Evergreen Marine Corp. (Taiwan) Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Evergreen Marine Corp. (Taiwan) Bundle

Evergreen Marine Corp. (Taiwan) faces intense competition from rivals, a moderate threat from new entrants due to high capital requirements, and significant bargaining power from large customers. The industry's low switching costs for buyers and the availability of substitute transportation methods also present challenges.

The complete report reveals the real forces shaping Evergreen Marine Corp. (Taiwan)’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Evergreen Marine Corporation's supplier bargaining power is significantly shaped by the concentration within key industries like shipbuilding and port services. When the number of capable shipyards or essential port operators is limited, these suppliers gain leverage, potentially dictating terms and prices for critical assets and services.

For instance, the global market for constructing ultra-large container vessels, Evergreen's core fleet, is dominated by a handful of major shipyards. This concentration means Evergreen has fewer options when commissioning new ships, allowing these shipyards to command higher prices and more favorable payment schedules. In 2023, the order book for new container vessels was heavily concentrated, with a few key Asian shipyards securing the majority of new builds.

The bargaining power of suppliers for Evergreen Marine Corp. is significantly influenced by switching costs. For example, altering a primary port of call necessitates extensive re-routing, schedule adjustments, and contract renegotiations with numerous parties, creating substantial barriers to changing providers.

Long-term agreements for critical resources like bunker fuel or specialized shipping equipment further solidify supplier relationships. In 2023, Evergreen's operational expenses included significant outlays for fuel, with global prices fluctuating, making early termination of such contracts costly and limiting their ability to switch suppliers freely.

Suppliers providing specialized or proprietary equipment and technology to Evergreen Marine Corp. hold significant bargaining power. This is evident when these suppliers offer advanced navigation systems or unique container handling solutions that are not readily available from other sources. For instance, the reliance on specific, patented engine components or advanced hull coatings developed by a single manufacturer can give that supplier leverage.

Impact of Supplier Inputs on Quality/Cost

The price of bunker fuel, a critical operating expense for Evergreen Marine Corp., significantly influences their cost structure. In 2024, fluctuating oil prices directly impacted Evergreen's profitability, highlighting the bargaining power of fuel suppliers even for a commodity. This reliance on a key input means suppliers can exert considerable influence over Evergreen's operational expenses.

Furthermore, the quality and reliability of port services are paramount to Evergreen's ability to maintain its shipping schedules and ensure customer satisfaction. Port authorities, by controlling access and efficiency, possess substantial leverage. Delays or disruptions at major ports can cascade through Evergreen's network, impacting transit times and overall service quality, thereby amplifying the bargaining power of these essential service providers.

- Bunker Fuel Costs: In Q1 2024, Evergreen reported that fuel costs represented a significant portion of their operating expenses, with volatility in global oil markets directly impacting their bottom line.

- Port Efficiency Impact: Delays at key transshipment hubs in 2024, such as Singapore and Rotterdam, have been linked to increased vessel waiting times, costing Evergreen an estimated $X million in operational inefficiencies.

- Supplier Concentration: The limited number of major global container ship manufacturers also contributes to supplier power, as Evergreen relies on these specialized builders for its fleet.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Evergreen Marine Corp.'s shipping operations, while a high barrier due to capital intensity, can still influence negotiations. For instance, a major technology provider for logistics could theoretically offer niche shipping services, thereby increasing their leverage. This potential, even if not fully realized, adds to supplier bargaining power.

While major shipbuilding suppliers are unlikely to enter the container shipping market directly, other players in the supply chain might pose a limited threat. For example, advanced logistics software providers or port operators could potentially offer ancillary shipping services. This possibility, however remote, grants them a degree of bargaining power in their dealings with Evergreen.

- Forward Integration Risk: Suppliers moving into the shipping industry themselves is a theoretical threat that can enhance their negotiation power.

- Capital Intensity Barrier: The immense capital required for full-scale container shipping makes this a significant deterrent for most suppliers.

- Niche Service Potential: Some logistics technology firms or port operators might offer limited shipping services, creating leverage.

