ESAB India Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESAB India Bundle

ESAB India navigates a competitive landscape shaped by moderate bargaining power of buyers and suppliers, alongside a significant threat from substitutes in the welding and cutting solutions market.

The intensity of rivalry among existing players and the potential for new entrants further define ESAB India's strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore ESAB India’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for ESAB India leans towards moderate to high, especially when dealing with highly specialized components or crucial raw materials. For instance, if there are limited providers of specific metal alloys, flux materials, or sophisticated electronic parts essential for their welding machinery, these suppliers gain significant leverage.

ESAB India's substantial operational scale does provide some counter-leverage in price negotiations. However, this is often balanced by the critical nature of these specialized inputs for maintaining product quality and technological edge in the competitive welding equipment market.

The availability of substitutes for essential raw materials significantly impacts the bargaining power of suppliers for ESAB India. If alternative materials are readily available and cost-effective, ESAB India can more easily switch suppliers, thereby reducing the leverage of any single supplier.

However, for specialized chemicals or unique components crucial for advanced welding technologies, the limited number of suppliers can grant them considerable pricing power. For instance, if a particular rare earth element is vital for high-performance welding electrodes and only a few global entities produce it, those suppliers can command higher prices.

The welding industry's continuous pursuit of novel material compositions can dynamically alter supplier power. As ESAB India and its competitors explore and adopt new material inputs, the supplier landscape shifts, potentially creating new dependencies or offering greater sourcing flexibility.

High switching costs for ESAB India would significantly bolster the bargaining power of its suppliers. For instance, if ESAB India needs to re-tool its production lines or undertake extensive re-qualification processes for critical raw materials when changing suppliers, this inertia grants existing suppliers greater leverage. In 2024, the complexity of specialized welding consumables and advanced alloys used by ESAB India likely means that finding and integrating new, equivalent suppliers involves considerable time and expense, thereby strengthening supplier positions.

Impact of Input on Product Quality/Differentiation

Suppliers of crucial, high-performance raw materials, such as specialized alloys for ESAB India's welding wires or unique chemicals for flux coatings, wield significant bargaining power. This is because their inputs are directly tied to the quality and differentiation of ESAB India's final products, impacting its brand reputation. For a market leader like ESAB India, any compromise on input quality due to supplier issues is unacceptable.

- Impact on Quality: Suppliers of critical components like specialty alloys for welding consumables directly influence the performance and reliability of ESAB India's products.

- Brand Reputation: ESAB India's standing as a premium manufacturer is contingent on the consistent quality of its inputs, giving suppliers of superior materials leverage.

- Limited Substitutability: For highly specialized materials, finding equally performing alternatives can be difficult and costly, further strengthening supplier power.

- Cost Pass-Through: In 2024, rising global commodity prices for metals and chemicals could have allowed key suppliers to pass increased costs onto ESAB India, impacting its margins.

Threat of Forward Integration by Suppliers

The threat of suppliers moving into manufacturing welding equipment or consumables themselves is generally quite low for ESAB India. This is because starting such a business requires substantial capital investment, advanced technology, and established distribution channels. For instance, developing proprietary welding technologies or building a nationwide sales network is a massive undertaking.

While theoretically, very large raw material suppliers could consider forward integration, this is an unlikely scenario for most. Such a move would drastically alter the supplier landscape and empower them significantly. However, the vast majority of material providers lack the necessary resources and expertise to compete directly in ESAB India's core manufacturing business.

For example, in 2024, the global welding equipment market was valued at approximately USD 25 billion, with significant R&D and manufacturing overheads. This high barrier to entry makes it impractical for typical raw material suppliers, such as steel or gas providers, to transition into producing welding machines or consumables.

The practical reality is that the specialized nature of welding technology and the established market presence of companies like ESAB India create a strong deterrent. Suppliers focus on their core competencies, which are providing raw materials like alloys, gases, and chemicals, rather than entering a complex manufacturing sector.

The bargaining power of ESAB India's suppliers is influenced by the criticality and specialization of the inputs they provide. Suppliers of unique alloys for welding consumables or specialized chemicals for flux coatings hold considerable sway due to their direct impact on product quality and ESAB India's brand reputation.

