Equinix Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equinix Bundle

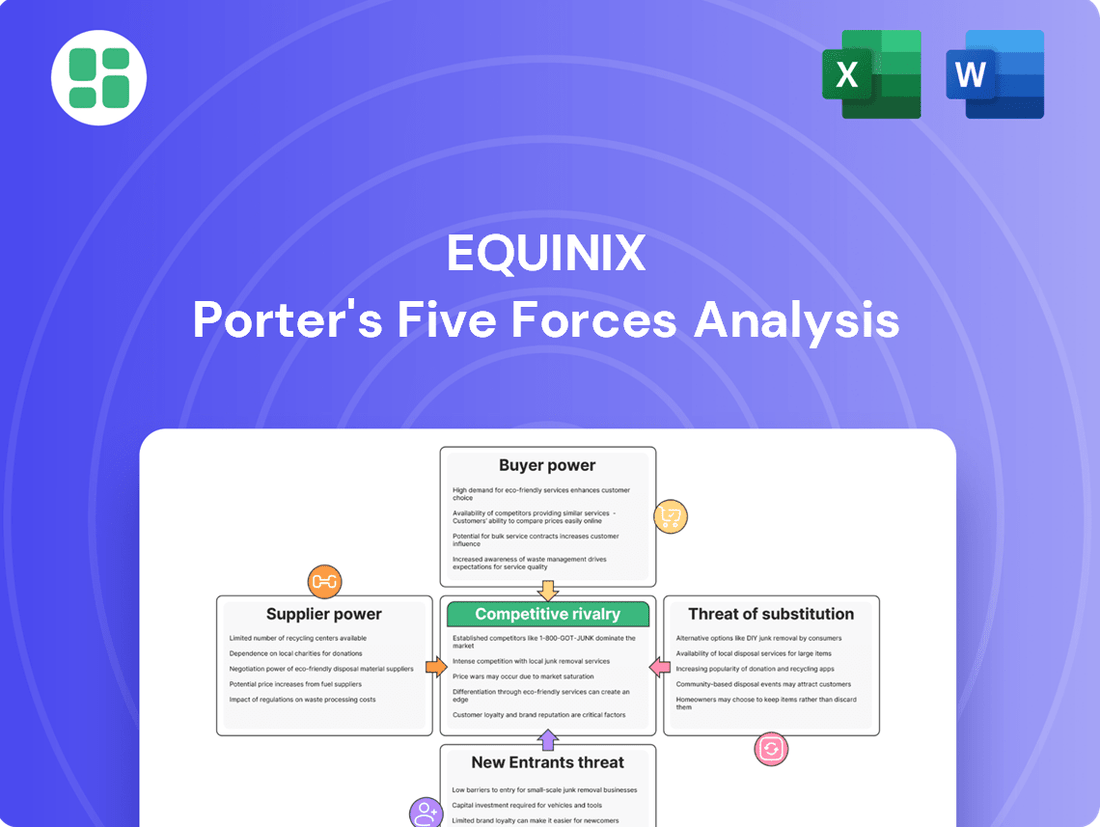

Equinix operates in a dynamic digital infrastructure landscape, facing intense competition and evolving customer demands. Understanding the interplay of these forces is crucial for navigating its market. Our analysis unpacks the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry within the data center and interconnection services sector.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Equinix’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Equinix's reliance on specialized suppliers for critical infrastructure, such as high-capacity power and advanced cooling systems, can create leverage for those suppliers. If only a few companies can provide these essential components, their bargaining power increases significantly.

The availability of prime real estate in key metropolitan areas, coupled with the need for substantial power infrastructure, also concentrates bargaining power with landowners and utility providers. For example, securing sites with direct fiber connectivity and robust electrical grids in major tech hubs like Northern Virginia or Silicon Valley can be highly competitive, giving these suppliers considerable influence.

Switching core suppliers for infrastructure components or utility providers can involve substantial costs and operational disruptions for Equinix. For instance, integrating new cooling systems or altering power grid dependencies in an existing data center facility is a complex and costly undertaking.

This inherent difficulty in changing fundamental operational elements grants established suppliers significant leverage, particularly when long-term contracts are in place. These contracts often lock in pricing and service levels, making it financially prohibitive for Equinix to seek alternative providers in the short to medium term.