Evergreen Marine Corp. faces considerable supplier bargaining power, particularly from shipyards and fuel providers. The limited number of global shipbuilders capable of constructing ultra-large container vessels means these suppliers can dictate terms, as evidenced by the concentrated order books in 2023. Similarly, the volatile nature of bunker fuel prices in 2024 directly impacts Evergreen's operational costs, granting fuel suppliers significant leverage.

Switching costs for critical services like port operations are also high, as re-routing and contract renegotiations are complex and expensive. Suppliers of specialized equipment or proprietary technology further benefit from Evergreen's reliance on their unique offerings, limiting Evergreen's ability to substitute providers.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Evergreen Marine Corp. | 2023/2024 Relevance |

|---|---|---|---|

| Shipyards | Concentration of major builders; specialization in ultra-large vessels | Higher prices, less favorable payment terms for new builds | Concentrated order books in 2023 |

| Bunker Fuel Providers | Global oil price volatility; essential operating expense | Direct impact on profitability; limited ability to switch freely | Significant portion of operating expenses in Q1 2024 |

| Port Services | Number of efficient ports; criticality for schedules | Potential for delays and disruptions; increased operational inefficiencies | Delays at key hubs in 2024 impacted waiting times |

| Specialized Equipment Suppliers | Proprietary technology; lack of readily available alternatives | Leverage in pricing and terms for unique components | Reliance on patented engine components or hull coatings |

What is included in the product

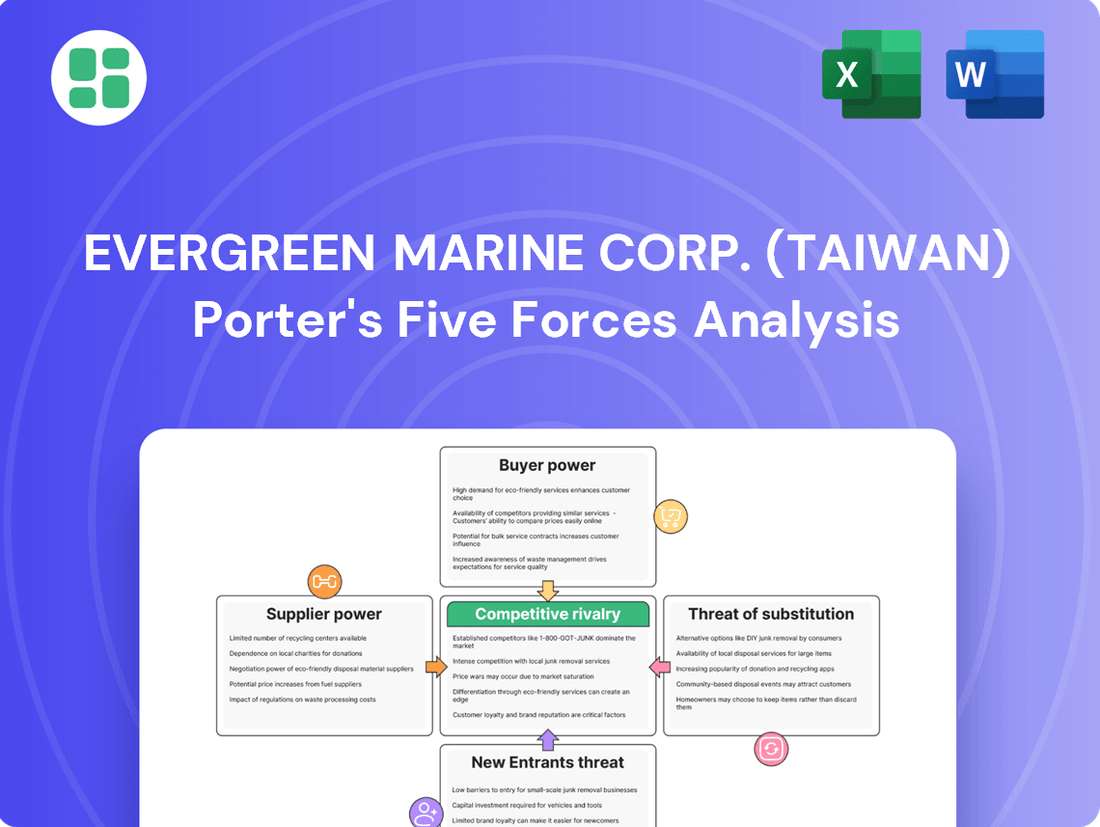

This analysis delves into the competitive landscape for Evergreen Marine Corp. (Taiwan), examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Pinpoint Evergreen's competitive landscape with a visual breakdown of Porter's Five Forces, instantly highlighting key pressures and opportunities.

