Equinix SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equinix Bundle

Equinix's dominance in data center colocation is a clear strength, but understanding the nuances of its competitive landscape and potential market saturation is crucial. Our full SWOT analysis dives deep into these factors, revealing opportunities for expansion and potential threats to its market share.

Want the full story behind Equinix's robust infrastructure, strategic partnerships, and the evolving regulatory environment? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment decisions and strategic planning.

Strengths

Equinix stands as a titan in the digital infrastructure realm, commanding a leading global market share. Its vast network of over 240 data centers spans more than 70 metropolitan areas across the Americas, Europe, and Asia-Pacific, a testament to its extensive reach. This unparalleled global footprint, which saw Equinix invest $2.1 billion in capital expenditures in 2023, enables seamless connectivity for businesses worldwide.

Equinix's core strength is its incredibly dense and varied interconnection ecosystem. This allows businesses, cloud providers, and network services to connect directly and securely, bypassing the public internet for better performance and safety.

This extensive network creates a powerful network effect; as more participants join, the platform becomes even more valuable, reinforcing Equinix's position as a critical hub for digital commerce.

In Q1 2024, Equinix reported a record 400,000+ cross-connects, demonstrating the scale and demand for its direct interconnection services.

Equinix's data centers are strategically placed in key global business and financial centers, acting as vital hubs for data exchange and digital commerce. This prime positioning grants customers unparalleled access to major peering points, financial markets, and concentrated digital service providers, facilitating their worldwide growth and digital transformation efforts.

For instance, Equinix's presence in major financial districts like New York, London, and Tokyo allows financial institutions to connect directly to critical trading platforms and exchanges, reducing latency for high-frequency trading and other time-sensitive operations. As of early 2024, Equinix operates over 240 data centers across more than 70 metropolitan areas, reinforcing its commitment to providing proximity to users and digital ecosystems.

This network of strategically located facilities is a significant competitive advantage, enabling Equinix to offer low-latency access to a vast array of digital ecosystems. In 2023, the company reported that over 95% of its revenue was generated from customers in its top 26 markets, underscoring the importance of these strategically chosen locations.

High Recurring Revenue and Customer Retention

Equinix thrives on a business model built around high recurring revenue, primarily from its long-term colocation and interconnection service contracts. This consistent income stream offers significant financial stability and a clear outlook on future earnings. For instance, in Q1 2024, Equinix reported a 9% year-over-year increase in revenue, reaching $2.2 billion, showcasing the strength of its recurring revenue model.

Customer retention is a key strength, with Equinix boasting industry-leading retention rates. The critical nature of its data center services, which house essential IT infrastructure, makes it difficult and costly for clients to switch providers. This sticky customer base is a testament to the value and reliability Equinix delivers, ensuring a predictable and growing revenue base.

- Recurring Revenue: Equinix's business model is heavily reliant on recurring revenue from long-term contracts, offering financial predictability.

- High Customer Retention: The mission-critical nature of its services fosters strong customer loyalty and low churn rates.

- Financial Stability: The combination of recurring revenue and high retention provides a stable financial foundation for growth and investment.

- Predictable Growth: This model allows for reliable forecasting and a consistent expansion of its service offerings and global footprint.

Foundation for Hybrid Multicloud and Digital Transformation

Platform Equinix serves as a critical enabler for businesses pursuing hybrid multicloud and digital transformation initiatives. Its architecture facilitates direct, secure, and low-latency connections to a vast ecosystem of cloud providers and digital services, allowing companies to build and manage sophisticated IT environments. This capability is essential for optimizing cloud performance and ensuring seamless integration across diverse digital platforms.

Equinix's strength lies in its ability to aggregate demand for digital infrastructure, making it a central hub for enterprise connectivity. This network effect is particularly valuable as organizations increasingly rely on multiple cloud providers and specialized digital services to drive innovation and efficiency. For instance, Equinix's global footprint and interconnection services are vital for companies looking to deploy edge computing solutions, a key trend in 2024 and beyond.

