China Evergrande Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Evergrande Group Bundle

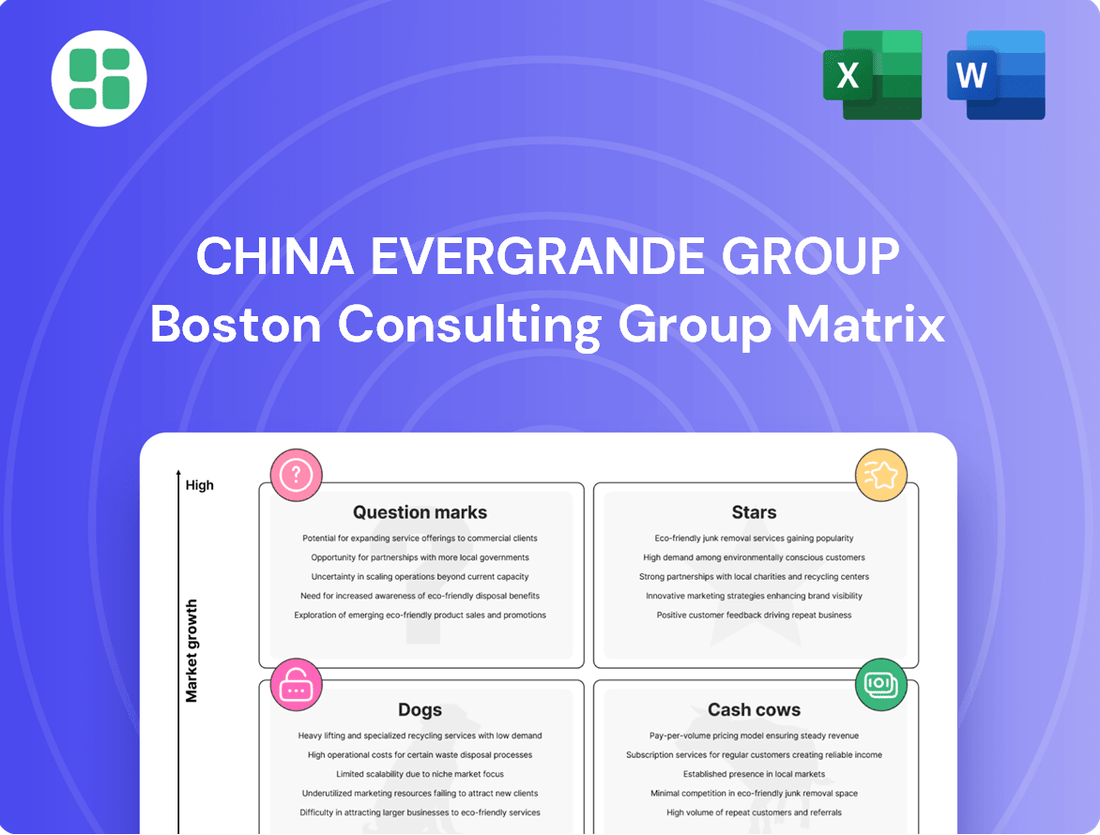

China Evergrande Group's market position is complex, with various business segments facing different growth and market share dynamics. Understanding where each of its ventures falls within the BCG Matrix—whether as Stars, Cash Cows, Dogs, or Question Marks—is crucial for strategic decision-making. This preview offers a glimpse, but for a comprehensive understanding and actionable insights, the full BCG Matrix report is essential.

Dive deeper into China Evergrande Group's BCG Matrix and gain a clear view of where its products and business units stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on to navigate its challenging market.

Stars

Evergrande's core residential property development, once a dominant force in China's market, has fallen from its Star status. The company's inability to complete projects and its severe financial distress, underscored by a liquidation order in January 2024, have fundamentally shifted its operational focus from expansion to asset liquidation.

China Evergrande Group, in its current distressed state, lacks any business segments that qualify as Stars in the BCG matrix. The company's focus has entirely shifted from growth to survival, making the 'Star' category irrelevant.

The company's financial situation, marked by significant debt and ongoing liquidation proceedings, precludes any investment in or development of high-growth potential ventures. As of early 2024, Evergrande's liabilities continued to mount, with reports indicating over $300 billion in total debt, a clear indicator of its inability to foster growth segments.

