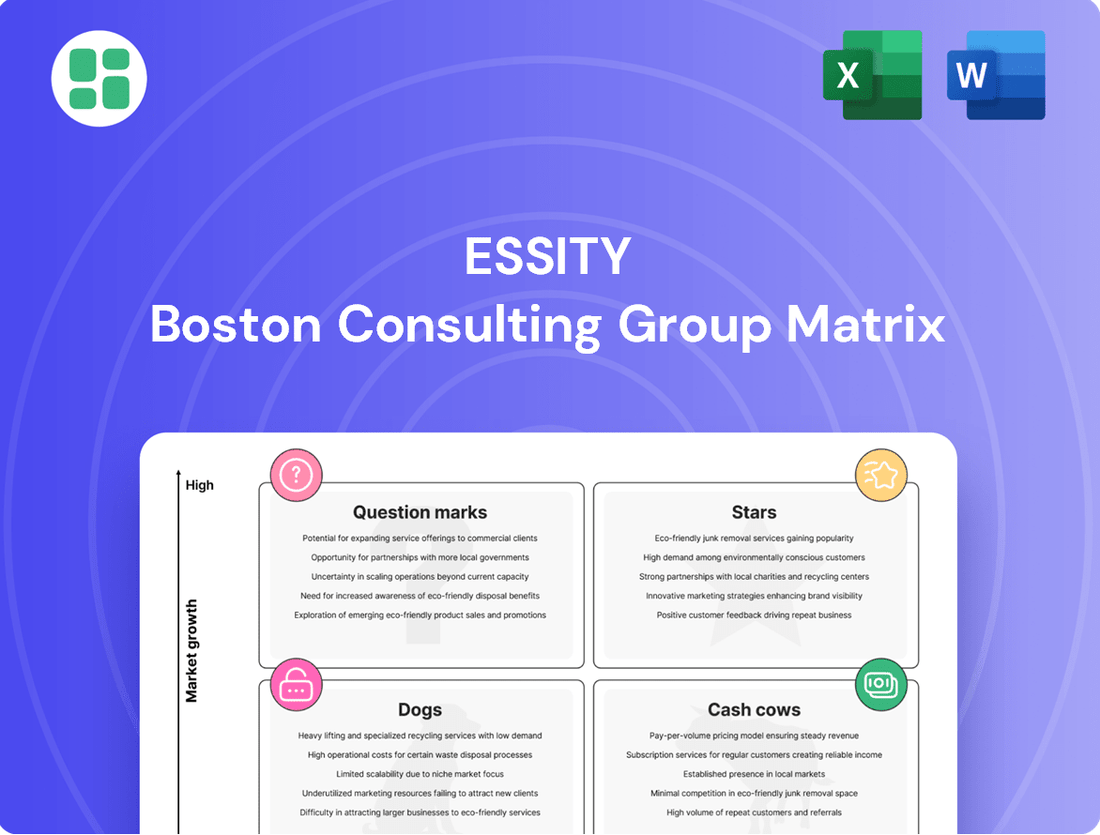

Essity Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Essity Bundle

Essity's BCG Matrix offers a powerful lens to understand their product portfolio's performance and market potential. Discover which of their brands are thriving as Stars, generating consistent revenue as Cash Cows, or require strategic re-evaluation as Dogs.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Essity.

Stars

The Incontinence Care Retail segment, spearheaded by the TENA brand, is a significant growth driver for Essity. This category is thriving due to an aging global population, a trend that is fueling a rapidly expanding market for adult incontinence products. Essity's commitment to innovation, exemplified by products like TENA Proskin Pants, solidifies its leading position and product excellence in this vital sector.

Essity's premium feminine care innovations, exemplified by brands like Bodyform and Libresse, are experiencing robust growth. The introduction of advanced products such as Bodyform Ultimate highlights a strategic push into high-value segments. This focus on premiumization and innovative brand building is positioning Essity to capture increasing market share in a rapidly expanding sector.

Essity's Medical Solutions segment, encompassing wound care and orthopedics with brands like Cutimed and JOBST, has achieved an impressive streak of 17 consecutive quarters of growth. This sustained performance underscores its robust market standing within the expanding specialized healthcare sector.

