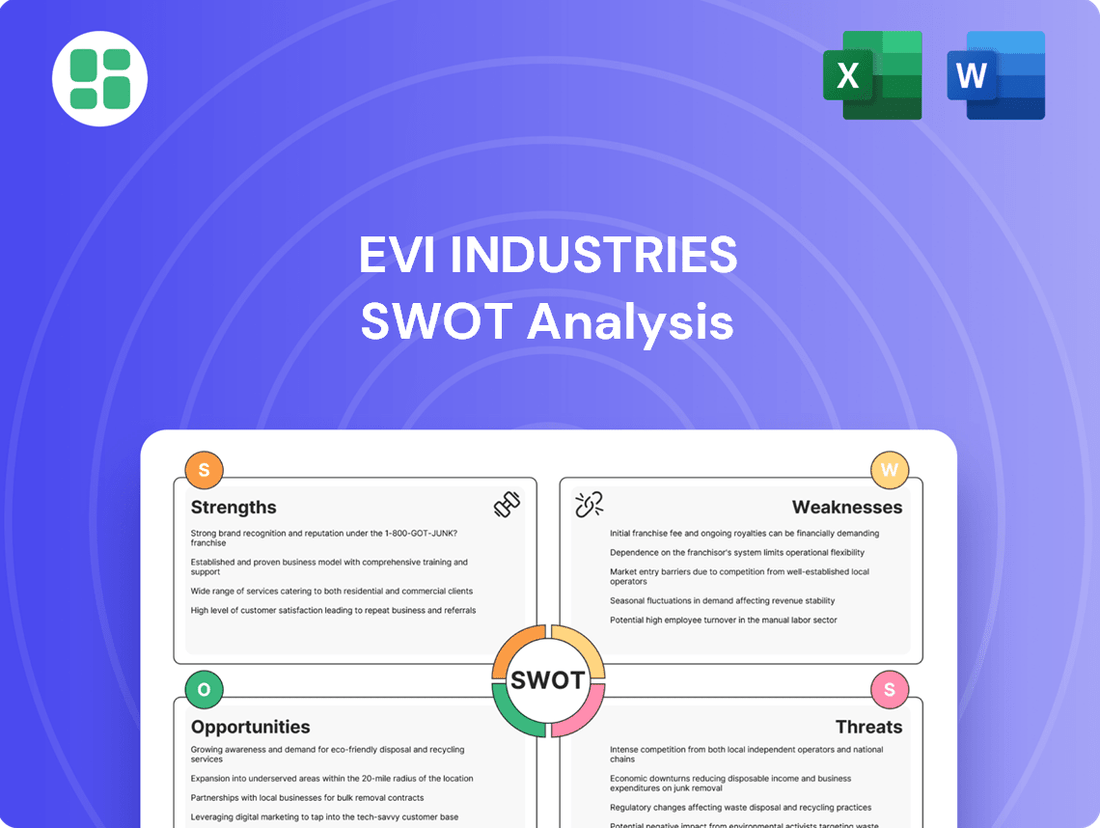

EVI Industries SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EVI Industries Bundle

EVI Industries is poised for growth, but understanding its competitive landscape is crucial. Our analysis reveals key strengths like innovative product lines and potential weaknesses in supply chain management that could impact future performance.

Want the full story behind EVI Industries' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

EVI Industries' strength lies in its remarkably diversified customer base, spanning critical sectors such as industrial laundries, textile rental, hospitality, healthcare, and government agencies. This broad reach significantly mitigates risk, as a downturn in one sector is unlikely to cripple the company due to stable demand from others.

This diversification ensures a consistent revenue stream, as essential services like healthcare and hospitality always require clean linens and operational laundry facilities. For instance, the healthcare sector's non-negotiable need for hygiene guarantees a baseline demand for EVI's equipment and services, regardless of broader economic sentiment.

EVI Industries excels with a comprehensive service and product portfolio, covering distribution, installation, maintenance, and parts for commercial laundry and dry cleaning equipment. This end-to-end approach positions EVI as a one-stop shop for its clientele, nurturing robust customer loyalty and creating consistent revenue from service agreements and parts, in addition to initial equipment sales.

EVI Industries excels with its strategic 'buy-and-build' acquisition approach, a core strength that has fueled its expansion. The company has a proven track record, successfully integrating over 30 acquisitions to date. This aggressive strategy has been instrumental in broadening its reach and market dominance.

