Evergreen Marine Corp. (Taiwan) PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Evergreen Marine Corp. (Taiwan) Bundle

Evergreen Marine Corp. (Taiwan) operates within a dynamic global landscape shaped by political shifts, economic volatility, and evolving social expectations. Understanding these external forces is crucial for strategic planning and risk mitigation in the competitive shipping industry. Our PESTLE analysis dives deep into these critical factors, offering actionable intelligence.

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Evergreen Marine Corp. (Taiwan). Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Geopolitical instability, particularly the ongoing Red Sea crisis and heightened tensions in the Taiwan Strait, directly disrupts major shipping lanes. This forces companies like Evergreen to reroute, as seen with vessels diverting around the Cape of Good Hope, adding significant transit time and escalating fuel and operational expenses. For example, rerouting around Africa can add 10-14 days to a voyage compared to the Suez Canal.

Furthermore, persistent US-China trade friction, including potential tariffs on Chinese-built vessels, poses a threat to supply chain resilience. Such measures could inflate shipping costs and encourage businesses to seek more diversified sourcing and logistics strategies, impacting Evergreen's route planning and pricing.

Changes in government trade policies and the imposition of tariffs significantly impact Evergreen Marine Corp. For instance, the US tariffs on Chinese goods, which saw various rounds and adjustments throughout 2023 and into early 2024, directly influence cargo volumes and freight rates. This creates a dynamic environment where Evergreen must adapt its routes and services to navigate these shifts.

As a global carrier, Evergreen is particularly sensitive to fluctuating trade environments. Shifts in traditional shipping patterns, driven by policies like those seen with US-China trade tensions, can increase logistical complexities and require strategic adjustments to vessel deployment and capacity management. The ongoing evolution of these policies necessitates continuous monitoring and adaptation.

Furthermore, government trade policies can actively encourage trends such as 'friendshoring' or supply chain diversification. This movement, gaining traction in 2024 as nations seek to build more resilient supply chains, can lead to the development of new, albeit potentially smaller, trade lanes and a re-evaluation of established routes, impacting Evergreen's long-term strategic planning.

International maritime regulations, particularly from the International Maritime Organization (IMO) and the European Union, are increasingly shaping shipping operations. These frameworks, focusing on emissions, safety, and environmental protection, demand substantial investment and strategic adjustments from carriers like Evergreen Marine Corp. For instance, the IMO's Ballast Water Management Convention, fully effective since September 2017, requires all ships to manage their ballast water to prevent the transfer of invasive aquatic species, a significant operational and capital expenditure.

Evergreen must navigate these evolving global and regional legal landscapes to maintain operational integrity and market access. Failure to comply with standards such as the IMO's 2020 sulfur cap, which mandated a reduction in sulfur content in fuel oil to 0.5% m/m, could result in substantial fines and reputational damage. The ongoing development of the EU's Emissions Trading System (ETS) for shipping, set to include maritime transport from 2024, will further necessitate investments in greener technologies and operational efficiencies to manage carbon costs, with initial estimates suggesting significant compliance expenses for the sector.

Alliance Restructuring and Competition Policy

The shipping industry is in constant flux due to alliance restructuring. For instance, the dissolution of the 2M alliance (Maersk and MSC) in early 2025 signals a significant shift. Evergreen, as a member of the Ocean Alliance, will likely see its competitive positioning and operational strategies influenced by these broader industry realignments. This can affect everything from how ships are deployed to which routes are prioritized, impacting market share.

Global regulatory bodies are increasingly scrutinizing these large shipping alliances. Concerns about antitrust and fair competition mean that the flexibility and scope of cooperation within alliances are under review. This regulatory oversight can shape the terms of engagement for carriers like Evergreen, influencing their ability to collaborate on capacity and pricing.

- Ocean Alliance Membership: Evergreen remains a key member of the Ocean Alliance, alongside CMA CGM and COSCO.

- Market Share Impact: Shifts in major alliances, like the 2M dissolution, can redistribute market share and alter competitive dynamics on key trade lanes.

- Regulatory Scrutiny: Antitrust concerns are a constant factor, with regulators in regions like the EU and US monitoring alliance activities.

- Capacity Management: Alliance members coordinate vessel deployment, and changes in alliances can lead to adjustments in overall industry capacity.

Political Stability in Taiwan

Political stability in Taiwan is a critical factor for Evergreen Marine Corp. As a Taiwan-based entity, the company’s operations are intrinsically linked to the geopolitical landscape, particularly the relationship between Taiwan and mainland China. Any significant shifts in cross-strait relations can directly impact its business environment.

Escalating geopolitical tensions in the region pose a substantial risk. These tensions can disrupt global supply chains, affecting Evergreen’s shipping routes and the overall demand for its services. For instance, in early 2024, heightened military exercises by China around Taiwan led to temporary shipping diversions and increased insurance premiums for vessels operating in the area, impacting operational costs.

