Essity Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Essity Bundle

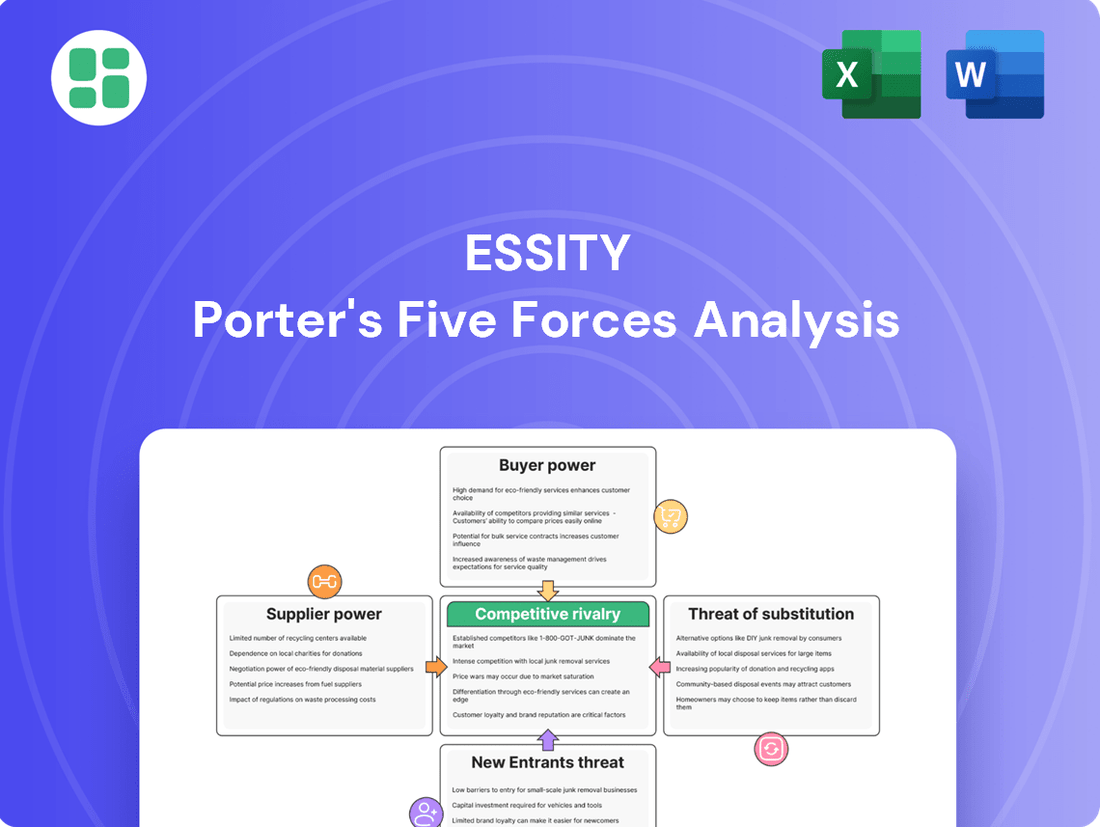

Essity operates in a dynamic market shaped by intense rivalry, significant buyer power, and the constant threat of substitutes. Understanding these forces is crucial for navigating the hygiene and health sector effectively.

The complete Porter's Five Forces Analysis dives deep into each of these pressures, offering a comprehensive view of Essity's competitive landscape. Ready to move beyond the basics? Get a full strategic breakdown of Essity’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Essity's reliance on key raw materials like pulp, superabsorbents, and chemicals makes its suppliers influential. For instance, the global pulp market, a critical component for Essity's tissue products, experienced significant price volatility in 2023 and early 2024 due to supply chain disruptions and increased demand, directly impacting Essity's cost of goods sold.

When there are few suppliers for essential raw materials, their bargaining power increases, allowing them to dictate higher prices. Essity actively manages these supplier relationships through annual risk assessments and ethical audits, demonstrating a strategy to diversify and mitigate potential price hikes from concentrated supply chains.

