Europcar Mobility Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Europcar Mobility Group Bundle

Europcar Mobility Group navigates a competitive landscape shaped by significant buyer power and the looming threat of substitutes, particularly ride-sharing services. The bargaining power of suppliers, while present, is somewhat mitigated by the industry's scale. Understanding these dynamics is crucial for any player in the mobility sector.

The complete report reveals the real forces shaping Europcar Mobility Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Europcar Mobility Group's dependence on a select group of global vehicle manufacturers grants these suppliers considerable leverage. For instance, in 2024, the automotive industry continued to see consolidation, with major players like Volkswagen Group, Toyota, and Stellantis accounting for a substantial portion of global vehicle production.

The ongoing transition to electric vehicles (EVs) and the tendency for Original Equipment Manufacturers (OEMs) to prioritize the production of higher-spec, more expensive models can further amplify supplier bargaining power. This trend may lead to increased acquisition costs for fleet operators like Europcar.

Suppliers of financing for Europcar's fleet acquisition, such as those involved in securitization programs, wield significant power. This power is primarily exercised through the interest rates and terms they offer, directly impacting Europcar's cost of capital for its vehicles. In 2024, Europcar actively renegotiated and extended several of its securitization programs, highlighting the critical nature of these financial arrangements and the ongoing negotiation with these key funding partners.

Europcar Mobility Group's increasing reliance on technology and digital solution providers for its connected fleet and digital customer experiences significantly bolsters the bargaining power of these suppliers. As the company integrates advanced telematics, sophisticated software platforms, and robust IT infrastructure, specialized providers offering unique or proprietary solutions can command greater influence, particularly if switching costs are high.

Fuel and Maintenance Services

Suppliers of fuel and vehicle maintenance services, while fragmented, are critical for Europcar Mobility Group's daily operations. The bargaining power of these suppliers is moderate. While they provide essential inputs, Europcar's substantial fleet size can provide some leverage in negotiations, particularly for bulk fuel purchases.

Fluctuations in global oil prices directly impact fuel costs, a significant operating expense for Europcar. For instance, Brent crude oil prices saw considerable volatility in 2024, with averages fluctuating around $80-$85 per barrel for much of the year, impacting Europcar's fuel expenditure. Similarly, the cost of specialized vehicle parts and skilled labor for maintenance can vary, potentially increasing operating expenses.

- Fuel Price Volatility: Global oil market dynamics directly influence Europcar's fuel costs, with 2024 seeing significant price swings.

- Maintenance Costs: The availability and cost of specialized parts and qualified technicians for vehicle upkeep represent a key supplier cost.

- Negotiation Leverage: Europcar's large fleet size can potentially offset some supplier power through volume-based purchasing agreements.

- Operational Dependence: Despite potential leverage, Europcar remains operationally dependent on reliable fuel and maintenance services to maintain fleet availability.

Impact of EV Transition on Supplier Power

The automotive industry's accelerated shift towards electric vehicles (EVs) is reshaping the bargaining power of suppliers for Europcar Mobility Group. As major manufacturers prioritize EV production, the availability and cost of traditional internal combustion engine (ICE) vehicles are likely to decrease. This dynamic can lead to increased procurement costs for Europcar's fleet, especially if the demand for ICE vehicles remains significant within their operational model.

This transition directly influences supplier relationships. For instance, by mid-2024, a significant portion of new vehicle registrations in key European markets like Norway were already electric. This trend suggests a diminishing supply of new ICE vehicles and a potential increase in the negotiating leverage of suppliers specializing in EV components or manufacturing. Europcar may face higher prices for the remaining ICE vehicles or be compelled to accelerate its own EV fleet expansion to secure supply.

- Shifting Production: Major automakers are reallocating resources from ICE to EV production, impacting the supply of traditional vehicles.

- Rising EV Costs: Increased demand and production complexities for EVs can translate to higher upfront costs for fleet operators like Europcar.

- Supplier Leverage: Suppliers of EV components or manufacturers with strong EV portfolios may gain increased bargaining power.

- Fleet Modernization Pressure: Europcar might face pressure to invest more heavily in EVs to align with market trends and supplier capabilities.

