ESAB India PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESAB India Bundle

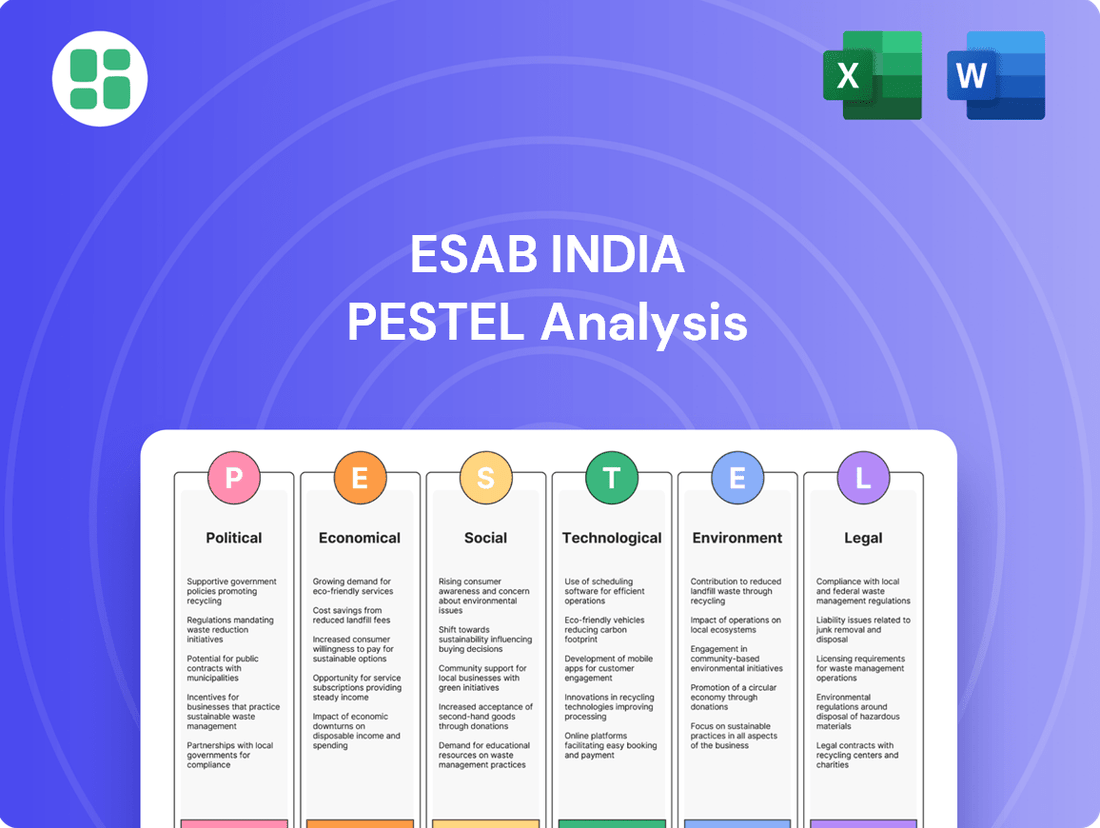

Gain a critical advantage with our comprehensive PESTLE analysis of ESAB India. Understand the intricate political, economic, social, technological, legal, and environmental forces actively shaping their operational landscape and future growth. This expertly crafted analysis is your key to unlocking strategic opportunities and mitigating potential risks. Download the full version now and equip yourself with the actionable intelligence needed to navigate the dynamic Indian market.

Political factors

The Indian government's 'Make in India' initiative, launched in 2014, is a significant driver for the manufacturing sector. Its core aim is to boost domestic production and encourage foreign investment, thereby reducing import dependency. This policy directly benefits companies like ESAB India by fostering a more robust local market for their welding and cutting solutions.

By promoting local manufacturing, 'Make in India' is expected to increase the manufacturing sector's contribution to India's Gross Domestic Product (GDP). Projections from the Department for Promotion of Industry and Internal Trade (DPIIT) indicated a target of 25% GDP contribution from manufacturing by 2022, a goal that continues to be pursued. This expansion translates into greater demand for industrial equipment, including the specialized products ESAB India offers.

The initiative's focus on job creation within the manufacturing ecosystem also plays a crucial role. As more factories are established and existing ones expand to meet domestic demand, the need for skilled labor and advanced machinery intensifies. This creates a positive feedback loop for ESAB India, as increased industrial activity necessitates greater use of welding and cutting technologies.

The Indian government's commitment to boosting domestic manufacturing is evident through its Production-Linked Incentive (PLI) schemes, spanning 14 key sectors. These initiatives are designed to encourage companies to scale up production and enhance exports by offering financial rewards.

