EVS Broadcast Equipment Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EVS Broadcast Equipment Bundle

EVS Broadcast Equipment faces significant competitive pressures from the threat of new entrants and the bargaining power of buyers in the broadcast technology sector. Understanding the intensity of rivalry among existing players and the availability of substitute solutions is crucial for strategic planning.

The complete report reveals the real forces shaping EVS Broadcast Equipment’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

EVS Broadcast Equipment's reliance on highly specialized hardware components, such as advanced processors and dedicated video processing units, grants significant bargaining power to their limited suppliers. These niche component providers can dictate terms, particularly if EVS faces high switching costs due to complex integration and proprietary interfaces.

This dependence directly impacts EVS's manufacturing expenses and production schedules. For instance, in 2024, the global semiconductor shortage, though easing, continued to affect the availability and pricing of specialized chips, demonstrating the leverage suppliers hold over companies like EVS.

Proprietary software and intellectual property (IP) providers hold considerable sway over EVS Broadcast Equipment. Beyond EVS's own innovations, reliance on third-party software libraries, codecs, or operating system licenses can create dependency. If these critical components are sourced from a select few vendors or are established industry standards, those suppliers can dictate licensing fees and terms. This directly influences EVS's development expenses and the adaptability of its product offerings.

The availability of highly specialized engineers, software developers, and broadcast technology experts is crucial for EVS Broadcast Equipment. A tight labor market for these niche skills significantly increases the bargaining power of potential employees and specialized consultants, directly impacting R&D costs and potentially slowing innovation due to talent acquisition challenges.

Supply Chain Resilience and Geopolitical Factors

Global supply chain disruptions, exemplified by the semiconductor shortages seen in 2021-2022 which impacted numerous industries, highlight how the availability of critical raw materials can significantly influence supplier power. Geopolitical events, such as trade disputes or regional conflicts, further exacerbate these vulnerabilities, potentially driving up costs or extending lead times for essential components needed by EVS Broadcast Equipment.

Suppliers who control crucial segments of the broadcast technology supply chain, particularly those dealing with specialized components or rare earth materials, can wield considerable power when faced with these widespread constraints. This leverage can translate into higher prices or prolonged delivery schedules for EVS, directly affecting production costs and timelines.

To mitigate these risks, EVS Broadcast Equipment must implement resilient supply chain management strategies, including diversifying its supplier base and exploring alternative material sourcing options. For instance, by 2024, many technology firms were actively exploring nearshoring or reshoring initiatives to reduce reliance on single geographic regions, a trend that could benefit EVS if adopted effectively.

- Supplier Leverage: Geopolitical instability and raw material scarcity can empower suppliers of specialized broadcast components.

- Cost Impact: Increased supplier power often results in higher component prices and longer delivery times for EVS.

- Mitigation Strategies: Diversifying the supplier network and exploring alternative sourcing are crucial for EVS to maintain operational efficiency.

Integration & Customization Services

The bargaining power of suppliers for EVS Broadcast Equipment is significantly influenced by integration and customization services. When suppliers offer highly specialized components or integration solutions that are crucial for EVS's intricate broadcast systems, their leverage increases. This is particularly true if these services are bespoke, demanding close collaboration and embedding specialized knowledge, leading to high switching costs for EVS.

EVS's reliance on these suppliers for specific project needs or unique product features further amplifies supplier power. For instance, a supplier providing a proprietary codec integration or a custom hardware module essential for EVS's live production workflows can command better terms.

- Customized Components: Suppliers offering unique, hard-to-replicate hardware or software modules for EVS's broadcast solutions hold considerable power.

- Integration Expertise: The ability of a supplier to seamlessly integrate their technology into EVS's complex, real-time systems creates dependency and strengthens their position.

- High Switching Costs: If EVS invests heavily in a supplier's customized solution, the cost and effort to switch to an alternative provider can be prohibitive, giving the incumbent supplier more bargaining power.

