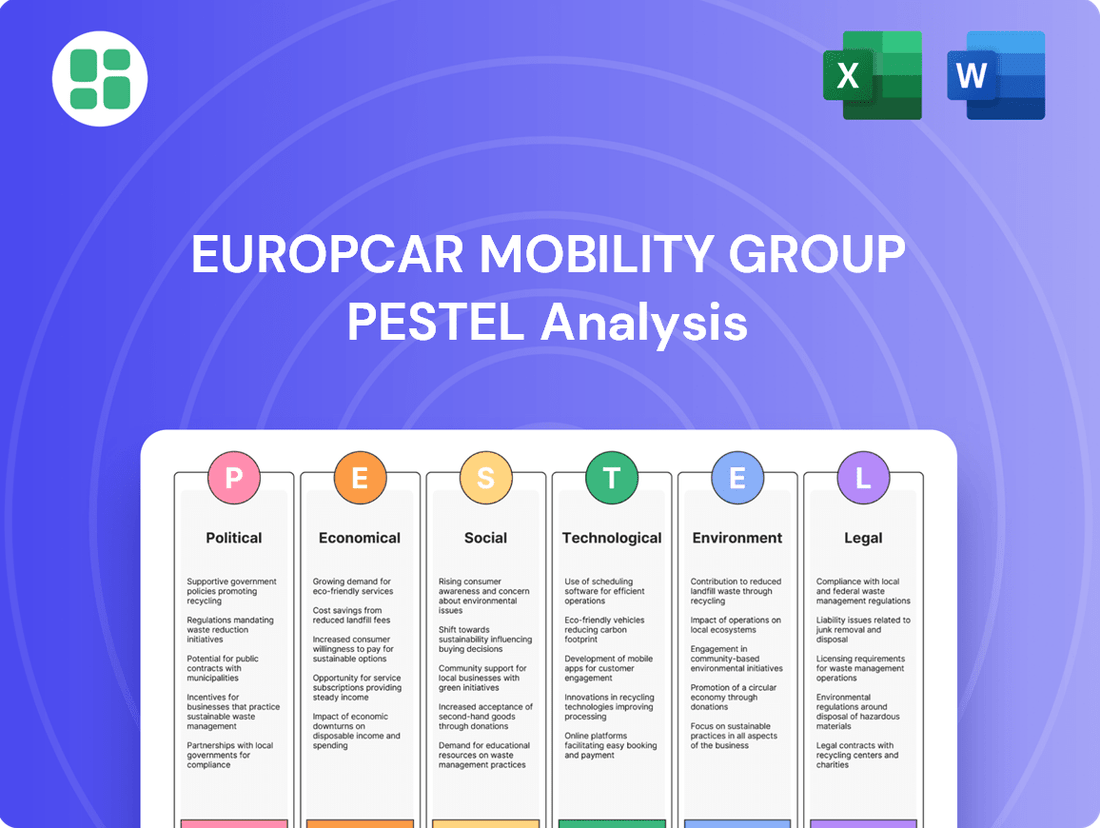

Europcar Mobility Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Europcar Mobility Group Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental forces shaping Europcar Mobility Group's future. Our expertly crafted PESTLE analysis provides a comprehensive overview of these external influences, offering invaluable insights for strategic planning and risk assessment.

Gain a competitive edge by understanding how global trends impact Europcar Mobility Group's operations and market position. This detailed PESTLE analysis is your key to unlocking actionable intelligence for informed decision-making.

Don't get left behind in the rapidly evolving mobility sector. Download the full PESTLE analysis of Europcar Mobility Group now to equip yourself with the strategic foresight needed to navigate challenges and capitalize on opportunities.

Political factors

Governments worldwide are tightening regulations on mobility services, affecting Europcar's traditional car rental business. For instance, the European Union's Green Deal initiatives, aiming for carbon neutrality by 2050, are driving stricter emissions standards for vehicles. This means Europcar will likely face increased pressure and costs to transition its fleet towards lower-emission or electric vehicles.

Navigating a patchwork of national and local policies is a significant challenge for Europcar. These can include varying urban access restrictions for certain vehicle types, differing licensing requirements for rental operations, and evolving regulations around data privacy for connected vehicles. In 2024, many European cities are expanding low-emission zones, impacting where and how Europcar can operate its fleet without incurring penalties or requiring fleet upgrades.

Political emphasis on environmental sustainability directly shapes the car rental industry. Policies promoting electric vehicle adoption, such as government subsidies for EV purchases and charging infrastructure development, encourage companies like Europcar to invest heavily in electric fleets. By the end of 2024, several countries are expected to announce new targets for EV sales, further accelerating this trend and requiring strategic fleet planning from Europcar.

