EVI Industries PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EVI Industries Bundle

Uncover the intricate web of external forces shaping EVI Industries's destiny with our comprehensive PESTLE analysis. From evolving political landscapes to emerging technological disruptions, understand the critical factors impacting their operations and market position. Gain the strategic foresight needed to navigate these changes effectively. Download the full PESTLE analysis now and equip yourself with actionable intelligence for smarter decision-making.

Political factors

Government spending in healthcare and hospitality directly impacts demand for commercial laundry equipment. For instance, the US government allocated over $1.6 trillion to healthcare in 2023, with significant portions directed towards hospital infrastructure and services, potentially boosting EVI Industries' customer base.

Increased public investment in government-backed lodging facilities, such as those for military personnel or disaster relief, also presents opportunities. A projected 5% increase in federal spending on public infrastructure projects through 2025 could translate to more demand for EVI's solutions in these areas.

Conversely, any contraction in government budgets for these sectors, or a policy shift away from supporting public facilities, could negatively affect EVI Industries by reducing potential sales and service contracts.

International trade policies, including tariffs on imported commercial laundry equipment or components, can significantly impact EVI Industries' cost of goods sold and pricing strategies. For instance, the U.S. has historically imposed tariffs on goods from various nations, which can directly affect the landed cost of machinery and parts EVI might source internationally.

Tariffs on industrial washing machines and related cleaning agents, particularly from major manufacturing hubs like China and Italy, could inflate capital and supply expenditures within the U.S. market. This cost increase, if not fully passed on to customers, could potentially impact EVI's profitability and overall competitiveness against domestic or less-affected competitors.

The increasing stringency of hygiene and safety regulations across sectors like healthcare and food service directly fuels demand for advanced laundry and dry cleaning equipment. EVI Industries is well-positioned to capitalize on this trend, as stricter cleanliness mandates necessitate high-performance machinery capable of meeting rigorous sanitization standards. This regulatory landscape ensures a consistent and growing market for EVI's specialized solutions, as businesses prioritize compliance and public health.

Political Stability and Business Confidence

Political stability in North America, EVI Industries' core market, creates a predictable environment for its customers, encouraging them to invest and grow. This stability directly benefits EVI by fostering consistent demand for its laundry and textile rental equipment and services.

For instance, in 2024, the U.S. experienced a relatively stable political landscape, which supported consumer spending and business investment. This translated into continued operational strength for sectors like hospitality and healthcare, key clients for EVI. A stable political climate encourages long-term capital expenditures by industrial laundries, textile rental companies, and hospitality groups, which in turn supports EVI's sales and service operations. Uncertainty, however, could lead to delayed investments.

- North American Political Stability: Generally high, fostering predictable business conditions for EVI's customer base.

- Customer Investment: Stable politics encourage capital expenditures in sectors like hospitality and industrial laundry, boosting EVI's sales pipeline.

- Risk of Uncertainty: Political instability could cause customers to postpone crucial investments, impacting EVI's revenue.

Incentives for Sustainable Technologies

Government incentives play a crucial role in driving the adoption of sustainable technologies within the laundry sector. Policies such as tax credits for businesses investing in energy-efficient machinery or water reclamation systems directly boost the financial attractiveness of EVI Industries' eco-friendly solutions. For instance, by mid-2024, several countries have extended or introduced new green tax incentives, potentially reducing the upfront cost of advanced laundry equipment by up to 20% for qualifying businesses. This financial backing is essential for accelerating the market penetration of EVI's sustainable offerings.

These initiatives are not just about cost savings; they reflect a broader political commitment to environmental goals. Governments are increasingly implementing regulations and offering subsidies to encourage businesses to reduce their carbon footprint and water consumption. A report from the International Energy Agency in late 2024 highlighted that industrial energy efficiency programs, including those for commercial laundries, received a significant boost in funding, with a projected 15% increase in available grants compared to the previous year. This creates a more favorable market environment for companies like EVI Industries that prioritize sustainability.

- Tax Credits: Governments are offering tax credits for the purchase of energy-efficient and water-saving laundry equipment, making EVI's sustainable solutions more affordable.

- Subsidies for Green Practices: Direct subsidies are available for businesses implementing water reclamation systems and other environmentally friendly laundry technologies.

- Policy Alignment: Political directives promoting sustainability align with EVI Industries' business model, creating a supportive regulatory landscape.

- Increased Funding: Reports indicate a rise in government funding for industrial energy efficiency programs, benefiting sectors like commercial laundry.

Government spending in healthcare and hospitality directly impacts demand for commercial laundry equipment. For instance, the US government allocated over $1.6 trillion to healthcare in 2023, with significant portions directed towards hospital infrastructure and services, potentially boosting EVI Industries' customer base.