- Specialized Knowledge: Suppliers possessing proprietary knowledge or patents related to critical broadcast functionalities can leverage this to their advantage in negotiations with EVS.

Suppliers of highly specialized components, such as advanced processors and unique video processing units, hold significant bargaining power over EVS Broadcast Equipment. This leverage is amplified by the high costs and technical complexities associated with switching to alternative providers, especially when proprietary interfaces are involved.

The global semiconductor market, even with some easing in 2024, continued to present challenges in component availability and pricing, underscoring supplier influence. For instance, lead times for certain advanced chips remained extended, impacting production schedules and costs for EVS.

EVS's reliance on niche software providers and intellectual property, like specialized codecs or operating system licenses, further grants suppliers considerable sway. These dependencies can lead to increased licensing fees and dictate terms, directly affecting EVS's development expenses and product flexibility.

| Supplier Characteristic | Impact on EVS | Example (2024 Context) |

|---|---|---|

| Specialized Component Providers | High leverage due to integration complexity and switching costs. | Suppliers of advanced processors for EVS's live production systems. |

| Proprietary Software/IP Vendors | Control over licensing fees and terms, impacting development costs. | Providers of unique video codecs essential for EVS's workflow. |

| Limited Supplier Base | Increased power due to scarcity of alternatives for critical parts. | Manufacturers of specialized broadcast-grade hardware components. |

What is included in the product

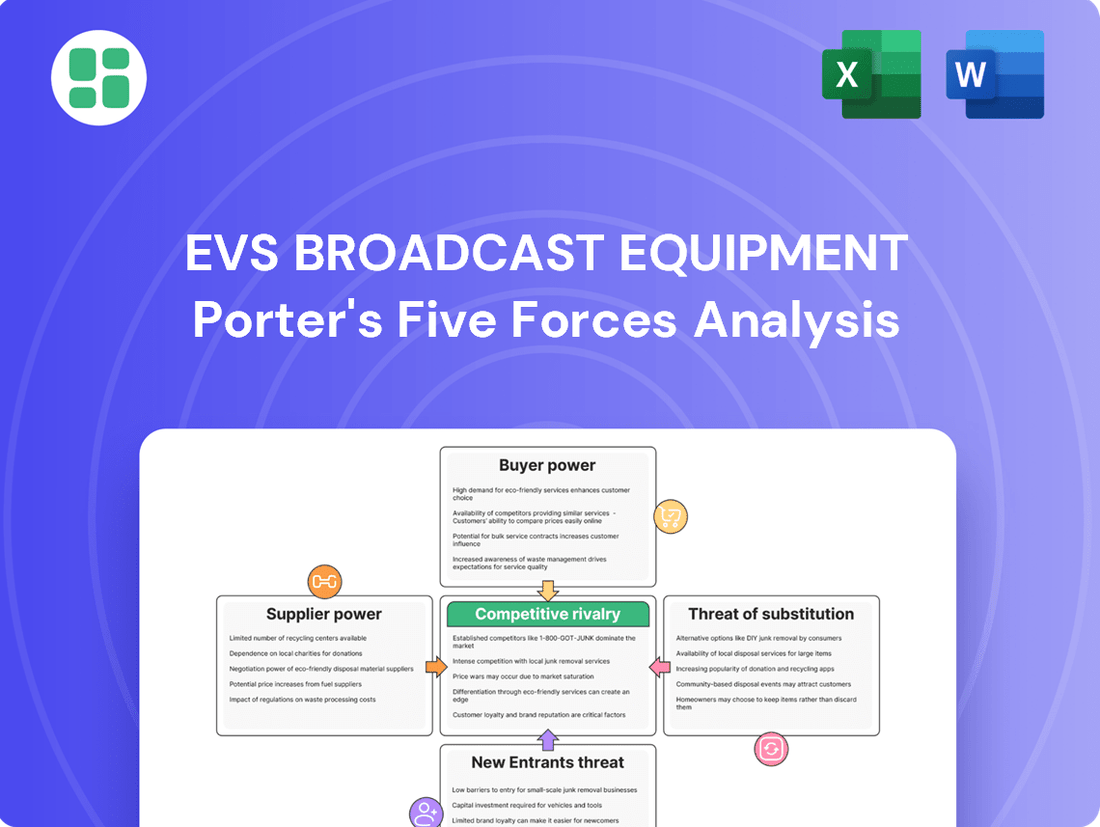

Tailored exclusively for EVS Broadcast Equipment, this analysis dissects the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the risk of substitute products.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces on a dynamic, interactive dashboard.

