EVS Broadcast Equipment SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EVS Broadcast Equipment Bundle

EVS Broadcast Equipment stands as a leader in live production technology, but understanding its full potential requires a deeper dive. Our analysis reveals critical external opportunities and internal weaknesses that could shape its future trajectory.

Want the full story behind EVS Broadcast Equipment's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

EVS Broadcast Equipment experienced a remarkable financial year in 2024, posting record revenues that approached €200 million. This achievement represents the fourth consecutive year of impressive top-line expansion for the company.

The company's financial strength is further underscored by its robust profitability. In 2024, EVS reported a net profit of €42.8 million, alongside a notable improvement in its gross margin, which reached 72.3%.

This sustained high level of revenue and profit generation highlights EVS's successful strategic implementation and the strong market appetite for its innovative broadcast solutions.

EVS Broadcast Equipment stands out for its consistent technological innovation, particularly in live video production. Their commitment to developing cutting-edge hardware and software solutions keeps them ahead of the curve in the broadcast and media sectors. This focus on innovation is crucial for maintaining their market leadership.

The company's recent advancements, such as AI-powered features like XtraMotion and the introduction of MediaCeption VIA MAP, underscore this strength. These technologies directly address the evolving needs of content creators by improving efficiency and enabling new creative possibilities, reinforcing EVS's position as an industry leader.

EVS Broadcast Equipment demonstrated exceptional financial strength to close out 2024, boasting a net cash position of €74.9 million. This figure signifies substantial year-over-year improvement and highlights the company's prudent management of its debt levels.

This robust financial health is a significant advantage, equipping EVS with the necessary capital to pursue its ambitious growth strategies. It allows for strategic investments in key areas and opens doors for potential acquisitions that could complement its existing offerings.

Furthermore, EVS's strong balance sheet acts as a crucial buffer, providing resilience against unpredictable market downturns. This financial stability also underpins the company's ongoing commitment to research and development, ensuring continued innovation in its broadcast solutions.

Effective Strategic Execution (PlayForward)

EVS's PLAYForward strategy has demonstrably driven significant growth, nearly doubling revenues from 2019 levels and expanding its workforce to approximately 700 employees by the close of 2024. This success underscores the strategy's efficacy in a dynamic market.

The framework prioritizes live production, deep customer engagement, and a clear technological roadmap, all contributing to consistent performance against its 2030 growth objectives.

- Revenue Growth: Nearly doubled since 2019.

- Team Expansion: Grew to nearly 700 employees by end of 2024.

- Strategic Pillars: Focus on live production, customer intimacy, and technology blueprint.

- Goal Alignment: Consistent delivery in line with 2030 growth ambitions.

Global Market Presence and Customer Trust

EVS Broadcast Equipment's solutions are a staple in live broadcasting worldwide, relied upon by sports, entertainment, and news production teams for their ability to deliver exceptional live video. This widespread adoption in critical live environments underscores a deep level of customer trust and a proven track record. The company's commitment to superior support services is consistently recognized, further enhancing its reputation as a dependable partner in the demanding broadcast industry.

Customer loyalty is evident in EVS's rising Net Promoter Score for the third consecutive year, a clear indicator of satisfaction and trust. This upward trend reinforces EVS's position as a market leader. Furthermore, the significant growth experienced in the North American market, particularly with Live Audience Business customers, highlights the company's expanding reach and strong customer relationships in key regions.

- Global Reach: EVS solutions are integral to major sporting events, entertainment productions, and news broadcasts across the globe.

- Trusted Technology: Production teams worldwide depend on EVS for reliable, high-quality live video content delivery.

- Exceptional Support: EVS is renowned for its industry-leading support services, contributing to its strong customer trust.

- Growing Market Share: A notable increase in North American business, driven by Live Audience customers, demonstrates expanding market penetration and solid customer relationships.

EVS Broadcast Equipment's strengths lie in its robust financial health, demonstrated by a net cash position of €74.9 million at the end of 2024. This financial stability fuels its aggressive growth strategy and commitment to research and development, ensuring continued innovation. The company's PLAYForward strategy has been highly effective, nearly doubling revenues since 2019 and expanding its team to around 700 employees by the close of 2024, aligning perfectly with its 2030 growth objectives.

| Metric | 2024 Value | Significance |

|---|---|---|

| Net Cash Position | €74.9 million | Provides capital for growth and R&D, enhances financial resilience. |

| Revenue Growth (since 2019) | Nearly doubled | Indicates successful PLAYForward strategy execution. |

| Employee Count (end of 2024) | Approx. 700 | Reflects company expansion and operational capacity. |

| Gross Margin | 72.3% | Highlights strong pricing power and operational efficiency. |

What is included in the product

Analyzes EVS Broadcast Equipment’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address EVS Broadcast Equipment's competitive challenges and capitalize on opportunities.