- Geopolitical Risk: Increased military activity or political disputes between Taiwan and China can lead to shipping disruptions and higher operational costs.

- Market Access: Political instability can affect Evergreen's access to key markets, especially those reliant on stable trade routes through the Taiwan Strait.

- Investment Climate: A volatile political environment can deter foreign and domestic investment, potentially limiting Evergreen's ability to fund expansion or upgrades.

Political factors significantly influence Evergreen Marine Corp.'s operations through trade policies and geopolitical stability. For example, US tariffs on Chinese goods, which saw adjustments throughout 2023 and into early 2024, directly impact cargo volumes and freight rates, requiring Evergreen to adapt its routes and services. Additionally, geopolitical instability, such as the Red Sea crisis in late 2023 and early 2024, forces rerouting, adding considerable transit time and costs, with diversions around Africa potentially adding 10-14 days to voyages.

What is included in the product

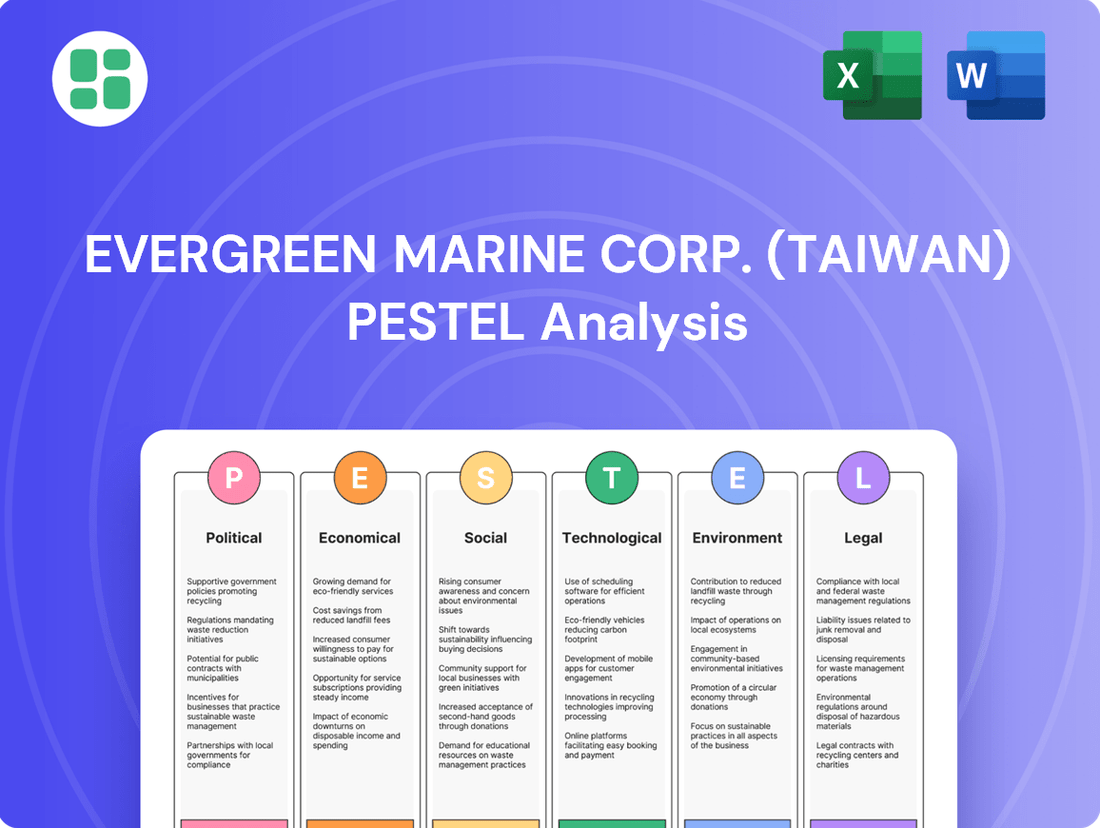

This PESTLE analysis of Evergreen Marine Corp. (Taiwan) examines the Political, Economic, Social, Technological, Environmental, and Legal forces shaping its operational landscape.

It provides a comprehensive understanding of external influences, offering strategic insights for navigating opportunities and mitigating risks within the global shipping industry.

This PESTLE analysis for Evergreen Marine Corp. (Taiwan) acts as a pain point reliever by providing a structured overview of external factors, enabling proactive strategy development and mitigating potential risks.

It offers a concise, easily digestible format perfect for quick alignment across teams and supports informed decision-making regarding market positioning and external challenges.

Economic factors

Global freight rates have been on a rollercoaster. The Red Sea crisis in late 2023 and early 2024 significantly boosted container shipping costs, with spot rates for major East-West trade lanes soaring. For instance, the Shanghai Containerized Freight Index (SCFI) saw substantial increases during this period.