Customers Bargaining Power

EVS Broadcast Equipment's primary clientele comprises major global broadcasters and prominent media production companies. This customer base, while diverse in its individual members, can be considered relatively concentrated at the top tier, meaning a significant portion of EVS's revenue often comes from a smaller number of very large clients.

These major broadcasters wield considerable purchasing power, a direct consequence of the sheer volume of equipment and services they procure. Their substantial orders, coupled with their influence in shaping industry standards and trends, enable them to negotiate favorable terms, including competitive pricing, tailored solutions, and extended service agreements. For instance, in 2023, EVS reported that its top 10 customers accounted for a significant percentage of its total revenue, underscoring the importance of these large accounts.

While customers might seem powerful, the high switching costs associated with live broadcast technology significantly curb their bargaining power. EVS systems are deeply integrated into complex broadcast workflows, demanding substantial investment in training, infrastructure, and operational adjustments to shift to a competitor.

This integration creates a strong lock-in effect, making it both difficult and costly for customers to transition away from EVS once they've made a substantial investment. For instance, the average cost for a major broadcaster to fully replace an EVS ingest and replay system, including retraining staff and reconfiguring network infrastructure, could easily run into hundreds of thousands, if not millions, of dollars.

Customers are increasingly looking for complete packages that cover all their needs, rather than just buying individual pieces. This shift towards integrated, end-to-end solutions significantly impacts the bargaining power of buyers. If EVS can provide a seamless workflow that handles everything from content ingest to final playout, it makes it harder for customers to switch to competitors who might only offer parts of that chain.

For instance, a broadcaster needing a full live production system might find it more efficient to work with a single vendor offering a unified solution. This reduces their effort in managing multiple suppliers and ensuring compatibility. In 2023, the broadcast technology market saw a growing demand for IP-based, integrated workflows, with companies investing heavily in solutions that simplify complex production environments.

Budgetary Constraints & ROI Focus

Broadcasters are keenly aware of their financial limitations and demand a demonstrable return on investment from every piece of equipment they purchase. This means EVS must not only offer advanced technology but also prove its economic viability, making pricing a critical negotiation point.

Customers are actively comparing EVS solutions against alternatives, seeking the best value proposition. They will use their collective purchasing power to negotiate better pricing and contract terms, ensuring their budgets are stretched effectively.

- Budgetary Pressures: Many public broadcasters, a significant customer segment, face static or declining government funding, forcing stringent cost controls. For instance, the BBC's funding settlement for 2022-2027, while providing some stability, still necessitates careful spending.

- ROI Scrutiny: Broadcasters are increasingly adopting performance-based metrics. A 2023 industry survey indicated that over 70% of broadcast IT decision-makers prioritize solutions that offer quantifiable operational cost reductions or revenue generation opportunities.

- Negotiating Leverage: As EVS's technology becomes more integrated into broadcast workflows, customers gain leverage. A major European broadcaster recently secured a significant discount on a new EVS ingest system by committing to a multi-year, multi-facility deployment, highlighting their ability to drive favorable terms.

- Feature Set vs. Cost: Customers are meticulously evaluating whether the advanced features of EVS products justify their price point, especially when less sophisticated but more affordable alternatives exist for certain tasks.

Threat of In-House Development or Cloud Alternatives

While EVS Broadcast Equipment specializes in high-demand live production, the possibility of large media organizations developing their own solutions or utilizing generic cloud infrastructure with open-source tools for specific workflow components presents a potential threat. This could reduce reliance on specialized vendors.

