EVS Broadcast Equipment PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EVS Broadcast Equipment Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping EVS Broadcast Equipment's landscape. This comprehensive PESTLE analysis provides actionable intelligence to anticipate market shifts and identify strategic opportunities. Gain a competitive edge by understanding the external forces driving the broadcast industry forward. Download the full report now for an in-depth strategic advantage.

Political factors

Government policies significantly shape the media and broadcasting sector, directly impacting EVS Broadcast Equipment. Regulations concerning media ownership, content censorship, and public broadcasting mandates dictate the operational environment for companies like EVS. For instance, shifts in content regulations can influence the demand for EVS's live production solutions, as broadcasters adapt their workflows to comply with new standards. In 2024, many countries continued to debate and implement stricter rules around digital media content, potentially affecting the types of broadcast technologies that are prioritized.

Trade policies and international relations are also critical. Tariffs or trade barriers can increase the cost of manufacturing and distributing EVS's equipment globally, impacting market access and supply chain efficiency. The ongoing geopolitical landscape in 2024 presented a complex environment for international trade, with some regions experiencing increased protectionist measures that could affect EVS's global sales and sourcing strategies.

Regulatory bodies like the FCC in the US and Ofcom in the UK, along with sports federations, dictate standards for live broadcast quality, content integrity, and operational safety. EVS Broadcast Equipment and its clients must adhere to these evolving rules, impacting the design and functionality of their solutions to ensure compliance and maintain broadcast licenses.

For instance, new regulations concerning data privacy or content accessibility, potentially emerging in late 2024 or 2025, could necessitate upgrades to EVS's workflow management or media asset management systems. The global nature of live broadcasting means EVS must navigate a complex web of international regulations, where a change in one major market can ripple through its product development roadmap.

Global geopolitical stability is a critical factor for EVS Broadcast Equipment, directly influencing the broadcast industry's ability to cover major live events. Political unrest or conflicts can cause significant disruptions, impacting everything from event scheduling to the advertising revenue that fuels broadcast operations. For instance, the ongoing geopolitical tensions in Eastern Europe have led to the cancellation or postponement of several international sporting events in 2024, directly affecting the demand for live broadcast solutions.

EVS, with its global footprint, is particularly sensitive to these geopolitical shifts. Market expansion plans and sales cycles can be significantly altered by regional instability. In 2024, EVS reported a cautious approach to investments in regions experiencing heightened political risk, leading to a projected 5% slowdown in new infrastructure deployments in those specific markets compared to initial forecasts.

Funding for Public Broadcasters

Many public broadcasters globally depend on government allocations or public fees for their operations and technological advancements. Fluctuations in these funding streams can significantly impact EVS's sales pipeline, as these entities are crucial clients. For instance, a decrease in government support for public broadcasting in Europe, which saw some nations re-evaluating media subsidies in 2024, could lead to postponed investments in EVS's advanced live production solutions. Conversely, an uptick in public funding, as potentially seen in initiatives aimed at bolstering digital infrastructure in certain Asian markets by 2025, could spur demand.

The reliance on public funding creates a direct link between government fiscal policy and EVS's market opportunities. For example, budget constraints in countries like the United Kingdom, where the BBC's funding model is under periodic review, might temper the pace of technology adoption. Conversely, increased government investment in public media, such as the planned expansion of public broadcasting services in South Korea through 2026, presents a more favorable environment for EVS. This dynamic underscores the importance of monitoring political decisions regarding public service media funding.

- Government funding levels directly influence the purchasing capacity of public broadcasters, a key client segment for EVS.

- Reduced public broadcaster budgets can lead to delays in technology upgrades, impacting EVS's sales cycles.

- Increased government funding for public media can stimulate demand for EVS's advanced live production systems and solutions.

- Political decisions on media subsidies and public service broadcasting funding are critical indicators for EVS's market outlook.

International Trade Agreements and Tariffs

International trade agreements and tariffs significantly influence EVS Broadcast Equipment's operational costs and market competitiveness. For instance, the European Union's Digital Single Market initiatives aim to reduce barriers, potentially lowering costs for EVS within member states. Conversely, the imposition of tariffs, such as those seen in trade disputes impacting electronics, can directly increase the cost of components and finished goods, forcing EVS to re-evaluate its pricing strategies in affected markets.

The evolving landscape of trade policies presents both opportunities and challenges for EVS. Favorable agreements, like potential future trade pacts involving key broadcast markets in Asia or North America, could reduce import duties and streamline logistics, thereby enhancing EVS's ability to compete globally. However, the introduction of new tariffs on electronic components or finished broadcast equipment, as experienced in past trade tensions, could lead to increased expenses and diminish the price competitiveness of EVS's advanced solutions in those regions.

Key considerations for EVS regarding international trade include:

- Impact of tariffs on component sourcing: Tariffs on semiconductors or specialized broadcast components can increase the cost of goods sold (COGS) for EVS. For example, the US-China trade war saw tariffs imposed on various electronic goods, affecting supply chains.

- Market access and export costs: Trade agreements can reduce barriers to entry and lower export duties, making EVS products more accessible and affordable in new international markets.

