Evergreen Marine Corp. (Taiwan) Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Evergreen Marine Corp. (Taiwan) Bundle

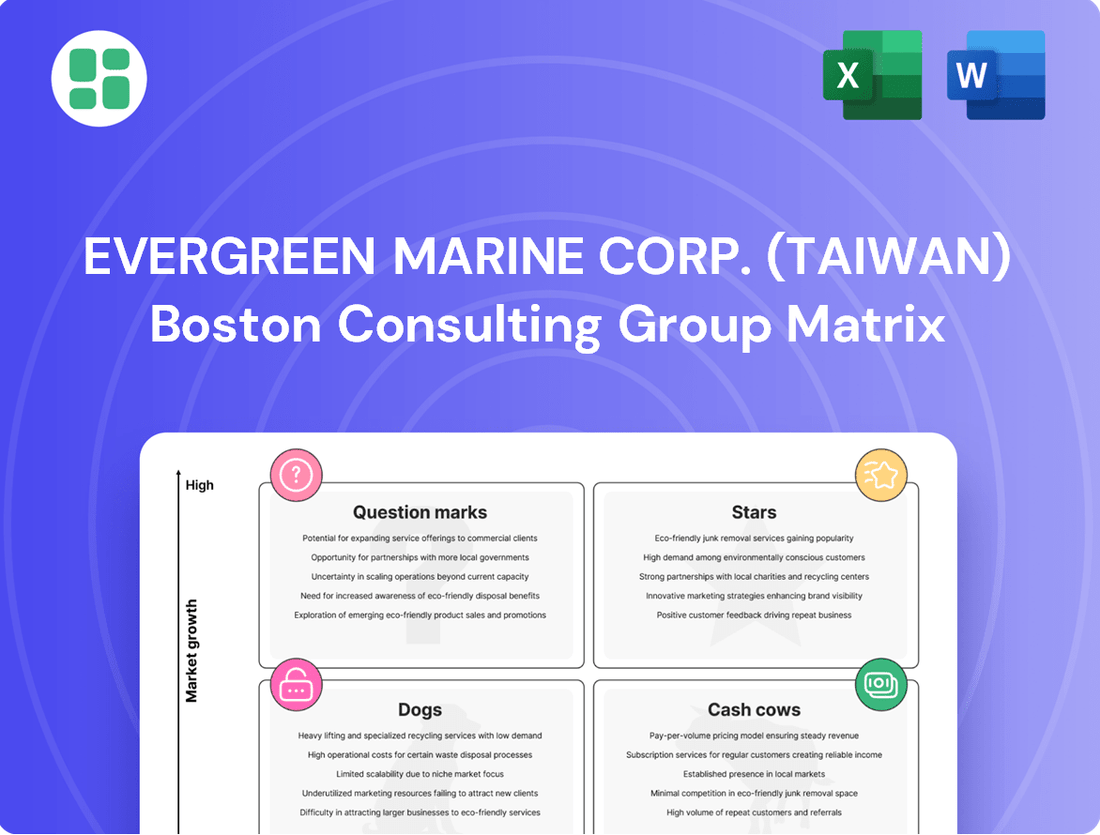

Evergreen Marine Corp. (Taiwan)'s BCG Matrix reveals a fascinating landscape of their shipping services, highlighting which segments are driving growth and which require careful management. Understand the strategic implications of their current portfolio to make informed decisions about future investments.

Get the full BCG Matrix to unlock a detailed breakdown of Evergreen's offerings across the four quadrants—Stars, Cash Cows, Dogs, and Question Marks. This comprehensive analysis will equip you with the insights needed to navigate the competitive shipping industry effectively.

Don't miss out on the complete strategic picture of Evergreen Marine Corp. (Taiwan). Purchase the full BCG Matrix report for actionable intelligence that can guide your investment strategies and optimize your business's performance in the global maritime market.

Stars

Evergreen's dominance on trans-Pacific routes, fueled by robust demand, positions these lanes as a Star in its BCG Matrix. In 2024, Evergreen continued to capitalize on strong market dynamics, including ongoing supply chain adjustments, which have sustained high shipping volumes and favorable rates on these key trade lanes.