The bargaining power of suppliers for Equinix is significantly influenced by the critical nature of their inputs, especially as demand for high-density AI workloads escalates. Suppliers of advanced power solutions and specialized cooling systems are becoming increasingly vital. For instance, the global data center cooling market was valued at approximately $7.5 billion in 2023 and is projected to grow substantially, indicating a rising demand for these specialized technologies.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into data center operations, like Equinix, is generally low. While a large utility or real estate firm could theoretically enter the market, the immense specialized knowledge, global presence, and established interconnection networks are significant barriers. Equinix's own robust supplier relationships, built on structured procurement, further diminish this risk.

For instance, the capital expenditure for building and operating a hyperscale data center is substantial, often running into hundreds of millions of dollars. Suppliers would need to replicate Equinix's extensive global footprint, which in 2024 spans over 250 markets across more than 30 countries, to pose a credible threat. This level of investment and operational complexity makes direct competition via forward integration a highly unlikely strategy for most suppliers.

Key deterrents for suppliers considering forward integration include:

- Specialized Expertise: Data center operations require deep technical knowledge in areas like power management, cooling, and network infrastructure.

- Global Footprint: Replicating Equinix's vast international presence and market penetration is a significant hurdle.

- Interconnection Ecosystem: The value of Equinix lies in its dense network of interconnected businesses, which is difficult for new entrants to build.

- Capital Intensity: The enormous upfront investment needed for data center development and maintenance deters many potential entrants.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences supplier power in the data center industry. For general components, a wide array of alternative technologies and suppliers can exist, thereby reducing the leverage any single supplier holds. For instance, standard server racks or basic networking cables often have numerous manufacturers, making it difficult for any one to command excessive prices.

However, this dynamic shifts when specialized components are required. For highly advanced needs, such as cutting-edge liquid cooling systems essential for AI workloads or specific, high-capacity network hardware, the pool of viable suppliers becomes considerably smaller. This scarcity grants these niche providers greater bargaining power. For example, as of early 2024, the demand for advanced cooling solutions for AI infrastructure has outstripped supply for some specialized providers, leading to longer lead times and increased costs for data center operators.

Furthermore, the industry's increasing focus on sustainability is creating new power dynamics. The growing demand for green energy solutions, such as renewable energy procurement and advanced energy efficiency technologies, can empower providers in this specific sector. Companies that can offer verifiable green energy solutions, like direct solar or wind power purchase agreements, may find themselves in a stronger negotiating position with data center operators aiming to meet ESG (Environmental, Social, and Governance) targets.

- Limited Substitutes for Specialized AI Hardware: The scarcity of providers for advanced AI-specific server components and cooling systems in 2024 grants these suppliers significant pricing power.

- Growing Influence of Green Energy Providers: As data centers prioritize sustainability, companies offering certified renewable energy solutions are gaining leverage, impacting procurement strategies.

- Impact on Operational Costs: The availability or lack thereof of substitute inputs directly affects the capital expenditure and ongoing operational costs for data center infrastructure.

The bargaining power of suppliers for Equinix is moderate but can be high for specialized components. Suppliers of critical infrastructure like high-capacity power and advanced cooling systems hold significant leverage due to the limited number of providers and the essential nature of their offerings. For instance, the global data center cooling market was valued at approximately $7.5 billion in 2023, with specialized solutions for AI workloads seeing increased demand and pricing power for their providers.

Switching costs for core infrastructure and utility providers are substantial, further strengthening supplier positions. Integrating new cooling systems or altering power grid dependencies in existing facilities involves considerable expense and operational disruption. This makes it financially unfeasible for Equinix to change fundamental operational elements in the short to medium term, especially under long-term contracts.

The availability of substitutes is generally low for specialized inputs crucial for advanced data center operations, particularly those supporting AI workloads as of early 2024. This scarcity grants niche providers greater negotiating power, leading to longer lead times and increased costs. Conversely, for more general components, a wider array of suppliers exists, reducing individual supplier leverage.

