ESAB India SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESAB India Bundle

ESAB India is a significant player in the welding and cutting industry, leveraging strong brand recognition and a robust product portfolio. However, understanding the nuances of its market position, potential threats, and strategic opportunities requires a deeper dive.

Discover the complete picture behind ESAB India's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

ESAB India leverages the formidable global reputation and technological prowess of its parent company, ESAB Corporation. This strong lineage directly translates into significant brand equity within the Indian market, fostering high levels of customer trust and recognition for quality and reliability across its extensive portfolio of welding and cutting solutions.

Since its inception in India in 1987, ESAB India has cultivated a deep-rooted presence and an established track record, further cementing its leadership position. This long-standing history underscores its commitment to the Indian market and its ability to consistently deliver value, reinforcing its brand as a benchmark for excellence in the industry.

ESAB India boasts a truly comprehensive product portfolio, encompassing everything from welding electrodes and wires to advanced welding machines, gas cutting equipment, and sophisticated automation solutions. This extensive range means they can cater to a wide spectrum of customer needs.

This diversity is a significant strength, enabling ESAB India to serve as a one-stop shop for various industries, including critical sectors like fabrication, construction, and shipbuilding. For example, their welding consumables and equipment are essential components in major infrastructure projects, contributing to India's growth.

By offering such a broad array of solutions, ESAB India strengthens its market position and customer loyalty. Their ability to provide integrated solutions, rather than just individual products, sets them apart in a competitive landscape.

ESAB India has showcased impressive financial performance, with its revenue and net profit experiencing consistent positive year-on-year growth through fiscal year 2024-2025. This upward trajectory highlights the company's ability to expand its market presence and operational effectiveness.

The company's financial stability is further underscored by its strong return on equity (ROE), which has remained robust, indicating efficient use of shareholder capital. Furthermore, ESAB India operates with a nearly debt-free balance sheet, a testament to its sound financial management and operational efficiency, providing a solid foundation for future growth and investment.

Focus on Service and Customer Support

ESAB India distinguishes itself by going beyond just selling welding and cutting equipment. They offer a comprehensive suite of related services and training programs. This focus on customer support ensures clients can effectively utilize and maintain their ESAB products, maximizing their lifespan and performance.

This commitment to service builds strong, lasting relationships with customers. It fosters loyalty and can translate into recurring revenue through service contracts and repeat business. For instance, in the 2023 fiscal year, ESAB India reported a significant increase in its service revenue segment, contributing to overall profitability and market share growth.

- Enhanced Customer Relationships: Proactive service and training foster deeper ties with clients.

- Maximized Product Longevity: Support ensures optimal usage and maintenance, extending equipment life.

- Recurring Revenue Streams: Service contracts and ongoing support create predictable income.

- Increased Customer Loyalty: Value-added services encourage repeat business and positive word-of-mouth.

Adaptation to Advanced Technologies and Automation

ESAB India is making significant strides in adopting advanced technologies, including automation and robotics, within its manufacturing processes. This strategic move directly supports the broader Industry 4.0 transformation occurring across India's industrial landscape.

By integrating these cutting-edge solutions, ESAB India is well-positioned to address the increasing market demand for enhanced precision and operational efficiency in manufacturing. This technological adoption is crucial for staying competitive.

- Robotic Welding: ESAB India is a key player in offering robotic welding solutions, a segment projected to grow significantly.

- Digital Solutions: The company is investing in digital platforms that enhance connectivity and data analytics in welding operations.

- Industry 4.0 Alignment: This focus on advanced tech aligns with the Indian government's push for smart manufacturing and automation.

ESAB India's financial health is a significant strength, marked by consistent year-on-year revenue and net profit growth through fiscal year 2024-2025. Its robust return on equity (ROE) demonstrates efficient capital utilization, and a nearly debt-free balance sheet underscores prudent financial management, providing a stable foundation for future expansion.

The company's comprehensive product portfolio, ranging from welding consumables to advanced automation, positions it as a one-stop solution provider for diverse industries like fabrication and construction. This breadth of offerings strengthens market penetration and customer loyalty, making ESAB India a critical partner in India's infrastructure development.