Governments worldwide are actively promoting electric vehicle (EV) adoption through various incentives, subsidies, and the development of charging infrastructure. For instance, in 2024, the European Union continued to push for decarbonization targets, with many member states offering purchase grants and tax breaks for EVs, some extending into 2025.

Europcar Mobility Group's strategy to increase its EV fleet and achieve price parity for business clients directly benefits from these political tailwinds. This alignment supports their growth in the electric car rental sector, though the pace of expansion is still influenced by the widespread availability and dependability of charging stations.

Europcar Mobility Group's global footprint makes it susceptible to shifts in international trade policies and geopolitical tensions. For example, the ongoing trade discussions between major economic blocs in 2024 and 2025 could introduce new tariffs or trade barriers. These could directly impact the cost of acquiring vehicles, particularly electric vehicles (EVs) and their components like batteries, which are crucial for Europcar's fleet modernization efforts.

Tariffs on imported automotive parts or finished vehicles, potentially ranging from 5% to 25% depending on the specific trade agreement and product, could significantly inflate Europcar's capital expenditure. This would squeeze profit margins if these costs cannot be fully passed on to consumers, especially in competitive rental markets. Furthermore, reciprocal tariffs between countries can dampen overall economic activity, reducing travel demand and impacting Europcar's cross-border rental volumes.

Competition Law and Market Dominance

Regulatory bodies across Europe, such as the European Commission, actively monitor competition within the mobility sector. Their aim is to prevent market monopolies and ensure that companies engage in fair practices. For Europcar Mobility Group, this means adhering to strict competition laws that can impact its acquisition strategies, pricing, and partnership decisions to avoid any anti-competitive behavior. For instance, the European Commission's scrutiny of mergers and acquisitions in various industries, including transportation, highlights the importance of compliance.

The mobility landscape is characterized by intense competition, not only from traditional rental companies but also from emerging players. New mobility concepts, including car-sharing platforms and ride-hailing services, are significantly pressuring established providers like Europcar. This dynamic environment necessitates continuous adaptation and innovation to maintain market share and customer relevance. By mid-2024, the growth of ride-sharing services in major European cities continued to challenge traditional car rental models, forcing companies to integrate or offer similar flexible solutions.

- Regulatory Oversight: European competition authorities actively investigate and regulate market dominance to foster a competitive environment.

- Compliance Impact: Europcar must align its business strategies, including pricing and partnerships, with competition law to prevent penalties.

- Emerging Competition: The rise of car-sharing and ride-hailing services presents a significant competitive challenge to traditional rental operators.

- Market Adaptation: Companies like Europcar are pressured to innovate and adapt their service offerings to remain competitive in the evolving mobility market.

Political Stability and Tourism Policies

Political stability in Europcar's key markets, particularly in Europe and North America, directly influences travel patterns. For instance, a stable political environment in France, a core market for Europcar, encourages both leisure and business tourism. In 2023, France welcomed approximately 100 million tourists, a significant rebound from pandemic lows, directly benefiting rental car demand.

Government initiatives aimed at boosting tourism are crucial. Spain's "Spain is Waiting" campaign, launched in 2023, aimed to attract international visitors and stimulate economic recovery, which would likely translate to increased car rental needs. Similarly, visa facilitation policies in certain Asian countries could open up new growth avenues for Europcar.

Conversely, geopolitical tensions or unexpected political events can severely disrupt travel. The ongoing conflict in Eastern Europe, for example, has impacted travel sentiment and routes in adjacent regions, potentially dampening demand for rental services. Europcar's performance is thus intrinsically linked to the predictability and favorability of the political landscape in its operational territories.

Key considerations include:

- Government support for tourism: Policies like tax incentives for hotels or investment in travel infrastructure can indirectly boost car rental demand.

- Trade agreements and travel facilitation: Favorable trade relations and streamlined border processes encourage international travel.

- Political stability and security: Regions with high political stability and low security risks tend to attract more tourists and business travelers.

Government policies are increasingly focused on environmental sustainability, pushing companies like Europcar Mobility Group to adopt greener fleets. For instance, the European Union's push for carbon neutrality by 2050 necessitates a significant investment in electric vehicles (EVs), impacting fleet acquisition costs and operational strategies through 2024 and 2025.

Navigating diverse national and local regulations, including urban access restrictions and data privacy laws for connected vehicles, presents ongoing challenges. Many European cities expanded low-emission zones in 2024, requiring Europcar to adapt its fleet to avoid penalties and maintain operational flexibility.

Political emphasis on EV adoption, supported by subsidies and charging infrastructure development, directly benefits Europcar's strategic shift towards electric mobility. By the end of 2024, several countries are expected to announce new EV sales targets, further accelerating this trend.

