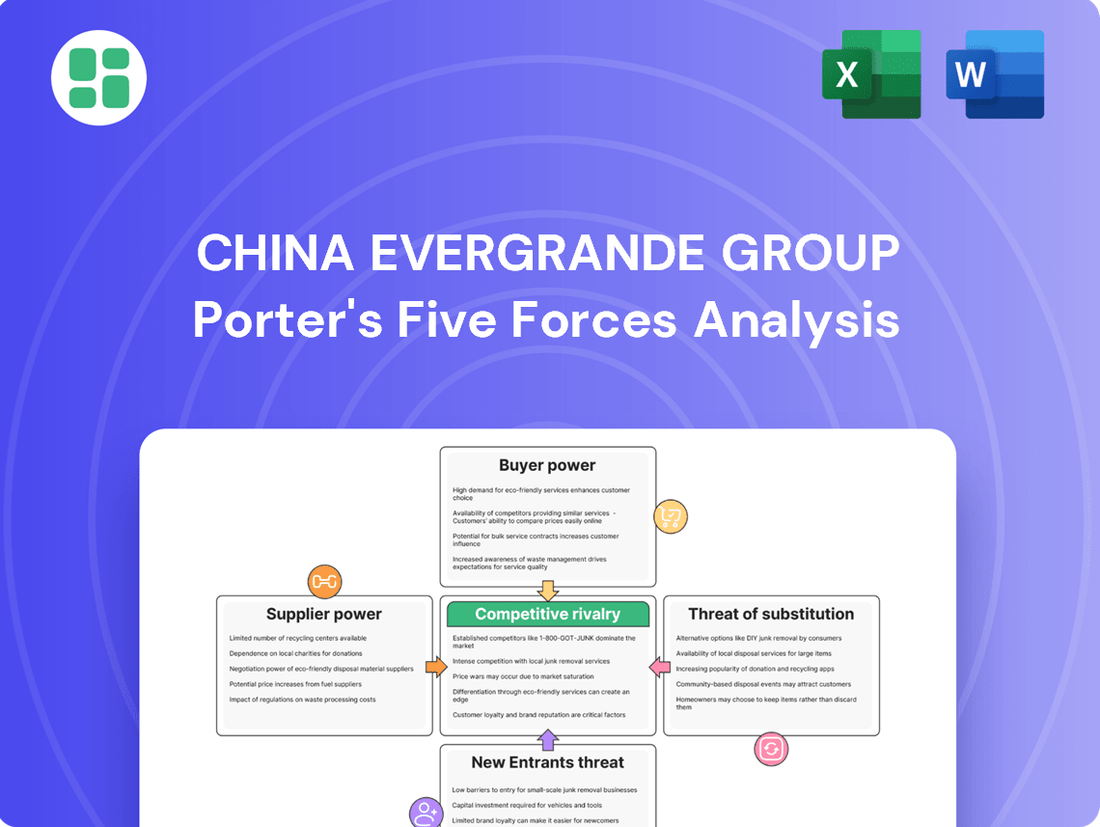

China Evergrande Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Evergrande Group Bundle

China Evergrande Group faces intense competition, with a moderate threat from new entrants due to high capital requirements in the real estate sector. Buyer power is significant, as customers have numerous housing options, and substitute products, like alternative investments, also exert pressure. The bargaining power of suppliers, particularly for construction materials, can impact profitability.

The complete report reveals the real forces shaping China Evergrande Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for essential inputs, such as land, construction materials, and financing, significantly amplifies their bargaining power over developers like China Evergrande Group. In China, local governments hold considerable sway over land availability, a critical component for real estate development, and can leverage this control, particularly when facing their own financial pressures.

Given China Evergrande Group's severe financial distress and ongoing liquidation proceedings, its suppliers, such as construction companies and material providers, face significant payment risks. This precarious situation inherently increases their bargaining power.

Suppliers can now demand upfront payments, more stringent contract terms, or even refuse to work with Evergrande altogether, seeking more financially stable clients. In 2023, reports indicated that many suppliers had not been paid for months, highlighting the depth of the financial strain and the leverage this gives them.