Sectors like automotive, electronics, and capital goods, which are crucial for ESAB India's clientele, are directly targeted by these PLI schemes. For instance, the PLI scheme for the automotive sector aims to promote advanced automotive technologies and electric vehicles, with an outlay of INR 25,938 crore. Similarly, the electronics manufacturing sector has seen significant investment through PLI, with a total outlay of INR 76,000 crore for IT hardware and mobile manufacturing.

This government push is expected to stimulate growth in these industries, leading to increased demand for ESAB India's welding and cutting solutions as businesses invest in expanding their production capabilities to capitalize on these incentives. The capital goods sector PLI, with an outlay of INR 12,150 crore, specifically targets increased domestic manufacturing of machinery and equipment, directly benefiting ESAB's core market.

Changes in India's trade policies, including import duties and export incentives, significantly influence ESAB India's operational costs and market competitiveness. For instance, a reduction in import duties on key raw materials would lower production expenses, while increased export incentives could boost the profitability of its overseas sales.

Protectionist measures, such as higher tariffs on imported welding and cutting equipment, could create a more favorable environment for domestic manufacturers like ESAB India by making foreign alternatives more expensive. This shift could lead to increased demand for locally produced goods.

Furthermore, the potential for higher US tariffs on other Asian economies may indirectly benefit India's manufacturing sector. If US buyers seek alternative sourcing locations due to these tariffs, India, and by extension ESAB India, could see an uplift in export orders for its products, leveraging its manufacturing capabilities.

Political Stability and Governance

Political stability and the ease of doing business in India are paramount for ESAB India's long-term success and operational smoothness. A predictable political landscape directly translates to consistent policy execution and a significant reduction in business uncertainties, which is especially critical for a capital goods manufacturer reliant on long-term capital investments.

The Indian government's ongoing efforts to enhance the regulatory framework and streamline bureaucratic processes are expected to further simplify operations for companies like ESAB India. For instance, initiatives like the introduction of the Goods and Services Tax (GST) in 2017 aimed to create a unified national market, potentially reducing inter-state transaction complexities.

- Government Focus: Continued emphasis on policy continuity and investor-friendly reforms.

- Ease of Doing Business: India's ranking improved to 63rd out of 190 economies in the World Bank's 2020 Doing Business report, reflecting progress in regulatory reforms.

- Manufacturing Push: Policies like 'Make in India' aim to boost domestic manufacturing, benefiting capital goods providers.

- Regulatory Environment: Efforts to digitize services and reduce compliance burdens are ongoing.

Infrastructure Development Projects

Government initiatives focused on large-scale infrastructure development, including railways, roads, and construction, significantly boost the demand for welding and cutting equipment. ESAB India, with its presence in sectors like construction and shipbuilding, is directly positioned to benefit from this increased activity.

The Indian government's commitment to infrastructure expansion is substantial. For example, the National Infrastructure Pipeline (NIP) aims for a total investment of ₹111 lakh crore (approximately $1.4 trillion) between 2020 and 2025. This massive outlay translates into heightened demand for the specialized equipment ESAB India provides.

- PM GatiShakti Initiative: This master plan aims to develop integrated, multimodal connectivity infrastructure across the country, directly increasing the need for construction and heavy machinery, which are key markets for ESAB India's welding solutions.

- Railway Modernization: Significant investments are being channeled into modernizing India's vast railway network, requiring extensive welding for track laying, bridge construction, and rolling stock manufacturing.

- Road Network Expansion: The government's focus on building and upgrading highways and expressways, such as the Bharatmala Pariyojana, creates a sustained demand for welding and cutting technologies in the construction sector.

Government policies like the Production-Linked Incentive (PLI) schemes are actively stimulating growth in key sectors such as automotive and capital goods, areas where ESAB India's welding and cutting solutions are essential. The Indian government's sustained focus on improving the ease of doing business, evidenced by its steady rise in global rankings, creates a more predictable and favorable operating environment for manufacturers.

India's ambitious infrastructure development agenda, exemplified by the National Infrastructure Pipeline (NIP) with its projected ₹111 lakh crore investment through 2025, directly drives demand for heavy machinery and construction equipment, benefiting ESAB India.