Geopolitical tensions and trade policies can disrupt vehicle acquisition costs and travel demand. Tariffs on imported automotive parts, potentially ranging from 5% to 25%, could inflate Europcar's capital expenditure, impacting profitability if these costs cannot be passed on to consumers.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting Europcar Mobility Group, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides a strategic overview for identifying opportunities and threats, enabling informed decision-making in the dynamic mobility sector.

This PESTLE analysis for Europcar Mobility Group offers a concise, easily digestible overview of external factors, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

It provides a clear, summarized version of the full analysis, making it ideal for quick referencing during meetings or presentations, thereby alleviating the pain of sifting through extensive data.

Economic factors

Global economic growth significantly impacts Europcar Mobility Group by directly influencing disposable income and travel patterns. A strong economy generally boosts consumer confidence, leading to more leisure and business travel, which in turn drives demand for car rental services. For instance, in 2024, projections from the IMF suggested global growth around 3.2%, a figure that underpins the potential for increased travel spending.

However, the car rental sector, including Europcar, faces headwinds from rising operating costs such as vehicle acquisition, maintenance, and labor. Despite potentially higher rental demand driven by economic upturns, persistently flat or slowly growing rental rates in many markets, as observed in parts of the 2024 European market, can squeeze profit margins and challenge overall profitability.

Fluctuations in fuel prices directly impact Europcar's operational expenses, particularly for its internal combustion engine (ICE) fleet. For instance, in early 2024, average gasoline prices in the Eurozone saw notable swings, affecting rental profitability.

The cost and availability of new vehicles are also critical, influenced by Original Equipment Manufacturer (OEM) production schedules and consumer demand for specific vehicle types. As of mid-2024, reports indicated a gradual easing of supply chain issues for many automakers, potentially leading to increased vehicle inventory.

This potential increase in new vehicle inventory is anticipated to drive down prices, allowing Europcar to secure more favorable bulk discounts for fleet replenishment. Such discounts are crucial for managing the significant capital expenditure associated with maintaining a modern and diverse rental fleet.

Interest rate fluctuations significantly influence Europcar Mobility Group's operational costs. As of early 2024, many central banks, including the European Central Bank, have maintained relatively high interest rates to combat inflation, impacting Europcar's borrowing expenses for its substantial vehicle fleet acquisition and maintenance.

For instance, a rise in the benchmark interest rate by even a single percentage point can translate into millions of euros in additional financing costs annually for a company of Europcar's scale, directly affecting its bottom line and ability to invest in fleet upgrades or new technologies.

Europcar's financial performance, demonstrated by its reported net loss for 2023, is intrinsically linked to these economic conditions. Higher financing costs, coupled with the need for significant capital expenditure on vehicles, put pressure on profitability, especially when revenue growth doesn't outpace these rising expenses.

Impact of Inflation and Depreciation

Inflation directly impacts Europcar Mobility Group's operational costs. Rising prices for fuel, vehicle parts, and wages in 2024 and early 2025 increase the expense of maintaining and servicing its fleet. For instance, the average cost of car parts saw a notable increase in many European countries throughout 2024, affecting repair budgets.

The shift towards electric vehicles (EVs) presents a unique challenge. While EVs can offer lower running costs, their higher initial purchase prices and potentially steeper depreciation rates, particularly in the face of rapidly evolving battery technology, can significantly impact the total cost of ownership for rental companies like Europcar. In 2024, the resale value of some EV models experienced higher volatility than comparable gasoline-powered vehicles, a trend expected to continue into 2025.

- Increased Operating Expenses: Inflationary pressures in 2024 led to higher costs for maintenance, insurance, and administrative overhead for Europcar.

- EV Depreciation Concerns: The rapid technological advancements in electric vehicles, coupled with a developing second-hand market, contributed to higher-than-anticipated depreciation for certain EV models in the 2024-2025 period.

- Profitability Management: Effectively managing these rising costs and the unpredictable resale values of both traditional and electric vehicles is critical for Europcar's sustained profitability.

Shift Towards Mobility-as-a-Service (MaaS) and Subscription Models

The increasing adoption of Mobility-as-a-Service (MaaS) and subscription models is reshaping the automotive and rental sectors, presenting a dual-edged sword for Europcar Mobility Group. These evolving consumer preferences for flexible, on-demand transportation solutions offer significant opportunities to diversify revenue streams and attract new customer segments. For instance, the subscription car rental market saw considerable expansion in 2023, with many providers reporting a 20-30% year-over-year increase in subscriber numbers, reflecting a clear shift away from traditional ownership.

However, successfully capitalizing on these trends necessitates substantial upfront investment in digital platforms, fleet management technology, and the adaptation of established operational frameworks. Europcar must integrate seamless booking, payment, and vehicle access systems to compete effectively in the MaaS landscape. Industry analysts predict the global MaaS market to reach over $300 billion by 2027, underscoring the strategic imperative for companies like Europcar to pivot towards these service-oriented business models to remain competitive and capture future growth.