Europcar's reliance on a few major global vehicle manufacturers, such as Stellantis and Volkswagen Group, grants these suppliers significant power. This is amplified by the ongoing industry shift towards electric vehicles (EVs), where manufacturers may prioritize higher-margin EVs, potentially increasing costs for traditional fleet vehicles. In 2024, the automotive sector continued its consolidation, with a few large players dominating production, giving them more leverage in negotiations with fleet operators.

Financing providers for Europcar's fleet acquisitions also hold considerable sway, influencing costs through interest rates and loan terms. Europcar's active renegotiation of securitization programs in 2024 underscores the importance of these relationships and the power these financial suppliers possess. The increasing integration of advanced technology and digital solutions for fleet management and customer experience further empowers specialized IT and software providers, especially when switching costs are high.

| Supplier Type | Bargaining Power Indicator | 2024 Context/Data |

|---|---|---|

| Vehicle Manufacturers | Concentration, EV transition | Major OEMs like VW, Toyota, Stellantis dominate production. EV shift may increase ICE vehicle costs. |

| Financing Providers | Interest rates, loan terms | Europcar actively renegotiated securitization programs, highlighting supplier influence on capital costs. |

| Technology Providers | Proprietary solutions, switching costs | Increased reliance on advanced telematics and software elevates power of specialized providers. |

| Fuel & Maintenance | Price volatility, specialization | Brent crude averaged $80-$85/barrel in 2024. Specialized parts and labor costs can fluctuate. |

What is included in the product

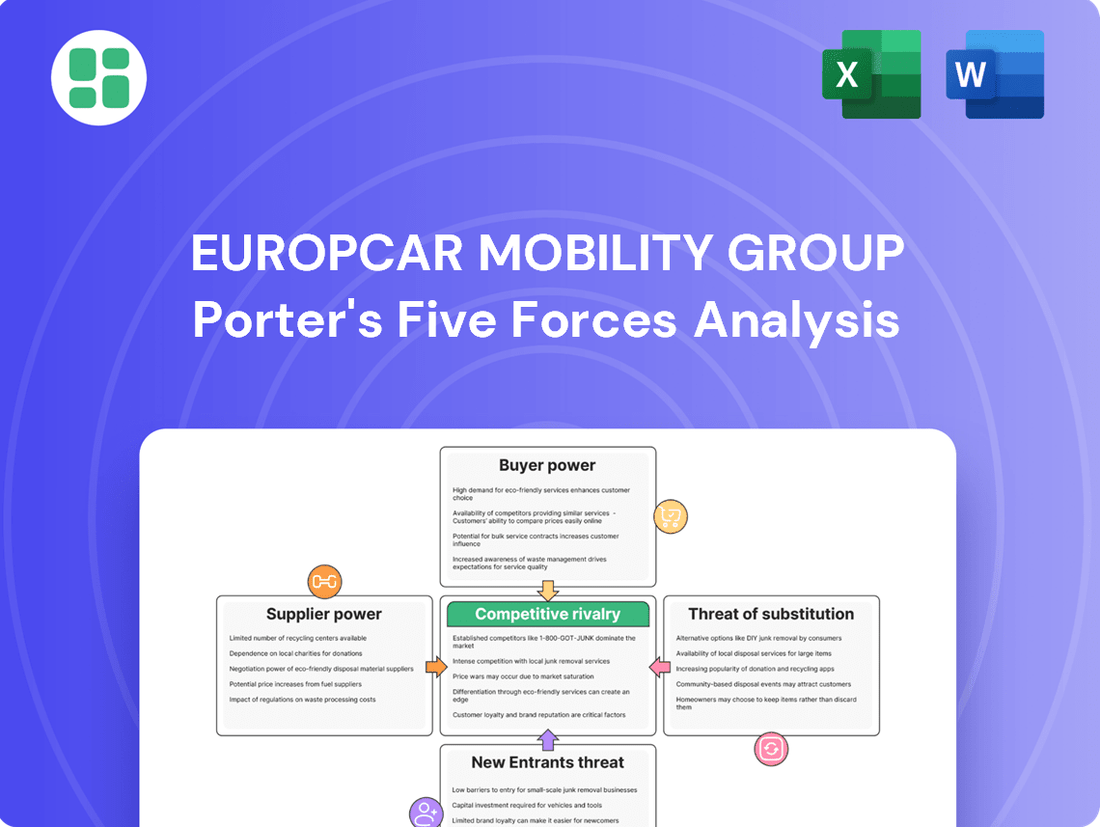

This analysis comprehensively examines the competitive forces impacting Europcar Mobility Group, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

A dynamic, interactive model that quantifies the impact of each Porter's Five Forces on Europcar's profitability, enabling targeted strategies to mitigate competitive pressures.