Switching suppliers for Essity's specialized raw materials, like specific pulp grades or hygiene chemicals, can incur substantial costs. These include the expense and time required for re-qualifying new suppliers and their materials to meet Essity's stringent quality standards, alongside potential disruptions to production lines while new processes are integrated. In 2023, Essity reported that raw material costs, particularly for pulp, were a significant factor impacting its profitability, underscoring the sensitivity to supplier pricing and availability.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, while not a primary concern for Essity, represents a potential challenge. If a significant supplier were to enter the finished hygiene and health products market, it could disrupt Essity's operations and market position. However, the substantial capital investment and the extensive brand building necessary to compete in this sector create a considerable barrier for raw material providers.

Essity's strong brand equity and established distribution channels present a formidable defense against potential supplier forward integration. Replicating Essity's market penetration and consumer loyalty would be an arduous and costly undertaking for any supplier. For instance, Essity's Tork brand is a leading global professional hygiene brand, indicating the significant investment in brand building that would need to be matched.

- Supplier Integration Risk: While uncommon in the hygiene and health sector, a key supplier entering the finished product market could pose a threat to Essity.

- High Barriers to Entry: The significant capital requirements and brand-building efforts needed for finished hygiene products deter most raw material suppliers from forward integration.

- Essity's Competitive Strengths: Essity's established brands, such as Tork and Tena, and its robust distribution network are difficult for suppliers to replicate.

- Market Position: Essity's strong market share in segments like professional hygiene and incontinence care underscores the challenges any integrating supplier would face.

Importance of Supplier's Input to Essity's Product Quality

The quality and consistency of raw materials are paramount to Essity's hygiene and health solutions, directly influencing consumer trust and brand reputation. For instance, specialized suppliers providing critical components for products like incontinence care or medical textiles can wield significant bargaining power. Essity's commitment to quality is underscored by its Global Supplier Standard, which mandates stringent quality and product safety requirements.

Essity's reliance on specific, high-quality inputs, particularly for its medical and personal care segments, grants specialized suppliers considerable leverage. This is evident in the critical nature of materials used in products designed for sensitive applications, where any compromise in quality can have serious repercussions. Essity's Global Supplier Standard reinforces this by setting clear expectations for quality and product safety.

- Input Criticality: The essential nature of certain raw materials for Essity's premium hygiene and health products enhances supplier power.

- Specialized Suppliers: Providers of unique or highly regulated materials, such as those for medical applications, often have greater negotiation strength.

- Quality Standards: Essity's Global Supplier Standard, which details rigorous quality and safety expectations, can empower suppliers who consistently meet these benchmarks.

Essity's bargaining power with its suppliers is influenced by the concentration of suppliers for critical raw materials like pulp and superabsorbents. When few suppliers exist, they gain leverage, as seen with pulp price increases in early 2024 impacting Essity's costs. Essity mitigates this by diversifying its supplier base and conducting regular risk assessments.

The high switching costs for specialized materials, coupled with Essity's stringent quality demands, further strengthen supplier positions. In 2023, Essity noted that raw material costs, particularly for pulp, were a significant factor affecting profitability, highlighting supplier influence on Essity's financial performance.

| Factor | Impact on Essity | Supplier Leverage |

| Supplier Concentration | Reliance on few pulp suppliers | High |

| Switching Costs | Re-qualification of specialized materials | Moderate to High |

| Input Criticality | High-quality materials for medical/personal care | High |

What is included in the product

This Porter's Five Forces analysis unpacks the competitive intensity within Essity's markets, examining supplier and buyer power, the threat of new entrants and substitutes, and the rivalry among existing players.

Easily identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces impacting Essity's market position.

Customers Bargaining Power

Essity's diverse customer base, spanning individual consumers in Personal Care and Consumer Tissue to businesses in Professional Hygiene, significantly influences its bargaining power. Large retail chains and major institutional buyers, for instance, often wield more influence due to their purchasing volume compared to individual consumers.

The company's strategic product segmentation, offering a range of products at various price points, allows it to cater to a wide spectrum of customer needs and income levels. This tiered approach helps Essity maintain pricing flexibility and manage the bargaining power of different customer segments.

Essity's strong brand portfolio, featuring global leaders such as TENA, Tork, and Libero, significantly curbs customer bargaining power. These brands hold dominant market positions, fostering deep consumer loyalty and making it difficult for customers to switch to competitors or demand lower prices. For instance, TENA, a leading brand in incontinence care, benefits from extensive consumer trust built over years of product innovation and consistent quality, as evidenced by its consistent market share growth.

