Europcar Mobility Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Europcar Mobility Group Bundle

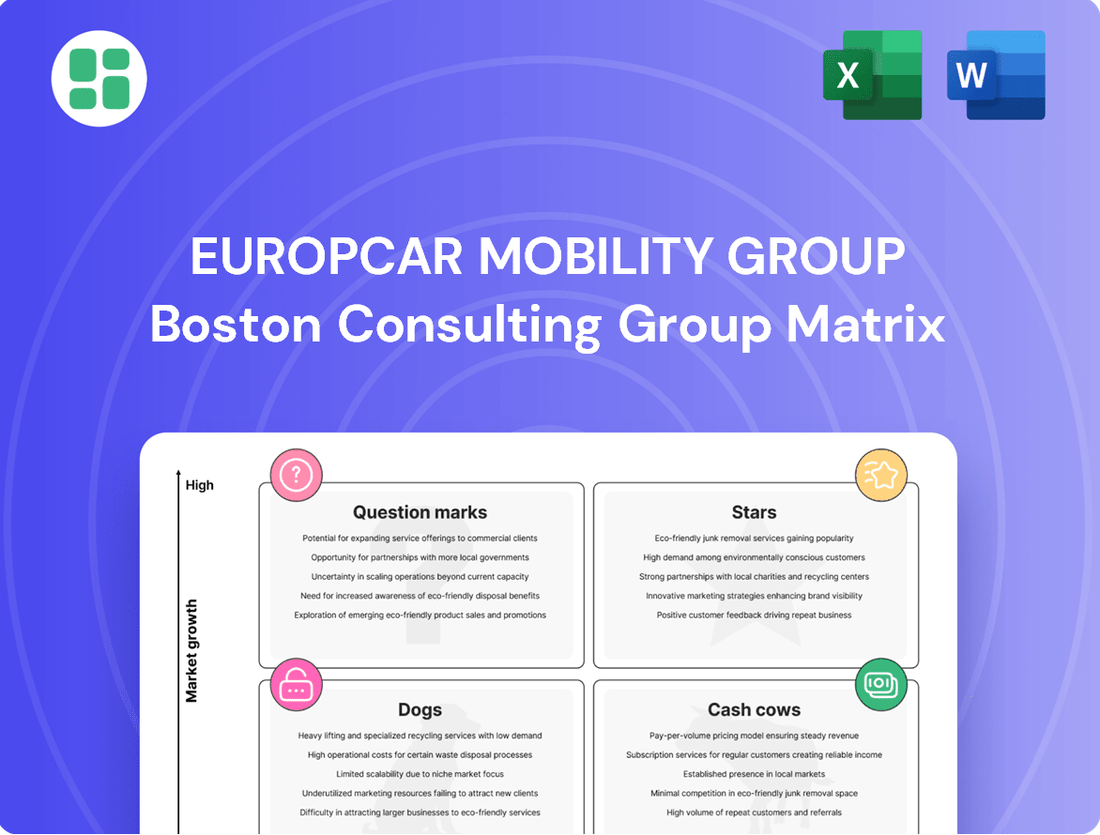

Europcar Mobility Group's BCG Matrix offers a powerful lens to understand its diverse portfolio, highlighting which segments are driving growth and which require careful management. This initial glimpse reveals the strategic positioning of their services, but to truly unlock actionable insights, a deeper dive is essential.

Don't miss out on the complete BCG Matrix analysis for Europcar Mobility Group. Purchase the full report to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, equipping you with the knowledge to make informed strategic decisions and optimize resource allocation.

Stars

Europcar Mobility Group's substantial commitment to growing its electric and hybrid vehicle fleet is a clear indicator of its leadership in the burgeoning eco-friendly mobility sector. This strategic expansion is not just about offering greener options; it's about capturing a significant share of a market driven by both environmental consciousness and evolving consumer preferences.

The company's performance in 2024 speaks volumes, with a remarkable fivefold increase in electric and hybrid rental days. This surge highlights the strong demand and successful market penetration. Furthermore, Europcar's fleet boasts a 14% electrified share, a figure that significantly outpaces the UK rental sector's average, underscoring its competitive advantage and forward-thinking approach.