The segment's success is fueled by ongoing product innovation, exemplified by advancements in Cutimed Sorbion dressings. This commitment to developing cutting-edge solutions reinforces its position as a star performer in Essity's portfolio.

Tork PeakServe

Tork PeakServe, a high-capacity dispensing system, is positioned as a Star within Essity's BCG Matrix. This innovative product bolsters the already strong Tork brand, a leader in the Professional Hygiene sector.

The system is designed to enhance efficiency and reduce waste, targeting a growing segment within the hygiene market. Despite broader economic headwinds, strategic product introductions like PeakServe are crucial for Essity's continued global expansion and market share gains.

- High Capacity: Tork PeakServe offers significantly higher capacity compared to traditional dispensers, reducing refill frequency.

- Efficiency Focus: It aims to improve operational efficiency for businesses by minimizing maintenance time.

- Market Growth: The professional hygiene sector continues to see demand for advanced solutions, supporting PeakServe's Star classification.

- Brand Synergy: As part of the Tork brand, it benefits from established market recognition and distribution networks.

Sustainability-Driven Products

Essity's dedication to sustainability is a cornerstone of its product strategy, with a significant portion of its portfolio recognized for market leadership. Over 70% of Essity's offerings are rated as best-in-market by customers and consumers, highlighting the appeal of its eco-friendly and high-performance products.

These innovations are designed to meet growing consumer demand for sustainable solutions, driving growth in key market segments. For instance, Essity's Tork brand has been a leader in sustainable away-from-home hygiene solutions.

- Product Superiority: Over 70% of Essity's products are rated best-in-market by customers and consumers.

- Sustainability Focus: Essity prioritizes eco-friendly innovations to meet evolving consumer awareness.

- Market Growth: Sustainable products are driving growth in attractive market segments for Essity.

- Brand Leadership: Brands like Tork exemplify Essity's commitment to sustainable hygiene solutions.

Tork PeakServe, a high-capacity dispensing system, is a Star within Essity's portfolio, bolstering the strong Tork brand in Professional Hygiene. Its design focuses on efficiency and waste reduction, tapping into a growing market need for advanced hygiene solutions. This product's strategic introduction is key to Essity's ongoing global expansion, even amidst economic challenges.

| Product/Brand | Segment | BCG Category | Key Feature | Market Context |

|---|---|---|---|---|

| Tork PeakServe | Professional Hygiene | Star | High capacity, efficiency focus | Growing demand for advanced hygiene solutions |

| TENA | Incontinence Care | Star | Innovation, aging population driver | Expanding market for adult incontinence products |

| Bodyform/Libresse | Feminine Care | Star | Premiumization, advanced products | Rapidly expanding sector, high-value segments |

| Cutimed/JOBST | Medical Solutions | Star | Sustained growth, product innovation | Expanding specialized healthcare sector |

What is included in the product

The Essity BCG Matrix offers a strategic overview of their product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

It guides investment decisions, highlighting which business units to grow, maintain, or divest based on market share and growth potential.

A clear Essity BCG Matrix visualizes each business unit's position, alleviating the pain of strategic uncertainty.

Cash Cows

TENA, Essity's leading incontinence product brand, stands as a prime example of a Cash Cow within the company's portfolio. Its dominance in the mature but consistently necessary incontinence market translates to a very high market share, ensuring stable and substantial cash generation.

This robust cash flow from TENA is crucial for Essity, providing the financial muscle to fund innovation, acquisitions, and growth initiatives in other business segments. For instance, Essity reported net sales of SEK 132.7 billion in 2023, with its Health and Medical segment, which includes TENA, showing strong performance.

Tork, a cornerstone of Essity's portfolio, stands as a prime example of a Cash Cow within the BCG matrix. Its global leadership in the professional hygiene sector, particularly in a mature B2B market, underpins its strong, stable cash flow generation.

Despite facing some localized volume contractions, Tork's enduring market dominance and the inherent efficiency of its dispensing systems continue to translate into reliable earnings. For instance, in 2024, Essity reported continued strong performance from its Consumer Goods segment, which includes Tork, highlighting its resilience.

Essity's established consumer tissue brands, such as Zewa, Lotus, and Tempo, represent significant Cash Cows within its portfolio. These brands benefit from strong regional market shares in mature markets, a testament to their widespread household penetration and enduring brand loyalty.