The growing industry focus on sustainability is also shifting power dynamics, empowering providers of certified green energy solutions. Companies offering verifiable renewable energy procurement, such as direct solar or wind power purchase agreements, are gaining leverage as data center operators strive to meet ESG targets.

| Component Category | Supplier Bargaining Power | Key Factors | 2024 Data Point/Trend |

|---|---|---|---|

| Specialized Power Solutions (e.g., high-density AI power) | High | Limited providers, critical for AI, high switching costs | Increased demand for AI driving higher costs for specialized power components. |

| Advanced Cooling Systems (e.g., liquid cooling) | High | Niche technology, essential for AI, long lead times | Global data center cooling market ~ $7.5 billion in 2023; specialized AI cooling in high demand. |

| General IT Hardware (e.g., racks, cables) | Low to Moderate | Many suppliers, readily available substitutes | Competitive pricing due to a broad supplier base. |

| Utility Providers (Power, Fiber) | Moderate to High | Location-dependent, critical infrastructure, high switching costs | Securing prime locations with robust power and fiber in tech hubs remains competitive. |

| Green Energy Solutions | Moderate to High | Growing ESG focus, verifiable renewable sources | Increased negotiation leverage for providers of certified renewable energy PPAs. |

What is included in the product

This analysis unpacks the competitive forces shaping Equinix's data center and interconnection business, revealing the intensity of rivalry, the power of buyers and suppliers, and the barriers to entry and substitutes.

Effortlessly identify and quantify competitive threats with a visual, data-driven analysis, simplifying complex market dynamics.

Customers Bargaining Power

Equinix's broad customer base, encompassing enterprises, cloud giants, and network providers, generally dilutes individual customer leverage. However, the sheer volume demanded by major hyperscale cloud providers or large enterprise clients can grant them increased bargaining power.

Equinix's Q2 2025 earnings highlighted robust customer activity, with numerous transactions involving thousands of clients, indicating a healthy demand across its platform.

Customers face substantial hurdles when considering a move away from Equinix's data centers. These switching costs involve the complex and risky process of relocating physical IT equipment, meticulously re-establishing all network links, and managing the potential for service interruptions during the transition. For instance, a single migration can involve hundreds of servers and networking devices, each requiring careful planning and execution.

Equinix's vast interconnection fabric significantly amplifies these switching costs. By offering direct, low-latency access to over 3,000 networks and more than 2,000 cloud on-ramps, customers have built intricate dependencies within the Equinix ecosystem. Severing these established connections and rebuilding them elsewhere represents a considerable investment of time, resources, and potential performance degradation.

Customer price sensitivity for Equinix is moderated by the critical nature of its services. While businesses always look for value, the need for secure, reliable, and low-latency data center solutions often makes price a secondary consideration. For instance, companies relying on real-time trading or critical cloud applications cannot afford downtime or performance degradation, making Equinix’s robust infrastructure a non-negotiable requirement.

The evolving landscape, particularly the surge in AI and hybrid cloud adoption, further diminishes the impact of pure price sensitivity. Equinix’s extensive global network and specialized AI-ready infrastructure offer unique advantages that are difficult to replicate on cost alone. In 2024, the demand for high-density compute power and direct cloud connectivity, areas where Equinix excels, is projected to grow significantly, reinforcing the value proposition beyond mere price points.

Customer Ability to Backward Integrate

Large enterprises and hyperscale cloud providers possess the financial clout and technical wherewithal to construct and manage their own data centers, a move known as backward integration. However, this path demands significant capital outlay, specialized knowledge, and considerable time. For instance, building a hyperscale data center can cost hundreds of millions of dollars, a figure that underscores the substantial barrier to entry.

Equinix's colocation and interconnection services present a compelling alternative, offering greater agility and immediate access to a global network and diverse digital ecosystems. This makes it a more appealing strategy for many businesses, especially those prioritizing rapid expansion and broad connectivity.

- High Capital Investment: Building a new data center facility can cost upwards of $100 million to $500 million or more, depending on scale and location.

- Specialized Expertise Required: Operating a data center demands in-depth knowledge in areas like power management, cooling systems, network engineering, and physical security.

- Time to Market: The process from site selection and construction to operational readiness can take 18-36 months or longer.

- Ecosystem Access: Equinix provides access to over 3000 customers, including more than 2200 networks and 3000 cloud and IT service providers, a diverse ecosystem difficult to replicate independently.

Availability of Alternative Providers

The availability of alternative providers significantly influences customer bargaining power. Equinix customers can opt for other colocation providers like Digital Realty and CoreSite, or shift to public cloud services from AWS, Azure, or Google Cloud. Many also maintain on-premise infrastructure, presenting another choice.

Equinix counters this by offering a unique value proposition. Its extensive global footprint, with data centers in over 70 markets worldwide, provides a reach few competitors can match. This global presence is a key differentiator, especially for multinational corporations.