- Pricing strategy adjustments: Increased import costs due to tariffs may necessitate price increases for EVS equipment in certain countries, potentially impacting sales volume and market share.

- Supply chain resilience: EVS must continually assess and adapt its supply chain to mitigate risks associated with sudden changes in trade policy and tariffs, ensuring consistent product availability.

Government policies and regulations significantly influence the broadcast industry, directly impacting EVS Broadcast Equipment. Shifts in media ownership rules, content regulations, and public broadcasting mandates shape the operational landscape. For instance, in 2024, many nations intensified debates and implementations of stricter digital media content rules, potentially prioritizing different broadcast technologies.

Geopolitical stability is crucial for live event broadcasting and, consequently, for EVS. Political unrest can disrupt event schedules and advertising revenue, impacting the demand for live broadcast solutions. In 2024, ongoing geopolitical tensions led to the postponement of several international sporting events, directly affecting the need for EVS's services. EVS, operating globally, is particularly susceptible to these shifts, with market expansion plans being altered by regional instability. For example, the company adopted a cautious investment approach in high-risk regions in 2024, projecting a 5% slowdown in new infrastructure deployments in those specific areas.

Government funding levels for public broadcasters are a key determinant of EVS's sales pipeline. Budgetary constraints or re-evaluations of media subsidies, as seen in some European nations in 2024, can lead to postponed investments in advanced live production solutions. Conversely, increased public funding for digital infrastructure, as observed in some Asian markets by 2025, can boost demand for EVS's offerings.

International trade agreements and tariffs critically affect EVS's operational costs and market competitiveness. Favorable agreements can reduce import duties and streamline logistics, enhancing global competitiveness. However, tariffs on electronic components or finished broadcast equipment, as experienced in past trade disputes, can escalate expenses and reduce price competitiveness in affected regions. For example, tariffs imposed during the US-China trade war impacted electronics supply chains, increasing the cost of goods sold for companies like EVS.

What is included in the product

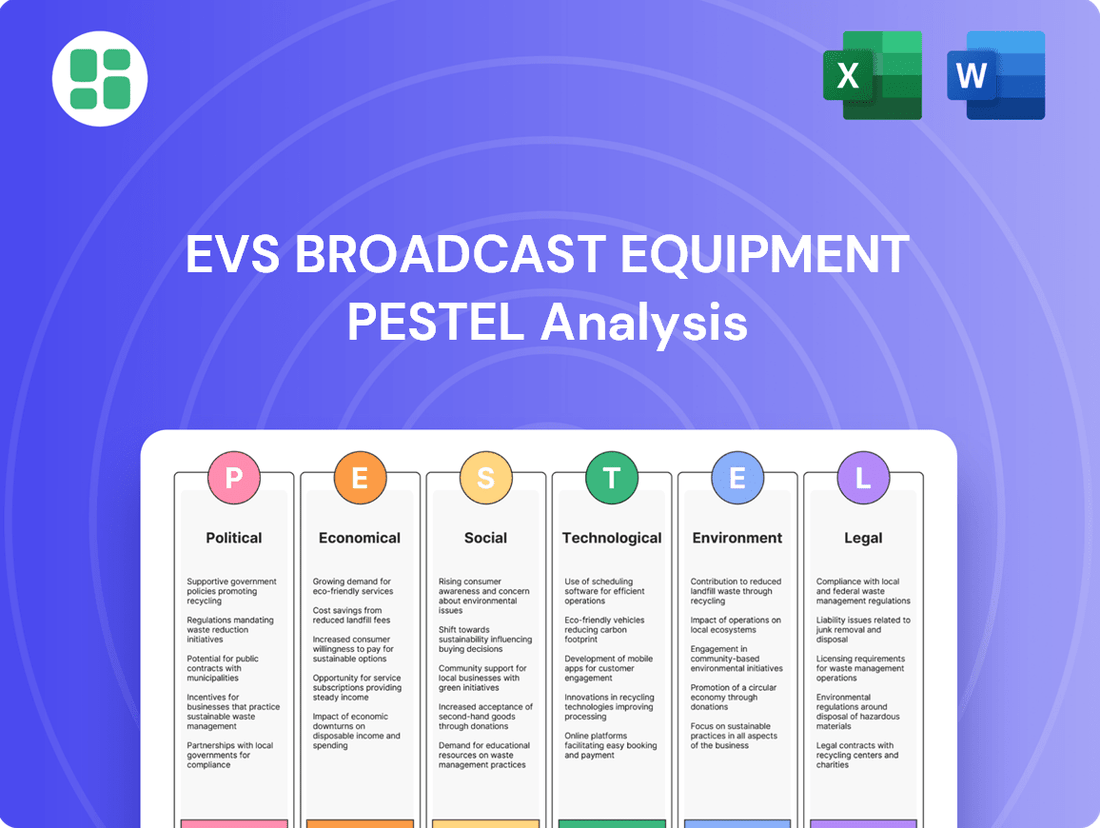

This PESTLE analysis of EVS Broadcast Equipment examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company's operations and strategic planning.