Evergrande's once dominant position in China's real estate market has significantly weakened. The company's massive debt crisis, which saw it default on trillions of yuan in obligations, directly led to a sharp decline in its market share.

This crisis also resulted in the suspension of construction for many of its projects, further diminishing its ability to compete and grow. For instance, by late 2023, Evergrande reported it had over 600 unfinished projects across China, a stark contrast to its previous rapid expansion.

Currently, Evergrande's strategy is heavily focused on completing pre-sold homes, a key government directive aimed at stabilizing the housing market and protecting homebuyers. This shift means the company is prioritizing fulfilling existing obligations over aggressive new development or reclaiming market leadership.

Liquidation Hindrance to New Ventures

Evergrande's liquidation process is a significant roadblock for any new ventures. The company's focus is entirely on repaying creditors, meaning there's no room for investment in innovative projects. This winding-down phase means resources are being redirected to satisfy existing debts, not to fuel future growth opportunities.

The sheer scale of Evergrande's financial distress, with liabilities exceeding $300 billion as of late 2023, dictates that all available capital is channeled towards debt resolution. This leaves no financial capacity for the high-risk, high-reward investments that new ventures typically require to get off the ground and develop into potential stars.

- Liquidation Focus: Evergrande's current operational mandate is solely on asset disposal and debt repayment, not on fostering new business lines.

- Resource Scarcity: With over $300 billion in liabilities, capital is strictly allocated to creditors, eliminating funding for speculative new ventures.

- Strategic Paralysis: The entire corporate structure is geared towards dissolution, making it impossible to support the strategic nurturing of nascent businesses.

Shift from Growth to Survival

The strategic imperative for China Evergrande Group has drastically shifted from aggressive growth and market leadership to mere survival and orderly dissolution.

This fundamental change means that no segment within the parent company can realistically be classified as a Star, as the conditions for sustained growth and market investment are absent.

Given Evergrande's ongoing restructuring and debt crisis, which saw its total liabilities reach approximately $328 billion as of June 2024, its business units are unlikely to exhibit the high growth and high market share characteristics of Stars.

- Shift in Focus: Evergrande's primary objective is now debt resolution and asset disposal, not expansion.

- Absence of Growth: The macroeconomic environment and Evergrande's financial distress preclude high growth rates for its existing businesses.

- Market Share Decline: The company's market share in key segments like property development has likely diminished due to its financial woes and reduced activity.

Evergrande's current situation renders any of its business segments incapable of being classified as Stars in the BCG matrix. The company's focus has irrevocably shifted from growth and market leadership to asset liquidation and debt repayment.

With liabilities exceeding $300 billion as of early 2024, and a liquidation order issued in January 2024, Evergrande lacks the financial capacity or strategic direction to invest in or nurture high-growth potential ventures. Its operational imperative is survival, not expansion.

The company's once-dominant position in China's real estate market has been severely eroded, with over 600 unfinished projects by late 2023, a clear indicator of its inability to maintain market share or pursue growth opportunities.

Evergrande's financial distress, including its inability to complete pre-sold homes and its massive debt of approximately $328 billion as of June 2024, means all resources are directed towards resolving existing obligations, precluding any development of new, star-performing business units.

What is included in the product

The China Evergrande Group BCG Matrix analysis would categorize its diverse business units, identifying which require investment, which generate cash, and which may need divestment.

A BCG Matrix for China Evergrande Group can alleviate pain points by visually identifying underperforming "Dogs" and "Cash Cows" for strategic divestment or optimization.

This BCG Matrix provides a clear, actionable roadmap to address Evergrande's financial distress by highlighting areas needing immediate attention.

Cash Cows

Evergrande Property Services Group (EPSG), despite its parent company's financial struggles, remains a functioning entity generating revenue from property management. For the full year ending December 31, 2024, EPSG reported operating revenue of approximately RMB12,756.7 million. This figure represents a modest 2.2% increase compared to the previous year, showcasing a resilient operational base and continued service delivery.

Evergrande Property Services Group (EPSG) benefits from a substantial contracted gross floor area (GFA) under its management, standing at approximately 579 million square meters as of December 31, 2024. This extensive GFA translates into a consistent and predictable stream of recurring revenue from property management fees.