- Global Connectivity: Equinix operates over 240 data centers across more than 70 metropolitan areas worldwide, offering unparalleled reach for digital transformation.

- Interconnection Ecosystem: The platform hosts over 10,000 enterprises, including more than 50% of the Fortune 500, and over 2,900 cloud and IT service providers.

- Hybrid Cloud Enablement: Equinix facilitates direct connections to major cloud providers like AWS, Azure, and Google Cloud, simplifying hybrid and multicloud strategies.

Equinix's robust recurring revenue model, driven by long-term colocation and interconnection contracts, provides significant financial stability and predictable earnings. This is further bolstered by exceptionally high customer retention rates, as the mission-critical nature of its services makes switching providers costly and complex. The company's financial performance in Q1 2024, with a 9% year-over-year revenue increase to $2.2 billion, underscores the strength of this recurring revenue stream and customer loyalty.

Equinix's extensive global footprint, encompassing over 240 data centers in more than 70 metropolitan areas, is a primary strength, enabling unparalleled connectivity and access to digital ecosystems. This vast network, supported by $2.1 billion in capital expenditures in 2023, facilitates direct, low-latency connections for businesses worldwide. The strategic placement of these facilities in key business hubs ensures proximity to critical peering points and financial markets, a crucial advantage for digital commerce and transformation.

The company's dense interconnection ecosystem is a significant competitive differentiator, allowing over 10,000 enterprises, including more than half of the Fortune 500, to connect directly with nearly 3,000 cloud and IT service providers. This aggregation of digital infrastructure creates a powerful network effect, enhancing the value of Platform Equinix for businesses pursuing hybrid multicloud strategies and edge computing deployments, key trends throughout 2024.

| Key Strength | Description | Supporting Data (2023/Q1 2024) |

| Global Footprint | Vast network of data centers in key metropolitan areas worldwide. | Over 240 data centers; 70+ metropolitan areas; $2.1B CapEx in 2023. |

| Interconnection Ecosystem | Dense network of direct connections between businesses, cloud providers, and networks. | 10,000+ enterprises; 2,900+ cloud/IT providers; 400,000+ cross-connects (Q1 2024). |

| Recurring Revenue Model | High reliance on long-term contracts for colocation and interconnection services. | 9% YoY revenue growth to $2.2B (Q1 2024); 95%+ revenue from top 26 markets (2023). |

| Customer Retention | Mission-critical services lead to strong customer loyalty and low churn. | Industry-leading retention rates (specific percentage not publicly disclosed but implied by financial stability). |

What is included in the product

Analyzes Equinix’s competitive position through key internal and external factors, examining its market leadership and potential challenges.

Offers a clear framework to identify and address Equinix's competitive vulnerabilities and market challenges.

Weaknesses

Equinix faces significant financial strain due to its high capital expenditure needs. Building and maintaining its global data center footprint demands massive upfront investment in land acquisition, construction, and cutting-edge technology. For instance, in Q1 2024, Equinix reported capital expenditures of $760 million, a substantial amount reflecting ongoing development and expansion projects.

This continuous need for capital can constrain free cash flow, often requiring Equinix to rely on debt or equity financing to fuel its growth. The company's commitment to staying at the forefront of technology and expanding its capacity means these substantial investments are not a one-time event but an ongoing financial obligation.

As a Real Estate Investment Trust, Equinix faces inherent risks tied to the real estate market. This includes potential impacts from fluctuating property values, rising property taxes, and challenges in securing prime locations for its data centers. For instance, in 2024, property taxes for large commercial real estate holdings saw an average increase of 4.5% across major U.S. markets, directly affecting Equinix's operational expenses.

Equinix's substantial electricity consumption makes it highly susceptible to energy price volatility. Data centers are power-intensive operations, and any significant shifts in electricity costs can directly impact profitability. In 2025, wholesale electricity prices in key regions where Equinix operates are projected to remain elevated due to increased demand and ongoing grid modernization efforts, presenting a continuous cost management challenge.