In 2024, rising global commodity prices for metals and chemicals likely enabled key suppliers to pass on increased costs to ESAB India, potentially affecting its profit margins. The high barrier to entry in the welding equipment manufacturing sector, valued at around USD 25 billion globally in 2024, deters typical raw material suppliers from forward integration.

| Factor | Impact on ESAB India | 2024 Relevance |

|---|---|---|

| Specialized Inputs | High supplier leverage | Critical for advanced welding technologies |

| Switching Costs | Strengthens existing supplier positions | Re-tooling and re-qualification are time-consuming and costly |

| Commodity Prices | Potential cost pass-through | Rising metal and chemical prices in 2024 |

| Forward Integration Threat | Generally Low | High capital and technological barriers for suppliers |

What is included in the product

This analysis unpacks the competitive forces impacting ESAB India, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Unlock strategic insights into ESAB India's competitive landscape with a dynamic Porter's Five Forces analysis, allowing for rapid scenario planning and proactive risk mitigation.

Customers Bargaining Power

ESAB India's customer base is largely B2B, with significant demand from sectors like large-scale fabrication, construction, and shipbuilding. These industries frequently involve substantial volume purchases, giving large clients considerable leverage.

While ESAB India doesn't rely on a single dominant customer, the concentration of a few major industrial buyers means their collective purchasing power can significantly influence pricing and terms. For instance, if a few key clients in the shipbuilding sector, which accounted for a notable portion of India's manufacturing output in 2024, decide to consolidate their suppliers or seek bulk discounts, ESAB India would need to respond.

Customers in sectors like construction and general fabrication are often very focused on price, particularly when buying common welding supplies. This is because these industries themselves face significant competition, pushing them to seek cost-effective solutions. In 2023, the construction sector in India saw a growth of approximately 12.1%, highlighting the scale of this price-sensitive market.

The existence of a substantial unorganized sector, which frequently offers lower-priced welding consumables, further amplifies the price sensitivity for ESAB India's offerings. This competitive landscape means that price is a critical factor in purchasing decisions for a significant portion of their potential customer base.

Customers considering welding solutions from ESAB India face a significant number of alternatives. Beyond ESAB's direct competitors offering similar welding equipment and consumables, customers can opt for entirely different joining methods. For instance, mechanical fasteners like bolts and nuts, or adhesives, can serve as substitutes in many assembly applications, particularly where extreme strength or specialized welding expertise isn't paramount.

This availability of substitutes directly amplifies customer bargaining power. When a customer can easily switch to a different joining technology, or even a different welding supplier, ESAB India must remain competitive on price and value. This is especially true for less demanding welding tasks where the technical nuances of ESAB's offerings might be less critical than the overall cost of the solution.

Switching Costs for Customers

Switching costs for customers in the welding industry, including those for ESAB India, can be moderate. While switching between consumable brands like welding electrodes might be a straightforward process, a more significant hurdle arises when customers consider changing their primary welding equipment supplier or adopting entirely new joining technologies. This transition often necessitates substantial capital outlays for new machinery, extensive employee training, and potentially reconfiguring existing production lines. For instance, a company moving from traditional arc welding to advanced laser welding would face considerable upfront costs and a learning curve, making them more inclined to stick with their current, familiar supplier if satisfied.

These switching costs create a degree of customer loyalty or stickiness for established players like ESAB India. The investment in training and equipment integration means that customers are less likely to switch suppliers frequently. This is particularly true for large industrial clients who rely on specialized welding equipment and processes. In 2023, the global welding equipment market was valued at approximately $27.5 billion, with a significant portion driven by industrial applications where such switching costs are more pronounced.

The impact of switching costs can be observed in several ways:

- Customer Retention: Moderate switching costs contribute to higher customer retention rates for ESAB India, as the effort and expense of changing suppliers deter many clients.

- Supplier Lock-in: For customers heavily invested in ESAB's integrated solutions, including consumables, equipment, and support services, switching to a competitor becomes a complex and costly undertaking.

- Competitive Landscape: While moderate, these costs still allow for competition, as new entrants or existing rivals can attract customers by offering superior value propositions, innovative technologies, or significantly lower switching barriers.

- Pricing Power: The presence of switching costs can grant ESAB India some degree of pricing power, as customers may be willing to absorb slightly higher prices rather than incur the costs associated with changing suppliers.

Customer Information and Market Transparency

Customer Information and Market Transparency: The digital age has significantly amplified market transparency. Online platforms and readily available industry reports empower customers with detailed information on pricing, product features, and competitor offerings. This ease of access allows buyers to conduct thorough comparisons, directly influencing their purchasing decisions.

