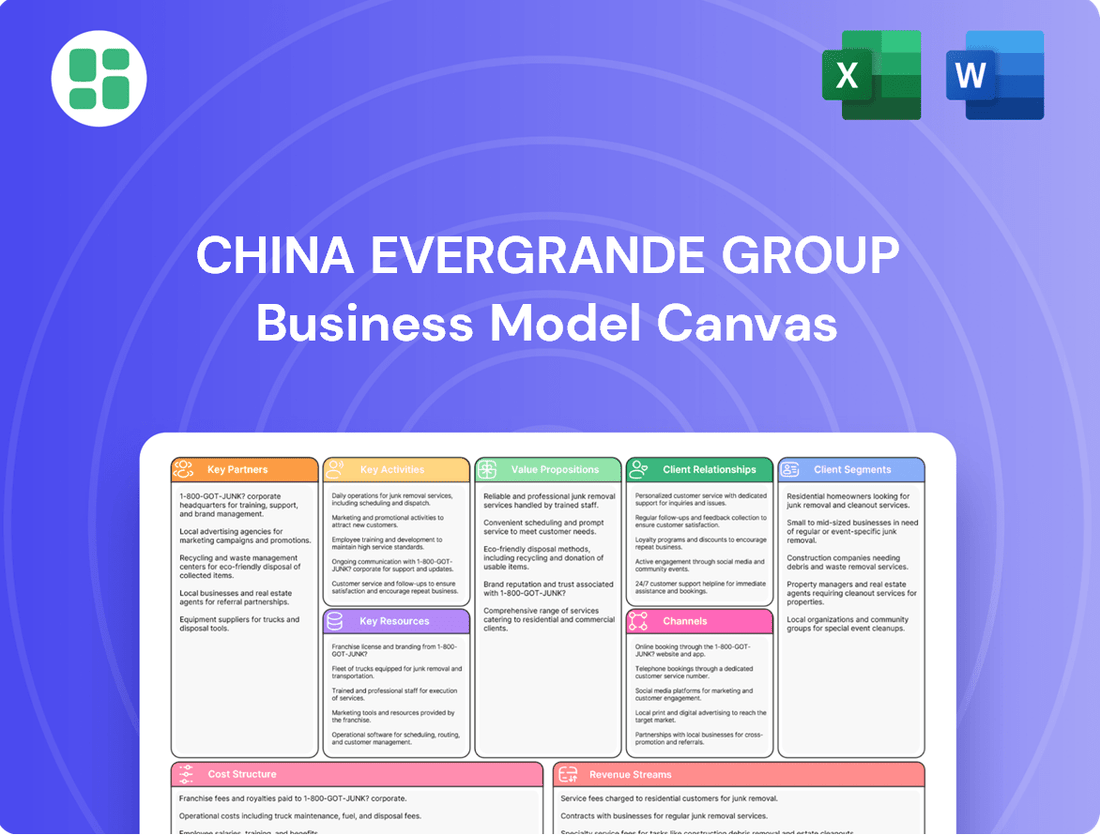

China Evergrande Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Evergrande Group Bundle

Uncover the intricate workings of China Evergrande Group's business model with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer segments, value propositions, and revenue streams, offering a strategic roadmap for understanding their market dominance. Download the full canvas to gain actionable insights for your own business strategies.

Partnerships

China Evergrande Group's mainland subsidiaries rely heavily on government agencies and local authorities for crucial project approvals and navigating complex regulatory landscapes. These relationships are vital for obtaining land use rights, construction permits, and sales licenses, underpinning the company's extensive development activities.

The Chinese government's intervention, particularly through the 'white-list' mechanism, highlights the critical role of state-backed entities in providing financing for projects deemed essential for completing unfinished homes. This system, which began to gain traction in late 2023 and continued through 2024, aims to stabilize the property market and protect homebuyers, directly impacting Evergrande's ability to manage its ongoing restructuring and liquidation by potentially facilitating the completion of key developments.

Creditors and Lenders are a cornerstone of Evergrande's financial structure, encompassing a wide array of domestic and offshore bondholders, banks, and various financial institutions. These relationships are currently defined by ongoing, intricate debt restructuring negotiations and legal battles, all aimed at navigating the company's significant financial obligations.

The company's inability to present a creditor-backed, viable restructuring plan directly led to a liquidation order from a Hong Kong court in January 2024, highlighting the critical nature of these partnerships in its operational survival.

Historically, China Evergrande Group depended on an extensive network of construction contractors and material suppliers for its vast real estate projects. This reliance was fundamental to its rapid expansion.

Despite Evergrande's financial challenges, preserving these partnerships remains vital for finishing ongoing, incomplete developments. The government's focus on delivering these properties necessitates continued engagement with construction firms.

As of late 2023 and into 2024, the real estate sector in China, including companies like Evergrande, has seen significant shifts in payment terms and project financing, impacting these supplier relationships.

Property Management Service Providers (Third-Party Clients)

Evergrande Property Services has been aggressively seeking third-party clients, a strategic move to diversify its revenue. In 2023, this expansion significantly boosted its contracted Gross Floor Area (GFA) from external sources, signaling a pivot towards a more operational, less capital-intensive model within its property management arm.

This strategy is crucial for building more resilient and predictable income streams. By serving a wider range of properties beyond Evergrande’s own developments, the company mitigates risks associated with its core real estate business.

- Diversified Revenue: Partnerships with third-party property owners provide a stable income base, reducing reliance on Evergrande's development pipeline.

- Operational Focus: The expansion supports a 'light-asset, heavy-operation' model, emphasizing service delivery and management efficiency.

- Growth Potential: Tapping into the broader property management market offers substantial growth opportunities for the services subsidiary.