Evergreen Marine Corp.'s strategic investment in 24,000-TEU LNG dual-fuel container ships, with deliveries commencing in 2028, firmly places these new builds as Stars within its BCG Matrix. This substantial commitment to environmentally compliant, high-capacity vessels positions Evergreen as a leader in the burgeoning green shipping sector, anticipating future market demands and regulatory shifts. The company is investing billions in this fleet modernization, with reports indicating orders for numerous such vessels, underscoring its aggressive pursuit of market share in a segment expected to grow significantly.

Evergreen Marine Corp.'s membership in the Strategic Ocean Alliance is a clear Star in its BCG Matrix. As a core partner in the Ocean Alliance, the third-largest shipping cooperative worldwide, Evergreen benefits from unparalleled global network reach and significant operational efficiencies. This collaboration is crucial for maintaining Evergreen's robust market share on key international trade routes.

The alliance structure, which includes shared capacity and operational synergies, directly translates into competitive advantages for Evergreen. This cooperative model allows the company to access a wider customer base and optimize its vessel deployment, leading to enhanced financial performance. In 2024, the Ocean Alliance collectively managed a significant portion of global containerized trade, with Evergreen playing a pivotal role in its success.

Robust Financial Performance and Profit Growth

Evergreen Marine Corp. (Taiwan) demonstrates robust financial performance, solidifying its Star position. The company achieved record revenue in 2024, with net income tripling, and continued this momentum with strong profit growth in the first quarter of 2025. This financial health reflects a significant market share within a thriving market, bolstered by elevated freight rates and operational efficiencies.

- Record 2024 Revenue: Evergreen Marine reported substantial revenue figures for the fiscal year 2024, indicating strong demand and pricing power.

- Tripled Net Income in 2024: The company's profitability saw a threefold increase in 2024, showcasing exceptional earnings growth.

- Q1 2025 Profit Growth: Continued positive financial trends were observed in the first quarter of 2025, with sustained profit increases.

- Market Share and Buoyant Market: This financial strength is directly linked to Evergreen Marine’s high market share in a favorable market environment, driven by factors such as increased freight rates.

Early Adoption of Sustainable Shipping Technologies

Evergreen Marine Corp. is making significant strides in sustainable shipping, positioning its early adoption of new technologies as a Star in the BCG matrix. The company is actively investing in vessels capable of running on both Liquefied Natural Gas (LNG) and methanol, a clear indicator of its commitment to cleaner fuel alternatives.

This strategic move is complemented by agreements for green shipping routes, signaling a proactive approach to capturing market share in a rapidly expanding sector. While the green shipping market is still in its nascent stages, Evergreen's substantial early investments are designed to secure a leading position.

- Early Investment in LNG and Methanol Dual-Fuel Vessels: Evergreen has placed orders for a significant number of these advanced vessels, demonstrating a tangible commitment to decarbonization. For instance, as of early 2024, the company had a substantial portion of its new builds slated for dual-fuel capabilities.

- Green Shipping Route Agreements: These partnerships are crucial for establishing Evergreen's presence in the growing eco-friendly shipping segment. The company is actively collaborating with partners to develop and implement these routes.

- High Growth Potential: The global push for decarbonization in the shipping industry, driven by regulations and increasing customer demand for sustainable logistics, creates a high-growth environment for companies like Evergreen that are investing early.

- Attracting Environmentally Conscious Clients: By leading in sustainable technologies, Evergreen is better positioned to attract clients who prioritize environmental responsibility in their supply chains, a trend that is expected to accelerate.

Evergreen's dominance on key trans-Pacific routes, supported by robust demand and favorable rates in 2024, solidifies these lanes as a Star. The company's substantial investments in 24,000-TEU LNG dual-fuel container ships, with deliveries starting in 2028, position these as future Stars, reflecting a commitment to green shipping and market leadership.

Evergreen's integral role within the Ocean Alliance, the third-largest shipping cooperative, is a Star due to the unparalleled global network reach and operational efficiencies it provides. This strategic partnership directly contributes to Evergreen's strong market share and financial performance, as evidenced by its record revenue and tripled net income in 2024.

| Aspect | BCG Category | Supporting Data/Facts |

| Trans-Pacific Routes | Star | Sustained high shipping volumes and favorable rates in 2024 due to ongoing supply chain adjustments. |

| New LNG Dual-Fuel Vessels | Star | Significant investment in high-capacity, environmentally compliant vessels with deliveries commencing 2028; orders for numerous such vessels. |

| Ocean Alliance Membership | Star | Core partner in the third-largest global shipping cooperative, providing extensive network reach and operational efficiencies. |

| Financial Performance | Star | Record revenue and tripled net income in 2024; continued profit growth in Q1 2025, driven by high market share and freight rates. |

What is included in the product

Evergreen Marine Corp.'s BCG Matrix would likely categorize its diverse shipping services, highlighting which are market leaders (Stars) or stable cash generators (Cash Cows).