Consumers are showing increased price sensitivity, a trend amplified by 2024's persistent inflation and economic uncertainties. This makes them actively seek out value-for-money options, even for established brands.

The proliferation of e-commerce and digital platforms in 2024 has significantly empowered customers by providing unprecedented access to product information and facilitating easy price comparisons. This transparency directly translates to greater bargaining power for consumers.

Essity faces the challenge of maintaining pricing discipline while remaining competitive in a market where consumers can readily compare prices and features. Balancing brand value with market demands is crucial for sustained success.

Switching Costs for Customers

For individual consumers, the bargaining power of customers is often amplified by low switching costs in the hygiene product market. Consumers can readily switch between brands of toilet paper, paper towels, or feminine care products with minimal effort or financial penalty. This ease of transition means that price or perceived value differences can quickly sway purchasing decisions.

However, for Essity's professional hygiene segment, which serves businesses like hospitals, offices, and restaurants, switching costs can be slightly higher. Changing to a different supplier might necessitate replacing existing dispensing systems or retraining staff on new product usage, introducing minor operational friction. For instance, a business might have invested in specialized dispensers for their current paper towel or soap provider.

Essity aims to mitigate this customer bargaining power by focusing on the convenience and consistent quality of its integrated solutions. By offering reliable products and potentially compatible dispensing systems, the company seeks to make the perceived cost and effort of switching less appealing to its B2B clientele. This strategy helps to lock in customers and reduce their inclination to seek out competitors, even if lower prices are available elsewhere.

- Low Individual Switching Costs: Consumers can easily change hygiene product brands with little to no financial or operational impact.

- Minor Professional Switching Costs: Businesses may face minor costs related to new dispensing systems or operational adjustments when switching hygiene suppliers.

- Essity's Mitigation Strategy: Focus on convenience and consistent quality to reduce the perceived cost and effort of switching for professional clients.

Customer Volume and Purchase Frequency

The high frequency of purchase for many of Essity's hygiene products, like toilet paper and tissues, means that even though individual transactions are small, the total volume bought over time is substantial. This consistent demand gives customers leverage.

Major retail chains and large distributors, due to their significant purchasing volumes of Essity's consumer goods, possess considerable bargaining power. Similarly, large businesses operating in the professional hygiene sector, such as hospitals or large corporations, also benefit from their scale.

These powerful customers can influence Essity through their ability to dictate shelf space in stores or negotiate favorable terms in supplier contracts, directly impacting Essity's market access and profitability.

- Significant Cumulative Volume: Frequent purchases of everyday hygiene items create a large, ongoing demand for Essity.

- Retailer Influence: Large retail chains leverage their buying power to negotiate terms, affecting Essity's product placement and pricing.

- B2B Purchasing Power: Major business clients in the professional hygiene sector also command significant influence due to their substantial order sizes.

Essity's customers exhibit considerable bargaining power, particularly large retail chains and major institutional buyers who leverage their substantial purchasing volumes. This power is further amplified by the high frequency of purchases for essential hygiene products, where even small individual transactions accumulate into significant demand. The ease with which consumers can switch between brands in the personal care segment also contributes to this leverage, as minimal switching costs allow price sensitivity to drive purchasing decisions.

The digital landscape of 2024 has significantly enhanced customer power through increased price transparency and easy comparison shopping. For Essity's professional hygiene segment, while switching costs are slightly higher due to potential dispenser compatibility issues, the overall trend favors customers demanding value. Essity counters this by emphasizing integrated solutions, consistent quality, and brand loyalty, as seen with its strong TENA brand, to mitigate customer leverage.

| Customer Segment | Sources of Bargaining Power | Impact on Essity |

|---|---|---|

| Individual Consumers | Low switching costs, price sensitivity (heightened by 2024 inflation), easy online price comparison | Pressure on pricing, need for value-driven product offerings |

| Large Retail Chains | High purchase volume, control over shelf space, negotiation power | Influence on product placement, pricing, and promotional terms |

| Institutional Buyers (B2B) | Large order sizes, potential for integrated solution adoption, minor switching costs for dispensing systems | Ability to negotiate bulk discounts, demand for tailored solutions |

What You See Is What You Get

Essity Porter's Five Forces Analysis

This preview showcases the comprehensive Essity Porter's Five Forces analysis, detailing the competitive landscape of the hygiene and health company. The document you see here is the exact, fully formatted report you will receive immediately upon purchase, offering actionable insights into industry rivalry, buyer and supplier power, and the threat of new entrants and substitutes. You're looking at the actual document, ensuring no surprises and immediate usability for your strategic planning needs.

