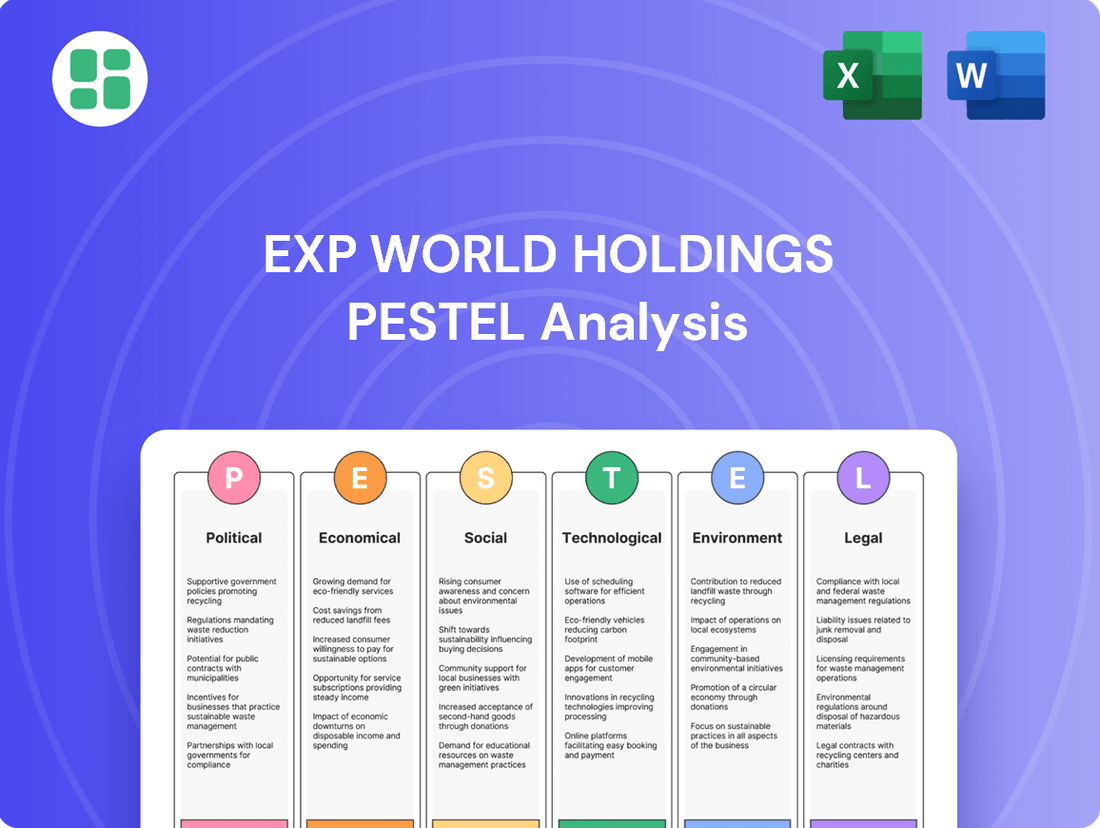

EXp World Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EXp World Holdings Bundle

Discover how political stability, economic fluctuations, and evolving social trends are shaping EXp World Holdings's trajectory. Our PESTLE analysis provides a crucial understanding of these external forces, empowering you to anticipate challenges and capitalize on opportunities. Don't navigate the market blindly; download the full PESTLE analysis for EXp World Holdings and gain the strategic clarity you need to succeed.

Political factors

Government policies and regulations significantly shape eXp Realty's business. For instance, in 2024, several states continued to review and update their real estate licensing requirements, impacting agent recruitment and retention. Changes in commission structures, notably following the NAR settlement in late 2023 and early 2024, directly affected how eXp Realty compensates its agents, requiring swift adaptation of their business models.

eXp World Holdings' global expansion is directly shaped by international trade agreements and foreign investment regulations. The company's ambitious goal of reaching 50,000 agents in 50 countries by 2030 means navigating diverse political landscapes.

Recent expansions into markets like Türkiye, Peru, and Egypt highlight the importance of favorable political environments and streamlined business regulations. These factors are crucial for eXp World Holdings to successfully implement its international growth strategy and achieve its ambitious agent and country targets.

Government housing policies significantly influence the real estate landscape where eXp World Holdings operates. Initiatives aimed at boosting housing affordability, such as first-time homebuyer tax credits or down payment assistance programs, directly stimulate demand for real estate services. For instance, the continuation or expansion of programs like the FHA loan limits, which were adjusted for 2024, can make homeownership more accessible, thereby increasing transaction volumes for eXp agents.