This surge translated into strong profitability for companies like Evergreen Marine Corp. in 2024. However, the market is shifting. Projections for 2025 indicate a potential easing of freight rates as new vessel capacity comes online and demand growth remains moderate, creating a more balanced market dynamic.

Evergreen's financial performance is intrinsically linked to these freight rate fluctuations. The company's profitability in 2025 will heavily depend on its ability to navigate this evolving market equilibrium and manage the impact of increased supply against demand.

Fuel costs are a significant operational expense for Evergreen Marine Corp., directly influencing their profitability. Global oil price volatility, a persistent factor in 2024 and projected into 2025, directly impacts the cost of traditional bunker fuels, which remain a primary energy source for their fleet. For instance, crude oil prices have seen considerable swings, with Brent crude averaging around $80-$85 per barrel in early 2024, a key benchmark for bunker fuel costs.

The ongoing transition to alternative fuels presents a dual challenge for Evergreen. While crucial for environmental compliance and sustainability goals, these greener options often come with a price premium. Sourcing these fuels and developing the necessary infrastructure are also new cost considerations that will shape operational expenditures through 2025, potentially adding to the already volatile fuel expense landscape.

The global economic outlook significantly shapes Evergreen Marine Corp.'s operational volume. Forecasts suggest a moderate global GDP growth of around 2.7% for 2025, a figure that, while positive, could be constrained by lingering inflationary pressures and geopolitical uncertainties.

Consumer demand is a critical driver for shipping, as it dictates the flow of goods. However, potential headwinds such as persistent inflation impacting purchasing power and the imposition of increased import tariffs in major trading blocs like the European Union or the United States could dampen consumer spending and, consequently, reduce the demand for containerized freight.

Evergreen's financial performance is therefore closely tied to these macroeconomic trends. For instance, a slowdown in consumer spending in key markets, which account for a substantial portion of global trade, could directly translate into lower cargo volumes for Evergreen, impacting their revenue and profitability.

Supply Chain Disruptions and Resilience Investments

Ongoing supply chain challenges, including port congestion and container shortages, continue to affect shipping efficiency and costs for companies like Evergreen Marine Corp. For instance, the ongoing labor negotiations with the International Longshoremen's Association (ILA) in late 2024 could introduce further volatility and potential disruptions at key North American ports.

To navigate these persistent issues, Evergreen must prioritize investments in supply chain resilience. This includes strategies such as diversifying port calls and developing more flexible routing options to mitigate the impact of unforeseen delays and maintain service reliability.

- Port Congestion: Global port congestion remained a significant factor in 2024, with average vessel waiting times fluctuating but generally elevated compared to pre-pandemic levels.

- Container Availability: While the severe container shortages of 2021-2022 eased, imbalances and regional shortages still occurred throughout 2024, impacting Evergreen's operational fluidity.

- Labor Relations: The ILA's contract negotiations, set to conclude by September 30, 2024, represent a critical juncture for East Coast US ports, with potential for work stoppages impacting Evergreen's operations.

- Resilience Investment: Companies are increasing spending on supply chain visibility tools and alternative logistics providers, with global spending on supply chain management software projected to grow significantly in the coming years.

Investment in Fleet Capacity and Modernization

Evergreen Marine Corp. (Taiwan) is significantly investing in fleet capacity and modernization to stay competitive and meet evolving environmental standards. This includes the acquisition of new, larger vessels designed for greater fuel efficiency. For instance, Evergreen ordered six 24,000-TEU LNG dual-fuel container ships from Hanwha Ocean, a move that underscores their commitment to sustainability and operational excellence.

These substantial capital expenditures, while crucial for maintaining a modern and efficient fleet, directly influence Evergreen's financial leverage and future operational cost structures. The introduction of these advanced vessels aims to reduce fuel consumption and emissions, aligning with stricter global environmental regulations and enhancing their market position.

Key aspects of Evergreen's investment strategy include:

- Fleet Expansion: Acquiring larger capacity vessels to capitalize on economies of scale.

- Fuel Efficiency: Prioritizing LNG dual-fuel technology to lower operating costs and environmental impact.

- Modernization: Replacing older, less efficient ships with state-of-the-art tonnage.

- Financial Impact: Managing the significant capital outlay and its effect on debt and future expenses.

Global economic growth forecasts for 2025 point to a moderate expansion, around 2.7%, but this could be tempered by ongoing inflation and geopolitical tensions. Consumer demand, a key driver for shipping volumes, might face headwinds from reduced purchasing power due to persistent inflation and potential import tariffs in major economies.

Evergreen's profitability in 2025 will be closely watched as freight rates are expected to stabilize after the 2024 surge, influenced by new vessel capacity entering the market. Fuel costs remain a significant variable, with oil price volatility impacting bunker fuel expenses, while the adoption of pricier alternative fuels adds another layer of cost consideration.