- Global Reach: Equinix operates in over 70 markets across 32 countries, offering a significant advantage for businesses with international operations.

- Interconnection Ecosystem: Equinix boasts the largest interconnection ecosystem, enabling customers to connect with over 10,000 businesses, including more than 3,000 cloud providers and networks.

- Carrier-Neutrality: Equinix's carrier-neutral policy allows customers to choose from a wide range of network providers, fostering competition and potentially lowering costs.

While individual customers have limited sway due to Equinix's vast client base, large hyperscale providers can exert influence through their significant demand. However, the substantial costs and complexities associated with migrating Equinix's intricate interconnection fabric and physical IT infrastructure significantly deter customers from switching, effectively lowering their bargaining power.

Customer price sensitivity is tempered by the essential nature of Equinix's reliable and low-latency services, especially with the growing demand for AI infrastructure in 2024. The prohibitive capital expense and lengthy timelines for building equivalent data centers, often exceeding $100 million and 18-36 months, further reduce the threat of backward integration and thus customer leverage.

| Factor | Equinix's Position | Customer Bargaining Power Impact |

|---|---|---|

| Switching Costs | Extremely High due to complex ecosystem and physical migration | Low |

| Price Sensitivity | Moderate, as reliability and performance are paramount | Low to Moderate |

| Threat of Backward Integration | High capital cost ($100M-$500M+) and time (18-36 months) make it difficult | Low |

| Availability of Alternatives | Competitors exist, but Equinix's global reach and ecosystem are differentiators | Moderate |

Preview the Actual Deliverable

Equinix Porter's Five Forces Analysis

This preview offers a comprehensive look at the Equinix Porter's Five Forces Analysis, showcasing the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're viewing the complete, professionally written analysis, which will be fully formatted and ready for your strategic decision-making the moment your transaction is complete. This ensures you get precisely the in-depth insights into Equinix's competitive landscape that you need, without any alterations or missing sections.

Rivalry Among Competitors

The data center and digital infrastructure landscape is a crowded one, featuring major global operators like Digital Realty and CoreSite, alongside numerous regional players. Hyperscalers, such as Amazon Web Services, Microsoft Azure, and Google Cloud, also contribute to this competitive intensity through their own self-build data center strategies, directly competing in some areas.

Equinix holds a strong position, especially in the retail colocation and interconnection services markets, where it's a recognized leader. However, the company contends with robust competition across all its service offerings, from wholesale colocation to managed infrastructure services, making market share defense and expansion a constant challenge.

The data center colocation market is booming, with projections indicating substantial expansion through 2025 and into the future. This rapid growth is fueled by increasing cloud adoption, the rise of artificial intelligence, and the ongoing digital transformation across industries. For instance, the global data center colocation market was valued at approximately $50 billion in 2023 and is expected to reach over $100 billion by 2028, showing a compound annual growth rate of around 15%.

While this robust growth generally eases competitive pressures by ensuring sufficient demand for most participants, it doesn't eliminate rivalry entirely. Intense competition persists, particularly for securing prime real estate in desirable locations and for attracting specific, high-value customer segments. Companies are vying for market share in a dynamic and expanding landscape.

Equinix stands out by offering Platform Equinix, a global interconnection hub providing direct, low-latency access to a massive network of partners. This extensive ecosystem is a key differentiator, making it difficult for competitors to replicate.

The complexity and value derived from Equinix's interconnected services create significant switching costs for its customers. These costs, both tangible and intangible, lock in clients and deter them from easily moving to a competitor, even if pricing is slightly more attractive.

For instance, in 2024, Equinix reported that its customers connect to an average of 10.5 ecosystems on its platform, highlighting the deep integration and value customers receive. This level of integration makes the prospect of migrating to a less interconnected environment a substantial undertaking.

Exit Barriers

The data center industry, including major players like Equinix, faces substantial exit barriers. The immense capital required to build and equip data centers, often running into hundreds of millions of dollars per facility, makes leaving the market a financially daunting prospect. For instance, Equinix's capital expenditures in 2023 were $2.3 billion, highlighting the significant investment needed to maintain and expand its global footprint.

These high fixed costs mean that companies are incentivized to stay operational even when market conditions are challenging. This persistence can lead to intensified competition as firms fight to maintain occupancy rates and revenue streams. Competitors might engage in aggressive pricing strategies or focus on retaining existing clients to offset the burden of underutilized, costly infrastructure, thereby increasing the pressure on all market participants.