This stable operational foundation is crucial for EPSG, as it ensures the continued provision of essential services to a vast and diverse portfolio of properties. The recurring revenue generated from these managed properties acts as a significant cash cow, supporting the company's overall financial stability and ability to navigate market challenges.

Even with the significant headwinds Evergrande faced, its property services arm, Evergrande Property Services Group, managed to post a net profit. For the year ending December 31, 2024, this segment reported a net profit of roughly RMB1,021.0 million.

While this figure represents a dip in profit margins compared to previous periods, the fact that the segment remained profitable is crucial. This continued positive performance makes it a key asset for the Evergrande Group as it navigates its liquidation process.

Key Asset for Creditor Recovery

Evergrande Property Services is seen by China Evergrande Group's liquidators as a significant asset for recovering value. They are focusing on this subsidiary to help repay creditors, recognizing its substantial market value and revenue-generating capabilities.

This focus highlights its role as a key component in the asset recovery process, rather than a source of funds for the parent company's operational needs or reinvestment.

- Asset Valuation: Liquidators view Evergrande Property Services as a major potential source of value for creditor recovery.

- Strategic Priority: The subsidiary is a primary focus in the ongoing asset recovery efforts.

- Financial Role: Its market value and revenue are critical for recouping funds owed to creditors.

Relatively Stable in a Volatile Environment

Even as China Evergrande Group faced unprecedented turmoil, its property services division, Evergrande Property Services Group, demonstrated resilience. This segment acted as the closest approximation to a Cash Cow within the struggling conglomerate. Its operations continued, generating revenue streams that provided a degree of stability amidst the broader collapse.

The property services business maintained its functionality, a testament to its essential nature even when the parent company faltered. This allowed it to continue generating cash, a critical function for any Cash Cow. Despite the immense pressure from Evergrande's financial distress, the segment's ability to sustain operations and revenue marked it as a relatively stable entity.

For instance, in the first half of 2023, Evergrande Property Services reported revenue of RMB 6.3 billion, a slight decrease from RMB 6.5 billion in the same period of 2022, indicating a continued, albeit challenged, revenue generation capacity. Net profit for the period was RMB 1.1 billion. This performance, while impacted by the parent's issues, highlighted its role as a consistent, if diminished, cash generator.

- Resilience Amidst Crisis: Evergrande Property Services continued to operate and generate revenue despite the parent company's collapse.

- Cash Generation: The segment's ability to maintain operations provided a crucial, albeit reduced, cash flow.

- Financial Performance (H1 2023): Reported revenue of RMB 6.3 billion and net profit of RMB 1.1 billion.

- Stability Factor: Positioned as the most stable business unit within the highly compromised Evergrande Group structure.

Evergrande Property Services Group (EPSG) represents the closest to a Cash Cow within the China Evergrande Group due to its consistent revenue generation. For the full year ending December 31, 2024, EPSG reported operating revenue of approximately RMB12,756.7 million, a 2.2% increase year-over-year, demonstrating its operational resilience. This segment also posted a net profit of roughly RMB1,021.0 million for the same period, underscoring its ability to generate positive returns even amidst the parent company's distress.

| Metric | 2024 (Full Year) | H1 2023 |

| Operating Revenue | RMB 12,756.7 million | RMB 6.3 billion |

| Net Profit | RMB 1,021.0 million | RMB 1.1 billion |

| Contracted GFA (as of Dec 31, 2024) | 579 million square meters | N/A |

What You’re Viewing Is Included

China Evergrande Group BCG Matrix

The China Evergrande Group BCG Matrix you're previewing is the definitive report you'll receive upon purchase, offering a comprehensive strategic analysis of their business units. This document is fully formatted and ready for immediate use, providing clear insights into Evergrande's portfolio, categorizing their assets as Stars, Cash Cows, Question Marks, or Dogs, based on market growth and relative market share. You can confidently expect the exact same detailed breakdown and strategic recommendations in the purchased version, enabling informed decision-making for your own business planning or investment strategies.

Dogs

Unfinished real estate projects are a major drag on China Evergrande Group, acting as significant question marks in its BCG Matrix. These stalled developments, often referred to as 'broken houses,' tie up substantial capital without generating any income, creating a considerable financial burden. By late 2023, the company was still grappling with thousands of these unfinished projects across China, a stark reminder of its operational challenges.