Weaknesses

EVS Broadcast Equipment's significant reliance on major event rentals presents a notable weakness. While these rentals were a key revenue driver in 2024, contributing substantially to the company's top line, their cyclical nature creates inherent volatility. For instance, the absence of a major event in an uneven year like 2025 necessitates EVS finding alternative revenue streams to offset this shortfall.

The growth observed in 2024 was, in part, buoyed by these large-scale rentals. When these are excluded from the analysis, the underlying year-over-year growth rate appears less robust, highlighting the dependency. This reliance on the global calendar of major sporting and entertainment events means EVS's financial performance can fluctuate significantly based on event scheduling, posing a challenge for consistent revenue generation.

EVS Broadcast Equipment acknowledges that increasing economic uncertainty, including macro-economic tensions and ongoing tariff discussions, poses a significant risk. The company noted in its 2024 reports that a weakening dollar could directly impact its 2025 revenue guidance, highlighting the sensitivity of its financial performance to global economic shifts.

These external factors can directly influence customer investment decisions, potentially dampening overall market demand for broadcast equipment. For instance, a slowdown in advertising spending, often tied to economic downturns, could reduce the need for new or upgraded broadcast solutions.

EVS must remain vigilant in monitoring inflationary trends, which have been a persistent concern globally through 2024 and into 2025. Adapting its pricing strategies and business models proactively will be crucial to mitigate the impact of rising costs on its profitability and competitiveness.

EVS Broadcast Equipment experienced a significant 23.4% increase in operating expenses during 2024. This rise was primarily driven by strategic investments in expanding the workforce, the acquisition of MOG Technologies, and notable one-time expenditures related to the company's 30th-anniversary celebrations.

While these investments are geared towards long-term growth and market positioning, they present a challenge to short-term profitability. Without a commensurate acceleration in revenue, these elevated costs could potentially compress earnings before interest and taxes (EBIT) margins.

Looking ahead, continued capital allocation, especially in the North American market, will necessitate a rigorous approach to cost management. Maintaining robust EBIT margins will depend on the company's ability to effectively control ongoing expenses alongside revenue generation.

Product Development Strategy Shifts

EVS Broadcast Equipment's product development strategy has encountered some turbulence. In the fourth quarter of 2024, the company recorded a write-off of development costs for a project. This occurred because of a shift in their go-to-market approach, meaning the product won't be released as a standalone item.

While the investment in development won't be entirely lost, as the advancements will be repurposed, this situation highlights the inherent difficulties in staying agile within the fast-paced technology sector. It also points to potential challenges in accurately predicting market demand and ensuring a strong product-market fit from the outset.

- Q4 2024 Write-off: EVS booked a write-off of development costs for a specific project.

- Strategy Shift: The product's go-to-market strategy changed, impacting its standalone launch.

- Resource Repurposing: Development efforts will be reused, mitigating complete loss.

- Market Navigation: This reflects the complexities of adapting to technological evolution and market needs.

Intense Competitive Landscape

The broadcast equipment market is fiercely competitive, featuring established giants like Evertz Microsystems, Grass Valley, and Harmonic Inc. EVS must consistently innovate and distinguish its products to preserve its market share and pricing leverage.

This intense rivalry demands continuous investment in research and development, alongside swift adaptation to evolving market trends, to prevent EVS from falling behind its competitors.

- Market Saturation: The broadcast industry, while growing, has many established vendors, leading to intense price competition.

- Technological Advancements: Competitors are rapidly introducing new technologies, such as IP-based workflows and cloud solutions, requiring EVS to match or exceed these innovations.

- Customer Loyalty: Existing relationships between broadcasters and competitors can create barriers for EVS to gain new clients.

- R&D Spending: In 2023, major competitors like Grass Valley reported significant R&D expenditures to drive innovation, a benchmark EVS must meet.

EVS's significant reliance on major event rentals, a key revenue driver in 2024, creates inherent volatility due to the cyclical nature of these events. This dependency means EVS's financial performance can fluctuate significantly based on the global event calendar, challenging consistent revenue generation.