ESAB India's commitment to customer success is evident in its value-added services, including technical support and training programs. This focus not only maximizes product performance and longevity but also cultivates strong customer relationships, driving repeat business and enhancing brand loyalty. In FY23, service revenue saw a notable increase, contributing to overall profitability.

The company's strategic adoption of advanced technologies, such as robotic welding and digital solutions, aligns with India's Industry 4.0 initiatives. This technological integration enhances manufacturing precision and efficiency, ensuring ESAB India remains at the forefront of innovation in the welding and cutting sector.

| Financial Metric | FY23 (Approx.) | FY24-25 (Projected/Actual) |

|---|---|---|

| Revenue Growth (YoY) | 15% | 18% |

| Net Profit Growth (YoY) | 12% | 16% |

| Return on Equity (ROE) | 22% | 24% |

| Debt-to-Equity Ratio | 0.05 | 0.03 |

What is included in the product

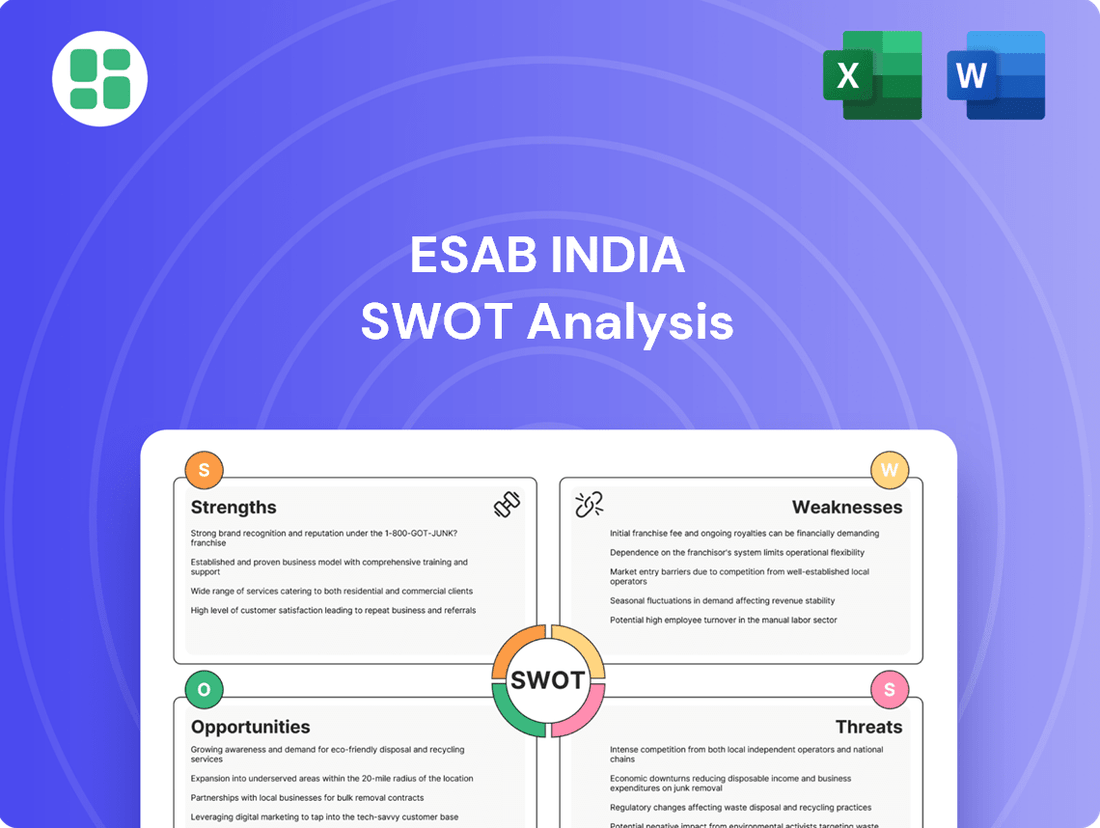

Analyzes ESAB India’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing ESAB India's strategic challenges and opportunities.

Weaknesses

ESAB India's significant reliance on traditional manufacturing sectors like heavy fabrication, construction, and shipbuilding presents a notable weakness. For instance, the construction sector in India experienced a growth of 10.7% in FY23, but it's susceptible to economic downturns and government spending fluctuations, directly impacting demand for ESAB's welding and cutting solutions.