It provides a comprehensive understanding of the external forces shaping the broadcast industry, enabling informed decision-making and risk mitigation.

This PESTLE analysis for EVS Broadcast Equipment acts as a pain point reliever by providing a clear, summarized version of external factors, enabling quick referencing during meetings and simplifying complex market dynamics for all stakeholders.

Economic factors

Global economic growth significantly influences EVS Broadcast Equipment's prospects. In 2024, the International Monetary Fund (IMF) projected a 3.2% global growth rate, a steady but moderate pace. This stability generally supports investment in media infrastructure, as broadcasters are more inclined to upgrade their systems and adopt new technologies when the economic outlook is positive.

However, recession risks remain a concern. While major economies like the United States showed resilience in early 2024, with GDP growth exceeding expectations, other regions faced more headwinds. For instance, some European economies experienced slower growth, potentially impacting EVS's sales in those markets. A significant global downturn could lead to reduced capital expenditure by broadcasters, delaying or canceling equipment upgrades.

The media and entertainment sector, EVS's primary market, is sensitive to consumer and advertising spending, which are directly tied to economic health. During economic expansions, advertising revenues typically rise, providing broadcasters with more funds to invest in advanced broadcast solutions. Conversely, during recessions, advertising budgets are often the first to be cut, directly affecting EVS's revenue streams.

Advertising revenue remains a cornerstone for broadcasters, directly impacting their ability to invest in advanced broadcast technology. For instance, in 2024, while some traditional advertising sectors saw modest growth, the overall broadcast advertising market faced continued pressure from digital alternatives, with digital ad spending projected to reach over $370 billion in the US alone by the end of the year.

A downturn in advertising expenditure, perhaps triggered by economic headwinds or a sustained migration of viewers and advertisers to online platforms, could significantly curtail broadcasters' budgets for capital expenditures. This directly affects their capacity to acquire new live production solutions, such as those offered by EVS Broadcast Equipment, as they might prioritize cost-saving measures.

For example, if a major sporting event, a key driver of broadcast advertising, experiences a decline in viewership or attracts lower ad rates in 2025 due to increased competition from streaming services, broadcasters may scale back on technology upgrades. Keeping a close eye on these advertising revenue trends is therefore essential for EVS to anticipate shifts in customer spending and demand for its products.

As a global player, EVS Broadcast Equipment faces significant exposure to currency exchange rate fluctuations. These shifts directly impact the company's reported revenues, operational costs, and overall profitability. For instance, if EVS primarily reports in Euros, a strengthening Euro against key trading currencies like the US Dollar or British Pound could render its products more expensive for international buyers, potentially dampening sales volumes in those markets.

Managing this currency risk is a critical economic consideration for EVS. The company's financial strategy must account for the volatility inherent in foreign exchange markets. For example, in early 2024, the Euro experienced fluctuations against the US Dollar, trading in a range of approximately 1.07 to 1.11 USD per EUR, highlighting the real-world impact on a company with international sales and operations.

Interest Rates and Access to Capital

Interest rates directly impact the cost of capital for EVS Broadcast Equipment and its customers. When interest rates rise, borrowing becomes more expensive. This can lead broadcasters to delay or scale back investments in new technology, affecting EVS's sales pipeline. For instance, a significant increase in central bank rates, such as the European Central Bank's policy rate reaching 4.50% by September 2023, makes financing large capital expenditures more challenging for clients.

EVS itself faces higher costs if it needs to borrow money for operational needs, research and development, or expansion initiatives. This increased cost of debt can squeeze profit margins or necessitate a re-evaluation of investment strategies. The general trend of rising interest rates throughout 2023 and into early 2024, with many major economies experiencing inflation-driven rate hikes, presents a headwind for capital-intensive industries like broadcast technology.

- Impact on Client Investment: Higher borrowing costs for broadcasters can lead to postponed or reduced spending on new broadcast solutions.

- EVS's Financing Costs: Increased interest rates raise the expense of any debt EVS may utilize for growth or innovation.

- Market Sensitivity: Broadcast technology purchases are often discretionary and sensitive to economic conditions, including the cost of financing.

Competition and Pricing Pressures

The broadcast equipment sector is notably competitive, with numerous companies providing live video technology. This intense rivalry often translates into significant pricing pressures, which can directly affect EVS Broadcast Equipment's profitability.

For instance, a market characterized by oversupply or a general downturn in demand amplifies these pricing challenges. EVS must therefore consistently focus on innovation and product differentiation to maintain its market position and margins.

- Market Share Dynamics: While specific market share data for broadcast equipment can fluctuate, industry reports from 2023 and early 2024 indicate a fragmented market with key players like Sony, Grass Valley, and EVS vying for dominance in specialized segments.

- Impact on Margins: Increased competition can force price reductions. For example, if a competitor introduces a similar product at a lower price point, EVS may need to adjust its own pricing, potentially squeezing gross margins.

- Innovation as a Differentiator: EVS's investment in R&D, such as its focus on IP-based workflows and cloud solutions, is crucial for staying ahead of competitors and justifying premium pricing for its advanced offerings.