This enhanced transparency directly translates to increased bargaining power for customers. They can readily identify the best deals and terms across the market, putting pressure on suppliers like ESAB India to offer competitive pricing and favorable conditions. For instance, in 2024, online marketplaces for industrial equipment saw a significant surge in user engagement, with many customers leveraging these platforms to negotiate better deals.

- Increased Online Price Comparison: Customers can easily compare pricing for welding consumables and equipment from multiple vendors.

- Access to Detailed Product Specifications: Buyers can scrutinize technical details and performance metrics, leading to more informed choices.

- Growth in Industry Review Platforms: Online reviews and forums provide insights into product quality and supplier reliability, further strengthening customer leverage.

- Negotiation Leverage: Armed with market data, customers are better positioned to negotiate discounts and favorable payment terms with ESAB India.

ESAB India's customer base, primarily B2B, includes large industrial buyers in sectors like fabrication and construction, which are price-sensitive due to their own competitive pressures. The Indian construction sector's 12.1% growth in 2023 underscores the scale of this price-conscious market, where customers often seek cost-effective welding solutions.

The availability of substitutes, both alternative joining methods and lower-priced consumables from the unorganized sector, significantly enhances customer bargaining power. This forces ESAB India to remain competitive on price and value, especially for less demanding applications.

While switching costs for consumables are low, changing core welding equipment or adopting new technologies involves substantial investment in machinery and training. This creates moderate switching costs, fostering customer loyalty but also allowing competitors to attract clients with superior value propositions or lower barriers to entry.

Enhanced market transparency through online platforms empowers customers to compare pricing and product features, increasing their negotiation leverage. In 2024, online industrial equipment marketplaces saw increased user engagement, facilitating better deals for buyers.

| Factor | Impact on ESAB India | Supporting Data (2023-2024) |

|---|---|---|

| Customer Concentration | Moderate, as few large clients can exert influence. | Key industrial sectors drive significant volume purchases. |

| Price Sensitivity | High, especially in construction and general fabrication. | Indian construction sector grew ~12.1% in 2023, indicating price-driven demand. |

| Availability of Substitutes | Increases bargaining power; pressure on pricing. | Unorganized sector offers lower-priced alternatives. |

| Switching Costs | Moderate; creates stickiness but allows for competitive offers. | Global welding equipment market valued at ~$27.5 billion in 2023, with industrial applications dominating. |

| Market Transparency | Amplifies customer power through easy comparison. | Surge in online marketplace engagement in 2024 for industrial equipment. |