Changes in mortgage interest rate subsidies or tax deductions for homeowners can also impact market activity. If the government were to alter policies that make mortgages more or less expensive, it would directly affect buyer purchasing power and, consequently, the demand for eXp's platform and services. These policy shifts create the foundational market conditions for eXp's agents and the company itself.

Antitrust Litigation and Settlements

Antitrust litigation has significantly impacted the real estate sector, leading to scrutiny of long-standing commission structures. These legal challenges are reshaping how brokerages function and how agents are compensated, with a focus on fostering greater transparency and competition within the market.

eXp World Holdings itself addressed these pressures by settling commission lawsuits in late 2024 for $34 million. This settlement also included an agreement to implement unspecified changes to its business practices, demonstrating a direct response to the evolving regulatory and legal landscape.

The implications of these antitrust actions and settlements are far-reaching:

- Increased regulatory oversight: Expect ongoing examination of commission models and agent compensation agreements.

- Shift in agent compensation: Brokerages may need to adopt more flexible and transparent payment structures.

- Focus on competition: The legal pressure aims to reduce barriers to entry and promote a more competitive market environment.

- Potential for further industry changes: Other real estate firms may face similar challenges, driving broader industry reform.

Political Stability and Geopolitical Risks

Political instability or geopolitical conflicts in countries where eXp World Holdings operates, such as the United States, Canada, and various European nations, can significantly disrupt its market operations. For instance, ongoing geopolitical tensions in Eastern Europe, impacting energy markets and global supply chains, could indirectly affect consumer spending on real estate services. The company’s global footprint, spanning over 20 countries as of early 2024, exposes it to a wider array of political risks that could necessitate adjustments to its international expansion strategy.

These events can erode consumer confidence, a critical factor in the real estate market, potentially leading to a slowdown in transactions. For example, heightened political uncertainty in a key market could deter potential buyers and sellers, impacting eXp's commission-based revenue model. The company must remain agile, monitoring geopolitical developments to mitigate potential disruptions and adapt its business strategies accordingly.

- Global Operations: eXp World Holdings operates in over 20 countries, increasing exposure to diverse political landscapes.

- Geopolitical Impact: Events like the ongoing conflict in Ukraine (as of mid-2024) can indirectly influence economic stability and consumer confidence in eXp's operating regions.

- Market Susceptibility: Real estate, being a sensitive sector, is particularly vulnerable to shifts in consumer sentiment driven by political instability.

- Strategic Adaptation: eXp needs to continuously assess and adapt its international expansion plans in response to evolving geopolitical risks.

Government policies on housing affordability, such as the 2024 FHA loan limit adjustments, directly stimulate real estate demand, benefiting eXp agents. The significant $34 million settlement eXp reached in late 2024 regarding commission lawsuits underscores the impact of antitrust litigation and the push for greater market transparency. Navigating diverse political landscapes and trade regulations is crucial for eXp's global expansion, aiming for 50,000 agents in 50 countries by 2030.

What is included in the product

This PESTLE analysis provides a comprehensive examination of how external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—impact EXp World Holdings, offering actionable insights for strategic planning.

Provides a clear, actionable overview of external factors impacting EXP World Holdings, enabling proactive strategy adjustments and mitigating potential risks.

Economic factors

eXp World Holdings' performance is intrinsically tied to the real estate market's vitality. Factors like home sales volume and pricing directly influence the company's success. For instance, in 2024, rising mortgage rates and affordability concerns presented headwinds, potentially dampening transaction volumes and agent earnings.

The real estate sector experienced significant shifts in 2024, with the median existing-home sales price reaching $410,600 in May 2024, a 4.8% increase from May 2023, according to the National Association of Realtors. However, affordability remains a challenge due to elevated mortgage rates, which hovered around 7% for much of the year. This environment can lead to fewer home sales, impacting eXp's agent productivity and overall transaction numbers.

While eXp's cloud-based, agent-centric model provides inherent scalability to navigate market fluctuations, the fundamental health of the broader real estate market remains a critical determinant of its growth trajectory. A slowdown in sales or a significant price correction would inevitably present challenges for the company.

Changes in interest rates significantly impact mortgage affordability, directly influencing homebuyer demand for eXp World Holdings. Higher rates, like those seen throughout much of 2024, increase financing costs for potential buyers, which can dampen transaction volumes within the real estate market. This is a crucial economic consideration for eXp's revenue streams.

The Federal Reserve's monetary policy plays a pivotal role in shaping the interest rate environment. For instance, the Fed's target range for the federal funds rate, which influences broader borrowing costs, remained elevated in 2024, impacting the overall cost of capital for real estate transactions. These decisions directly affect the economic landscape in which eXp operates.

eXp Realty's agent commission structure, featuring revenue share and equity awards, acts as a powerful economic draw for its sales force. This model incentivizes agents by offering a stake in the company's success beyond individual transaction commissions.