- Economic Slowdown Effects: A general economic slowdown, as seen in some regions in late 2023 and projected for parts of 2024, can reduce overall demand for capital equipment in the broadcast industry, intensifying competitive pressures.

Global economic stability, projected at 3.2% growth for 2024 by the IMF, generally benefits EVS Broadcast Equipment by encouraging investment in media infrastructure. However, risks like slower growth in some European economies in early 2024 could temper demand for EVS's advanced solutions, as broadcasters may postpone capital expenditures during uncertain economic periods.

What You See Is What You Get

EVS Broadcast Equipment PESTLE Analysis

The preview you see here is the exact EVS Broadcast Equipment PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying, showcasing the comprehensive PESTLE analysis for EVS Broadcast Equipment, delivered exactly as shown, no surprises.

The content and structure of this EVS Broadcast Equipment PESTLE Analysis preview is the same document you’ll download after payment, providing immediate actionable insights.

Sociological factors

Audiences are increasingly opting for on-demand content, with global streaming service subscriptions reaching over 1.5 billion by the end of 2024. This shift away from traditional linear broadcasting means EVS must ensure its solutions support seamless content delivery across diverse platforms and devices, including mobile.

The rise of social media as a primary news source and entertainment hub, with platforms like TikTok and Instagram seeing billions of active users in 2024, further fragments traditional media consumption. EVS's technology needs to facilitate the creation and distribution of short-form, engaging content suitable for these channels.

Furthermore, viewers now expect interactive and personalized experiences, driving demand for features like multi-angle viewing and real-time statistics. EVS's product development must prioritize technologies that enable these richer, more engaging viewer interactions, reflecting a market where personalized content is king.

The appetite for live events, from sports to concerts, continues to surge, defying the trend towards on-demand viewing. In 2024, major sporting events like the UEFA European Championship and the Paris Olympics are expected to draw billions of viewers globally, showcasing the enduring power of shared, real-time experiences.

This persistent demand fuels the need for sophisticated broadcast technology that can capture and deliver these moments flawlessly. EVS Broadcast Equipment's solutions are crucial for providing the instant replays and dynamic live production capabilities that enhance these immersive viewing experiences, making them indispensable for broadcasters aiming to engage audiences.

The broadcast sector is grappling with an aging workforce, with many experienced professionals nearing retirement, potentially leading to a significant skills gap, particularly in emerging IP-based and cloud production technologies. This demographic shift means that as older, experienced hands retire, there's a growing need for individuals proficient in newer, more complex systems. For EVS Broadcast Equipment, this translates into a demand for solutions that are not only powerful but also intuitive, minimizing the learning curve for broadcast professionals adapting to these technological advancements.

To address this, EVS must ensure its products are user-friendly and integrate smoothly into the evolving broadcast workflows, likely necessitating robust training and ongoing support programs for its client base. The company's success hinges on its ability to empower existing staff and new hires with the necessary expertise. As of early 2024, reports suggest that over 30% of broadcast engineers are over 50, highlighting the urgency of knowledge transfer and upskilling initiatives.

Furthermore, EVS itself faces the critical challenge of attracting and retaining talent possessing the specialized skills needed for developing and supporting cutting-edge broadcast technology. The competition for these tech-savvy individuals is fierce, making workforce development and talent acquisition a strategic imperative for maintaining its market leadership and innovation pipeline.

Social Influence of Sports and Entertainment

Major sporting events and entertainment shows are deeply embedded in global social and cultural fabric, drawing immense viewership, both in person and through broadcast. EVS's business thrives on facilitating the seamless, high-quality production of these spectacles, directly benefiting from their social resonance and financial viability.

The continued public fascination with live events fuels ongoing investment in the advanced production technologies EVS provides. For instance, the 2024 Paris Olympics, a prime example of a major global event, is expected to generate billions in revenue and attract a massive worldwide audience, underscoring the demand for robust broadcast solutions.

- Global Reach: Major events like the 2026 FIFA World Cup, projected to reach over 5 billion viewers, highlight the vast audience potential.

- Viewer Engagement: The Super Bowl consistently ranks as one of the most-watched television events annually in the United States, demonstrating sustained public interest.

- Technological Demand: Increased demand for immersive viewing experiences, such as 4K and HDR, directly impacts the need for sophisticated broadcast equipment like EVS's solutions.

- Cultural Impact: The social significance of events like the Eurovision Song Contest, which saw over 160 million viewers in 2023, translates into sustained demand for live production services.

Globalization of Content Production

The increasing globalization of content production and distribution means live events are frequently produced and shared across international borders. This trend demands interoperable and globally compatible broadcast solutions, a core offering for EVS. For instance, major sporting events in 2024, like the Paris Olympics, were broadcast in over 200 territories, highlighting the need for seamless international workflows.

This interconnectedness opens new markets for EVS but also requires careful navigation of diverse cultural preferences and varying technical standards across regions. Companies must adapt their solutions to meet local requirements, such as different broadcast regulations or preferred content delivery methods. The global sports rights market alone was projected to exceed $80 billion in 2024, indicating the vast potential and complexity of international content distribution.