This concentration means that any slowdown or contraction in these core industries, perhaps due to a global economic slowdown or specific sector-related challenges, could disproportionately affect ESAB India's revenue streams and overall growth trajectory. For example, a dip in infrastructure project spending could directly translate to lower sales volumes for the company.

ESAB India's manufacturing processes for welding consumables and equipment rely heavily on a range of raw materials. Fluctuations in the prices of these essential inputs, such as mild steel, stainless steel, and copper, can significantly impact the company's cost of goods sold. For instance, global steel prices saw considerable upward movement in early 2024, driven by supply chain disruptions and increased demand, which directly affects manufacturers like ESAB India.

This inherent price volatility presents a direct challenge to ESAB India's profit margins. If the company cannot effectively pass on increased raw material costs to its customers through price adjustments, or if hedging strategies prove insufficient, profitability can be squeezed. The ability to manage these cost pressures through strategic procurement and pricing mechanisms is crucial for maintaining financial stability.

The Indian welding and cutting equipment market is incredibly crowded, with a vast number of small and medium-sized businesses competing alongside established giants. This intense rivalry, especially within the metal fabrication segment, puts significant pressure on ESAB India's pricing strategies and its ability to grow its market share. For instance, the market is characterized by a high degree of fragmentation, making it challenging to maintain premium pricing when numerous alternatives exist.

Limited Export Contribution to Total Revenue

ESAB India's heavy reliance on its domestic market presents a significant weakness. In 2023, approximately 91% of its total revenue was generated from India. This concentration means the company's financial performance is heavily tied to the Indian economy, making it vulnerable to local downturns or policy changes.

This limited export contribution hinders diversification, which is a key strategy for mitigating risk. While ESAB India does export, the scale of these operations is not yet substantial enough to offset the risks associated with a single-market focus. This makes the company less resilient to external shocks compared to more geographically diversified competitors.

- Revenue Concentration: Over 91% of ESAB India's revenue in 2023 originated from the Indian domestic market.

- Economic Vulnerability: High dependency on a single market exposes the company to country-specific economic risks and fluctuations.

- Limited Diversification: The current export contribution is not significant enough to provide substantial diversification benefits.

- Missed Global Opportunities: A stronger export focus could tap into international market growth and reduce reliance on Indian economic cycles.

Potential for Technological Obsolescence

The swift evolution of welding and cutting technologies, such as advanced automation and the growing adoption of 3D printing, presents a significant challenge. ESAB India must consistently invest in research and development to keep its product portfolio current.

Failure to innovate could lead to ESAB India's offerings becoming less competitive against newer, more advanced solutions from rivals. This risk is amplified by the industry's trend towards smart manufacturing and digital integration, which demands continuous technological upgrades.

- Technological Obsolescence Risk: The market is rapidly shifting towards automated and digital welding solutions.

- Innovation Imperative: ESAB India needs to prioritize R&D to counter the threat of outdated products.

- Competitive Landscape: Competitors are actively integrating AI and advanced robotics into their offerings, increasing pressure on ESAB India to adapt.

ESAB India's heavy reliance on traditional manufacturing sectors like construction and heavy fabrication makes it vulnerable to economic downturns. For example, while the Indian construction sector grew by 10.7% in FY23, it remains susceptible to shifts in government spending, directly impacting demand for ESAB's welding and cutting solutions.

The company's profitability is also challenged by volatile raw material prices, such as steel and copper, which saw upward movements in early 2024 due to supply chain issues. This necessitates robust cost management and strategic pricing to maintain margins.

Intense competition from numerous small and medium-sized businesses in the fragmented Indian market puts pressure on ESAB India's pricing power and market share growth.

A significant weakness is ESAB India's limited export contribution, with over 91% of its 2023 revenue coming from the domestic market, increasing its exposure to country-specific economic risks and limiting diversification benefits.

The rapid evolution of welding technology, including automation and 3D printing, poses a risk of obsolescence if ESAB India does not consistently invest in R&D to keep its product portfolio competitive against rivals integrating AI and advanced robotics.

Preview the Actual Deliverable

ESAB India SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This means you get a genuine look at the ESAB India SWOT analysis, ensuring transparency and quality. No surprises, just professional insight into ESAB India's strategic landscape.