The analysis would also identify emerging routes (Question Marks) needing investment and underperforming segments (Dogs) for potential divestment.

A clear BCG Matrix for Evergreen Marine Corp. instantly clarifies which business units are Stars, Cash Cows, Question Marks, and Dogs, relieving the pain of strategic uncertainty.

This visual tool simplifies complex portfolio analysis, allowing Evergreen's leadership to make informed decisions about resource allocation and future investments.

Cash Cows

Evergreen Marine Corp.'s established global container liner services, particularly those connecting East Asia with Europe and North America, are clear Cash Cows. These routes boast high market share and operational efficiency, consistently generating substantial cash flow.

In 2023, Evergreen reported a net profit of NT$18.1 billion (approximately US$580 million), demonstrating the profitability of its core services despite a challenging global shipping market. The company's extensive network ensures stable revenue streams with minimal need for aggressive promotional spending due to its deeply entrenched market position.

Evergreen Marine Corp.'s extensive and fully utilized fleet of container ships is a prime example of a Cash Cow. These vessels, having already passed their peak investment phase, now represent a steady source of income with reduced capital expenditure needs for new acquisitions.

In 2024, Evergreen operated a substantial fleet, underscoring its capacity to generate consistent revenue. The operational reliability and sheer scale of these ships ensure efficient cargo movement, directly contributing to stable profit margins for the company.

Evergreen Marine Corp.'s comprehensive logistics and transshipment solutions are a clear Cash Cow. These services, which seamlessly integrate with their primary shipping operations, generate consistent, high-margin revenue by effectively utilizing existing infrastructure and a strong customer base. For example, in 2023, Evergreen reported a significant portion of its revenue derived from ancillary services, showcasing the stability of these offerings.

Long-Term Contracted Cargo Volumes

Long-term contracted cargo volumes are a significant Cash Cow for Evergreen Marine Corp. (Taiwan). These agreements, especially on crucial trade lanes such as North America, guarantee a predictable revenue stream and stable cargo flow, insulating the company from the fluctuations of the spot market. This stability is key for effective capacity management and consistent cash generation, even when the market is unpredictable.

These contracts highlight Evergreen's robust and loyal customer relationships. For instance, in 2024, Evergreen reported that a considerable percentage of its capacity was committed through these long-term agreements, providing a solid foundation for its financial performance. This strategic approach ensures that Evergreen maintains a steady income, allowing for reinvestment and operational efficiency.

- Predictable Revenue: Long-term contracts offer a reliable income source, reducing reliance on fluctuating freight rates.

- Stable Cargo Volumes: These agreements ensure consistent utilization of Evergreen's fleet.

- Reduced Market Volatility Exposure: Contracts shield the company from the unpredictable swings of the spot market.

- Strong Customer Base: The existence of these contracts signifies a loyal and established clientele.

Global Brand Recognition and Network Efficiency

Evergreen Marine Corp.'s global brand recognition and efficient network are key to its Cash Cow status. Its reputation for dependability and optimized shipping routes enable high capacity utilization, allowing it to secure premium pricing in established markets. This strong market position translates to reduced marketing expenses and consistently high profit margins.

The company's integrated network facilitates smooth global trade, a significant advantage in the shipping industry. This operational efficiency directly contributes to its ability to generate substantial and reliable cash flow, reinforcing its Cash Cow designation within the BCG matrix.

- Global Brand Recognition: Evergreen is consistently ranked among the top global container shipping lines, fostering customer loyalty and trust.

- Network Efficiency: The company operates a vast network of vessels and terminals, optimizing transit times and reducing operational costs.

- Premium Rate Capability: In 2024, Evergreen's reliability allowed it to maintain strong freight rates, even amidst market fluctuations, contributing to robust profitability.

- High Profit Margins: The combination of brand strength and operational efficiency results in industry-leading profit margins, indicative of a mature and dominant market position.

Evergreen Marine Corp.'s established global container liner services, particularly those connecting East Asia with Europe and North America, are clear Cash Cows. These routes boast high market share and operational efficiency, consistently generating substantial cash flow. In 2023, Evergreen reported a net profit of NT$18.1 billion (approximately US$580 million), demonstrating the profitability of its core services despite a challenging global shipping market.