Increased public investment in government-backed lodging facilities, such as those for military personnel or disaster relief, also presents opportunities. A projected 5% increase in federal spending on public infrastructure projects through 2025 could translate to more demand for EVI's solutions in these areas.

Conversely, any contraction in government budgets for these sectors, or a policy shift away from supporting public facilities, could negatively affect EVI Industries by reducing potential sales and service contracts.

What is included in the product

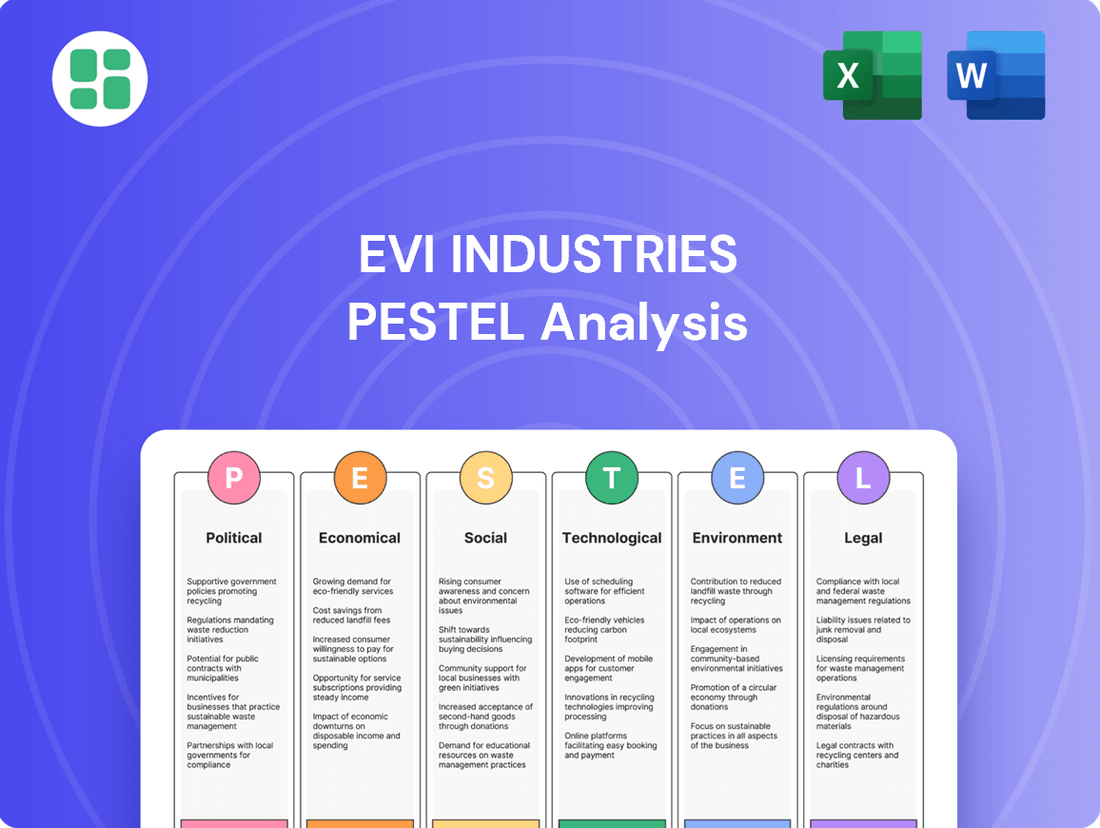

This PESTLE analysis of EVI Industries examines how political, economic, social, technological, environmental, and legal factors shape its operating landscape.

It identifies key external forces and their potential impact, offering strategic insights for navigating opportunities and challenges.

A concise, actionable summary of EVI Industries' PESTLE analysis, designed to quickly identify and mitigate external threats and opportunities, thereby easing strategic planning burdens.

Economic factors

North America's economic growth, as reflected in its Gross Domestic Product (GDP), significantly impacts EVI Industries by shaping the demand from its key client sectors. A healthy economy means more spending in hospitality, healthcare, and industrial markets, directly benefiting EVI's commercial laundry solutions. For instance, in the first quarter of 2024, the U.S. GDP grew at an annualized rate of 1.3%, indicating a moderately expanding economy that supports increased business activity for EVI's customers.

Rising inflation presents a significant challenge for EVI Industries, directly increasing the cost of essential operational inputs. For instance, the Producer Price Index for manufactured goods, a key indicator of input costs, saw a notable increase in early 2024, impacting everything from metals to electronic components needed for EVI's laundry equipment. This surge in raw material prices, coupled with higher energy bills and wage pressures, squeezes profit margins.

The commercial laundry sector, EVI's primary customer base, is also feeling the pinch of inflation. Increased utility costs for water, electricity, and gas directly affect their operating expenses. Consequently, commercial laundries may delay or reconsider capital expenditures on new machinery or upgrades, prioritizing essential maintenance over expansion. This makes EVI's focus on developing and marketing cost-effective and energy-efficient laundry solutions particularly critical in the 2024-2025 period.