- High Capital Investment: Building a data center can cost hundreds of millions of dollars, creating a significant financial commitment.

- Specialized Infrastructure: The need for advanced cooling, power, and security systems adds to the cost and complexity of exiting.

- Long-Term Leases and Contracts: Commitments to customers and real estate can lock companies into the market for extended periods.

Strategic Stakes and Acquisitions

The digital infrastructure sector, particularly with the burgeoning demand from artificial intelligence (AI) workloads, has become a battleground for intense competition. Companies are pouring capital into expansion and strategic acquisitions to secure market position and capitalize on this growth. Equinix, a key player, is actively engaged in substantial capital expenditures, highlighting the high strategic stakes involved in achieving and maintaining market leadership.

This aggressive investment environment fuels significant competitive rivalry. Equinix's own capital expenditure plans, which reached $2.2 billion in 2023 and were projected to increase in 2024, underscore the financial commitment required to stay competitive. The company's strategy includes both organic growth through new builds and expansions, as well as opportunistic acquisitions to enhance its global footprint and service offerings.

- AI Demand Driving Investment: The exponential growth in AI is a primary catalyst for increased spending on data center capacity and connectivity.

- Equinix's Capital Strategy: Equinix's significant capital expenditures, exceeding $2 billion annually, demonstrate its commitment to expansion and market share.

- Strategic Acquisitions: Equinix has a history of strategic acquisitions, such as its $3.1 billion acquisition of MainOne in 2022, to expand its reach and capabilities.

- High Stakes for Market Leadership: The substantial investments reflect the critical importance of securing a leading position in the rapidly evolving digital infrastructure landscape.

Competitive rivalry in the data center sector is fierce, driven by substantial market growth and significant capital investments. Equinix faces competition from global operators like Digital Realty and CoreSite, as well as hyperscalers building their own facilities. This intense competition is further amplified by the demand for AI infrastructure, prompting companies to invest heavily in expansion and strategic acquisitions to maintain market leadership.

Equinix's strength lies in its Platform Equinix, a global interconnection hub, and the high switching costs associated with its interconnected services. These factors create customer stickiness, making it difficult for competitors to lure away clients. For instance, in 2024, Equinix customers connected to an average of 10.5 ecosystems, demonstrating deep integration.

The industry exhibits high exit barriers due to the immense capital required for data center construction and specialized infrastructure, with Equinix's 2023 capital expenditures reaching $2.3 billion. These high fixed costs encourage companies to remain in the market, potentially intensifying competition through aggressive pricing or client retention efforts.

| Competitor | Market Focus | 2023 Revenue (Approx.) | Key Differentiator |

|---|---|---|---|

| Digital Realty | Global Colocation, Interconnection | $5.5 Billion | Large global footprint, enterprise solutions |

| CoreSite | US-based Colocation, Interconnection | $650 Million | Dense network hubs in key US markets |

| Hyperscalers (AWS, Azure, GCP) | Cloud Infrastructure, Self-Builds | Varies (significant internal investment) | Integrated cloud services, massive scale |

SSubstitutes Threaten

The widespread adoption of public cloud services like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud presents a potential substitute for traditional colocation data centers. As of 2024, a significant portion of enterprise IT workloads are migrating to these public cloud platforms, offering scalability and cost-efficiency.

However, the threat is nuanced. Many organizations are not choosing exclusively public cloud but are instead embracing hybrid multicloud strategies. This approach necessitates robust interconnection between their private infrastructure and multiple public cloud providers.

Equinix's strength lies in its ability to facilitate these complex connections. By providing direct, private access to numerous cloud on-ramps and other networks, Equinix transforms the public cloud from a pure substitute into a key component of its customers' digital infrastructure, thereby mitigating the direct threat.

Companies can opt to build and manage their own on-premise data centers. This route offers ultimate control but demands significant upfront investment and ongoing operational costs. For instance, establishing a new data center can cost tens to hundreds of millions of dollars, a considerable barrier for many businesses.

While on-premise solutions provide control, they often fall short in offering the global reach, rich interconnection ecosystems, and specialized expertise that colocation providers like Equinix deliver. This is particularly evident for businesses with evolving digital infrastructure needs, such as those scaling for AI workloads, where the agility and access to a broad network of partners are crucial.

Managed Service Providers (MSPs) present a nuanced threat. By offering bundled IT services, they can potentially reduce a company's direct reliance on colocation, as MSPs manage infrastructure in-house or through their own arrangements. This can be seen as a substitute for a portion of the colocation market.