Strategic Investors and Asset Purchasers

Strategic investors and asset purchasers are critical partners for China Evergrande Group, especially given its ongoing liquidation and asset disposal. These entities, which could include rival property developers, investment funds, or even state-backed firms, are essential for the recovery of value from Evergrande's vast portfolio of projects and land holdings. For instance, as of early 2024, liquidators are actively seeking buyers for various Evergrande assets, aiming to satisfy creditor claims.

These partnerships are vital for the orderly wind-down of the company. Potential buyers are looking for distressed assets at opportune prices, while liquidators need these transactions to generate funds. The success of these sales directly impacts the distribution of proceeds to creditors and stakeholders. The market for distressed real estate assets in China remains dynamic, influenced by government policies and overall economic conditions.

- Rival Property Developers: Companies like Country Garden or Vanke might acquire specific projects or land banks to expand their market share or secure development pipelines.

- Investment Firms and Funds: Private equity or distressed debt funds could be interested in purchasing portfolios of Evergrande's assets, often with a strategy to restructure and resell them.

- State-Owned Enterprises (SOEs): Government-backed entities may step in to acquire key assets, particularly those with strategic importance or those that can ensure project completion for homebuyers.

China Evergrande Group's key partnerships are undergoing significant transformation due to its liquidation. Government agencies remain crucial for navigating approvals and the 'white-list' financing mechanism, which in 2024 continued to support project completion. Creditors and lenders are central to the ongoing restructuring and liquidation process, with the January 2024 liquidation order underscoring their critical role. Strategic investors and asset purchasers are now vital for asset disposal, with liquidators actively seeking buyers for Evergrande's extensive portfolio in early 2024 to satisfy creditor claims.

| Partner Type | Role in Business Model | 2024 Relevance/Data |

| Government Agencies/Local Authorities | Project approvals, land rights, regulatory navigation | Continued reliance on 'white-list' financing for project completion. |

| Creditors and Lenders | Financing, debt restructuring | Central to liquidation process following January 2024 court order; ongoing negotiations. |

| Strategic Investors/Asset Purchasers | Acquisition of distressed assets, portfolio sales | Liquidators actively seeking buyers for assets in early 2024 to recover value. |

What is included in the product

China Evergrande Group's business model revolved around aggressive expansion in the real estate sector, targeting a broad customer base with diverse housing products and leveraging extensive sales channels and partnerships.

This model, characterized by high leverage and rapid growth, focused on delivering value through affordable housing and integrated urban development, though it proved vulnerable to market shifts and debt accumulation.

China Evergrande Group's Business Model Canvas serves as a pain point reliever by offering a high-level, editable view of its core components, allowing for quick identification of issues and strategic adjustments.

This one-page snapshot condenses complex strategy into a digestible format, saving hours of formatting and enabling rapid adaptation for new insights or data, thus relieving the pain of inefficient analysis.

Activities

Following the Hong Kong court's winding-up order in January 2024, a crucial activity for China Evergrande Group is the liquidation and disposal of its extensive asset portfolio, especially those held offshore. This complex undertaking aims to generate value for creditors.

The process faces considerable hurdles, particularly concerning the enforcement of claims against assets located in mainland China, where the majority of Evergrande's holdings reside. Appointed liquidators are actively managing these efforts to maximize recovery.

Evergrande's core activity, even amidst its financial struggles, involves completing and delivering pre-sold, unfinished residential projects across mainland China. This crucial task is often guided by the Chinese government, prioritizing social stability and the delivery of homes to millions of buyers.

To facilitate this, the company is leveraging 'white-list' financing mechanisms, a government-backed initiative designed to provide essential funding for these stalled developments. As of early 2024, reports indicated that hundreds of projects were on these white lists, aiming to unblock funds for construction and delivery.

Evergrande Property Services, a crucial arm of the group, actively manages and grows its core offerings. These services encompass essential property upkeep, enriching community living experiences, and strategic asset management.

The company is dedicated to enhancing service quality and broadening its market reach. This dual focus aims to solidify its revenue streams and fuel continued profit expansion.

In 2023, Evergrande Property Services reported revenues of approximately RMB 20.5 billion, demonstrating its ongoing operational capacity despite broader group challenges.

Debt Restructuring and Legal Proceedings

China Evergrande Group is deeply enmeshed in extensive debt restructuring talks with diverse creditor factions, a critical process for managing its substantial financial obligations. This ongoing engagement directly shapes the potential future operational framework and overall sustainability of any surviving business units.

The company is actively engaged in navigating a complex web of legal proceedings, a direct consequence of its numerous payment defaults. These legal battles are paramount in determining how Evergrande will address its massive liabilities and define the path forward for its remaining assets.

Key legal activities include efforts to contest or appeal liquidation orders, alongside contentious disputes concerning the recovery and distribution of company assets among creditors. For instance, by early 2024, the group faced continued pressure from offshore bondholders seeking clarity on asset recovery and restructuring plans, with many of these legal avenues still unfolding.

- Debt Restructuring Negotiations: Ongoing discussions with various creditor groups to arrive at a viable repayment plan.

- Legal Proceedings: Actively involved in court cases related to defaults, asset seizures, and liquidation attempts.

- Liquidation Order Appeals: Efforts to challenge or delay formal liquidation proceedings initiated by creditors.

- Asset Recovery Disputes: Legal battles over the ownership and distribution of Evergrande's assets among its many claimants.

Maintaining Core Business Operations (Property Services)

Evergrande Property Services, a key operational subsidiary, focuses on maintaining financial independence and adhering to regulatory standards. This includes robust internal audit oversight and meticulous cash flow management. The objective is to bolster the financial health of the Group's more stable business units.