Trade policies, including import duties and export incentives, are continuously reviewed, impacting ESAB India's cost structure and market reach. Political stability ensures consistent policy implementation, crucial for long-term investment decisions in the manufacturing sector.

| Policy/Initiative | Objective | Impact on ESAB India | Key Data/Figures |

|---|---|---|---|

| Make in India | Boost domestic manufacturing & FDI | Increased demand for industrial equipment | Targeted 25% GDP contribution from manufacturing by 2022 |

| PLI Schemes | Incentivize production & exports | Growth in automotive, electronics, capital goods sectors | INR 25,938 crore for automotive; INR 76,000 crore for electronics |

| National Infrastructure Pipeline (NIP) | Massive infrastructure development | Heightened demand for welding & cutting solutions | ₹111 lakh crore investment (2020-2025) |

| Ease of Doing Business | Streamline regulations & processes | Reduced operational uncertainties, smoother operations | India ranked 63rd out of 190 economies (2020) |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting ESAB India, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying key trends and their potential effects on ESAB India's operations and market position.

A concise ESAB India PESTLE analysis presented in a user-friendly format, enabling rapid identification of external factors impacting business strategy and mitigating potential risks.

Economic factors

India's economy is on a strong growth trajectory, with its Gross Domestic Product (GDP) projected to expand significantly. This robust economic expansion directly fuels the manufacturing sector, which is the core market for ESAB India. A healthy economy typically encourages greater investment in industrial infrastructure and production, leading to a higher demand for the welding and cutting solutions ESAB provides.

Industrial output in India has been consistently rising, reflecting the dynamism of its manufacturing base. For 2025, the manufacturing sector's contribution to India's GDP is anticipated to be in the range of 13-14%. This upward trend in industrial activity directly translates into increased opportunities for ESAB India, as more factories and production facilities will require their specialized equipment and consumables.

Inflationary pressures directly impact ESAB India's operational expenses by increasing the cost of essential raw materials such as steel and various metals, alongside energy prices. These rising input costs can significantly squeeze profit margins, particularly within a highly competitive manufacturing landscape where passing on these increases to customers is challenging.

A recent positive development for manufacturers like ESAB India is the easing of output inflation, which reportedly reached its lowest point in a year as of early 2024. This trend suggests a potential stabilization or even reduction in production costs, offering a more favorable environment for maintaining profitability and competitive pricing.

Interest rates significantly impact ESAB India's borrowing costs for capital investments, influencing decisions on new machinery and factory expansions. Higher rates can deter such investments, while lower rates can encourage them, directly affecting demand for ESAB's welding and cutting solutions.

The availability of credit for ESAB's customers, particularly in manufacturing, is crucial. When credit is readily available and affordable, businesses are more likely to invest in new equipment and projects, boosting demand for ESAB's products. Tentative signs in late 2024 and early 2025 suggest a potential uptick in manufacturing lending growth, which could translate to increased capital expenditure and a stronger market for ESAB India.

Foreign Direct Investment (FDI) Inflows

Increased Foreign Direct Investment (FDI) in India's manufacturing sector, particularly in areas like automotive and electronics, directly fuels demand for sophisticated welding and cutting equipment as multinational corporations establish or expand their production facilities. This influx of capital and technology, often spurred by government initiatives, leads to the adoption of more advanced manufacturing processes.

The 'Make in India' initiative has demonstrably boosted FDI, with notable inflows into manufacturing. For instance, FDI equity inflows into the manufacturing sector reached approximately $21.3 billion in the fiscal year 2023-24, a significant jump from earlier periods, directly benefiting industries reliant on advanced fabrication technologies.

- Manufacturing Sector Growth: FDI in manufacturing, reaching $21.3 billion in FY24, drives demand for advanced welding and cutting solutions.

- Technology Transfer: Foreign investment brings cutting-edge technology, necessitating and enabling the use of higher-grade welding and cutting equipment.

- 'Make in India' Impact: This initiative has been a key catalyst, attracting substantial FDI that upgrades India's industrial capabilities.

- Job Creation and Skill Development: FDI-backed manufacturing expansion creates jobs and fosters demand for skilled labor in operating advanced machinery.

Market Demand and Competition

The demand for welding and cutting equipment in India is closely tied to the performance of major sectors like automotive, construction, and defense. As these industries expand, so does the need for advanced welding solutions. For instance, the Indian automotive sector, a significant consumer of welding technology, saw production increase by approximately 10-12% in the fiscal year 2023-24, driving demand for ESAB India's products.

ESAB India operates in a competitive landscape, facing rivals from both established domestic manufacturers and global leaders. To maintain its market position, the company must focus on delivering innovative products and maintaining competitive pricing strategies. The welding equipment market in India is expected to see robust growth, with projections indicating a compound annual growth rate (CAGR) of around 8-10% through 2025, fueled by ongoing industrialization and infrastructure projects.

- Automotive Sector Growth: India's automotive production is a key demand driver, with recent estimates showing a healthy year-on-year increase.