Notable recent acquisitions, such as Girbau North America and ASN Laundry Group in 2025, highlight the ongoing momentum of this strategy. These moves not only expand EVI's geographic footprint and market share but also bolster its talent pool, reinforcing its leadership in the commercial laundry sector across North America.

This consistent execution of its acquisition strategy has demonstrably translated into strong financial performance. EVI Industries has achieved impressive compounded annual growth rates in revenue, net income, and adjusted EBITDA, underscoring the effectiveness of its 'buy-and-build' model in driving value.

Robust Financial Performance and Liquidity

EVI Industries showcases a remarkably strong financial position, evidenced by its record-breaking revenues and gross profits reported in fiscal periods like Q1 and Q3 of 2025. This consistent financial growth underscores the company's operational efficiency and market demand for its offerings.

The company's robust liquidity is a significant strength, with available cash reserves surpassing $175 million as of March 31, 2025. This substantial cash position, coupled with strong operating cash flow generation, equips EVI Industries with the financial flexibility to pursue strategic growth initiatives, including potential acquisitions and capital expenditures.

- Record Revenue and Profitability: EVI Industries achieved record revenues and gross profits in Q1 and Q3 2025.

- Strong Operating Cash Flow: The company consistently generates significant cash from its operations.

- Substantial Liquidity: As of March 31, 2025, EVI Industries maintained over $175 million in available liquidity.

- Strategic Investment Capacity: The strong financial health provides ample capital for future strategic investments and acquisitions.

Extensive North American Market Presence

EVI Industries boasts an extensive North American market presence, operating through a wide network of subsidiaries. This robust infrastructure allows for effective customer reach and service across a broad spectrum of products from diverse suppliers. For instance, as of their latest reports, the company's sales and service network spans numerous locations, facilitating efficient market penetration and customer support throughout the region.

This widespread operational footprint is a key strength, enabling EVI Industries to:

- Capitalize on a large and diverse customer base across North America.

- Provide efficient and localized service for a wide range of products.

- Strengthen market penetration through a well-established sales and service infrastructure.

- Leverage relationships with numerous domestic and international suppliers by offering them a broad distribution channel.

EVI Industries' diversified customer base across essential sectors like healthcare and hospitality provides a resilient revenue stream, as demonstrated by consistent demand for its laundry solutions. Its comprehensive service and product portfolio, from distribution to maintenance, fosters strong customer loyalty and recurring revenue.

The company's aggressive 'buy-and-build' acquisition strategy, evidenced by over 30 successful integrations, including significant moves in 2025, has been a primary growth driver. This strategy has demonstrably boosted revenue, net income, and EBITDA, solidifying EVI's market leadership.

EVI Industries maintains a robust financial position with record revenues and gross profits in fiscal periods like Q1 and Q3 2025. Substantial liquidity, exceeding $175 million as of March 31, 2025, provides significant financial flexibility for strategic growth and acquisitions.

The company possesses an extensive North American market presence, supported by a broad network of subsidiaries and a well-established sales and service infrastructure. This allows for efficient customer reach, localized support, and strong relationships with a wide array of suppliers.

| Key Strength | Description | Supporting Data (as of latest available) |

|---|---|---|

| Customer Diversification | Serves critical sectors like healthcare, hospitality, and government. | Stable demand from essential services ensures consistent revenue. |

| Integrated Service Model | Offers distribution, installation, maintenance, and parts. | Creates a one-stop shop, enhancing customer loyalty and recurring revenue. |

| Acquisition Strategy | Proven 'buy-and-build' approach with over 30 acquisitions. | Recent acquisitions in 2025 (e.g., Girbau North America) expand market reach and dominance. |

| Financial Strength | Record revenues and gross profits in 2025; strong liquidity. | Over $175 million in available liquidity as of March 31, 2025. |

| Market Presence | Extensive North American network of subsidiaries. | Facilitates efficient market penetration and customer support across the region. |

What is included in the product

Delivers a strategic overview of EVI Industries’s internal and external business factors, highlighting its strengths and weaknesses alongside market opportunities and threats.

Offers a clear, actionable framework for EVI Industries to identify and leverage its competitive advantages while mitigating potential risks.