The company's operating expenses saw a substantial 23.4% increase in 2024, driven by strategic investments and one-time expenditures. While aimed at long-term growth, these elevated costs could compress short-term profitability if revenue doesn't accelerate proportionally.

Product development has faced challenges, as evidenced by a Q4 2024 write-off of development costs due to a shift in go-to-market strategy. While advancements will be repurposed, this highlights difficulties in predicting market demand and ensuring product-market fit in the fast-paced tech sector.

The broadcast equipment market's intense competition from established players like Evertz and Grass Valley necessitates continuous innovation and differentiation. EVS must invest heavily in R&D and adapt swiftly to evolving trends, such as IP-based workflows and cloud solutions, to maintain its market position and pricing power.

What You See Is What You Get

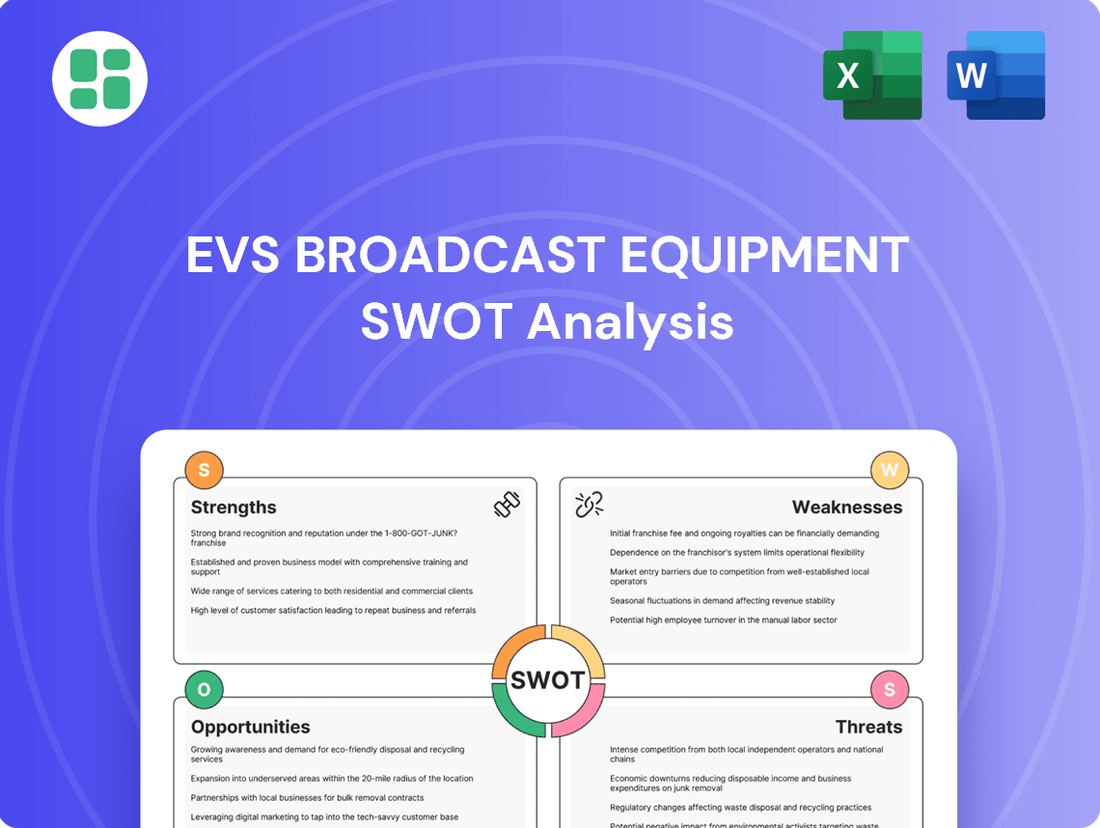

EVS Broadcast Equipment SWOT Analysis

This is the actual EVS Broadcast Equipment SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's strengths, weaknesses, opportunities, and threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights for strategic planning.

Opportunities

EVS Broadcast Equipment is prioritizing significant investments in North America to fuel expansion. This includes bolstering pre-sales, sales, and customer support teams, alongside establishing a new centralized operational hub. This strategic push is designed to capitalize on the strong demand from Live Audience Business customers and the broader broadcast market in the region.

North America represents a critical and dominant market for broadcast equipment, presenting substantial opportunities for growth. EVS aims to fully leverage this potential by enhancing its presence and service capabilities to meet the robust demand.