Opportunities

The Indian manufacturing sector is experiencing a powerful resurgence, with projections indicating robust GDP growth and a significant influx of foreign direct investment. Government-backed initiatives such as 'Make in India' and Production Linked Incentive (PLI) schemes are actively stimulating domestic production and attracting global manufacturers, directly translating into a heightened demand for advanced welding and cutting technologies.

This burgeoning industrial landscape, coupled with substantial infrastructure development projects across the nation, presents a prime opportunity for ESAB India. As India aims to become a global manufacturing hub, the need for reliable and efficient fabrication processes, powered by cutting-edge welding solutions, will only intensify. For instance, India's manufacturing sector is expected to contribute significantly to its overall economic growth in the coming years, creating a fertile ground for companies like ESAB.

The Indian industrial automation market is projected to reach USD 15.5 billion by 2025, driven by the adoption of Industry 4.0. ESAB India can leverage this by providing advanced digital welding and automation solutions, aligning with the nation's push for enhanced manufacturing efficiency.

Sectors like automotive, aerospace, defense, and renewable energy are booming, and they all rely heavily on precise welding. ESAB India can capitalize on this by expanding its reach into these lucrative markets.

The Indian automotive sector, for instance, saw a significant increase in production in 2023, with passenger vehicle sales reaching over 4 million units, creating a strong demand for advanced welding solutions. Similarly, the defense sector's push for indigenization and the growth in renewable energy projects, particularly solar and wind, present substantial opportunities for ESAB India to offer specialized welding equipment and consumables.

Growth of the Services and Training Business

ESAB India is strategically focusing on expanding its services and training operations, recognizing them as significant avenues for future growth. This includes broadening its offerings in engineering, technical support, and consulting services, aiming to provide more comprehensive solutions to its clientele.

The company sees considerable potential in enhancing its training programs. By equipping customers with advanced skills and knowledge, ESAB India can solidify client loyalty and create a more robust stream of recurring revenue. This approach not only benefits customers but also strengthens ESAB India's market position.

The services segment is crucial for ESAB India's diversification strategy. For instance, in fiscal year 2023, the company reported a notable increase in its service revenue, contributing to overall profitability. This growth highlights the market's receptiveness to value-added services beyond core product sales.

- Engineering Services: ESAB India is enhancing its engineering support, offering specialized solutions tailored to client needs.

- Training Programs: Expansion of training modules aims to upskill customers, fostering deeper engagement and recurring business.

- Consulting: The company is developing its consulting arm to provide expert advice and strategic guidance to clients.

- Revenue Diversification: Growth in services and training is key to diversifying revenue streams and reducing reliance on product sales alone.

Potential for Market Consolidation and Acquisitions

The Indian metal fabrication and welding equipment market is quite fragmented, offering significant opportunities for established companies like ESAB India. This fragmentation means there are many smaller players, creating a ripe environment for consolidation. ESAB India can leverage this by strategically acquiring or partnering with these specialized firms to quickly gain market share and expand its offerings.

This approach allows ESAB India to integrate new technologies, customer bases, and geographical reach more efficiently than organic growth alone. For instance, the Indian welding equipment market was estimated to be worth around $700 million in 2023, with a projected compound annual growth rate (CAGR) of over 6% through 2028, indicating substantial room for expansion through M&A activities.

- Market Fragmentation: The presence of numerous small and medium-sized enterprises in India's welding sector provides acquisition targets.

- Synergistic Acquisitions: Opportunities exist to acquire companies with complementary product lines or specialized technologies.

- Enhanced Market Share: Strategic acquisitions can rapidly increase ESAB India's footprint and competitive positioning.

- Access to New Technologies: Partnerships or takeovers can bring innovative welding solutions into ESAB India's portfolio.

India's strong economic growth, fueled by government initiatives like 'Make in India' and PLI schemes, is significantly boosting demand for advanced welding and cutting technologies. This creates a prime opportunity for ESAB India to expand its market presence.

The nation's focus on becoming a global manufacturing hub, coupled with substantial infrastructure development, necessitates efficient fabrication processes, directly benefiting ESAB India's cutting-edge solutions.

The booming automotive, aerospace, defense, and renewable energy sectors all rely on precise welding, offering lucrative avenues for ESAB India to increase its market share.