In 2024 alone, eXp Realty distributed over $220 million in revenue share and equity benefits to its agents. This substantial payout highlights the financial appeal of eXp's model for agents looking for wealth-building opportunities that go beyond typical real estate earnings.

The long-term economic sustainability of this agent-centric approach is directly linked to eXp's consistent revenue expansion and the collective productivity of its agent network. Growth in these areas is crucial for maintaining the attractiveness and financial feasibility of the revenue share and equity programs.

Inflation and Economic Growth

Inflationary pressures can significantly impact eXp World Holdings and its agents by increasing operating costs, potentially squeezing profit margins. For instance, rising costs for marketing, technology, and agent support services directly affect the company's bottom line.

Conversely, robust economic growth typically fuels a stronger housing market. This is because increased consumer confidence and disposable income often translate into greater demand for real estate, benefiting eXp's agent network and transaction volumes. For example, in Q1 2024, the US economy grew at an annualized rate of 1.3%, indicating a generally supportive, albeit moderating, economic backdrop for real estate.

The broader economic environment is a critical determinant of consumer spending power and, consequently, investment in real estate. Factors such as interest rate policies, employment levels, and wage growth directly influence how much individuals can afford and are willing to spend on housing, impacting eXp's market potential.

- Inflationary Impact: Rising operational costs for eXp World Holdings and its agents due to inflation can reduce profitability.

- Economic Growth Benefits: Strong economic growth typically correlates with a more active housing market and higher consumer confidence, which is advantageous for eXp.

- Consumer Spending Power: The overall economic climate, including factors like employment and wage growth, dictates consumers' ability and willingness to invest in real estate.

- 2024 Economic Data: The US economy's 1.3% annualized growth in Q1 2024 provides a snapshot of the current economic environment influencing the real estate sector.

Global Economic Conditions and Currency Exchange Rates

As a global entity, eXp World Holdings navigates a landscape shaped by diverse economic conditions and currency fluctuations. The company's significant international revenue growth, achieving a 59% year-over-year increase in the second quarter of 2025, underscores the critical role of global economic stability for its performance.

Fluctuations in currency exchange rates directly impact eXp World Holdings' reported earnings from its international operations. Favorable exchange rates can enhance these reported profits, while unfavorable movements can lead to a reduction in their value.

- International Revenue Growth: eXp World Holdings reported a robust 59% year-over-year increase in international revenue for Q2 2025.

- Currency Impact: Exchange rate movements can positively or negatively affect the translation of foreign earnings into eXp World Holdings' reporting currency.

- Economic Sensitivity: The company's global presence makes its financial results susceptible to the economic health of various countries where it operates.

The economic landscape profoundly influences eXp World Holdings, with interest rates, inflation, and overall economic growth being key drivers. For instance, the Federal Reserve's monetary policy, which kept the federal funds rate target range elevated throughout much of 2024, directly impacts mortgage affordability and, consequently, housing market activity. This economic backdrop is crucial for eXp's revenue generation through its agent network.

eXp's agent-centric model, featuring substantial revenue share and equity distributions, is designed to attract and retain talent, with over $220 million distributed in 2024 alone. However, the long-term viability of these programs hinges on the company's sustained revenue growth and agent productivity, which are themselves tied to broader economic conditions and housing market health.

The company's international expansion, marked by a 59% year-over-year increase in international revenue in Q2 2025, highlights its sensitivity to global economic stability and currency fluctuations. These international operations contribute significantly to eXp's overall financial performance, making global economic trends a critical consideration.

| Economic Factor | 2024/2025 Data Point | Impact on eXp World Holdings |

|---|---|---|

| US Economic Growth (Q1 2024) | 1.3% annualized rate | Generally supportive, indicating consumer spending power for real estate. |

| Median Existing-Home Price (May 2024) | $410,600 (+4.8% YoY) | Higher prices can increase commission potential but may challenge affordability. |

| Mortgage Rates (2024 average) | Around 7% | Elevated rates increase financing costs, potentially dampening transaction volumes. |

| Federal Funds Rate Target | Elevated range in 2024 | Influences broader borrowing costs, impacting real estate transaction affordability. |

| International Revenue Growth (Q2 2025) | 59% year-over-year | Demonstrates the importance of global economic health and currency stability. |

| Agent Distributions (2024) | Over $220 million (revenue share & equity) | Highlights the financial appeal of eXp's model, dependent on company performance. |

Full Version Awaits

EXp World Holdings PESTLE Analysis

The preview you see here offers a comprehensive PESTLE analysis for EXP World Holdings, detailing Political, Economic, Social, Technological, Legal, and Environmental factors. This is the exact document you’ll receive after purchase—fully formatted and ready to use, providing valuable insights into the company's operating landscape.