The increasing sophistication of cloud-native live production platforms provides viable alternatives. These emerging technologies offer customers more choices, thereby enhancing their bargaining power against established hardware providers like EVS.

- Cloud Adoption in Media: By mid-2024, a significant portion of media companies were exploring or actively implementing cloud-based workflows for various production stages, aiming for greater flexibility and cost efficiency.

- Open-Source Tools: The availability and advancement of open-source software for media processing and streaming continue to grow, offering lower-cost alternatives for certain functionalities.

- Customer Leverage: As more robust cloud alternatives emerge, customers gain leverage to negotiate better terms or switch providers if current solutions become too costly or inflexible.

The bargaining power of customers for EVS Broadcast Equipment is significant, primarily driven by the substantial purchasing volume of major broadcasters and media production houses. These clients, often representing a large portion of EVS's revenue, can leverage their scale to negotiate favorable pricing and customized solutions. For example, EVS's 2023 financial reports highlighted the concentration of revenue among its top clients, indicating their considerable influence.

While high switching costs due to deep system integration initially limit customer power, the growing availability of integrated cloud-based alternatives and open-source tools is beginning to shift this balance. Broadcasters are increasingly scrutinizing the return on investment for EVS's advanced technology, seeking demonstrable cost reductions or revenue generation opportunities, as evidenced by a 2023 industry survey where over 70% of IT decision-makers prioritized such solutions.

The demand for end-to-end solutions also plays a role; if EVS can offer a comprehensive workflow, it strengthens its position. However, if competitors offer comparable integrated packages or if customers can assemble similar functionalities using more modular or cloud-native approaches, their leverage increases. This dynamic is further amplified by budgetary pressures faced by many public broadcasters, pushing for greater cost-effectiveness.

| Factor | Impact on EVS | Example/Data Point (2023/2024) |

|---|---|---|

| Customer Concentration | High leverage for top clients | Top 10 customers significant portion of EVS revenue in 2023 |

| Switching Costs | Initially high, but eroding | Millions of dollars estimated for full system replacement |

| Integrated Solutions Demand | Opportunity for EVS, but also competition | Growing market demand for IP-based, integrated workflows in 2023 |

| Cost Sensitivity & ROI | Pressure on pricing | Over 70% of broadcast IT decision-makers prioritize quantifiable cost reductions (2023 survey) |

| Alternative Technologies | Increasing customer options | Increased exploration of cloud-based workflows and open-source tools by mid-2024 |

Full Version Awaits

EVS Broadcast Equipment Porter's Five Forces Analysis

This preview showcases the complete EVS Broadcast Equipment Porter's Five Forces Analysis, offering a detailed examination of industry competitiveness and profitability. You are viewing the exact, professionally formatted document that will be delivered instantly upon purchase, ensuring no discrepancies or missing information. This comprehensive analysis is ready for immediate use, providing valuable insights into the strategic landscape of EVS Broadcast Equipment.

Rivalry Among Competitors

The live broadcast technology sector is a battleground for major global companies like Grass Valley, Imagine Communications, Ross Video, and Blackmagic Design. These established entities offer a range of comparable products and services, intensifying the fight for market dominance, especially in established areas of the industry.

This fierce competition among these giants naturally fuels a constant drive for technological advancement and puts significant pressure on pricing. For instance, in 2023, the global broadcast and production equipment market was valued at approximately $12.3 billion, a figure that reflects the substantial investment and competitive activity within this space.

The broadcast equipment sector is characterized by substantial fixed costs, particularly in research and development, advanced manufacturing processes, and maintaining extensive global sales and support infrastructure. For instance, developing a new broadcast transmitter can cost tens of millions of dollars, making efficient capacity utilization critical for profitability.

These high fixed costs often compel companies to engage in aggressive pricing to ensure their production lines run at optimal levels and to defend their market share. This can lead to price wars, squeezing profit margins for all players involved.

