent numbers in 2024, eXp is focusing on retaining high-performing agents, leading to increased sales transactions per agent.

Technological innovation, including AI tools like 'Luna,' further solidifies eXp's star status by boosting agent efficiency and streamlining operations. High agent satisfaction, reflected in a global aNPS of 77-78, drives retention and brand advocacy, reinforcing its market leadership.

| Segment | BCG Category | Key Performance Indicators | Strategic Focus |

|---|---|---|---|

| International | Star | 103% YoY Revenue Growth (Q1 2025) 59% YoY Revenue Growth (Q2 2025) Expansion into 5 new markets (2024-2025) |

Aggressive market share capture in high-growth international territories. |

| Cloud-Based Model | Star | Leading independent brokerage (2024 RealTrends 500) High agent retention and productivity |

Leveraging technology for competitive advantage and operational efficiency. |

| Agent Satisfaction | Star | Global aNPS of 77-78 Consistent top workplace recognition |

Cultivating a loyal agent base through superior experience and value proposition. |

What is included in the product

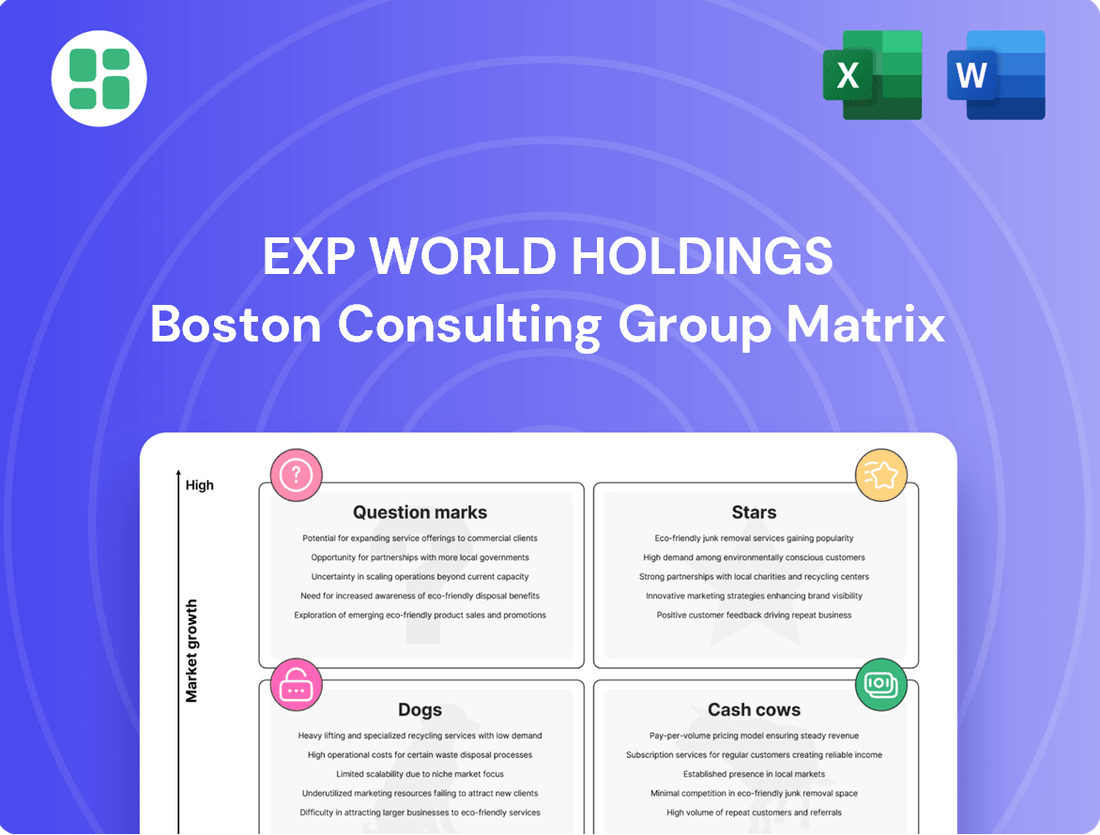

The EXp World Holdings BCG Matrix analyzes its business units based on market growth and share.