What You See Is What You Get

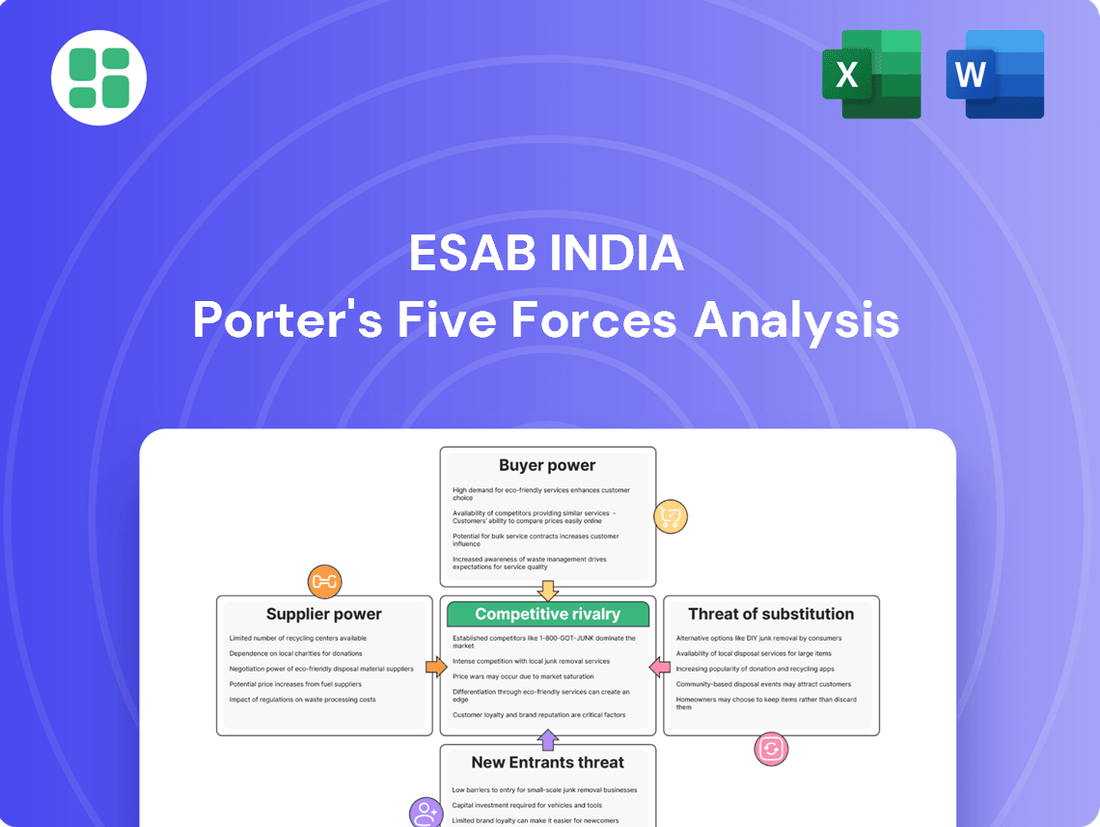

ESAB India Porter's Five Forces Analysis

This preview showcases the complete ESAB India Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the Indian welding and cutting industry. You are viewing the exact, professionally formatted document that will be delivered instantly upon purchase, ensuring you receive a ready-to-use strategic resource without any discrepancies.

Rivalry Among Competitors

The Indian welding and cutting market is quite crowded, with a mix of substantial domestic companies like Ador Welding Limited and major international players such as Lincoln Electric India Pvt. Ltd. and Kemppi India Pvt. Ltd. This competitive landscape is further complicated by a large, less structured sector.

The presence of numerous competitors, including both established brands and a significant unorganized segment that commands an estimated 50-55% market share, fuels intense rivalry. This fragmentation means companies like ESAB India must constantly innovate and compete on price, quality, and service to maintain their market position.

The Indian welding equipment market is expected to see a compound annual growth rate of 4.91% between 2025 and 2033. Welding consumables are projected to grow even faster, at a 6% CAGR over the same period.

This robust growth, fueled by ongoing industrialization and significant infrastructure development across India, is a double-edged sword for competitive rivalry.

While a growing market can absorb more participants and potentially dilute the impact of any single competitor, it also acts as a magnet, attracting new entrants and encouraging existing players to invest more heavily, thus sustaining and even intensifying the competitive landscape.

ESAB India actively differentiates itself by offering a broad spectrum of high-tech welding and cutting gear, alongside consumables and automation systems. Their emphasis on superior quality, cutting-edge technology, and robust service support sets them apart.

However, the market for basic consumables presents a challenge to differentiation, often leading to competition primarily on price. This segment sees intense rivalry where cost-effectiveness is paramount for customers.

The real battle for differentiation is increasingly being fought in the realm of smart welding technologies and advanced automation. Companies are investing heavily in R&D to introduce innovative solutions that improve efficiency and precision, thereby gaining a competitive edge.

Exit Barriers

High exit barriers are a significant factor in the competitive landscape for companies like ESAB India. These barriers, which include substantial investments in specialized manufacturing assets and long-term contractual obligations, make it economically challenging for firms to leave the market, even when profitability is low. This situation can lead to sustained competitive intensity, as companies remain engaged in a battle for market share rather than withdrawing.

The Indian government's 'Make in India' initiative further reinforces these exit barriers. By encouraging domestic production and investment in local manufacturing capabilities, the program makes exiting the market less attractive for both domestic and international players. This policy environment contributes to a market where companies are more inclined to persevere through challenging economic conditions, thereby maintaining a higher level of rivalry.

For instance, the automotive sector in India, a key market for welding and cutting solutions, saw significant capital expenditure in 2023, with many companies investing heavily in new plants and advanced machinery. This trend suggests that companies within ESAB India's operational sphere are likely facing similar high capital investment requirements, which act as a strong deterrent to exit.

- Specialized Assets: Many manufacturing processes require highly specific machinery and technology, making these assets difficult to repurpose or sell at a favorable price if a company decides to exit.