However, the relationship is often symbiotic. Many MSPs themselves depend on robust colocation facilities, like those provided by Equinix, to house their own infrastructure and ensure reliable connectivity for their clients. In 2024, the global managed services market was valued at over $260 billion, demonstrating significant growth, yet a substantial portion of this growth is underpinned by colocation infrastructure.

Edge Computing Solutions

The growing trend towards edge computing, where data processing happens closer to where it's generated, might seem like a substitute for traditional, centralized data centers. However, edge deployments often still need to connect back to these core facilities for data aggregation and more complex analysis.

This interconnectedness actually positions companies like Equinix as enablers of edge strategies, rather than direct substitutes. Equinix's global network of data centers is vital for providing the necessary interconnection points for these distributed edge environments.

- Edge computing growth: The global edge computing market was valued at approximately $11.4 billion in 2023 and is projected to reach over $100 billion by 2030, indicating significant expansion.

- Interconnection needs: Many edge architectures rely on hybrid cloud models, requiring robust and low-latency connections to central cloud infrastructure, a service Equinix specializes in.

- Equinix's role: Equinix's Platform Equinix provides the physical infrastructure and interconnection services that are essential for businesses to build and manage their edge computing strategies effectively.

Technological Advancements (e.g., Quantum Computing)

Long-term technological shifts, such as the widespread adoption of quantum computing, have the potential to fundamentally alter data processing needs and, consequently, the demand for traditional data center services. While quantum computing is still in its early stages, its eventual maturation could lead to a reduced reliance on current data center architectures for certain computational tasks.

However, for the foreseeable future, including 2025 and beyond, these advanced technologies are more likely to spur new demands for specialized infrastructure within existing data center frameworks. For instance, the development of quantum computing will require significant power and cooling, creating opportunities for data center providers like Equinix to offer tailored colocation solutions.

- Quantum computing's impact: While not an immediate threat, quantum computing could eventually offer alternative processing capabilities, potentially reducing the need for conventional data center services for specific workloads.

- Near-term opportunities: In the interim, the development and testing of quantum computing technologies will likely increase demand for specialized, secure, and high-density data center environments.

- Infrastructure demands: Equinix, as a leading global data center provider, is positioned to benefit from the need for robust power, cooling, and connectivity required by emerging technologies like quantum computing.

While public cloud services offer an alternative, many businesses adopt hybrid multicloud strategies, increasing their need for interconnection, which Equinix facilitates. This makes public cloud less of a direct substitute and more of a complementary service. The ongoing migration to cloud in 2024 highlights this trend, yet Equinix's role in connecting these environments remains critical.

Companies can also opt for on-premise data centers, but the substantial capital expenditure, often in the tens to hundreds of millions of dollars for new builds, makes this prohibitive for many. Equinix offers a more flexible and cost-effective solution, especially for businesses requiring global reach and advanced interconnection capabilities.

Managed Service Providers (MSPs) present another consideration. While they can manage IT infrastructure, many rely on colocation providers like Equinix to host their own operations. The global MSP market, exceeding $260 billion in 2024, demonstrates significant growth, with colocation forming a foundational element for many of these services.

Entrants Threaten

The sheer scale of capital required to establish a competitive data center operation presents a formidable barrier to entry. Building a global network of facilities comparable to Equinix demands substantial upfront investment in land, state-of-the-art construction, robust power infrastructure, and sophisticated cooling technologies.

For instance, Equinix itself is projecting capital expenditures of up to $5 billion annually through 2029 for data center development. This significant financial commitment underscores the prohibitive cost that deters potential new players from challenging established giants in this capital-intensive industry.

Equinix, like other established data center providers, leverages substantial economies of scale. This means they can spread their massive fixed costs, like building and equipping data centers, over a larger operational base. For instance, their global network of over 240 data centers allows for more efficient procurement of equipment and a streamlined approach to construction and maintenance, driving down per-unit costs.

Furthermore, Equinix benefits from economies of scope by offering a diverse suite of interconnected services, from colocation and interconnection to cloud exchange and managed infrastructure. This breadth of offerings creates a more compelling value proposition for customers and enhances operational synergies. New entrants would find it incredibly challenging to replicate this cost advantage and comprehensive service portfolio without significant upfront investment and time.