Enhancing cash reserves is a critical activity, aiming to fortify the Group's overall financial resilience. This strategic focus on stable segments like property services is designed to improve their operating and financial standing, contributing to the Group's broader stability efforts.

- Financial Independence: Ensuring subsidiaries can operate without direct reliance on the distressed parent company.

- Compliance and Transparency: Adhering to all legal and regulatory requirements, with clear financial reporting.

- Cash Flow Optimization: Implementing strategies to improve the generation and management of cash within operations.

- Cash Reserve Enhancement: Actively building and maintaining healthy cash balances to support operations and potential liabilities.

The core activities of China Evergrande Group, particularly in the wake of its January 2024 winding-up order, revolve around managing its vast asset portfolio through liquidation, completing unfinished property projects, and navigating complex debt restructuring and legal battles. These efforts are crucial for satisfying creditors and addressing liabilities.

A significant ongoing activity involves the completion of pre-sold housing projects across China, often supported by government-backed financing initiatives like the 'white-list' system. This focus aims to ensure delivery to homeowners and maintain social stability.

Evergrande Property Services continues its operations, managing properties and seeking to expand its service offerings to bolster revenue. The company reported revenues of approximately RMB 20.5 billion in 2023, highlighting its continued operational capacity.

The group is deeply involved in debt restructuring negotiations with diverse creditor groups and actively engages in legal proceedings stemming from payment defaults. These legal activities are critical in determining the distribution of assets and the company's future path.

| Key Activity | Description | Status/Data Point |

|---|---|---|

| Asset Liquidation | Disposal of offshore and onshore assets to generate value for creditors. | Ongoing; facing challenges with mainland China asset enforcement. |

| Project Completion | Finishing pre-sold residential developments. | Leveraging government 'white-list' financing; hundreds of projects targeted in early 2024. |

| Debt Restructuring | Negotiations with various creditor factions. | Critical process shaping potential future operations. |

| Legal Proceedings | Managing court cases related to defaults and asset distribution. | Includes contesting liquidation orders and asset recovery disputes. |

| Property Services Operations | Managing and growing property management services. | Reported RMB 20.5 billion in revenue for 2023. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas for China Evergrande Group you are currently viewing is the exact document you will receive upon purchase. This comprehensive breakdown, detailing Evergrande's operations, customer segments, value propositions, and revenue streams, is not a sample but a direct representation of the final deliverable. You'll gain immediate access to this fully realized canvas, ready for your analysis and strategic planning.

Resources

China Evergrande Group's remaining land bank and property projects are its core tangible assets, though many are currently stalled or subject to restructuring. These developments, primarily located in mainland China, are crucial for any potential creditor repayment and the group's future viability.

As of late 2023, Evergrande's land reserves were estimated to be around 231 million square meters, a significant reduction from its peak but still substantial. The successful completion and sale of these projects are paramount to resolving the group's massive debt obligations.

Evergrande's skilled workforce, particularly within its property management division, represents a core resource. Despite widespread challenges, including significant layoffs impacting other segments like its New Energy Vehicle (NEV) operations, the company still employs individuals with critical expertise in property development, construction, and ongoing property services. This human capital is vital for maintaining its existing assets and operations.

The property services segment specifically highlights the quality of its management team and staff. This focus underscores the importance of experienced leadership and dedicated personnel in delivering services and managing client relationships, even amidst the company's broader financial difficulties.

Evergrande Property Services' key resources include its extensive contracted and managed Gross Floor Area (GFA), spanning numerous cities throughout China. As of the end of 2023, the company managed a significant GFA, underpinning its recurring revenue streams and market presence.

This vast GFA portfolio, a critical asset, translates directly into a predictable and substantial recurring revenue base for Evergrande Property Services. The sheer scale of managed properties is a testament to its operational capacity and market penetration.

The established operational infrastructure, including its workforce and management systems, alongside a loyal client base, are foundational to the subsidiary's continued performance and its potential for future expansion within the competitive property services sector.

Brand Recognition (Historical) and Customer Base

Evergrande's historical strength lay in its widespread brand recognition as a major residential developer throughout China. This brand equity, though tarnished, remains a foundational asset. By late 2023, the company still had millions of uncompleted homes, representing a vast existing customer base that the property services division could potentially engage.

The ongoing efforts to deliver previously promised homes are a crucial strategy to rebuild a degree of customer trust, even amidst the financial turmoil. This focus on fulfilling existing commitments is a direct attempt to leverage the residual goodwill from its historical customer base.

- Historical Brand Recognition: Evergrande was once among China's top property developers, known for its large-scale projects.

- Extensive Customer Base: The company had millions of homebuyers across China, many of whom are still awaiting property delivery.

- Leveraging Property Services: The property services arm can tap into this existing customer base for recurring revenue streams.

Intellectual Property and Technology (NEV)

Despite significant operational challenges and a near halt in its New Energy Vehicle (NEV) segment, China Evergrande Group's NEV division still possesses valuable intellectual property, including patents and technological know-how in electric vehicle R&D and manufacturing. These intangible assets, though currently underutilized due to the company's financial distress, could represent a residual value for potential future sales or strategic partnerships.

The company's NEV segment, Evergrande Electric Vehicle Group Limited (stock code 00708.HK), reported substantial losses. For the year ended December 31, 2023, the group recorded a net loss of RMB 11.93 billion (approximately USD 1.65 billion), a considerable increase from the RMB 5.91 billion (approximately USD 815 million) loss in 2022. This financial strain highlights the precarious state of its operational capabilities.

- Intellectual Property Portfolio: Evergrande NEV has accumulated a portfolio of patents related to electric vehicle design, battery technology, and manufacturing processes.

- Technological Capabilities: The company invested heavily in R&D, developing expertise in areas like intelligent driving systems and advanced manufacturing techniques.