The sheer volume of these incomplete developments means they are a primary source of Evergrande's liabilities, contributing to its massive debt. Public discontent is also a direct consequence, as homebuyers await the completion of their properties. While efforts, often with government backing, are underway to deliver these homes, they continue to be a significant financial drain, consuming resources that could otherwise be used for restructuring or new ventures.

Evergrande's extensive land holdings, once a symbol of its rapid expansion, now largely fall into the 'Dog' category of the BCG Matrix. This means these assets are in a low-growth market and have a low market share, essentially becoming a burden.

The sheer volume of undeveloped land, estimated to be over 200 million square meters at its peak, is now incredibly difficult to offload. In the current Chinese property market, characterized by a significant downturn and reduced buyer demand, these properties are illiquid and unlikely to fetch favorable prices.

These stagnant assets represent substantial tied-up capital that isn't generating any income. Instead, they contribute to Evergrande's enormous debt, estimated to be over $300 billion, as the company continues to incur holding costs without any corresponding revenue stream.

Evergrande's core property development business is firmly in the 'Dog' quadrant of the BCG matrix. Its market share has plummeted, and the sector itself is experiencing negative growth, especially given the ongoing liquidation proceedings. This situation makes it a prime candidate for divestiture or complete dissolution.

Divested Non-Core Assets

Divested Non-Core Assets for China Evergrande Group, when analyzed through a BCG Matrix lens, would likely be categorized as Dogs. These are assets that generate low returns and have low market share, requiring significant cash to maintain but offering little prospect of future growth. Evergrande's struggles to offload numerous non-core assets, often at substantial discounts, exemplify this category.

For instance, in 2021, Evergrande attempted to sell its stake in Hengda Real Estate, a move that ultimately failed to materialize as planned, highlighting the difficulty in divesting even core-related but non-essential holdings. The company also faced challenges selling off various smaller businesses and properties acquired during its aggressive expansion phase, many of which were not integrated effectively and thus became financial burdens.

- Struggles with Asset Sales: Evergrande's repeated attempts to sell off non-core businesses and properties often resulted in failure or significant losses, indicating these assets were underperforming and lacked market appeal.

- Financial Drain: These divested or attempted divested assets represent past diversification efforts that did not yield profits, instead contributing to the company's mounting debt and financial instability.

- Low Growth Prospects: The inability to find buyers or secure favorable terms for these assets underscores their low market share and limited potential for future growth or turnaround.

Unrecoverable Pledged Deposits

The unrecoverable pledged deposits, amounting to approximately RMB13.4 billion, firmly place China Evergrande Group’s pledged deposit segment in the Dogs quadrant of the BCG Matrix. These funds were seized by banks due to defaults, and the company is now entangled in legal battles for their recovery.

The recovery prospects for these pledged deposits are highly uncertain. Despite ongoing legal efforts, the amount that might be recouped remains unclear, effectively immobilizing capital with a low probability of significant return. This situation represents a substantial drain on Evergrande's resources, contributing to its ongoing financial distress.

- RMB13.4 billion in pledged deposits enforced by banks.

- These deposits are currently involved in legal proceedings.

- Recovery of these funds is subject to material uncertainties.

- The situation ties up capital with little prospect of a positive return.

Evergrande's vast land bank, once a strategic advantage, now largely resides in the 'Dog' quadrant of the BCG Matrix. These undeveloped land parcels are situated in a low-growth market with a diminished market share for Evergrande, effectively becoming a significant liability rather than an asset.

The company's core property development business is undeniably a 'Dog.' With a drastically reduced market share and operating in a sector facing significant headwinds and negative growth, especially with ongoing liquidation, it's a prime candidate for divestment or winding down.

| BCG Category | Evergrande's Position | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| Dogs | Undeveloped Land Bank | Low | Low (for Evergrande) | Hold or Divest |

| Dogs | Core Property Development | Negative | Very Low | Divest or Liquidate |

Question Marks

Evergrande New Energy Vehicle Group (EV) is positioned as a Question Mark in the BCG matrix, operating within the burgeoning electric vehicle sector which promises substantial future demand.