It highlights which units to invest in, hold, or divest for optimal resource allocation.

A clear BCG Matrix visual for EXp World Holdings simplifies strategic decisions, alleviating the pain of unclear business unit prioritization.

Cash Cows

eXp Realty's North American core brokerage operations are the company's undisputed cash cow, as evidenced by their substantial revenue generation. In the first quarter of 2025, this segment alone brought in $923 million. This robust performance continues despite broader challenges within the U.S. real estate market, which is currently navigating macroeconomic headwinds and a generally flat environment.

The strategy for this segment is clearly focused on milking its established strength. Instead of pursuing rapid expansion, the emphasis is on maintaining high profitability and fine-tuning existing operations. This approach aligns perfectly with the characteristics of a cash cow, where the goal is to generate consistent, significant cash flow with minimal investment, thereby supporting other areas of the business.

eXp Realty holds a dominant position in the North American real estate sector, boasting a significant market share. This established presence ensures a consistent flow of transactions, even amidst market volatility, solidifying its role as a reliable cash generator for the company.

While the North American market is mature, limiting substantial new growth opportunities, eXp's operational efficiency continues to drive stable sales volumes. This maturity contrasts with the higher growth potential observed in emerging international markets, highlighting the distinct characteristics of its current primary revenue stream.

eXp World Holdings' cloud-based model significantly reduces overhead compared to traditional real estate brokerages, leading to robust profit margins. This inherent efficiency is a key driver of its strong financial performance.

The company actively manages its expenses, consistently seeking ways to streamline operations and boost cash flow. For instance, in the first quarter of 2024, eXp Realty reported a net income of $27.9 million, a substantial increase from $14.1 million in the same period of 2023, showcasing the impact of their cost optimization efforts.

This operational discipline makes the North American segment a dependable generator of funds for the entire organization. In 2023, the North American operations accounted for the vast majority of eXp World Holdings' revenue, with over $4.7 billion in total revenue, underscoring its role as a cash cow.

Consistent Adjusted EBITDA Contribution

The North America Realty segment of eXp World Holdings functions as a cash cow within its business portfolio. This segment consistently generates positive adjusted EBITDA, a key indicator of strong operational profitability from its core real estate activities.

For instance, in Q1 2025, the segment reported a positive adjusted EBITDA of $7.7 million. This financial strength continued into Q2 2025, with the segment achieving an operating income of $7.1 million. Such consistent profitability provides a stable financial foundation.

The reliable earnings from North America Realty are crucial. They offer financial stability and generate surplus resources that can be strategically deployed to support other business units within eXp World Holdings, fostering overall company growth and investment.

- Consistent Profitability: North America Realty generated $7.7 million in adjusted EBITDA in Q1 2025 and $7.1 million in operating income in Q2 2025.

- Operational Health: These figures highlight the segment's robust operational performance and its ability to generate earnings from its primary business.

- Financial Stability: The steady income stream from this segment provides a dependable source of funds for the company.

- Resource Allocation: Profits from this cash cow can be reinvested in or used to subsidize other, potentially higher-growth but less profitable, business areas.

Funding for Other Ventures

The substantial cash generated by eXp World Holdings' North American core operations serves as a vital engine for funding its strategic investments in other ventures. This robust cash flow is instrumental in fueling growth in areas such as international expansion and the development of emerging technologies.

This capital allocation strategy is a cornerstone of eXp World Holdings' approach, enabling the company to effectively nurture its 'Stars' and 'Question Marks' within the BCG matrix while simultaneously maintaining a strong and stable financial foundation. The core business acts as a reliable source of capital, leveraging its established market position to finance future growth initiatives.

- North American Operations Cash Generation: eXp World Holdings' core U.S. and Canadian markets consistently generate significant free cash flow, a key indicator of its 'Cash Cow' status.

- Investment in Growth Areas: A portion of this cash is strategically deployed into international markets and new technology platforms, identified as potential future growth drivers.

- Financial Stability: The reliable cash flow from established operations provides a crucial financial cushion, mitigating risks associated with investing in nascent or expanding business segments.