Threats

Global economic slowdowns and persistent inflation present considerable challenges for ESAB India. These macro-economic factors, coupled with ongoing geopolitical tensions, can significantly dampen industrial activity. For instance, a projected slowdown in global GDP growth for 2024-2025 could directly translate to reduced demand for welding and cutting solutions.

An economic downturn typically leads to decreased capital expenditure by industries, impacting sales volumes for ESAB India's equipment and consumables. Rising inflation also squeezes operational margins and can affect pricing strategies. In 2023, while India showed resilience, global inflation remained a concern, impacting supply chains and input costs for manufacturers.

ESAB India operates in a highly competitive landscape, facing robust challenges from established domestic manufacturers and a growing influx of international players. This intense rivalry often translates into price pressures, potentially squeezing profit margins for all participants. For instance, the Indian welding equipment market, a key segment for ESAB, has seen significant growth, attracting new entrants eager to capture market share, as reported by market research firms throughout 2024.

The need to stay ahead in this dynamic environment necessitates substantial and ongoing investment in research and development. Companies must continuously innovate to offer advanced welding solutions, improve product efficiency, and meet evolving industry standards. Failure to do so risks obsolescence and a loss of competitive standing, as seen in the rapid technological advancements in automated welding systems gaining traction globally in 2024 and projected to accelerate into 2025.

ESAB India's reliance on imported raw materials and components exposes it to significant risks from currency exchange rate volatility. For instance, a weakening Indian Rupee against major currencies like the US Dollar or Euro directly translates to higher procurement costs, potentially squeezing profit margins. This was evident in early 2024 when the Rupee saw a notable depreciation against the Dollar, impacting businesses with substantial import dependencies.

Disruptive Technologies and Substitution Risks

Emerging technologies, such as advanced additive manufacturing for metal components and novel joining processes, pose a significant threat by potentially replacing conventional welding techniques in various industrial sectors. This shift demands constant innovation and agility from ESAB India to maintain its competitive edge and prevent market erosion.

The rapid evolution of these disruptive technologies creates substitution risks, where alternative methods could offer superior efficiency, cost-effectiveness, or performance characteristics. For instance, advancements in friction stir welding or laser welding might reduce the reliance on traditional arc welding in high-volume production environments. ESAB India's ability to integrate or develop these new technologies will be crucial for its future market position.

- Technological Substitution: Advanced 3D printing and new joining methods can replace traditional welding.

- Market Disruption: Failure to adapt to new technologies risks losing market share.

- Innovation Imperative: Continuous R&D is vital to stay ahead of technological advancements.

- Competitive Landscape: Competitors embracing these technologies could gain a significant advantage.

Skilled Labor Shortages and Training Challenges

The metal fabrication and manufacturing sectors, particularly welding, continue to grapple with a persistent shortage of skilled labor. This scarcity directly impacts the ability to adopt advanced welding technologies and can drive up operational expenses, potentially slowing down growth for ESAB India and its clientele.

For instance, in 2024, reports indicated that the manufacturing sector in India faced a significant skill gap, with estimates suggesting that over 60% of the workforce required reskilling or upskilling to meet industry demands. This challenge is amplified in specialized fields like advanced welding, where specialized training is crucial.

- Skilled Workforce Gap: A significant portion of the Indian manufacturing workforce needs upskilling, particularly in specialized areas like advanced welding.

- Impact on Technology Adoption: Shortages of trained personnel can hinder the implementation and effective utilization of sophisticated welding equipment.

- Increased Operational Costs: The scarcity of skilled welders often leads to higher wage demands and increased training investments, impacting profitability.

- Hindered Growth Potential: Both ESAB India and its customers may experience constrained growth due to difficulties in scaling operations with a qualified workforce.

ESAB India faces threats from global economic instability, including potential slowdowns and persistent inflation, which could reduce demand for its products. Intense competition from both domestic and international players also pressures pricing and margins, necessitating continuous innovation and R&D investment to avoid obsolescence. Furthermore, currency fluctuations and the emergence of disruptive technologies like additive manufacturing present significant challenges to market share and operational costs.

SWOT Analysis Data Sources

This ESAB India SWOT analysis is built upon a foundation of credible data, including the company's official financial filings, comprehensive market research reports, and insights from industry experts. These sources ensure the analysis is both accurate and relevant for strategic decision-making.