- Long-Term Contracts: Companies often enter into long-term supply or service agreements, which can impose penalties or significant costs if terminated prematurely.

- Capital Investment: The substantial capital outlay required for establishing and maintaining modern manufacturing facilities, particularly in sectors relevant to ESAB India, creates a significant financial hurdle to exiting.

- 'Make in India' Initiative: This government policy promotes local manufacturing, potentially increasing the cost or complexity of exiting by favoring domestic operations and discouraging divestment.

Imports and Unorganized Sector

The substantial import of welding equipment and the pervasive unorganized sector in India create intense competitive rivalry for organized players like ESAB India. These imports, often from countries with lower manufacturing costs, directly challenge domestic pricing structures.

The unorganized sector, characterized by lower operational expenses and less rigorous quality standards, offers significantly cheaper alternatives. This price pressure can erode market share for regulated manufacturers who must adhere to higher production and quality benchmarks.

- Imported Welding Equipment: In 2023, India's imports of welding and cutting equipment saw a notable increase, reflecting global supply dynamics and competitive pricing pressures on domestic manufacturers.

- Unorganized Sector Dominance: While precise figures are elusive, industry estimates suggest the unorganized sector accounts for a significant portion of the Indian welding consumables market, potentially over 40% in certain segments, by volume.

- Price Sensitivity: The unorganized sector's ability to offer products at prices 15-25% lower than organized players directly impacts ESAB India's pricing power and necessitates a focus on value proposition beyond just cost.

- Quality Discrepancies: This competition highlights the challenge for ESAB India in differentiating its high-quality, reliable products against lower-cost, potentially less consistent offerings from the unorganized segment.

The Indian welding market is highly competitive, featuring established domestic and international players alongside a substantial unorganized sector. This fragmentation intensifies rivalry, pushing companies like ESAB India to compete on price, quality, and service. The market's projected growth, with welding equipment expected to grow at 4.91% CAGR and consumables at 6% CAGR from 2025-2033, attracts new entrants and encourages existing ones to invest more, further fueling competition.

| Competitor Type | Market Share (Est.) | Key Competitive Factor |

|---|---|---|

| Organized Domestic (e.g., Ador Welding) | 15-20% | Brand reputation, established distribution |

| Organized International (e.g., Lincoln Electric, Kemppi) | 25-30% | Advanced technology, global R&D |

| Unorganized Sector | 50-55% | Low price, accessibility |

SSubstitutes Threaten

The threat of substitutes for traditional welding, like those ESAB India offers, is growing as alternative joining technologies become more advanced. Mechanical fasteners, adhesives, brazing, soldering, and clinching are increasingly viable for a range of applications, offering distinct advantages. For instance, adhesives can provide excellent vibration damping and sealing properties, while mechanical fasteners are easily disassembled for maintenance.

While welding often provides the highest joint strength, these alternatives can offer compelling benefits that sway customer decisions. Faster assembly times, reduced heat distortion in sensitive materials, and lower labor skill requirements are significant draws. For example, the automotive industry increasingly uses adhesives and clinching to reduce vehicle weight and improve fuel efficiency, with adhesive bonding alone accounting for a significant portion of joining methods in modern car manufacturing.

Adhesives present a significant threat due to their potential cost-effectiveness, often being cheaper than traditional welding methods while delivering comparable joint strength in specific applications. For instance, advancements in structural adhesives in 2024 have seen their adoption increase in automotive and aerospace sectors where weight reduction and vibration dampening are critical, offering a compelling alternative to welding.

Mechanical fasteners, such as bolts and rivets, also pose a threat by offering faster assembly times and the advantage of easy disassembly, which is crucial for maintenance and repair. In 2024, the construction industry, particularly in modular building, has increasingly favored mechanical fastening systems for their speed and labor efficiency compared to on-site welding.

The overall threat of substitutes hinges on their price-performance ratio relative to welding. When substitutes become more cost-efficient or offer superior ease of use for particular tasks, they directly challenge ESAB India's market position in welding solutions.

Customer willingness to switch to alternative welding solutions hinges on tangible benefits like reduced labor costs, accelerated production cycles, or the creation of lighter end products. Industries prioritizing lightweighting, such as the automotive and aerospace sectors, are particularly open to exploring these innovative alternatives.