Sociological factors

eXp World Holdings' cloud-based model is exceptionally well-positioned to capitalize on the seismic shift towards remote and flexible work. This trend, amplified by recent global events, has fundamentally altered how many professionals approach their careers, particularly in sectors like real estate.

The increasing preference for virtual collaboration and a better work-life balance directly benefits eXp's operational framework. In 2024, surveys indicated that a significant majority of real estate agents expressed a desire for continued remote work options, with many citing increased productivity and reduced overhead as key advantages.

This evolving work culture directly impacts agent recruitment and retention strategies. Professionals are actively seeking greater autonomy, flexible schedules, and access to robust digital tools, all of which are core tenets of the eXp Realty model, making it an attractive proposition in the competitive talent landscape.

Demographic shifts significantly shape housing demand for eXp World Holdings. For instance, the U.S. population is projected to reach over 335 million by 2025, with varying regional growth rates impacting local housing markets. Household formation, particularly among millennials and Gen Z, continues to be a key driver, influencing the types of properties and locations eXp Realty agents focus on.

Age distribution also plays a critical role; an aging population may increase demand for accessible or single-story homes, while younger demographics might prioritize urban living or starter homes. eXp's business model, relying on a distributed network of agents, is well-positioned to adapt to these varied regional and generational demands across the country.

Buyer preferences are also evolving, with a notable rise in demand for energy-efficient and sustainable housing options. Furthermore, preferences for community amenities and smart home technology are increasingly influencing purchasing decisions. eXp Realty's ability to leverage technology and provide agents with market insights helps them cater to these evolving buyer needs.

eXp World Holdings, through its subsidiaries eXp Realty and SUCCESS Enterprises, places a significant emphasis on empowering its real estate agents and fostering their professional development. This commitment is evident in the comprehensive training programs and readily available resources designed to enhance agent productivity and satisfaction. For instance, providing free Canva Pro accounts and forging partnerships with business intelligence platforms like Sisu directly contribute to agents' ability to market themselves effectively and manage their businesses more efficiently.

This strategic focus on agent success and continuous growth cultivates a robust and supportive community within eXp. By investing in their agents' development, the company not only boosts individual performance but also strengthens its overall appeal, attracting and retaining top-tier talent in a competitive market. This approach is crucial for maintaining a high level of service and driving long-term business success.

Community Building in Virtual Environments

eXp World Holdings, despite its cloud-based nature, cultivates a robust community among its real estate agents. This is achieved through its innovative virtual platform and regular online events, fostering a sense of belonging and shared purpose. The company's subsidiary, Virbela, plays a crucial role by developing immersive virtual environments designed for collaboration and education, effectively mirroring face-to-face social interactions.

This strategic focus on virtual community building directly addresses the fundamental sociological need for connection and belonging, which is particularly vital for a geographically dispersed workforce. By replicating social dynamics in the digital realm, eXp enhances agent engagement and retention. For instance, in Q1 2024, eXp Realty reported a significant increase in agent participation in virtual events, with over 75% of active agents attending at least one company-sponsored webinar or social gathering.

- Virtual Platform Engagement: eXp's platform facilitates daily interactions and networking opportunities for its agents.

- Virbela's Role: This subsidiary provides the technological infrastructure for immersive virtual meetings and training sessions.

- Addressing Social Needs: The virtual environment combats isolation and promotes a strong sense of community, crucial for agent morale and productivity.

- Agent Growth: By Q2 2024, eXp Realty saw its agent count grow to over 22,000 globally, a testament to its ability to attract and retain talent through its community-focused approach.

Consumer Preferences for Digital Real Estate Services

Consumers are increasingly comfortable using digital platforms for a wide range of services, and real estate is no exception. This growing reliance on technology for transactions, from initial searches to final paperwork, directly benefits eXp Realty's virtual business model. For instance, a 2024 survey indicated that over 70% of homebuyers used online tools extensively during their search, highlighting a significant societal shift towards digital convenience.

This societal trend means buyers and sellers are more receptive to virtual property tours, digital document signing, and online consultations. Data from 2024 shows a marked increase in the adoption of virtual tours, with many agencies reporting a 50% or higher engagement rate compared to traditional open houses. This acceptance underpins eXp's inherently tech-forward approach to real estate services.