Rivalry Among Competitors

The hygiene and health sector is a battleground with many strong contenders. Essity faces off against global giants like Procter & Gamble, Kimberly-Clark, Unilever, Johnson & Johnson, and Unicharm. These companies operate across Essity's various product lines, ensuring a highly competitive environment.

For instance, in the tissue paper market, Essity competes directly with Kimberly-Clark's Kleenex and Cottonelle brands, and Procter & Gamble's Bounty and Charmin. Similarly, in the personal care segment, Johnson & Johnson's Tena and Always compete with Essity's Tork and Libero brands.

This broad spectrum of competitors, each with significant market share and brand recognition, intensifies the rivalry. Essity's 2023 revenue was SEK 146.7 billion (approximately $13.8 billion USD), highlighting the scale of the market and the financial power of its competitors.

The hygiene and health market is experiencing growth, fueled by an aging global population, heightened awareness of hygiene practices, and improving living standards worldwide. This general market expansion can temper intense competition by offering ample opportunities for all participants to gain share.

However, certain mature segments within the market exhibit more moderate growth rates. This slower expansion intensifies the competitive rivalry as companies fiercely battle for existing market share, making every customer acquisition crucial.

For instance, the professional hygiene market is a key area to watch. Projections indicate a compound annual growth rate (CAGR) between 5.84% and 6.4% for this segment from 2024 through 2030, suggesting a dynamic environment where competition for dominance will likely remain robust.

Essity actively differentiates itself through innovation, leveraging its strong brand portfolio including TENA for incontinence care, Tork for professional hygiene, and Libero for baby care. This focus on premium products and new technologies, such as advanced absorbency materials, allows Essity to command higher margins and maintain a competitive edge. For instance, in 2023, Essity reported net sales of SEK 132.5 billion, with a significant portion driven by its innovation pipeline.

While Essity invests heavily in R&D, its competitors are also engaged in a constant cycle of product development. This persistent innovation from rivals means Essity must continually introduce new and improved solutions to retain its market position and prevent commoditization. The personal care and hygiene sectors are characterized by rapid technological advancements, requiring ongoing investment to stay ahead.

Exit Barriers

High capital investments in manufacturing facilities and extensive global supply chains create significant exit barriers for companies like Essity. These substantial sunk costs make it difficult and expensive for firms to leave the market, even if profitability declines. This situation often leads to intensified competition as players are incentivized to remain and defend their market positions.

Essity's operational footprint, with approximately 70 production sites globally, underscores the significant capital tied up in its infrastructure. Such large-scale, specialized assets are not easily repurposed or sold, further cementing exit barriers. Consequently, this encourages a strategy of persistent engagement within the market, rather than withdrawal, thereby fueling ongoing competitive rivalry.

- High Capital Investment: Significant funds are required to establish and maintain manufacturing plants and distribution networks.

- Global Supply Chains: The complexity and scale of global logistics add to the cost and difficulty of exiting the market.

- Asset Specificity: Production facilities are often highly specialized, limiting their value if sold to other industries.

- Market Persistence: Exit barriers encourage companies to stay and compete, even in challenging economic conditions.

Competitive Strategies and Market Positioning

Essity's strategic focus on profitable growth, high-margin segments, and price leverage intensifies rivalry. The company's ambition to secure a top-two position in 90% of its branded sales highlights a determined pursuit of market dominance.

This aggressive market positioning is met by competitors who are also prioritizing sustainable innovation and expansion into emerging economies. This creates a landscape of direct competition, where differentiation through product development and market reach is crucial.

- Market Share Ambition: Essity aims for #1 or #2 market share in 90% of its branded sales.

- Competitor Strategies: Rivals also focus on sustainable innovation and emerging market expansion.