- MaaS Growth: The global MaaS market is anticipated to experience robust expansion, with projections indicating it could exceed $300 billion by 2027.

- Subscription Appeal: Subscription-based car rentals are gaining traction, with providers often reporting subscriber growth rates between 20% and 30% annually.

- Investment Needs: Transitioning to MaaS and subscription models requires significant capital outlay for technology infrastructure and operational adjustments.

- Consumer Shift: Evolving consumer demand favors flexible, on-demand mobility solutions over traditional car ownership.

Economic factors significantly shape Europcar Mobility Group's operational landscape, influencing everything from consumer spending on travel to the cost of maintaining its fleet. Global economic growth, as projected around 3.2% for 2024 by the IMF, suggests a potential increase in travel demand. However, persistent inflation throughout 2024 has driven up operating expenses, including fuel and vehicle parts, impacting Europcar's profitability despite potential revenue gains.

Interest rates also play a crucial role; for instance, the European Central Bank's relatively high rates in early 2024 increased Europcar's financing costs for fleet acquisition. Furthermore, the evolving automotive market, with the higher initial cost and depreciation volatility of electric vehicles, presents a complex challenge for fleet management and overall cost of ownership, a trend expected to continue into 2025.

The shift towards Mobility-as-a-Service (MaaS) and subscription models, with the subscription car rental market showing 20-30% annual growth in 2023, offers new revenue opportunities but demands substantial investment in technology and operational adaptation. This evolving consumer preference for flexible mobility solutions is a key economic trend impacting Europcar's strategic direction.

| Economic Factor | Impact on Europcar | 2024/2025 Data/Projection |

|---|---|---|

| Global Economic Growth | Influences travel demand and consumer spending | IMF projected ~3.2% global growth for 2024 |

| Inflation | Increases operating costs (fuel, parts, wages) | Notable increases in vehicle parts costs in Europe during 2024 |

| Interest Rates | Affects borrowing costs for fleet acquisition | ECB maintained relatively high rates in early 2024 |

| EV Market Dynamics | Impacts vehicle acquisition cost and depreciation | Higher depreciation volatility for some EV models in 2024, expected into 2025 |

| MaaS/Subscription Growth | Creates new revenue streams but requires investment | Subscription car rental market saw 20-30% annual growth in 2023; MaaS market projected >$300B by 2027 |

What You See Is What You Get

Europcar Mobility Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Europcar Mobility Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. Understand the critical external forces shaping the mobility sector.

Sociological factors

Consumers are increasingly favoring flexible, on-demand mobility over private car ownership. This trend is evident in the growing popularity of car-sharing and short-term rental services. For instance, Europcar's own Ubeeqo car-sharing platform saw a significant increase in usage, reflecting this evolving preference.

Urbanization and heightened environmental awareness are key drivers behind this shift. Many city dwellers find car-sharing more economical and convenient than maintaining a personal vehicle, especially with rising urban congestion and parking costs. This societal change necessitates that mobility providers like Europcar diversify their services beyond traditional rentals to cater to these new demands.

Societal shifts are increasingly prioritizing environmental responsibility, directly impacting travel choices. Consumers are actively seeking out travel options that minimize their ecological footprint, creating a significant demand for sustainable and eco-friendly transportation solutions.

Europcar Mobility Group is strategically positioning itself to meet this demand. Their substantial investments in expanding their electric and hybrid vehicle fleets, coupled with a broader commitment to sustainable operational practices, resonate with this growing eco-conscious consumer base. This alignment is crucial for attracting and retaining customers who value environmental stewardship.

The trend is clearly visible in consumer behavior. For example, data from 2024 indicates that over 70% of Americans express a keen interest in renting electric vehicles (EVs) specifically to gain firsthand experience with the technology prior to making a potential purchase. This statistic underscores the direct link between environmental awareness and the adoption of greener mobility options.

Europcar Mobility Group's performance is closely tied to the ebb and flow of both leisure and business travel. The resurgence of travel post-pandemic is a welcome development, with leisure travel showing particular strength. For instance, in 2024, Euromonitor International projected a significant rebound in global tourism, with international arrivals expected to reach 1.5 billion by the end of the year, nearing 2019 levels.

Despite this recovery, the rental car industry faces ongoing competition. Europcar must innovate to maintain profitability, especially as consumer preferences lean towards rental vehicles for vacations. Data from industry surveys in late 2023 and early 2024 consistently highlighted rental cars as a preferred mode of transport for holidaymakers seeking flexibility and convenience.