Customers Bargaining Power

Leisure customers, particularly those who book through online travel agencies and price comparison sites, exhibit significant price sensitivity. This makes them a powerful force, as they can easily switch between providers based on the lowest available rate. For instance, in 2024, the average rental price for leisure travel in Europe saw fluctuations, with discounts often driving booking decisions.

Europcar's strategic acquisition and operation of brands like Goldcar directly address this market segment. Goldcar's business model is built on offering highly competitive, low-cost rentals, acknowledging that a substantial portion of the leisure market prioritizes price above all else. This focus is crucial for capturing market share in a segment where value for money is paramount.

Large corporate clients represent a significant portion of Europcar Mobility Group's customer base, and their substantial rental volumes grant them considerable bargaining power. These businesses often require flexible, long-term rental agreements and can negotiate favorable terms due to the consistent revenue they generate. For instance, in 2023, corporate and business rentals formed a key segment for the automotive rental industry, with companies seeking cost-effective fleet management solutions.

The widespread availability of online booking platforms and aggregators significantly enhances customer bargaining power for Europcar Mobility Group. These platforms allow consumers to effortlessly compare rental prices and service offerings from numerous providers, including competitors like Hertz and Avis. In 2024, the online travel agency (OTA) market continued its growth trajectory, with car rental bookings through these channels representing a substantial portion of overall rentals, forcing providers to remain competitive on price.

Demand for Flexible Mobility Solutions

Customers are increasingly seeking adaptable and readily available transportation, including options for short, medium, and long-term rentals, as well as subscription models. This growing preference for flexibility naturally shifts leverage towards consumers who can set the terms for their mobility needs.

Europcar Mobility Group is actively positioning itself to be a significant provider of these flexible mobility services on a global scale. For instance, in 2023, the company continued to expand its car-sharing and subscription offerings, aiming to capture a larger share of this evolving market. Their commitment to innovation in this area is crucial for maintaining competitiveness.

- Growing Demand: The global car-sharing market alone was projected to reach over $10 billion by 2025, indicating a strong customer appetite for flexible options.

- Subscription Services: Europcar's own subscription services saw a notable increase in uptake in 2023, reflecting customer interest in predictable, long-term mobility solutions.

- On-Demand Needs: The rise of ride-sharing and the expectation of immediate availability for rental vehicles further empower customers to choose providers that meet their instant needs.

- Competitive Landscape: With numerous players entering the flexible mobility space, customers have more choices, intensifying the pressure on companies like Europcar to offer competitive pricing and superior service.

Impact of Digitalization on Customer Experience

Customers today demand highly integrated and effortless digital interactions, extending from the initial booking process right through to accessing their rented vehicle. This shift means companies must prioritize digital solutions to meet these evolving expectations.

Europcar Mobility Group, like many in the industry, is responding by investing in digital platforms and connected car technology. For instance, by enabling keyless entry and mobile app-based vehicle management, Europcar can directly address the customer's desire for convenience and control. This proactive approach helps to solidify customer loyalty and can lessen the impact of their bargaining power by differentiating the service offering.

- Digital Booking Dominance: In 2024, over 70% of travel bookings are expected to be made online, highlighting the critical importance of a robust digital presence for customer acquisition and retention.

- Connected Car Adoption: The global fleet of connected cars is projected to surpass 500 million units by the end of 2025, indicating a strong customer preference for technology-enabled vehicle services.

- Customer Experience as a Differentiator: Studies show that 86% of buyers are willing to pay more for a great customer experience, underscoring the strategic value of digitalization in mitigating customer bargaining power.