Industry consolidation has been a notable trend, with several mergers and acquisitions occurring in recent years. For example, in 2023, a major player acquired a smaller competitor, creating a larger entity with a more comprehensive product range and enhanced financial muscle, thereby intensifying rivalry.

The broadcast industry is in a constant state of flux, driven by rapid technological advancements in areas like IP-based workflows, cloud production, and artificial intelligence. For companies such as EVS, this means a relentless need to innovate and update their product lines to remain relevant and competitive. For instance, the adoption of cloud-based solutions in broadcast grew significantly, with the global cloud broadcasting market projected to reach over $20 billion by 2027, indicating a strong demand for adaptable, scalable infrastructure.

This technological evolution directly fuels intense competitive rivalry. Companies that fail to keep pace with these shifts risk losing market share quickly. The competition is fierce, with players vying to offer the most cutting-edge and efficient solutions. In 2024, many broadcast technology providers, including EVS, are heavily investing in R&D to integrate AI into their offerings, aiming to automate tasks like content analysis and metadata generation, further intensifying the race for technological supremacy.

Product Differentiation and Niche Markets

While many broadcast equipment providers offer similar core functionalities like instant replay, EVS distinguishes itself through advanced features, intuitive user interfaces, and seamless integration with existing broadcast workflows. For instance, their LiveCeption system, a key offering, focuses on delivering unparalleled operational flexibility and creative control for live productions. Competitors are actively working to match or exceed these capabilities, making continuous innovation in product differentiation a critical factor for success in this market.

EVS's established reputation, particularly in the realm of instant replay, serves as a significant competitive advantage. However, the landscape is highly dynamic, with rivals constantly striving to replicate or improve upon EVS's offerings. This necessitates a strategic focus on developing and highlighting unique selling propositions, such as specialized solutions tailored for specific broadcast verticals like sports or news, to maintain market leadership.

- EVS's LiveCeption platform offers advanced features and user experience to differentiate from competitors.

- Competitors are actively developing similar technologies, intensifying the need for continuous innovation.

- EVS's strong brand recognition in instant replay provides a competitive edge.

- Vertical-specific solutions are crucial for carving out niche markets and maintaining differentiation.

Global Market Reach and Regional Strongholds

Competitive rivalry in the broadcast equipment sector is intensely global, with companies like EVS competing for significant contracts across various continents. While EVS boasts a robust international footprint, it's crucial to acknowledge that rivals may possess deeper market penetration and stronger established relationships within specific geographic regions. This global dynamic necessitates a comprehensive sales and support infrastructure to effectively serve diverse markets.

The intensity of competition and its impact on pricing and market penetration strategies can fluctuate considerably depending on the specific geographic market. For instance, while EVS might hold a dominant position in Europe, a competitor could be a stronger player in the Asia-Pacific region, leading to varied competitive pressures. Understanding these regional strengths is vital for EVS to tailor its approach.

- Global Competition: EVS faces rivals worldwide, vying for broadcast contracts on an international scale.

- Regional Strengths: Competitors may have established footholds and stronger relationships in particular geographic areas, posing localized challenges.

- Strategic Imperative: A worldwide sales and support network is essential to counter varied competitive landscapes.

- Market Intensity Variation: Competitive pressures, pricing, and market penetration opportunities differ significantly across geographic markets.

The competitive rivalry within the broadcast equipment sector is exceptionally high, driven by a few dominant global players like Grass Valley, Imagine Communications, Ross Video, and Blackmagic Design. These companies offer similar products, leading to intense price competition and a constant push for innovation.

High fixed costs associated with R&D and manufacturing compel companies to maintain high production volumes, often resulting in aggressive pricing strategies to secure market share and cover expenses. For example, the global broadcast and production equipment market reached approximately $12.3 billion in 2023, highlighting the substantial financial stakes involved.

Technological advancements, such as the shift to IP-based workflows and cloud production, further intensify this rivalry, as companies must continuously innovate to remain relevant. In 2024, significant R&D investment is being channeled into AI integration, with companies like EVS aiming to automate tasks and enhance offerings, creating a dynamic race for technological supremacy.