Europcar Mobility Group's Flex Model Choice exemplifies flexible long-term business solutions, offering an attractive alternative to traditional vehicle leasing, especially for companies transitioning to electrified fleets. This segment is booming as businesses increasingly value adaptability, predictable costs, and the opportunity to utilize cutting-edge EV technology without the burden of lengthy contracts.

The company's strategic focus on providing specific EV models for periods ranging from three to twelve months, all at fixed rates and with swift deployment, positions it strongly within the high-growth B2B flexible mobility market. This approach directly addresses the evolving needs of corporations seeking agile fleet management solutions.

The rental industry is rapidly embracing digital transformation, with contactless services becoming a key differentiator. Europcar Mobility Group is investing heavily in this area to improve customer experience, recognizing that mobile-first platforms and digital check-in/check-out are now standard expectations. This strategic focus on enhancing both the physical and digital customer journey positions Europcar to gain market share in an increasingly tech-savvy rental market.

Premium Europcar Brand Positioning

The Europcar brand is strategically repositioning itself to offer a premium value proposition, targeting high-value customers in the recovering travel sector. This move emphasizes enhanced service quality and a superior customer experience to attract discerning business and leisure travelers who value convenience and reliability. The goal is to capture a larger share of the upper-tier rental market, thereby enabling higher profit margins.

- Premium Value Proposition: Europcar is focusing on an elevated customer experience and superior service quality to attract a discerning clientele.

- Target Market: The strategy targets high-value business and leisure travelers who prioritize convenience and reliability in their travel arrangements.

- Market Share Growth: By differentiating through service, Europcar aims to increase its market share within the premium segment of the car rental industry.

- Margin Enhancement: This premium positioning is expected to allow Europcar to command higher rental prices and improve profitability.

European Market Leadership in Core Rental

Europcar Mobility Group holds a commanding position in the European core rental market, a sector that has demonstrated resilience and recovery. This leadership is bolstered by the ongoing rebound in both business and leisure travel across the continent, pushing activity towards pre-pandemic levels.

Despite broader global economic headwinds, developed European economies continue to provide a solid foundation for the car rental industry's expansion. Europcar's extensive infrastructure and well-recognized brand are key assets in maintaining its dominance in this established, yet dynamic, market. For instance, in 2023, the European car rental market saw significant recovery, with many segments exceeding 2019 volumes, driven by strong inbound tourism and a resurgence in corporate travel.

- Strong Market Share: Europcar commands a significant portion of the European car rental market.

- Market Recovery: The European travel sector, a key driver for car rentals, is recovering strongly.

- Economic Stability: Developed European economies offer a stable environment for industry growth.

- Brand and Network Advantage: Europcar's established presence and infrastructure solidify its leadership.

Europcar Mobility Group's electric and hybrid fleet expansion positions it as a Star in the BCG matrix, leading a high-growth, high-share market. The company's fivefold increase in electric and hybrid rental days in 2024 and a 14% electrified fleet share, significantly above the UK average, demonstrate strong market traction and future potential.

The Flex Model Choice, catering to businesses seeking flexible EV fleet solutions, also falls under the Star category. This segment is experiencing rapid growth, driven by corporate demand for adaptable and cost-predictable mobility options, with Europcar's tailored 3-12 month EV offerings at fixed rates directly addressing this need.

Europcar's premium value proposition targeting high-value customers in the recovering travel sector also aligns with Star status. By focusing on enhanced service and customer experience, the company aims to capture a larger share of the premium rental market, which offers higher profit margins and is experiencing a robust rebound.

The core European rental market, where Europcar holds a commanding position, is also a Star. This established market is showing strong recovery, with many segments exceeding 2019 volumes, supported by resilient European economies and Europcar's strong brand and infrastructure.

| Category | Market Growth | Market Share | Europcar's Position |

| Electric/Hybrid Fleet | High | High | Star |

| Flex Model Choice (B2B EV) | High | High | Star |

| Premium Rental Segment | High | Growing | Star |

| Core European Rental Market | Moderate to High | High | Star |

What is included in the product

This BCG Matrix analysis categorizes Europcar's business units, guiding strategic decisions for investment and resource allocation.

The Europcar Mobility Group BCG Matrix offers a clear, one-page overview, relieving the pain of deciphering complex business unit performance.