- Infrastructure Development: Government initiatives in infrastructure, such as smart cities and transportation networks, significantly boost the need for welding services.

- Competitive Landscape: ESAB India competes with a mix of local players and international brands, necessitating a focus on technological advancement and cost-effectiveness.

- Market Growth Projections: The Indian welding equipment market is anticipated to expand, supported by strong economic fundamentals and increased manufacturing activity.

India's economic outlook remains robust, with GDP growth expected to be among the highest globally through 2025. This expansion underpins demand for industrial goods and services, directly benefiting ESAB India's market. While inflation has shown signs of easing, with output inflation reaching a yearly low in early 2024, managing input costs remains crucial for profitability.

Interest rates and credit availability significantly influence capital expenditure decisions for ESAB India's customers. Favorable credit conditions, potentially improving through late 2024 and early 2025, can spur investment in manufacturing, thereby increasing demand for welding and cutting solutions. The 'Make in India' initiative continues to attract substantial FDI, with manufacturing sector inflows reaching approximately $21.3 billion in FY24, signaling a strong push for industrial modernization.

| Economic Factor | 2023-24 Data/Projection | Impact on ESAB India |

| GDP Growth | Projected 6.5-7.0% for FY24-25 | Drives overall industrial demand |

| Manufacturing Sector Contribution | Expected 13-14% of GDP by 2025 | Directly increases need for fabrication equipment |

| Output Inflation | Lowest in a year as of early 2024 | Potentially reduces production cost pressures |

| FDI in Manufacturing | ~$21.3 billion in FY24 | Fuels demand for advanced welding tech |

Full Version Awaits

ESAB India PESTLE Analysis

The ESAB India PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting ESAB India. You can trust that the insights and structure presented are precisely what you'll gain access to immediately upon completing your transaction.

Sociological factors

The availability of a skilled workforce in welding, fabrication, and automation is paramount for ESAB India's success and that of its clientele. A deficit in these specialized skills can directly hinder production efficiency and slow down the integration of cutting-edge welding technologies across industries.

In 2023, India faced a significant skill gap, with reports indicating that over 70% of the workforce in manufacturing sectors lacked the necessary advanced technical skills. This shortage directly impacts ESAB India's ability to deploy its advanced automation solutions, as end-users require trained personnel to operate and maintain them effectively.

To counter this, ESAB India is actively involved in training programs and partnerships with technical institutes. For instance, their collaboration with ITIs (Industrial Training Institutes) aims to upskill students in modern welding techniques, ensuring a pipeline of qualified individuals who can leverage ESAB's innovative products, thereby supporting the broader industrial ecosystem's growth.

There's a growing focus on keeping workers safe, especially in industries that involve tough physical work. This push for better safety and health rules means more demand for sophisticated safety gear and automated systems that can take over dangerous jobs. For ESAB India, which provides welding and cutting tools, this trend is a real opportunity to supply products that boost employee safety.

In 2024, India's manufacturing sector, a key market for ESAB, saw increased investment in safety compliance. For instance, reports from the Directorate General Factory Advice Service and Labour Institutes highlighted a 15% rise in workplace safety audits across major industrial hubs. This heightened scrutiny directly translates to a greater need for the types of advanced welding and cutting technologies that minimize risk and improve working conditions.

India's rapid urbanization, with over 35% of its population now residing in cities as of 2024, is a significant driver for ESAB India. This trend directly translates into heightened demand for construction and infrastructure development projects, which in turn fuels the need for welding and cutting equipment. The expanding urban landscape necessitates new buildings, roads, and utilities, all of which rely heavily on these essential industrial tools.

Furthermore, this demographic shift is actively creating new industrial clusters and expanding existing ones across the country. These burgeoning manufacturing hubs, fueled by the availability of a larger urban workforce, present substantial opportunities for ESAB India to cater to an increasingly diverse and growing industrial base. The concentration of economic activity in these urban centers means a more accessible and concentrated market for ESAB's product and service offerings.

Changing Consumer Preferences

While ESAB India primarily operates in the business-to-business (B2B) sector, shifts in consumer preferences have a significant indirect impact. Growing consumer demand for products like electric vehicles (EVs) and advanced electronics directly influences ESAB India's key client industries, such as automotive and manufacturing.

For instance, the automotive sector, a major consumer of welding and cutting technologies, saw a notable increase in EV production in 2024. This trend fuels the need for specialized welding solutions that ESAB India provides, as EV manufacturing often involves new materials and joining techniques. Similarly, the burgeoning demand for sophisticated consumer electronics, driven by technological advancements and changing lifestyle choices, translates into increased production volumes for electronics manufacturers, thereby boosting demand for ESAB India's advanced fabrication equipment.