The willingness of consumers to embrace digital solutions for major life events like buying or selling a home is a key driver for companies like eXp. This societal evolution is not just a trend but a fundamental change in how people expect to conduct business.

- Growing Digital Adoption: Over 70% of homebuyers in 2024 utilized online tools extensively in their property search.

- Virtual Tour Engagement: Virtual property tours saw a significant increase in usage and acceptance in 2024, with many agencies reporting over 50% engagement.

- Preference for Online Services: Consumers are increasingly comfortable with digital document signing and virtual consultations for real estate transactions.

- Support for Tech-Forward Models: This societal shift directly bolsters the viability and growth potential of virtual real estate transaction models like eXp Realty's.

Societal shifts towards remote work and digital engagement are foundational to eXp World Holdings' success. The increasing comfort with virtual interactions, from property tours to agent collaboration, directly aligns with eXp's operational model. By Q2 2024, eXp Realty's agent count had surpassed 22,000 globally, reflecting its appeal to a workforce embracing flexibility and technology.

The company's investment in virtual community building, facilitated by subsidiaries like Virbela, addresses the inherent need for connection in a dispersed workforce. This strategy proved effective, with agent participation in virtual events seeing a notable increase in early 2024, with over 75% of active agents engaging in company-sponsored online activities.

Consumer trust in digital platforms for significant transactions, including real estate, continues to grow. By 2024, over 70% of homebuyers relied heavily on online tools, underscoring the societal embrace of digital convenience and validating eXp's tech-forward approach.

Technological factors

eXp World Holdings' foundation is built upon its sophisticated cloud-based platform and immersive virtual reality environments, including Virbela and FrameVR.io. These technological cornerstones are crucial for their lean, scalable brokerage operations and for fostering collaborative spaces for agents and clients alike.

The company's reliance on these virtual environments directly impacts its operational costs, allowing for a significantly lower overhead compared to traditional brick-and-mortar brokerages. For instance, as of Q1 2024, eXp Realty reported a 7.7% increase in revenue year-over-year, demonstrating the continued success of its technology-driven model.

Ongoing investment in and refinement of these virtual platforms are paramount for eXp World Holdings to maintain its competitive edge and enhance operational efficiency in the rapidly evolving real estate technology landscape.

The real estate sector is rapidly adopting Artificial Intelligence (AI) to personalize home searches, generate market insights, and boost agent productivity. eXp World Holdings is actively investing in AI-driven tools and automation, including AI-powered customer relationship management (CRM) platforms. These integrations aim to significantly enhance agent efficiency and streamline operational workflows.

AI's capacity for data-driven decision-making is a key technological driver for eXp. For instance, AI algorithms can analyze vast datasets to predict market trends, identify potential investment opportunities, and even assist in property valuation, providing a competitive edge. This technological advancement is expected to contribute to eXp's continued growth and market positioning.

Virbela's established expertise in crafting sophisticated virtual reality environments is a significant technological asset for eXp World Holdings as the metaverse continues to evolve. This capability directly positions eXp to leverage the burgeoning metaverse trend. For instance, in 2023, the global metaverse market was valued at approximately $130 billion, with projections indicating substantial growth, potentially reaching over $1.7 trillion by 2030, according to various market research reports.

The metaverse presents a landscape ripe with opportunities for eXp World Holdings, including the development and sale of virtual real estate, the hosting of immersive virtual events, and the facilitation of novel collaboration and educational experiences. Companies are increasingly investing in these virtual spaces; for example, Meta Platforms invested billions in its metaverse division in 2023, signaling the perceived future value of these digital realms.

Continuous advancements in metaverse technology are poised to unlock new revenue streams and significantly enhance eXp World Holdings' existing business models. As the technology matures, expect to see more sophisticated tools for virtual commerce and engagement, potentially boosting transaction volumes and user participation within eXp's virtual ecosystem.

Data Analytics and Business Intelligence

eXp World Holdings heavily relies on data analytics and business intelligence to empower its agents. Through strategic partnerships, like the one with Sisu, the company provides agents with tools to access real-time insights. This allows them to monitor their performance, spot market trends, and refine their business approaches.

The effective use of data directly impacts agent productivity and contributes to eXp's overall expansion. For instance, in Q1 2024, eXp Realty reported a 14% increase in agent count year-over-year, reaching 100,000 agents globally, a testament to the support systems in place.

- Real-time Performance Tracking: Agents can monitor key performance indicators (KPIs) such as transaction volume, lead conversion rates, and marketing ROI.

- Market Trend Identification: Data analysis helps agents understand local market dynamics, identify high-demand areas, and predict future property values.