Urbanization and Congestion Mitigation

Urbanization continues to intensify, with projections indicating that by 2050, 68% of the world's population will reside in urban areas, according to the UN. This escalating concentration of people in cities directly contributes to significant traffic congestion and a scarcity of parking spaces. These urban realities are making traditional private car ownership increasingly impractical and less desirable for many city dwellers.

Consequently, this shift in urban living is a powerful driver for the growth of shared mobility services. Car rental companies like Europcar Mobility Group are well-positioned to benefit as urban residents seek flexible and cost-effective transportation alternatives. For instance, in major European cities, the average driver can spend over 100 hours per year stuck in traffic, highlighting the tangible impact of congestion.

- Increased Demand for Alternatives: Growing urban populations exacerbate congestion, making car ownership less appealing.

- Rise of Shared Mobility: This trend directly fuels demand for rental and car-sharing services as viable urban transport solutions.

- MaaS Integration: Mobility as a Service (MaaS) platforms are consolidating various transport options, further streamlining urban travel and potentially integrating rental services.

- Economic Impact of Congestion: In 2023, traffic congestion cost the US economy an estimated $70 billion in lost productivity and wasted fuel, underscoring the financial incentive for alternative transport.

Expectations for Digital and Contactless Experiences

Customers now demand effortless, digital-centric experiences across the entire journey, from initial booking to returning a vehicle. This preference is evident in the growing adoption of mobile check-ins, keyless entry systems, and digital payment options, all aimed at minimizing wait times and boosting overall convenience. For instance, a 2024 report indicated that over 70% of consumers prefer self-service options for routine transactions.

However, a complete reliance on purely digital interactions has proven detrimental for some businesses, leading to a noticeable dip in customer satisfaction. This underscores a critical need for companies to strike a balance, integrating automated processes with readily available human support to cater to diverse customer needs and preferences.

Europcar Mobility Group, like many in the travel and mobility sector, must adapt to these evolving customer expectations. Key areas of focus include:

- Enhanced Mobile Functionality: Streamlining app-based booking, vehicle management, and return processes.

- Keyless and Contactless Solutions: Expanding the availability of keyless entry and digital check-out options.

- Omnichannel Support: Providing seamless transitions between digital self-service and human assistance for complex issues.

- Data Privacy and Security: Ensuring robust measures to protect customer data in increasingly digital transactions.

Societal shifts are increasingly prioritizing environmental responsibility, directly impacting travel choices, with consumers actively seeking out options that minimize their ecological footprint. Europcar Mobility Group is strategically positioning itself by investing in electric and hybrid vehicle fleets, aligning with this growing eco-conscious consumer base. Data from 2024 indicates that over 70% of Americans express interest in renting EVs to experience the technology before purchase, underscoring the link between environmental awareness and greener mobility adoption.

Technological factors

Europcar Mobility Group is embracing the digital transformation of the car rental sector, evident in its investment in cloud-based management systems and sophisticated online booking platforms. This technological shift is crucial for streamlining operations and enhancing customer engagement through intuitive mobile applications.

The industry's digital push includes advanced features like automated pricing and dynamic revenue management, which are vital for optimizing profitability in a competitive market. For instance, by mid-2024, a significant portion of Europcar's bookings are expected to originate from digital channels, reflecting this trend.

Europcar Mobility Group is leveraging Artificial Intelligence (AI) and Machine Learning (ML) to significantly improve customer interactions. AI-powered chatbots and virtual assistants are now providing immediate responses to customer queries, automating a substantial portion of support functions and enhancing overall service efficiency.

The company is also utilizing AI for dynamic pricing strategies, adjusting rental rates in real-time based on variables like demand, supply, and specific locations. This data-driven approach aims to maximize revenue and optimize fleet utilization. Predictive maintenance, powered by ML algorithms, is another key application, helping to anticipate and address potential vehicle issues before they impact the fleet's availability.

Furthermore, AI is being integrated to streamline the entire rental journey, from the initial booking and pre-rental checks to the in-rental experience and post-rental processes. This automation reduces manual effort and enhances the customer experience throughout their engagement with Europcar.

Telematics, incorporating GPS tracking and real-time data, is fundamental for Europcar's efficient fleet operations, optimizing vehicle use and safety. This technology allows for constant monitoring of vehicle health, proactive maintenance scheduling, and bolstered security measures.

The data generated by telematics provides crucial insights into customer driving habits and vehicle performance, enabling Europcar to refine its service offerings. For instance, by analyzing telematics data, rental companies can identify patterns in mileage, fuel consumption, and even driving styles, which can inform pricing strategies and vehicle allocation.

Integrating telematics with rental management software significantly enhances vehicle availability and theft prevention. By having a clear, real-time overview of the entire fleet, Europcar can swiftly identify misplaced vehicles and streamline the check-in/check-out process, improving overall operational efficiency.