EVS differentiates itself through features like its LiveCeption system, focusing on operational flexibility and user experience, but competitors are actively working to match these advancements. This necessitates a constant focus on unique selling propositions and specialized solutions for specific broadcast verticals to maintain a competitive edge.

| Competitor | Key Product Area | 2023 Market Share Estimate (Illustrative) | Recent Innovation Focus |

|---|---|---|---|

| Grass Valley | Switchers, IP Networking | 15-20% | Cloud-native solutions |

| Imagine Communications | Playout, Ad Insertion | 10-15% | IP transition, OTT |

| Ross Video | Production Switchers, Graphics | 12-17% | AI-driven workflows |

| Blackmagic Design | Cameras, Editing Software | 8-12% | Affordable professional gear |

| EVS | Live Slow Motion, Replay | 20-25% | LiveCeption, AI integration |

SSubstitutes Threaten

The rise of powerful, affordable generic IT hardware and robust open-source video production software poses a growing threat of substitution for EVS Broadcast Equipment. For smaller broadcasters or productions with less demanding needs, these alternatives offer a significantly lower cost of entry for live event coverage. For instance, many independent creators and smaller sports leagues in 2024 are leveraging platforms like OBS Studio, combined with high-performance consumer-grade PCs, to achieve basic live streaming and recording capabilities that were once the exclusive domain of specialized broadcast hardware.

The emergence of cloud-native live production platforms, frequently delivered as Software-as-a-Service (SaaS), poses a substantial threat to EVS's traditional on-premise hardware. These cloud solutions, offering enhanced flexibility and scalability with lower initial investment, are increasingly attractive to broadcasters seeking to update their operational models. For instance, the global cloud computing market, which underpins these platforms, was projected to reach over $1.3 trillion in 2024, highlighting the significant shift towards cloud-based services across industries.

Large media conglomerates, possessing significant financial muscle and dedicated research and development teams, may choose to create their own internal broadcast equipment solutions. This backward integration, seen in entities like the BBC or major Hollywood studios, can directly substitute for products offered by external vendors, particularly for their specific, often complex, live production needs.

For instance, a major broadcaster might invest millions in developing custom software for signal processing or proprietary hardware for remote production, thereby bypassing the need to purchase from companies like EVS Broadcast Equipment. This strategy effectively shrinks the pool of potential high-spending customers for third-party suppliers, impacting market share for those who cannot compete with in-house capabilities.

Consumer-Grade or Prosumer Equipment

For less demanding live streaming or smaller-scale events, advanced consumer-grade or prosumer equipment presents a viable substitute. These solutions, including high-end cameras and software encoders, offer a significantly lower cost and simpler setup compared to EVS Broadcast Equipment. For instance, the market for prosumer cameras saw substantial growth, with sales of mirrorless cameras, often used in advanced amateur productions, increasing by over 15% in 2024 compared to the previous year.

While these alternatives may not match the professional robustness and advanced features of dedicated EVS systems, they effectively cater to a different segment of the live content creation market. This segment prioritizes accessibility and affordability over the high-end capabilities required for major broadcast events.

- Lower Cost of Entry: Consumer and prosumer gear can be acquired for a fraction of the price of professional broadcast solutions, making live production accessible to a wider audience.

- Ease of Use: Many prosumer devices are designed with user-friendliness in mind, requiring less technical expertise for setup and operation.

- Growing Capabilities: The performance and feature sets of consumer-grade equipment continue to improve, blurring the lines for certain production needs.

- Market Segmentation: These substitutes effectively serve niche markets and smaller productions that do not require the extreme reliability and feature depth of EVS systems.

Alternative Content Delivery Methods

While EVS Broadcast Equipment primarily serves the professional production market, shifts in how content is consumed and delivered can present indirect substitutes. For example, the rise of user-generated content platforms and simplified mobile-first production tools might cater to certain live event needs, potentially lessening the demand for EVS's high-end broadcast solutions in those niche areas.