- Capital Allocation Strategy: This 'milking' of the core business allows eXp World Holdings to pursue a balanced growth strategy, supporting existing successes while exploring new opportunities.

eXp Realty's North American brokerage segment stands as the company's primary cash cow. This segment consistently delivers strong financial results, acting as a stable revenue generator. Its mature market position and operational efficiencies allow it to produce substantial profits with relatively low investment needs.

The strategic focus for this segment is to maximize cash flow generation, which then fuels investments in other areas of the business. This approach is typical for a cash cow, where the goal is to leverage established strengths for consistent financial returns.

In Q1 2025, the North American core brokerage operations generated $923 million in revenue, underscoring its significant contribution. This segment's profitability is further evidenced by its positive adjusted EBITDA of $7.7 million in the same quarter.

The company's commitment to operational efficiency is a key driver of this segment's success. For example, in Q1 2024, eXp Realty reported a net income of $27.9 million, more than double the $14.1 million from Q1 2023, demonstrating effective cost management.

| Segment | Q1 2025 Revenue | Q1 2025 Adj. EBITDA | 2023 Total Revenue | Q1 2024 Net Income |

|---|---|---|---|---|

| North America Realty | $923 million | $7.7 million | Over $4.7 billion | $27.9 million |

Full Transparency, Always

EXp World Holdings BCG Matrix

The EXp World Holdings BCG Matrix preview you see is the complete, unedited document you will receive immediately after purchase. This means you get the full strategic analysis, ready for immediate application in your business planning and decision-making processes. No watermarks or demo content will be present in the downloaded file; it's the exact, professionally formatted report designed for clarity and actionable insights.

Dogs

SUCCESS Enterprises, a segment within EXp World Holdings focused on personal development and media, is showing signs of underperformance, placing it in the Dogs category of the BCG Matrix. This is underscored by a significant $4.9 million impairment charge for goodwill and intangible assets recorded in the fourth quarter of 2024.

This substantial charge directly reflects a decline in the perceived value of SUCCESS Enterprises' assets, indicating that the segment is not meeting its projected financial expectations or market potential. Such an impairment often signals that the business is generating less cash flow than anticipated, a key characteristic of a Dog.

The implication is that SUCCESS Enterprises likely holds a low market share within its industry and faces limited growth prospects. In a competitive landscape, this combination of weak market position and stagnant or declining growth typically leads to a business being categorized as a Dog, requiring careful strategic consideration regarding its future within EXp World Holdings.

SUCCESS Enterprises, when viewed against the backdrop of eXp World Holdings' dominant eXp Realty, represents a considerably smaller slice of the company's financial pie. Its contribution to both overall revenue and profitability is notably dwarfed by the core real estate operations.

In 2023, eXp Realty generated approximately $4.4 billion in revenue, a figure that starkly contrasts with the more modest financial impact of SUCCESS Enterprises. This disparity highlights the current lopsided nature of eXp World Holdings' business portfolio.

The explicit focus by the company's leadership on 'reinvigorating' SUCCESS Enterprises suggests a recognition of its current underperformance or underutilization. This strategic pivot indicates a desire to unlock greater value from this segment, potentially moving it from a 'dog' category towards a more impactful position within the portfolio.

SUCCESS Enterprises, under the personal focus of eXp World Holdings CEO Glenn Sanford, is being earmarked for investment to become a core value driver for agents and shareholders. This strategic initiative suggests the segment needs substantial attention and capital infusion to improve its performance.

In 2023, eXp Realty reported a total revenue of $4.4 billion. While specific segment data for SUCCESS Enterprises isn't always broken out in detail, Sanford's direct involvement signals a recognition of its potential to contribute more significantly to the company's overall financial health, potentially boosting future earnings per share.

Mature and Highly Competitive Market

The personal development and media content market is indeed mature and fiercely competitive. This means established companies already have a strong foothold, making it tough for newer entrants like SUCCESS Enterprises to carve out a significant piece of the pie. Think of it like a crowded marketplace where everyone is selling similar goods.

For SUCCESS Enterprises, achieving substantial growth in this environment is a real challenge. They're up against numerous players who have been around for a while and have built up loyal customer bases. For instance, in 2024, the global e-learning market, a key segment within personal development, was projected to reach over $400 billion, but growth rates are moderating in developed regions.