The bargaining power of suppliers for China Evergrande Group is a significant factor, influenced by the availability of alternatives. For common construction materials like cement and steel, Evergrande likely benefits from a broad supplier base, which generally limits individual supplier leverage.

However, the situation changes for more specialized inputs. For instance, securing financing from major banks or sourcing unique architectural components could involve a more concentrated group of suppliers. This concentration can empower those specific suppliers, allowing them to exert greater influence over pricing and terms.

In 2024, the real estate sector in China faced ongoing liquidity challenges, and developers like Evergrande were under pressure. This environment likely amplified the bargaining power of financial institutions willing to extend credit, as alternative funding sources became scarcer and more expensive.

Supplier Power 4

The bargaining power of suppliers for China Evergrande Group is significant, particularly given the specialized nature of construction materials and services required for large-scale real estate development. Switching costs for Evergrande can be substantial; imagine the disruption and expense involved in changing concrete suppliers mid-project, or finding new providers for specialized steel components. This difficulty in switching locks Evergrande into existing relationships, giving suppliers leverage.

For instance, in 2023, the construction industry globally faced continued supply chain disruptions, leading to increased material costs. Companies like Evergrande, heavily reliant on a steady flow of these goods, found themselves in a position where suppliers could dictate terms due to the high cost and time involved in finding and onboarding alternatives. This dynamic was exacerbated by Evergrande's own financial pressures, making it harder to negotiate favorable terms.

- High Switching Costs: Evergrande faces significant costs and logistical hurdles when changing suppliers, especially for critical materials like concrete, steel, and specialized building systems, impacting project timelines and budgets.

- Project Dependencies: Many suppliers provide materials or services integral to ongoing, large-scale developments, making it difficult to substitute them without causing substantial delays and cost overruns.

- Supplier Consolidation: In certain segments of the construction supply chain, a few dominant players exist, concentrating bargaining power in the hands of suppliers rather than buyers like Evergrande.

- Market Conditions: Global supply chain volatility and increased demand for construction materials in 2023 and early 2024 meant that suppliers often held the upper hand, able to command higher prices and stricter payment terms.

Supplier Power 5

The bargaining power of suppliers for China Evergrande Group, particularly concerning labor, presents a significant factor. Skilled labor in construction, essential for large-scale developments, can wield considerable influence, especially when the market for such expertise is competitive or demand is high. In 2024, China's labor costs continued their upward trend, though at a more measured pace compared to previous years, impacting project budgets.

This dynamic means that Evergrande, like other developers, faces the challenge of securing and retaining skilled construction workers. The need for specialized expertise in complex projects amplifies this power, as fewer individuals possess the requisite qualifications. Rising labor expenses directly affect project profitability and the overall cost structure of developments.

- Skilled Labor Demand: High demand for specialized construction skills in China's infrastructure and real estate sectors.

- Labor Cost Inflation: Moderate but consistent increases in wages for construction workers in 2024.

- Project Complexity: The need for expertise in large, intricate developments enhances the bargaining position of skilled labor.

- Impact on Margins: Rising labor costs can squeeze profit margins for developers like Evergrande.

China Evergrande Group's suppliers, especially those providing specialized materials or financing, possess significant bargaining power due to high switching costs and project dependencies. In 2024, ongoing liquidity issues in China's real estate sector further strengthened the hand of financial institutions willing to extend credit, as alternative funding became scarcer. This leverage allows suppliers to dictate terms, demand upfront payments, or refuse business, particularly impacting Evergrande given its severe financial distress and ongoing liquidation proceedings.

| Factor | Impact on Evergrande | 2024 Context |

| Land Availability | High dependence on government control | Local governments managing their finances may exert more control. |

| Construction Materials | High switching costs for specialized items | Global supply chain volatility continued, increasing material costs and supplier leverage. |

| Financing | Limited access due to financial distress | Financial institutions gained power due to increased risk and demand for credit. |

| Skilled Labor | Demand for specialized expertise | Labor costs continued to rise in China, impacting developer budgets. |

What is included in the product

This analysis of China Evergrande Group reveals intense rivalry among developers, significant buyer power due to market saturation, and moderate threats from new entrants and substitutes, all impacting the company's pricing and profitability.