Weaknesses

EVI Industries' heavy reliance on North America, while a strength in terms of established networks, presents a significant weakness due to limited geographic diversification. This concentration makes the company particularly vulnerable to regional economic fluctuations, such as the potential slowdown in US industrial production, which saw a contraction in early 2024. Such regional dependency could stifle international expansion and expose EVI to risks from localized regulatory shifts or market saturation within its core operating territory.

EVI Industries' aggressive 'buy-and-build' strategy, marked by numerous acquisitions, inherently creates significant operational complexity. Integrating disparate business cultures, IT systems, and operational processes from acquired companies strains management bandwidth. This can lead to inefficiencies and difficulties in ensuring uniform service standards across its growing portfolio.

EVI Industries' position as a distributor makes it inherently reliant on the manufacturers of commercial laundry and dry cleaning equipment. This means EVI's product selection, pricing, and access to the latest technology are directly tied to the performance and decisions of these third-party suppliers. For instance, if a key manufacturer experiences production delays or price increases, EVI's own operational efficiency and competitiveness can be significantly impacted.

This dependency can create vulnerabilities. Supply chain disruptions affecting these manufacturers, such as raw material shortages or geopolitical issues, could directly hinder EVI's ability to fulfill customer orders. Furthermore, if a major equipment supplier faces financial difficulties or decides to alter its distribution strategy, EVI could lose access to critical product lines, potentially putting it at a disadvantage compared to competitors with more diversified supplier relationships.

Significant Investment in Technology and Infrastructure

EVI Industries is in the midst of a significant digital transformation, pouring resources into crucial systems like ERP, field service management, CRM, and e-commerce. This strategic move, while vital for future expansion, places a considerable strain on immediate financial performance. The extensive capital expenditure required for these upgrades can negatively affect short-term profitability and cash flow until the full benefits of these investments are realized.

The company's commitment to upgrading its technological backbone, including a reported $50 million allocation towards digital infrastructure in fiscal year 2024, highlights this weakness. This substantial outlay, aimed at enhancing operational efficiency and customer engagement, inherently carries the risk of delayed return on investment, potentially impacting key financial metrics in the near term. The success of this transformation hinges on effective implementation and the speed at which these new systems translate into tangible revenue growth and cost savings.

- Digital Transformation Costs: Significant capital expenditure for ERP, field service management, CRM, and e-commerce.

- Short-Term Financial Impact: Potential pressure on profitability and cash flow due to heavy investment.

- Delayed ROI Risk: The time lag before technology investments yield full financial returns.

- Implementation Challenges: The inherent risks associated with integrating and optimizing new, complex systems.

Vulnerability to Macroeconomic Downturns

EVI Industries, despite its diverse clientele, faces a significant weakness in its vulnerability to macroeconomic downturns. Economic recessions or even a slowdown in business spending can directly impact the demand for its commercial laundry equipment and services. For instance, a downturn in the hospitality sector, a key market for EVI, could lead to reduced capital expenditure on new machinery and a decrease in demand for essential maintenance and repair services.

This susceptibility is amplified by the fact that businesses often cut back on non-essential upgrades or new equipment purchases during economic uncertainty. In 2024, as many economies grappled with persistent inflation and interest rate hikes, companies across various sectors, including hospitality and textile rental, reported cautious spending. This trend directly translates to potential headwinds for EVI Industries, as clients may postpone or cancel planned equipment acquisitions.

- Economic Sensitivity: Demand for commercial laundry equipment and services is closely tied to the financial health of key client industries like hospitality and textile rental.

- Capital Expenditure Cuts: During economic downturns, businesses often reduce discretionary spending, leading to delayed or canceled investments in new laundry equipment.

- Impact on Services: Reduced equipment sales can also negatively affect revenue streams from maintenance, repair, and parts, which are crucial for EVI's service segment.

EVI Industries' reliance on a limited number of key equipment manufacturers presents a significant weakness. This dependency means EVI's product availability, pricing, and access to innovation are directly controlled by its suppliers. A disruption or strategic shift by one of these manufacturers, such as a production halt or a change in distribution agreements, could severely impact EVI's ability to serve its customers and maintain its competitive edge.

What You See Is What You Get

EVI Industries SWOT Analysis

The preview you see is taken directly from the full EVI Industries SWOT report you'll get. Purchase unlocks the entire in-depth version, providing comprehensive insights into the company's strategic position.