- Automotive Sector Growth: Global EV sales are projected to reach over 15 million units in 2024, a substantial rise that necessitates advanced manufacturing processes, including specialized welding.

- Consumer Electronics Demand: The Indian consumer electronics market is expected to grow at a CAGR of approximately 10-12% through 2025, indicating sustained demand for manufacturing inputs.

- Preference for Durability and Sustainability: Consumers increasingly favor durable goods and products with a lower environmental footprint, pushing manufacturers to adopt more efficient and sustainable production methods, often relying on advanced joining technologies.

Demographic Dividend and Youth Employment

India's significant demographic dividend, with a large youth population, offers a substantial pool of potential workers for industries like ESAB India. However, this demographic advantage hinges on the nation's ability to generate adequate employment opportunities for its burgeoning young workforce. The Economic Survey 2024-25 noted a positive trend in labor market indicators, suggesting a gradual improvement in job creation, which is crucial for absorbing this demographic bulge.

Government initiatives focusing on skill development, particularly within manufacturing, are vital for aligning the youth's capabilities with industry demands. These programs aim to create a skilled ecosystem that can reliably supply labor not only to ESAB India but also to its diverse customer base. For instance, the Production Linked Incentive (PLI) schemes across various sectors are designed to boost manufacturing and, by extension, employment.

- Demographic Dividend: India's median age was around 28.4 years in 2023, indicating a large proportion of the population is in its productive years.

- Youth Employment Challenges: While the labor force participation rate for youth (15-29 years) is significant, ensuring quality employment remains a key challenge.

- Skilling Initiatives: Programs like Skill India Mission aim to train millions of youth annually, with a focus on industry-relevant trades.

- Manufacturing Focus: Government emphasis on manufacturing, supported by policies like 'Make in India,' is intended to drive job creation for young people.

India's growing urbanization, with over 35% of its population in cities by 2024, directly fuels demand for construction and infrastructure, boosting the need for ESAB India's welding and cutting equipment. This demographic shift also creates new industrial clusters, expanding the market for ESAB's offerings as economic activity concentrates in urban centers.

Consumer preferences for durable and sustainable products indirectly impact ESAB India by influencing its client industries. For example, the rise in electric vehicle (EV) production in 2024 requires specialized welding solutions, a key area for ESAB, as EV manufacturing often uses new materials and joining techniques.

India's large youth population represents a significant potential workforce, but job creation is crucial to absorb this demographic dividend. Government skill development initiatives and manufacturing-focused policies like 'Make in India' aim to align youth capabilities with industry needs, supporting ESAB India and its customer base.

| Sociological Factor | Description | 2024-2025 Data/Trend |

|---|---|---|

| Urbanization | Increasing city populations driving infrastructure demand. | Over 35% of India's population resided in cities in 2024. |

| Consumer Trends | Demand for EVs and electronics influencing manufacturing needs. | EV sales projected over 15 million units globally in 2024; Indian consumer electronics market CAGR ~10-12% through 2025. |

| Demographic Dividend | Large youth population as a potential labor pool. | India's median age around 28.4 years (2023); focus on skilling initiatives like Skill India Mission. |

Technological factors

ESAB India must keep pace with ongoing advancements in welding and cutting, like laser welding and additive manufacturing, necessitating significant R&D investment and product line updates to remain competitive.

The Indian market is increasingly embracing smart welding technologies, with a notable rise in the adoption of AI-powered welding robots and collaborative robots (cobots), reflecting a shift towards automation and intelligent manufacturing solutions.

India's manufacturing sector is rapidly embracing Industry 4.0 principles, with a significant focus on automation, the Internet of Things (IoT), artificial intelligence (AI), and advanced data analytics. This technological shift is fundamentally reshaping how factories operate, driving efficiency and innovation.

ESAB India's product portfolio, which includes sophisticated automation solutions and a growing range of digital offerings, is strategically aligned to capitalize on this trend. The company is well-equipped to support the development of smart factories and cater to the increasing market need for enhanced productivity and streamlined operations, as evidenced by the projected growth in India's industrial automation market, which was valued at approximately USD 1.5 billion in 2023 and is expected to reach over USD 4 billion by 2030.

ESAB India is leveraging the surge in digitalization, with advancements in welding software and AI-driven monitoring systems significantly boosting operational efficiency and quality control. These digital tools, including cloud-based platforms for data management, are becoming integral to modern welding processes.