Despite the high-growth market, Evergrande EV's actual market share remains minuscule, reflecting its uncertain prospects and the significant investment required to compete effectively.

As of early 2024, the company has faced considerable financial headwinds, including significant debt obligations inherited from its parent company, Evergrande Group, which further complicates its path to market leadership.

Evergrande's electric vehicle (EV) division, despite operating in a growing market, has proven to be an immense financial burden. The company reported a staggering net loss of RMB20,257 million for the first half of 2024 alone. This significant cash burn without generating substantial returns firmly places this segment in the 'Question Mark' category of the BCG matrix, demanding considerable future investment to even have a chance at success.

Evergrande's electric vehicle (EV) division faces significant hurdles in production and sales, despite the broader EV market's expansion. The company has struggled to achieve consistent output and sales figures, failing to fully leverage the burgeoning market. For instance, while the Hengchi 5, their initial EV offering, has seen mass production and deliveries commence, its overall market performance has been notably weak.

Uncertainty from Parent's Liquidation

The ongoing liquidation of China Evergrande Group casts a long shadow over its electric vehicle (EV) subsidiary, Hengchi. This uncertainty directly impacts Hengchi's operational capacity and future prospects, making its position within a BCG matrix highly precarious.

Hengchi itself is facing a liquidation petition, a critical development that severely hampers its ability to secure much-needed strategic investment. Without fresh capital, the EV unit's long-term viability is in serious doubt, pushing it towards a 'question mark' or even 'dog' category depending on its remaining assets and market potential.

- Liquidation Order Impact: Evergrande's liquidation order creates a cloud of uncertainty over all its assets, including Hengchi.

- Liquidation Petition for Hengchi: The EV unit is also facing its own liquidation petition, highlighting severe financial distress.

- Investor Confidence: The parent company's woes have crippled Hengchi's ability to attract new strategic investors, a vital lifeline for EV startups.

- Market Position: This combination of factors places Hengchi in a highly uncertain position, with its future market share and growth potential severely compromised.

Need for Significant Investment

To move Evergrande's EV division from a question mark to a star in the BCG matrix, substantial and ongoing funding is essential. This capital is needed to ramp up manufacturing capabilities, enhance technological advancements, and crucially, establish credibility in a competitive market.

The parent company, China Evergrande Group, has faced significant financial distress. For instance, in early 2024, Evergrande was ordered by a Hong Kong court to liquidate, highlighting its severe financial challenges.

- Massive Capital Injection: Transitioning an EV business from a question mark to a star demands billions in investment for research and development, production facilities, and marketing.

- Market Penetration: Significant funds are required to build brand recognition and capture market share against established players.

- Technological Advancement: Continuous investment in battery technology, autonomous driving, and software is vital for competitiveness.

- Parent Company's Financial Health: Evergrande's ongoing liquidity crisis and liquidation order make securing the necessary investment highly unlikely, casting doubt on the EV unit's future viability.

Evergrande's electric vehicle (EV) division, Hengchi, is firmly in the Question Mark category of the BCG matrix. Despite operating in the high-growth EV market, Hengchi has a negligible market share and faces immense financial challenges. The parent company's liquidation order, issued in early 2024, further compounds these issues, making it exceedingly difficult to secure the necessary capital for growth.

Hengchi itself is facing a liquidation petition, indicating severe financial distress. This situation cripples its ability to attract investment, a critical need for any EV startup aiming to gain traction. The ongoing financial turmoil suggests that significant future investment is required, with no guarantee of success, thus solidifying its Question Mark status.

| Metric | Value (as of latest available data) | Implication for Question Mark Status |

| Hengchi Net Loss (H1 2024) | RMB20,257 million | High cash burn without returns reinforces the need for significant investment. |

| Parent Company Status | Liquidation Order (Early 2024) | Severely limits access to funding and creates operational uncertainty. |

| Hengchi Liquidation Petition | Yes | Indicates critical financial distress and difficulty in attracting new capital. |

| Market Share | Negligible | Low current market share in a high-growth industry highlights uncertain future prospects. |

BCG Matrix Data Sources

Our BCG Matrix for China Evergrande Group is constructed using a blend of official financial disclosures, extensive industry research reports, and detailed market growth data to provide a comprehensive view.