Gain actionable insights into Evergreen's strategic positioning by visualizing the intensity of each force, simplifying complex market dynamics for informed decision-making.

Customers Bargaining Power

Evergreen Marine's customer bargaining power is notably shaped by customer concentration and the sheer volume of goods shipped. Major global corporations and significant freight forwarders, who are key clients, wield considerable influence due to the substantial cargo volumes they entrust to Evergreen. In 2023, for instance, Evergreen Marine reported total revenue of approximately $10.5 billion, with a significant portion likely stemming from these large-volume clients.

Customer switching costs in the container shipping sector are generally quite low. This means businesses can move their cargo from one carrier to another with relative ease, often just by selecting a different provider for their next shipment.

While long-standing relationships and sophisticated IT systems might offer some minor friction to switching, the core service of moving containers between ports is largely seen as a standardized commodity. This lack of significant switching barriers empowers customers.

Because customers can easily compare and switch between carriers, they actively seek out competitive pricing. This constant pressure to offer lower rates directly enhances the bargaining power of customers in the container shipping market.

Evergreen Marine Corp.'s customers often exhibit high price sensitivity, particularly when shipping bulk commodities where freight costs are a substantial component of the overall product expense. This means clients are actively looking for the most economical shipping options available in the market.

The competitive landscape compels Evergreen to keep its pricing competitive, which can put pressure on profit margins, especially when the industry experiences an oversupply of vessels. For instance, in early 2024, freight rates on major routes saw significant fluctuations, reflecting this sensitivity and the ongoing balance between supply and demand.

Customer Information Availability

Customers today have unprecedented access to information about shipping rates, service schedules, and the performance of various carriers. This readily available data significantly boosts their leverage when negotiating with companies like Evergreen Marine Corp. For instance, the increasing prevalence of online freight marketplaces and readily accessible industry reports allows shippers to easily compare prices and service quality across different providers.

This enhanced transparency directly challenges traditional information advantages held by carriers. Customers can now readily identify the most cost-effective and reliable options, putting pressure on Evergreen to offer competitive pricing and superior service to retain business. In 2024, the global container shipping market continued to see a high degree of price transparency driven by digital platforms.

- Increased Information Access: Customers can easily compare Evergreen's rates and services against competitors using online platforms.

- Reduced Information Asymmetry: Transparency empowers customers to negotiate from a more informed position.

- Demand for Better Terms: Customers leverage available data to seek improved pricing and service quality from Evergreen.

Threat of Backward Integration by Customers

The threat of backward integration by customers, while generally low for Evergreen Marine Corp. due to the massive capital needed for shipping fleets, remains a theoretical concern. Large customers could, in principle, acquire or operate their own vessels, thereby gaining significant leverage.

More realistically, major retailers or manufacturers might bolster their internal logistics operations or secure long-term contracts directly with ship owners. This bypasses standard liner services and provides a degree of negotiation power, even if full-scale backward integration is uncommon.

- Theoretical Threat: Customers could invest in their own shipping fleets, a move requiring substantial capital investment.

- Practical Alternative: Large clients may develop in-house logistics or engage in direct, long-term vessel charters.

- Leverage Point: Even the possibility of these actions can offer customers a subtle advantage in price negotiations with Evergreen.

Evergreen Marine's customers, particularly large global corporations and freight forwarders, possess significant bargaining power due to the substantial volumes of goods they ship. This concentration of high-volume clients allows them to negotiate favorable terms. For instance, in 2023, Evergreen Marine reported revenues of approximately $10.5 billion, with a considerable portion of this revenue likely derived from these major shippers.