The company's extensive and fully utilized fleet of container ships is a prime example of a Cash Cow. These vessels, having already passed their peak investment phase, now represent a steady source of income with reduced capital expenditure needs. In 2024, Evergreen operated a substantial fleet, underscoring its capacity to generate consistent revenue and maintain strong profit margins.

Long-term contracted cargo volumes are a significant Cash Cow for Evergreen Marine Corp. (Taiwan). These agreements, especially on crucial trade lanes such as North America, guarantee a predictable revenue stream and stable cargo flow, insulating the company from spot market fluctuations. In 2024, Evergreen reported that a considerable percentage of its capacity was committed through these long-term agreements, providing a solid foundation for financial performance.

Evergreen's global brand recognition and efficient network are key to its Cash Cow status. Its reputation for dependability and optimized shipping routes enable high capacity utilization, allowing it to secure premium pricing in established markets. In 2024, Evergreen's reliability allowed it to maintain strong freight rates, contributing to robust profitability.

| Business Segment | BCG Matrix Category | Key Characteristics | 2023/2024 Data Points |

|---|---|---|---|

| Core Container Liner Services (East Asia-Europe/North America) | Cash Cow | High Market Share, Operational Efficiency, Stable Revenue | NT$18.1 billion net profit (2023); Strong freight rates maintained in 2024 |

| Fleet Operations | Cash Cow | Mature Assets, Reduced Capex, Consistent Income Generation | Substantial fleet size operated in 2024 |

| Long-Term Cargo Contracts | Cash Cow | Predictable Revenue, Stable Cargo Flow, Reduced Market Volatility Exposure | Considerable capacity committed via long-term agreements in 2024 |

| Global Brand & Network Efficiency | Cash Cow | Brand Recognition, Network Optimization, Premium Pricing Capability | Industry-leading profit margins; Ranked among top global carriers |

What You’re Viewing Is Included

Evergreen Marine Corp. (Taiwan) BCG Matrix

The Evergreen Marine Corp. (Taiwan) BCG Matrix preview you're viewing is the complete, unwatermarked document you'll receive immediately after purchase. This comprehensive analysis, detailing Evergreen's product portfolio within the BCG framework, is ready for immediate strategic application, offering actionable insights into their market positions and future growth potential.

Dogs

Evergreen Marine Corp.'s older U-class vessels, many of which have been sold for demolition or to the second-hand market, clearly fall into the Dog category of the BCG Matrix. These ships, by their nature, likely incurred higher operating expenses and possessed lower fuel efficiency compared to newer, more advanced tonnage.

The decision to divest these older U-class ships reflects a strategic move to shed assets that were no longer competitive. In 2023, Evergreen continued its fleet renewal program, a trend that would have certainly included the phasing out of these less efficient vessels, which may have struggled to meet evolving environmental standards and thus generated diminished returns.

Certain niche shipping routes or less strategically important regional services within Evergreen Marine Corp.'s portfolio might be experiencing persistently low demand or facing fierce price wars. These segments may not be exhibiting growth and Evergreen could hold a relatively small market share, resulting in minimal profitability or even ongoing losses.

For instance, if a specific intra-Asia route saw a 5% year-over-year decline in cargo volume in 2024, and Evergreen's market share on that route was only 3%, continued investment would likely not generate significant returns. Such routes become candidates for rationalization or outright withdrawal, with the primary objective being to stem losses rather than pursue expansion.

In periods of significant market overcapacity, Evergreen Marine Corp. (Taiwan) might find certain chartered vessels categorized as Dogs. These are vessels that cannot be profitably deployed or sub-chartered, meaning they represent a cost without generating sufficient revenue, acting as a drain on resources. For instance, if Evergreen has chartered vessels on short-term contracts and the market weakens considerably, these ships could become unproductive assets.

While Evergreen has strategically acquired some chartered vessels to enhance control over its fleet, any remaining excess capacity from these short-term charters, especially in a sluggish shipping market, poses a risk. Such assets require diligent management to prevent them from becoming a continuous financial burden, impacting overall profitability.

Outdated Ancillary Services

Outdated ancillary services within Evergreen Marine Corp. (Taiwan) could be classified as Dogs in the BCG Matrix if they possess a low market share and are in a low-growth market. These might include inland transportation or logistics services that haven't kept pace with technological advancements or face overwhelming local competition. For instance, if Evergreen's traditional trucking operations are struggling against more efficient, technology-driven freight forwarders, they could represent a Dog.