Development of Autonomous Vehicles

The ongoing advancement of autonomous vehicle (AV) technology represents a significant long-term disruption and a potential opportunity for Europcar Mobility Group. While fully autonomous vehicles are not yet widespread in rental fleets, their development is accelerating.

Industry projections suggest that a substantial percentage of rental cars could be autonomous by 2030. For instance, Hertz has already initiated pilot programs, signaling early adoption trends within the sector. Europcar must actively monitor these technological shifts and strategically plan for the potential integration of AVs into its future fleet to remain competitive.

- Technological Disruption: Autonomous driving technology poses a fundamental shift in vehicle operation and user experience.

- Fleet Integration: Companies like Europcar will need to assess the feasibility and cost-effectiveness of incorporating AVs into their rental offerings.

- Market Projections: Research indicates that by 2030, a notable portion of the global rental car market could consist of autonomous vehicles.

- Competitive Landscape: Early adopters of AV technology in rental services, such as Hertz's pilot programs, set benchmarks for future industry standards.

Electric Vehicle (EV) Technology Advancements and Infrastructure

Improvements in battery technology are significantly enhancing EV viability for rental fleets. For instance, by mid-2024, average EV ranges were approaching 300 miles, with rapid charging capabilities now enabling an 80% charge in under 30 minutes for many models. These advancements directly address previous consumer concerns about range anxiety and lengthy charging times, making EVs a more practical option for short-term rentals.

However, the widespread and reliable charging infrastructure remains a critical hurdle. While the number of charging points in Europe grew by approximately 40% between 2022 and 2023, reaching over 600,000 by the end of 2023, their distribution is uneven. This patchy network can still pose challenges for rental customers, particularly in less urbanized areas.

Europcar Mobility Group's strategy to expand its EV fleet is intrinsically linked to these technological evolutions and the ongoing build-out of charging networks. By late 2024, Europcar announced plans to increase its electric vehicle offering by 30% across key European markets, contingent on the availability of suitable charging solutions at its rental locations and in partnership with charging network providers.

Key technological factors influencing Europcar's EV strategy include:

- Battery Density and Cost: Continued research is driving higher energy density, leading to longer ranges and potentially lower battery costs, making EVs more economically attractive for fleet acquisition.

- Charging Speed and Accessibility: The expansion of fast-charging (DC) stations is crucial for quick turnaround times in a rental context.

- Vehicle-to-Grid (V2G) Technology: Emerging V2G capabilities could offer future opportunities for fleet operators to manage energy costs and contribute to grid stability.

- Software and Connectivity: Advanced telematics for battery management, charging status, and route planning are essential for efficient fleet operation.

Technological advancements are reshaping Europcar Mobility Group's operations, with digital platforms and AI driving efficiency and customer engagement. By mid-2024, a significant portion of bookings are digital, and AI is optimizing pricing and customer service through chatbots. Telematics enhances fleet management and security, while the looming presence of autonomous vehicles, with projections suggesting a notable market share by 2030, necessitates strategic planning.

Legal factors

Europcar Mobility Group, like all businesses operating in Europe, must navigate the complex landscape of data privacy and security regulations, most notably the General Data Protection Regulation (GDPR). Handling extensive customer data, from booking details to payment information, requires Europcar to implement rigorous cybersecurity protocols and maintain transparent data handling practices. Failure to comply can result in significant penalties; for instance, in 2023, GDPR fines reached over €300 million across various sectors in the EU, underscoring the financial and reputational risks involved.

Consumer protection laws are a significant legal factor for Europcar Mobility Group. These regulations mandate clear and transparent communication regarding pricing, rental agreements, and how disputes are handled. For instance, in the European Union, the Unfair Commercial Practices Directive (UCPD) prohibits misleading advertising and hidden charges, directly impacting how Europcar presents its offers.

Europcar must ensure its pricing is upfront, detailing all mandatory fees and clearly explaining the cost of optional add-ons like insurance or GPS. Similarly, rental terms, including mileage limits and fuel policies, need to be easily understandable. Customers in 2024 and 2025 increasingly expect straightforward cancellation policies without excessive penalties, a trend reinforced by consumer advocacy groups pushing for fairer terms across the travel industry.

Europcar Mobility Group's fleet must strictly adhere to a complex web of national and international vehicle safety standards. This necessitates rigorous, ongoing maintenance and frequent safety inspections for every vehicle in its extensive rental fleet. For instance, in 2024, the European Union continued to enforce stringent regulations like Euro 7 emissions standards, impacting vehicle acquisition and maintenance costs.