- Potential for Monetization: While operations are severely curtailed, these intellectual assets could be licensed or sold to other automotive players seeking to accelerate their EV development.

- Market Context: The global NEV market continued its growth trajectory in 2024, driven by increasing consumer demand and government support for electric mobility, suggesting a potential market for acquired EV technologies.

China Evergrande Group's key resources are its substantial, albeit reduced, land bank and ongoing property projects, representing its primary tangible assets. These developments, concentrated in China, are critical for any debt repayment strategy and the group's future. The property services segment, Evergrande Property Services, boasts a significant contracted and managed Gross Floor Area (GFA), providing a stable recurring revenue base. Furthermore, the NEV division holds valuable intellectual property and technological capabilities in electric vehicle R&D, even amidst significant financial losses, offering potential for future monetization.

| Resource Category | Specific Resource | Status/Key Data (as of late 2023/early 2024) | Relevance |

| Tangible Assets | Land Bank | Approx. 231 million sq meters | Core for project completion and debt resolution |

| Intangible Assets | NEV Intellectual Property | Patents, R&D expertise in EV technology | Potential for licensing or sale |

| Human Capital | Skilled Workforce (Property Services) | Experienced in property development, construction, services | Maintaining existing assets and operations |

| Brand Equity | Historical Brand Recognition | Recognized major residential developer | Leveraging residual goodwill and customer engagement |

| Operational Infrastructure | Managed GFA (Property Services) | Significant contracted and managed GFA | Underpins recurring revenue streams |

Value Propositions

For hundreds of thousands of homebuyers, the core value is the eventual completion and delivery of their pre-purchased homes. This addresses a fundamental need for housing and stability. Government support, through initiatives like 'white-lists,' aims to facilitate this delivery, providing a degree of assurance to these buyers.

Evergrande Property Services provides a full suite of management solutions, encompassing basic upkeep, community engagement, and asset oversight. These services cater to both Evergrande-developed properties and external clients, ensuring resident satisfaction and property value preservation.

In 2023, Evergrande Property Services managed a significant portfolio, aiming to enhance living standards through diversified offerings and a commitment to quality. The company's strategy involves continuous improvement and expanding its service range to meet evolving customer needs.

For China Evergrande Group's creditors, the primary value proposition is the orderly recovery and maximization of value from the company's extensive asset base. This structured liquidation process aims to provide a clear path for addressing the significant debt, even if full repayment remains improbable.

The goal is to facilitate a systematic approach to asset disposition, ensuring that recovered funds are distributed equitably among the diverse group of stakeholders. This contrasts with a chaotic, unmanaged collapse, offering a semblance of control in a challenging financial situation.

As of early 2024, Evergrande's total liabilities stood at approximately $328 billion, highlighting the scale of the challenge in asset recovery. The orderly process is crucial for creditors to realize any portion of their claims.

Stabilization of the Real Estate Market

For the Chinese government and the broader economy, Evergrande's restructuring and the completion of its projects are crucial for stabilizing the distressed real estate sector. By tackling this major default, it aims to rebuild confidence and mitigate systemic risks.

The successful restructuring process is vital for ensuring the delivery of pre-sold homes. In 2023, Evergrande committed to delivering 600,000 units, a significant undertaking that directly impacts homeowners and maintains social stability.

Evergrande's efforts to resume construction and sales are essential for deleveraging and meeting its financial obligations. This includes managing its substantial debt pile, which stood at over $300 billion as of mid-2024, a key factor in the market's perception of stability.

- Project Completion: Focus on finishing stalled developments to satisfy homebuyers.

- Debt Management: Implement restructuring plans to address significant liabilities.

- Market Confidence: Restore trust in the property market through tangible progress.

- Economic Impact: Prevent contagion and support broader economic stability.

Integrated Community Living

Historically, China Evergrande Group's core value proposition centered on developing integrated communities. These projects offered more than just residences, incorporating a wide array of amenities and services designed to create a self-sufficient living environment for residents.

Even with current development limitations, Evergrande's property management segment continues to uphold this commitment. They focus on delivering elements of this holistic living experience to existing homeowners, ensuring continued value through ongoing services and community upkeep.

This integrated living concept was a key differentiator for Evergrande, aiming to attract buyers seeking convenience and a complete lifestyle package within their residential developments.

- Community Focus: Evergrande historically built developments with integrated amenities like clubhouses, shopping centers, and green spaces.

- Service Provision: The property management arm continues to offer services such as security, maintenance, and community event organization for existing residents.

- Resident Experience: The aim was to provide a comprehensive living solution, enhancing the daily lives of homeowners.

For homebuyers, the value is the eventual delivery of their homes, a fundamental need for stability. Evergrande Property Services offers comprehensive management solutions, enhancing resident satisfaction and property value for both its own and external properties. The government's role, through initiatives like 'white-lists,' aims to facilitate project completion, offering some assurance to buyers amidst financial restructuring.

Creditors see value in the orderly recovery and maximization of assets from Evergrande's extensive portfolio. This structured liquidation aims to provide a path for addressing the company's substantial debt, with total liabilities around $328 billion as of early 2024. The systematic disposition of assets is crucial for equitable distribution among stakeholders.

The Chinese government views Evergrande's restructuring and project completion as vital for stabilizing the real estate sector and rebuilding market confidence. By addressing this major default, the aim is to mitigate systemic risks and ensure the delivery of pre-sold homes, a commitment that included 600,000 units in 2023.

| Stakeholder | Core Value Proposition | Key Data/Fact |

|---|---|---|

| Homebuyers | Completion and delivery of pre-purchased homes | Commitment to deliver 600,000 units in 2023 |

| Creditors | Orderly asset recovery and debt resolution | Total liabilities approx. $328 billion (early 2024) |

| Government/Economy | Stabilization of real estate sector, market confidence | Efforts to resume construction and sales to manage debt over $300 billion (mid-2024) |

Customer Relationships

China Evergrande Group's relationship with homebuyers is paramount, especially given the significant number of unfinished properties. In 2024, the company continued to face immense pressure to deliver these homes, directly impacting trust and future sales. Managing these relationships involves transparent communication about construction progress and addressing concerns stemming from the company's financial challenges.

