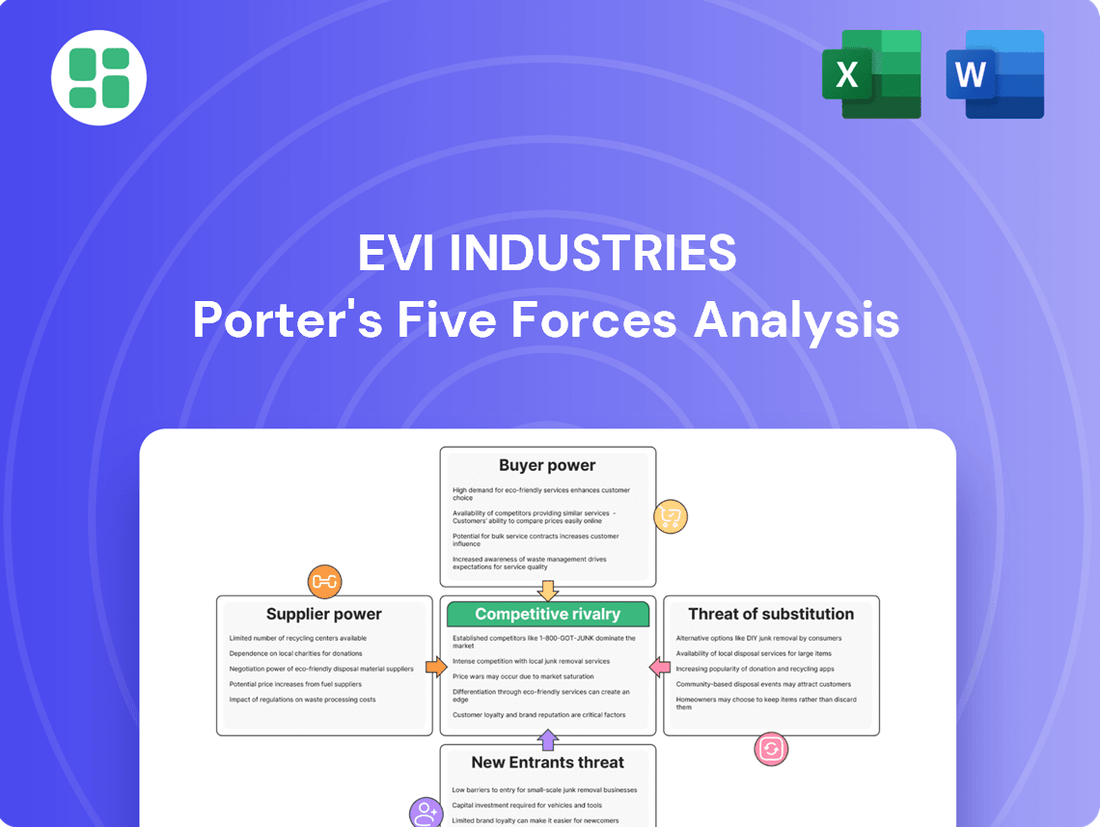

EVI Industries Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EVI Industries Bundle

EVI Industries faces a dynamic competitive landscape, with moderate threat from new entrants and significant bargaining power from buyers. Understanding these forces is crucial for navigating its market.

The complete report reveals the real forces shaping EVI Industries’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

EVI Industries faces a considerable challenge due to its reliance on a small number of key manufacturers for its commercial laundry and dry cleaning equipment. This supplier concentration means these few companies hold significant sway.

In fiscal year 2024, a striking 73% of EVI Industries' product purchases came from just four manufacturers. This high percentage underscores the substantial bargaining power these suppliers possess, as EVI Industries is heavily dependent on them for its core product offerings.

The commercial laundry sector's reliance on specialized, high-tech equipment, like advanced sanitization washers, significantly bolsters supplier bargaining power. Manufacturers of this sophisticated machinery, often a limited group, dictate terms due to their control over essential operational technology.

EVI Industries faces significant supplier bargaining power due to high switching costs. Changing core equipment manufacturers involves substantial investment in new technical integration and potentially disrupts established relationships. For instance, in 2024, the average cost for a manufacturing firm to switch its primary ERP system, which often dictates core equipment compatibility, was estimated to be upwards of $150,000, not including the equipment itself.

These considerable expenses, coupled with the imperative to maintain a consistent product offering for its varied clientele, solidify EVI's reliance on current suppliers. Building new supplier relationships and reconfiguring supply chains from scratch represents a time-intensive and costly endeavor, further tilting the scales in favor of existing equipment providers.