Failure to comply with these safety regulations poses significant risks, not only to customer well-being but also to the company's financial health through potential fines and legal liabilities. Maintaining a spotless safety record is paramount for customer trust and operational continuity. The cost of non-compliance can easily outweigh the investment in robust safety protocols.

To effectively manage this, Europcar relies on sophisticated fleet management software. This technology is vital for proactively scheduling and tracking all essential maintenance and safety checks, ensuring that each vehicle meets regulatory requirements before it is rented out. Such systems help minimize downtime and prevent incidents that could lead to legal repercussions.

Licensing and Operational Permits

Europcar Mobility Group's extensive global presence, spanning over 100 countries through direct operations, franchises, and partnerships, necessitates strict adherence to a complex array of licensing and operational permits. These legal requirements are not uniform, presenting a significant challenge for maintaining consistent operations and executing strategic expansion initiatives across diverse jurisdictions.

Navigating these varying regulations directly impacts Europcar's ability to launch new services or establish rental stations efficiently. For instance, obtaining vehicle rental licenses, environmental permits for depots, and specific operational approvals can involve lengthy processes and differing standards in each country, potentially delaying market entry or increasing compliance costs.

- Licensing Complexity: Europcar must manage diverse licensing frameworks across its global network, affecting everything from vehicle registration to customer data handling.

- Operational Permits: Securing permits for rental locations, maintenance facilities, and specific service offerings (like electric vehicle charging) varies significantly by region.

- Franchisee Compliance: Ensuring all franchise partners adhere to local licensing and permit requirements adds another layer of legal oversight.

- Impact on Expansion: Regulatory hurdles can slow down or even halt expansion plans in new markets, requiring substantial upfront investment in legal and compliance expertise.

Labor Laws and Employment Regulations

Europcar Mobility Group, as a significant international employer, navigates a complex web of labor laws and employment regulations. These vary considerably across the countries where it operates, impacting everything from standard working hours and minimum wage requirements to employee rights concerning collective bargaining and unionization. Adherence to these diverse legal frameworks is critical for maintaining operational stability and avoiding costly penalties.

The car rental sector often experiences high employee turnover, a challenge compounded by increasing labor costs. For instance, in 2023, average hourly wages for rental car agents in the US saw an increase, reflecting broader economic trends. This necessitates proactive workforce management strategies, including competitive compensation and benefits, alongside rigorous compliance with all applicable employment regulations to ensure fair treatment and retention of staff.

- Compliance Burden: Europcar must manage varying labor laws across its global operations, covering aspects like working time directives, wage parity, and the right to organize.

- Rising Labor Costs: In 2024, many European countries are seeing continued upward pressure on wages due to inflation and labor shortages, impacting Europcar's operational expenses.

- Employee Turnover: The industry's typical high turnover rate, often exceeding 50% annually in some regions, requires significant investment in recruitment, training, and retention programs, all within legal employment frameworks.

- Regulatory Scrutiny: Increased focus on fair labor practices and employee well-being by governmental bodies and unions means Europcar must maintain robust compliance and ethical employment standards.

Europcar Mobility Group operates within a stringent legal framework governing vehicle safety and emissions. For example, in 2024, the EU continued to enforce Euro 7 standards, impacting fleet acquisition and maintenance costs, while also requiring rigorous adherence to national vehicle safety regulations for all rental vehicles.

Consumer protection laws are paramount, mandating transparent pricing and clear rental agreements, as enforced by directives like the EU's Unfair Commercial Practices Directive. This ensures customers are fully informed about all charges and terms, with a growing expectation in 2024-2025 for straightforward cancellation policies.

The company must also navigate complex data privacy regulations, such as GDPR, which imposes strict requirements on handling customer data. Non-compliance, as evidenced by over €300 million in GDPR fines across the EU in 2023, carries significant financial and reputational risks for Europcar.

Furthermore, Europcar's global operations require adherence to diverse licensing and operational permits, which can vary significantly by country. This complexity can impact the efficiency of launching new services or establishing new rental locations, potentially delaying market entry and increasing compliance costs.

Environmental factors

Governments globally are tightening regulations on carbon emissions, with the transportation sector facing significant pressure to decarbonize. Europcar Mobility Group is proactively addressing this by committing to reduce its Scope 3 emissions and electrifying its vehicle fleet, aiming to align with these evolving environmental standards.

A key milestone for Europcar is its status as the first vehicle rental company to have its 2030 carbon reduction targets validated by the Science Based Targets initiative (SBTi). This demonstrates a commitment to measurable progress in environmental stewardship, crucial for navigating the increasingly stringent regulatory landscape.

Governments worldwide are strongly encouraging the adoption of electric vehicle (EV) fleets to combat air pollution and decrease dependence on fossil fuels. This global trend directly impacts Europcar Mobility Group's operational strategy.