Preview the Actual Deliverable

Evergreen Marine Corp. (Taiwan) PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Evergreen Marine Corp. (Taiwan) delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the global shipping industry. Understand the key drivers and challenges shaping Evergreen's strategic landscape.

Sociological factors

The maritime sector, including Evergreen Marine Corp., is grappling with evolving workforce dynamics. A significant concern is the potential for labor shortages, particularly for skilled seafarers and essential shore-based roles. This is compounded by an aging workforce in many developed nations, creating a need for robust recruitment and retention strategies.

Attracting and keeping talent is paramount for Evergreen's operational continuity. The industry must address fair remuneration and improve working conditions to compete for skilled labor. Furthermore, fostering diverse representation within the workforce is increasingly important for innovation and broader appeal. For instance, the International Chamber of Shipping (ICS) has highlighted the need for significant investment in training and development to meet future crewing demands, a challenge relevant to Evergreen's global operations.

Societal expectations for corporate social responsibility (CSR) are significantly shaping the shipping industry, with Evergreen Marine Corp. facing increased scrutiny regarding its environmental and social footprint. In 2024, for instance, the maritime sector is under pressure to decarbonize, with initiatives like the International Maritime Organization's (IMO) strategy aiming for net-zero emissions by or around 2050. Evergreen's proactive engagement in sustainable shipping, including investments in greener vessel technologies and robust crew welfare programs, directly addresses these evolving societal demands. This commitment not only bolsters its brand reputation but also appeals to a growing segment of environmentally and ethically conscious clients, a trend that is likely to intensify in 2025.

Consumers and businesses increasingly prioritize sustainability, driving demand for eco-friendly logistics. This shift influences cargo owners to select carriers demonstrating a commitment to greener practices, such as those using alternative fuels and reducing emissions. For instance, in 2024, a significant percentage of global consumers indicated they would pay more for products shipped via sustainable methods, directly impacting carrier selection.

Public Perception and Brand Image

Public perception and brand image are crucial for Evergreen Marine Corp. High-profile incidents, like the 2021 Suez Canal blockage involving the Ever Given, significantly damaged its global reputation, highlighting the vulnerability of its brand. This event led to widespread media scrutiny and public discussion about shipping safety and efficiency.

Maintaining a strong safety record is paramount. In 2023, the maritime industry, including companies like Evergreen, faced ongoing challenges related to piracy and security threats in key shipping lanes, which can indirectly influence public trust if incidents occur on their vessels. Evergreen's commitment to transparent communication and effective crisis management is vital for rebuilding and preserving stakeholder confidence.

The company's brand image is also shaped by its environmental, social, and governance (ESG) performance. As of early 2024, there's increasing public and investor demand for sustainable shipping practices. Evergreen's efforts in reducing emissions and improving working conditions directly influence how it is perceived by consumers and business partners.

- Suez Canal Blockage Impact: The 2021 Ever Given incident caused an estimated $9.6 billion in lost trade daily, directly impacting Evergreen's operational visibility and public image.

- Safety and Security Focus: In 2023, the Red Sea shipping disruptions underscored the critical need for robust security protocols, which are a key factor in public perception of reliability.

- ESG Expectations: Public and investor pressure for greener shipping solutions continues to grow, making Evergreen's sustainability initiatives a significant component of its brand image in 2024.

Health and Safety Standards for Seafarers

Maintaining robust health and safety standards for seafarers is a critical sociological imperative for Evergreen Marine Corp. The demanding nature of seafaring necessitates a strong focus on crew well-being to foster a motivated and stable workforce, thereby reducing the likelihood of accidents and labor conflicts.

Adherence to international labor regulations, such as those set by the International Labour Organization (ILO) Maritime Labour Convention, 2006 (MLC, 2006), is fundamental. This convention, which came into force in 2013 and has been ratified by over 100 countries, sets minimum standards for seafarers' working and living conditions.

- MLC, 2006 Coverage: Over 1.2 million seafarers are covered by the MLC, 2006, ensuring basic rights and protections.

- Accident Reduction: Investing in safety training and equipment can significantly reduce the estimated 2,000 maritime accidents annually.

- Crew Retention: Companies prioritizing seafarer welfare often see higher crew retention rates, a key factor in operational efficiency.

- Reputational Impact: Strong safety records enhance Evergreen's reputation, attracting both talent and business partners.

Societal expectations increasingly demand ethical and sustainable business practices from companies like Evergreen Marine Corp. This includes a strong focus on crew welfare, as highlighted by the International Labour Organization's Maritime Labour Convention, 2006, which ensures basic rights for over 1.2 million seafarers. Furthermore, public perception, significantly impacted by events like the 2021 Ever Given incident which cost an estimated $9.6 billion daily in lost trade, underscores the importance of safety and transparency for Evergreen's brand image in 2024 and beyond.