Evergrande Property Services cultivates customer relationships by delivering dependable, professional, and top-tier property management. This means actively engaging with property owners through responsive service requests, organizing community events, and maintaining open lines of communication. For instance, in 2023, the company managed over 2.7 billion square meters of property, underscoring the scale of its service-oriented approach.

The core objective is to ensure owner satisfaction and secure the renewal of management contracts. This focus on service quality aims to build loyalty and trust, which are crucial for long-term business stability. The company's commitment to customer satisfaction is a key differentiator in a competitive market.

China Evergrande Group's relationships with its creditors are strictly formal and legalistic, heavily influenced by complex debt agreements and international insolvency laws. This involves continuous engagement with legal counsel and financial restructuring experts to navigate the intricacies of its massive debt, which stood at approximately $328 billion in early 2024.

These interactions are characterized by ongoing negotiations, court-supervised proceedings, and extensive restructuring talks. The liquidation order in Hong Kong in January 2024 further solidified this legalistic approach, intensifying the focus on asset realization and creditor claims, with the company owing substantial amounts to thousands of creditors globally.

Cooperative and Compliance-Driven with Government

Evergrande's relationship with the Chinese government is characterized by a strong emphasis on cooperation and compliance with regulations. This means the company actively follows all central and local government policies concerning the property market. For instance, in 2024, Evergrande continued to engage with authorities on measures aimed at stabilizing the real estate sector, a key government priority.

The company's strategy includes participating in government-led initiatives designed to ensure the completion of unfinished housing projects. This demonstrates a commitment to meeting social obligations and maintaining stability, which is crucial for governmental approval and support. Such participation is often a prerequisite for receiving any form of governmental assistance or leniency during challenging financial periods.

Seeking government support is a vital aspect of Evergrande's operational model, particularly in navigating its ongoing financial restructuring. This support can range from guidance on regulatory compliance to potential interventions that facilitate project delivery and debt resolution. The government's role is instrumental in shaping the company's future trajectory and its ability to manage its liabilities.

- Regulatory Adherence: Evergrande prioritizes strict compliance with all property market regulations and policies issued by central and local government bodies, a cornerstone of its operational framework in 2024.

- Government Initiatives Participation: The company actively engages in government-led programs focused on property market stabilization and the timely completion of residential projects, reflecting a cooperative stance.

- Seeking Government Support: Evergrande relies on governmental guidance and potential support mechanisms to navigate its financial challenges and ensure the successful delivery of its developments.

- Governmental Influence: The government's directives and policy framework significantly influence Evergrande's strategic decisions and operational planning, underscoring a compliance-driven partnership.

Limited and Transactional for New Sales

Given the ongoing financial crisis and market volatility impacting China Evergrande Group, customer relationships for new property sales are significantly curtailed and primarily transactional. The company's focus has pivoted from expansion to managing its existing liabilities and distressed assets.

Any new sales activity, if pursued, would likely be confined to smaller, completed projects where clear ownership and delivery are assured. This shift reflects a pragmatic approach to asset liquidation rather than relationship building.

- Transactional Nature: Interactions are purely based on the immediate sale of available units, devoid of long-term engagement strategies.

- Limited Scope: New sales are restricted to completed or near-completion properties, minimizing pre-sale risks and customer expectations.

- Crisis Management Focus: The primary objective for any customer interaction is asset disposal to address financial obligations, not fostering brand loyalty.

- Market Conditions Impact: The severe downturn in China's property market in 2024 and ongoing liquidity issues necessitate a highly cautious and transactional approach to sales.

Evergrande's customer relationships are heavily shaped by its financial distress, with a focus on managing expectations and fulfilling existing obligations. The company's property services arm, however, aims to build loyalty through professional management, serving over 2.7 billion square meters in 2023. New property sales in 2024 are largely transactional, prioritizing asset disposal over long-term engagement due to market conditions and liquidity challenges.

| Relationship Type | Key Characteristics | 2023/2024 Data Points |

| Homebuyers (Unfinished Properties) | Managing expectations, transparent communication on progress, addressing concerns. | Continued pressure to deliver homes in 2024. |

| Property Owners (Evergrande Property Services) | Responsive service, community engagement, contract renewal focus. | Managed over 2.7 billion sq meters in 2023. |

| Creditors | Formal, legalistic, debt-focused, ongoing negotiations. | Approx. $328 billion in debt (early 2024); liquidation order in Jan 2024. |

| Government | Cooperation, compliance, participation in stabilization initiatives. | Engaging with authorities on real estate sector stabilization in 2024. |

| New Property Buyers | Transactional, limited scope to completed units, asset disposal focus. | Shift from expansion to managing liabilities; market downturn impact. |

Channels

Historically, Evergrande's physical sales centers at project sites were key for direct customer engagement, allowing potential buyers to see property progress and finalize purchases. This channel was vital for managing sales of both pre-construction and completed units.

As of late 2023 and into 2024, with Evergrande's ongoing restructuring, the operational capacity of these on-site sales centers has been significantly curtailed. However, for any remaining sellable inventory or projects nearing completion, these physical locations remain the primary, albeit limited, avenue for sales transactions and buyer inquiries.