These underperforming ancillary services can become resource drains, diverting capital and management attention from more promising areas of the business. For example, if these services require significant investment to modernize or compete, but the market potential is limited, the return on investment is likely to be poor. Evergreen Marine's 2024 financial reports would need to be analyzed to identify specific ancillary segments showing declining revenues or profitability despite ongoing operational costs.

- Low Market Share: Ancillary services with a market share below 5% in their respective segments.

- Stagnant Growth: Inland transportation or logistics services experiencing annual growth rates of less than 2%.

- Resource Drain: Operations requiring substantial capital expenditure for upgrades with uncertain payback periods.

- Divestiture Consideration: Services that are candidates for sale or discontinuation due to persistent unprofitability.

Underperforming Regional Offices or Agencies

Underperforming regional offices or agencies within Evergreen Marine Corp. (Taiwan) would likely be categorized as Dogs in a BCG Matrix analysis. These entities demonstrate low market share in their respective local markets and operate within industries or regions experiencing minimal growth. For instance, an office in a region with declining industrial output or a saturated shipping market might fit this profile.

These operations may require significant administrative oversight and resources but contribute little to Evergreen's overall revenue or strategic objectives. In 2024, Evergreen continued to navigate global shipping dynamics, and any regional office failing to adapt to shifting trade volumes or competitive pressures would be a prime candidate for this classification. For example, if a specific regional office saw its market share drop below 5% in a market growing at less than 2% annually, it would signal a Dog status.

- Low Market Penetration: Offices with a market share significantly below industry averages in their operating regions.

- Stagnant Local Markets: Operations located in areas with limited economic growth or declining demand for shipping services.

- Resource Drain: Units that consume administrative and operational costs without generating proportional returns or contributing to global market share expansion.

- Strategic Review Necessity: These underperformers necessitate a thorough evaluation of their viability, potentially leading to restructuring, divestment, or repositioning.

Evergreen Marine Corp.'s older U-class vessels, having been sold or scrapped, represent clear Dogs in the BCG Matrix due to their diminished competitiveness and likely higher operating costs. This strategic divestment aligns with fleet modernization efforts, phasing out assets that struggle to meet efficiency and environmental standards, thereby generating lower returns. For example, in 2024, Evergreen's continued fleet renewal would have further reduced the presence of such older tonnage.

Certain less strategic shipping routes or regional services within Evergreen's network might also fall into the Dog category if they exhibit low demand, intense competition, and a small market share, leading to minimal profitability. For instance, a route experiencing a consistent decline in cargo volume, coupled with Evergreen holding a minor market share, would likely yield poor returns and necessitate rationalization to cut losses.

The company may also hold chartered vessels that cannot be profitably deployed due to market overcapacity, effectively becoming unproductive assets that incur costs without generating revenue. Such situations, especially in a weakened shipping market, require careful management to prevent them from becoming a continuous financial burden, impacting overall profitability.

Outdated ancillary services, such as traditional trucking operations, can also be classified as Dogs if they possess a low market share in a low-growth market and face strong competition from more technologically advanced providers. These underperforming segments can divert resources and management attention, offering poor returns on investment, particularly if significant modernization is required with uncertain payback.

Question Marks

Evergreen Marine Corp.'s collaboration with X-Press Feeders on Europe's inaugural green methanol-powered feeder network places this venture squarely in the Question Mark category of the BCG Matrix. This initiative taps into the burgeoning demand for sustainable shipping solutions, a sector experiencing rapid growth.

Despite the promising market outlook for green methanol, Evergreen's current market share within this emerging segment remains minimal. The company faces substantial investment needs to expand these operations and establish a significant presence.

The potential for high returns is considerable if this green methanol network achieves widespread adoption and operational efficiency. However, the long-term viability of green methanol as a primary fuel source is still subject to ongoing development and market acceptance.

Evergreen Marine Corp. (Taiwan) is investing in advanced digital logistics platforms and tech solutions, such as intelligent port technologies and enhanced container tracking. These initiatives are categorized as Question Marks within the BCG matrix due to their high-growth potential but currently developing market share for Evergreen in these specific tech-driven services.