The company's competitive edge is sharpened by its capacity to offer integrated digital solutions that complement its core equipment and consumables. This holistic approach, providing both the hardware and the smart software to manage it, positions ESAB India as a comprehensive partner for its clients in 2024 and beyond.

Research and Development Investment

ESAB India's commitment to research and development is crucial for staying ahead in the competitive welding and cutting industry. Continuous investment ensures the introduction of innovative products that boost efficiency, elevate quality, and improve safety for users. This includes delving into advanced materials and cutting-edge processes.

In 2023, ESAB Corporation, the parent company, reported a significant focus on R&D, with investments aimed at developing next-generation welding and automation solutions. This strategic allocation supports ESAB India's efforts to bring advanced technologies to the Indian market.

- Focus on Efficiency: Developing welding machines that consume less power and offer faster welding speeds.

- Material Innovation: Exploring new alloys and consumables that provide stronger, more durable welds.

- Safety Enhancements: Integrating features like advanced fume extraction and improved ergonomic designs in equipment.

- Digital Integration: Investing in R&D for smart welding solutions that offer connectivity and data analytics for better process control.

Cybersecurity and Data Protection

As manufacturing processes become increasingly digitized and interconnected, cybersecurity is paramount for safeguarding ESAB India's intellectual property, operational data, and automated systems. The growing reliance on IoT devices and cloud-based platforms in the welding and cutting industry amplifies the risk of cyber threats. ESAB India must implement stringent cybersecurity protocols to protect its digital offerings, including its advanced welding equipment with connectivity features, and its internal operational systems from potential breaches.

The financial implications of cyber incidents can be substantial. For instance, a 2023 report indicated that the average cost of a data breach in India reached $2.12 million, a significant increase from previous years. This underscores the necessity for ESAB India to invest proactively in robust cybersecurity measures, including advanced threat detection, data encryption, and employee training, to mitigate financial and reputational damage.

Key considerations for ESAB India's cybersecurity strategy include:

- Securing connected welding equipment: Implementing secure firmware updates and network segmentation for IoT-enabled devices.

- Protecting sensitive data: Ensuring compliance with data protection regulations and employing strong access controls for internal systems.

- Supply chain security: Vetting third-party vendors and partners for their cybersecurity posture to prevent vulnerabilities.

- Incident response planning: Developing and regularly testing comprehensive plans to address and recover from cyberattacks.

ESAB India's technological landscape is shaped by rapid advancements in welding and cutting, pushing the company towards innovations like laser welding and additive manufacturing. This necessitates ongoing R&D investment to keep its product lines competitive and aligned with the Indian market's increasing adoption of smart welding technologies, including AI-powered robots.

The manufacturing sector's embrace of Industry 4.0 principles, focusing on automation, IoT, and AI, directly impacts ESAB India. The company's strategic product portfolio, featuring automation and digital offerings, is well-positioned to support smart factory development. This aligns with the projected substantial growth in India's industrial automation market, expected to more than double from approximately USD 1.5 billion in 2023 to over USD 4 billion by 2030.

Digitalization is a key driver, with ESAB India leveraging advancements in welding software and AI for enhanced efficiency and quality control. The company's integrated digital solutions, combining hardware with smart software, solidify its role as a comprehensive partner, especially as the parent company, ESAB Corporation, continues its strategic R&D investments, as seen in 2023, to develop next-generation solutions.

Cybersecurity is a critical technological consideration for ESAB India, given the increasing reliance on connected devices and cloud platforms. With the average cost of a data breach in India reaching $2.12 million in 2023, robust security measures are essential to protect intellectual property and operational data.

Legal factors

ESAB India must strictly adhere to India's comprehensive labor laws, covering aspects like minimum wages, safe working conditions, and industrial dispute resolution. Non-compliance can lead to significant penalties and operational disruptions.

Anticipated shifts in labor regulations, such as those concerning gig workers or social security, could influence ESAB India's human resource strategies and operational expenses. The Economic Survey 2024-25 highlights the government's intent to foster more adaptable labor laws to encourage business expansion and employment generation.

Environmental Protection Laws significantly influence ESAB India's operations. Strict regulations on emissions, waste disposal, and the handling of hazardous substances directly impact manufacturing and product development. For instance, India's Central Pollution Control Board (CPCB) continuously updates guidelines for industrial emissions, requiring companies like ESAB India to invest in advanced pollution control technologies.

Compliance with rules concerning air and water pollution, hazardous waste management, and e-waste disposal is paramount. The Ministry of Environment, Forest and Climate Change often introduces new directives, such as enhanced Extended Producer Responsibility (EPR) schemes for electronic waste, which ESAB India must adhere to. Failure to comply can result in substantial penalties and operational disruptions.