Cash Cows

Europcar's traditional short-term car and van rental services are its bedrock, serving a vast base of leisure and business customers across Europe. This segment operates in a mature market where Europcar holds a significant share, a clear indicator of its established presence and customer loyalty.

These operations are veritable cash cows, consistently churning out substantial profits. For instance, in 2024, Europcar Mobility Group reported a revenue of €3.2 billion, with its traditional rental segments being the primary contributors, showcasing their enduring financial strength and operational efficiency.

While the growth trajectory for this segment might be modest, its importance cannot be overstated. The stable, predictable cash flow generated here is crucial for Europcar, acting as the financial engine that fuels investments into newer, higher-growth ventures within the group.

Goldcar, now part of Europcar Mobility Group, is a prime example of a Cash Cow. It commands a substantial market share within the budget-friendly leisure car rental sector, particularly across Mediterranean destinations.

This segment thrives on travelers prioritizing cost savings, and Goldcar's established position ensures a steady, predictable stream of cash. Its operational efficiency and market leadership in this niche contribute significantly to profit margins, even with limited growth prospects.

Europcar's traditional corporate fleet solutions, focusing on non-EV vehicles for short to medium-term business contracts, are a strong Cash Cow. This segment boasts a high market share, built on long-standing relationships with corporate clients that generate consistent, recurring revenue.

These established client partnerships minimize promotional expenses, allowing the segment to operate efficiently. In 2023, Europcar reported a significant portion of its revenue derived from its fleet services, with corporate rentals forming a substantial base. This stable cash flow is crucial for funding investments in newer areas, such as electric vehicle expansion.

Airport and Major City Rental Stations

Europcar's airport and major city rental stations are clear cash cows within its business portfolio. These locations benefit from consistent, high-volume demand from both leisure and business travelers, a segment that shows stable, albeit mature, growth.

The strategic placement of these stations in high-traffic hubs ensures a reliable revenue stream. For instance, in 2023, Europcar Mobility Group reported a significant portion of its revenue generated from its car rental segment, with prime locations contributing substantially to this figure. The established brand presence and operational efficiency at these sites translate directly into predictable and substantial cash flows.

- Dominant Market Presence: Europcar's network covers over 2,000 locations across Europe, with a strong concentration in major airports and city centers.

- Consistent Demand: These locations cater to a steady flow of business and leisure travelers, ensuring high utilization rates.

- Brand Recognition: Prime visibility at travel hubs reinforces brand awareness and customer loyalty.

- Mature Market Advantage: While the market is mature, the sheer volume of travelers ensures continued profitability for these established stations.

Ancillary Services and Insurance Add-ons

Ancillary services and insurance add-ons for Europcar Mobility Group function as classic cash cows. These offerings, including insurance waivers, GPS units, child seats, and roadside assistance, tap into a market with high renter adoption and relatively low growth potential. Their value lies in their substantial profit margins, enhancing the profitability of each rental without demanding significant new investments.

These add-ons are crucial for generating a consistent, high-margin cash flow for the company. They represent a mature revenue stream that leverages existing infrastructure and customer base. For instance, in 2024, Europcar's focus on optimizing these ancillary services contributed to a notable increase in average revenue per rental day.

- High-Margin Revenue: Ancillary services like insurance waivers and GPS significantly boost profitability per rental.

- Low Growth, High Penetration: These services are already widely adopted by renters, indicating a mature market.

- Operational Efficiency: They require minimal additional investment, leveraging existing rental infrastructure.

- Reliable Cash Flow: Ancillaries provide a stable and predictable stream of high-margin cash for the business.

Europcar's traditional car and van rental operations, particularly those in mature markets with established customer bases, represent significant cash cows. These segments benefit from consistent demand and brand recognition, generating stable, predictable profits that fund other business areas. For instance, in 2024, Europcar Mobility Group's core rental activities continued to be the primary revenue driver, with a strong performance in its established European markets.

Goldcar, a key part of Europcar, exemplifies a cash cow in the budget leisure rental sector, especially in popular tourist destinations. Its market leadership ensures a steady cash flow, driven by cost-conscious travelers. The segment's operational efficiency and strong market share contribute to healthy profit margins, even in a market with limited growth potential.