Property management offices and service desks within Evergrande's managed communities served as crucial, on-the-ground channels. These physical touchpoints allowed residents direct access for service requests, inquiries, and issue resolution, fostering a sense of proximity and immediate support. By 2023, Evergrande Property Services managed over 2,800 properties, demonstrating the extensive reach of these on-site service points.

Evergrande Property Services leverages digital platforms and mobile applications to streamline resident interactions, facilitating easy payment of management fees and access to various community amenities. This digital approach significantly boosts customer engagement by offering unparalleled convenience and efficiency.

The company also maintains its official websites as a crucial channel for disseminating corporate announcements and investor relations information, ensuring transparency and timely communication with stakeholders.

Legal and Financial Advisory Networks

Legal and financial advisory networks, including liquidators and restructuring specialists, are crucial channels for China Evergrande Group. These professionals act as intermediaries, managing communications with a vast array of creditors, international courts, and Chinese regulatory authorities. Their involvement is essential for navigating the intricate processes of debt restructuring, asset sales, and eventual liquidation, ensuring compliance and attempting to maximize recovery for stakeholders.

As of early 2024, the sheer volume of claims against Evergrande underscores the critical role of these networks. With hundreds of thousands of individual bondholders and numerous institutional creditors, the complexity of managing these relationships is immense. For instance, by the end of 2023, the company faced claims totaling well over $300 billion, necessitating a highly organized and legally sound approach to communication and negotiation.

- Creditor Communication: Facilitating orderly dialogue with diverse creditor groups, from banks and bondholders to suppliers and homebuyers.

- Regulatory Compliance: Ensuring adherence to all legal and regulatory frameworks in China and other relevant jurisdictions during restructuring and liquidation.

- Asset Disposal: Managing the sale of Evergrande's vast property portfolio and other assets in a structured manner to generate liquidity.

- Court Representation: Acting on behalf of the company in various court proceedings, including the ongoing winding-up petition in Hong Kong.

Government-Led Platforms and Initiatives

The Chinese government's 'white-list' mechanism acts as a crucial channel, facilitating Evergrande's access to vital financing. This initiative, aimed at stabilizing the property market, allows developers to secure funding from state-backed financial institutions for their projects.

Beyond financing, these government-led platforms foster coordination between developers like Evergrande, financial institutions, and local authorities. This collaboration is essential for ensuring the completion of unfinished projects and maintaining social stability, a key objective for the government.

- Policy Support: Government 'white-lists' enable access to state-backed loans.

- Project Completion: Initiatives aim to ensure the delivery of stalled housing developments.

- Social Stability: These platforms are designed to mitigate social unrest arising from property defaults.

While physical sales centers were historically key, their role has diminished in 2024 due to restructuring, with remaining sales relying on these limited on-site interactions. Property management offices and digital platforms remain vital for resident services and engagement, with Evergrande Property Services managing over 2,800 properties by 2023.

Legal and financial advisory networks are critical for managing Evergrande's complex restructuring, dealing with hundreds of thousands of creditors and over $300 billion in claims by late 2023. Government initiatives, like the 'white-list' mechanism, are crucial for accessing financing and ensuring project completion, directly impacting social stability.

| Channel Type | Description | Status/Relevance (Early 2024) | Key Function | Associated Data/Facts |

|---|---|---|---|---|

| Physical Sales Centers | On-site locations at project sites | Significantly curtailed, primary for remaining inventory | Direct customer engagement, purchase finalization | Historically vital for pre-construction and completed units |

| Property Management Offices/Service Desks | Within managed communities | Crucial, on-the-ground service points | Resident services, inquiries, issue resolution | Managed over 2,800 properties by end of 2023 |

| Digital Platforms/Mobile Apps | Online services for residents | Boosts customer engagement, convenience | Fee payments, amenity access, streamlined interaction | Enhances convenience and efficiency for residents |

| Official Websites | Corporate communication portal | Crucial for transparency | Corporate announcements, investor relations | Disseminates essential corporate information |

| Legal & Financial Advisory Networks | Restructuring specialists, liquidators | Essential intermediaries | Creditor communication, regulatory compliance, asset disposal | Managing over $300 billion in claims by late 2023 |

| Government 'White-List' Mechanism | Government-backed financing initiative | Crucial for accessing vital financing | Securing loans from state-backed institutions | Aims to stabilize the property market and ensure project completion |

Customer Segments

Existing homebuyers who purchased unfinished properties from Evergrande are a crucial segment. These individuals are primarily concerned with the completion and delivery of their pre-sold homes, a situation exacerbated by the company's ongoing financial difficulties.

As of late 2023 and into 2024, reports indicated that hundreds of thousands of these homebuyers were awaiting their properties, with many having made significant down payments. The uncertainty surrounding delivery directly impacts their financial stability and living arrangements, making their satisfaction paramount for any resolution.

Property owners, both individuals residing in Evergrande's residential developments and businesses operating in its commercial spaces, represent a crucial customer segment for Evergrande Property Services. These clients expect dependable, high-quality management of their properties, encompassing everything from maintenance and security to lifestyle amenities and even asset enhancement services.

The client base extends beyond those who purchased homes in original Evergrande projects. Evergrande Property Services actively courts and serves third-party property owners, demonstrating a strategy to diversify its revenue streams and leverage its management expertise across a broader market. This expansion is vital for growth, especially considering the challenges faced by the parent company.

In 2023, Evergrande Property Services managed a significant portfolio, serving millions of residents across China. Despite the financial headwinds of the parent group, the property services arm continued to operate, highlighting the demand for its core services. For example, by the end of 2023, the company reported managing over 430 million square meters of gross floor area, underscoring the sheer scale of its operations and the number of property owners it serves.