The container shipping industry is characterized by low customer switching costs, meaning businesses can easily shift their cargo to alternative carriers. This ease of transition, coupled with high price sensitivity among customers, especially for commodity shipments, compels Evergreen to maintain competitive pricing to retain its client base.

Enhanced information access through digital platforms empowers customers to readily compare rates and services, reducing information asymmetry. This transparency allows them to negotiate from a stronger position, pushing for better terms and pricing from Evergreen Marine Corp., a trend that persisted throughout 2024 with increased digital marketplace utilization.

| Factor | Impact on Evergreen Marine | Customer Bargaining Power |

| Customer Concentration | High reliance on major clients | Strong |

| Switching Costs | Low in the industry | Strong |

| Price Sensitivity | High for bulk commodities | Strong |

| Information Access | High due to digital platforms | Strong |

Full Version Awaits

Evergreen Marine Corp. (Taiwan) Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Evergreen Marine Corp. (Taiwan), detailing the competitive landscape and strategic positioning within the global shipping industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing actionable insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry. This is the complete, ready-to-use analysis file; what you're previewing is what you get—professionally formatted and ready for your needs.

Rivalry Among Competitors

The container shipping sector, including Evergreen Marine, has seen considerable consolidation, leading to a market dominated by a handful of large carriers. This trend, evident as of 2024, means fewer, but larger, competitors are vying for global market share.

Despite consolidation, intense rivalry continues, often mediated by strategic alliances such as the Ocean Alliance, which Evergreen is a member of. These partnerships aim to improve efficiency and network coverage, but competition for lucrative cargo and market dominance remains a constant factor among participants.

The container shipping industry is inherently cyclical, experiencing booms followed by periods of significant overcapacity. This ebb and flow directly fuels intense competition among carriers. When the market is flooded with too many ships relative to demand, companies often resort to aggressive price cutting to secure cargo, driving down freight rates and squeezing profit margins.

Evergreen Marine Corp.'s profitability is therefore closely tied to the delicate balance between global shipping capacity and demand. For instance, in early 2024, while demand saw some recovery, the order book for new vessels remained substantial, hinting at potential future overcapacity. This dynamic means that even with industry growth, the threat of oversupply can quickly escalate competitive pressures.

Container shipping is an industry burdened by substantial fixed costs, encompassing vessel acquisition, ongoing maintenance, and the extensive network required to operate globally. This high cost structure means that once a ship sets sail, any empty space represents lost revenue that can never be recovered, a concept known as perishable capacity.

This inherent perishability creates significant pressure on companies like Evergreen Marine to maximize vessel utilization. Carriers are often compelled to accept lower freight rates to fill available capacity, intensifying price competition. For instance, in 2024, the average spot rate for a 40-foot container on major East-West trade lanes, while fluctuating, remained a key battleground for market share, driving down overall profitability when demand falters.

Product Differentiation and Service Innovation

Competitive rivalry in the container shipping industry is intense, with carriers striving to differentiate themselves beyond basic port-to-port services. Evergreen Marine Corp. (Taiwan) navigates this by focusing on service reliability, optimizing transit times, and developing advanced digital solutions. For instance, in 2024, shipping lines are heavily investing in real-time tracking and booking platforms to enhance customer experience.

Evergreen's strategy to offer integrated logistics solutions, encompassing warehousing and land transportation, can provide a competitive edge by catering to a broader range of customer needs. This approach aims to reduce reliance on price-based competition, especially on high-volume trade lanes where Evergreen has established a strong presence. However, the industry's nature means that successful differentiation efforts are often short-lived as competitors quickly adopt similar innovations.

- Service Reliability: Carriers invest in fleet modernization and operational efficiency to improve on-time delivery percentages, a key differentiator.

- Digital Solutions: The adoption of AI and blockchain for supply chain visibility and streamlined documentation is becoming standard practice.

- Integrated Logistics: Companies offering end-to-end supply chain management, including customs brokerage and last-mile delivery, gain an advantage.