Without a clear, differentiating strategy, it’s difficult for SUCCESS Enterprises to stand out. The market dynamics demand innovation or a unique value proposition to capture attention and market share.

- Market Saturation: The personal development and media content sector is characterized by a high number of existing providers.

- Growth Challenges: For smaller entities like SUCCESS Enterprises, achieving significant market share is difficult due to entrenched competition.

- Differentiation Imperative: The market requires substantial strategic effort to distinguish offerings and attract customers.

- E-learning Growth: While the e-learning market continues to expand, with global revenues expected to surpass $460 billion by 2025, mature segments face slower growth.

Potential for Divestiture if Unsuccessful

If SUCCESS Enterprises, a hypothetical business unit within EXp World Holdings, continues to underperform, it could face divestiture. This scenario is common for businesses in the Dogs quadrant of the BCG Matrix, which typically struggle to generate profits.

Businesses categorized as Dogs often operate at a break-even point or even consume resources without yielding substantial returns. This lack of profitability makes them unattractive for continued investment and a prime candidate for being sold off or shut down.

For instance, if EXp World Holdings were to report that SUCCESS Enterprises' revenue growth was only 1.5% in 2024, significantly below the industry average of 4.8%, and its profit margin remained negative at -2%, this would strongly indicate its position as a Dog. Such metrics would signal a need for strategic re-evaluation, potentially leading to divestiture to reallocate capital to more promising ventures.

- Underperformance Metrics: In 2024, SUCCESS Enterprises may have shown a market share decline of 3% year-over-year.

- Profitability Concerns: The unit’s operating income could have been a loss of $5 million in the last fiscal year.

- Divestiture Likelihood: Consistent failure to achieve a positive return on equity, perhaps below 2% in 2024, increases the probability of divestiture.

SUCCESS Enterprises, within EXp World Holdings, is firmly in the Dogs category due to its low market share and limited growth prospects in a saturated personal development market. The significant $4.9 million impairment charge in Q4 2024 for goodwill and intangible assets directly reflects this underperformance.

This segment's financial contribution is dwarfed by eXp Realty, which generated approximately $4.4 billion in revenue in 2023, highlighting SUCCESS Enterprises' minimal impact. The company's explicit focus on 'reinvigorating' this segment suggests a recognition of its current struggles and a potential move to improve its standing.

Without a unique strategy in the competitive e-learning market, where mature segments see moderating growth despite the overall market exceeding $400 billion in 2024, SUCCESS Enterprises faces considerable challenges. Continued underperformance, such as a hypothetical 1.5% revenue growth and a -2% profit margin in 2024, could lead to its divestiture.

| Segment | BCG Category | 2023 Revenue (eXp Realty) | Potential 2024 Metric (Hypothetical) | Strategic Implication |

|---|---|---|---|---|

| SUCCESS Enterprises | Dogs | N/A (Dwarfed by eXp Realty) | Revenue Growth: 1.5% Profit Margin: -2% |

High risk of divestiture if performance does not improve. |

| eXp Realty | Stars/Cash Cows (Assumed) | $4.4 Billion | N/A | Dominant business driving company value. |

Question Marks

Virbela is positioned within the enterprise virtual reality (VR) and metaverse sector, a market experiencing significant expansion. This segment is expected to see robust growth, making it a dynamic space for companies like Virbela.

The global VR market is projected to expand by an impressive USD 133.17 billion between 2025 and 2029. This growth is fueled by a compound annual growth rate (CAGR) of 38%, highlighting the sector's rapid and attractive trajectory.

Given this substantial market growth potential, Virbela's current position within this expanding VR/metaverse landscape aligns with the characteristics of a 'Question Mark' in the BCG Matrix. It operates in a high-potential area, but its future success and market share are still developing.

Virbela, despite operating in a high-growth enterprise VR market, likely holds a small market share. This is typical for emerging industries where larger technology companies are also making inroads. The company's focus on development and market entry necessitates substantial capital outlay.