The growing consumer and business preference for eco-friendly logistics is a major sociological driver. In 2024, a notable percentage of global consumers indicated a willingness to pay more for sustainably shipped goods, directly influencing carrier selection and pressuring companies like Evergreen to invest in greener technologies and practices to meet these evolving demands.

Attracting and retaining a skilled workforce is a critical challenge, exacerbated by an aging maritime workforce in many developed nations. Evergreen must prioritize competitive remuneration and improved working conditions to secure talent, a move supported by industry bodies like the International Chamber of Shipping, which emphasizes the need for significant training investments to address future crewing needs.

| Sociological Factor | Impact on Evergreen Marine Corp. | Supporting Data/Trends (2023-2025) |

| Crew Welfare & Labor Standards | Ensuring fair working conditions and adherence to international labor laws is crucial for workforce stability and operational efficiency. | MLC, 2006 covers over 1.2 million seafarers. Companies prioritizing welfare see higher crew retention rates. |

| Public Perception & Brand Image | High-profile incidents and ESG performance significantly influence public trust and business partnerships. | Ever Given blockage (2021) caused estimated $9.6 billion daily trade loss. Growing ESG pressure in 2024 for sustainable shipping. |

| Consumer & Business Sustainability Preferences | Demand for eco-friendly logistics drives carrier choice, pushing for greener operational practices. | Significant consumer willingness in 2024 to pay more for sustainably shipped products. |

| Workforce Dynamics & Talent Acquisition | Addressing potential labor shortages and attracting skilled personnel is vital for operational continuity. | Aging maritime workforce in developed nations necessitates enhanced recruitment and retention strategies. |

Technological factors

Evergreen Marine Corp. is actively embracing digital transformation, a critical technological factor in the maritime sector. The company is exploring and implementing technologies like the Internet of Things (IoT), Artificial Intelligence (AI), and blockchain to modernize its operations.

AI integration offers significant potential for Evergreen, particularly in optimizing voyages, predicting equipment maintenance needs, enhancing cargo visibility, and refining route planning. These advancements are projected to boost operational efficiency and curb fuel expenses.

The development of smart ports, powered by IoT and 5G technology, is also a key technological trend. These smart ports are designed to streamline logistics processes and reduce vessel turnaround times, which directly benefits Evergreen's supply chain.

Advancements in automation, including semi-autonomous vessels and automated port operations, are significantly reshaping maritime logistics. These technologies promise to streamline operations and increase efficiency across the industry.

While fully autonomous vessels are still some years away, Evergreen Marine Corp. can leverage current automation for tangible benefits. For instance, automated mooring systems and AI-assisted berthing can reduce the risk of human error, leading to more precise and safer vessel movements in ports.

Remote monitoring capabilities further enhance operational oversight, allowing for proactive management and quicker responses to potential issues. This focus on automation is crucial for maintaining a competitive edge in the evolving shipping landscape, aiming to boost operational precision and overall safety.

The global push for decarbonization is rapidly advancing the development and adoption of alternative fuels, including Liquefied Natural Gas (LNG), methanol, ammonia, and even emerging options like hydrogen and nuclear power.

Evergreen Marine Corp. is strategically investing in LNG dual-fuel ships, a clear indication of its commitment to cleaner energy sources. However, the widespread availability, fluctuating costs, and the necessary bunkering infrastructure for these novel fuels present significant challenges that will shape their future adoption.

Cybersecurity Risks and Data Protection

As Evergreen Marine Corp. increasingly relies on digital systems, cybersecurity threats pose a significant risk. The interconnected nature of modern shipping means that a cyberattack could cripple operations, leading to costly disruptions. For instance, the maritime industry has seen a rise in ransomware attacks targeting port operations and vessel management systems, with some incidents causing delays of several days in 2023 and early 2024.

Evergreen must prioritize substantial investments in both IT and OT security to safeguard its infrastructure. This includes protecting sensitive customer data, proprietary operational information, and the control systems that manage vessel movements and cargo handling. Failure to do so could result in severe financial losses from operational downtime, recovery costs, and potential regulatory fines for data breaches.

- Increased Vulnerability: Digitization of shipping operations, including vessel tracking, cargo management, and communication systems, expands the attack surface for cyber threats.

- Operational Disruption: Cyberattacks can halt critical functions, leading to significant delays in cargo delivery, port congestion, and reputational damage.

- Data Breach Impact: Protection of sensitive data, from customer information to operational logs, is crucial to prevent financial losses and maintain trust.

- Investment Necessity: Robust cybersecurity measures are essential, with global spending on maritime cybersecurity projected to grow significantly in the coming years to counter evolving threats.

Advanced Navigation and Communication Systems

Technological advancements are significantly reshaping maritime operations. Innovations like advanced electronic navigation systems, including Global Positioning System (GPS) and Electronic Chart Display and Information Systems (ECDIS), are becoming standard, enhancing navigational accuracy and safety. Real-time weather monitoring systems provide critical data for optimizing routes and avoiding hazardous conditions.