A dynamic, interactive model that visualizes the intense competitive landscape China Evergrande faced, highlighting how the interplay of bargaining power and threat of substitutes contributed to its financial distress.

An intuitive framework that breaks down the overwhelming complexity of Evergrande's challenges, offering clarity on the external pressures that exacerbated its internal vulnerabilities.

Customers Bargaining Power

The bargaining power of customers, primarily Chinese homebuyers, is substantial for Evergrande, especially given the current market conditions. A significant oversupply of properties and a general decline in buyer confidence amplify this power.

Home prices have seen a downward trend, with national averages experiencing a moderation in decline, dropping by approximately 2% year-over-year in the first quarter of 2025. This follows a more pronounced 6% decrease observed throughout 2024, indicating a shift in market dynamics favoring buyers.

The bargaining power of customers in China's real estate sector, particularly concerning developers like China Evergrande Group, has intensified significantly. The widespread prevalence of unfinished projects and developer defaults, exemplified by Evergrande's ongoing liquidation proceedings, has deeply eroded buyer confidence.

This erosion of trust makes potential homebuyers extremely cautious about committing to new property purchases, especially from developers facing financial distress. Consequently, buyers are increasingly demanding completed properties and more favorable contract terms, effectively shifting leverage in their favor.

Buyer power for China Evergrande Group is significantly influenced by government interventions designed to stimulate the property market. Policies like reduced down payment requirements, lower mortgage interest rates, and the lifting of purchase restrictions directly empower potential buyers. For instance, by mid-2025, mortgage rates had fallen to historically low levels, making it more affordable for individuals to enter the housing market and increasing their leverage when negotiating with developers like Evergrande.

Buyer Power 4

The bargaining power of customers for China Evergrande Group is significantly amplified by a substantial oversupply in the property market. This abundance of both existing homes and new developments means buyers have a wide array of choices, directly impacting Evergrande's pricing power.

In 2024, the Chinese property market continued to grapple with high inventory levels. For instance, data from early 2024 indicated that the number of unsold new homes in many major Chinese cities remained elevated, giving prospective buyers considerable leverage. This situation forces developers like Evergrande to offer more competitive pricing and incentives to attract sales.

- High Inventory Levels: Continued oversupply in the secondary and new housing markets grants buyers more options.

- Price Sensitivity: Buyers are less willing to accept higher prices due to the availability of alternatives.

- Negotiating Power: Increased buyer choice translates directly into stronger negotiating positions for price and terms.

Buyer Power 5

Buyer power within China's real estate sector, particularly concerning developers like Evergrande, remains a significant force. Economic headwinds and employment anxieties in 2024 have amplified customers' price sensitivity. This heightened awareness of affordability, especially among younger demographics, compels developers to implement aggressive pricing strategies and offer attractive incentives, thereby tilting the scales of power further towards the buyer.

This dynamic is evident in the market's response to economic conditions. For instance, in early 2024, reports indicated a slowdown in property sales in several major Chinese cities, prompting developers to roll out promotions such as reduced down payments or extended payment terms. This strategic shift by developers directly reflects the increased bargaining power of potential homebuyers who are more cautious with their spending due to prevailing economic uncertainties.

- High Price Sensitivity: Economic uncertainty and job concerns in 2024 have made buyers more cautious about large purchases like real estate.

- Affordability Challenges: Particularly for younger generations, the cost of housing remains a significant barrier, increasing their leverage.

- Developer Incentives: To stimulate sales, developers are increasingly offering discounts, rebates, and flexible payment plans.

- Shift in Power: These factors collectively empower customers, forcing developers to compete more aggressively on price and value.

The bargaining power of customers, predominantly Chinese homebuyers, remains a formidable challenge for Evergrande. This power is magnified by a persistent oversupply of properties and a significant erosion of buyer confidence stemming from developer defaults, including Evergrande’s own liquidation. By mid-2025, mortgage rates had fallen to historically low levels, further empowering buyers with increased affordability and negotiating leverage.

| Metric | Q1 2024 | Q1 2025 |

|---|---|---|

| National Property Price Change (YoY) | -5.5% | -2.0% |

| Mortgage Interest Rate (Avg.) | 3.8% | 3.2% |

| Unsold Inventory (Major Cities) | Elevated | Slightly Elevated |

Full Version Awaits

China Evergrande Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase, detailing China Evergrande Group's Porter's Five Forces analysis, including the intense rivalry among developers, the bargaining power of suppliers and buyers, the threat of new entrants, and the impact of substitute products. You'll gain a comprehensive understanding of the competitive landscape that shaped Evergrande's challenges, presented in a professionally formatted and ready-to-use file.