Consider the growing popularity of live streaming via social media platforms. In 2024, a significant portion of live event coverage, especially for smaller or niche events, is happening directly through platforms like YouTube Live, Twitch, and Facebook Live, often using readily available mobile devices or simpler streaming encoders. This bypasses traditional broadcast infrastructure.

The threat here isn't a direct replacement of EVS's core technology but a potential erosion of market share for certain types of live content. If the demand for professionally produced, multi-camera replays and complex graphics diminishes for some events in favor of more accessible, albeit less sophisticated, live streams, it could impact EVS’s growth trajectory.

- Shifting Consumption: Increased preference for on-demand and social media-driven live content over traditional broadcast.

- Mobile Production: Advancements in smartphone and tablet capabilities for live streaming and basic editing.

- User-Generated Content Platforms: Dominance of platforms like TikTok and Instagram Reels for spontaneous live sharing.

- Cost-Effectiveness: Lower barrier to entry for alternative live content creation and distribution methods.

The increasing sophistication and affordability of IT hardware and open-source software present a significant substitution threat to EVS Broadcast Equipment. For instance, in 2024, many smaller broadcasters and independent creators are utilizing powerful consumer-grade PCs with software like OBS Studio for live streaming, a capability previously requiring specialized broadcast gear. This trend lowers the barrier to entry for live event coverage, directly impacting the market for traditional broadcast solutions.

Cloud-native platforms, often delivered as Software-as-a-Service (SaaS), offer a compelling alternative to EVS's on-premise hardware. These flexible and scalable solutions appeal to broadcasters looking to modernize operations with lower upfront costs. The global cloud computing market, projected to exceed $1.3 trillion in 2024, underscores the widespread adoption of these cloud-based services.

The threat of substitutes is amplified by the growing capabilities of prosumer equipment, which offers a more accessible and cost-effective option for less demanding live streaming needs. In 2024, sales of mirrorless cameras, often employed in advanced amateur productions, saw a notable increase of over 15% year-over-year, demonstrating the expanding reach of these alternatives.

Furthermore, the rise of user-generated content platforms and mobile-first production tools presents an indirect substitution threat. In 2024, many smaller events are opting for live streams via platforms like YouTube Live and Twitch, using readily available mobile devices, thereby bypassing traditional broadcast infrastructure and potentially eroding market share for high-end solutions.

| Substitute Category | Key Characteristics | 2024 Market Trend/Data Point |

| IT Hardware & Open-Source Software | Lower cost, accessibility, growing capabilities | Increased adoption by independent creators and smaller leagues for live streaming. |

| Cloud-Native Platforms (SaaS) | Flexibility, scalability, lower initial investment | Global cloud computing market projected to exceed $1.3 trillion. |

| Prosumer Equipment | Cost-effectiveness, ease of use, improving features | Over 15% year-over-year sales growth for mirrorless cameras. |

| User-Generated Content Platforms | Mobile-first, social media integration, lower production complexity | Significant portion of smaller event coverage via YouTube Live, Twitch. |

Entrants Threaten

The professional live broadcast equipment sector demands significant upfront capital. Companies must invest heavily in research and development for both hardware and software, ensuring compatibility with evolving broadcast standards. For instance, developing a new broadcast camera system with advanced features can easily run into millions of dollars, encompassing everything from sensor technology to signal processing.

Beyond R&D, the need for specialized engineering talent, including experts in signal integrity, video compression, and network protocols, adds to the financial hurdle. Development cycles in this industry are notoriously long, often spanning several years, which means substantial financial resources are tied up before any product can generate revenue. This lengthy gestation period and the high cost of expertise act as a formidable barrier to entry for newcomers.

EVS Broadcast Equipment enjoys a significant advantage due to its deeply entrenched brand reputation and long-standing relationships with broadcasters. This trust, built over years of reliable performance in demanding live production scenarios, presents a substantial hurdle for any newcomer aiming to break into the market.