- Global Reach: Live events in 2024, such as the UEFA Champions League Final, were distributed to hundreds of millions of viewers worldwide, necessitating robust international broadcast infrastructure.

- Market Diversity: EVS must cater to varied technical standards and consumer preferences in markets ranging from North America to Asia-Pacific, influencing product development.

- Interoperability Needs: The seamless exchange of content between production hubs in different countries, a common practice in 2024 for major productions, requires standardized and compatible broadcast equipment.

The broadcast industry faces a significant demographic shift with an aging workforce, leading to a potential skills gap in newer technologies. EVS must prioritize user-friendly solutions and robust training to bridge this gap, as over 30% of broadcast engineers were reportedly over 50 in early 2024.

Attracting and retaining talent with specialized skills in broadcast technology is a critical challenge for EVS due to intense competition. This necessitates strategic workforce development and talent acquisition to maintain market leadership and innovation.

The increasing globalization of content production and distribution demands interoperable and globally compatible broadcast solutions, a key area for EVS. The 2024 Paris Olympics, broadcast in over 200 territories, exemplifies this need for seamless international workflows.

Navigating diverse cultural preferences and varying technical standards across regions is crucial for EVS’s global market strategy. Adapting solutions to local requirements, such as broadcast regulations, is vital, especially as the global sports rights market was projected to exceed $80 billion in 2024.

| Sociological Factor | Impact on EVS Broadcast Equipment | Supporting Data (2024/2025) |

|---|---|---|

| Aging Workforce & Skills Gap | Need for intuitive products and comprehensive training programs. | Over 30% of broadcast engineers are over 50 (early 2024). |

| Talent Acquisition & Retention | Strategic imperative to attract and keep specialized tech talent. | Intense competition for skilled broadcast technology professionals. |

| Globalization of Content | Demand for interoperable and globally compatible solutions. | 2024 Paris Olympics broadcast in over 200 territories. |

| Cultural & Technical Diversity | Requirement to adapt solutions to local preferences and standards. | Global sports rights market projected to exceed $80 billion (2024). |

Technological factors

The broadcast industry's move to IP-based workflows is accelerating, with a significant portion of new infrastructure projects now prioritizing IP. This transition, moving away from older SDI systems, offers broadcasters enhanced flexibility and scalability, crucial for handling the increasing volume and complexity of content.

EVS Broadcast Equipment must therefore continue its focus on developing and refining IP-native solutions to maintain its competitive edge. This includes ensuring their hardware and software are not only compatible but actively enhance these new IP infrastructures, solidifying their position as a leader in this evolving technological landscape.

The shift towards cloud production and remote workflows is fundamentally reshaping broadcast operations. This trend allows for content creation from virtually any location, significantly cutting down the need for extensive on-site facilities. For EVS, this means that offering cloud-native or cloud-compatible solutions for critical functions like instant replay, media asset management, and content distribution is no longer just an advantage, but a necessity for enabling these distributed production setups and broadening their market presence. This evolution also opens up substantial opportunities in the Software as a Service (SaaS) model.

Artificial intelligence and machine learning are revolutionizing broadcast operations, with EVS’s clients increasingly adopting these technologies for tasks like automated content logging and metadata tagging. This trend is evident as many broadcasters are investing in AI-powered solutions to streamline their workflows. For example, by mid-2024, a significant portion of major broadcasters were piloting or implementing AI for content recognition, aiming to reduce manual effort and accelerate content discovery.

EVS is well-positioned to capitalize on this technological shift. By integrating AI and machine learning into its existing broadcast solutions, EVS can offer enhanced efficiency and develop innovative tools. Imagine AI-driven automated replay selection during live events, a feature that could significantly reduce operator workload and improve the speed of delivering key moments to viewers, a capability that was a key discussion point at IBC 2024.

Evolution of Video Formats and Standards (e.g., UHD, HDR)

The relentless advancement in video technology, particularly the widespread adoption of Ultra High Definition (UHD) and High Dynamic Range (HDR), directly impacts EVS Broadcast Equipment. These evolving standards necessitate continuous updates to EVS's product lines to ensure compatibility and maintain their competitive edge in delivering premium broadcast solutions. Broadcasters are increasingly demanding higher resolutions and richer color depth, pushing the need for equipment that can handle these sophisticated formats.

Staying current with emerging video standards is crucial for EVS to remain a leader in the broadcast industry. For instance, the increasing demand for 4K UHD content, which offers four times the resolution of Full HD, requires EVS's solutions to process and manage significantly larger data streams. Similarly, HDR, which provides a wider range of colors and contrast, demands specialized hardware and software capabilities that EVS must integrate.

- UHD Adoption: By late 2024, it's estimated that over 60% of new televisions sold globally will support 4K resolution, a key driver for UHD content production.

- HDR Growth: The HDR market is projected to grow significantly, with adoption rates in premium content production expected to exceed 70% by 2025.