ESAB India must strictly adhere to national and international product safety and quality standards, such as those set by the Bureau of Indian Standards (BIS). For instance, BIS certification is often mandatory for welding consumables, ensuring they meet specific performance and safety benchmarks. This commitment is vital for building customer trust and ensuring product reliability in the competitive Indian market.

Failure to comply with these regulations can have severe consequences. ESAB India could face product recalls, significant financial penalties, and irreparable damage to its brand reputation. In 2023, the Indian government continued to strengthen enforcement of quality standards across various manufacturing sectors, increasing the risk for non-compliant businesses.

Intellectual Property Rights (IPR)

Protecting its intellectual property, particularly patents related to its advanced welding and cutting technologies and consumables, is paramount for ESAB India to maintain its competitive edge in the market. India's evolving intellectual property rights (IPR) framework and the effectiveness of its enforcement mechanisms are crucial factors that ESAB India must closely monitor.

The Indian government has been strengthening its IPR regime, with initiatives aimed at improving patent examination processes and combating counterfeit products. For instance, the number of patent applications filed in India saw a significant increase, with domestic filings growing by 17.4% in the fiscal year 2022-23, indicating a more robust IP landscape.

ESAB India's ability to secure and defend its patents directly impacts its ability to innovate and differentiate its product offerings. The company's reliance on proprietary technology means that any weaknesses in IPR enforcement could lead to unauthorized replication, eroding market share and profitability.

- Patent Protection: ESAB India's core technologies in welding and cutting equipment are protected by patents, crucial for maintaining a technological advantage.

- IPR Enforcement: The company's success hinges on the effectiveness of India's legal framework for enforcing these intellectual property rights.

- Market Competition: A strong IPR regime deters competitors from infringing on ESAB India's patented innovations, ensuring fair competition.

- Innovation Investment: Robust IP protection encourages ESAB India to continue investing in research and development for new welding solutions.

Corporate Governance and Compliance

ESAB India, as a publicly traded entity, operates under the stringent corporate governance and compliance mandates established by India's Securities and Exchange Board of India (SEBI) and other relevant authorities. This necessitates a commitment to transparent financial reporting, upholding ethical business standards, and ensuring full adherence to all prevailing legal frameworks. For instance, ESAB India's Annual Report for the fiscal year 2024-25 and its Business Responsibility and Sustainability Report serve as crucial disclosures, detailing the company's governance practices and commitment to responsible operations.

Key aspects of ESAB India's corporate governance and compliance framework include:

- Board Oversight: Ensuring an independent and diverse board of directors to provide effective oversight and strategic guidance.

- Shareholder Rights: Protecting and promoting the rights of all shareholders, including timely and accurate dissemination of information.

- Ethical Conduct: Maintaining high standards of integrity and ethical behavior across all business operations and dealings.

- Regulatory Adherence: Strict compliance with all applicable laws, rules, and regulations governing listed companies in India.

ESAB India must navigate India's evolving legal landscape, particularly concerning labor laws and environmental regulations. The government's focus on adaptable labor laws, as noted in the Economic Survey 2024-25, could impact hiring practices and costs, while stringent environmental compliance, especially regarding emissions and waste management, requires continuous investment in pollution control technologies.

Adherence to product safety and quality standards, such as BIS certifications for welding consumables, is critical for market access and brand reputation, with increased enforcement observed in 2023. Furthermore, robust intellectual property rights (IPR) protection is vital for ESAB India's innovation, supported by the government's efforts to strengthen the IPR regime, evidenced by a 17.4% rise in domestic patent filings in FY 2022-23.

The company's corporate governance is governed by SEBI mandates, emphasizing transparency, ethical conduct, and shareholder rights, as detailed in its Annual Report and Business Responsibility and Sustainability Report for fiscal year 2024-25.

Environmental factors

There's a significant global push towards greener manufacturing, with countries and companies increasingly focusing on energy efficiency and lowering their carbon emissions. This trend extends to India, where sustainable practices are gaining traction. For ESAB India, aligning with these environmental expectations is crucial for maintaining a positive brand image and securing a competitive edge in the market.

In 2024, India's renewable energy capacity reached over 180 GW, signaling a broader commitment to decarbonization that impacts manufacturing sectors. Companies like ESAB India are expected to demonstrate tangible efforts in reducing their greenhouse gas output. For example, by adopting advanced welding technologies that consume less energy, ESAB India can directly contribute to this national objective and enhance its appeal to environmentally conscious clients and investors.