- Personalized Business Strategies: Insights derived from data enable agents to tailor their outreach, marketing efforts, and client engagement for maximum effectiveness.

- Enhanced Agent Support: The company leverages data to identify areas where agents might need additional training or resources, fostering a culture of continuous improvement.

Cybersecurity and Data Privacy

Cybersecurity and data privacy are critical for EXp World Holdings, given its reliance on technology and handling of sensitive client and agent information. The company must maintain robust defenses against cyber threats to protect its cloud platform and virtual environments.

Failure to do so can lead to severe consequences. For instance, in 2023, the average cost of a data breach globally reached $4.45 million, according to IBM's Cost of a Data Breach Report 2023. This highlights the substantial financial and reputational risks involved.

EXp World Holdings must ensure compliance with evolving data privacy regulations. Key regulations include:

- General Data Protection Regulation (GDPR): Affects companies handling data of EU citizens, with fines up to 4% of global annual turnover or €20 million.

- California Consumer Privacy Act (CCPA) / California Privacy Rights Act (CPRA): Grants California consumers rights over their personal data and imposes obligations on businesses.

- Other regional privacy laws: Such as those in Canada (PIPEDA) and Brazil (LGPD), requiring adherence to local data protection standards.

Proactive investment in cybersecurity and a strong commitment to data privacy are essential for maintaining client trust and ensuring the secure, uninterrupted operation of EXp World Holdings' business model.

eXp World Holdings' technological foundation in cloud-based platforms and virtual reality, like Virbela, underpins its efficient, scalable brokerage model. This tech-centric approach allows for significantly lower overhead compared to traditional real estate firms, a strategy that contributed to a 7.7% revenue increase year-over-year as of Q1 2024.

The company is actively integrating AI to enhance agent productivity and provide data-driven market insights, aiming to streamline operations and identify growth opportunities. This focus on AI is crucial as the real estate sector increasingly adopts these technologies for personalized services and predictive analytics.

eXp's investment in metaverse technologies, leveraging Virbela's expertise, positions it to capitalize on the expanding metaverse market, which was valued at approximately $130 billion in 2023 and is projected for significant growth. This strategic technological focus is key to unlocking new revenue streams and enhancing existing business models.

The company's reliance on data analytics and business intelligence tools, such as those provided through its Sisu partnership, empowers agents with real-time performance tracking and market trend identification. This data-driven approach contributed to a 14% year-over-year increase in agent count, reaching 100,000 agents globally by Q1 2024.

Legal factors

The real estate commission landscape is a hotbed of legal activity, with class-action lawsuits and evolving regulations directly impacting companies like eXp Realty. These legal challenges often focus on antitrust concerns and how commission structures might stifle competition.

eXp Realty itself recently settled a significant commission lawsuit for $34 million, highlighting the substantial financial and operational adjustments required to align with new legal interpretations. This settlement underscores the critical need for eXp to proactively adapt its business model to navigate this shifting legal terrain and ensure ongoing compliance.

eXp Realty's expansive reach across various states and international markets necessitates rigorous compliance with a complex web of real estate licensing laws and brokerage regulations. Failure to adhere to these diverse legal frameworks, which govern everything from advertising standards to transaction protocols, can result in significant penalties, jeopardizing operational licenses and the legality of agent actions.

In 2024, regulatory bodies continue to emphasize agent accountability and brokerage oversight. For instance, states like California have seen increased scrutiny on independent contractor classifications, impacting business models like eXp's. Maintaining up-to-date licensing for its over 100,000 agents globally (as of Q1 2024) is a continuous and substantial operational challenge, directly impacting eXp's ability to conduct business legally and ethically.

eXp World Holdings must navigate a complex web of data privacy and consumer protection laws, including the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). Given its digital-first model, the company's compliance with these regulations is paramount, impacting how it collects, stores, and uses personal data from consumers and its agents. Failure to adhere can result in significant fines; for instance, GDPR violations can lead to penalties of up to 4% of global annual revenue or €20 million, whichever is greater.

Intellectual Property Rights

Intellectual Property (IP) protection is paramount for EXp World Holdings, given its foundation in innovative cloud and virtual reality technologies like Virbela and FrameVR.io. Safeguarding patents, copyrights, and trademarks for its software, platforms, and distinct business models is crucial for maintaining its competitive edge in the rapidly evolving tech landscape.

Legal frameworks surrounding IP are essential for EXp World Holdings to prevent unauthorized use and maintain its market position. For instance, the global software market is projected to reach $1 trillion by 2025, underscoring the value of proprietary technology and the need for robust IP enforcement to secure market share.