Equinix contends with formidable competition, not just from established colocation rivals but also from hyperscale cloud giants like AWS, Azure, and Google Cloud, who are expanding their own vast data center footprints. This landscape is further complicated by the potential for new, specialized providers to disrupt market segments with tailored offerings.

The increasing self-sufficiency of hyperscalers in data center infrastructure poses a direct challenge, as they can offer integrated solutions that bypass traditional colocation services. For instance, in 2024, hyperscalers continued to be the primary drivers of new data center construction, capturing a significant portion of the demand for large-scale deployments.

Emerging niche players also present a threat by focusing on specific services or geographic regions, potentially fragmenting the market and requiring Equinix to constantly innovate and adapt its value proposition to maintain its leading position.

Vulnerability to Technological Obsolescence and Disruption

The relentless speed of technological advancement in the IT and data center sector presents a significant challenge for Equinix. Failure to consistently innovate and upgrade its infrastructure risks rendering its current assets obsolete. For instance, the emergence of advanced liquid cooling systems or novel energy-efficient power management solutions could disrupt established operational paradigms. Equinix's ability to maintain its competitive edge hinges on substantial research and development outlays and a highly adaptable operational strategy.

Equinix faces the inherent weakness of potential technological obsolescence. The IT landscape evolves at an extraordinary pace, meaning that the very infrastructure Equinix builds today could be surpassed by newer, more efficient technologies tomorrow. This necessitates continuous investment in R&D and a proactive approach to upgrading facilities. For example, advancements in AI-driven cooling or next-generation network fabrics could render existing Equinix deployments less competitive if not addressed promptly.

- Technological Obsolescence: The rapid evolution of IT infrastructure, including cooling, power, and networking, poses a risk if Equinix does not continuously invest in upgrades.

- Disruptive Technologies: Emerging innovations like advanced liquid cooling or new network architectures could disrupt Equinix's current operational models.

- R&D Investment: Staying ahead requires significant and ongoing investment in research and development to anticipate and adopt new technologies.

- Agile Adaptation: Equinix must maintain agility to quickly integrate new technological solutions and adapt its strategies to market shifts.

Reliance on Network and Power Infrastructure Uptime

Equinix's fundamental business model hinges on uninterrupted network and power availability, a critical dependency. Any lapse in these services, whether from internal issues, external threats like cyberattacks, or environmental events, poses a significant risk. For instance, in 2023, data center outages, though often localized, can cost businesses millions per hour in lost revenue and productivity, directly impacting Equinix's reliability perception.

The company's reputation and customer loyalty are directly tied to its uptime guarantees, often backed by stringent Service Level Agreements (SLAs). Failure to meet these can trigger substantial financial penalties and accelerate customer migration to competitors. Equinix's commitment to operational resilience is therefore not just a technical challenge but a core strategic imperative to safeguard its market position.

- High Uptime Dependency: Equinix's value proposition is built on near-perfect uptime for power and network connectivity.

- Reputational Risk: Service disruptions can severely damage customer trust and lead to churn.

- Financial Penalties: SLA breaches can result in significant financial liabilities for Equinix.

Equinix's reliance on debt financing to fund its aggressive expansion presents a significant weakness. High leverage increases financial risk, especially in a rising interest rate environment. For example, as of Q1 2024, Equinix's total debt stood at approximately $19.8 billion, highlighting its substantial borrowing. This debt burden can limit future investment flexibility and impact profitability through increased interest expenses.

The company's substantial capital expenditure requirements, while driving growth, also create a continuous need for funding. This can lead to dilution for existing shareholders if equity financing is pursued. In 2024, Equinix planned capital expenditures of $4.5 billion to $5.0 billion, underscoring the ongoing demand for capital to support its global build-out.

Equinix operates in a highly capital-intensive industry. The sheer scale of investment required for land acquisition, construction, and technology upgrades means that even minor operational inefficiencies can have a magnified impact on financial performance. This makes efficient capital allocation paramount.