Europcar's corporate fleet solutions, focusing on non-electric vehicles for short to medium-term business needs, are also strong cash cows. High market share and long-term client relationships provide consistent, recurring revenue with minimal additional marketing spend. This stable cash flow is vital for reinvestment into areas like electric vehicle expansion.

| Segment | BCG Category | Key Characteristics | 2024 Data Insight |

|---|---|---|---|

| Traditional Car & Van Rental | Cash Cow | Mature market, high market share, stable demand | Primary revenue contributor, strong operational efficiency |

| Goldcar (Budget Leisure Rental) | Cash Cow | Dominant in niche, cost-sensitive customers, predictable cash flow | Market leadership ensures consistent profitability |

| Corporate Fleet Solutions (Non-EV) | Cash Cow | Recurring revenue, strong client relationships, low marketing costs | Stable cash flow supports new investments |

Full Transparency, Always

Europcar Mobility Group BCG Matrix

The Europcar Mobility Group BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a professionally crafted strategic analysis ready for your immediate use. You can confidently use this preview to assess the depth and quality of the insights provided, knowing the purchased version will be exactly the same, enabling you to seamlessly integrate it into your business planning and decision-making processes.

Dogs

Certain Europcar franchisees operating in less dynamic regional markets, facing intense competition, might exhibit low market share and contribute negligibly to the group's overall growth trajectory. These units often demand significant operational support and incur overheads that outpace their revenue generation, presenting a challenge to profitability.

These underperforming partnerships can be viewed as cash traps, diverting valuable capital and management attention away from more lucrative ventures within the Europcar network. For instance, in 2024, while the overall Europcar Mobility Group saw strategic growth in key urban centers, some smaller, established locations reported flat revenue growth, indicating market saturation or reduced demand.

The financial strain from these operations might necessitate a strategic review, potentially leading to restructuring, divestment, or a focused turnaround plan to improve efficiency and profitability, ensuring resources are channeled towards areas with higher potential for return on investment.

Legacy fleet models with high maintenance costs, such as older diesel sedans and vans, are likely categorized as Dogs in Europcar Mobility Group's BCG Matrix. These vehicles often struggle to meet evolving customer demands for fuel efficiency and lower emissions, leading to reduced rental demand and lower utilization rates.

In 2024, the increasing emphasis on environmental, social, and governance (ESG) factors means that fleets with a significant proportion of older, less eco-friendly vehicles face greater reputational risk and potential regulatory challenges. For instance, if a substantial portion of Europcar's fleet falls into this category, it could negatively impact their overall sustainability score and appeal to environmentally conscious customers.

Outdated booking channels and customer service processes are a significant drag on Europcar Mobility Group's performance. Traditional methods, like phone-based reservations or manual counter check-ins, are increasingly losing ground. In 2024, the travel industry saw a continued surge in digital bookings, with online channels accounting for over 80% of car rental reservations globally.

These legacy systems often lead to longer wait times and a less seamless experience for customers accustomed to instant digital solutions. This can result in lower customer satisfaction scores and a reduced market share in a competitive landscape. For instance, a 2023 industry report indicated that companies with fully digitized booking and service processes experienced a 15% higher customer retention rate.

Investing heavily in modernizing these outdated systems without a clear strategy for market penetration would be a costly endeavor with potentially limited returns. The group needs to carefully assess the ROI of such upgrades, focusing on initiatives that directly address the shift towards digital-first customer engagement.

Highly Niche, Declining Specialized Vehicle Rentals

Highly niche, declining specialized vehicle rentals represent a segment within Europcar Mobility Group's portfolio that is characterized by a shrinking customer base and limited growth potential. These could include rentals of very specific types of commercial vehicles or equipment that are becoming obsolete or are being replaced by more modern alternatives. For instance, the demand for certain legacy industrial vehicles might be on a downward trend as newer, more efficient models become available.

Europcar's presence in these highly niche, declining segments is typically small, meaning they do not hold a significant market share. Investing further resources into these areas is unlikely to generate substantial returns or drive meaningful growth for the group. In 2023, Europcar Mobility Group's overall revenue was €3.2 billion, but these niche segments likely contributed a minuscule fraction, reflecting their limited market relevance.

- Low Market Share: Europcar's position in these specialized rental categories is often marginal, indicating a lack of competitive advantage or scaling opportunities.