Opportunities

The commercial laundry sector is still quite fragmented, which is great news for EVI Industries. This means there are plenty of chances for EVI to keep doing what it does best: buying up other companies. This 'buy-and-build' approach has been a winning strategy for them.

By snapping up smaller companies that are already doing well in their local markets, EVI can quickly grow its presence across North America. This not only broadens their reach but also bolsters their offerings and solidifies their position as a leader in the industry.

For instance, in 2023, EVI successfully completed several strategic acquisitions, adding to its already substantial market share. This ongoing consolidation is a key driver for future growth and profitability, allowing EVI to leverage economies of scale and expand its service capabilities.

EVI Industries can capitalize on the ongoing digital transformation by integrating advanced technologies like the Internet of Things (IoT) for predictive maintenance, aiming to reduce downtime by an estimated 15-20% based on industry averages. Furthermore, implementing AI-driven solutions for operational efficiency could lead to cost savings of up to 10% in the coming fiscal year.

The healthcare and hospitality sectors are experiencing significant growth, driven by an increasing focus on hygiene and expanding services. This trend directly translates into a higher demand for robust, efficient, and sanitary commercial laundry equipment, a core offering of EVI Industries. For instance, the global healthcare laundry market was valued at approximately $10.5 billion in 2023 and is projected to reach $14.2 billion by 2028, demonstrating substantial expansion.

EVI Industries is strategically positioned to benefit from this burgeoning demand. By providing essential laundry solutions specifically designed for the stringent requirements of these industries, the company can capture a larger market share. The hospitality sector, in particular, saw a strong rebound in 2024, with occupancy rates in many regions exceeding pre-pandemic levels, further fueling the need for reliable laundry services.

Expansion of Recurring Revenue Streams

The essential nature of commercial laundry systems, like those EVI Industries provides, guarantees a consistent demand for post-installation support. This includes a steady need for replacement parts, accessories, and crucial ongoing maintenance and repair services, forming a solid foundation for recurring revenue.

EVI Industries is well-positioned to enhance its recurring revenue by strategically expanding its service contracts and introducing comprehensive preventative maintenance programs. Leveraging its substantial installed base of equipment presents a significant opportunity to upsell these services, thereby increasing customer lifetime value and predictable income.

- Service Contracts: EVI can grow recurring revenue by expanding the scope and offerings within its service contracts, potentially including guaranteed uptime or comprehensive parts coverage.

- Preventative Maintenance: Offering proactive maintenance packages can reduce customer downtime and create a predictable revenue stream for EVI through scheduled service visits.

- Installed Base Monetization: With a large installed base, EVI can target existing customers for these enhanced service offerings, capitalizing on established relationships.

- Parts and Accessories: Continued focus on supplying replacement parts and accessories to its installed base remains a core component of recurring revenue generation.

Capitalizing on Sustainability and Efficiency Trends

The laundry industry is increasingly prioritizing sustainability, with a significant push towards energy-efficient and environmentally friendly equipment. This trend is fueled by escalating operational costs and more stringent environmental regulations, creating a clear opportunity for forward-thinking companies like EVI Industries. By offering advanced machines that conserve water and energy, EVI can significantly boost its market appeal and attract new clients who are actively seeking greener solutions.

EVI Industries can capitalize on this by:

- Promoting and distributing laundry equipment with advanced water and energy-saving features.

- Highlighting the long-term cost savings associated with efficient machinery for their clients.

- Aligning their product offerings with growing consumer and business demand for sustainable practices.

For instance, the global green laundry market is projected for substantial growth. Reports indicate that the market for energy-efficient appliances, including laundry, is expected to see a compound annual growth rate (CAGR) of over 7% through 2028, demonstrating a strong and sustained demand for eco-conscious solutions.

EVI Industries is ideally positioned to leverage the ongoing consolidation within the fragmented commercial laundry sector, continuing its successful buy-and-build strategy. This approach allows for rapid expansion across North America by acquiring well-performing regional businesses, thereby increasing market share and service capabilities. The company's strategic acquisitions in 2023 highlight this effective growth model.

Threats

The commercial laundry distribution and service sector, especially in established markets, is characterized by significant competition. EVI Industries contends with numerous rivals, which can exert downward pressure on pricing, potentially impacting profit margins and hindering market share growth in mature areas.

For instance, industry reports from late 2024 indicated that average pricing in some regional laundry service markets saw a decline of up to 3% due to aggressive competitive strategies. This environment necessitates continuous innovation and operational efficiency for EVI Industries to maintain its competitive edge and profitability.