Equinix faces intense competition from both established players and hyperscale cloud providers who are increasingly building their own infrastructure. This competitive pressure can limit pricing power and necessitate aggressive investment to maintain market share, potentially squeezing margins. For instance, hyperscalers like Amazon Web Services (AWS) and Microsoft Azure are significant customers but also potential competitors as they expand their own data center capabilities.

| Metric | Value (Q1 2024) | Trend/Implication |

|---|---|---|

| Total Debt | ~$19.8 billion | High leverage increases financial risk and interest expense. |

| Capital Expenditures | $760 million (Q1 2024) | Ongoing need for significant funding, potentially impacting free cash flow. |

| Planned CapEx (2024) | $4.5 billion - $5.0 billion | Continuous investment required for growth, necessitating careful financial management. |

Full Version Awaits

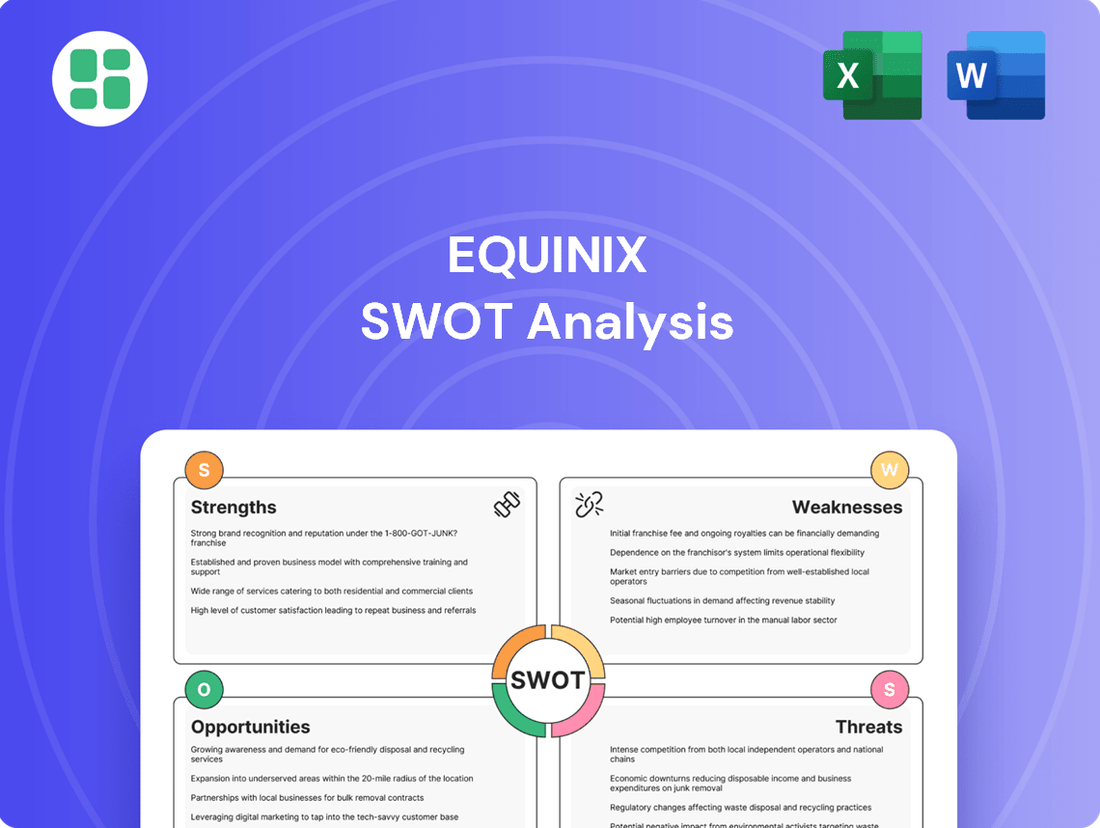

Equinix SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Equinix's Strengths, Weaknesses, Opportunities, and Threats, meticulously researched for accuracy and actionable insights.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering detailed explanations and strategic recommendations derived from this analysis.

Opportunities

Equinix can capitalize on the burgeoning demand for digital infrastructure in emerging markets, where connectivity needs are rapidly expanding. For instance, regions in Southeast Asia and Latin America are experiencing significant digital transformation, presenting fertile ground for Equinix's colocation and interconnection services.