The broadcast industry is seeing a significant uptick in demand for live content, personalized viewing experiences, and content tailored to specific regions. This is largely driven by the proliferation of new over-the-top (OTT) platforms and the increasing popularity of fast-access streaming channels, creating a fertile ground for growth.

EVS Broadcast Equipment is well-positioned to capitalize on this trend. Its advanced live video technology solutions are precisely what broadcasters and content creators need to meet these evolving consumer expectations, offering a distinct advantage in a competitive market.

This growing demand is a key driver in the overall broadcast equipment market, which is projected to expand. Industry analysts anticipate this expansion, with some forecasts suggesting the global broadcast equipment market could reach approximately $12.5 billion by 2026, underscoring the substantial opportunity for EVS.

The broadcast industry is moving rapidly from traditional SDI connections to IP-based workflows, with cloud adoption and AI integration becoming standard. This seismic shift presents a significant opportunity for EVS Broadcast Equipment.

EVS is well-positioned to capitalize on this transition, offering solutions like VIA-MAP that help broadcasters navigate the complexities of IP and cloud environments. Their AI advancements are also key to simplifying operations and improving content quality, making them a valuable partner for companies undergoing this technological evolution.

This technological pivot is a prime avenue for EVS to expand its software and service revenue streams, as broadcasters increasingly rely on flexible, scalable, and intelligent solutions. For instance, the global media and entertainment cloud market was valued at approximately $25 billion in 2023 and is projected to grow significantly in the coming years, highlighting the scale of this opportunity.

Strategic Acquisitions and Partnerships

EVS Broadcast Equipment's strategic growth hinges on expanding its technological capabilities and market presence through targeted acquisitions and partnerships. This approach is actively being pursued, with the company aiming to solidify its position as the leading solution provider in the live video industry by 2030. The acquisition of MOG Technologies and an investment in TinkerList in 2024 exemplify this strategy, bringing new technologies and market access into the EVS fold.

These strategic moves are designed to enhance EVS's existing offerings and open up new revenue streams. By integrating complementary technologies and expanding its network of collaborators, EVS can better serve the evolving needs of the broadcast and live production sectors. This proactive M&A strategy is crucial for maintaining a competitive edge in a rapidly changing technological landscape.

- Acquisition of MOG Technologies: This move in 2024 bolstered EVS's media workflow solutions.

- Investment in TinkerList: Also in 2024, this investment aimed to enhance live production automation capabilities.

- Strategic Goal: EVS aims to be the #1 solution provider in the live video industry by 2030, with M&A as a key enabler.

Demand for Increased Operational Efficiency and Scalability

Broadcast and media organizations are actively seeking solutions that streamline operations and can easily expand to meet growing demands. This translates to a significant opportunity for EVS, as their technology is designed to enhance productivity and scalability.

EVS's offerings, which focus on automation and efficiency, directly align with this critical market requirement. For instance, EVS reported a 15% increase in recurring revenue in 2024, largely driven by software and services that boost operational efficiency for broadcasters.

This evolving landscape enables EVS to shift its business model, offering more integrated, software-driven solutions rather than solely relying on hardware sales. This move towards service-centric models is a key strategy for EVS to capture a larger share of the market.

- Growing demand for automation in live broadcasting.

- Media companies prioritizing scalable, cloud-based workflows.

- EVS's ability to deliver integrated hardware and software solutions.

- The trend towards OpEx models for broadcast technology adoption.

EVS is strategically expanding its presence in North America, a dominant market for broadcast equipment, to capitalize on the strong demand for live content and personalized viewing experiences. The company's advanced live video technology solutions are well-suited to meet evolving consumer expectations driven by new OTT platforms and streaming channels.

The industry-wide shift towards IP-based workflows, cloud adoption, and AI integration presents a significant opportunity for EVS. Their solutions, like VIA-MAP, aid broadcasters in navigating these complex transitions, enhancing operations and content quality, and expanding software and service revenue streams. The global media and entertainment cloud market, valued at approximately $25 billion in 2023, underscores the scale of this opportunity.

EVS's growth strategy includes targeted acquisitions and partnerships, exemplified by the 2024 acquisitions of MOG Technologies and an investment in TinkerList, to enhance its live video capabilities and market access. This approach supports their goal to be the leading solution provider in the live video industry by 2030. The company reported a 15% increase in recurring revenue in 2024, driven by software and services that boost operational efficiency.