For instance, in the automotive industry, the drive for fuel efficiency and electric vehicle range directly fuels demand for advanced welding techniques that can reduce vehicle weight. ESAB India's competitors offering solutions that demonstrably contribute to this lightweighting trend will find a more receptive market, especially as regulatory pressures and consumer preferences increasingly favor lighter vehicles.

Technological Advancements in Substitutes

Technological advancements are continuously enhancing the capabilities of substitute joining methods, posing a significant threat. Ongoing research and development in areas like adhesives and advanced fasteners are leading to improved performance and broader applications, directly challenging traditional welding methods.

Innovations such as high-strength structural adhesives and advanced clinching techniques are increasingly capable of replacing welding in specific applications, particularly where weight reduction or dissimilar material joining is critical. For instance, the automotive industry, a major consumer of welding, is seeing a growing adoption of structural adhesives; by 2024, the global automotive adhesives market is projected to reach over $12 billion, indicating a substantial shift.

- Adhesive Strength: Newer adhesives offer tensile strengths that rival some welding processes, making them viable for structural components.

- Fastening Innovation: Advanced mechanical fasteners, like self-piercing rivets and flow-drill screws, provide strong joints without the heat-affected zones associated with welding.

- Material Compatibility: These substitutes often excel at joining dissimilar materials, a challenge for traditional welding.

- Automation Integration: Many new joining technologies are designed for seamless integration with robotic automation, mirroring the efficiency of automated welding systems.

Regulatory and Environmental Considerations

Environmental regulations are increasingly pushing industries towards greener alternatives. For instance, stricter rules on welding fume emissions, like those being considered or implemented in various regions impacting global supply chains in 2024, could make welding less attractive. This could drive adoption of substitutes that produce fewer harmful byproducts.

The push for energy efficiency in manufacturing processes is another significant factor. As energy costs remain a concern for businesses throughout 2024, welding technologies that are perceived as more energy-intensive might face pressure from substitutes offering lower power consumption. This trend aligns with broader sustainability goals across industries.

- Increased regulatory scrutiny on welding emissions: Some countries are tightening limits on particulate matter and volatile organic compounds from welding processes, potentially increasing compliance costs for welders.

- Growing demand for sustainable manufacturing: Companies are actively seeking to reduce their carbon footprint, making energy-efficient joining methods more appealing.

- Potential cost advantages of substitutes: If alternative joining methods become more cost-effective due to technological advancements or reduced regulatory burdens, their threat to traditional welding will rise.

The threat of substitutes for traditional welding is intensifying as advanced joining technologies gain traction. Adhesives, mechanical fasteners, brazing, and soldering offer distinct advantages like reduced heat distortion and easier disassembly, directly challenging welding's dominance in various sectors.

The automotive industry, for example, is increasingly adopting adhesives and clinching to achieve lightweighting goals, with structural adhesives alone representing a significant portion of joining methods in modern car manufacturing. This trend is driven by the pursuit of fuel efficiency and extended electric vehicle range, making alternatives that contribute to weight reduction particularly attractive.

By 2024, the global automotive adhesives market is projected to exceed $12 billion, underscoring the substantial shift towards these substitute technologies. Furthermore, environmental regulations and the drive for energy efficiency in manufacturing are pushing industries towards greener alternatives, potentially making welding less appealing due to emissions and perceived energy intensity.

| Substitute Technology | Key Advantages | Market Trend (2024 Focus) |

|---|---|---|

| Adhesives | Lightweighting, vibration damping, sealing, joining dissimilar materials | Growing adoption in automotive and aerospace for structural components. Global market projected over $12 billion. |

| Mechanical Fasteners (e.g., rivets, screws) | Fast assembly, easy disassembly for maintenance, no heat-affected zones | Increased use in modular construction for speed and labor efficiency. |

| Brazing/Soldering | Joining dissimilar materials, lower temperature than welding | Steady use in electronics and specialized manufacturing where heat sensitivity is key. |

Entrants Threaten

Entering the welding and cutting equipment sector demands significant upfront capital. This includes substantial investment in research and development to innovate, setting up advanced manufacturing plants, and building a robust distribution network. For instance, establishing a new manufacturing facility for specialized welding equipment can easily cost tens of millions of dollars.

These high capital requirements act as a formidable barrier, deterring many potential new entrants. Only firms with considerable financial backing can realistically consider competing with established players like ESAB India, who have already made these substantial investments.