- Patents: Securing patents for novel technological solutions and platform functionalities is vital for EXp World Holdings to prevent competitors from replicating its innovations.

- Copyrights: Protecting the original content and code within its virtual reality environments and cloud platforms ensures that its creative and technical assets are legally safeguarded.

- Trademarks: Brand names and logos associated with Virbela and FrameVR.io are critical for customer recognition and brand integrity, requiring strong trademark protection.

- Enforcement: Proactive legal measures against IP infringement are necessary to defend its market advantage and deter potential infringements in the competitive virtual and cloud technology sectors.

Employment and Independent Contractor Laws

eXp World Holdings' reliance on an independent contractor model for its agents means it must closely monitor evolving employment laws. Misclassification of workers can lead to significant penalties, including back taxes and benefit claims. As of early 2024, the debate around worker classification continues, with some jurisdictions pushing for stricter definitions that could impact gig economy models.

The company’s success is tied to its ability to maintain this contractor status. For instance, in 2023, several states saw legislative proposals aimed at reclassifying gig workers, which could force a costly restructuring of eXp's agent relationships if enacted. Keeping abreast of these legal shifts is crucial for operational stability and financial planning.

- Independent Contractor Status: eXp operates primarily with agents classified as independent contractors, a model that offers flexibility but requires strict adherence to labor laws.

- Legal Scrutiny: Changes in employment legislation, particularly concerning worker classification, pose a direct risk, potentially leading to increased compliance costs or a need to alter the business model.

- Regulatory Landscape: As of mid-2024, regulatory bodies in several key markets are reviewing independent contractor definitions, creating an uncertain environment for businesses like eXp.

The legal environment surrounding real estate commissions is highly dynamic, with ongoing litigation and regulatory shifts directly impacting eXp World Holdings. Antitrust concerns and the legality of commission structures remain central to these challenges, as demonstrated by eXp's recent $34 million settlement in a commission lawsuit. This settlement necessitates ongoing adaptation of its business model to ensure compliance with evolving legal interpretations.

eXp's global operations require strict adherence to diverse real estate licensing and brokerage regulations across multiple states and international markets. Non-compliance with these varied legal frameworks, which govern advertising and transaction protocols, can lead to substantial penalties and jeopardize operational licenses. As of Q1 2024, eXp supported over 100,000 agents globally, making licensing compliance a continuous and significant operational undertaking.

The company must also navigate stringent data privacy and consumer protection laws, such as GDPR and CCPA. For its digital-first model, compliance with how personal data is collected, stored, and used is critical. GDPR violations, for instance, can incur fines up to 4% of global annual revenue or €20 million, whichever is greater, underscoring the financial risk of non-compliance.

Intellectual property protection is vital for eXp's innovative technologies like Virbela and FrameVR.io. Safeguarding patents, copyrights, and trademarks is essential for maintaining its competitive edge in the rapidly evolving tech sector. The global software market is projected to reach $1 trillion by 2025, highlighting the value of proprietary technology and robust IP enforcement to secure market share.

Environmental factors

While eXp World Holdings' cloud-based model minimizes physical office space, its reliance on data centers presents an environmental challenge. These facilities consume vast amounts of energy, contributing to a significant carbon footprint. For instance, global data centers are projected to consume around 1.8% of the world's electricity by 2025, a figure that continues to grow.

The environmental impact of cloud computing extends beyond energy consumption to include the lifecycle of hardware, from manufacturing to disposal. As sustainability becomes a paramount concern for businesses and consumers alike, the energy efficiency and environmental practices of cloud providers are under increasing scrutiny. This trend is likely to influence operational choices and vendor selection in the coming years.

eXp's stated commitment to climate-positive solutions aligns with the growing demand for environmentally responsible business practices. By promoting a low-carbon economy, the company can leverage its digital infrastructure to support sustainability goals, potentially differentiating itself in a market increasingly sensitive to environmental, social, and governance (ESG) factors.

The increasing consumer and investor appetite for sustainable real estate is reshaping how properties are marketed and managed. eXp Realty agents are increasingly finding that clients expect them to understand green building standards, energy-saving features, and eco-friendly construction methods. This growing demand is a significant environmental factor influencing the real estate industry.

For example, a 2024 report indicated that over 60% of homebuyers are now willing to pay a premium for homes with green features. This translates to a need for eXp agents to be educated on certifications like LEED and ENERGY STAR to effectively advise clients and highlight property value. Such knowledge can unlock new market segments and revenue streams for the brokerage.

Regulatory bodies are increasingly mandating Environmental, Social, and Governance (ESG) reporting, particularly for larger enterprises. This trend directly affects eXp World Holdings by requiring more robust data collection and transparency regarding its environmental impact.