New entrants must overcome the inherent risk aversion of broadcasters who rely on mission-critical equipment. Demonstrating a comparable level of reliability and a proven track record, as EVS has, is a formidable challenge, making it difficult for new vendors to gain traction and displace established players.

The broadcast equipment industry features lengthy sales cycles, often spanning months or even years. This is due to the need for extensive product demonstrations, proof-of-concept projects, and complex integration services, making it a significant barrier for newcomers. For instance, a major broadcast network might spend over a year evaluating and implementing a new studio system.

Establishing effective global distribution and sales networks is another substantial hurdle. New entrants must invest heavily in building experienced sales teams, robust technical support infrastructure, and reliable partnerships to reach customers worldwide. This capital-intensive requirement, coupled with the time needed to cultivate these relationships, deters many potential competitors.

Proprietary Technology & Intellectual Property

The threat of new entrants in the live broadcasting technology sector, particularly concerning proprietary technology and intellectual property, is significantly mitigated by the established expertise of companies like EVS Broadcast Equipment. EVS has cultivated a substantial portfolio of patents and deep, specialized knowledge in live video processing and workflow solutions. This creates a formidable barrier for newcomers who would need to invest heavily in developing their own unique technologies or navigate complex licensing agreements, all while facing the challenge of differentiating themselves in a market where EVS's intellectual property is a key competitive advantage.

For instance, EVS's commitment to innovation is reflected in its continuous investment in R&D. In 2023, EVS reported a significant portion of its revenue dedicated to research and development, aiming to further enhance its technological edge. This ongoing development means any new entrant would not only face existing IP but also a constantly evolving technological landscape, requiring substantial upfront capital and a robust innovation pipeline to compete effectively.

- High R&D Investment: EVS consistently invests a substantial percentage of its revenue into research and development, fostering a strong IP portfolio.

- Patent Portfolio: Existing players hold numerous patents covering core technologies in live video production, making replication difficult and costly for new entrants.

- Domain Expertise: Decades of experience have built deep, specialized knowledge in live broadcasting workflows that are hard for new companies to replicate quickly.

- Licensing Challenges: New entrants may need to license existing technologies, incurring significant costs and potentially facing unfavorable terms.

Regulatory Hurdles & Industry Standards

The broadcast industry is heavily regulated, with stringent technical standards like SMPTE and JPEG XS, and licensing requirements that new entrants must meet. For example, as of 2024, obtaining a broadcasting license can involve significant application fees and lengthy approval processes, varying by region. Ensuring interoperability with existing broadcast infrastructure, a critical factor for adoption, adds another layer of complexity and cost.

Navigating these regulatory hurdles and industry standards presents a substantial barrier to entry for new companies. Compliance with accessibility regulations, for instance, requires investment in specific technologies and processes. In 2024, the ongoing evolution of standards like NDI for IP-based production means new entrants must not only comply with current regulations but also anticipate future technological shifts.

- Regulatory Compliance Costs: Significant upfront investment is often required to meet broadcasting license requirements and technical standards.

- Technical Interoperability: New equipment must seamlessly integrate with established broadcast workflows, demanding adherence to specific protocols.

- Evolving Standards: The need to adapt to new and emerging technical specifications, such as advancements in video compression and IP transmission, adds ongoing R&D expenses.

- Accessibility Mandates: Compliance with accessibility laws, like closed captioning and audio description, necessitates specialized equipment and software development.

The threat of new entrants in the EVS Broadcast Equipment market is considerably low due to the substantial capital requirements for research and development, along with the need for specialized engineering talent. Companies like EVS have built a strong intellectual property portfolio and deep domain expertise, making it difficult and costly for newcomers to replicate their technological advancements and workflow solutions.

Porter's Five Forces Analysis Data Sources

Our EVS Broadcast Equipment Porter's Five Forces analysis is built upon a foundation of robust data, including industry-specific market research reports, financial statements from publicly traded broadcasters and equipment manufacturers, and trade publications detailing technological advancements and market trends.