Domestic and offshore creditors represent a crucial, albeit distressed, customer segment for China Evergrande Group. This group is vast, encompassing banks, institutional bondholders, and numerous suppliers and contractors. Their collective interest is singularly focused on recouping as much of their outstanding investments and payments as possible.

As of early 2024, Evergrande's debt situation remained dire, with total liabilities exceeding $300 billion. Creditors, particularly bondholders, have faced significant losses, with many offshore bonds trading at distressed levels, reflecting the low probability of full recovery.

The restructuring and potential liquidation processes are the primary avenues through which these creditors seek resolution. Their engagement is critical to any potential path forward for the company, influencing the terms of any debt-for-equity swaps or asset sales designed to satisfy their claims.

Chinese Government and Local Authorities

The Chinese government and local authorities represent a critical stakeholder segment for Evergrande, acting as both regulators and entities deeply concerned with social stability and economic impact. Their directives significantly shape Evergrande's operational landscape.

In 2024, the focus for these authorities remained on ensuring the completion of pre-sold housing projects, a key factor in preventing widespread social unrest. The sheer scale of Evergrande's unfinished developments meant this was a paramount concern.

- Governmental Oversight: Central and local governments actively monitor and intervene in Evergrande's restructuring to ensure housing delivery and maintain financial market stability.

- Policy Influence: Government policies on property development, debt resolution, and social welfare directly impact Evergrande's ability to operate and restructure.

- Economic Stability Mandate: Authorities prioritize preventing systemic risk and ensuring that the fallout from Evergrande's financial distress does not destabilize the broader Chinese economy.

- Social Stability Concerns: Ensuring that millions of homebuyers receive their properties is a primary objective, directly influencing governmental approaches to Evergrande's crisis.

Potential Investors and Asset Buyers

Potential investors and asset buyers represent a crucial segment for China Evergrande Group, particularly in its current distressed state. These entities are actively seeking opportunities arising from the company's financial challenges, looking to acquire distressed assets or participate in restructuring efforts. For instance, as of early 2024, reports indicated significant interest from domestic developers and state-backed entities in acquiring Evergrande's land bank and unfinished projects, aiming to absorb these assets at discounted prices.

This segment can be further broken down into several key players:

- Other Real Estate Developers: Competitors looking to expand their market share by acquiring Evergrande's prime land parcels or operational projects.

- Investment Funds: Private equity and distressed debt funds specializing in acquiring troubled assets and seeking to profit from their turnaround or liquidation.

- State-Owned Enterprises (SOEs): Government-backed entities that may step in to stabilize the market, acquire key assets, or manage the orderly wind-down of certain operations to prevent systemic risk.

- Strategic Buyers: Companies in related industries, such as construction or property management, that might see value in acquiring specific components of Evergrande's business.

The willingness of these investors to engage is heavily influenced by the clarity of the restructuring plan and the perceived value of the assets being offered. For example, in 2023, asset sales were often conducted through auctions or direct negotiations, with prices reflecting the prevailing market conditions and the urgency of Evergrande's liquidity needs.

Existing homebuyers, numbering in the hundreds of thousands by early 2024, remain a critical segment. Their primary concern is the delivery of their pre-sold homes, with significant down payments already made. The ongoing financial distress of Evergrande directly impacts their housing security and financial well-being.

Property owners, both residential and commercial, rely on Evergrande Property Services for management. This segment includes millions of residents across China, with the company managing over 430 million square meters of gross floor area by the end of 2023, highlighting the scale of its service provision.

Creditors, including banks and bondholders, are a vital segment focused on recovering outstanding investments. By early 2024, Evergrande's liabilities exceeded $300 billion, with offshore bonds trading at distressed levels, indicating significant losses for this group.

Potential investors and asset buyers are actively seeking opportunities in Evergrande's distressed assets. This includes other developers, investment funds, and state-owned enterprises looking to acquire land banks and unfinished projects, often at discounted prices, as seen in asset sales throughout 2023.

| Customer Segment | Key Concerns/Interests | Data Point (as of early 2024 unless otherwise noted) |

| Existing Homebuyers | Delivery of pre-sold homes, return of down payments | Hundreds of thousands awaiting property delivery |

| Property Owners (Residential & Commercial) | Quality property management, maintenance, security | Managed over 430 million sqm of GFA (end of 2023) |

| Creditors (Banks, Bondholders, Suppliers) | Recovery of outstanding debts and payments | Total liabilities exceeding $300 billion |

| Potential Investors/Asset Buyers | Acquisition of distressed assets, land banks, projects | Interest from domestic developers and SOEs in asset acquisition |

Cost Structure

Evergrande's cost structure is heavily burdened by its substantial debt obligations. The company faces significant interest payments and fees related to its massive borrowings, which are a primary drain on its resources.

The ongoing restructuring and liquidation efforts add another layer of substantial costs. Legal fees, advisory services, and administrative expenses associated with navigating these complex processes are considerable, further impacting the company's financial health.

In 2024, these debt servicing and restructuring expenses represent a critical component of Evergrande's financial challenges, directly impacting its ability to meet its obligations and fund future operations.

Despite its ongoing financial challenges, Evergrande continues to incur substantial costs to finish its existing residential projects. These expenses cover essential elements like acquiring building materials, paying wages to construction workers, and settling outstanding payments to contractors. For instance, in 2024, the company has allocated a significant portion of its remaining capital towards these project completions, aiming to meet its commitments to millions of homebuyers.

Evergrande Property Services faces significant operational expenses, encompassing staff salaries, essential property maintenance, robust security services, and efficient utility management. These costs are crucial for delivering quality services to residents and property owners.

The company's strategy focuses on cost control to ensure profitability within this segment, aiming to balance service excellence with financial prudence. For instance, in 2023, property management companies in China generally saw their operating costs rise due to inflation and increased service demands.