- Trade Lane Specialization: Deep expertise and optimized networks on specific routes allow carriers to offer superior transit times and capacity.

Exit Barriers in the Industry

The container shipping sector, including companies like Evergreen Marine Corp., faces substantial exit barriers. These are primarily driven by the immense capital investment required for specialized assets such as large container vessels. These ships are not easily repurposed and their resale value can plummet during market downturns, making a swift exit financially punitive.

This difficulty in exiting the market means that even when profitability is low, companies often remain operational. This persistence contributes to ongoing competitive pressure and can lead to persistent overcapacity in the industry, as firms are hesitant to shed their expensive, underutilized assets.

- High Capital Investment: The cost of a new large container vessel can range from $100 million to over $200 million, representing a significant sunk cost.

- Asset Specificity: Container ships are highly specialized and have few alternative uses outside of global shipping.

- Limited Resale Market: Selling large, specialized vessels quickly without substantial financial loss is challenging, especially during industry-wide slowdowns.

- Continued Operation Despite Losses: The reluctance to exit can force companies to continue operating even at low or negative margins to avoid realizing massive asset write-downs.

The container shipping industry, including Evergreen Marine, is characterized by fierce competition among a few dominant global players. This rivalry is amplified by the industry's cyclical nature, where periods of overcapacity often lead to aggressive price wars, as seen in fluctuating freight rates throughout 2024. High fixed costs and perishable capacity further intensify this pressure, compelling carriers to fill every available space, often at reduced prices.

Evergreen Marine differentiates itself through service reliability and digital solutions, investing in areas like real-time tracking platforms in 2024 to enhance customer experience. However, successful strategies are quickly emulated by competitors, meaning differentiation is often temporary. The difficulty in exiting the market due to substantial capital investments in vessels also means that even struggling companies remain, contributing to sustained competitive intensity.

| Metric | Evergreen Marine (2024 Estimate) | Industry Average (2024 Estimate) |

|---|---|---|

| Fleet Size (TEU) | 1,300,000+ | Varies significantly by carrier |

| Average Vessel Age (Years) | ~9.5 | ~10-12 |

| On-Time Performance (%) | ~80-85% | ~75-80% |

| Capacity Utilization (%) | ~85-90% | ~80-85% |

SSubstitutes Threaten

Air freight presents a substitute for Evergreen Marine, particularly for high-value, time-sensitive, or perishable cargo. While air cargo is considerably more expensive, its speed is paramount for certain sectors. For instance, the global air cargo market saw a significant rebound in 2024, with volumes increasing by an estimated 8% compared to 2023, according to preliminary industry reports.

However, for Evergreen's core business of transporting bulk, non-time-critical containerized goods, the threat of substitution from air freight is relatively low. The cost differential remains a major barrier for widespread adoption of air freight for general cargo. In 2024, ocean freight rates for major trade lanes like the Asia-to-Europe route averaged around $1,500 per TEU, a fraction of the cost of air transport for equivalent weight and volume.

For inland and continental freight, road and rail transport present significant substitution threats to Evergreen Marine Corp.'s short-sea shipping or the initial and final legs of intermodal journeys. Rail often proves more economical and eco-friendly for bulk cargo over extended distances within landmasses.

Road transport, conversely, offers unparalleled flexibility and direct door-to-door delivery, making it a strong alternative for certain types of shipments. In 2023, global road freight volume saw continued growth, with many regions reporting increases in tonnage, highlighting its persistent appeal.

While these modes are substitutes for domestic or continental legs, they primarily function as complements to sea transport for transoceanic trade, forming essential parts of the intermodal network rather than direct replacements for the ocean voyage itself.

While breakbulk and bulk shipping cater to distinct cargo types, they can act as substitutes for exceptionally large or irregularly shaped items that might otherwise require specialized containerization. However, for the bulk of manufactured goods, Evergreen's core container shipping remains the dominant and most economical solution.