Established players like ESAB India leverage significant economies of scale in manufacturing, raw material sourcing, and distribution networks. This allows them to achieve lower per-unit costs, making it difficult for newcomers to compete on price. For instance, in 2023, ESAB India reported a revenue of INR 1,980 crore, indicating a substantial operational footprint.

New entrants would face considerable challenges in matching these cost efficiencies without substantial upfront investment and a long gestation period to build volume. This experience curve advantage means that ESAB India can absorb price fluctuations and invest more readily in research and development, further widening the gap.

ESAB India benefits from substantial brand loyalty, cultivated over years of operation and a wide array of welding and cutting solutions. This deep-rooted customer trust presents a significant barrier for newcomers aiming to establish a foothold.

New entrants must invest heavily in marketing and product innovation to challenge ESAB India's established reputation. Without compelling differentiation, attracting customers away from a trusted brand like ESAB is a formidable task, impacting their potential market penetration.

Access to Distribution Channels

New companies entering the Indian welding market face a significant challenge in establishing their own distribution channels. Building an extensive and reliable network for welding equipment and consumables across diverse industries in India is a complex and time-consuming endeavor.

Established players like ESAB India have already cultivated deep-rooted relationships with distributors, dealers, and end-users. These existing networks represent a substantial barrier to entry, making it difficult for newcomers to secure market access and reach their target customers effectively.

For instance, as of 2024, the Indian welding consumables market alone is valued at over USD 1.5 billion, with a significant portion dominated by a few key players who leverage their established distribution infrastructure. New entrants must invest heavily in creating parallel networks or securing partnerships, which can be costly and protracted.

- Established Relationships: Incumbents benefit from long-standing partnerships with a wide array of distributors and dealers across India.

- Market Penetration: Existing players have achieved broad market penetration, making it hard for new entrants to gain initial traction.

- Logistical Hurdles: Setting up a comparable logistical and supply chain network requires substantial capital and time investment.

- Customer Loyalty: Brand loyalty and established trust with end-users further solidify the position of incumbents, requiring new entrants to offer compelling value propositions.

Government Policy and Regulations

Government policies significantly shape the threat of new entrants in ESAB India's sector. Initiatives like 'Make in India' aim to boost domestic production, potentially attracting new players. However, these entrants must also contend with stringent quality control measures and environmental regulations, which can be substantial hurdles.

Navigating the complex and often costly regulatory landscape presents a significant barrier. For instance, compliance with Bureau of Indian Standards (BIS) certifications for welding consumables, a key product area for ESAB, requires time and investment. Failure to adhere to these standards can prevent market entry or lead to penalties, thus deterring less prepared new companies.

- Regulatory Hurdles: New entrants face challenges in complying with India's evolving environmental and quality standards, impacting their ability to establish operations.

- Cost of Compliance: Meeting regulatory requirements, such as obtaining necessary certifications and adhering to safety protocols, adds considerable upfront costs for potential new competitors.

- Policy Incentives vs. Restrictions: While government schemes may encourage manufacturing, the simultaneous enforcement of strict regulations can create a dual challenge for new market participants.

The threat of new entrants for ESAB India is moderate, primarily due to high capital requirements, established brand loyalty, and strong distribution networks. While government initiatives might encourage domestic manufacturing, the significant investment needed for R&D, advanced manufacturing, and market penetration acts as a substantial deterrent. Newcomers must overcome these barriers to effectively compete with established players like ESAB India.

| Barrier Type | Impact on New Entrants | Example for ESAB India Context |

|---|---|---|

| Capital Requirements | High | Establishing a new welding equipment plant can cost tens of millions of dollars. |

| Brand Loyalty & Reputation | Significant | Customers trust ESAB India's long-standing presence and product quality. |

| Distribution Networks | Challenging to Replicate | ESAB India's established relationships with dealers and end-users are difficult for newcomers to match. |

| Economies of Scale | Advantageous for Incumbents | ESAB India's large production volumes lead to lower per-unit costs, impacting price competition. |

| Regulatory Compliance | Moderate to High | Meeting BIS certifications and environmental standards adds cost and time for new entrants. |

Porter's Five Forces Analysis Data Sources

Our ESAB India Porter's Five Forces analysis is built upon a robust foundation of data, including the company's annual reports, industry-specific market research from reputable firms, and relevant government and regulatory filings. This comprehensive approach ensures a thorough understanding of the competitive landscape.