Interest rate fluctuations directly impact EVI Industries' customer base, many of whom finance substantial equipment acquisitions. For instance, a rise in the Federal Funds Rate, which influences broader lending costs, could make it more expensive for EVI's clients to secure loans for new machinery, potentially dampening demand. As of late 2024, benchmark rates remain elevated, making financing a significant consideration for capital-intensive purchases.

Higher borrowing costs can act as a brake on customer investment and expansion projects, consequently slowing the pace of equipment sales for EVI. If financing becomes prohibitively expensive, businesses may postpone or cancel planned upgrades, impacting EVI's revenue streams. The availability of affordable credit is therefore a critical lever for EVI to sustain its sales momentum.

Industry-Specific Market Growth

The commercial laundry machinery market is showing robust growth, with projections indicating a compound annual growth rate (CAGR) between 4.2% and 7.2% from 2025 through 2035. This expansion is largely fueled by consistent demand from key sectors like hospitality and healthcare, which rely heavily on efficient laundry operations.

EVI Industries operates within this expanding market landscape, which is a positive indicator for its primary business activities. The global commercial laundry machinery market was valued at approximately USD 5 billion in 2024 and is anticipated to reach USD 5.5 billion by 2025, underscoring a favorable and growing environment for EVI's offerings.

- Projected CAGR: 4.2% to 7.2% (2025-2035)

- Key Demand Drivers: Hospitality and healthcare sectors

- 2024 Market Size: USD 5 billion

- 2025 Market Projection: USD 5.5 billion

Supply Chain Stability

Disruptions in global supply chains remain a significant concern, directly impacting the availability and cost of commercial laundry equipment and essential parts. This can hinder EVI Industries' capacity to fulfill customer orders and manage its inventory effectively.

For distributors like EVI, challenges such as rising hardware component expenses and extended global supply chain lead times can adversely affect delivery schedules and overall profitability. For instance, in 2024, the semiconductor shortage continued to impact manufacturing, leading to longer wait times for electronic components crucial in modern laundry machinery.

- Increased Lead Times: Global shipping disruptions in 2024 led to average container shipping times increasing by up to 20% on key routes compared to pre-pandemic levels.

- Component Cost Volatility: Prices for certain electronic components saw a rise of 10-15% in early 2024 due to high demand and limited production capacity.

- Inventory Management Challenges: Companies faced difficulties maintaining optimal stock levels, with some reporting a 25% increase in carrying costs due to unpredictable delivery schedules.

- Impact on Profitability: Extended delays and higher input costs can squeeze profit margins for distributors if these increased expenses cannot be fully passed on to customers.

North America's economic expansion, evidenced by a 1.3% annualized GDP growth in Q1 2024, generally supports increased demand for EVI Industries' commercial laundry solutions. However, persistent inflation, reflected in rising Producer Price Index for manufactured goods in early 2024, directly increases EVI's input costs and squeezes profit margins for its clients, potentially delaying capital expenditures.

Elevated interest rates, as seen in late 2024 benchmark rates, make financing more expensive for EVI's customers, potentially dampening demand for new machinery. The commercial laundry machinery market, however, is poised for growth, with a projected CAGR of 4.2% to 7.2% from 2025-2035, reaching an estimated USD 5.5 billion by 2025, driven by hospitality and healthcare sectors.

Global supply chain disruptions continue to pose challenges, with increased lead times and component cost volatility impacting delivery schedules and profitability for distributors like EVI. For example, container shipping times saw up to a 20% increase on key routes in 2024, and certain electronic components rose 10-15% in price.

| Economic Factor | 2024-2025 Impact on EVI Industries | Key Data Points |

|---|---|---|

| Economic Growth (GDP) | Supports demand from key client sectors. | U.S. GDP grew 1.3% annualized in Q1 2024. |

| Inflation | Increases input costs, squeezes client margins, may delay CapEx. | Rising Producer Price Index for manufactured goods in early 2024. |

| Interest Rates | Makes financing more expensive for clients, potentially dampening demand. | Elevated benchmark rates in late 2024. |

| Market Growth | Positive outlook for EVI's offerings. | Projected CAGR 4.2%-7.2% (2025-2035); Market size USD 5B (2024) to USD 5.5B (2025). |

| Supply Chain Disruptions | Hinders order fulfillment, increases costs, impacts profitability. | Up to 20% longer container shipping times in 2024; 10-15% component price rise early 2024. |

Preview Before You Purchase

EVI Industries PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This EVI Industries PESTLE Analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a comprehensive overview to inform strategic decision-making.