The bargaining power of customers is a significant force for Europcar Mobility Group, driven by price sensitivity among leisure travelers and the substantial volume commitments of corporate clients. The ease of comparing options through online platforms in 2024 means customers can readily switch providers based on cost, putting pressure on rental companies to offer competitive pricing. Europcar's strategy, including brands like Goldcar, directly targets price-conscious segments, while corporate deals leverage volume for better terms.

The increasing demand for flexible mobility solutions, such as car-sharing and subscriptions, further empowers customers by allowing them to dictate terms for their transportation needs. Europcar's expansion into these areas, with notable growth in subscription uptake in 2023, reflects an effort to meet this evolving customer preference and maintain competitiveness. This shift towards flexible models is supported by a growing global car-sharing market projected to exceed $10 billion by 2025.

| Customer Segment | Bargaining Power Drivers | Europcar's Strategic Response |

|---|---|---|

| Leisure Travelers | Price sensitivity, easy comparison via OTAs | Low-cost brands (Goldcar), digital booking optimization |

| Corporate Clients | High rental volumes, long-term agreements | Negotiated favorable terms, fleet management solutions |

| Flexible Mobility Seekers | Demand for subscriptions, car-sharing | Expansion of car-sharing and subscription services |

Full Version Awaits

Europcar Mobility Group Porter's Five Forces Analysis

This preview showcases the complete Europcar Mobility Group Porter's Five Forces Analysis, detailing the competitive landscape of the car rental industry. You'll gain a thorough understanding of the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing players. The document you see here is precisely the same professionally formatted and ready-to-use analysis you'll receive immediately after purchase.

Rivalry Among Competitors

The car rental industry is highly competitive, with a few dominant global players. In 2024, the top five companies in the global car rental market are estimated to capture about 65% of the total revenue. This concentration means that companies like Europcar Mobility Group face significant rivalry from established giants such as Hertz, Avis Budget Group, and Enterprise Holdings.

This intense competition forces Europcar to constantly vie for market share, rather than benefiting from broad market growth. Strategies often revolve around price, service quality, and fleet availability to attract and retain customers in a saturated landscape.

The car rental sector in established regions is largely mature. Growth hinges on factors like tourism rebound and expansion in developing economies, which intensifies competition as players vie for a finite customer base. The United States car rental market, for example, saw a slight downturn in 2024.

The car rental sector is inherently capital-intensive, primarily driven by the substantial investment required for fleet acquisition. This means companies such as Europcar Mobility Group carry significant fixed costs associated with owning and maintaining their vehicles. For instance, in 2024, the average cost of a new passenger car in Europe can range from €20,000 to €40,000, with rental companies often purchasing vehicles in bulk, amplifying this initial outlay.

Consequently, Europcar and its competitors are compelled to achieve high fleet utilization rates to effectively cover these substantial fixed expenses and generate profitability. This pressure intensifies the competitive landscape, as companies actively vie for customer bookings to ensure their assets are consistently generating revenue. In 2023, industry-wide fleet utilization rates across major European rental companies often hovered around 75-85% during peak seasons, highlighting the critical need to maximize vehicle usage.

Product and Service Differentiation

Competitive rivalry in the car rental sector is intense, with Europcar Mobility Group facing rivals who differentiate through fleet offerings, digital platforms, and customer service. While the fundamental service of renting a vehicle is similar across competitors, the nuances in fleet diversity, particularly the inclusion of electric vehicles (EVs) and premium models, significantly impact market positioning. For instance, Europcar's commitment to expanding its EV fleet, aiming for 20% of its fleet to be electric by 2024, directly addresses evolving customer preferences and regulatory pressures, setting it apart from competitors with less sustainable options.

Europcar's strategy emphasizes a broad spectrum of services beyond basic car rentals, including mobility solutions like car-sharing and subscription models. This diversification, coupled with a strong emphasis on digital services such as app-based booking and keyless entry, aims to enhance customer convenience and loyalty. The group's extensive network, encompassing numerous locations across Europe, also serves as a critical differentiator, providing accessibility and convenience that many smaller or more geographically limited competitors cannot match. In 2023, Europcar reported a significant increase in its digital bookings, highlighting the growing importance of these services.