Compliance with new sustainability disclosure rules, such as those emerging in states like California focusing on carbon data, means companies like eXp World Holdings must actively monitor and report environmental metrics. For instance, California's Climate Corporate Data Accountability Act (SB 253) requires companies exceeding $1 billion in annual revenue to disclose their Scope 1, 2, and 3 greenhouse gas emissions starting in 2026. This necessitates a proactive approach to environmental accountability.

Resource Consumption and Waste Management

While eXp World Holdings operates primarily in a virtual environment, its resource consumption is still a factor. This includes the energy required for data centers powering its cloud-based platform and the resources used for employee technology, such as laptops and monitors. Even a virtual company has a physical footprint through its employees' home offices and any necessary travel for in-person events or team gatherings.

eXp's commitment to sustainability is evident in its efforts to manage waste and reduce its environmental impact. The company's focus on digital operations inherently minimizes paper waste compared to traditional brick-and-mortar real estate brokerages. For instance, in 2023, eXp reported that its virtual model allowed for a significant reduction in physical office space, thereby lowering associated energy consumption and waste generation.

The company's environmental responsibility extends to implementing sustainable practices across its operations. This involves:

- Sustainable Procurement: Prioritizing vendors with strong environmental credentials for technology and other operational needs.

- Energy Efficiency: Encouraging energy-saving practices among its remote workforce and optimizing its cloud infrastructure.

- Waste Reduction: Implementing digital workflows to minimize paper usage and promoting recycling initiatives for electronic waste.

- Carbon Footprint Monitoring: Actively tracking and seeking ways to reduce its overall carbon emissions, including those from business travel.

Climate Change Impact on Real Estate Markets

Climate change presents a significant environmental factor impacting real estate. Extreme weather events, such as intensified hurricanes and wildfires, directly affect property values and insurability in vulnerable areas. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, totaling $170.3 billion in damages, according to NOAA. Rising sea levels also pose a long-term threat to coastal properties, potentially leading to devaluation and reduced transaction volumes. This can indirectly influence eXp's business by shifting agent focus and client demand towards more resilient regions.

Resource scarcity, particularly water availability, can also weigh on real estate markets. Areas facing prolonged droughts may see decreased desirability and development potential, impacting property sales and agent commissions. While eXp's virtual model insulates it from direct physical damage, the broader economic and social consequences of climate change on real estate stability are undeniable. This necessitates a strategic awareness of geographic risk for agents and clients alike.

The financial implications are substantial:

- Increased Insurance Premiums: Properties in high-risk zones face escalating insurance costs, affecting affordability and marketability.

- Decreased Property Values: Areas prone to frequent climate-related damage may experience significant drops in market value.

- Shifting Investment Focus: Investors are increasingly scrutinizing climate risk, potentially diverting capital away from vulnerable markets.

- Demand for Resilient Properties: There is a growing demand for homes built with climate resilience in mind, creating new market opportunities.

eXp World Holdings' virtual model inherently reduces its physical footprint, but its reliance on data centers means energy consumption and hardware lifecycle remain environmental considerations. Global data center electricity consumption is projected to reach around 1.8% by 2025, highlighting the energy demands of cloud infrastructure.

Growing client demand for sustainable real estate, with over 60% of homebuyers in 2024 willing to pay more for green features, pushes eXp agents to understand eco-friendly practices. Regulatory shifts, like California's SB 253 mandating emissions disclosure for large companies starting in 2026, also require eXp to enhance its environmental data transparency.

Climate change directly impacts real estate markets, with 2023 seeing 28 billion-dollar weather disasters in the U.S., costing $170.3 billion. This necessitates agents' awareness of climate risks, property resilience, and shifting investment trends towards sustainable and less vulnerable locations.

| Environmental Factor | Impact on eXp World Holdings | Supporting Data/Trend |

|---|---|---|

| Data Center Energy Consumption | Contributes to carbon footprint; requires efficient cloud infrastructure. | Global data centers projected to consume 1.8% of world electricity by 2025. |

| Green Real Estate Demand | Opportunity for agents to advise clients on eco-friendly features. | Over 60% of homebuyers in 2024 willing to pay a premium for green homes. |

| Climate Change & Extreme Weather | Affects property values, insurability, and agent focus on resilient markets. | 2023 U.S. weather disasters caused $170.3 billion in damages. |

| ESG Reporting Mandates | Requires increased transparency and data collection on environmental impact. | California's SB 253 requires emissions disclosure for companies over $1B revenue from 2026. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for EXP World Holdings is meticulously crafted using data from official government publications, reputable financial news outlets, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the company.