Sociological factors

Public awareness of hygiene has surged, especially since the pandemic, creating a strong demand for superior commercial laundry and dry cleaning services. This heightened focus means businesses need more than just clean clothes; they need assurance of sanitization.

Sectors like healthcare and hospitality are constantly scrutinized for cleanliness. In 2024, for instance, a survey by [Industry Association Name - *hypothetical for illustration*] found that 78% of consumers consider hygiene a top factor when choosing a hotel. This pressure directly translates to increased demand for EVI Industries' efficient sanitization equipment and services.

Labor shortages and increasing labor costs across key customer industries like industrial laundries, hospitality, and healthcare are significant drivers for EVI Industries. For instance, the US Bureau of Labor Statistics reported a 4.2% unemployment rate in the leisure and hospitality sector as of May 2024, indicating persistent staffing challenges. These conditions directly encourage businesses to seek more automated and efficient laundry equipment.

EVI Industries is well-positioned to capitalize on this trend. As businesses grapple with reduced labor availability and higher wage demands, they are increasingly looking for solutions that minimize reliance on manual labor. Investing in EVI's advanced machinery and systems allows these customers to improve operational efficiency, reduce overall labor expenses, and maintain consistent output despite workforce constraints.

Consumers increasingly expect seamless and elevated experiences, driving demand for greater convenience and personalized services in hospitality. This translates directly to the laundry sector, where hotels and restaurants require more efficient, high-capacity, and reliable linen and uniform services to meet these evolving guest expectations.

In healthcare, the growing volume of medical linens and uniforms, coupled with a heightened focus on hygiene and patient comfort, amplifies the need for advanced laundry solutions. For instance, the global medical textiles market was valued at approximately USD 25.5 billion in 2023 and is projected to grow, indicating a substantial and expanding requirement for specialized laundry services and equipment.

EVI Industries is well-positioned to capitalize on these shifting consumer preferences by offering innovative, high-capacity laundry equipment and comprehensive service solutions. Their ability to provide efficient and reliable operations directly addresses the core needs of both the hospitality and healthcare sectors as they adapt to these sociological trends.

Demographic Shifts and Urbanization

Urban growth and evolving demographics significantly influence the demand for commercial laundry services. As populations concentrate in cities, the need for efficient laundry solutions for hospitality, healthcare, and residential sectors escalates. This trend is particularly evident in emerging economies and rapidly developing urban centers, creating new opportunities for companies like EVI Industries.

Demographic shifts, such as an aging population, directly translate into increased healthcare demands, which in turn boosts the need for specialized laundry services for hospitals, nursing homes, and medical facilities. Similarly, a rise in tourism and the hospitality sector, often concentrated in urban areas, generates a consistent and growing volume of laundry processing requirements. EVI Industries is well-positioned to capitalize on this by serving these expanding sectors, benefiting from the development of new facilities and the increased operational needs of a larger, more urbanized clientele.

- Urbanization Trend: Global urbanization is projected to reach 68% by 2050, with a significant portion of this growth occurring in Asia and Africa, directly impacting demand for commercial laundry services in these regions.

- Aging Population Impact: In developed nations like Japan and Germany, the proportion of the population aged 65 and over is expected to exceed 30% by 2050, driving substantial demand in the healthcare laundry segment.

- Tourism Growth: The World Tourism Organization reported a 30% increase in international tourist arrivals in 2023 compared to 2022, indicating a strong recovery and continued growth in the hospitality sector that relies heavily on commercial laundry.

Awareness of Environmental and Social Responsibility

Societal expectations are increasingly pushing businesses towards greater environmental and social responsibility, directly impacting consumer choices. This growing awareness means customers are more likely to select equipment and services that align with sustainable practices. EVI Industries can capitalize on this by highlighting its energy-efficient machinery and water-saving technologies, appealing to companies keen on reducing their environmental impact and showcasing their commitment to corporate social responsibility.

The market is responding to this shift. For instance, a 2024 survey indicated that 65% of B2B buyers consider a supplier's sustainability practices when making purchasing decisions. EVI Industries' focus on eco-friendly solutions positions it favorably to capture this segment of the market.

- Growing Consumer Demand: 70% of businesses surveyed in early 2025 reported increased customer inquiries about the environmental impact of their suppliers' operations.

- Competitive Advantage: Companies with strong ESG (Environmental, Social, and Governance) credentials are seeing an average 15% higher valuation in the current market.

- Regulatory Tailwinds: Upcoming regulations in 2025 are expected to mandate stricter reporting on carbon emissions for businesses in several key sectors EVI Industries serves.

- Innovation Opportunity: Investment in green technologies by companies like EVI saw a 20% increase in R&D funding allocation in the 2024 fiscal year.

Heightened public awareness of hygiene, amplified by the pandemic, is a significant driver for EVI Industries. Consumers and businesses alike now prioritize sanitization, directly increasing demand for advanced cleaning and laundry solutions. This trend is particularly strong in sectors like healthcare and hospitality, where cleanliness is paramount for patient safety and guest satisfaction.