Evergreen Marine Corp. (Taiwan) stands to benefit immensely from integrating these technologies. The adoption of low-earth orbit (LEO) satellite communication systems, for instance, promises more reliable and faster data transmission at sea, crucial for fleet management and operational responsiveness. This improved connectivity can lead to more efficient voyage planning and better crew welfare through enhanced communication capabilities.

- Enhanced Safety: ECDIS integration reduces navigational errors, a critical factor given that human error contributed to 85% of maritime accidents in recent years.

- Improved Efficiency: Real-time weather data and advanced route optimization can cut voyage times and fuel consumption by up to 10%.

- Connectivity Boost: LEO satellite communication offers bandwidth improvements, enabling better data exchange for predictive maintenance and crew communication, a significant upgrade from traditional satellite systems.

Technological advancements are pivotal for Evergreen Marine Corp., driving efficiency and sustainability. The company's investment in LNG dual-fuel vessels, for example, aligns with global decarbonization efforts, though the infrastructure for alternative fuels remains a challenge.

Digitalization, including AI for route optimization and IoT for smart ports, is enhancing operational capabilities. Cybersecurity is a growing concern, with the maritime sector experiencing increased cyber threats impacting operations in 2023 and early 2024, necessitating robust security investments.

Advanced navigation systems like ECDIS and real-time weather data integration are improving safety and reducing voyage times. Enhanced connectivity through LEO satellite systems further supports fleet management and crew welfare.

| Technology Area | Impact on Evergreen | Supporting Data/Trends |

|---|---|---|

| Digitalization & AI | Optimized voyages, predictive maintenance, enhanced cargo visibility | AI integration projected to boost operational efficiency and curb fuel expenses. |

| Alternative Fuels | Reduced emissions, compliance with environmental regulations | Evergreen investing in LNG dual-fuel ships; global maritime decarbonization efforts accelerating. |

| Cybersecurity | Protection of operations and data, mitigation of disruption risks | Maritime industry saw rise in ransomware attacks in 2023-2024, causing significant delays. |

| Advanced Navigation & Connectivity | Improved safety, efficiency, and communication | ECDIS integration reduces navigational errors; LEO satellite systems promise faster data transmission at sea. |

Legal factors

Evergreen Marine Corporation faces increasing scrutiny from international bodies like the International Maritime Organization (IMO). The IMO's push for a net-zero framework and greenhouse gas (GHG) emissions pricing, with potential implementation phases starting in 2024, directly impacts shipping operations by requiring substantial investments in cleaner technologies and fuels to meet stricter emission limits for CO2, SOx, and particulate matter.

Regional environmental regulations, particularly from the European Union, are also a significant factor. The EU Emissions Trading System (ETS) for maritime transport, which commenced in January 2024, and the upcoming FuelEU Maritime Regulation, set to be fully phased in by 2027, impose direct costs and operational adjustments. These regulations mandate reductions in emissions of CO2, methane, and nitrous oxide, compelling Evergreen to accelerate its adoption of low-carbon fuels and advanced abatement systems to avoid penalties and maintain market access.

The Hong Kong International Convention for the Safe and Environmentally Sound Recycling of Ships, set to enter into force in June 2025, will significantly impact Evergreen Marine Corp.'s vessel lifecycle management. This convention imposes strict requirements, necessitating that Evergreen's ships exceeding 500 gross tonnage (GT) maintain an Inventory of Hazardous Materials.

Compliance with these new regulations means Evergreen must ensure that any recycling facilities used for its vessels meet rigorous safety and environmental standards. This will likely influence Evergreen's end-of-life vessel disposal strategies and potentially increase associated costs, as only certified facilities will be permissible for recycling.

The International Maritime Organization's Ballast Water Management Convention, with its D-2 standard, mandates that all vessels must comply with ballast water discharge regulations by 2025. This means Evergreen Marine Corp. needs to ensure its fleet is equipped with approved ballast water treatment systems, a significant undertaking.

The installation and operation of these systems represent a substantial capital expenditure and introduce new operational protocols. For Evergreen, this could translate to millions in investment for their extensive fleet, impacting profitability and requiring careful financial planning to meet these updated environmental mandates.

Antitrust and Competition Laws

Evergreen Marine Corp., as a key member of the Ocean Alliance, navigates a complex web of international antitrust and competition laws. These regulations are crucial for maintaining fair market practices within the global shipping industry. Regulatory bodies worldwide, including the European Commission and the US Federal Maritime Commission, actively scrutinize shipping alliances. For instance, in 2024, the European Commission continued its review of various maritime consortia to ensure compliance with competition rules, impacting how alliances like Ocean Alliance can coordinate their services.