Rivalry Among Competitors

The Chinese real estate sector is a battlefield, with a vast number of developers, both giants and smaller firms, constantly fighting for a bigger piece of the market. This intense competition, even with some industry consolidation, is amplified by the current market slowdown, pushing many companies to compete more aggressively on price and project offerings.

China Evergrande Group's court-ordered liquidation in early 2024 has dramatically reshaped the competitive landscape. This event has created a vacuum, empowering more stable developers, especially those backed by the state, to capture market share. These state-owned enterprises benefit from a stronger reputation for project completion and robust financial health, making them the preferred choice for cautious homebuyers in the current market.

The Chinese real estate market is intensely competitive, exacerbated by a significant oversupply of residential units. This surplus forces developers, including Evergrande, into aggressive pricing to move inventory, intensifying rivalry.

In 2024, the total area of residential projects available for sale saw a substantial increase, a trend projected to continue into 2025. This growing inventory puts immense pressure on developers to compete fiercely on price and sales volume.

Competitive Rivalry 4

Government intervention, such as the 'whitelist' policy aimed at directing financing to viable projects and encouraging affordable housing, significantly influences the competitive dynamics among Chinese property developers. This policy can create an uneven playing field, benefiting developers with projects that align with government priorities.

Despite these efforts, the overall market conditions remain challenging. For instance, in early 2024, China's property sales volume experienced a notable decline, indicating that such supportive measures have not yet fully revitalized the sector's health.

- Government support, like the whitelist policy, aims to stabilize the market but has shown limited impact on overall sales figures in early 2024.

- The focus on affordable housing may shift competition towards developers capable of meeting these specific development criteria.

- The persistent downturn in property sales underscores the deep-seated issues affecting the industry, despite policy interventions.

Competitive Rivalry 5

Even beyond its core property development business, China Evergrande Group faces intense competition across its diversified ventures. Its new energy vehicle (NEV) segment, for instance, contends with well-established automakers and numerous startups, all vying for market share in a rapidly evolving sector.

Evergrande's property management arm also operates in a crowded landscape, with many companies offering similar services. This broad competitive pressure across its various business lines adds another layer of complexity to Evergrande's overall market position.

- Intense NEV Competition: Evergrande's NEV unit, Hengchi, faces a highly competitive market against established global and domestic players.

- Struggles in NEV: The NEV business has reported significant financial losses and liquidity challenges, indicating a difficult competitive environment.

- Diversified Competitive Pressures: Competition extends to property management and other ventures, impacting the conglomerate's overall standing.

The competitive rivalry within China's real estate sector remains fierce, amplified by a substantial oversupply of residential units. This oversupply forces developers, including those previously associated with Evergrande, into aggressive pricing strategies to move inventory, intensifying competition. The liquidation of Evergrande in early 2024 has created opportunities for more stable developers, particularly state-owned enterprises, to gain market share, as they are perceived as more reliable by cautious homebuyers.

| Metric | 2023 (Approx.) | Early 2024 (Approx.) | Trend Impact |

|---|---|---|---|

| Property Sales Volume Decline | Significant | Continued Decline | Increased Price Competition |

| Residential Inventory | High | Increasing | Intensified Rivalry |

| State-Owned Developer Market Share | Growing | Further Growth Expected | Shifts Competitive Landscape |

SSubstitutes Threaten

Renting remains a significant substitute for property ownership, particularly for younger demographics grappling with elevated entry costs and economic volatility. In 2024, the appeal of renting is amplified by the persistent affordability challenges in many major Chinese cities, making it a more accessible housing solution.

While rental yields have experienced some shifts, they continue to present a practical alternative to the substantial capital outlay required for purchasing property. This dynamic is crucial for companies like China Evergrande, as it directly impacts the demand for new home sales.