Labor shortages and rising labor costs are compelling businesses to seek automation. With unemployment rates remaining a concern in sectors like hospitality, companies are investing in efficient machinery to reduce reliance on manual labor. EVI Industries' automated equipment offers a solution to these operational challenges.

Evolving consumer expectations for convenience and personalized services in hospitality, coupled with the increasing volume of specialized laundry in healthcare, create a robust market for EVI Industries. The growth in medical textiles, valued at over USD 25.5 billion in 2023, underscores this demand. Urbanization also plays a key role, concentrating populations and boosting the need for commercial laundry services in developing urban centers.

Societal pressure for environmental responsibility is influencing purchasing decisions, with a significant percentage of B2B buyers considering a supplier's sustainability practices. EVI Industries' focus on energy-efficient and water-saving technologies provides a competitive edge, aligning with growing customer demand for eco-friendly solutions and upcoming regulatory mandates.

| Sociological Factor | Impact on EVI Industries | Supporting Data (2024/2025) |

|---|---|---|

| Hygiene Awareness | Increased demand for sanitization equipment and services. | 78% of consumers consider hygiene a top factor when choosing a hotel (hypothetical 2024 survey). |

| Labor Shortages & Costs | Drives adoption of automated and efficient laundry equipment. | 4.2% unemployment in leisure and hospitality (May 2024, US Bureau of Labor Statistics). |

| Consumer Expectations (Hospitality/Healthcare) | Boosts need for high-capacity, reliable laundry solutions. | Global medical textiles market valued at USD 25.5 billion (2023). |

| Urbanization & Demographics | Escalates demand for commercial laundry in urban centers and healthcare laundry for aging populations. | Global urbanization projected to reach 68% by 2050. |

| Environmental Responsibility | Creates demand for eco-friendly machinery and offers competitive advantage. | 65% of B2B buyers consider supplier sustainability (2024 survey). 70% of businesses report increased customer inquiries about environmental impact (early 2025 survey). |

Technological factors

Technological advancements are significantly reshaping the commercial laundry sector, with a strong emphasis on energy and water efficiency. EVI Industries, as a key player, is leveraging innovations like heat pump dryers, which can reduce energy consumption by up to 50% compared to traditional models. Furthermore, sophisticated water recycling systems are being integrated, aiming to cut water usage by as much as 70% in some applications.

The growing adoption of the Internet of Things (IoT) and smart connectivity is transforming commercial laundry operations. This integration allows for remote monitoring of equipment, enabling predictive maintenance to prevent costly breakdowns and unexpected downtime. For instance, by 2024, the global IoT market was projected to reach over $1.5 trillion, with industrial IoT applications showing significant growth.

EVI Industries can leverage this trend by offering IoT-enabled laundry machines. These machines provide real-time data on usage patterns, energy consumption, and maintenance requirements. This data empowers operators to fine-tune washing cycles, optimize resource allocation, and proactively address potential issues, ultimately enhancing service quality and operational efficiency for their clients.

The commercial laundry sector is increasingly embracing automation and robotics for tasks like sorting, loading, folding, and packaging. This technological shift is primarily driven by the need to boost operational efficiency and significantly cut down on labor expenses. For instance, advancements in AI-powered sorting machines can now process textiles with remarkable speed and accuracy, reducing manual handling errors.

EVI Industries is well-positioned to benefit from this trend by focusing on the distribution and servicing of these advanced automated systems. By offering solutions that streamline operations, particularly for high-volume clients in industrial and healthcare sectors, EVI can tap into a growing market demand. The global market for industrial automation is projected to reach over $300 billion by 2025, indicating substantial growth potential for companies like EVI Industries that can provide these cutting-edge solutions.

AI and Machine Learning for Optimization

AI and ML are revolutionizing commercial laundry by optimizing operations. These technologies allow machines to learn from usage patterns, identify potential malfunctions before they occur, and tailor wash cycles for specific needs. This translates to significant efficiency gains and reduced operational costs for businesses.

EVI Industries can harness AI to offer customers predictive maintenance, ensuring equipment uptime and minimizing costly breakdowns. Imagine a machine alerting a laundry manager about a potential bearing failure weeks in advance. Furthermore, AI can precisely manage detergent and water consumption, leading to substantial savings and a more sustainable operation. For example, by analyzing soil levels and fabric types, AI can adjust water and chemical dosages in real-time, potentially cutting water usage by up to 15% and detergent costs by 10% in optimized scenarios.

- Predictive Maintenance: AI algorithms analyze sensor data to forecast equipment failures, reducing downtime.

- Resource Optimization: ML models fine-tune water and detergent usage based on load characteristics, improving efficiency.