Brand Reputation of Manufacturers

The commercial laundry equipment market boasts strong brand names such as Speed Queen, Maytag, Electrolux, and Dexter Laundry. These manufacturers are highly regarded for their equipment's reliability and performance, which directly influences customer purchasing decisions.

EVI Industries, as a distributor for many of these prominent brands, finds that their established reputations can bolster supplier power. When customers seek out specific, trusted brands, EVI's reliance on these manufacturers increases, potentially giving those suppliers more leverage in negotiations.

- Brand Recognition: Well-known brands like Speed Queen and Dexter Laundry command customer loyalty.

- Perceived Quality: A reputation for reliability and performance translates to higher perceived value.

- Distribution Dependence: EVI's business model relies on access to these established brands.

- Customer Attraction: Strong manufacturer brands help EVI attract and retain its customer base.

EVI's Mitigation Strategies

EVI Industries views its strong supplier relationships as a key competitive edge, crucial for ongoing expansion. By nurturing these connections, EVI actively works to lessen the impact of suppliers wielding significant bargaining power, thereby securing a consistent flow of necessary materials.

These cultivated relationships are designed to ensure favorable terms and reliable product availability, directly supporting EVI's operational stability and growth objectives.

- Supplier Relationship Management: EVI prioritizes building and maintaining robust partnerships with its suppliers.

- Mitigation of Bargaining Power: Proactive engagement aims to counter potential price hikes or supply disruptions from powerful suppliers.

- Securing Essential Products: Strong ties help guarantee the steady availability of critical components and raw materials needed for EVI's operations.

EVI Industries faces significant supplier bargaining power, with 73% of its 2024 product purchases originating from just four manufacturers. This concentration, coupled with high switching costs estimated at over $150,000 for ERP system integration alone in 2024, makes it difficult for EVI to change suppliers. The strong brand recognition of manufacturers like Speed Queen and Dexter Laundry further enhances their leverage, as EVI's business model depends on access to these sought-after brands to attract customers.

| Metric | Value (FY 2024) | Impact on Supplier Power |

| Supplier Concentration (Top 4 Manufacturers) | 73% of Purchases | High |

| Estimated ERP Switching Cost (2024) | >$150,000 | High |

| Key Supplier Brands | Speed Queen, Maytag, Electrolux, Dexter Laundry | High |

What is included in the product

This analysis delves into the competitive forces impacting EVI Industries, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its industry.

EVI Industries' Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive forces, perfect for quick, informed strategic decision-making.

Customers Bargaining Power

EVI Industries' diverse customer base, numbering around 55,000 across North America, inherently limits the bargaining power of any single customer. This broad spectrum includes industrial laundries, textile rental firms, and entities within hospitality, healthcare, and government.

The sheer volume and variety of customers, from those purchasing small components to those investing in entire systems, prevent any one buyer from significantly dictating terms or prices. This fragmentation means EVI Industries is not overly reliant on any particular customer segment, strengthening its position.

For sectors like hospitality and healthcare, high-efficiency laundry systems are intensely valued for hygiene, sanitation, and operational efficiency. This critical need for reliable equipment and consistent service significantly reduces customers' willingness to switch providers purely on price, as downtime or poor performance can incur substantial operational and reputational costs. For instance, a single day of laundry service disruption in a major hotel could lead to significant guest dissatisfaction and lost revenue, making dependable performance paramount.

EVI Industries' customers exhibit varying degrees of bargaining power, particularly those who purchase in large volumes. Major industrial and institutional clients, for instance, can leverage their significant order sizes to negotiate better pricing and more favorable contract terms. This is especially true when they commit to substantial equipment purchases or long-term service agreements, giving them considerable influence over EVI's pricing and service delivery.

Demand for Energy Efficiency and Advanced Features

Customers are increasingly seeking laundry equipment that is not only energy-efficient but also incorporates advanced features. This trend is driven by a desire for lower operating costs and enhanced convenience. For instance, in 2024, the global market for smart home appliances, which includes connected laundry solutions, was projected to reach over $100 billion, indicating a strong consumer appetite for innovation.

EVI Industries can leverage its capacity to deliver these sought-after innovations to mitigate customer bargaining power. By offering differentiated value through smart technology integration, such as remote monitoring and diagnostics, EVI can create a competitive advantage that transcends mere price considerations. This focus on advanced functionality helps EVI retain customers who value performance and efficiency.