The growth of edge computing, fueled by the proliferation of IoT devices, AI applications, and the rollout of 5G networks, offers a substantial opportunity. Equinix's strategy to deploy smaller, distributed data centers closer to end-users and data sources aligns perfectly with this trend, potentially opening up new revenue streams and strengthening its market position.

The rapid growth of Artificial Intelligence (AI) and Machine Learning (ML) is a significant opportunity. These technologies require substantial computing power, driving demand for specialized data center infrastructure. Equinix's ability to offer high-density and liquid-cooled solutions directly addresses this need.

Equinix is strategically positioned to benefit from this trend. Their global footprint and expertise in providing robust data center environments are ideal for supporting the intensive power and cooling demands of AI and high-performance computing (HPC). By focusing on these specialized services, Equinix can attract high-value clients.

For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to grow substantially, with some estimates suggesting it could reach over $1.8 trillion by 2030. This surge in AI adoption directly translates into increased demand for the kind of advanced data center capacity Equinix provides.

Enterprises are increasingly adopting hybrid multicloud strategies, creating a significant demand for robust interconnection solutions. This trend is fueling the need for seamless connectivity between diverse cloud providers, on-premises data centers, and various SaaS applications. Equinix's global platform, designed as a digital nexus, is perfectly positioned to capitalize on this growing requirement.

The complexity of these hybrid environments necessitates secure, low-latency connections, which are core to Equinix's service offerings. As organizations expand their digital footprints, the reliance on Equinix's interconnection fabric for managing these intricate architectures is expected to grow substantially. This directly translates into increased demand for Equinix's foundational interconnection services.

Strategic Partnerships and Acquisitions

Equinix can significantly boost its market presence and service portfolio through strategic alliances with major cloud players like Amazon Web Services, Microsoft Azure, and Google Cloud, alongside network providers and technology innovators. This collaborative approach allows Equinix to tap into new markets and offer more integrated solutions.

Furthermore, acquiring smaller data center firms or companies with niche technologies presents a clear opportunity for Equinix to rapidly expand its geographic footprint, gain specialized expertise, or strengthen its competitive standing in critical markets. For instance, in 2023, Equinix continued its global expansion, opening new International Business Exchange IBX data centers in markets like Madrid and Jakarta, demonstrating a commitment to strategic growth through physical expansion, which can be complemented by M&A.

- Strategic Partnerships: Collaborations with hyperscalers and network providers to expand service offerings and market reach.

- Acquisitions: Targeted M&A to gain new capabilities, enter new markets, or consolidate market position.

- Market Consolidation: Acquisitions can accelerate growth and enhance Equinix's leading position in the global data center market.

Leveraging Sustainability and Green Initiatives

The growing global emphasis on environmental responsibility presents a significant opportunity for Equinix to enhance its market position. By continuing to invest in and actively promote sustainable data center operations, such as expanding renewable energy sourcing and implementing cutting-edge energy-efficient designs, Equinix can further distinguish itself from competitors. This commitment to sustainability aligns with increasing customer and investor demand for strong Environmental, Social, and Governance (ESG) performance, potentially boosting brand reputation and unlocking long-term operational cost efficiencies.

Equinix's proactive approach to sustainability is already yielding tangible results. As of early 2024, the company has achieved 100% renewable energy for its global operations, a significant milestone. This commitment not only appeals to a growing segment of environmentally conscious customers but also positions Equinix favorably for future regulatory landscapes and investor preferences.

Further opportunities lie in:

- Expanding Green Building Certifications: Pursuing and highlighting certifications like LEED Platinum for new and existing facilities can solidify Equinix's leadership in sustainable infrastructure.

- Developing Circular Economy Practices: Implementing robust programs for equipment reuse and recycling can reduce waste and create new revenue streams.

- Investing in Innovative Cooling Technologies: Exploring and deploying advanced cooling solutions, such as liquid cooling, can significantly improve energy efficiency and reduce water consumption.

- Transparent ESG Reporting: Continuing to provide detailed and transparent reporting on ESG metrics will build trust and attract stakeholders aligned with sustainable business practices.