Significant research and development alongside market adoption efforts are necessary for these ventures to gain substantial market share and achieve profitability. The success of these digital transformations is directly tied to rapid customer uptake and Evergreen's ability to differentiate its technological offerings in a competitive landscape.

Evergreen's potential expansion into emerging trade lanes, such as those driven by manufacturing diversification into countries like India, can be characterized as a question mark in the BCG Matrix. These markets present significant growth opportunities, but Evergreen's current market share is likely to be minimal, necessitating substantial investment to build a presence.

Successfully entering these new territories hinges on Evergreen's ability to adeptly manage evolving regulatory frameworks and competitive dynamics. The company will need to invest heavily to capture market share and establish a strong foothold in these high-potential, yet uncertain, ventures.

Exploring Specialized Cargo Segments

Evergreen Marine Corp. (Taiwan) could explore specialized cargo segments, distinct from its main container operations, as potential Stars or Question Marks in a BCG matrix. These niche areas, like advanced cold chain logistics or oversized project cargo, often exhibit high growth potential driven by specific industry demands. For instance, the global cold chain logistics market was valued at approximately USD 170 billion in 2023 and is projected to grow significantly, offering a prime example of such a specialized segment.

Venturing into these areas means Evergreen would likely begin with a relatively low market share, necessitating substantial investment in tailored services and market development to gain traction. The risks are considerable, as these markets require specialized equipment, expertise, and regulatory navigation. However, success could lead to significant rewards and diversification from the highly competitive standard container shipping market.

- High Growth Potential: Specialized segments like refrigerated cargo or oversized project shipments are experiencing robust demand.

- Low Initial Market Share: Evergreen would likely enter these niches with limited existing presence.

- Intensive Investment Required: Capturing market share demands tailored services, specialized assets, and dedicated marketing efforts.

- High Risk, High Reward: Success in these specialized areas offers significant profit potential but carries substantial operational and market entry risks.

Pilot Projects for Advanced Automation (e.g., Autonomous Shipping)

Evergreen Marine Corp. is likely exploring pilot projects for advanced automation, such as autonomous shipping, positioning these initiatives as potential Stars or Question Marks within the BCG framework. These ventures require substantial investment in research and development, with uncertain timelines for commercial viability and market adoption. For instance, the global maritime industry is projected to see significant investment in digitalization and automation, with some estimates suggesting the autonomous shipping market could reach billions by the late 2020s and early 2030s, though specific Evergreen investments are not publicly detailed.

- High R&D Investment: These advanced automation projects demand significant capital allocation for research, testing, and development, mirroring the characteristics of Question Marks.

- Nascent Market Share: Current market share for fully autonomous shipping operations is effectively zero, reflecting the early stage of technological development and regulatory hurdles.

- Future Growth Potential: Successful implementation could revolutionize logistics, offering potential for exponential growth and a competitive edge, aligning with the high-growth, low-market-share profile of Question Marks.

- Strategic Importance: Despite the risks, investing in these future-oriented technologies is crucial for long-term industry leadership and adaptation to evolving operational paradigms.

Evergreen Marine Corp.'s foray into green methanol-powered feeder networks and investments in advanced digital logistics platforms are classic examples of Question Marks in the BCG Matrix. These ventures are characterized by high growth potential in emerging markets, such as sustainable shipping and tech-driven logistics, but currently hold a low market share for Evergreen.

Significant capital is required to scale these operations, develop new technologies, and build market presence. The success of these initiatives hinges on factors like market adoption, technological advancement, and competitive positioning, making them high-risk, high-reward propositions.

For instance, the global green methanol market, while nascent, is projected for substantial growth, with the shipping industry aiming for significant decarbonization by 2050. Similarly, investments in digital logistics are crucial for efficiency, with the global logistics market expected to reach over $15 trillion by 2027, indicating a vast, albeit competitive, landscape.

| Initiative | BCG Category | Key Characteristics | Market Outlook | Evergreen's Position |

| Green Methanol Feeder Network | Question Mark | High growth potential, low current market share, high investment needs | Growing demand for sustainable shipping, significant R&D required | Low initial market share, substantial investment to scale |

| Advanced Digital Logistics Platforms | Question Mark | High growth potential, low current market share, high investment needs | Rapid digitalization of supply chains, increasing demand for efficiency | Developing market share in tech-driven services, needs differentiation |

BCG Matrix Data Sources

Our BCG Matrix for Evergreen Marine Corp. is built on comprehensive data, including their annual reports, investor presentations, and industry growth forecasts.