- Intensified Rivalry: These converging strategies lead to direct competition across multiple product categories and geographies.

- Pricing Power Dynamics: Essity's emphasis on pricing power is challenged by competitors' similar efforts to optimize profitability.

The competitive rivalry within the hygiene and health sector is fierce, with Essity facing numerous well-established global players like Procter & Gamble and Kimberly-Clark. These competitors are not only large in scale but also possess strong brand recognition across Essity's diverse product categories, from tissue to personal care.

The market's growth, projected to see segments like professional hygiene expand at a CAGR of 5.84% to 6.4% between 2024 and 2030, fuels this intense competition. Essity's own ambition to secure a top-two market position in 90% of its branded sales directly confronts similar expansionist strategies from rivals focused on innovation and emerging markets.

High capital investments in manufacturing and complex global supply chains create significant exit barriers, compelling companies to remain and compete vigorously. Essity's 2023 net sales of SEK 132.5 billion demonstrate the substantial market value, but also the financial muscle of its competitors who are equally committed to product development and market share.

| Competitor | Key Brands | 2023 Revenue (Approx. USD) |

|---|---|---|

| Procter & Gamble | Bounty, Charmin, Always | $84.1 billion |

| Kimberly-Clark | Kleenex, Cottonelle, Huggies | $19.2 billion |

| Unilever | Dove, Dove Men+Care, Lifebuoy | £59.6 billion (approx. $75.7 billion) |

| Johnson & Johnson | Tena, Neutrogena, Listerine | $85.2 billion |

| Unicharm | MamyPoko, Sofy, Lifree | ¥1.8 trillion (approx. $12.1 billion) |

SSubstitutes Threaten

The threat of substitutes for Essity is significant across its product lines. In consumer tissue, while traditional paper products remain dominant, the increasing adoption of reusable cleaning cloths and alternative hygiene solutions presents a viable substitute. For instance, a growing segment of environmentally conscious consumers are exploring options that reduce paper waste.

Within personal care, particularly in feminine hygiene and incontinence management, the market for reusable alternatives is expanding. Menstrual cups, period underwear, and washable pads offer a direct substitute to Essity's disposable offerings. The global market for menstrual cups alone was valued at over $1.5 billion in 2023 and is projected to grow substantially, indicating a clear shift towards reusable options.

Reusable hygiene products, like cloth diapers and menstrual cups, present a compelling price-performance trade-off. While their upfront cost can be higher, often ranging from $20-$50 for a set of reusable diapers or $20-$40 for a menstrual cup, they offer significant long-term savings by eliminating the recurring expense of disposable alternatives. This cost-effectiveness is a major draw for environmentally conscious and price-sensitive consumers.

The environmental appeal of reusables is another powerful factor, as they reduce landfill waste. However, recent scrutiny of 'forever chemicals' like PFAS in some reusable menstrual products has introduced a new layer of concern regarding potential health impacts. This could temper the perceived health benefits and potentially slow the adoption rate of these products, even with their economic advantages.

Switching from Essity's disposable hygiene products to reusable alternatives presents significant behavioral and operational hurdles. Consumers must adapt new routines, a psychological barrier that requires a conscious shift away from the ingrained convenience of disposables. This change in habit is a key factor influencing the threat of substitutes.

For businesses, adopting reusable hygiene solutions often necessitates investments in new infrastructure, such as washing facilities or updated cleaning protocols, adding to the switching costs. Essity's extensive distribution network and the sheer convenience of its disposable product range mean that the effort required to switch to substitutes is substantial, reinforcing customer loyalty.

Innovation in Substitute Industries

The market for reusable hygiene products is seeing a surge of innovation. Companies are developing better materials, smarter designs like improved leak-proof layers, and even advanced odor control features. This constant evolution in substitutes, often spearheaded by smaller, nimble businesses and social enterprises, presents a growing long-term challenge to traditional disposable hygiene products.

Essity itself is actively engaging with this trend, incorporating reusable solutions into its sustainability strategy. This demonstrates an awareness of how evolving consumer preferences and technological advancements in substitute industries can impact market share and product demand.

- Innovation in Reusable Materials: Development of advanced fabrics with enhanced absorbency and antimicrobial properties.