- Fleet Diversity: Europcar is actively expanding its electric vehicle (EV) fleet, with a target of 20% of its fleet being electric by 2024.

- Digital Services: The group prioritizes app-based booking and keyless entry to improve customer experience and operational efficiency.

- Network Reach: Europcar maintains a comprehensive network of rental locations across Europe, offering broad accessibility to customers.

- Service Expansion: Beyond traditional rentals, Europcar offers car-sharing and subscription services to cater to diverse mobility needs.

Strategic Acquisitions and Market Share Battles

Competitive rivalry within the car rental sector is intense, with companies like Europcar Mobility Group and SIXT actively vying for market dominance. In 2024, both Europcar and SIXT demonstrated robust revenue growth, a testament to their success in capturing market share from competitors. This aggressive expansion often involves strategic acquisitions and consolidation to bolster their competitive standing.

Mergers and acquisitions remain a critical tool for players in this industry to consolidate their operations, enhance their service offerings, and ultimately gain a stronger foothold against rivals. These strategic moves are not just about scale; they are about optimizing resources and expanding geographic reach to better serve a diverse customer base.

- Europcar Mobility Group and SIXT reported substantial revenue increases in 2024, indicating successful market share gains.

- Aggressive strategies are being employed by key players to outmaneuver competitors and expand their customer base.

- Mergers and acquisitions are a recurring theme, enabling companies to consolidate their market position and achieve greater economies of scale.

Competitive rivalry in the car rental industry is fierce, with Europcar Mobility Group facing significant pressure from established players and emerging mobility providers. In 2024, the market continues to be shaped by aggressive pricing strategies and the ongoing pursuit of customer loyalty through enhanced digital experiences and fleet diversification, particularly with electric vehicles.

Companies are investing heavily in technology and service innovation to differentiate themselves. For example, Europcar's focus on expanding its electric vehicle fleet, aiming for 20% by 2024, and enhancing its app-based services directly addresses evolving consumer demands and competitive pressures. This intense competition necessitates continuous adaptation and strategic investment to maintain market position.

| Competitor | Key Differentiators | 2024 Market Focus |

|---|---|---|

| Europcar Mobility Group | EV Fleet Expansion, Digital Services, Broad Network | Customer Loyalty, Mobility Solutions |

| Hertz | Brand Recognition, Global Presence | Fleet Modernization, Premium Services |

| Avis Budget Group | Customer Service, Loyalty Programs | Technology Integration, Fleet Efficiency |

| Enterprise Holdings | Extensive Branch Network, Corporate Accounts | Sustainability Initiatives, New Mobility Models |

SSubstitutes Threaten

Ride-hailing services such as Uber and Lyft present a substantial threat to Europcar Mobility Group by offering a convenient, on-demand alternative, especially for shorter journeys within cities. These platforms directly compete for customers who might otherwise opt for a short-term rental, particularly in urban environments where parking and convenience are key factors. In 2024, ride-hailing continued its robust growth, with global revenues projected to reach over $200 billion, underscoring their increasing market penetration.

The rise of car-sharing services, like Europcar's own Ubeeqo, and flexible car subscription models presents a significant threat of substitutes for traditional car rental. These alternatives offer users greater convenience and often lower costs for shorter-term mobility needs, directly competing with Europcar's core business.

For instance, car-sharing platforms allow users to rent vehicles by the minute or hour, bypassing the need for daily or weekly rentals. Subscription services, on the other hand, provide access to a vehicle for a fixed monthly fee, encompassing insurance and maintenance, which can be more attractive than traditional rental agreements for certain customer segments.

Improvements in public transportation and micromobility pose a significant threat. For instance, many European cities are expanding their metro and tram networks. In 2023, cities like Berlin saw significant investment in public transport infrastructure, aiming to reduce reliance on private cars.

The rise of electric scooters and bike-sharing services, particularly in dense urban areas, provides convenient and often cheaper alternatives for short trips. By mid-2024, the micromobility market in Europe was estimated to be worth billions, with companies like Lime and Tier operating in numerous major cities, directly competing for urban mobility needs.