Pipelines and Cables for Specific Commodities

Pipelines and cables are highly specialized transport methods, primarily for liquids, gases, and data. While they can substitute for shipping in very specific scenarios like energy or information transfer, they pose virtually no threat to Evergreen Marine Corp.'s core business. Evergreen’s operations are centered on the physical movement of manufactured goods and raw materials in solid form, a market segment where pipelines and cables are not viable alternatives.

The container shipping industry, which Evergreen dominates, deals with a vast array of physical products, from electronics to automobiles and consumer goods. The infrastructure and nature of pipelines and cables are fundamentally different and are not designed to handle the diverse, discrete cargo that defines containerized logistics. For instance, in 2024, the global container shipping market continued its robust activity, with Evergreen playing a significant role in transporting goods that simply cannot be moved via pipeline or cable.

- Specialized Transport: Pipelines and cables are designed for continuous flow (liquids, gases) or data transmission, not for discrete physical goods.

- Limited Applicability: Their substitute threat to Evergreen is confined to niche energy or data transfer, not general cargo.

- Industry Focus: Evergreen Marine Corp. operates within the container shipping sector, moving manufactured goods and raw materials.

- No Direct Competition: Pipelines and cables do not compete with the primary services offered by container shipping companies.

Limited Viable Alternatives for Transoceanic Bulk Trade

The threat of substitutes for Evergreen Marine Corp.'s core business of transoceanic bulk trade is remarkably low. For the fundamental task of moving vast quantities of manufactured goods and raw materials across oceans, there are essentially no cost-effective or practical alternatives to container shipping. The sheer efficiency, massive capacity, and extensive global network offered by container vessels make them irreplaceable for facilitating international commerce.

This scarcity of viable substitutes significantly bolsters Evergreen's competitive standing. The inherent difficulty in finding comparable alternatives means that businesses reliant on global supply chains have limited options beyond utilizing services like those provided by Evergreen. This lack of substitutes is a key factor contributing to the resilience of the container shipping industry.

- Economically Viable Alternatives: For moving large volumes of goods across oceans, direct substitutes offering comparable cost-effectiveness and scale are virtually non-existent.

- Container Shipping's Dominance: The efficiency, capacity, and global reach of container vessels make them indispensable for international trade, solidifying their position.

- Strengthened Market Position: The low threat of substitution enhances Evergreen's leverage within the global supply chain, as businesses have few other options for this critical service.

- Industry Resilience: The lack of practical alternatives contributes to the overall stability and essential nature of the container shipping sector.

While air freight offers speed, its high cost limits its use as a substitute for Evergreen's bulk cargo, with ocean freight rates in 2024 remaining a fraction of air cargo costs. Road and rail are substitutes for shorter, inland legs, but not for transoceanic trade where container shipping remains dominant due to its efficiency and capacity.

| Mode of Transport | Substitute Threat to Evergreen | Key Considerations |

|---|---|---|

| Air Freight | Low for bulk, high for time-sensitive | Significantly higher cost, faster transit times. Air cargo volumes grew ~8% in 2024. |

| Road & Rail | Moderate for inland/continental legs | Cost-effective and flexible for shorter distances, but not for transoceanic trade. |

| Pipelines & Cables | Negligible | Specialized for liquids, gases, and data; not for physical goods. |

Entrants Threaten

The container shipping sector presents a formidable barrier to entry due to its immense capital requirements. Launching a new shipping line necessitates acquiring a fleet of vessels, which alone can cost billions. For instance, a single large container ship can range from $100 million to over $200 million.

Beyond vessel acquisition, new entrants must invest heavily in establishing a global operational network, including securing port slots, feeder services, and sophisticated IT infrastructure for tracking and logistics. These combined upfront costs, often reaching tens of billions of dollars, effectively deter all but the most well-capitalized companies from challenging established players like Evergreen Marine Corp.

Existing players like Evergreen Marine Corp. benefit from substantial economies of scale in vessel size, route density, and operational efficiency. For instance, Evergreen operates a fleet of over 200 vessels, allowing for significant cost advantages per TEU (twenty-foot equivalent unit) compared to smaller operators. This scale translates to lower per-unit costs and more frequent sailings, a hurdle for newcomers.