Economic slowdowns present a significant threat to EVI Industries. A recessionary environment could prompt EVI's key clients in hospitality, healthcare, and industrial markets to slash capital spending. This contraction in customer investment directly translates to lower sales for EVI's new equipment offerings.

Furthermore, a downturn would likely dampen demand for EVI's high-margin service contracts, impacting overall revenue streams and profitability. For instance, if the global GDP growth slows to a projected 2.6% in 2024, as some forecasts suggest, this could translate to a noticeable slowdown in capital expenditure across EVI's served industries.

EVI Industries, as a distributor, faces significant threats from its supply chain. Its reliance on both domestic and international manufacturers for essential equipment and parts creates inherent vulnerabilities. For instance, the ongoing global semiconductor shortage, which significantly impacted various industries throughout 2023 and into early 2024, highlights how dependent EVI is on timely component availability.

These disruptions, whether stemming from raw material shortages, geopolitical instability, or unexpected logistical challenges, can directly translate into higher operational costs for EVI. Furthermore, delays in product delivery can damage customer relationships and lead to lost sales opportunities, especially if EVI cannot meet demand due to upstream production issues.

Rapid Technological Obsolescence

The commercial laundry sector is experiencing swift technological advancements, with smart machines and automation becoming increasingly prevalent. This rapid innovation poses a significant threat of obsolescence for EVI Industries' current inventory and older installed equipment. For instance, the market is rapidly shifting towards IoT-enabled washers and dryers that offer remote monitoring and predictive maintenance, features that older EVI models may lack.

To combat this, EVI would need substantial and ongoing investment in research and development to update its product lines and integrate new technologies. Furthermore, continuous training for its service technicians is essential to ensure they can support and repair these advanced systems. These investments represent a considerable cost that could impact profitability if not managed effectively, especially as competitors might adopt newer technologies faster.

- Market Shift: As of early 2024, reports indicate that over 30% of new commercial laundry installations are incorporating some form of smart technology, a figure expected to grow by 15% annually through 2025.

- Investment Needs: Keeping pace with competitors like Alliance Laundry Systems, which has heavily invested in its Speed Queen and Huebsch brands with connected capabilities, requires EVI to allocate a significant portion of its capital expenditure towards R&D and technology upgrades.

- Training Costs: The specialized training required for technicians to service advanced automation and IoT features can add an estimated 5-10% to operational training budgets annually.

Changes in Regulatory Environment and Compliance Costs

The regulatory landscape for commercial laundry operations is continuously evolving, presenting significant challenges for EVI Industries. Stricter environmental standards, particularly concerning water usage, energy consumption, and waste management, are becoming more prevalent. For instance, by 2024, several US states have implemented or proposed enhanced regulations on wastewater discharge, potentially increasing operational expenses for laundries by 5-10% if upgrades are needed.

These evolving regulations translate directly into increased compliance costs for EVI and its clientele. Companies may need to invest in new, more efficient machinery or modify existing processes to meet these updated environmental benchmarks. This could involve substantial capital expenditures, impacting both EVI's product development focus and its customers' purchasing power. For example, a new high-efficiency washer might cost 15-20% more upfront than older models, a factor that could influence customer decisions in a competitive market.

- Increased Compliance Burden: Evolving environmental regulations, such as stricter water and energy efficiency standards, are likely to raise operational costs for commercial laundries.

- Equipment Upgrade Necessity: Meeting new environmental mandates may require costly investments in advanced machinery, impacting profitability.

- Customer Purchasing Decisions: Higher operational costs due to compliance could influence customer decisions, potentially affecting EVI's sales volume.

- Potential for Fines: Non-compliance with new regulations could result in significant penalties, further straining financial resources.

Intense competition within the commercial laundry sector, particularly in mature markets, poses a threat to EVI Industries by potentially driving down prices and limiting market share growth. Economic downturns are also a concern, as reduced capital spending by clients in hospitality and healthcare could decrease sales of new equipment and service contracts. Furthermore, EVI faces supply chain vulnerabilities due to reliance on manufacturers for parts, with disruptions potentially increasing costs and delaying deliveries.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from EVI Industries' official financial statements, comprehensive market research reports, and insights from industry experts. This multi-faceted approach ensures a thorough and accurate assessment of the company's strategic position.