In 2023, Equinix reported significant revenue growth, reaching $9.7 billion, underscoring their market leadership and the benefits derived from their scale. This financial performance highlights the difficulty for newcomers to compete on price and service breadth against such an entrenched operator.

Equinix's core strength is its vast interconnection ecosystem. The more businesses, networks, and cloud providers that connect within Equinix data centers, the more valuable it becomes for everyone. This is a classic example of a network effect, making it incredibly difficult for new entrants to compete.

This dense digital community creates a powerful lock-in effect. Customers are hesitant to leave an environment where they have established critical connections, as replicating that level of integration elsewhere would be prohibitively expensive and time-consuming. In 2024, Equinix continued to expand its global footprint, further solidifying these network effects.

Regulatory Hurdles and Permitting

The significant regulatory hurdles and complex permitting processes required to build and operate data centers present a substantial barrier to entry. These include obtaining numerous local, regional, and national approvals, conducting thorough environmental impact studies, and securing reliable access to power and high-speed network infrastructure. For instance, in 2024, the average time to secure all necessary permits for a large-scale data center project in major European markets could extend over 18 months, significantly increasing upfront costs and project timelines for potential new competitors.

Navigating these intricate regulatory landscapes, especially across diverse international jurisdictions, demands considerable expertise and financial resources. New entrants often face challenges in understanding and complying with varying zoning laws, building codes, and data privacy regulations, which can differ dramatically from one country to another. This complexity acts as a powerful deterrent, favoring established players like Equinix who have already invested in building relationships and expertise within these regulatory frameworks.

- Complex Permitting: New data center construction requires navigating a web of approvals, from zoning to environmental compliance, often taking over a year.

- International Variability: Regulations differ significantly across countries, increasing the challenge for global expansion by new entrants.

- Infrastructure Access: Securing reliable power and network connectivity involves dealing with utility monopolies and long lead times, adding to the barrier.

- Cost of Compliance: The financial investment in meeting diverse regulatory standards is substantial, favoring well-capitalized incumbents.

Brand Reputation and Customer Trust

Equinix's established brand reputation, built over decades of reliable service, security, and operational excellence, acts as a formidable barrier. In an industry where data integrity and continuous uptime are critical, new entrants would struggle to quickly gain the trust and credibility necessary to attract major clients.

Building a comparable level of customer trust takes significant time and consistent performance. For instance, Equinix's commitment to its global uptime standards, often exceeding 99.999%, is a key differentiator that new competitors would need years to replicate and prove.

- Brand Reputation: Equinix is widely recognized for its stability and dependability.

- Customer Trust: Decades of high uptime and robust security measures foster deep client confidence.

- Barrier to Entry: New entrants face a substantial challenge in cultivating similar trust and credibility.

- Competitive Advantage: Equinix's established reputation directly hinders new companies seeking to enter the market.

The threat of new entrants in the data center market, particularly for a company like Equinix, is significantly mitigated by the immense capital requirements, economies of scale, and powerful network effects. Building a global data center footprint comparable to Equinix's requires billions in investment, making it an extremely high barrier for newcomers. For example, Equinix's projected capital expenditures of up to $5 billion annually through 2029 highlight the scale of investment needed.

Furthermore, Equinix's established interconnection ecosystem, where a vast number of businesses and networks already connect, creates a strong lock-in effect. Customers are reluctant to leave this dense digital community due to the high cost and complexity of replicating their existing connections. This network advantage, coupled with their global brand reputation for reliability and uptime, further deters new players from effectively competing.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Building and equipping data centers globally demands billions in investment. | Extremely high; deters most potential entrants. |

| Economies of Scale & Scope | Lower per-unit costs due to large operational base and diverse service offerings. | New entrants struggle to match cost efficiency and value proposition. |

| Network Effects | Value increases with more users; difficult to replicate Equinix's dense ecosystem. | Creates customer lock-in; new entrants lack critical mass. |

| Regulatory Hurdles | Complex and time-consuming permitting processes across jurisdictions. | Increases upfront costs and project timelines; favors incumbents. |

| Brand Reputation & Trust | Decades of reliable service and security build deep customer confidence. | New entrants face a significant challenge in gaining credibility. |

Porter's Five Forces Analysis Data Sources

Our Equinix Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Equinix's annual reports, investor presentations, and SEC filings. We supplement this with industry research from reputable sources like Gartner and IDC, alongside macroeconomic data to capture the broader market landscape.