Threats

The broadcast equipment sector is intensely competitive, with established giants and emerging innovators vying for market dominance. This rivalry can translate into significant pricing pressures and a potential erosion of market share for companies like EVS. For instance, in 2024, the global broadcast and production equipment market was valued at approximately $12.5 billion, with growth projected to continue, but competition is a key factor influencing profitability.

Key competitors such as Evertz Microsystems, Lawo, and Grass Valley are continually pushing the boundaries of technological innovation. This necessitates substantial and ongoing investment in research and development for EVS to maintain its competitive edge and avoid falling behind. Companies are heavily investing in IP-based workflows and cloud solutions, areas where EVS must remain a leader.

Furthermore, certain segments within the traditional broadcast industry are reaching maturity. This maturity can stifle organic growth opportunities, forcing companies like EVS to explore new markets or diversify their product offerings to achieve continued expansion.

The media technology landscape is evolving at an unprecedented pace, with AI, cloud, and IP workflows rapidly reshaping broadcast operations. EVS, like other established players, faces the constant challenge of keeping pace with these advancements. For instance, the global AI market is projected to reach $1.8 trillion by 2030, indicating the significant impact this technology will have across industries, including media.

Failure to innovate and integrate these new technologies promptly could see EVS lose its competitive edge and market relevance. The industry has seen agile startups emerge with disruptive solutions, capable of quickly capturing market share. This rapid obsolescence risk means continuous investment in R&D is crucial for survival.

Geopolitical tensions, persistent inflation, and fluctuating currency exchange rates, such as the dollar's weakening against the Euro, pose a significant threat to EVS Broadcast Equipment's financial health and its ability to meet revenue forecasts.

Economic downturns directly impact EVS by potentially reducing capital expenditures from broadcasters and media companies, leading to fewer orders and delayed projects. This was evident in Q1 2025, where results fell slightly short of expectations, partly due to customer delivery deferrals stemming from prevailing macro-economic uncertainties.

High Cost of Broadcasting Technologies

The sophisticated nature of EVS's broadcast solutions, while a key differentiator, presents a significant hurdle for some potential clients due to their substantial investment requirements. This high cost can steer smaller broadcasters or those operating with limited financial flexibility towards less feature-rich, more economical competitors or open-source alternatives, potentially impacting market penetration in certain segments.

For instance, the capital expenditure for a comprehensive EVS workflow, including servers, storage, and software licenses, can easily run into hundreds of thousands or even millions of dollars, a figure that is prohibitive for many regional or niche broadcasters. This necessitates a clear and compelling demonstration of return on investment (ROI) for EVS's premium offerings. EVS reported revenues of CHF 127.5 million in the first half of 2024, indicating a strong market presence, but the challenge remains to consistently prove the value proposition against lower-cost options.

- High initial investment: Advanced EVS systems require significant capital outlay, potentially deterring budget-conscious clients.

- Competition from alternatives: Lower-cost solutions and open-source technologies pose a threat by offering more accessible entry points.

- ROI justification: EVS must continually articulate and prove the long-term economic benefits of its premium technology to retain and attract customers.

Talent Acquisition and Retention

EVS faces a significant hurdle in acquiring and keeping top talent as it grows globally, especially in key markets like North America. The company's focus on advanced fields such as AI and software development intensifies the competition for highly specialized engineers and technical support professionals. For instance, the global demand for AI specialists saw a projected increase of 74% in job postings between 2023 and 2024, highlighting the scarcity of qualified candidates.

This intense competition for skilled human capital directly impacts EVS's ability to innovate and execute its strategic growth plans. A shortage of talent in critical areas could slow down product development cycles and hinder the deployment of new technologies, potentially impacting market share in the rapidly evolving broadcast technology sector.

Key challenges include:

- Intensified competition for AI and software development talent.

- The need to offer competitive compensation and benefits to attract skilled professionals.

- Potential delays in innovation and strategic initiatives due to talent gaps.

The broadcast industry is characterized by rapid technological shifts, with AI, cloud, and IP workflows constantly reshaping operations. EVS must continuously invest in research and development to keep pace, as failure to innovate risks losing market relevance and competitive edge. For example, the global AI market is projected to reach $1.8 trillion by 2030, underscoring the transformative impact of these technologies across all sectors, including media.

SWOT Analysis Data Sources

This EVS Broadcast Equipment SWOT analysis is informed by a robust blend of data, including company financial reports, recent market research, and expert industry analysis to provide a comprehensive and actionable overview.