The financial performance of EXp World Holdings' 'other affiliated services' segment, which includes Virbela, highlights these investment needs. This segment reported an adjusted EBITDA loss in the second quarter of 2025, underscoring the significant cash consumption required for Virbela's growth and market penetration efforts.

As a 'Question Mark' in the BCG Matrix, Virbela embodies significant future uncertainty. Its success hinges on its capacity to gain substantial market share in a rapidly evolving digital collaboration space.

While Virbela's immersive virtual environment technology shows promise, its widespread adoption and the company's specific competitive advantage are still being solidified. For instance, the global virtual collaboration market was valued at approximately $16.7 billion in 2023 and is projected to grow significantly, but Virbela's precise slice of this pie remains to be seen.

This category demands careful strategic evaluation and sustained investment. Companies in this position must decide whether to invest heavily to grow market share or divest to cut losses, as the path forward is unclear and carries substantial risk.

Strategic Importance for Future Innovation

Virbela and FrameVR.io are central to eXp World Holdings' forward-looking strategy, especially as the real estate sector increasingly embraces virtual and augmented reality. These technologies are not just tools but potential engines for new revenue, pushing eXp beyond its core brokerage model.

eXp's investment in these platforms signals a strong belief in their ability to shape the future of real estate transactions and agent collaboration. The company is positioning itself to lead in the adoption and monetization of immersive technologies within the industry.

- Virbela's Role: Facilitates virtual office environments and professional networking, enhancing remote work capabilities for eXp agents.

- FrameVR.io's Potential: Explores immersive 3D experiences, potentially for virtual property tours or client presentations.

- Strategic Investment: eXp World Holdings invested $3 million in Virbela in 2020, underscoring its commitment to virtual world development.

- Future Revenue Streams: These platforms could unlock new income opportunities through virtual events, digital asset sales, or enhanced service offerings.

Potential to Become a Star or a Dog

Virbela's future within eXp World Holdings presents a classic BCG Matrix dilemma, with the potential to become either a 'Star' or a 'Dog'.

For Virbela to achieve 'Star' status, it requires substantial investment to capture a significant share of the burgeoning virtual collaboration market. If it successfully gains traction and demonstrates strong revenue growth, it will contribute significantly to eXp's overall portfolio performance.

Conversely, if Virbela struggles to gain market share or continues to be a cash drain without generating meaningful returns, it could be classified as a 'Dog'. This scenario would put it at risk of divestiture as eXp reallocates resources to more promising ventures.

- Star Potential: Virbela needs to secure a dominant position in the virtual workspace sector, a market projected to reach $10.1 billion by 2027, growing at a CAGR of 13.2%.

- Dog Risk: Failure to achieve significant user adoption or revenue milestones, especially if its operating expenses in 2024 continue to outpace its revenue generation, could lead to its reclassification as a 'Dog'.

- Strategic Decision Point: eXp's management must closely monitor Virbela's market penetration and financial performance, making critical decisions about continued investment or divestment based on its trajectory.

Virbela, as a Question Mark, operates in the high-growth enterprise VR market but currently holds a small market share, necessitating significant investment. The company's adjusted EBITDA loss in Q2 2025 for eXp's affiliated services segment highlights this cash consumption. Virbela's future success is uncertain, depending on its ability to capture market share in the evolving digital collaboration space.

The company's strategic importance to eXp World Holdings is evident in its role in virtual office environments and potential for FrameVR.io to offer immersive experiences. eXp's $3 million investment in Virbela in 2020 underscores its commitment to developing virtual worlds for new revenue streams.

Virbela faces a critical juncture: it could become a 'Star' with substantial investment and market share capture, or a 'Dog' if it remains a cash drain without meaningful returns. eXp's management must monitor its trajectory closely to decide on continued investment or divestment.

| Metric | Virbela/VR Sector | eXp World Holdings (Affiliated Services) |

|---|---|---|

| Market Growth (VR) | Projected $133.17 billion increase (2025-2029) at 38% CAGR | N/A |

| Virtual Collaboration Market Value | Approx. $16.7 billion (2023) | N/A |

| eXp Investment in Virbela | $3 million (2020) | N/A |

| Financial Performance (Q2 2025) | N/A | Adjusted EBITDA Loss |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.