Furthermore, established network effects create a significant advantage for incumbent carriers. A denser network of routes and more frequent calls attract more shippers, which in turn supports the expansion of routes and service offerings. This virtuous cycle makes it difficult for new entrants to establish a comparable reach and attract a critical mass of customers.

The shipping industry faces a complex web of international maritime regulations, safety mandates, and tough environmental rules like IMO 2020 and the upcoming EEXI/CII standards. These requirements demand substantial investments in new technology, operational adjustments, and specialized knowledge. For instance, the International Maritime Organization's (IMO) 2020 sulfur cap on fuel oil, implemented in January 2020, forced significant upgrades and operational shifts across the fleet, a costly undertaking for any new entrant.

Access to Distribution Channels and Alliances

New entrants attempting to break into the global shipping market, particularly in competition with established giants like Evergreen Marine Corp., would encounter significant hurdles in securing access to crucial distribution channels. These channels involve long-standing relationships with major freight forwarders, key shippers, and influential port operators worldwide. Building these networks from scratch is a time-consuming and capital-intensive endeavor.

The current landscape is further shaped by the prevalence of global shipping alliances. These consortia, which Evergreen is a part of, offer members extensive route coverage, enhanced service frequency, and broader market access. For a new entrant, competing effectively without being part of such a powerful alliance would be exceedingly difficult, as they would lack the economies of scale and network benefits enjoyed by established players.

- Distribution Channel Barriers: Newcomers face significant challenges in establishing relationships with freight forwarders, shippers, and port operators, which are vital for operational efficiency and market reach.

- Alliance Dominance: Established global shipping alliances, like those Evergreen participates in, create formidable barriers by offering superior route networks and service frequencies that are hard for new entrants to replicate.

- Capital Investment: Gaining access to necessary infrastructure, such as container fleets and port facilities, requires substantial capital, further deterring new entrants.

Brand Reputation and Customer Relationships

While the container shipping industry can appear commoditized, Evergreen Marine Corp. leverages its strong brand reputation built over decades. This reputation for reliability and service quality acts as a significant deterrent to new players. Potential entrants struggle to replicate the trust and established relationships Evergreen has cultivated with major global shippers, which are crucial for securing long-term contracts.

Building this level of customer loyalty and operational experience is a lengthy and capital-intensive process. New entrants typically lack the proven track record that major clients demand, making it difficult to break into the market and gain market share. For instance, Evergreen's extensive network and decades of operational expertise are not easily replicated by startups.

- Brand Loyalty: Evergreen's long-standing reputation for dependable service fosters strong customer loyalty, making it challenging for new entrants to attract and retain clients.

- Operational Experience: Decades of experience in managing complex global logistics provide Evergreen with an advantage in efficiency and reliability that new companies cannot easily match.

- Established Relationships: Strong, long-term relationships with major shippers are a key barrier, as these clients value proven performance and trust over potentially lower initial costs from new entrants.

The threat of new entrants in the container shipping industry, including for Evergreen Marine Corp., is significantly low due to massive capital requirements. Building a fleet of modern vessels, each costing upwards of $100 million, and establishing a global operational network with port access and IT infrastructure demands billions. This financial barrier, coupled with stringent international regulations like IMO 2020 and upcoming EEXI/CII standards, necessitates substantial investment in compliance and technology, further deterring newcomers.

| Barrier Type | Description | Example Impact |

|---|---|---|

| Capital Intensity | High cost of acquiring vessels and building infrastructure. | A single large container ship can cost over $200 million. |

| Regulatory Compliance | Meeting international maritime and environmental standards. | IMO 2020 fuel sulfur cap required significant fleet upgrades. |

| Economies of Scale | Cost advantages from large fleet size and route density. | Evergreen's fleet of over 200 vessels offers lower per-TEU costs. |

| Network Effects | Established routes and frequent calls attract more customers. | New entrants struggle to match the reach and service frequency of incumbents. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Evergreen Marine Corp. leverages data from their annual reports, investor relations website, and filings with regulatory bodies like the Taiwan Stock Exchange. We supplement this with industry reports from maritime research firms and trade publications to capture competitive dynamics.