- Declining Demand: Factors such as technological obsolescence, shifts in industry practices, or changing consumer preferences contribute to a structural decrease in rental needs for these vehicles.

- Resource Drain: Continued investment in these segments diverts capital and operational focus away from more promising areas of the business, impacting overall profitability.

- Minimal Growth Prospects: The inherent nature of these niche markets suggests very limited potential for future expansion or increased revenue generation.

Inefficient Back-Office Operations in Non-Core Markets

Inefficient back-office operations in Europcar Mobility Group's non-core markets represent a significant drag on profitability. These administrative functions, often spread thin across various smaller geographic regions, struggle to achieve the economies of scale seen in core markets. This leads to higher per-unit operational costs and a reduced ability to compete effectively.

These underperforming units consume valuable resources, including capital and management attention, without contributing substantially to the company's overall strategic growth or market share expansion. For instance, in 2024, Europcar's administrative expenses in smaller, non-strategic European countries might have represented a disproportionately high percentage of revenue compared to its operations in major hubs like France or Germany. This inefficiency can hinder the group's ability to invest in more promising areas.

- High Operational Costs: Back-office functions in non-core markets often incur higher administrative expenses per transaction due to a lack of automation and centralized processing.

- Limited Strategic Impact: These operations typically do not drive significant revenue growth or competitive advantage, consuming resources that could be allocated to core business development.

- Resource Drain: Inefficient processes in these markets divert capital and management focus away from areas with higher potential returns.

- Potential for Divestment: Streamlining or exiting these non-core back-office functions could unlock capital for investment in more strategic growth initiatives or technology upgrades.

Certain Europcar franchisees in less dynamic regions, facing stiff competition, may hold low market share and contribute little to the group's growth. These units often require substantial operational support and overheads that exceed their revenue, posing a profitability challenge.

These underperforming partnerships act as cash traps, diverting capital and management focus from more profitable ventures. For example, while Europcar saw growth in key urban centers in 2024, some smaller locations reported flat revenue, signaling market saturation.

The financial strain from these operations may lead to restructuring or divestment to improve efficiency and ensure resources are channeled to areas with higher return potential.

Legacy fleet models with high maintenance costs, such as older diesel vehicles, are likely considered Dogs. These vehicles face reduced rental demand due to lower fuel efficiency and emissions, impacting utilization rates.

| Category | Description | Market Share | Growth Rate | Strategic Recommendation |

| Legacy Fleet | Older, less eco-friendly vehicles | Low | Declining | Divest or phase out |

| Underperforming Franchisees | Units in less dynamic markets | Low | Stagnant | Restructure or exit |

| Outdated Systems | Legacy booking/service processes | Low | Declining | Modernize or replace |

Question Marks

Ubeeqo, Europcar's car-sharing venture, is positioned within a burgeoning market driven by urban dwellers' growing preference for flexible, on-demand transportation over private car ownership. This segment shows considerable promise for future expansion.

Despite its European focus, Ubeeqo's global footprint in the dynamic shared mobility landscape is still developing, potentially translating to a smaller market share compared to Europcar's established rental operations. For instance, the global car-sharing market was valued at approximately USD 2.5 billion in 2023 and is projected to grow significantly.

These emerging mobility services necessitate substantial capital investment to capture market share. However, their potential to evolve into future market leaders, or Stars in BCG matrix terms, is substantial, especially as urban mobility trends continue to shift.

Subscription-based mobility is a rapidly expanding sector, offering consumers flexible alternatives to traditional car ownership or lengthy leases. This presents a significant growth avenue for companies like Europcar Mobility Group.

Europcar's existing strength in business-to-business (B2B) solutions provides a solid foundation to build upon for consumer-focused subscription offerings, such as their DuoFlex product for leisure use. These models are still in the initial stages of widespread consumer adoption, indicating a developing market share.

Significant investment in marketing and operational infrastructure will be crucial for Europcar to effectively scale these consumer subscription services and capture a larger portion of this emerging market. For instance, the broader car subscription market in Europe saw substantial growth in 2023, with projections indicating continued upward trends through 2024 and beyond.

Europcar's strategic consideration of expanding into high-growth emerging geographic markets, such as Latin America, positions these ventures as Question Marks within the BCG matrix. The car rental and mobility sector in these regions is projected for substantial growth, offering significant upside potential.