The constant oversight by these authorities directly influences Evergreen's operational strategies, particularly concerning capacity deployment, pricing strategies, and route agreements. Any perceived anti-competitive behavior can lead to significant penalties and operational restrictions. For example, past investigations into similar alliances have resulted in commitments to increase service transparency and capacity sharing to foster greater competition.

Key considerations for Evergreen under these legal frameworks include:

- Compliance with alliance agreements: Ensuring that the Ocean Alliance's operational framework adheres to all relevant competition laws globally.

- Regulatory scrutiny: Proactively addressing potential concerns raised by antitrust authorities regarding market concentration and pricing.

- Impact on service offerings: Understanding how regulatory decisions might affect Evergreen's ability to offer integrated services and optimize routes with alliance partners.

- Future collaboration: Adapting business strategies to accommodate evolving regulatory landscapes that govern international shipping collaborations.

Data Privacy and Cybersecurity Laws

Evergreen Marine Corp. navigates a complex web of data privacy and cybersecurity laws as its operations become increasingly digital. Regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) mandate stringent controls over customer data. Failure to comply can result in significant financial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. This necessitates robust data protection measures and secure digital infrastructure.

Protecting sensitive operational data, including shipping manifests, vessel tracking information, and proprietary logistics algorithms, is a critical legal requirement. Similarly, safeguarding customer information, such as booking details and personal contact information, is paramount to maintaining trust and avoiding reputational damage. Cybersecurity laws globally require companies to implement reasonable security measures to prevent data breaches. In 2023, the global average cost of a data breach reached $4.45 million, highlighting the financial risks associated with inadequate cybersecurity.

- GDPR Fines: Potential penalties up to 4% of global annual revenue or €20 million.

- CCPA Impact: Focuses on consumer rights regarding personal information collection and sale.

- Cybersecurity Costs: Global average data breach cost in 2023 was $4.45 million.

- Reputational Risk: Data breaches can severely damage customer trust and brand image.

Evergreen Marine Corp. faces evolving legal frameworks impacting its global operations and alliances. The company must navigate international antitrust laws, with bodies like the European Commission scrutinizing maritime consortia in 2024 to ensure fair market practices. This oversight influences Evergreen's capacity deployment and pricing strategies, as non-compliance can lead to significant penalties and operational restrictions.

Data privacy and cybersecurity laws, such as GDPR and CCPA, are also critical. With GDPR fines potentially reaching 4% of global annual revenue, Evergreen must implement robust data protection measures to safeguard sensitive operational and customer information. The global average cost of a data breach in 2023 was $4.45 million, underscoring the financial and reputational risks of inadequate security.

| Legal Factor | Impact on Evergreen Marine Corp. | Relevant Regulation/Body | Key Consideration/Data Point |

|---|---|---|---|

| Antitrust & Competition Law | Scrutiny of alliances (e.g., Ocean Alliance) | European Commission, US Federal Maritime Commission | Ensuring compliance with global competition rules to avoid penalties. |

| Data Privacy | Strict controls over customer data | GDPR, CCPA | Potential fines up to 4% of global annual revenue for GDPR non-compliance. |

| Cybersecurity | Protection of operational and customer data | Global Cybersecurity Laws | 2023 average cost of data breach: $4.45 million. |

Environmental factors

Evergreen Marine Corp. operates within a global shipping sector under intense pressure to decarbonize. International Maritime Organization targets aim for net-zero emissions by or around 2050, while the European Union mandates a 55% greenhouse gas (GHG) reduction by 2030. These ambitious goals necessitate significant investment in cleaner fuels, advanced energy-efficient technologies, and operational changes to curb emissions of CO2, methane, and nitrous oxide.

Climate change is increasingly impacting global shipping, with more frequent extreme weather events like typhoons and hurricanes directly disrupting Evergreen Marine Corp.'s operations. These events can cause significant delays, rerouting, and damage to vessels, leading to increased insurance premiums and repair costs. For instance, in 2024, several major shipping lanes experienced disruptions due to unusually severe storm seasons, impacting delivery schedules and increasing fuel consumption for longer, alternative routes.

Rising sea levels also pose a long-term challenge, potentially affecting the accessibility and operational capacity of key ports where Evergreen operates. Changes in ice conditions, particularly in Arctic regions, could open new, albeit challenging, shipping routes, requiring Evergreen to assess and potentially invest in specialized vessels and navigational equipment to capitalize on these shifts while managing associated risks.

Beyond greenhouse gas emissions, Evergreen Marine Corporation must actively manage other environmental impacts, such as potential oil spills, wastewater discharge, and the disposal of solid waste, all governed by international regulations like MARPOL Annexes.

In 2023, the maritime industry continued to face scrutiny over its environmental footprint, with a growing emphasis on operational practices that minimize pollution. Evergreen's commitment to robust waste management systems and strict pollution prevention measures is not just about regulatory compliance but is fundamental to its role as an environmentally responsible operator.