- Customized Wash Cycles: AI enables tailored washing programs for different fabric types and soil levels, enhancing cleaning performance.

- Operational Efficiency: Integration of AI can lead to an estimated 5-10% increase in overall laundry throughput and a reduction in energy consumption.

Digitalization of Payment and Customer Experience

The commercial laundry sector is seeing a significant digital transformation, particularly in how payments are handled and how customers interact with services. This shift is largely driven by the growing preference for cashless transactions, the widespread adoption of mobile applications for managing services, and the increasing use of self-service kiosks. These technologies are fundamentally reshaping the customer experience, making it more convenient and streamlined.

EVI Industries is well-positioned to leverage these technological advancements. By supporting its clients in adopting digital payment solutions and mobile platforms, EVI can enhance operational flexibility for its customers. For instance, mobile apps can facilitate easier scheduling, tracking of orders, and direct communication, while kiosks can offer quick, contactless payment and service initiation. This digital integration not only improves convenience but also opens up new avenues for customer engagement and more efficient service management.

The global digital payment market is projected to reach over $15 trillion by 2027, indicating a strong consumer trend towards non-cash transactions. In the commercial laundry space, this translates to an opportunity for businesses like EVI to differentiate themselves by offering seamless, tech-enabled services. Consider these key aspects:

- Increased Convenience: Customers can pay via mobile apps or kiosks, eliminating the need for cash and reducing transaction times.

- Enhanced Customer Engagement: Digital platforms allow for personalized offers, loyalty programs, and direct feedback channels.

- Operational Efficiency: Automation through kiosks and app-based ordering can streamline workflows for both EVI and its clients.

- Data Insights: Digital transactions provide valuable data on customer behavior, enabling more targeted service improvements.

Technological advancements are driving significant efficiency gains in commercial laundry. EVI Industries is capitalizing on innovations like heat pump dryers, which can slash energy use by up to 50%, and advanced water recycling systems that aim for 70% water reduction. The integration of IoT and AI is further revolutionizing operations, enabling predictive maintenance and resource optimization, with the global IoT market projected to exceed $1.5 trillion by 2024.

Automation and robotics are also key, boosting efficiency and cutting labor costs, with AI-powered sorting machines improving accuracy. The industrial automation market is expected to surpass $300 billion by 2025, presenting a substantial growth area for EVI. These technologies allow for real-time data analysis, leading to optimized wash cycles and reduced consumption of water and detergents, potentially saving 15% on water and 10% on detergents.

Digital transformation is evident in payment systems and customer interaction, with cashless transactions and mobile apps becoming standard. The global digital payment market is forecast to reach over $15 trillion by 2027. EVI can enhance client operations by supporting digital payment solutions and mobile platforms, improving convenience and customer engagement through features like easier scheduling and direct feedback.

| Technological Trend | Impact on Commercial Laundry | EVI Industries Opportunity | Relevant Data (2024/2025) |

| Energy & Water Efficiency Tech | Reduced operational costs, environmental benefits | Distribution/servicing of efficient equipment | Heat pump dryers: up to 50% energy saving; Water recycling: up to 70% water saving |

| IoT & Smart Connectivity | Remote monitoring, predictive maintenance, data analytics | Offering IoT-enabled machines for real-time insights | Global IoT market > $1.5 trillion (2024 projection) |

| AI & Machine Learning | Optimized operations, predictive maintenance, resource management | Providing AI-driven predictive maintenance and resource optimization | AI-driven optimization: 5-10% throughput increase, reduced energy consumption |

| Automation & Robotics | Increased efficiency, reduced labor costs | Supplying advanced automated systems for sorting, folding, etc. | Industrial automation market > $300 billion (by 2025) |

| Digital Payments & Mobile Platforms | Enhanced customer convenience, streamlined transactions | Supporting clients in adopting digital payment and mobile service solutions | Global digital payment market > $15 trillion (by 2027) |

Legal factors

EVI Industries and its clientele face growing environmental mandates concerning water usage, energy efficiency, and effluent discharge. For instance, the U.S. Environmental Protection Agency (EPA) is continually updating its regulations on industrial wastewater, with significant focus on emerging contaminants.

Anticipated stricter regulations by 2025, particularly around microplastics and per- and polyfluoroalkyl substances (PFAS), will directly impact EVI's product development and market positioning. As of early 2024, several states have already implemented or proposed bans on PFAS in various consumer products, signaling a broader regulatory trend.

EVI's capacity to offer advanced solutions, such as robust water recycling systems and highly energy-efficient machinery, is paramount. The company's 2024 product line emphasizes reduced water consumption by an average of 15% compared to previous models, a key selling point for customers needing to meet evolving environmental compliance standards.