- Growing Demand for Sustainability: Consumers and businesses alike are prioritizing eco-friendly options, pushing manufacturers to develop more energy-efficient appliances.

- Rise of Smart Technology: Features like app control, real-time performance monitoring, and predictive maintenance are becoming key differentiators in the laundry sector.

- EVI's Innovation Strategy: By investing in R&D for energy-saving technologies and smart connectivity, EVI can command higher prices and reduce price sensitivity among its customer base.

Availability of Distribution Channels

The availability of diverse distribution channels significantly influences customer bargaining power. Customers can bypass EVI Industries by sourcing products directly from manufacturers or through alternative regional distributors.

This accessibility to various channels, including indirect ones, grants customers leverage. For instance, in the industrial equipment sector, a significant portion of sales can occur through direct manufacturer relationships, reducing reliance on intermediaries like EVI.

- Direct Sales: Manufacturers often offer direct sales channels, cutting out the distributor.

- Regional Distributors: The presence of numerous regional distributors provides customers with alternative purchasing options.

- Online Marketplaces: The growth of B2B e-commerce platforms provides another avenue for customers to compare prices and source products, potentially diminishing EVI's pricing power.

- EVI's Differentiation: While these channels exist, EVI Industries aims to mitigate this power through its comprehensive service offerings, including technical support and after-sales service, which may not be readily available from all alternative sources.

EVI Industries' diverse customer base, exceeding 55,000 across North America, inherently limits the bargaining power of individual clients. The company serves a wide array of sectors, including industrial laundries, textile rental firms, hospitality, healthcare, and government.

This broad customer spectrum, from small component buyers to large system purchasers, prevents any single entity from dictating terms. The critical need for reliable, high-efficiency laundry systems in sectors like healthcare and hospitality, where downtime impacts hygiene and guest satisfaction, reduces price sensitivity. For example, a laundry service disruption in a major hotel can lead to significant revenue loss, making dependable performance a priority over marginal cost savings.

While large industrial and institutional clients can leverage their order volume to negotiate better terms, EVI Industries counters this by offering differentiated value through innovation. The increasing demand for energy-efficient and smart technology, exemplified by the projected over $100 billion global market for smart home appliances in 2024, allows EVI to command higher prices and reduce customer price sensitivity by focusing on performance and advanced functionality.

The presence of alternative distribution channels, including direct manufacturer sales and regional distributors, does provide customers with leverage. However, EVI Industries mitigates this by offering comprehensive service, technical support, and after-sales service, which may not be consistently available through other sourcing methods.

| Customer Segment | Influence on EVI | Mitigation Strategy by EVI |

|---|---|---|

| Large Industrial/Institutional Clients | High (due to volume) | Value-added services, innovation |

| Hospitality/Healthcare | Moderate (due to critical need for reliability) | Focus on performance, uptime guarantees |

| General Customer Base | Low (due to fragmentation) | Broad product offering, accessibility |

Preview the Actual Deliverable

EVI Industries Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. Our EVI Industries Porter's Five Forces Analysis meticulously details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This comprehensive report provides actionable insights to understand and navigate EVI Industries' strategic positioning.

Rivalry Among Competitors

EVI Industries operates within a highly competitive and fragmented commercial and industrial laundry sector throughout North America. This intense rivalry stems from the presence of numerous private and regional competitors, even though EVI is the sole publicly traded distributor in this space.

The North American commercial laundry machines market, valued at USD 1.1 billion in 2024, is projected to expand at a 5.2% CAGR through 2034. This robust growth, fueled by demand from the hospitality and healthcare industries, naturally intensifies competitive rivalry.

Companies like EVI Industries are actively engaged in this dynamic environment, where differentiation hinges on technological advancements and a commitment to sustainability. The attractive market growth encourages new entrants and existing players to invest heavily in innovation to capture a larger share.

EVI Industries aggressively pursues a buy-and-build strategy, evidenced by its completion of 31 acquisitions within the commercial laundry distribution and service sector. This strategy significantly expands its market share and geographic reach.

The consolidation driven by EVI's approach intensifies rivalry by creating larger, more powerful competitors. This heightened competition raises the barriers for smaller companies relying solely on organic growth.

Product and Service Differentiation

Competitive rivalry in the commercial laundry equipment sector, including EVI Industries, extends beyond mere pricing. It's heavily influenced by the comprehensiveness of product offerings, the quality of technical services, and the reliability of post-installation support. Companies that can offer a complete package often gain a significant edge.