Administrative and Overhead Costs

Even as China Evergrande Group undergoes significant restructuring and downsizing, it continues to incur administrative and overhead costs. These include expenses for executive compensation, maintaining office spaces, and fulfilling compliance requirements. The company is likely prioritizing rigorous cost-saving measures to optimize its operations amidst its ongoing financial challenges.

Specific figures for these costs are difficult to isolate due to the company's complex financial situation and ongoing disclosures. However, reports from 2023 and early 2024 indicated substantial efforts to reduce staff and streamline management structures, which would directly impact these overhead categories. For instance, a significant reduction in workforce would naturally lower salary and benefits expenses.

- Executive Compensation: While reduced, executive salaries and bonuses remain a component of administrative costs.

- Office Expenses: Costs associated with maintaining corporate offices, even if scaled back, continue to be incurred.

- Compliance and Legal: Expenditures related to regulatory compliance, legal counsel, and financial reporting persist.

- Restructuring Costs: The process of downsizing itself can generate additional administrative expenses.

Fines and Penalties

China Evergrande Group has been subject to substantial fines and penalties from regulatory authorities, a significant drain on its resources. These costs stem from past financial reporting irregularities and a failure to comply with various regulations, impacting its overall financial stability.

The company has faced scrutiny and potential sanctions, which can represent unpredictable and significant expenses. For instance, in August 2023, China's securities regulator announced a fine of 4.175 billion yuan (approximately $575 million USD at the time) against Evergrande and its chairman, Hui Ka Yan, for fraudulent information disclosure.

- Regulatory Fines: Significant financial penalties imposed by Chinese authorities for non-compliance and financial misconduct.

- Legal Costs: Expenses associated with defending against lawsuits and regulatory actions.

- Reputational Damage: Indirect costs stemming from a damaged public image, potentially affecting future business opportunities and investor confidence.

Evergrande's cost structure is dominated by its massive debt, leading to substantial interest expenses. Ongoing restructuring and legal proceedings add significant administrative and advisory fees. The company continues to allocate capital to complete existing projects, covering material, labor, and contractor payments, a critical focus in 2024.

Revenue Streams

Evergrande Property Services generates its most stable and significant recurring revenue from collecting management fees. These fees are charged to owners of both residential and commercial properties for a range of services. This segment has demonstrated consistent growth, increasingly acting as a buffer against the financial instability of its parent company, China Evergrande Group.

In the context of its liquidation, China Evergrande Group's revenue streams are significantly impacted by the proceeds from asset sales and disposals. Liquidators are actively managing the sale of the company's extensive real estate portfolio, land reserves, and various other holdings to satisfy creditor claims.

This process is crucial for generating funds to address Evergrande's substantial debt obligations. For instance, as of early 2024, the company's total liabilities remained immense, underscoring the importance of these asset sales in the repayment process.

While significantly curtailed, any revenue from property sales for Evergrande would primarily stem from the disposal of newly completed or existing inventory within mainland China. This might also include sales potentially supported by government-backed initiatives aimed at stabilizing the market. However, the focus is clearly not on large-scale new project sales due to the ongoing crisis.

Community Living and Asset Management Services

Beyond its core property management, Evergrande Property Services diversified its revenue through community living services, which included retail and educational support for residents. Additionally, asset management services, such as property leasing and sales assistance, formed another significant income stream for the segment.

These value-added offerings were crucial in boosting the segment's overall profitability.

- Community Living Services: Provided retail, education, and lifestyle support to residents.

- Asset Management Services: Included property leasing, sales, and consulting.

- Revenue Diversification: These services aimed to broaden income sources beyond basic property upkeep.

Potential Government-Backed Project Financing

While not a direct revenue stream, government-backed financing, particularly through project white-lists, was crucial for Evergrande. These lists, designating projects eligible for financial support, aimed to ensure the completion of stalled developments. This support provided essential liquidity, enabling Evergrande to move forward with construction and, by extension, eventually monetize those assets and meet its obligations to buyers.

For instance, in early 2024, Chinese authorities announced measures to support around 300 projects on these white-lists, signaling a commitment to stabilizing the property market. This type of indirect financial backing was vital for Evergrande to unlock its existing, albeit illiquid, asset base and generate the cash needed to fulfill its contractual commitments.

- Indirect Liquidity Infusion: Government white-lists provided access to funds from state-backed banks, crucial for completing projects.

- Asset Monetization Facilitation: By enabling project completion, this financing indirectly allowed for the sale of units and recovery of capital.

- Risk Mitigation for Stakeholders: The support aimed to protect homebuyers and ensure the stability of the broader real estate sector.

Evergrande Property Services, a key revenue generator, primarily derives income from property management fees. These recurring fees, charged for maintaining residential and commercial properties, have become a vital source of stability for the group.

Beyond core management, the company also generated revenue through community living services, including retail and educational support, and asset management services like property leasing and sales assistance. These diversified offerings aimed to bolster profitability and broaden income streams.

| Revenue Stream | Description | Significance (as of early 2024) |

|---|---|---|

| Property Management Fees | Recurring fees for property upkeep and services. | Most stable and significant recurring revenue. |

| Community Living Services | Retail, education, and lifestyle support for residents. | Diversified income, boosted profitability. |

| Asset Management Services | Property leasing, sales, and consulting. | Another key income stream for the segment. |

| Asset Disposals (Liquidation) | Proceeds from selling real estate, land, and other holdings. | Crucial for addressing substantial debt obligations. |

Business Model Canvas Data Sources

The China Evergrande Group Business Model Canvas is informed by a combination of publicly available financial disclosures, extensive real estate market research, and reports on the company's operational activities. These sources provide a comprehensive view of Evergrande's business strategy and market position.