Biodiversity Protection and Ecosystem Impact

Shipping operations, including those of Evergreen Marine Corp., can significantly affect marine biodiversity. This impact stems from various sources such as noise pollution from vessels, the risk of ship strikes with marine mammals, and the introduction of invasive species through ballast water discharge. For instance, the International Maritime Organization (IMO) has been actively working on ballast water management conventions to curb species transfer.

Evergreen is anticipated to bolster its environmental stewardship by adhering to stringent ballast water management regulations, a critical step in preventing the spread of non-native organisms. Furthermore, the company is expected to invest in technologies and operational practices aimed at reducing underwater noise pollution, thereby mitigating disturbance to marine life. These actions are crucial for minimizing the company's ecological footprint and safeguarding fragile marine ecosystems.

In 2024, the global shipping industry is facing increased scrutiny regarding its environmental impact, with a growing emphasis on biodiversity protection. Evergreen, as a major player, is expected to align with international standards and best practices. For example, by 2025, more than 70% of global shipping capacity is projected to comply with advanced ballast water treatment systems, a trend Evergreen is likely to follow.

- Ballast Water Management: Compliance with IMO's Ballast Water Management Convention is essential to prevent the introduction of invasive species.

- Noise Reduction: Implementing quieter ship designs and operational adjustments to minimize underwater noise pollution affecting marine mammals.

- Ecosystem Impact Monitoring: Conducting regular assessments of shipping routes and operational areas to understand and address potential impacts on marine biodiversity.

- Sustainable Practices: Exploring and adopting eco-friendly technologies and operational strategies to enhance the protection of marine environments.

Transition to Green Fuels and Infrastructure Challenges

The shipping industry's pivot to greener fuels such as Liquefied Natural Gas (LNG), methanol, and ammonia offers substantial environmental benefits but introduces complex infrastructure hurdles. Evergreen Marine Corp. faces the challenge of securing consistent fuel availability and developing the necessary bunkering facilities globally to support these cleaner alternatives.

The life-cycle emissions of these new fuels are also under scrutiny, requiring careful evaluation as the industry moves away from traditional heavy fuel oil. Evergreen's fleet modernization strategy, including investments in dual-fuel vessels, is critical for adapting to these evolving environmental regulations and market demands.

- Fuel Availability: As of early 2024, the global supply of LNG and methanol for marine bunkering is still developing, with limited port availability in many regions.

- Infrastructure Investment: Significant capital is required to build new bunkering terminals and adapt existing ones for alternative fuels, a cost that will be shared across the industry.

- Life-Cycle Emissions: While direct emissions at the point of combustion may be lower, the production and transportation of green fuels like ammonia can still have considerable carbon footprints, necessitating a holistic approach to sustainability.

- Fleet Modernization Costs: Evergreen's commitment to newbuilds and retrofits for dual-fuel engines represents a substantial financial outlay, estimated to be 10-20% higher per vessel compared to conventional fuel engines in 2024.

Evergreen Marine Corp. is navigating a landscape increasingly shaped by environmental regulations and climate change impacts. The company faces pressure to decarbonize, with the International Maritime Organization targeting net-zero emissions by 2050 and the EU aiming for a 55% GHG reduction by 2030. Extreme weather events, like those seen in 2024's severe storm seasons, directly disrupt operations, causing delays and increasing costs. Furthermore, the industry is focusing on biodiversity, with Evergreen expected to enhance ballast water management and reduce underwater noise pollution, aligning with trends where over 70% of global shipping capacity is projected to use advanced ballast water treatment systems by 2025.

| Environmental Factor | Impact on Evergreen Marine Corp. | 2024/2025 Data/Trend |

|---|---|---|

| Decarbonization Targets | Need for investment in cleaner fuels and technologies to meet IMO and EU emission reduction goals. | IMO net-zero by 2050; EU 55% GHG reduction by 2030. |

| Climate Change & Extreme Weather | Disruptions to operations, increased insurance premiums, and repair costs due to more frequent severe storms. | Severe storm seasons in 2024 caused significant shipping lane disruptions. |

| Biodiversity Protection | Requirement to comply with ballast water management conventions and reduce underwater noise pollution. | Over 70% of global shipping capacity expected to use advanced ballast water treatment by 2025. |

| Alternative Fuels | Challenges in securing fuel availability and investing in bunkering infrastructure for LNG, methanol, and ammonia. | Limited global availability of alternative marine fuels in early 2024; dual-fuel vessel costs 10-20% higher in 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Evergreen Marine Corp. is built on a foundation of comprehensive data from official government publications, international maritime organizations, and leading economic and industry analysis firms. We incorporate insights from trade agreements, environmental regulations, technological advancements in shipping, and global economic forecasts to provide a robust overview.