- Design Enhancements: Introduction of features like secure fastenings and discreet designs to improve user experience.

- Market Entry of Agile Competitors: Smaller companies and social enterprises are driving innovation and capturing niche markets.

- Essity's Strategic Response: Exploration and integration of reusable product lines to align with sustainability goals and market shifts.

Perceived Value and Environmental Consciousness

The increasing global emphasis on sustainability is significantly boosting the perceived value of eco-friendly alternatives to Essity's products. Consumers, particularly in regions like Europe and North America, are actively seeking out goods with a lower environmental footprint. For example, in 2024, the global market for sustainable hygiene products, including biodegradable and compostable options, continued its upward trajectory, with analysts projecting continued double-digit growth through 2025.

This societal shift directly impacts demand for conventional disposable items, creating a notable threat of substitutes for Essity. As consumers become more environmentally aware, they are more likely to opt for reusable or biodegradable options, even if they come at a slightly higher initial cost. This trend is particularly pronounced in categories like feminine hygiene and baby diapers, where innovation in sustainable materials is rapidly advancing.

- Growing Consumer Preference: A 2024 Nielsen report indicated that over 60% of consumers globally are willing to pay more for sustainable products, a figure that has been steadily rising.

- Market Penetration of Eco-Alternatives: While specific market share data varies by product category, the availability and marketing of plant-based, compostable, or reusable substitutes for items like disposable pads and diapers are expanding significantly.

- Regulatory Tailwinds: Many governments are implementing policies to encourage the use of sustainable materials and reduce single-use plastics, further incentivizing the adoption of eco-friendly substitutes.

- Innovation in Materials: Advances in material science are making substitutes more competitive in terms of performance and cost, narrowing the gap with traditional products.

The threat of substitutes for Essity's products is amplified by the growing consumer demand for sustainable and reusable alternatives. This trend is particularly evident in feminine hygiene and baby care, where eco-conscious consumers are increasingly choosing options like menstrual cups or cloth diapers. By 2024, the market for sustainable hygiene products was experiencing robust growth, with projections indicating continued double-digit expansion through 2025.

Reusable hygiene products offer a compelling long-term cost advantage, despite a higher initial investment. For example, a set of reusable diapers might cost between $20-$50, while a menstrual cup typically ranges from $20-$40. These upfront costs are offset by eliminating the recurring expense associated with disposable items, making them attractive to both environmentally aware and budget-conscious consumers.

Innovations in materials and design are making substitutes more competitive. Companies are developing advanced fabrics with enhanced absorbency and antimicrobial properties, alongside features like secure fastenings for improved user experience. This continuous innovation, often driven by agile competitors, poses a growing challenge to traditional disposable hygiene products.

| Substitute Category | Example Products | Estimated 2024 Market Growth (YoY) | Key Driver |

|---|---|---|---|

| Feminine Hygiene | Menstrual Cups, Period Underwear | 15-20% | Environmental concerns, long-term cost savings |

| Baby Care | Cloth Diapers, Biodegradable Diapers | 10-15% | Sustainability, reduced landfill waste |

| Consumer Tissue | Reusable Cleaning Cloths | 5-10% | Waste reduction, durability |

Entrants Threaten

Starting a business in the hygiene and health sector, particularly on a global scale like Essity, demands significant upfront capital. This includes building modern manufacturing plants, acquiring sophisticated equipment, and establishing robust distribution networks.

The initial investment for these essentials can be a major hurdle. For instance, setting up a new tissue paper production line, a core area for companies like Essity, can easily cost tens of millions of dollars, even before considering research and development or marketing.

While automation offers long-term cost efficiencies, the substantial capital outlay required for these advanced systems acts as a powerful deterrent for potential new competitors looking to enter the market.

Essity benefits from strong, established global brands like TENA and Tork, which have cultivated significant consumer trust and loyalty. This brand equity acts as a substantial barrier to entry, as new companies would need to invest heavily in marketing and time to achieve similar recognition and market share.

For instance, Essity's Tork brand holds a leading position in the away-from-home tissue market, with extensive distribution networks built over years. New entrants face the daunting task of replicating this reach and brand awareness, which is a costly and lengthy endeavor, thus limiting the threat of new entrants.