The ongoing digital transformation across emerging markets presents a substantial avenue for Equinix's expansion. Regions like Southeast Asia and Latin America are witnessing accelerated adoption of digital services, driving demand for robust colocation and interconnection infrastructure. This trend is expected to continue growing through 2025 as digital economies mature.

The accelerating adoption of AI and high-performance computing (HPC) is a significant growth driver. These technologies demand immense processing power and specialized cooling solutions, areas where Equinix is investing. The global AI market, valued at over $200 billion in 2023, is projected for exponential growth, directly translating into increased demand for Equinix's advanced data center capabilities.

Equinix's strategic focus on enabling hybrid multicloud architectures positions it to benefit from increasing enterprise reliance on interconnected digital ecosystems. The demand for seamless, low-latency connectivity between diverse cloud environments and on-premises infrastructure is a core strength for Equinix's global platform. By 2025, the complexity of these hybrid strategies will further necessitate Equinix's interconnection fabric.

Strategic partnerships with hyperscalers and technology innovators remain a key opportunity. Collaborative efforts expand Equinix's service offerings and market reach. Furthermore, targeted acquisitions of smaller data center operators or those with niche technologies can accelerate geographic expansion and bolster competitive standing. For instance, Equinix's continued global build-out, including new IBX data centers in 2023 and planned expansions through 2025, underscores this growth strategy.

| Opportunity Area | Description | Projected Impact (2025) |

|---|---|---|

| Emerging Markets Digitalization | Increased demand for digital infrastructure in regions like Southeast Asia and Latin America. | Significant revenue growth from new market penetration. |

| AI & HPC Demand | Need for high-density, specialized data center solutions to support AI/ML workloads. | Higher average revenue per cabinet due to specialized infrastructure requirements. |

| Hybrid Multicloud Enablement | Growing enterprise adoption of hybrid multicloud strategies requiring robust interconnection. | Increased utilization of Equinix's interconnection services and digital exchange platform. |

| Strategic Alliances & M&A | Collaborations with hyperscalers and acquisitions to expand capabilities and market share. | Accelerated market expansion and enhanced competitive positioning. |

Threats

The data center landscape is certainly getting crowded. We're seeing a surge of new companies entering the market, while established players are aggressively expanding their footprints. This means more options for customers, and for companies like Equinix, it translates directly into tougher competition.

Adding to this, the big hyperscale cloud providers, like Amazon Web Services, Microsoft Azure, and Google Cloud, are increasingly building their own massive data centers. While they still rely on colocation for certain needs, this trend could mean they need less third-party space over time, which could impact demand for Equinix's core services.

All this competition naturally leads to pricing pressure. For standard colocation offerings, margins could shrink. Equinix will need to keep innovating and offering more advanced, value-added services to stand out and maintain profitability in this environment.

Global economic headwinds, including the potential for recessions and persistent inflation, pose a significant threat to Equinix. These conditions often prompt businesses to curb their IT budgets, directly impacting demand for data center services.

A slowdown in enterprise capital expenditure could reduce Equinix's revenue growth and potentially lower occupancy rates in its facilities. For instance, if major clients delay or scale back their digital transformation projects, this directly translates to less demand for colocation space and interconnection services.

Historical data shows that IT spending is highly cyclical. During economic downturns, companies tend to prioritize essential operational costs over new technology investments, which can significantly affect Equinix's sales pipeline and existing contract renewals.

The increasing complexity of global data privacy regulations, such as GDPR and CCPA, presents a significant challenge for Equinix. These laws, and emerging data sovereignty mandates in countries like China and India, dictate strict rules on data storage and processing locations. For instance, the European Union's GDPR, implemented in 2018, has set a precedent for stringent data protection requirements worldwide.

Compliance with these diverse and evolving regulations may necessitate substantial investments in new data center infrastructure or costly adaptations to existing facilities to meet specific local data residency requirements. This could lead to increased operational complexity and higher capital expenditures, impacting Equinix's cost structure and strategic expansion plans.