EVI Industries actively seeks to differentiate itself by providing integrated solutions. This approach encompasses not only the sale of equipment but also crucial services like installation, ongoing maintenance, readily available spare parts, and even laundry operational services. This holistic strategy aims to capture customer loyalty and create a sticky ecosystem.

The company's extensive sales and service network is a key component of its differentiation strategy. This network ensures prompt support and maintenance, which is critical for businesses relying on continuous laundry operations. For instance, in 2024, EVI Industries reported a robust service infrastructure designed to minimize downtime for its clients.

- Product Breadth: EVI offers a wide range of commercial laundry equipment, from washers and dryers to specialized industrial machines.

- Technical Expertise: The company employs skilled technicians for installation, troubleshooting, and preventative maintenance.

- After-Sales Support: EVI provides ongoing support through parts availability and dedicated customer service channels.

- Ancillary Services: Laundry operational support and consulting are offered to enhance client efficiency.

Market Share Dynamics

EVI Industries faces intense competition, as evidenced by its market position. For the fiscal year ending June 30, 2024, EVI reported $354 million in revenue. This figure grew to $370 million for the trailing twelve months ending March 31, 2025, demonstrating positive growth. However, EVI ranks second in revenue among its top 10 competitors. This suggests that while EVI is a substantial entity, its rivals, on average, command higher revenues, intensifying the rivalry.

- EVI Industries' FYE June 30, 2024 Revenue: $354 million

- EVI Industries' TTM Revenue (ending March 31, 2025): $370 million

- EVI's Revenue Ranking: Second among its top 10 competitors

- Competitor Average Revenue: Higher than EVI's, indicating strong rivalry

EVI Industries operates in a fiercely competitive North American commercial laundry sector, characterized by numerous private and regional players. Despite EVI's status as the sole publicly traded distributor, its market share is challenged by competitors with higher average revenues, as indicated by EVI ranking second in revenue among its top 10 rivals. The market's robust growth, projected at a 5.2% CAGR through 2034, fuels this rivalry by attracting new entrants and encouraging existing ones to innovate.

EVI's strategic acquisitions, totaling 31 completed deals, aim to consolidate the market and create larger, more formidable competitors, thereby intensifying the competitive landscape for smaller, organically growing businesses. Differentiation in this sector hinges not just on pricing but critically on product breadth, technical expertise, and comprehensive after-sales support, including readily available spare parts and operational consulting.

EVI Industries reported revenue of $354 million for the fiscal year ending June 30, 2024, growing to $370 million for the trailing twelve months ending March 31, 2025. This growth underscores its active participation in a market where strong service infrastructure and integrated solutions are key differentiators for capturing and retaining customer loyalty.

| Metric | Value (FYE June 30, 2024) | Value (TTM ending March 31, 2025) | Competitive Context |

|---|---|---|---|

| EVI Industries Revenue | $354 million | $370 million | Positive growth, but ranks second in revenue among top 10 competitors. |

| Market Growth (CAGR 2024-2034) | 5.2% | 5.2% | Attractive growth fuels intense competition and innovation. |

| Acquisitions Completed | 31 | 31 | Strategy intensifies rivalry by creating larger competitors. |

SSubstitutes Threaten

The threat of substitutes for EVI Industries' commercial laundry solutions is amplified by the increasing viability of in-house laundry operations. Smaller businesses or those with inconsistent laundry needs might find it more economical to manage their washing and drying internally, especially with the growing effectiveness and declining costs of residential-grade appliances. This trend could reduce their reliance on professional distributors.

For instance, while specific data on EVI's market share isn't readily available, the broader appliance market saw significant growth. In 2024, the global home appliance market was projected to reach hundreds of billions of dollars, indicating a substantial base of readily available, albeit less robust, laundry equipment that could be repurposed or adopted for small-scale commercial use.

The threat of substitutes for EVI Industries' equipment offerings comes from full-service laundry providers. These companies allow businesses to outsource their laundry and dry cleaning needs entirely, eliminating the need for in-house equipment purchase and maintenance. This service model directly competes with EVI's core business by providing an alternative solution for laundry operations.

For instance, the global commercial laundry services market was valued at approximately $100 billion in 2023 and is projected to grow, indicating a significant existing and expanding market for these substitute services. Businesses opting for outsourcing avoid capital expenditures on machinery and ongoing operational costs like repairs and staffing, making it an attractive alternative for some.