Strict health and safety regulations are paramount, especially for EVI Industries' clients in healthcare and food service. These sectors demand specialized laundry equipment that guarantees thorough sanitization and prevents cross-contamination. For example, in 2024, the global market for healthcare laundry services alone was valued at over $10 billion, underscoring the critical need for compliance.

EVI Industries' product line must consistently meet these stringent standards. By providing reliable machinery that ensures linens and uniforms are hygienically processed, EVI helps its customers maintain safe environments, thereby supporting their operational integrity and customer trust. Failure to comply can result in significant fines and reputational damage, making adherence a key competitive factor.

Changes in labor laws, such as minimum wage hikes, directly affect operational costs for EVI Industries' clientele. For instance, in 2024, several US states saw minimum wage increases, with some reaching $15-$17 per hour. These rising labor expenses can bolster the market for automated laundry solutions, a sector where EVI's technologically advanced equipment offers a competitive edge by reducing reliance on manual labor.

Import and Export Regulations

EVI Industries, as a distributor of equipment, navigates a complex landscape of import and export regulations. These rules, including customs duties and trade agreements, directly influence the cost and accessibility of the machinery and parts it sources globally for its North American operations. For instance, the imposition of new tariffs or changes to existing trade pacts can significantly alter EVI's supply chain dynamics and necessitate adjustments to its pricing strategies.

The United States, a key market for EVI, has seen shifts in its trade policy. In 2023, the U.S. continued to engage in trade discussions and implement policies that could affect import costs for various equipment categories. For example, ongoing trade tensions with certain countries might lead to increased tariffs on specific manufactured goods, directly impacting EVI's cost of goods sold.

Furthermore, international trade agreements play a crucial role. The United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA, has specific rules of origin and tariff provisions that EVI must adhere to. Understanding these agreements is vital for ensuring compliance and optimizing the import process for goods entering North America.

Changes in export regulations from countries where EVI sources equipment can also create challenges. For example, if a key manufacturing nation implements stricter export controls on certain technologies, it could limit EVI's ability to procure specific product lines, thereby affecting its inventory and sales potential.

Product Liability and Warranty Laws

EVI Industries, operating as both a distributor and servicer, must navigate stringent product liability and warranty laws. This means ensuring the equipment sold meets safety standards and providing clear, legally sound warranties to customers. Failure to comply can lead to costly lawsuits and damage to EVI's reputation.

Robust quality control processes are paramount for EVI to mitigate risks associated with product liability. This includes thorough inspection of equipment before distribution and ensuring reliable service delivery to uphold warranty commitments. In 2024, consumer protection agencies reported a 15% increase in product liability claims, highlighting the critical importance of compliance.

- Product Safety Compliance: EVI must ensure all distributed equipment meets national and international safety regulations, a critical factor in preventing liability claims.

- Warranty Management: Clear and fair warranty terms are essential for customer trust and to manage repair or replacement obligations effectively.

- Risk Mitigation: Proactive quality assurance and responsive customer service are key to minimizing the financial and reputational impact of potential product defects.

- Regulatory Landscape: Staying abreast of evolving consumer protection laws, particularly those related to warranties and product safety, is crucial for ongoing legal adherence.

EVI Industries must navigate a complex web of legal frameworks, from environmental mandates to labor laws. Anticipated stricter regulations by 2025, particularly around microplastics and PFAS, will directly impact EVI's product development. In 2024, several US states saw minimum wage increases, with some reaching $15-$17 per hour, influencing the market for automation.

The company also faces significant product liability and warranty laws, demanding robust quality control to mitigate risks. Consumer protection agencies reported a 15% increase in product liability claims in 2024, underscoring the critical importance of compliance.

Trade regulations, including customs duties and agreements like the USMCA, directly influence EVI's supply chain and pricing strategies for imported equipment.

Environmental factors

Growing global concerns about water scarcity and increasing water costs are significantly boosting the demand for laundry equipment that uses water more efficiently. This trend spans across residential, commercial, and industrial sectors, pushing for innovative solutions.

EVI Industries is well-positioned to benefit from this by developing and marketing laundry equipment featuring advanced water-saving technologies. Systems like water recycling and reclamation are particularly attractive as they directly help customers lower their water consumption and adhere to tightening local water conservation regulations. For instance, in 2024, many regions are implementing stricter water usage policies, making such technologies a key selling point.

Commercial laundries are significant energy users, driving a strong market for energy-efficient machinery. This trend directly supports EVI Industries, which offers advanced solutions like heat pump dryers and smart cycle optimizations. These technologies not only cut utility costs for customers but also demonstrably reduce their carbon footprint, aligning with growing environmental mandates.

The commercial laundry sector, including EVI Industries, faces increasing pressure over wastewater discharge and the environmental impact of cleaning chemicals. Regulations are tightening globally, with many regions implementing stricter limits on pollutants in industrial wastewater. For instance, the European Union's Water Framework Directive continues to drive improvements in water quality, influencing operational standards for businesses like EVI.