Decline in Private Vehicle Ownership Propensity

A significant shift is underway, particularly in developed nations and urban centers, with a noticeable decline in the desire for private vehicle ownership. This trend is fueled by growing environmental awareness, persistent traffic congestion issues, and the increasing accessibility of a wide array of alternative transportation solutions. Consequently, these substitutes are becoming increasingly appealing to consumers.

The rise of ride-sharing services, robust public transportation networks, and micro-mobility options like e-scooters and bike-sharing programs directly challenge the necessity of individual car ownership. For instance, in 2024, cities like Paris and London saw further expansions of their congestion charging zones and low-emission zones, incentivizing alternatives. Reports from 2023 indicated that car-sharing services alone served millions of users globally, demonstrating the growing market for these substitute offerings.

- Growing Urbanization: Over 57% of the world's population lived in urban areas in 2023, a figure projected to reach 60% by 2030, increasing reliance on public and shared transport.

- Sustainability Focus: Consumer surveys in early 2024 revealed that over 65% of respondents in Western Europe considered environmental impact when choosing transportation.

- Cost of Ownership: The average annual cost of owning and operating a new car in the US exceeded $12,000 in 2023, making alternatives more financially attractive.

Cost-Effectiveness and Convenience of Alternatives

The threat of substitutes for Europcar Mobility Group is significant, particularly from ride-hailing services and car-sharing platforms. These alternatives often present a more compelling value proposition for specific use cases.

For instance, a quick city trip or a one-way journey might be perceived as more economical and convenient when using services like Uber or a local car-sharing scheme compared to the traditional rental process. This can directly impact Europcar's customer base, especially for shorter rental periods.

In 2024, the global ride-hailing market was valued at approximately $170 billion, demonstrating its substantial reach and customer adoption. Similarly, car-sharing services continue to grow, offering flexible and often cheaper access to vehicles for urban dwellers. These trends highlight a clear challenge to traditional car rental models, forcing companies like Europcar to adapt their offerings.

- Ride-hailing services offer on-demand convenience for short trips, often at a lower perceived cost than traditional rentals.

- Car-sharing platforms provide flexible, pay-per-use access to vehicles, appealing to users who need a car infrequently.

- The growth in these alternative mobility solutions directly pressures Europcar's market share, especially for urban and short-duration rentals.

- Europcar must innovate to compete with the cost-effectiveness and ease of use offered by these substitute services.

The threat of substitutes for Europcar Mobility Group is significant, primarily driven by the increasing popularity and accessibility of ride-hailing services and car-sharing platforms. These alternatives offer convenient, often more cost-effective solutions for specific mobility needs, directly challenging traditional car rental models. For example, in 2024, the global ride-hailing market was valued at approximately $170 billion, indicating a vast customer base that might otherwise consider car rentals.

Car-sharing services, in particular, provide flexible, pay-per-use access to vehicles, appealing to users who require a car infrequently or for short durations. This directly pressures Europcar's market share, especially in urban areas where these services are most prevalent. Europcar must therefore innovate to compete with the perceived cost-effectiveness and ease of use offered by these substitute mobility options.

| Substitute | Key Advantage | Impact on Europcar | 2024 Market Data/Trend |

| Ride-hailing (e.g., Uber, Lyft) | On-demand convenience, short trips | Reduces demand for short-term rentals | Global market valued at ~$170 billion |

| Car-sharing (e.g., Zipcar, Share Now) | Flexible, pay-per-use access | Competes for urban and infrequent users | Growing adoption in major cities |

| Public Transportation & Micromobility | Cost-effectiveness, sustainability (for short distances) | Decreases need for personal or rental vehicles in cities | Micromobility market in Europe worth billions |

Entrants Threaten

The substantial capital needed to purchase and maintain a modern, diverse vehicle fleet presents a significant hurdle for potential newcomers to the car rental industry. Europcar, for instance, operates a fleet exceeding 260,000 vehicles, illustrating the scale of investment involved.

Established players like Europcar Mobility Group leverage significant brand loyalty built over years of service. This loyalty, coupled with extensive networks of rental locations and robust customer loyalty programs, creates a substantial barrier for newcomers. For instance, in 2024, Europcar's continued investment in customer experience and its established presence across major travel hubs solidified its market position, making it challenging for new entrants to replicate this scale and reach quickly.