- Frame Rate Expectations: Broadcasters are exploring higher frame rates (e.g., 120fps) for live sports, requiring EVS to develop solutions capable of handling this increased data throughput.

Cybersecurity and Data Management

As broadcast workflows increasingly rely on interconnected IP networks and cloud services, cybersecurity is no longer optional but a critical necessity for EVS Broadcast Equipment. The company must prioritize securing its hardware and software against evolving cyber threats to safeguard valuable content and sensitive operational data. For instance, the global cybersecurity market was projected to reach $230 billion in 2024, highlighting the immense value placed on security solutions.

Robust data management capabilities are also essential for EVS, given the ever-increasing volume of live video assets generated by modern productions. Efficiently handling and storing this data is key to operational success. By 2025, the total amount of data created, captured, copied, and consumed globally is expected to reach 181 zettabytes, underscoring the scale of data management challenges.

- Cybersecurity Investment: EVS must continue to invest in advanced security features for its IP-based solutions.

- Data Integrity: Ensuring the integrity and accessibility of vast amounts of live video data is paramount.

- Threat Landscape: Staying ahead of sophisticated cyber threats targeting media infrastructure is a continuous challenge.

- Cloud Security: Implementing secure cloud integration strategies is vital for remote production workflows.

The broadcast industry's ongoing shift towards IP-based workflows and cloud production necessitates EVS Broadcast Equipment's continuous innovation in these areas. By mid-2024, a significant portion of new broadcast infrastructure projects prioritized IP, and cloud-native solutions are becoming essential for remote operations.

The integration of AI and machine learning is also a critical technological factor, with broadcasters increasingly adopting these tools for tasks like automated content logging and metadata tagging to enhance efficiency, a trend highlighted by discussions at IBC 2024.

Furthermore, the demand for higher video quality, such as UHD and HDR, requires EVS to adapt its solutions to handle increased data throughput and maintain compatibility with evolving standards. By late 2024, over 60% of new televisions sold globally supported 4K resolution, driving this demand.

Cybersecurity and robust data management are paramount given the growing volume of data and the increasing reliance on networked systems, with the global cybersecurity market projected to reach $230 billion in 2024.

| Technology Trend | Impact on EVS | Key Data/Projections (2024-2025) |

|---|---|---|

| IP Workflows | Need for IP-native solutions | Majority of new infrastructure projects prioritizing IP (mid-2024) |

| Cloud Production | Demand for cloud-compatible/native offerings | Essential for remote and distributed workflows |

| AI/ML | Opportunity for enhanced efficiency and new tools | Increasing adoption for content logging and metadata (IBC 2024 discussions) |

| UHD/HDR Adoption | Requirement for higher resolution and data handling | >60% of new TVs support 4K (late 2024); >70% premium content production HDR by 2025 |

| Cybersecurity | Critical for protecting content and operations | Global cybersecurity market ~$230 billion (2024) |

| Data Management | Essential for handling large volumes of live assets | Global data creation expected to reach 181 zettabytes (2025) |

Legal factors

Intellectual property laws, such as patents and copyrights, are foundational for EVS Broadcast Equipment, safeguarding its unique hardware and software solutions. In 2024, the company's ability to secure and defend its IP directly influences its market advantage. Navigating complex global IP landscapes and managing licensing for embedded technologies are ongoing strategic necessities for EVS.

Potential IP infringement or shifts in intellectual property legislation pose significant risks, capable of disrupting EVS's revenue streams and competitive standing. For instance, a key patent expiry or a new legal challenge could necessitate costly adjustments to product development or licensing strategies, impacting profitability in the 2024-2025 period.

Data privacy regulations like GDPR and CCPA significantly impact EVS Broadcast Equipment, especially with their digital workflow solutions. Compliance is crucial to avoid hefty fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. EVS must ensure its platforms, which may handle user data for content delivery, adhere to these stringent rules to maintain client trust and operational integrity.

EVS Broadcast Equipment’s business is indirectly influenced by legal frameworks governing broadcasting licenses and content rights. Shifts in how these licenses are granted or how content ownership is managed can impact the investment decisions and operational strategies of EVS’s broadcast clients, ultimately affecting the demand for its media production and distribution technology.

For instance, evolving regulations around digital content distribution and intellectual property protection, particularly in major markets like the US and EU, could necessitate new workflows and technologies for content management and rights enforcement, areas where EVS offers solutions. The global digital content creation market was valued at approximately $225 billion in 2023 and is projected to grow, indicating a substantial market for technologies that facilitate efficient content handling under various legal regimes.

Product Liability and Safety Standards

EVS Broadcast Equipment must navigate a complex web of product liability laws and safety standards across all its operating markets. This means ensuring that both their hardware and software solutions consistently meet stringent safety and quality benchmarks. Failure to do so could lead to significant legal challenges, costly product recalls, and severe damage to their reputation. For instance, in 2024, the European Union continued to emphasize the CE marking, requiring extensive documentation and testing to prove conformity with essential health and safety requirements for electronic products entering the market.