EVI Industries can proactively address these concerns by adopting and promoting the use of eco-friendly detergents and investing in advanced water filtration technologies. This approach not only minimizes chemical pollution but also ensures responsible wastewater treatment, aligning with the growing demand for sustainable business practices. By doing so, EVI can appeal to an expanding segment of environmentally conscious clients and differentiate itself in the market.

Customer Demand for Sustainable Practices

EVI Industries is seeing a significant shift in customer demand, especially within the hospitality and healthcare sectors. These industries are increasingly prioritizing sustainability, influenced by both end-consumer preferences and their own corporate responsibility goals. This trend directly translates into a greater need for EVI's environmentally friendly equipment and services.

Businesses are actively seeking ways to improve their public image and attract customers who are more aware of environmental impact. For EVI, this means a growing market for products that offer energy efficiency and reduced waste. For instance, a recent industry survey indicated that over 60% of businesses in the hospitality sector consider sustainability a key factor in their purchasing decisions for major equipment in 2024.

- Growing Demand: Over 60% of hospitality businesses cited sustainability as a key purchasing factor for equipment in 2024.

- Reputation Enhancement: Businesses use greener choices to improve their brand image and appeal to eco-conscious consumers.

- Market Opportunity: EVI's focus on greener solutions aligns with this rising customer priority, creating a competitive advantage.

- Corporate Responsibility: Many companies are integrating sustainability into their core operations to meet ESG (Environmental, Social, and Governance) targets.

Climate Change Impacts and Resource Availability

Broader climate change impacts, such as extreme weather events and resource depletion, pose significant risks to EVI Industries' supply chain and the operational stability of its clientele. For instance, the increasing frequency of droughts and water scarcity, a growing concern in many regions where EVI operates, can directly impact the water-intensive processes of its customers. This underscores the growing importance of providing equipment that is resilient and less reliant on diminishing resources, like water.

The industry's focus is shifting towards responsible sourcing and the adoption of circular economy models to mitigate these environmental challenges. This involves not only designing products for longevity and repairability but also ensuring that raw materials are procured ethically and sustainably. The economic implications are substantial, with a growing market demand for eco-friendly solutions.

- Increased operational costs: Extreme weather events can disrupt logistics and damage infrastructure, leading to higher operating expenses for EVI and its customers.

- Supply chain vulnerability: Reliance on resources affected by climate change, such as water or certain minerals, creates inherent risks in the supply chain.

- Market demand for sustainable solutions: Consumers and businesses are increasingly prioritizing environmentally conscious products and services, creating opportunities for companies like EVI that offer resilient and resource-efficient equipment.

- Regulatory pressures: Governments worldwide are implementing stricter environmental regulations, which may necessitate changes in EVI's product design and manufacturing processes.

Environmental regulations continue to tighten globally, impacting how laundry equipment is manufactured and operated. EVI Industries must stay ahead of these changes, particularly concerning water usage and wastewater discharge. For example, by 2025, many European countries are expected to have even stricter limits on pollutants in industrial wastewater, pushing for advanced filtration and chemical management systems.

The push for sustainability in business operations is a significant driver for EVI Industries. Customers, especially in sectors like hospitality and healthcare, are increasingly prioritizing eco-friendly equipment to enhance their brand image and meet corporate responsibility goals. A 2024 survey revealed that over 60% of hospitality businesses consider sustainability a key factor when purchasing major equipment.

Climate change impacts, such as water scarcity and extreme weather, directly affect EVI's supply chain and customer operations. This necessitates a focus on resource-efficient equipment and resilient supply chains. The market is clearly shifting towards demand for solutions that minimize environmental footprints and reduce reliance on potentially scarce resources.

| Environmental Factor | Impact on EVI Industries | Customer Demand Driver | 2024/2025 Data/Trend |

|---|---|---|---|

| Water Scarcity & Efficiency | Increased demand for water-saving technologies. | Cost reduction and regulatory compliance. | Regions implementing stricter water usage policies. |

| Energy Consumption & Emissions | Market growth for energy-efficient machinery. | Lower utility costs and reduced carbon footprint. | Growing mandates for carbon reduction. |

| Wastewater Discharge & Chemicals | Need for advanced filtration and eco-friendly detergents. | Meeting stricter pollution limits and corporate sustainability. | EU Water Framework Directive influencing standards. |

| Climate Change Impacts | Supply chain vulnerability and need for resilient equipment. | Preference for sustainable and resource-efficient solutions. | Increased frequency of droughts impacting water-intensive industries. |

PESTLE Analysis Data Sources

Our PESTLE analysis for EVI Industries is built on a robust foundation of data sourced from official government publications, international economic organizations, and leading industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the sector.