Increasing global and Indian regulations targeting carbon emissions are a significant environmental factor for ESAB India. These rules push for cleaner industrial practices, potentially requiring ESAB India to invest in more energy-efficient manufacturing. For instance, ESAB Corporation, the parent company, has publicly committed to reducing its Scope 1 and Scope 2 greenhouse gas emissions, indicating a strategic shift that will likely influence its Indian subsidiary's operations and product development roadmaps.

This regulatory push also creates opportunities for ESAB India to innovate by developing products that assist their customers in lowering their own carbon footprints. By offering solutions that enhance energy efficiency or enable cleaner welding and cutting processes, ESAB India can align with environmental goals while potentially capturing new market share. The company's focus on sustainability, as echoed by ESAB Corporation's emission reduction targets, suggests a proactive approach to navigating these evolving environmental landscapes.

Environmental regulations in India, particularly concerning industrial waste, demand ESAB India to maintain strict protocols for waste reduction, recycling, and proper disposal, especially for hazardous and electronic waste. The nation's commitment to sustainability, as evidenced by initiatives like the Swachh Bharat Abhiyan, indirectly pressures companies to adopt cleaner operational practices.

Compliance with Extended Producer Responsibility (EPR) mandates for e-waste and plastic waste is crucial. For example, India’s Central Pollution Control Board (CPCB) sets targets for e-waste collection and recycling, which ESAB India must meet to avoid penalties and maintain its environmental license.

Water Pollution Control

New water pollution control guidelines, effective January 2025, will impose more rigorous consent procedures and location restrictions for industrial facilities. ESAB India needs to adapt its operational practices to meet these evolving environmental standards, which could influence site selection and existing plant modifications. Non-compliance could lead to significant fines or operational disruptions, impacting ESAB India's manufacturing capacity and market presence.

These regulations are part of a broader push to enhance environmental stewardship across industries. For example, the Central Pollution Control Board (CPCB) in India has been actively revising discharge standards for various sectors. The updated guidelines aim to reduce industrial effluent discharge into water bodies by a targeted percentage, potentially impacting ESAB India's wastewater treatment infrastructure requirements and operational costs.

- Stricter Consent Processes: January 2025 regulations mandate more thorough environmental impact assessments before granting or renewing operating permits for industrial plants.

- Location Criteria: New rules will likely restrict industrial plant locations near sensitive water sources or in densely populated areas, requiring careful site planning for ESAB India.

- Compliance Costs: ESAB India may face increased capital expenditure for upgrading wastewater treatment facilities and ongoing operational costs to meet the new discharge limits.

- Penalty Avoidance: Adherence to these regulations is crucial to prevent penalties, which could include hefty fines and suspension of operating licenses, ensuring business continuity for ESAB India.

Resource Scarcity and Raw Material Sourcing

The availability and sustainable sourcing of raw materials for welding consumables and equipment are significantly impacted by growing environmental concerns and resource scarcity. ESAB India must navigate potential disruptions in its supply chain due to these factors.

For instance, global demand for key metals like iron ore and alloying elements, crucial for welding electrodes and wires, has seen price volatility. In 2024, projections indicated continued pressure on these commodities, with some analysts forecasting a 5-10% increase in raw material costs for manufacturing sectors, including welding, due to geopolitical factors and increased demand from infrastructure projects.

- Global demand for iron ore and key alloying elements presents a challenge for consistent and cost-effective sourcing.

- Environmental regulations increasingly scrutinize mining and extraction processes, potentially impacting raw material availability.

- ESAB India is exploring the use of recycled metals and more sustainable material alternatives to mitigate supply chain risks.

- The company's 2025 sustainability roadmap includes targets for increasing the percentage of recycled content in its products by 15%.

India's commitment to environmental protection is intensifying, with new water pollution control guidelines effective January 2025. These regulations will impose stricter consent procedures and location restrictions for industrial facilities, potentially impacting ESAB India's operations and expansion plans. The Central Pollution Control Board (CPCB) is also revising discharge standards, requiring companies to invest in enhanced wastewater treatment infrastructure.

The drive for sustainability also affects raw material sourcing. Global demand for metals like iron ore, crucial for welding consumables, saw price volatility in 2024, with some forecasts suggesting 5-10% increases in raw material costs. ESAB India is actively exploring recycled materials, aiming to increase recycled content in its products by 15% by 2025 to mitigate these supply chain risks and meet environmental goals.

PESTLE Analysis Data Sources

Our PESTLE Analysis for ESAB India is meticulously crafted using a blend of official government publications, reputable economic databases, and leading industry research reports. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting ESAB's operations in India.