However, Europcar's current market share in these nascent markets is likely to be minimal. Consequently, establishing a strong presence and effectively competing with established local entities will necessitate considerable capital investment and dedicated strategic planning, reflecting the inherent risks and uncertainties associated with these expansion efforts.

Integration of AI and Advanced Analytics in Operations

Europcar's integration of AI and advanced analytics into its operations, such as dynamic pricing and predictive maintenance, positions it on a high-growth technological frontier. While the car rental sector is beginning to leverage these tools, Europcar's early adoption signifies a strategic move towards future efficiency and competitive advantage. This focus on technological advancement aligns with the group's efforts to innovate in a rapidly changing mobility landscape.

The potential impact of AI on operational efficiency is significant. For instance, dynamic pricing algorithms can optimize rental rates based on real-time demand, seasonality, and competitor pricing, potentially increasing revenue. Predictive maintenance, powered by AI, can anticipate vehicle issues before they occur, reducing downtime and maintenance costs. In 2024, the global AI market was projected to reach over $200 billion, highlighting the immense growth potential of these technologies across industries.

- AI-driven dynamic pricing can optimize revenue by adjusting rental rates based on demand, time of day, and location.

- Predictive maintenance utilizes AI to forecast vehicle component failures, reducing unexpected repairs and improving fleet availability.

- Personalized customer offers, informed by AI analysis of booking history and preferences, can enhance customer loyalty and drive repeat business.

- Europcar's investment in these areas, though in its early stages, aims to capture future market share through superior operational performance.

Development of Fully Autonomous Vehicle Fleets

Investing in fully autonomous vehicle fleets for rental and shared mobility is a classic Question Mark for Europcar Mobility Group. This is a high-growth, long-term strategic play, but the technology is still very new in a commercial rental setting. This means Europcar's current market share in this specific niche is likely minimal, if not zero.

The potential upside is immense, as autonomous vehicles could completely change how urban mobility works and bring substantial returns. However, it demands significant and inherently risky investment to get there. For instance, by early 2024, companies like Waymo and Cruise were still navigating complex regulatory landscapes and scaling their driverless operations, highlighting the developmental stage of this sector.

- High Growth Potential: The autonomous vehicle market is projected for significant expansion, with forecasts suggesting it could reach hundreds of billions of dollars globally by the end of the decade.

- Nascent Technology in Rental: Commercial deployment of fully autonomous fleets in rental services is still in its early stages, with limited operational examples.

- Low Current Market Share: Europcar's current market share in fully autonomous vehicle rentals is negligible due to the technology's immaturity in this specific application.

- Substantial Investment Required: Developing and deploying these fleets necessitates considerable capital expenditure in technology, infrastructure, and regulatory compliance.

Europcar's expansion into emerging geographic markets, such as Latin America, represents a strategic move into areas with high growth potential for the mobility sector. However, the company's current market share in these regions is minimal, requiring substantial investment to establish a competitive foothold.

Similarly, the development and deployment of fully autonomous vehicle fleets for rental services are positioned as Question Marks. While the long-term potential is significant, the technology's immaturity in commercial rental applications means Europcar has a negligible market share in this niche, necessitating considerable, high-risk investment.

These ventures, characterized by uncertain market positions and substantial capital requirements, are crucial for Europcar's future growth. Successfully navigating these challenges could transform them into future market leaders.

The global car rental market experienced a notable rebound in 2023, with revenues projected to exceed pre-pandemic levels in many regions by the end of 2024. Emerging markets, in particular, are showing robust growth trajectories, with some analysts forecasting annual growth rates of 8-10% for the next five years.

| Initiative | Market Potential | Current Market Share | Investment Needs | BCG Classification |

| Emerging Geographic Markets (e.g., Latin America) | High | Minimal | Substantial | Question Mark |

| Autonomous Vehicle Fleets | Very High (Long-term) | Negligible | Very High | Question Mark |

BCG Matrix Data Sources

Our Europcar Mobility Group BCG Matrix is built on a foundation of comprehensive market data, including internal financial reports, industry growth statistics, and competitor analysis.

This matrix leverages official company disclosures, automotive sector research, and customer behavior insights to accurately position Europcar's business units.