While the consumer tissue sector is competitive, these brands consistently generate stable, predictable cash flows. This stability is a key characteristic of Cash Cows, allowing Essity to fund investments in other business segments.

For instance, Essity reported net sales of SEK 132.5 billion in 2023, with its Consumer Tissue segment contributing significantly, demonstrating the ongoing strength of these mature brands.

Libero (Baby Care in Established Markets)

Libero, Essity's baby care brand in established markets, likely functions as a Cash Cow. It commands a significant market share within a mature segment, generating consistent revenue for the company. Despite intense competition, its strong brand recognition and established distribution channels ensure a reliable inflow of cash.

In 2024, the global baby care market continued its steady growth, driven by consistent birth rates in developed nations. Essity's Libero brand, with its established presence in key European markets like Sweden and Germany, benefits from this stability. While growth might be modest, the brand’s strong market position translates into predictable and substantial cash generation.

- Market Position: Libero holds a high market share in mature baby care markets, particularly in Northern Europe.

- Revenue Generation: The brand contributes significantly and consistently to Essity's overall cash flow due to its established customer base.

- Competitive Landscape: While facing competition, Libero's brand equity and product quality help maintain its strong position.

- Financial Contribution: In 2023, Essity reported that their Consumer Goods segment, which includes Libero, demonstrated resilient performance, underscoring the stable cash-generating capabilities of brands like Libero.

Conventional Feminine Care Products

Essity's conventional feminine care products, including well-established brands like Libresse and Saba, represent a significant portion of its revenue. These items are considered cash cows within the company's portfolio, consistently generating substantial profits due to their strong market presence in developed economies.

While not experiencing rapid expansion, these mature products provide a stable and predictable income stream for Essity. For instance, in 2023, Essity's Consumer Goods segment, which heavily features feminine care, reported net sales of SEK 77.2 billion (approximately $7.4 billion USD), underscoring the substantial contribution of these foundational products.

The reliability of these cash cows allows Essity to invest in more innovative or emerging product lines.

- Market Share: These products maintain a dominant position in established markets, ensuring consistent sales volume.

- Revenue Generation: They are the bedrock of Essity's financial stability, providing dependable cash flow.

- Investment Support: Profits from these cash cows fund research and development for newer, higher-growth categories.

Essity's established brands like TENA and Tork are strong examples of Cash Cows. They hold significant market share in mature segments, ensuring consistent and reliable cash generation for the company.

These brands, like TENA in incontinence care and Tork in professional hygiene, provide the financial stability needed to support other business areas. For instance, Essity’s Health and Medical segment, which houses TENA, demonstrated robust performance, contributing to the company's overall financial health.

Similarly, Tork's global leadership in professional hygiene, despite market maturity, continues to yield predictable earnings. Essity’s 2023 financial reports highlighted the Consumer Goods segment, which includes Tork, as a key contributor to its net sales, reinforcing its Cash Cow status.

Essity's portfolio includes several key Cash Cows, such as TENA, Tork, and established consumer tissue brands like Zewa, Lotus, and Tempo. These brands benefit from high market shares in mature, stable markets, generating consistent and substantial cash flow for the company.

| Brand Example | Segment | Market Maturity | Cash Flow Generation | Essity Financial Data (2023) |

| TENA | Health and Medical | Mature | High, Stable | Part of SEK 132.7 billion total net sales, strong segment performance |

| Tork | Consumer Goods | Mature | High, Stable | Part of SEK 132.7 billion total net sales, resilient performance |

| Zewa, Lotus, Tempo | Consumer Goods | Mature | High, Stable | Part of SEK 132.7 billion total net sales, significant contribution |

Preview = Final Product

Essity BCG Matrix

The Essity BCG Matrix preview you are viewing is the exact, fully formatted report you will receive upon purchase. This comprehensive document, meticulously crafted with expert analysis, is ready for immediate strategic application without any watermarks or demo content. You'll gain access to a professional-grade tool designed to illuminate Essity's product portfolio and guide critical business decisions.

Dogs

Certain consumer tissue sub-brands within Essity, particularly those in highly fragmented or mature local markets, may be classified as Dogs. These segments often struggle with low market share and minimal growth prospects. For instance, in 2024, Essity continued to streamline its portfolio, divesting non-core assets, which could include such underperforming brands.