Failure to adhere to these data governance frameworks can result in severe financial penalties. For example, GDPR violations can incur fines of up to 4% of annual global turnover or €20 million, whichever is greater, underscoring the critical importance of robust compliance strategies for Equinix.

Cybersecurity Risks and Data Breaches

As a critical nexus for global data traffic, Equinix faces significant cybersecurity risks. A successful cyberattack, particularly a ransomware event or a major data breach, could cripple its operations and compromise sensitive client information. For instance, in 2023, the cybersecurity landscape saw a surge in attacks targeting critical infrastructure, with the average cost of a data breach reaching $4.45 million globally, according to IBM's 2023 Cost of a Data Breach Report. Equinix's reliance on interconnected systems makes it a prime target for sophisticated threat actors.

The potential fallout from a security incident is immense. A breach could not only lead to substantial financial penalties and legal liabilities but also erode the trust of its extensive customer base, which includes major cloud providers and enterprises. The ongoing investment in advanced security measures, including AI-driven threat detection and zero-trust architecture, is crucial but represents a continuous and escalating operational cost. Equinix's commitment to maintaining the highest security standards is paramount to its continued success and market position.

Equinix's operational model, which involves managing vast amounts of data for numerous clients, inherently magnifies the impact of any security lapse. The company must constantly adapt its defenses against evolving cyber threats, which is a complex and resource-intensive undertaking. The increasing sophistication of state-sponsored attacks and organized cybercrime groups presents a persistent challenge, requiring continuous vigilance and significant capital expenditure to safeguard its infrastructure and client data.

Technological Disruption from Emerging Technologies

Technological disruption remains a significant threat for Equinix. Emerging technologies like advanced AI, quantum computing, and novel network architectures could fundamentally change how data is stored and accessed, potentially reducing reliance on traditional colocation services. For instance, the continued development of edge computing, which brings processing closer to the data source, might alter the demand for centralized data centers.

The company faces the risk that disruptive innovations could render its current infrastructure and business model less relevant. A prime example is the potential for highly efficient distributed ledger technologies to decentralize data management, bypassing the need for centralized interconnection points. Equinix's ability to adapt and integrate these new paradigms will be crucial for its long-term viability.

To mitigate this, Equinix is investing heavily in innovation, aiming to leverage new technologies rather than be replaced by them. However, the pace of technological advancement is relentless, and unforeseen breakthroughs could still pose a significant challenge. For example, advancements in optical networking could drastically increase data transfer speeds, potentially impacting the value proposition of physical interconnection hubs if not proactively addressed.

- Quantum Computing Impact: While still in early stages, quantum computing could eventually disrupt current encryption and network security, necessitating new infrastructure solutions.

- Edge Computing Evolution: The ongoing growth of edge computing may shift demand away from large, centralized data centers towards smaller, distributed facilities.

- Network Architecture Changes: Innovations in software-defined networking (SDN) and network function virtualization (NFV) could lead to more flexible and potentially less hardware-dependent interconnection models.

The increasing competition from both new entrants and hyperscale cloud providers building their own facilities puts pressure on Equinix's market share and pricing power. This intensified competition, coupled with global economic headwinds like inflation and potential recessions, could lead to reduced IT spending by businesses, directly impacting Equinix's revenue growth and occupancy rates.

Navigating complex and evolving global data privacy regulations, such as GDPR, requires significant investment and operational adaptation, posing a risk of substantial financial penalties for non-compliance. Furthermore, Equinix faces substantial cybersecurity risks, as a successful breach could lead to severe financial and reputational damage, impacting client trust and increasing operational costs for enhanced security measures.

Technological disruption from advancements like quantum computing and edge computing presents a threat to Equinix's existing business model, potentially reducing reliance on traditional colocation services. The company must continuously innovate and adapt to new technological paradigms to maintain its relevance and competitive edge in a rapidly evolving digital landscape.

SWOT Analysis Data Sources

This Equinix SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market intelligence, and expert industry forecasts. These sources provide the data-driven insights necessary for a thorough and accurate strategic assessment.