The inherent technological and operational complexity of the vehicle rental sector presents a substantial barrier to new entrants. Operating a modern rental business demands sophisticated fleet management systems, advanced digital booking platforms, and robust customer service infrastructure. For instance, Europcar Mobility Group, like its peers, relies on intricate IT systems for real-time vehicle tracking, availability management, and pricing optimization. Newcomers must invest heavily in these areas to compete effectively, a significant hurdle without established operational expertise.

Regulatory Hurdles and Compliance Costs

New entrants into the mobility sector, like Europcar Mobility Group, must navigate a complex web of regulations. These include obtaining specific operating licenses, adhering to stringent safety standards, and securing comprehensive insurance, all of which vary significantly by country and even by city. For instance, in 2024, new car-sharing services in major European cities often faced lengthy approval processes and had to meet specific fleet diversity requirements.

These regulatory demands translate into substantial compliance costs. Setting up operations requires significant upfront investment in legal counsel, administrative processes, and insurance premiums. For a new player to compete effectively, they must absorb these initial expenses, which can be a considerable barrier to entry, especially when compared to established companies like Europcar that have already built out their compliance infrastructure.

- Licensing and Permits: Obtaining necessary operating licenses can be time-consuming and costly, with fees varying by jurisdiction.

- Insurance Requirements: Comprehensive insurance coverage, mandated by regulators, represents a significant ongoing expense for new entrants.

- Varying Regional Standards: The need to comply with diverse regulations across different markets increases operational complexity and costs.

- Capital Investment: Meeting regulatory capital requirements can demand substantial upfront financial resources, deterring smaller potential competitors.

Emergence of Mobility-as-a-Service (MaaS) Platforms

The rise of Mobility-as-a-Service (MaaS) platforms presents a nuanced threat. While often seen as a substitute for traditional car rental, these platforms can also serve as a gateway for new entrants. By aggregating diverse mobility options, MaaS can reduce the need for new players to build extensive physical infrastructure, like large car fleets. This lowers the initial investment hurdle, making it easier for specialized or niche mobility providers to access a broad customer base.

For instance, in 2024, several new urban mobility startups have successfully integrated with existing MaaS ecosystems, offering services like e-scooters or on-demand shuttles without the capital expenditure of traditional rental companies. This trend is expected to continue as MaaS adoption grows, potentially fragmenting the market and increasing competitive pressure on established players like Europcar Mobility Group.

- MaaS platforms can lower entry barriers for new mobility providers by offering a ready-made customer channel.

- This aggregation model allows smaller, specialized services to reach a wider audience without significant fleet investment.

- The growth of MaaS in 2024 has seen an increase in niche providers leveraging these platforms.

- This dynamic creates a more competitive landscape, challenging traditional rental models.

The threat of new entrants for Europcar Mobility Group remains moderate, primarily due to high capital requirements and established brand loyalty. However, the evolving mobility landscape, particularly the rise of Mobility-as-a-Service (MaaS) platforms, is beginning to lower these barriers. New, specialized providers can now more easily access customers through these aggregators, potentially increasing competition. For example, in 2024, the integration of micro-mobility services into broader MaaS offerings demonstrated this trend, allowing smaller players to gain traction without the extensive infrastructure of traditional car rental companies.

| Barrier to Entry | Impact on New Entrants | Europcar's Position (2024) |

|---|---|---|

| Capital Investment (Fleet) | High | Europcar operates a fleet of over 260,000 vehicles, requiring substantial capital. |

| Brand Loyalty & Network | High | Europcar benefits from established customer relationships and a wide network of locations. |

| Regulatory Compliance | Moderate to High | New entrants face licensing, insurance, and safety standard costs. |

| MaaS Platform Integration | Lowers Barriers | MaaS allows niche providers to reach customers, increasing competitive pressure. |

Porter's Five Forces Analysis Data Sources

Our Europcar Mobility Group Porter's Five Forces analysis is built upon a foundation of diverse and authoritative data sources, including Europcar's annual reports, industry-specific market research from firms like Statista and IBISWorld, and relevant regulatory filings. This comprehensive approach ensures a robust understanding of the competitive landscape.