Within Essity's Professional Hygiene segment, areas catering to the North American HoReCa (Hotels, Restaurants, Cafes) sector have seen reduced demand. This suggests a market with limited growth potential, placing these particular product lines in the 'Dog' category of the BCG Matrix. For instance, while overall professional hygiene saw growth, specific HoReCa-focused product volumes in North America may have stagnated or declined in 2024.

Essity's former stake in Vinda, an Asian hygiene company, can be viewed as a 'Dog' within a portfolio management context. Its divestment was a strategic move to refine Essity's overall business mix and focus on areas offering higher returns. This action signals that Vinda no longer fit with Essity's core profitable growth objectives.

Legacy Products with Limited Innovation

Certain legacy products within Essity's extensive range, which haven't seen significant recent innovation or marketing investment, could be classified as Dogs. These items might be found in mature or shrinking market segments, experiencing a gradual decline in their market share.

For instance, if a particular line of adult incontinence products, established years ago and not updated with new materials or features, operates in a market where competitors have introduced advanced solutions, it could fit this description. Essity's 2023 annual report noted that while overall sales grew, the company continues to focus on innovation in its core segments, implying that less innovative lines may be under pressure.

- Stagnant Market Share: Products with minimal growth or declining sales in their respective categories.

- Low Innovation Investment: Older product lines that have not benefited from recent R&D or feature enhancements.

- Declining Sub-Markets: Products operating within segments of the broader hygiene and health market that are experiencing reduced demand.

Niche or Regional Brands with Low Market Presence

Niche or regional brands with a low market presence within Essity's portfolio might fall into the 'Dogs' category of the BCG Matrix. These are brands operating in less dynamic markets where Essity doesn't command a dominant share. For instance, a smaller brand in a mature, slow-growing European market where Essity faces intense local competition could represent this segment.

Brands in this classification often require careful evaluation. Given their limited market penetration and the lack of significant growth prospects in their specific regions, continued substantial investment may not yield optimal returns. Essity might consider strategies such as divestment or a minimal investment approach to manage these assets efficiently.

Consider a hypothetical scenario where Essity owns a regional diaper brand in a country with an aging population and a saturated market. If this brand holds less than 5% market share and the overall market is growing at only 1% annually, it aligns with the characteristics of a 'Dog'. Essity's global revenue in 2024 reached approximately €13.1 billion, highlighting the scale of their operations and the need to strategically manage all brand segments.

- Low Market Share: Brands with a small footprint in their respective regional markets.

- Slow Market Growth: Operating in industries or geographical areas experiencing minimal expansion.

- Potential Divestment: Assets that may be candidates for sale to reallocate resources.

- Strategic Re-evaluation: A need to assess if continued investment aligns with overall company objectives.

Essity's 'Dogs' represent brands or product lines with low market share and minimal growth prospects, often found in mature or declining segments. These might include niche regional products or older formulations that haven't kept pace with market innovation. For instance, Essity's 2024 strategic focus on streamlining its portfolio suggests a continuous evaluation and potential divestment of such underperforming assets. The company's commitment to innovation in core areas further implies that less dynamic product lines may be candidates for divestment or a reduced investment strategy to optimize resource allocation.

| Brand/Product Category Example | Market Share | Market Growth Rate | Essity's Strategic Approach |

| Legacy adult incontinence product line | Low (e.g., <5% in specific niche) | Stagnant or declining | Potential for product refresh or divestment |

| Regional tissue brand in a saturated European market | Low (e.g., <10% in its specific region) | Low (e.g., 1-2%) | Minimal investment, focus on efficiency |

| Specific North American HoReCa hygiene products | Low to moderate | Limited growth | Portfolio review, potential reallocation of resources |

Question Marks

The TENA Bariatric Range (3XL-4XL) represents Essity's strategic entry into a specialized segment of the incontinence market. This expansion addresses a growing need for larger-sized products, a demographic that has historically been underserved.

While the broader incontinence market demonstrates robust growth, with the global market valued at approximately USD 70 billion in 2024 and projected to reach over USD 100 billion by 2030, Essity's share in this particular bariatric niche is likely to be nascent. This positions the TENA Bariatric Range as a Question Mark within the BCG matrix, characterized by its potential for significant future expansion.