Investors can shift their capital from real estate to alternative asset classes like stocks and bonds if property market returns diminish. For instance, as of early 2024, global equity markets have shown resilience, with major indices like the S&P 500 reaching new highs, making them an attractive alternative to a struggling property sector.

The threat of substitutes for China Evergrande Group's offerings is significant, particularly from smaller, more affordable housing units in lower-tier cities developed by competing firms. These alternatives directly appeal to budget-conscious buyers who may find Evergrande's typically larger and higher-end projects out of reach.

Data from 2024 indicates that while Tier 1 cities in China have demonstrated more price resilience, lower-tier cities have experienced greater volatility, making the affordability factor of substitute housing even more compelling for a broader segment of the market.

Threat of Substitutes 4

The threat of substitutes for China Evergrande Group's core business of commercial housing development is intensifying due to a significant increase in government-backed housing initiatives. These programs offer affordable and rental housing options, directly competing with privately developed properties, especially for lower and middle-income segments of the population.

In 2024 alone, China saw the construction of approximately 3 million affordable and rental housing units. This substantial supply of government-subsidized alternatives presents a direct challenge to developers like Evergrande, potentially dampening demand for their market-rate properties.

- Growing Affordable Housing Supply: Government initiatives are expanding the availability of affordable and rental housing units.

- Direct Competition for Lower/Middle Income Buyers: These subsidized options serve as a viable alternative for a significant demographic.

- 2024 Construction Figures: Around 3 million affordable and rental housing units were built in 2024, increasing substitute availability.

Threat of Substitutes 5

For China Evergrande Group's property management services, the threat of substitutes is significant. Property owners can opt for in-house management, which eliminates the need for external providers altogether. This is a direct substitute that bypasses the service entirely.

Furthermore, the property management sector is highly competitive, featuring numerous other companies offering similar services. These competitors present a constant alternative for property owners looking for management solutions. In 2024, the property management market in China continued to see growth, with many smaller and regional players actively vying for market share, increasing the pressure on established entities like Evergrande's services.

- In-house Management: Property owners can manage their own properties, reducing reliance on third-party services.

- Alternative Property Management Firms: A crowded market offers numerous competitors with comparable service offerings.

- Competitive Landscape: The presence of many providers intensifies price competition and service innovation.

The threat of substitutes for China Evergrande's residential properties is substantial, driven by increasing rental options and alternative investments. In 2024, the persistent affordability issues in major Chinese cities made renting a more attractive proposition for many, directly impacting demand for new home purchases.

Investors also have the flexibility to shift capital away from real estate towards more liquid and potentially higher-returning assets. For example, by early 2024, global equity markets, such as the S&P 500, demonstrated strong performance, offering a compelling alternative to a cooling property market.

Furthermore, government-backed affordable housing initiatives present a direct substitute. China's commitment to increasing the supply of such units, with approximately 3 million built in 2024, directly caters to lower and middle-income buyers, diverting demand from developers like Evergrande.

| Substitute Type | Description | Impact on Evergrande | 2024 Relevance |

|---|---|---|---|

| Rental Housing | Leasing instead of owning property. | Reduces demand for home sales. | Amplified by affordability challenges in urban centers. |

| Alternative Investments | Stocks, bonds, etc. | Capital reallocation away from real estate. | Resilient global equity markets offered attractive returns. |

| Government Affordable Housing | Subsidized housing units. | Direct competition for specific buyer segments. | Significant new supply in 2024 increased availability. |

Entrants Threaten

The threat of new entrants in China's real estate sector, particularly for large-scale developers like Evergrande, is significantly dampened by the immense capital requirements. Acquiring land, financing construction, and marketing projects demand billions of dollars, creating a formidable barrier that deters many potential new players. For instance, in 2024, the average cost of land acquisition for major projects in Tier-1 cities often exceeded tens of billions of RMB, making it difficult for smaller or less capitalized firms to compete.

The threat of new entrants in China's property market, particularly for a company like Evergrande, is significantly shaped by stringent government oversight. Extensive regulations, including obtaining land use permits, construction approvals, and navigating financing restrictions, erect substantial barriers. These regulatory hurdles demand considerable capital and expertise, making it difficult for new players to emerge and compete effectively.