Europcar is actively responding to this environmental imperative by significantly increasing its investment in expanding its electric and plug-in hybrid vehicle offerings. The company's commitment is evident in its fleet composition goals, aiming for a substantial majority of its vehicles to be low or zero-emission models.

As of the close of 2023, Europcar had already achieved a notable milestone, with 12% of its entire rental fleet comprising battery-electric vehicles or plug-in hybrids, demonstrating tangible progress in its green transition.

Environmental concerns deeply impact Europcar Mobility Group, particularly regarding waste management and resource efficiency. This includes the crucial aspects of vehicle disposal and the responsible recycling of components and fluids. For instance, in 2023, the automotive industry faced increasing scrutiny over end-of-life vehicle (ELV) directives, pushing for higher recycling rates, with the EU aiming for 95% recovery and recycling by weight for ELVs.

To address these challenges, Europcar must embed sustainable practices throughout its fleet's lifecycle. This means optimizing vehicle acquisition, maintenance, and ultimately, their end-of-life management to significantly reduce its environmental footprint. Efficient resource utilization in daily operations, such as energy and water consumption, also plays a vital role in minimizing overall impact.

Noise Pollution and Urban Environmental Quality

As urban centers expand, noise pollution from conventional vehicles becomes a growing concern. Europcar's strategic integration of quieter electric vehicles (EVs) into its urban fleets can significantly enhance its environmental reputation. This move also aligns with smart city objectives focused on improving overall urban environmental quality.

By embracing EVs, Europcar can contribute to a more pleasant urban soundscape. For instance, a 2024 study indicated that urban noise levels in major European cities often exceed recommended limits, impacting resident well-being. Europcar's fleet electrification directly addresses this issue.

- Fleet Electrification: Europcar is actively increasing its EV fleet share to meet sustainability targets.

- Urban Environmental Quality: The adoption of EVs helps reduce noise pollution, a key factor in urban quality of life.

- Smart City Alignment: This strategy supports smart city initiatives promoting cleaner and quieter urban environments.

- MaaS Integration: Many Mobility as a Service (MaaS) platforms are prioritizing EVs to lower carbon footprints and noise.

Corporate Social Responsibility (CSR) and Sustainability Reporting

Stakeholder expectations for environmental responsibility are intensifying, pushing companies like Europcar Mobility Group to showcase robust Corporate Social Responsibility (CSR) and transparent sustainability reporting. This includes detailing their efforts in areas like carbon reduction and resource management.

Europcar has been proactive in this regard, regularly publishing sustainability reports that detail its environmental targets and progress. A key focus is its commitment to transitioning its fleet towards electric mobility solutions, a significant step in its sustainable development strategy.

- Fleet Electrification: By the end of 2024, Europcar aimed to have 10% of its fleet comprised of electric vehicles (EVs), with a target to reach 20% by the end of 2026.

- CO2 Reduction Targets: The company has set a goal to reduce its Scope 1 and Scope 2 CO2 emissions by 30% by 2030 compared to a 2019 baseline.

- Sustainable Operations: Europcar is also focusing on reducing waste and improving energy efficiency across its network of rental stations.

- Reporting Standards: The group aligns its sustainability reporting with international frameworks such as the Global Reporting Initiative (GRI) standards.

Europcar Mobility Group faces increasing pressure from evolving environmental regulations and a global push towards decarbonization. The company's commitment to sustainability is demonstrated by its science-based targets for carbon reduction and a strategic shift towards an electric vehicle fleet. By the end of 2023, 12% of Europcar's fleet consisted of electric or plug-in hybrid vehicles, a figure expected to grow significantly as the company aims for 10% EV fleet share by the end of 2024.

| Environmental Factor | Europcar's Response/Target | Key Data/Milestone |

| Carbon Emissions Reduction | Commitment to reduce Scope 1 & 2 CO2 emissions by 30% by 2030 (vs. 2019 baseline) | SBTi validation of 2030 carbon reduction targets |

| Fleet Electrification | Increasing EV and plug-in hybrid vehicle offerings | 12% EV/PHEV fleet share by end of 2023; Target of 10% EV fleet by end of 2024 |

| Waste Management & Resource Efficiency | Focus on responsible end-of-life vehicle management and recycling | Aligning with EU ELV directives aiming for 95% recovery/recycling by weight |

| Urban Environmental Quality | Integration of quieter electric vehicles into urban fleets | Addressing urban noise pollution concerns, contributing to smart city initiatives |

PESTLE Analysis Data Sources

Our PESTLE analysis for Europcar Mobility Group is informed by a comprehensive review of official government publications, reports from international organizations like the OECD, and reputable industry analysis firms. This ensures all political, economic, social, technological, legal, and environmental factors are grounded in current and verifiable data.