Compliance with these regulations is not a static process; it requires ongoing vigilance and adaptation. EVS likely invests heavily in research and development to stay ahead of evolving international and regional technical standards. These standards can cover everything from electromagnetic compatibility to the safe handling of electrical components. For example, the IEC 62368-1 standard, which addresses safety for audio, video, and similar electronic apparatus, is widely adopted globally and requires manufacturers to demonstrate that their products do not pose a risk of harm.

- Adherence to global safety certifications: EVS must ensure its broadcast equipment meets standards like IEC 62368-1 and UL 62368-1, crucial for market access in 2024/2025.

- Mitigation of product recalls: Robust quality control processes help prevent costly recalls, which can impact revenue and brand trust.

- Navigating regional compliance: EVS needs to track and comply with specific regulations in key markets, such as FCC rules in the US and CE marking in the EU.

- Software safety and cybersecurity: Beyond hardware, EVS's software solutions must also meet safety standards, particularly concerning data integrity and operational security, a growing concern in 2024.

Anti-Trust and Competition Laws

Anti-trust and competition laws are crucial for EVS Broadcast Equipment, especially given the ongoing consolidation within the broadcast technology sector. Ensuring compliance with these regulations is paramount to avoid costly investigations and potential operational limitations. For instance, the European Union's competition authorities have been actively scrutinizing mergers and acquisitions in various tech industries, with significant fines levied for violations. EVS must proactively assess its market practices and any potential collaborations to maintain a competitive and lawful operational framework.

The potential for mergers and acquisitions in the broadcast technology landscape makes adherence to anti-trust regulations particularly important for EVS. Companies like EVS need to navigate these complex legal frameworks to ensure that their growth strategies do not inadvertently create anti-competitive market conditions. Failure to do so could result in substantial penalties, as seen in other sectors where regulatory bodies have imposed fines reaching hundreds of millions of dollars for breaches of competition law.

- Market Consolidation: The broadcast technology market has seen significant consolidation, increasing scrutiny on EVS's market share and practices.

- Regulatory Scrutiny: Compliance with anti-trust laws is vital to prevent investigations, fines, and restrictions on business operations.

- Merger & Acquisition Impact: Potential M&A activities by EVS require careful legal review to ensure they do not violate competition rules.

- Global Enforcement: Regulatory bodies worldwide, including the EU and US Federal Trade Commission, actively enforce competition laws, setting precedents for penalties.

EVS Broadcast Equipment operates within a dynamic legal environment, necessitating strict adherence to intellectual property rights, data privacy mandates, and product safety standards. The company's ability to innovate and protect its technology is directly tied to its IP portfolio, while compliance with regulations like GDPR, which can impose fines up to 4% of global annual revenue, is critical for maintaining client trust and operational integrity. Furthermore, navigating product liability laws and ensuring compliance with international safety certifications, such as IEC 62368-1, are paramount for market access and brand reputation in 2024 and 2025.

The company must also remain vigilant regarding anti-trust and competition laws, particularly as the broadcast technology sector experiences consolidation. Proactive legal review of market practices and any potential mergers or acquisitions is essential to avoid costly investigations and operational limitations, mirroring the stringent enforcement seen by regulatory bodies globally.

| Legal Factor | Impact on EVS Broadcast Equipment | Key Considerations (2024/2025) | Example/Data Point |

|---|---|---|---|

| Intellectual Property | Safeguards core technology and market advantage. | Securing and defending patents and copyrights; managing global IP landscapes. | EVS's ability to protect its proprietary software and hardware solutions is vital. |

| Data Privacy | Ensures compliance with global data protection regulations. | Adherence to GDPR, CCPA; protecting user data in digital workflows. | GDPR fines can reach up to 4% of global annual revenue. |

| Product Liability & Safety | Maintains product integrity and market access. | Meeting international safety standards (e.g., IEC 62368-1); robust quality control. | CE marking compliance in the EU requires extensive testing for electronic products. |

| Anti-trust & Competition | Ensures fair market practices and avoids regulatory penalties. | Navigating market consolidation; legal review of M&A activities. | Regulatory bodies worldwide actively enforce competition laws with significant fines. |

Environmental factors

The broadcasting industry is placing a significant emphasis on minimizing its environmental impact, a trend fueled by both client expectations and growing public demand for sustainable operations. This shift presents a clear opportunity for EVS Broadcast Equipment to innovate in areas like energy-efficient hardware design and software optimization for reduced power consumption.

By developing and promoting workflows that prioritize sustainability, EVS can directly support its clients' objectives of achieving 'green' broadcasting. This focus on eco-friendly solutions can also serve as a crucial competitive differentiator in a market increasingly conscious of environmental responsibility.

Regulations like the EU's WEEE Directive mandate that manufacturers, including EVS Broadcast Equipment, manage their products' end-of-life. This involves setting up recycling programs and ensuring responsible disposal, which impacts operational expenses. For instance, the global e-waste generated in 2022 reached 62 million tonnes, highlighting the scale of this challenge and the increasing regulatory pressure for compliance.