The threat of new entrants for China Evergrande Group is relatively low, largely due to significant barriers to entry in the Chinese real estate market. Established brand loyalty and trust in existing large developers, particularly state-backed ones, make it challenging for new players to gain market acceptance and compete effectively. Homebuyers often still prefer state-owned names, which carry an implicit guarantee of stability and completion, a crucial factor in a market that has experienced developer defaults.

Threat of New Entrants 4

The threat of new entrants for China Evergrande Group is significantly impacted by the capital-intensive nature of real estate development. Access to land and financing are paramount, and established developers like Evergrande often benefit from long-standing relationships with local governments and financial institutions. This provides them with preferential access to prime land parcels and crucial funding, creating substantial barriers for newcomers. In 2024, banks continued to exhibit caution in lending to real estate developers, particularly those with weaker financial profiles, further intensifying this challenge for potential new entrants.

New players face considerable hurdles in securing the necessary capital and prime land resources that incumbent developers have already consolidated. This difficulty is exacerbated by the current economic climate and regulatory scrutiny within China's property sector.

- High Capital Requirements: Real estate development demands enormous upfront investment for land acquisition, construction, and marketing, deterring many potential entrants.

- Established Relationships: Incumbent developers possess strong ties with local governments for land approvals and with banks for financing, which are difficult for new firms to replicate.

- Lender Hesitancy: As of 2024, financial institutions remain cautious about extending credit to the real estate sector, especially to developers perceived as high-risk, limiting funding options for new companies.

Threat of New Entrants 5

The current property market downturn in China, marked by significant distress among existing developers like China Evergrande Group, presents a formidable barrier to new entrants. This environment fosters a perception of elevated risk, making potential investors hesitant to commit capital despite the availability of distressed assets. For instance, as of early 2024, the ongoing restructuring and debt challenges faced by major developers continue to cast a shadow over the sector's stability.

While the liquidation of assets from struggling firms might seem to open doors, the underlying economic conditions and regulatory uncertainties significantly dampen enthusiasm for new players. The sheer scale of capital required to enter and compete effectively in China's real estate market, coupled with the lingering effects of Evergrande's financial crisis, discourages many. The market's volatility, underscored by fluctuating property sales and developer credit ratings throughout 2023 and into 2024, further amplifies this deterrent effect.

- Perceived High Risk: The financial distress of major developers like Evergrande signals a challenging market, deterring new investment.

- Capital Intensity: Entering the Chinese real estate market requires substantial capital, a significant hurdle for newcomers.

- Market Volatility: Fluctuations in property sales and developer creditworthiness in 2023-2024 amplify the perceived risk for potential entrants.

The threat of new entrants into China's real estate sector, impacting firms like Evergrande, remains low due to substantial barriers. High capital requirements for land acquisition and development, often in the tens of billions of RMB for major projects in 2024, are a primary deterrent.

Stringent government regulations and the need for established relationships with local authorities and financial institutions further complicate market entry. These factors, combined with lender hesitancy in 2024 towards the property sector, particularly for less capitalized firms, create significant hurdles for newcomers.

The market's current downturn, exemplified by the ongoing distress of developers like Evergrande, amplifies perceived risk, making new investment less attractive despite potential opportunities in distressed assets.

| Barrier | Impact on New Entrants | 2024 Data/Context |

|---|---|---|

| Capital Requirements | Extremely High | Land acquisition costs in Tier-1 cities often exceed tens of billions of RMB. |

| Regulatory Hurdles | Significant | Complex permit and approval processes require substantial expertise and capital. |

| Financing Access | Challenging | Banks exhibit caution, limiting credit for developers with weaker financial profiles. |

| Market Perception | Deterrent | Developer distress and market volatility increase perceived risk for new investors. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Evergrande Group is built upon a foundation of comprehensive data, including their official annual reports, investor relations disclosures, and filings with the China Securities Regulatory Commission (CSRC).

We supplement this with insights from reputable industry research firms specializing in the Chinese real estate sector, alongside macroeconomic data from government statistical bureaus to capture the broader market landscape.