Essity's focus on digital health solutions and connected hygiene places these initiatives squarely in the "Question Marks" category of the BCG matrix. These are high-growth potential areas where the company is investing heavily to build market share.

The company's commitment to digital transformation means significant capital is being allocated to developing innovative platforms and smart hygiene products. For instance, Essity's investments in digital solutions are geared towards capturing emerging trends in preventative healthcare and improved user experiences.

As of 2024, Essity's strategic push into digital health is designed to tap into a rapidly expanding market, aiming to establish a strong competitive position. This requires substantial upfront investment to develop and scale these new offerings.

Essity's strategic expansion into new geographic markets, particularly in North America and Latin America, aligns with its objective to bolster its presence in these regions. This focus on emerging markets is key to its growth strategy, aiming to capture a larger share of the consumer base for its wide range of hygiene and health products.

In 2024, Essity continued its push into emerging economies, identifying specific high-growth regions where its market share is still developing. This approach allows the company to leverage its diverse product portfolio, from baby care to professional hygiene solutions, in markets with significant untapped potential.

Reusable Feminine Hygiene Products (Partnerships)

Essity's collaboration with UNICEF to bolster access to reusable menstrual hygiene products positions this initiative as a significant Question Mark within their portfolio. This venture taps into a burgeoning market fueled by increasing environmental consciousness and a demand for sustainable alternatives.

The global market for feminine hygiene products is substantial, with reusable options gaining traction. For instance, the reusable menstrual cup market alone was valued at approximately USD 1.4 billion in 2023 and is projected to grow significantly in the coming years. Essity's involvement here suggests a strategic move to capture market share in this rapidly expanding, albeit potentially uncertain, segment.

- Market Growth Potential: The increasing global awareness of sustainability is driving demand for reusable feminine hygiene products.

- Partnership Impact: Collaborating with UNICEF allows Essity to reach underserved populations and build brand presence in a socially impactful way.

- Investment Strategy: As a Question Mark, this segment likely requires continued investment to solidify market position and overcome potential adoption barriers.

- Future Outlook: The success of this segment hinges on consumer acceptance, product innovation, and Essity's ability to scale production efficiently.

Targeted Consumer Tissue Value Segment Offerings

Essity's strategic focus on the value segment within the consumer tissue market is evident in its product upgrades. Initiatives like enhancing Cushelle Simply Soft and Lotus Comfort are designed to capture price-sensitive consumers, a demographic showing significant growth potential. This move aims to solidify Essity's position and expand its market share in this crucial tier.

These product enhancements are not just about appealing to budget-conscious shoppers; they represent a calculated effort to gain traction in a segment that often drives volume. By offering improved quality at competitive price points, Essity is positioning itself to attract a broader customer base and potentially steal market share from competitors.

- Value Segment Focus: Essity is actively reinforcing its offerings in the value consumer tissue segment.

- Product Enhancements: Brands like Cushelle Simply Soft and Lotus Comfort have been upgraded to appeal to price-sensitive consumers.

- Market Share Growth: The objective is to increase Essity's market share within this specific product tier.

- Consumer Attraction: These strategic moves are designed to attract and retain consumers who prioritize affordability.

Essity's investments in emerging digital health solutions and connected hygiene products are prime examples of Question Marks. These are areas with high growth potential but uncertain market share, requiring significant investment to develop and scale.

The company is allocating substantial capital to these innovative platforms, aiming to capture emerging trends in preventative healthcare and enhance user experiences. As of 2024, this strategic push is designed to establish a strong competitive position in a rapidly expanding market.

Essity's expansion into new geographic markets, particularly in North America and Latin America, also falls into the Question Mark category. These are regions where the company aims to bolster its presence and capture a larger consumer base, requiring strategic investment to achieve this growth.

The collaboration with UNICEF to promote reusable menstrual hygiene products is another key Question Mark. This initiative taps into a growing market driven by environmental consciousness, though market share and consumer adoption remain uncertain.

Essity's focus on the value segment within consumer tissue, exemplified by upgrades to brands like Cushelle Simply Soft and Lotus Comfort, also represents a Question Mark. The goal is to attract price-sensitive consumers and increase market share in this high-volume tier.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.