Broadcasters are increasingly prioritizing sustainability, with many setting aggressive carbon footprint reduction targets. For instance, by 2025, a significant percentage of major European broadcasters aim to cut their emissions by at least 30% compared to 2020 levels.

EVS can directly support these client objectives by offering solutions that facilitate remote production workflows. This reduces the necessity for large, power-intensive on-site equipment and significantly cuts down on travel emissions for production personnel, helping clients meet their environmental goals.

Furthermore, EVS is committed to lowering its own operational carbon emissions. In 2024, the company invested in renewable energy sources for its primary facilities, aiming for a 15% reduction in Scope 1 and 2 emissions by the end of the year.

Supply Chain Environmental Compliance

EVS Broadcast Equipment’s supply chain must navigate a complex web of environmental regulations, particularly concerning hazardous substances in components and manufacturing. For instance, compliance with directives like RoHS (Restriction of Hazardous Substances) is paramount. Failure to ensure suppliers meet these standards, such as those limiting lead or mercury content, could lead to product recalls or market access issues.

Maintaining robust environmental compliance within the supply chain is not just about avoiding penalties; it signals EVS’s dedication to responsible business practices. This commitment is increasingly important for stakeholders, including investors and customers, who scrutinize a company’s environmental, social, and governance (ESG) performance. For example, the global market for sustainable electronics is projected to grow significantly, with reports indicating a compound annual growth rate (CAGR) of over 10% from 2024 to 2030.

To manage these risks and opportunities, EVS likely implements several key strategies:

- Supplier Audits: Regularly assessing suppliers' environmental management systems and compliance records.

- Component Vetting: Ensuring all incoming materials and components meet stringent environmental specifications.

- Certifications: Encouraging or requiring suppliers to obtain relevant environmental certifications, such as ISO 14001.

- Traceability: Establishing clear traceability for materials to verify their compliance throughout the supply chain.

Corporate Social Responsibility (CSR) and Stakeholder Expectations

Growing societal awareness of environmental issues means EVS Broadcast Equipment faces increasing expectations from stakeholders regarding its environmental performance. For instance, in 2024, a significant majority of institutional investors surveyed by PwC indicated that ESG (Environmental, Social, and Governance) factors are material to their investment decisions, with environmental concerns topping the list.

Implementing robust Corporate Social Responsibility (CSR) initiatives related to environmental stewardship can enhance EVS's brand reputation. This is crucial as a 2025 report by Deloitte found that companies with strong ESG credentials often see a 10-15% higher valuation compared to their peers with weaker performance.

Furthermore, strong environmental CSR can attract top talent, as studies consistently show younger generations prioritize working for companies with a clear commitment to sustainability. EVS's appeal to environmentally conscious clients is also amplified, potentially leading to increased market share and customer loyalty in the broadcast sector.

- Stakeholder Pressure: Investors and customers increasingly demand demonstrable environmental responsibility from companies like EVS.

- Brand Enhancement: Effective CSR programs positively impact brand image and public perception.

- Talent Attraction: A commitment to environmental sustainability is a key factor for attracting and retaining skilled employees.

- Market Advantage: Appealing to environmentally conscious clients can create a competitive edge in the broadcast equipment market.

The broadcast industry's drive towards sustainability directly influences demand for EVS Broadcast Equipment's offerings, pushing for energy-efficient solutions. By 2025, many European broadcasters aim for a 30% reduction in emissions from 2020 levels, creating a market for EVS's remote production and power-saving technologies.

Environmental regulations, such as the EU's WEEE Directive, necessitate responsible end-of-life management for broadcast equipment, impacting operational costs. The global e-waste generated in 2022 reached 62 million tonnes, underscoring the increasing regulatory scrutiny on product lifecycles.

EVS's commitment to sustainability is evident in its 2024 investment in renewable energy, targeting a 15% reduction in Scope 1 and 2 emissions. This proactive approach aligns with growing stakeholder expectations, as a significant majority of institutional investors in 2024 considered ESG factors material to their decisions.

| Key Environmental Factor | Impact on EVS | Supporting Data/Trend |

| Client Demand for Sustainability | Drives innovation in energy-efficient products and workflows. | 30% emissions reduction target by 2025 for many European broadcasters. |

| Environmental Regulations (e.g., WEEE, RoHS) | Requires compliance in product design, manufacturing, and end-of-life management. | 62 million tonnes of global e-waste in 2022; Strict limits on hazardous substances in components. |

| Corporate Social Responsibility (CSR) & ESG | Enhances brand reputation, attracts talent, and appeals to investors. | 10-15% higher valuation for companies with strong ESG credentials (Deloitte, 2025); ESG factors material to institutional investors (PwC, 2024). |

| Operational Emissions Reduction | Requires investment in sustainable practices and renewable energy. | EVS invested in renewables in 2024, aiming for a 15% reduction in Scope 1 & 2 emissions. |

PESTLE Analysis Data Sources

Our EVS Broadcast Equipment PESTLE Analysis is built on a robust foundation of data from leading market research firms, industry publications, and government statistical agencies. We integrate insights from technological trend reports, economic forecasts, and regulatory updates to provide a comprehensive view of the macro-environment.