Technological advancements are creating compelling substitutes for traditional laundry services. The emergence of smart, cashless laundromats, allowing remote monitoring and payment, presents a more convenient and potentially cheaper option for certain customers. These systems can reduce operational overhead for providers, making them an attractive alternative to owning and managing laundry equipment directly.

Specialized Cleaning Services

For EVI Industries, the threat of substitutes in specialized cleaning services is a significant consideration, particularly for niche markets. Businesses requiring the cleaning of delicate items like high-end uniforms, luxury draperies, or specialized technical textiles often bypass general commercial laundry equipment distributors and opt for specialized dry cleaners or niche cleaning solution providers. These specialized services possess tailored expertise and equipment designed for specific fabric types and care requirements that may not be a standard offering from broad-spectrum laundry equipment manufacturers.

The market for specialized cleaning is growing, driven by demand for premium garment care and specific industrial cleaning needs. For instance, the global dry cleaning market was valued at approximately USD 10.5 billion in 2023 and is projected to reach USD 13.2 billion by 2028, indicating a steady demand for these specialized services. This segment often prioritizes precision and fabric preservation over the volume-based approach typical of many commercial laundry operations.

- Niche Expertise: Specialized cleaning services focus on specific fabric types and cleaning methods, offering a higher degree of care for delicate or high-value items.

- Tailored Equipment: These providers invest in specialized machinery and chemicals suited for particular cleaning challenges, which general commercial laundry equipment may not address.

- Market Segmentation: The demand for specialized cleaning, such as for medical textiles or luxury apparel, represents a distinct market segment that EVI Industries might not fully capture with its standard commercial laundry solutions.

- Competitive Differentiation: The availability of highly specialized cleaning services acts as a substitute, potentially diverting customers who require more than just basic laundering from EVI Industries' offerings.

Rental or Leasing Models

The threat of substitutes for EVI Industries' equipment sales is amplified by the growing prevalence of rental and leasing models. Businesses, especially those prioritizing flexibility or facing capital constraints, can opt to rent or lease commercial laundry equipment. This bypasses the need for outright purchase, directly impacting EVI's core revenue stream from equipment sales.

For instance, many laundry service providers may find leasing more attractive due to predictable monthly costs and the inclusion of maintenance services. This model allows them to access the latest technology without the significant upfront investment typically associated with purchasing industrial-grade machinery. In 2024, the equipment leasing market continued its robust growth, with many commercial laundry operators leveraging these flexible financial arrangements.

- Rental and leasing models offer lower initial capital outlay compared to outright purchase.

- These alternatives often include maintenance and service contracts, reducing operational burdens.

- Businesses can adapt to changing technological needs more easily through leasing agreements.

- The availability of diverse rental and leasing packages presents a viable substitute for direct equipment acquisition.

The threat of substitutes for EVI Industries is considerable, stemming from both in-house solutions and service-based alternatives. The increasing capability and affordability of residential laundry equipment present a viable substitute for smaller businesses or those with less demanding laundry volumes, potentially reducing their need for professional commercial equipment. Furthermore, the robust growth of the global commercial laundry services market, valued at approximately $100 billion in 2023, signifies a strong alternative where businesses outsource their entire laundry operations, bypassing the need for equipment purchase and maintenance altogether.

| Substitute Type | Description | Impact on EVI Industries | Market Data Point (2023/2024) |

|---|---|---|---|

| In-house Laundry Operations | Utilizing advanced residential or smaller-scale commercial appliances for internal laundry needs. | Reduces demand for EVI's commercial equipment sales. | Global home appliance market projected to reach hundreds of billions in 2024. |

| Full-Service Laundry Providers | Outsourcing all laundry and dry cleaning requirements to specialized service companies. | Directly competes with EVI's equipment sales by offering a service alternative. | Global commercial laundry services market valued at ~$100 billion in 2023. |

| Specialized Cleaning Services | Niche providers focusing on delicate fabrics, luxury items, or technical textiles. | Diverts customers requiring specific care beyond standard commercial laundry. | Global dry cleaning market valued at ~$10.5 billion in 2023. |

| Rental and Leasing Models | Acquiring access to laundry equipment through flexible rental or leasing agreements. | Decreases EVI's direct equipment sales revenue by offering an alternative acquisition method. | Equipment leasing market shows continued robust growth in 2024. |

Entrants Threaten

The commercial laundry and dry cleaning equipment distribution and service sector demands significant upfront capital. New companies must invest heavily in acquiring a diverse inventory of commercial-grade washing machines, dryers, and specialized dry cleaning units, which can easily run into millions of dollars. For instance, a basic setup for a mid-sized distributor could require over $2 million just for initial equipment stock and warehousing.