Essity's extensive global reach, operating in roughly 150 countries, presents a formidable barrier to new entrants due to the sheer complexity of its distribution networks. Establishing comparable access across diverse retail, healthcare, and professional channels requires immense investment and time.

New players must overcome the challenge of securing prime shelf space in dominant retail chains or forging crucial direct relationships with major institutional purchasers, a process Essity has perfected over years of operation. This established infrastructure significantly limits the ability of newcomers to effectively get their products to market.

Economies of Scale and Cost Advantages

Existing giants in the hygiene and health sector, such as Essity, leverage substantial economies of scale. This means they can produce goods more cheaply per unit because they buy materials in bulk, operate large, efficient factories, and have well-established distribution networks. For instance, Essity's global presence in 2023 allowed it to manage its supply chain costs effectively, a benefit that new entrants would find challenging to replicate quickly.

These significant cost advantages create a formidable barrier for potential new competitors. A startup would need to invest heavily to achieve comparable production volumes and efficiency, making it difficult to match the pricing of established players. This inherent cost disadvantage means new entrants often struggle to gain market share unless they can offer a highly differentiated product or service.

- Economies of Scale: Large players like Essity benefit from lower per-unit costs due to high production volumes.

- Procurement Power: Bulk purchasing of raw materials leads to significant cost savings for established firms.

- Distribution Efficiencies: Extensive logistics networks reduce transportation costs for incumbent companies.

- Capital Investment Barrier: New entrants require substantial capital to build comparable scale and achieve cost parity.

Regulatory Hurdles and Product Complexity

The threat of new entrants for Essity is significantly mitigated by substantial regulatory hurdles, particularly within its Personal Care and Health & Medical divisions. For instance, products like incontinence solutions face rigorous approval processes, demanding extensive investment in research, development, and compliance testing to meet stringent safety and efficacy standards. In 2024, the global market for incontinence products alone was valued at billions, underscoring the significant capital required to even enter such a regulated space.

These complex regulatory landscapes, which often involve multiple governmental agencies and evolving compliance requirements, necessitate substantial upfront investment in expertise and infrastructure. New players must also contend with the intricate product development cycles and the need for robust quality control systems. This high barrier to entry deters many potential competitors, allowing established companies like Essity to maintain a more stable market position.

- Regulatory Complexity: Navigating stringent safety, efficacy, and labeling standards for personal care and medical products requires significant expertise and capital.

- High R&D Investment: New entrants must commit substantial resources to research, development, and testing to meet established benchmarks.

- Compliance Costs: Adhering to diverse and evolving regulatory frameworks incurs considerable ongoing expenses, acting as a deterrent.

The threat of new entrants into the hygiene and health sector, where Essity operates, is generally low due to substantial barriers. High capital requirements for manufacturing and distribution, coupled with strong brand loyalty for established players like Essity's TENA and Tork, make it difficult for newcomers to gain a foothold. Furthermore, extensive global distribution networks and significant economies of scale enjoyed by incumbents create cost disadvantages for potential new competitors.

Regulatory complexities, particularly in areas like personal care and medical products, add another layer of difficulty. New entrants must invest heavily in research, development, and compliance to meet stringent standards, which can take years and considerable financial resources. For example, the global incontinence product market, a key segment for Essity, saw significant growth in 2024, highlighting the investment needed to compete in specialized, regulated areas.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building modern manufacturing facilities and distribution networks demands tens of millions of dollars. | Significant financial hurdle, limiting the number of potential entrants. |

| Brand Loyalty | Established brands like TENA and Tork have built strong consumer trust over years. | Requires massive marketing investment and time for new entrants to build comparable recognition. |

| Economies of Scale | Essity's global operations allow for lower per-unit production and procurement costs. | New entrants face higher initial costs, making it hard to compete on price. |

| Regulatory Hurdles | Strict safety and efficacy standards for products like incontinence solutions require extensive R&D and compliance. | Demands substantial upfront investment in expertise and infrastructure, deterring many. |

Porter's Five Forces Analysis Data Sources

Our Essity Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Essity's annual reports, investor presentations, and publicly available financial statements. We supplement this with industry-specific market research reports and data from reputable financial information providers to ensure a robust assessment of competitive forces.