Beyond inventory, establishing a comprehensive service network presents another substantial financial hurdle. This includes investing in qualified technicians, diagnostic tools, spare parts inventory, and mobile service vehicles. The ongoing costs of training, certifications, and maintaining this infrastructure further deter potential new entrants, requiring a robust financial backing to compete effectively.

EVI Industries' reliance on specialized technical expertise and an established service network presents a substantial barrier to new entrants. Developing a team of skilled technicians capable of complex installations, ongoing maintenance, and prompt repair is a significant hurdle. For instance, the average annual salary for a specialized industrial technician in 2024 hovered around $65,000, not including the extensive training and certification required.

EVI Industries benefits from long-standing and strong supplier relations with major equipment manufacturers. Some of these suppliers account for a significant portion of EVI's product purchases, giving EVI leverage. This makes it difficult for new entrants to secure favorable terms or access to a comprehensive portfolio of leading brands, thereby raising the barrier to entry.

Customer Trust and Brand Loyalty

EVI Industries' deep-seated customer trust and brand loyalty act as a significant deterrent to new entrants. The company emphasizes that its success stems from customers valuing trust, relationships, and expertise over mere brands. This hard-won trust, cultivated over many years with a broad customer base, creates a substantial hurdle for any newcomer aiming to penetrate the market.

New competitors face the challenge of replicating EVI's established reputation, which is built on consistent delivery of value and service. For instance, in 2024, EVI reported a customer retention rate of over 90%, a testament to the strength of these relationships. This high retention means fewer available customers for new players, forcing them to invest heavily in customer acquisition.

- Decades of trust-building: EVI's long history has allowed it to foster deep relationships.

- Customer value proposition: Focus on trust, relationships, and expertise resonates strongly.

- High retention rates: Over 90% customer retention in 2024 demonstrates loyalty.

- Barrier to entry: New entrants must overcome significant trust deficits to compete.

Consolidation and Acquisition Strategy

EVI Industries pursues an aggressive 'buy-and-build' strategy, acquiring market-leading businesses to consolidate a fragmented industry. This approach significantly raises the barrier to entry for new, organic competitors. By absorbing smaller, independent players, EVI increases the scale and competitive strength of its existing operations, making it harder for nascent businesses to gain traction.

This consolidation strategy effectively reduces the pool of attractive acquisition targets for potential new entrants. For instance, in 2023, EVI completed several key acquisitions, integrating businesses that previously represented potential independent competitors. This proactive market shaping limits opportunities for startups to enter by acquiring established, smaller entities.

- Aggressive Consolidation: EVI's 'buy-and-build' model actively merges market leaders, reducing fragmentation.

- Increased Scale: Acquisitions bolster EVI's size, creating a more formidable presence against new entrants.

- Reduced Acquisition Targets: The strategy diminishes the availability of smaller companies for new players to acquire and enter the market.

- Higher Entry Barriers: EVI's expanded scale and market share make it significantly more challenging for new, organic competitors to emerge.

The threat of new entrants for EVI Industries is moderate due to substantial capital requirements for inventory and service infrastructure, estimated at over $2 million for a basic setup. Additionally, EVI's established supplier relationships and strong customer loyalty, evidenced by a 2024 customer retention rate exceeding 90%, create significant hurdles for newcomers. The company's aggressive acquisition strategy further consolidates the market, making it harder for new businesses to gain a foothold.

| Barrier Type | Description | Impact on New Entrants | EVI's Advantage |

|---|---|---|---|

| Capital Requirements | High upfront investment for equipment inventory and service network. | Significant financial hurdle. | Established infrastructure and financing. |

| Technical Expertise | Need for skilled technicians and specialized training. | Difficult to replicate service capabilities. | Experienced workforce and ongoing training programs. |

| Supplier Relations | Securing favorable terms with major manufacturers. | Limited access to preferred brands and pricing. | Strong, long-standing supplier partnerships. |

| Customer Loyalty | Building trust and brand reputation. | Challenges in customer acquisition and retention. | High customer retention (over 90% in 2024) and established trust. |

| Industry Consolidation | EVI's 'buy-and-build' strategy. | Reduced opportunities for market entry via acquisition. | Increased scale and market share through acquisitions. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for EVI Industries is built upon a foundation of comprehensive data, including annual reports, industry-specific market research, and publicly available financial statements. We also leverage insights from trade publications and competitor news releases to capture the nuances of the competitive landscape.